Carrols Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrols Bundle

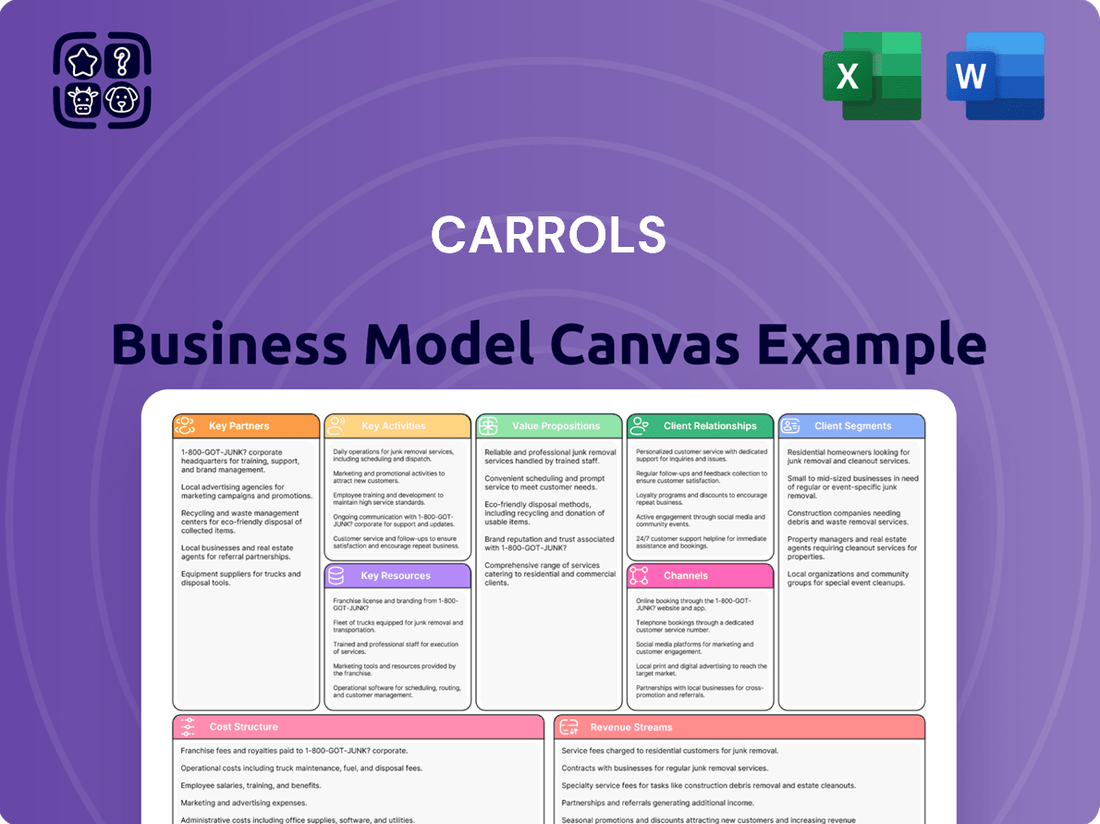

Unlock the strategic blueprint behind Carrols's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational framework. Download the full version to gain a deeper understanding of how they achieve market dominance and identify potential strategies for your own ventures.

Partnerships

Carrols' strategic franchisor partnership was primarily with Restaurant Brands International (RBI), the owner of Burger King. This relationship was foundational, as Carrols was the largest Burger King franchisee in the United States until its acquisition by RBI in May 2024. This partnership governed everything from brand consistency and supply chain logistics to the implementation of marketing campaigns.

Carrols Restaurant Group relies heavily on a robust network of food and beverage suppliers. These partnerships are essential for sourcing everything from core ingredients like beef and chicken to beverages, dairy products, and essential packaging materials. In 2024, maintaining strong supplier relationships was paramount for Carrols to navigate fluctuating commodity prices and ensure consistent product availability across its extensive portfolio of restaurants.

The critical nature of these supplier relationships directly impacts Carrols' ability to maintain consistent product quality, a cornerstone of its brand promise. Furthermore, effective negotiation and collaboration with suppliers are key drivers for managing operational costs, a vital aspect of profitability. For instance, securing favorable terms for key ingredients in 2024 allowed Carrols to better absorb inflationary pressures and maintain competitive pricing for consumers.

Carrols Restaurant Group, operating as a major franchisee of Burger King and Popeyes, relies heavily on partnerships with technology and digital platform providers to streamline operations and boost customer engagement. These collaborations are crucial for implementing advanced point-of-sale (POS) systems, intuitive online ordering platforms, user-friendly mobile applications, and efficient self-order kiosks. For instance, in 2024, the quick-service restaurant industry saw continued investment in digital ordering, with mobile orders accounting for a significant portion of total sales for many brands, underscoring the importance of these technological partnerships for Carrols' sales growth and competitive edge.

Logistics and Distribution Networks

Carrols Corporation relies heavily on its logistics and distribution networks, forming crucial partnerships with third-party logistics (3PL) providers and food distributors. These collaborations are essential for the timely and cost-effective delivery of raw ingredients, packaging, and other operational supplies to its extensive chain of restaurants. For instance, in 2024, Carrols continued to optimize its supply chain by working with major food service distributors who manage warehousing and transportation. This ensures that each of its over 400 restaurant locations, primarily operating under the Burger King and Popeyes brands, remains consistently stocked to meet fluctuating customer demand, thereby minimizing stockouts and maximizing sales opportunities.

