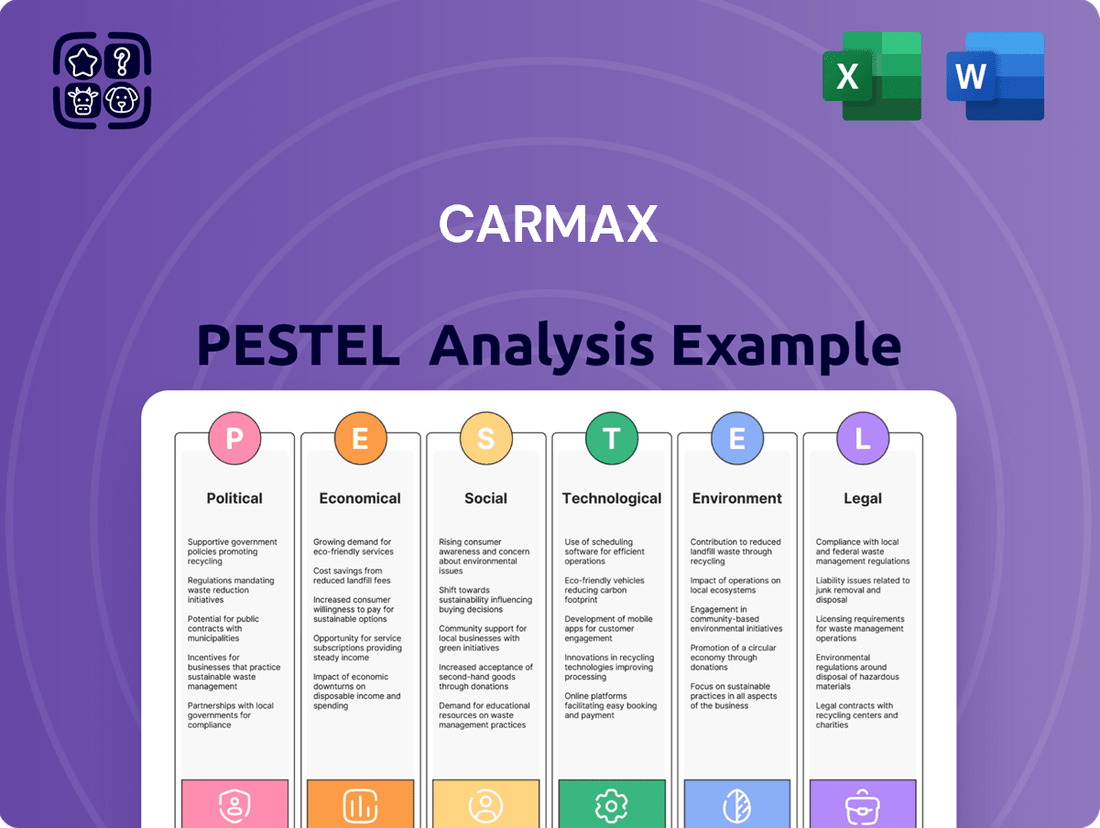

CarMax PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CarMax Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping CarMax's journey. Our expertly crafted PESTLE analysis provides a clear roadmap of these external forces, empowering you to anticipate challenges and seize opportunities. Gain a competitive edge by understanding the full picture—download the complete version now.

Political factors

CarMax, a major player in used car sales and financing, navigates a complex web of federal and state regulations impacting vehicle transactions and consumer credit. For instance, the Consumer Financial Protection Bureau (CFPB) actively monitors lending practices, and any shifts in their enforcement or new rules on interest rate disclosures or financing terms could directly influence CarMax's auto finance division. In 2023, the automotive retail sector saw continued scrutiny on data privacy, with states like California enacting stricter consumer data protection laws, which CarMax must adhere to in its customer interactions and online platforms.

Global trade policies, particularly tariffs on imported vehicles and automotive parts, can significantly impact the cost structure within the automotive industry. While CarMax focuses on used vehicles, these tariffs can indirectly affect the availability and pricing of vehicles entering the used car market by influencing new car sales and trade-in volumes. For instance, a 25% tariff on imported vehicles, as discussed by the U.S. in recent years, could lead to higher prices for new cars, potentially increasing the supply of trade-ins but also raising the baseline cost for acquiring inventory.

Stricter consumer protection laws, especially those focusing on vehicle safety and pre-owned car sales disclosures, present a significant political factor for CarMax. These regulations, often evolving, can increase compliance burdens and operational costs. For instance, enhanced Lemon Laws or mandated transparency around vehicle history reports require CarMax to invest more in rigorous inspection and reconditioning processes.