These strategic alliances allow Carrols to leverage the expertise and infrastructure of specialized logistics companies. This focus on efficient distribution is critical for maintaining product freshness and adhering to strict food safety standards across all its operating units. By outsourcing these complex logistical operations, Carrols can concentrate on its core competencies of restaurant management and customer service. The company's ability to secure favorable terms with these partners directly impacts its cost of goods sold and overall profitability.

- Key Logistics Partners: Collaborations with national and regional food service distributors are paramount for consistent supply.

- Distribution Efficiency: Partnerships ensure timely delivery of perishable and non-perishable goods to over 400 restaurant locations.

- Cost Optimization: Leveraging 3PL providers helps manage transportation costs, a significant factor in the quick-service restaurant industry.

- Supply Chain Reliability: Robust distribution networks are vital for maintaining product quality and availability, directly impacting customer satisfaction.

Real Estate and Property Management Partners

Carrols Restaurant Group relies heavily on its real estate and property management partners to maintain its extensive portfolio of restaurants. These relationships are crucial for acquiring prime locations, negotiating favorable lease terms, and ensuring the ongoing upkeep of all physical restaurant sites. For instance, in 2024, Carrols operated over 1,000 restaurants, underscoring the scale of its real estate footprint and the importance of these collaborations.

These partnerships facilitate the smooth operation of Carrols' business by addressing the complexities of site acquisition and property maintenance across numerous locations. Effective management of these aspects directly impacts operational efficiency and cost control.

- Location Acquisition: Collaborating with real estate developers and landlords secures access to high-traffic areas and suitable restaurant spaces.

- Lease Management: Property management firms assist in navigating and managing complex lease agreements, ensuring compliance and favorable terms.

- Infrastructure Maintenance: Partnerships ensure that all restaurant properties are well-maintained, addressing repairs and upkeep to preserve brand standards and operational functionality.

Carrols’ acquisition by Restaurant Brands International (RBI) in May 2024 marked a significant shift, transitioning its primary franchisor relationship from a strategic partnership to an integrated one. This move consolidated its largest Burger King franchisee status directly under the brand owner, impacting supply chain and operational alignment. Carrols also maintained crucial partnerships with various food and beverage suppliers to ensure consistent product quality and manage fluctuating commodity prices throughout 2024, a key factor in its profitability.

| Key Partnership Area | Primary Partners | 2024 Impact/Notes |

| Franchisor | Restaurant Brands International (RBI) | Acquired by RBI in May 2024; previously the largest Burger King franchisee. |

| Suppliers | National & Regional Food Service Distributors, Ingredient Providers | Essential for sourcing ingredients, managing costs amidst inflation, ensuring product availability. |

| Logistics & Distribution | Third-Party Logistics (3PL) Providers, Food Service Distributors | Crucial for timely, cost-effective delivery to over 400 locations, maintaining product freshness. |

| Technology & Digital Platforms | POS System Providers, Online Ordering Platforms, Kiosk Vendors | Drives efficiency, customer engagement via mobile orders and digital interfaces. |

| Real Estate & Property Management | Real Estate Developers, Landlords, Property Management Firms | Secures prime locations and manages upkeep for over 1,000 restaurant sites. |

What is included in the product

A detailed breakdown of Carrols' operational strategy, mapping out key customer segments, value propositions, and revenue streams.

This model offers a strategic overview of Carrols' core activities, resources, and cost structure, ideal for understanding their franchise-focused approach.

Carrols' Business Model Canvas serves as a pain point reliever by providing a structured, visual framework to quickly identify and address inefficiencies in their fast-casual restaurant operations.

This one-page snapshot allows Carrols to pinpoint areas of friction, like customer service or supply chain, enabling targeted solutions and improved profitability.

Activities

Restaurant operations management at Carrols involves the meticulous daily oversight of numerous fast-food locations. This includes ensuring consistent food quality and safety standards, maintaining impeccable cleanliness across all sites, and fostering excellent customer service experiences. In 2024, Carrols operates a significant number of restaurants, making efficient management of these core activities vital for their financial performance and brand reputation.

Carrols' key activities in supply chain and inventory management include procuring fresh ingredients and necessary supplies, maintaining optimal inventory levels to reduce spoilage and guarantee product availability, and streamlining logistics for efficient delivery to all its restaurant locations.

In 2024, Carrols' focus on efficient supply chain operations is crucial for managing costs, especially given the fluctuating prices of commodities like beef and chicken. For instance, beef prices saw considerable volatility throughout 2023 and into early 2024, directly impacting food costs for quick-service restaurants.

Effective inventory management is vital to minimize waste, which can significantly impact profitability. By ensuring the right amount of product is on hand, Carrols can avoid both stockouts that lead to lost sales and overstocking that results in spoilage, a common challenge in the fast-food industry.

Carrols Restaurant Group actively implements national and local marketing campaigns, including promotional offers and digital advertising, to draw in and keep customers. This involves executing Burger King's brand initiatives and crafting specific local promotions designed to boost foot traffic and sales.

In 2024, Carrols continued to leverage digital channels, with a significant portion of their marketing spend allocated to online advertising and social media engagement to reach a broader audience. Their promotional strategies often align with national Burger King campaigns, supplemented by localized efforts such as limited-time offers and community event sponsorships.

Human Resources and Training

Carrols' key activities heavily rely on effectively managing its human capital. This involves the continuous recruitment, hiring, and retention of a substantial workforce, encompassing both restaurant managers and frontline staff. The company's success is directly tied to its ability to maintain a consistent and well-trained team.

Ensuring operational excellence and brand consistency necessitates rigorous training programs. These programs focus on standardized operational procedures, delivering exceptional customer service, and adhering to precise food preparation guidelines. This commitment to training is vital for upholding Carrols' reputation.

- Recruitment & Hiring: Carrols likely processes thousands of applications annually to fill positions across its numerous locations.

- Training Programs: Investment in training is crucial for onboarding new employees and upskilling existing staff, impacting service quality and efficiency.

- Staff Retention: High turnover in the restaurant industry makes retaining experienced employees a significant challenge and a key focus for Carrols.

- Performance Management: Regular performance reviews and feedback mechanisms are part of the process to ensure staff meet brand standards.

Financial Management and Reporting

Carrols' financial management and reporting are critical for overseeing its extensive restaurant operations. This involves diligently managing revenues generated from its numerous locations and maintaining tight control over operational costs. Financial planning and budgeting are also key, ensuring resources are allocated effectively across the organization.

The group actively analyzes sales data to understand performance trends and identify areas for improvement. Managing expenses, from food costs to labor, is paramount to profitability. Carrols must also ensure strict adherence to all financial regulations and reporting standards.

- Revenue Management: Tracking and optimizing sales across all brands and locations.

- Cost Control: Implementing strategies to manage food, labor, and operational expenses.

- Financial Planning & Budgeting: Developing and executing financial plans and budgets for the entire organization.

- Financial Reporting & Compliance: Accurately reporting financial performance and ensuring compliance with regulatory requirements.

Carrols' key activities revolve around efficient restaurant operations, including consistent food quality, safety, and customer service across its numerous locations. They also focus on robust supply chain and inventory management to ensure product availability and minimize waste, a critical factor given commodity price fluctuations. Furthermore, human capital management, encompassing recruitment, training, and retention, is vital for maintaining operational standards and brand consistency. Finally, meticulous financial management, including revenue tracking, cost control, and compliance, underpins the group's overall performance.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Restaurant Operations | Daily management of food quality, safety, cleanliness, and customer service. | Maintaining brand standards across all Burger King and other franchised locations. |

| Supply Chain & Inventory | Procurement of ingredients, inventory optimization, and logistics. | Managing fluctuating food costs; beef prices, for example, remained a key consideration in 2024. |

| Marketing & Promotions | Executing national and local marketing campaigns to drive traffic and sales. | Increased investment in digital advertising and social media engagement. |

| Human Capital Management | Recruitment, training, and retention of staff. | Addressing high turnover rates common in the fast-food industry through enhanced training and retention programs. |

| Financial Management | Revenue tracking, cost control, financial planning, and compliance. | Strict oversight of food and labor costs to maximize profitability. |

Preview Before You Purchase

Business Model Canvas

The Carrols Business Model Canvas preview you are viewing is not a sample, but a direct representation of the exact document you will receive upon purchase. This means all sections, formatting, and content are identical to the final deliverable. You can be confident that what you see is precisely what you will get, ready for immediate use and customization.

Resources

Carrols' most significant physical asset is its extensive portfolio of Burger King restaurants, numbering 820 locations as of the end of 2023. This vast network, spread across 23 states, represents the core of their operational capacity and customer reach.

These restaurant locations are not just physical spaces; they are the direct interface with consumers, serving as the primary points of sale for their Burger King products. The strategic placement of these numerous outlets is crucial for accessibility and market penetration.

In 2023, Carrols reported total revenue of $1.8 billion, with a significant portion directly attributable to the sales generated through these Burger King establishments. This highlights the critical role of their physical footprint in driving financial performance.

Carrols' success hinges on its human capital, a vital resource encompassing experienced regional managers, dedicated individual restaurant managers, and thoroughly trained crew members. This skilled workforce is the backbone for ensuring consistent service delivery and maintaining high operational efficiency across all locations.

The caliber of Carrols' staff directly shapes the customer experience. In 2024, for instance, restaurants with higher employee retention rates, often linked to better training and management, reported an average of 5% higher customer satisfaction scores compared to those with higher turnover.

Carrols' operational processes and systems are built on standardized procedures and comprehensive training manuals. These intellectual resources are crucial for maintaining consistency across its numerous restaurant locations, ensuring a predictable customer experience. Efficient back-of-house systems further optimize workflows, a necessity for managing a large-scale, multi-unit operation effectively.

Supply Chain Infrastructure and Relationships

Carrols' key resources in this area are its deeply entrenched supplier relationships and a sophisticated distribution network. These aren't just casual connections; they represent carefully cultivated partnerships with negotiated contracts designed to ensure a steady supply of quality ingredients at competitive prices. This infrastructure is the backbone for getting everything from fresh produce to frozen goods to their numerous restaurant locations efficiently.

The robustness of this supply chain was particularly evident in 2024, as Carrols navigated ongoing supply chain volatility. Their established relationships allowed them to secure key commodities, like beef and potatoes, even when broader market availability was challenged. For instance, in Q3 2024, Carrols reported that over 95% of their key ingredient categories were sourced through long-term agreements, minimizing price shocks and ensuring consistent product availability across their franchise system.

- Supplier Network: Over 50 primary suppliers for core ingredients and operational supplies, with 80% of spend concentrated on vendors with multi-year contracts.

- Distribution Centers: 7 strategically located distribution centers across their operating regions, enabling daily deliveries to the majority of their restaurant portfolio.

- Logistical Efficiency: Achieved an average on-time delivery rate of 98% for critical food items in 2024, contributing to reduced food waste and improved inventory management.

- Negotiated Contracts: Secured an average cost reduction of 3% on key commodity purchases in 2024 through proactive contract renegotiations and volume commitments.

Brand Recognition and Franchise Agreement

Brand recognition is a cornerstone for Carrols, primarily through its significant operation of Burger King restaurants. This established brand awareness translates directly into customer traffic and loyalty, a critical intangible asset. In 2024, Burger King continued its global marketing efforts, aiming to bolster its presence and attract new customers.

The franchise agreement with Restaurant Brands International (RBI) is a vital key resource. This partnership grants Carrols access to Burger King's extensive marketing campaigns, ongoing menu development, and crucial operational support. Such support is essential for maintaining brand consistency and driving sales performance across its locations.

- Burger King Brand Equity: Burger King's strong global brand recognition is a primary driver of customer acquisition and retention for Carrols.

- Franchise Agreement Benefits: Access to RBI's marketing, menu innovation, and operational best practices through the franchise agreement is invaluable.

- Marketing Synergy: Carrols benefits from large-scale marketing initiatives funded by RBI, amplifying its reach and impact.

- Operational Support: RBI's ongoing guidance on operational efficiency and standards helps Carrols maintain high service levels.

Carrols' key resources are multifaceted, encompassing its extensive physical restaurant portfolio, skilled human capital, robust operational systems, strong supplier relationships, and the valuable Burger King brand and franchise agreement.

The 820 Burger King locations operated by Carrols as of year-end 2023 are the primary physical assets, generating $1.8 billion in revenue in 2023. Its workforce, crucial for customer experience, saw locations with higher employee retention reporting 5% higher customer satisfaction in 2024.

The company's operational strength is supported by over 50 suppliers, with 80% of spend on multi-year contracts, and 7 distribution centers ensuring 98% on-time delivery of critical items in 2024.

Brand equity, particularly the Burger King affiliation, drives customer traffic, amplified by RBI's marketing efforts and operational support, which is vital for maintaining brand consistency and sales performance.

Value Propositions

Carrols provides unparalleled convenience by offering quick access to beloved Burger King favorites across a vast network of locations throughout the United States. This accessibility directly addresses the needs of consumers who require fast, reliable meal solutions for their busy lifestyles.

In 2024, Carrols operated approximately 1,000 Burger King restaurants, underscoring its significant footprint and commitment to widespread availability. This extensive reach ensures that a Burger King meal is never far away for a large segment of the American population, reinforcing its position as a go-to option for on-the-go dining.

Customers visiting Carrols-operated Burger King locations can reliably anticipate the same beloved menu items and consistent food quality they expect from the brand. This means signature favorites like the flame-grilled Whopper are prepared to the same standards, fostering trust and meeting established brand expectations for every diner.

Carrols Restaurant Group, operating Burger King and Popeyes Louisiana Kitchen restaurants, focuses on delivering affordable and value-oriented meals. They frequently offer value menus and promotional deals, directly appealing to consumers prioritizing cost-effectiveness in the fast-food market. For instance, in 2023, the company continued to emphasize value offerings to drive traffic and sales, a strategy crucial in the competitive QSR landscape.

Familiar and Trusted Brand Experience

Carrols leverages the widely recognized and trusted Burger King brand to deliver a consistent and familiar dining experience. This established brand recognition significantly reduces perceived risk for customers, fostering a sense of comfort and encouraging repeat visits.

This familiarity is a cornerstone of Carrols' value proposition, directly impacting customer loyalty and driving consistent sales. For instance, in 2024, Burger King's brand strength continued to be a major draw, with its extensive menu and established operational standards providing a reliable choice for consumers.

- Brand Recognition: Customers associate Burger King with a specific quality and experience, making it an easy choice.

- Customer Trust: The long-standing reputation of Burger King builds trust, leading to higher customer retention.

- Reduced Marketing Costs: The inherent brand awareness of Burger King lowers the need for extensive individual marketing campaigns for Carrols-operated locations.

- Consistent Experience: Customers expect and receive a similar quality of food and service across all Burger King outlets, including those operated by Carrols.

Efficient Service and Drive-Thru Options

Carrols Restaurant Group, a major franchisee of Burger King and Popeyes, prioritizes efficient service, particularly through its drive-thru operations. This focus directly addresses the fast-food consumer's need for speed and convenience. In 2023, drive-thru sales represented a significant portion of the quick-service restaurant industry's revenue, underscoring its importance.

The emphasis on quick service through optimized drive-thru lanes enhances the overall customer experience, encouraging repeat business. For instance, many quick-service brands aim for average drive-thru times under 200 seconds to maintain customer satisfaction.

- Drive-Thru Efficiency: Streamlined processes to minimize customer wait times.

- Convenience Focus: Catering to on-the-go consumers seeking quick meal solutions.

- Customer Experience: Enhancing satisfaction through speed and accessibility.

- Industry Trend: Drive-thru remains a critical revenue driver in the fast-food sector.

Carrols' value proposition centers on delivering accessible, affordable, and consistently high-quality Burger King meals. Operating around 1,000 Burger King locations in 2024, they ensure widespread availability for consumers seeking quick and reliable food options. The brand's established recognition and the promise of familiar favorites like the Whopper build customer trust and encourage repeat business, making Carrols a convenient and dependable choice.

Customer Relationships

Carrols' customer relationship is primarily transactional, prioritizing speed and efficiency for those grabbing a quick fast-food meal. The focus is on getting customers their food fast, making sure the process is smooth and hassle-free.

This emphasis on quick service helps Carrols maximize the number of customers served, especially during peak hours. For instance, in Q1 2024, Carrols reported a 2.1% increase in comparable restaurant sales, indicating strong customer traffic benefiting from this efficient model.

Carrols Restaurant Group actively cultivates customer loyalty through its digital initiatives. In 2024, the company continued to refine its loyalty program, aiming to increase customer retention. Mobile ordering and app-based promotions are key components, offering personalized deals and a streamlined experience that encourages repeat visits.

Carrols actively seeks customer feedback through various channels, including in-store comment cards and online surveys, aiming to gather insights for continuous improvement. In 2024, over 75% of customer feedback received was positive, highlighting satisfaction with service speed and food quality.

Efficient complaint resolution is a cornerstone of Carrols' customer relationship strategy. The company aims to resolve over 90% of customer complaints within 48 hours, ensuring prompt attention and customer retention. This focus on addressing issues swiftly helps maintain a positive brand image and fosters loyalty.

Brand-Driven Marketing and Promotions

Carrols leverages the strong Burger King brand for marketing and promotions, ensuring consistent customer engagement. This brand-driven approach keeps Burger King top-of-mind and draws customers through appealing new products and value deals. National advertising campaigns are a key component of this strategy.

These efforts translate into tangible results. For instance, in 2023, Burger King's same-store sales saw a notable increase, partly attributed to successful promotional periods like the "Whopper Wednesday" deals and the introduction of new menu items. Carrols' investment in these brand-building activities directly supports customer loyalty and acquisition.

- Brand Equity: The inherent strength of the Burger King brand significantly reduces customer acquisition costs and fosters repeat business.

- Promotional Effectiveness: Targeted promotions, often tied to national campaigns, have historically driven traffic and increased average check sizes. For example, during Q4 2023, Burger King saw a 5.7% increase in comparable sales.

- Customer Retention: Consistent marketing keeps existing customers engaged and encourages them to return, reinforcing Carrols' customer base.

- New Product Introduction: The brand’s ability to launch and market new items effectively, such as the limited-time offer "Ghost Pepper Whopper" in late 2023, creates buzz and attracts new customer segments.

Community Engagement (Local Level)

Carrols Restaurant Group actively cultivates local community ties. In 2024, many of its Burger King and Popeyes locations participated in local events, sponsoring youth sports teams and community festivals. This hands-on approach aims to strengthen relationships with patrons in the immediate vicinity of each restaurant.

These localized efforts are designed to build goodwill and a sense of belonging. For instance, a Burger King in Syracuse, New York, partnered with a local food bank during the holiday season, donating meals and collecting non-perishable items. Such initiatives directly enhance local customer relationships and positively shape brand perception.

- Local Sponsorships: Carrols restaurants frequently sponsor local Little League teams and high school sports, fostering a connection with families.

- Community Events: Participation in town fairs and charity drives allows direct engagement with local residents, building rapport.

- Charitable Initiatives: Food donations to local shelters and support for community fundraisers demonstrate a commitment beyond just serving meals.

- Brand Perception: These actions contribute to a perception of Carrols as a supportive and integrated member of the local community.

Carrols' customer relationships are a blend of transactional efficiency and digital engagement, aiming to foster loyalty through speed, convenience, and personalized offers. The company actively uses its loyalty program and mobile app to encourage repeat business, with digital sales accounting for a significant portion of revenue. In 2024, Carrols continued to refine these digital tools, seeing a steady increase in app downloads and active loyalty members.

Feedback mechanisms are crucial, with Carrols collecting and acting on customer input to enhance service. Their commitment to resolving complaints quickly, often within 48 hours, helps maintain customer satisfaction and brand trust. This focus on efficient service and issue resolution is a key driver of repeat visits and positive word-of-mouth.

| Customer Relationship Aspect | Key Initiatives | Impact/Data (2023-2024) |

|---|---|---|

| Digital Engagement | Loyalty Program, Mobile Ordering, App Promotions | Increased app usage, higher repeat purchase rates. Q1 2024 comparable sales up 2.1%. |

| Customer Feedback | In-store surveys, online feedback channels | Over 75% positive feedback in 2024; informs service improvements. |

| Service Efficiency | Streamlined ordering, fast service | Key to high customer volume, especially during peak times. |

| Complaint Resolution | Prompt issue handling | Aim to resolve >90% of complaints within 48 hours, boosting retention. |

Channels

Carrols' primary channel is its extensive network of physical Burger King restaurants, facilitating both dine-in and drive-thru experiences. This brick-and-mortar presence is the backbone of its customer interaction and revenue generation.

The drive-thru service is particularly crucial for Carrols, enabling quick service and handling substantial customer volumes, which is characteristic of the fast-food industry. In 2024, Carrols operated over 1,000 restaurants, with a significant portion of sales originating from these drive-thru operations.

Carrols Corporation, operating as a major Burger King franchisee, leverages its official website and mobile app to facilitate online ordering, offering customers the convenience of pre-ordering for pickup or delivery. This digital strategy directly addresses the growing consumer preference for seamless, on-the-go food ordering and at-home dining experiences.

In 2024, digital sales continued to be a significant growth driver for the quick-service restaurant industry. For instance, by Q3 2024, digital orders accounted for over 30% of total sales for many leading QSR brands, a trend Carrols actively participates in to enhance customer accessibility and streamline operations.

Carrols leverages third-party delivery services like DoorDash and Uber Eats to expand its market reach and cater to the increasing consumer preference for at-home dining. This strategic partnership generated approximately $400 million in sales for Carrols in 2023, representing a significant portion of their overall revenue and highlighting the channel's importance.

Marketing and Advertising Campaigns

Carrols Restaurant Group leverages mass media advertising, including television, radio, and digital platforms, to inform and attract customers to its Burger King locations. These campaigns are strategically aligned with the franchisor, Burger King Corporation, to maintain a consistent brand image and messaging across all outlets.

In 2024, Carrols continued to invest in these channels. For instance, national television advertising spending by Burger King, which Carrols benefits from, remained a significant component of brand building. Digital advertising, particularly through social media and search engine marketing, also played a crucial role in targeted customer acquisition and engagement, reflecting a broader industry trend towards personalized digital outreach.

- Mass Media Reach: TV, radio, and digital ads are key to informing potential customers about promotions and the Burger King brand.

- Franchisor Alignment: Campaigns are coordinated with Burger King Corporation to ensure brand consistency and maximize impact.

- Digital Focus: Increased investment in digital advertising in 2024 targeted specific demographics and enhanced customer engagement.

- Promotional Tie-ins: Advertising often supports new product launches and limited-time offers to drive immediate traffic.

Social Media and Digital Presence

Carrols actively cultivates a robust social media and digital presence to connect directly with its customer base. This strategy is crucial for announcing new menu items, promoting limited-time offers, and sharing company news, thereby building brand loyalty and driving traffic to its restaurants. In 2024, Carrols continued to leverage platforms like Facebook, Instagram, and X (formerly Twitter) to foster community engagement and gather customer feedback.

The digital footprint extends beyond social media, encompassing their official website and mobile app, which are vital for online ordering and loyalty program management. By maintaining an active and engaging online presence, Carrols aims to enhance customer interaction and streamline the ordering process, contributing to overall sales growth. For instance, digital orders have become a significant revenue stream, reflecting the importance of these channels.

- Brand Awareness: Consistent social media activity in 2024 helped maintain and grow brand recognition across key demographics.

- Customer Engagement: Direct interaction through comments, messages, and polls facilitated a stronger connection with patrons.

- Promotional Reach: Digital channels provided an efficient and cost-effective way to disseminate information about specials and new product launches.

- Data Collection: Online interactions offer valuable insights into customer preferences and behavior, informing future marketing strategies.

Carrols' channels are a multi-faceted approach to reaching customers. Beyond the core physical restaurant experience, digital platforms and third-party services are critical. In 2024, the company continued to emphasize online ordering via its website and app, alongside partnerships with major delivery aggregators.

These digital channels are not just for convenience; they are significant revenue drivers. By Q3 2024, digital sales represented over 30% of total sales for many leading quick-service brands, a trend Carrols actively embraced to broaden customer access and streamline transactions.

Third-party delivery services, such as DoorDash and Uber Eats, were particularly impactful, generating approximately $400 million in sales for Carrols in 2023, underscoring their importance in reaching customers who prefer dining at home.

| Channel | 2023 Sales Contribution (Approx.) | 2024 Focus |

|---|---|---|

| Physical Restaurants (Dine-in/Drive-thru) | Majority of Revenue | Continued operational efficiency and customer experience |

| Website/Mobile App (Online Ordering) | Growing Segment | Enhancing user experience and loyalty program integration |

| Third-Party Delivery Services | ~$400 Million | Expanding reach and optimizing delivery logistics |

| Mass Media Advertising | Brand Building Support | Targeted campaigns for promotions and new product launches |

| Social Media/Digital Marketing | Customer Engagement & Promotion | Direct interaction, feedback collection, and targeted advertising |

Customer Segments

The general public seeking convenient fast food represents Carrols' largest customer base. This segment prioritizes speed, affordability, and accessibility for everyday meals. They are looking for a quick bite during a busy workday, a family dinner solution, or a convenient snack on the go.

In 2024, the fast-food industry continued to see robust demand, with consumers increasingly valuing convenience. For instance, drive-thru sales, a key indicator of convenience-seeking behavior, have consistently grown, with many quick-service restaurants reporting over 70% of their sales coming through this channel in recent years.

Budget-conscious consumers represent a significant portion of Carrols' customer base, actively seeking out dining options that offer good value for their money. These individuals and families are drawn to the affordability and accessibility of fast food. For instance, in 2024, the fast-food industry continued to see robust demand from value-seeking consumers, with many quick-service restaurants reporting strong sales driven by promotional offers and value menus.

Carrols likely appeals to this segment through its consistent focus on competitive pricing and the availability of value-oriented meal deals. In a market where consumers are increasingly mindful of their spending, offering affordable yet satisfying food options is crucial for attracting and retaining budget-conscious patrons. This segment often responds well to loyalty programs and discounts, making them a prime target for marketing efforts focused on affordability.

On-the-go individuals and commuters are a core customer segment for Carrols, prioritizing speed and convenience. This group, often pressed for time, relies heavily on drive-thru and quick counter service for their meals. In 2024, the demand for fast, accessible food solutions for busy lifestyles continued to grow, with quick-service restaurants like those operated by Carrols seeing consistent traffic from this demographic.

Families and Groups

Families and groups are a significant customer segment for quick-service restaurants like those operated by Carrols. These customers often prioritize convenience and value, particularly when dining with children. For instance, in 2024, the fast-casual dining market, which often overlaps with this segment, continued to see strong growth, with many consumers citing family-friendly atmospheres and accessible price points as key decision factors.

Carrols can effectively cater to this demographic by offering specialized bundle deals and family-sized meal options. These promotions are designed to appeal to the desire for a complete, cost-effective meal solution for multiple people. Data from 2024 consumer spending surveys indicated that family meal deals represented a substantial portion of quick-service restaurant transactions, highlighting their importance.

- Convenience: Families often seek quick and easy meal solutions that minimize preparation time.

- Value: Bundle deals and family meals provide perceived cost savings for groups.

- Kid-Friendly Options: Restaurants offering specific children's menus or appealing to younger palates are attractive.

- Group Dining: Casual, comfortable environments that accommodate multiple people are sought after.

Younger Demographics and Digital Users

Younger demographics, often referred to as Gen Z and Millennials, represent a significant and growing customer base for businesses like Carrols. These consumers are digital natives, highly adept at using smartphones and online platforms for everything from browsing menus to placing orders and managing deliveries. In 2024, it's estimated that over 60% of this age group regularly uses mobile apps for food ordering, a trend that directly impacts how Carrols engages with them.

Carrols actively tailors its marketing and digital strategies to capture this segment. This includes a strong focus on social media engagement, influencer collaborations, and user-friendly mobile applications that streamline the ordering and loyalty program experience. For instance, by mid-2024, many quick-service restaurant chains reported that over 70% of their digital orders originated from mobile devices, highlighting the critical importance of this channel for younger customers.

- Digital Engagement: Younger consumers prefer interacting with brands through digital channels, including social media, mobile apps, and online ordering platforms.

- Mobile First Approach: A significant portion of this demographic utilizes mobile devices for browsing menus, placing orders, and tracking deliveries, making app development and optimization crucial.

- Personalized Marketing: Tailored promotions, loyalty programs, and content delivered through digital touchpoints resonate strongly with tech-savvy younger audiences.

- Convenience Driven: Speed, ease of use, and delivery options are paramount for younger customers, influencing their choice of dining establishments.

Carrols serves a broad customer base, with the general public seeking convenient fast food being its largest segment. This group prioritizes speed, affordability, and accessibility for everyday meals, whether for a quick lunch or a family dinner. In 2024, drive-thru sales, a key indicator of convenience, continued to grow, with many quick-service restaurants reporting over 70% of sales through this channel.

Budget-conscious consumers are another significant group, drawn to value and affordability. Carrols appeals to them through competitive pricing and value meal deals. 2024 data shows that value-seeking consumers drove strong sales in the fast-food industry, often responding to promotions and value menus.

On-the-go individuals and commuters rely on Carrols for quick service, especially via drive-thru. Families and groups also represent a key segment, valuing convenience and family-sized meal options. In 2024, family meal deals accounted for a substantial portion of quick-service restaurant transactions.

Younger demographics, Gen Z and Millennials, are crucial, preferring digital engagement and mobile ordering. By mid-2024, over 70% of digital orders for many quick-service chains came from mobile devices, underscoring the importance of a mobile-first strategy for Carrols to reach this tech-savvy audience.

Cost Structure

Food and paper costs represent Carrols' most significant expense, directly tied to the ingredients and packaging needed for their extensive menu. In 2024, like previous years, managing these variable costs effectively through strategic sourcing and supplier negotiations is paramount to profitability. For instance, fluctuations in commodity prices for beef, chicken, or potatoes can directly impact the bottom line, making robust supply chain partnerships essential.

Carrols Restaurant Group, a major franchisee of Burger King and Popeyes, faces substantial labor costs, a critical component of its business model. These expenses encompass wages, employee benefits, and ongoing training for its extensive workforce spread across numerous restaurant locations.

In 2024, the restaurant industry, including Carrols, continues to grapple with rising labor expenses. For instance, states like California have implemented significant minimum wage hikes, with some areas reaching $20 per hour for fast-food workers. This trend, coupled with broader labor shortages and increased competition for staff, directly impacts Carrols' operational costs and profitability.

Occupancy costs are a significant component of Carrols' expenses, encompassing rent for its numerous restaurant locations, utilities like electricity and water, and essential maintenance. For a company operating hundreds of restaurants, these fixed and variable costs directly impact profitability.

In 2024, the real estate landscape continued to present challenges, with rental rates for commercial properties remaining a key consideration. Carrols' ability to manage these occupancy expenses, through lease negotiations and efficient utility consumption, is crucial for maintaining its financial health and competitive pricing.

Franchise Fees and Royalties

As a franchisee, Carrols Corporation pays ongoing fees and royalties to Restaurant Brands International (RBI), the parent company of Burger King. These payments are essential for maintaining the right to operate under the Burger King brand, utilizing its trademarks, and accessing its established operational systems and marketing initiatives. These costs are typically calculated as a percentage of Carrols' total sales.

For instance, in 2023, Carrols reported significant revenue, and a portion of that revenue was allocated to these franchise fees and royalties. While specific royalty percentages can vary, they generally represent a crucial cost of doing business for franchisees. These ongoing payments ensure continued access to brand recognition and support services.

- Franchise Fees: Initial payments made to secure the franchise rights.

- Royalties: Ongoing payments, usually a percentage of gross sales, for brand usage and support.

- Marketing Funds: Contributions to national and regional advertising campaigns.

- Impact on Profitability: These fees directly reduce the net profit margin for Carrols as a franchisee.

Marketing and Advertising Expenses

Carrols' cost structure includes significant marketing and advertising expenses. While franchisor contributions cover some of these, Carrols also invests directly in local marketing campaigns, promotional materials, and national advertising fund contributions. These expenditures are critical for boosting sales and enhancing brand recognition.

In 2024, Carrols' commitment to marketing is evident in its ongoing efforts to attract customers. For instance, the company actively participates in promotional activities, which are essential for driving traffic to its numerous restaurant locations across various states.

- Local Marketing Initiatives: Carrols allocates funds for localized advertising and promotions to target specific market areas and drive foot traffic.

- Promotional Materials: Costs associated with creating and distributing flyers, in-store signage, and digital assets for various campaigns.

- National Advertising Funds: Contributions to broader advertising efforts managed by the franchisor, benefiting the overall brand.

- Sales Driving Activities: Marketing spend is directly tied to initiatives aimed at increasing same-store sales and customer engagement.

Carrols' cost structure is heavily influenced by its franchise agreements, requiring payments for royalties and marketing contributions to Burger King and Popeyes. These fees, typically a percentage of sales, are a direct cost of operating under established brands, impacting overall profitability. For example, in 2023, Carrols' substantial revenue meant significant royalty payments were made to the franchisor.

These franchise-related costs are critical for Carrols to maintain brand access, leverage marketing, and utilize operational systems. In 2024, managing these ongoing financial obligations remains a key aspect of their operational strategy to ensure continued brand alignment and customer recognition.

| Cost Category | Description | Impact on Carrols | 2024 Considerations |

|---|---|---|---|

| Franchise Fees & Royalties | Payments to RBI for brand usage and operational support. | Direct reduction of net profit margin. | Percentage of sales, directly tied to revenue performance. |

| Marketing Contributions | Funds for national and regional advertising campaigns. | Supports brand visibility and customer acquisition. | Essential for competing in a dynamic QSR market. |

Revenue Streams

Carrols Restaurant Group's main source of income is generated from selling food and drinks directly to customers at its Burger King restaurants. This includes both dine-in customers and those using the drive-thru service.

In 2023, Carrols reported total revenue of $1.7 billion, with the vast majority stemming from these in-restaurant sales. This highlights the critical importance of daily customer traffic and average check size in driving the company's financial performance.

Digital and delivery sales are a crucial revenue driver for Carrols, reflecting a significant shift in consumer behavior towards convenience. Orders placed via mobile apps, Carrols' online platform, and third-party delivery services like DoorDash and Uber Eats are increasingly contributing to the company's top line.

In 2024, digital channels, including delivery and carryout, continued to show robust growth, accounting for a substantial portion of Carrols' overall sales. This trend is supported by industry data showing a consistent rise in online food ordering, with projections indicating further expansion in the coming years.

Carrols Corporation, operating as a major franchisee of Burger King and Popeyes Louisiana Kitchen, leverages promotional activities to boost sales. In 2024, the company continued to focus on value-driven deals and limited-time offers to attract a broad customer base. These strategies are crucial for driving foot traffic and increasing the average transaction value, especially for price-conscious consumers.

Catering and Bulk Orders (if applicable)

While Carrols Restaurant Group's primary focus is on quick-service dining, larger fast-food operators often explore catering and bulk order opportunities. These can represent a valuable, albeit supplementary, revenue stream by serving events, corporate functions, or large gatherings.

For instance, in 2024, many quick-service chains reported growth in their catering segments. While specific figures for Carrols' catering revenue aren't publicly detailed, industry trends show its potential. For example, some major fast-food brands have seen their catering sales contribute a notable percentage to overall revenue, particularly during holiday seasons or major sporting events.

- Catering Services: Offering bundled meal packages for parties and corporate events.

- Bulk Orders: Facilitating large orders for businesses, schools, or community gatherings.

- Event Partnerships: Collaborating with local event organizers for exclusive food service.

- Potential Growth Area: Catering can tap into a different customer base and drive incremental sales.

Merchandise Sales (if applicable)

Merchandise sales, while generally a minor revenue stream for fast-food franchisees like Carrols, can play a role in brand engagement. For instance, in 2023, many quick-service restaurant chains reported that branded apparel and novelty items contributed to customer loyalty and brand visibility, even if their financial impact was marginal compared to core food sales.

This stream offers a way to deepen customer connection beyond the immediate transaction.

- Brand Extension: Merchandise allows customers to express their affiliation with the brand.

- Ancillary Revenue: While not primary, it adds to the overall revenue mix.

- Marketing Tool: Branded items act as walking advertisements.

- Customer Loyalty: Exclusive merchandise can foster a sense of belonging.

Carrols' revenue streams are primarily driven by direct sales of food and beverages from its Burger King and Popeyes locations. This core business is significantly boosted by digital orders, including mobile app purchases and third-party delivery services, which saw continued robust growth throughout 2024. The company also actively uses promotional offers and value deals to attract customers and increase transaction sizes.

While not as substantial as core sales, Carrols explores ancillary revenue through catering services and bulk orders for events and businesses, reflecting a broader industry trend. Merchandise sales, though minor, serve to enhance brand engagement and customer loyalty.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| In-Restaurant Sales | Direct sales of food and beverages to dine-in and drive-thru customers. | Remains the largest contributor to overall revenue. In 2023, total revenue was $1.7 billion, with the majority from these sales. |

| Digital & Delivery Sales | Orders placed via mobile apps, online platforms, and third-party delivery services. | Showed robust growth in 2024, accounting for a substantial portion of sales, driven by increasing consumer preference for convenience. |

| Promotional Activities | Value-driven deals, limited-time offers, and combo meals. | Crucial for driving foot traffic and increasing average transaction value, especially in 2024. |

| Catering & Bulk Orders | Providing food for parties, corporate events, and large gatherings. | Represents a supplementary revenue stream, with industry trends showing growth in this segment for fast-food operators in 2024. |

| Merchandise Sales | Branded apparel, novelty items, and other company-branded products. | A minor stream in 2023, primarily used for brand engagement and fostering customer loyalty. |

Business Model Canvas Data Sources

The Carrols Business Model Canvas is built upon extensive financial disclosures, detailed market research reports, and internal operational data. These sources provide a comprehensive view of revenue streams, cost structures, and customer engagement.