Environmental Regulations and Incentives for EVs

Governmental mandates and incentives are significantly shaping the used electric vehicle (EV) market, a key area for CarMax. For instance, the Inflation Reduction Act in the United States continues to offer tax credits for qualifying new and used EVs, influencing consumer purchasing power and the overall demand for these vehicles. As of early 2024, these credits remain a substantial driver, encouraging a shift towards electric mobility and consequently impacting the supply and resale value of used EVs that CarMax handles.

Changes in these policies, such as potential adjustments to federal tax credits or increased state-level rebates for EV purchases, directly influence consumer preferences and CarMax's strategic approach to acquiring and selling used EVs. For example, a reduction in tax credits could dampen demand for used EVs, while investments in expanding charging infrastructure, like those supported by the Bipartisan Infrastructure Law, could bolster consumer confidence and the long-term viability of the used EV market for retailers like CarMax.

Specific policy impacts include:

- Federal Tax Credits: The continued availability of up to $7,500 for new EVs and up to $4,000 for used EVs (under certain conditions) directly affects affordability and resale values.

- State-Level Incentives: Many states offer additional rebates and tax credits, creating regional demand variations for used EVs. For example, California's Clean Vehicle Rebate Project has historically driven significant EV adoption.

- Charging Infrastructure Investment: Government funding for public charging stations aims to alleviate range anxiety, making used EVs a more attractive option for a broader consumer base.

- Emissions Standards: Increasingly stringent emissions regulations for internal combustion engine vehicles indirectly promote EV adoption, thereby influencing the long-term availability and desirability of used EVs.

Political Stability and Economic Policy

Broader political stability significantly influences consumer confidence and spending on major purchases like vehicles. Government economic policies, including fiscal measures and monetary strategies, play a crucial role. For instance, the Federal Reserve's decisions on interest rates directly affect the cost of financing for CarMax customers, impacting demand for used cars and the company's own financing operations. In 2024, the ongoing adjustments to monetary policy aimed at controlling inflation, with interest rates remaining elevated compared to recent years, have presented a more challenging environment for big-ticket purchases.

Government actions concerning inflation, employment, and overall economic health indirectly shape the market for used vehicles. A stable political climate fosters consumer optimism, leading to increased spending. Conversely, political uncertainty can dampen consumer sentiment, potentially reducing sales for companies like CarMax. The economic outlook for 2025 will be heavily influenced by how effectively these political and economic policies manage inflation and support job growth, directly impacting CarMax's revenue streams.

- Interest Rate Environment: The Federal Reserve maintained its target federal funds rate in the range of 5.25%-5.50% through early 2024, impacting auto loan affordability.

- Inflation Control Efforts: Government focus on managing inflation influences consumer purchasing power and the overall economic landscape for automotive sales.

- Employment Data: Strong employment figures generally correlate with higher consumer confidence and increased demand for vehicles, benefiting CarMax.

Government regulations, particularly those from agencies like the Consumer Financial Protection Bureau (CFPB), directly impact CarMax's financing operations by shaping lending practices and disclosure requirements. Ongoing scrutiny of data privacy laws, such as California's CCPA, necessitates robust adherence to protect customer information. Furthermore, evolving consumer protection laws, especially concerning vehicle safety and sales transparency, increase compliance burdens and operational costs for CarMax.

Governmental incentives and policies significantly influence the used electric vehicle (EV) market, a growing segment for CarMax. The Inflation Reduction Act continues to provide tax credits for used EVs, boosting consumer demand and affecting resale values. For instance, as of early 2024, these credits remain a key factor in EV affordability. Changes in these incentives, alongside investments in charging infrastructure, will continue to shape the long-term viability and desirability of used EVs.

Political stability and economic policies are paramount for consumer confidence and vehicle purchasing. The Federal Reserve's monetary policy, including interest rate decisions, directly impacts the affordability of auto loans for CarMax customers. Elevated interest rates observed through early 2024 present a more challenging market for big-ticket purchases.

| Factor | Impact on CarMax | Example Data/Trend (2023-2025) |

|---|---|---|

| Consumer Protection Laws | Increased compliance costs, stricter sales practices | Continued enforcement of disclosure requirements for vehicle history and condition. |

| EV Incentives (e.g., IRA) | Boosts demand for used EVs, influences resale values | Used EV tax credit up to $4,000 remains a key driver for affordability (as of early 2024). |

| Monetary Policy (Interest Rates) | Affects auto loan affordability and consumer spending | Federal Reserve's federal funds rate target remained 5.25%-5.50% through early 2024, impacting loan costs. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing CarMax's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on CarMax's market position and future growth.

A concise PESTLE analysis for CarMax, presented in an easily digestible format, alleviates the pain of information overload by providing key external factors impacting the business, enabling swift strategic decision-making.

Economic factors

Rising interest rates directly affect CarMax's financing arm, CarMax Auto Finance (CAF), and the ability of consumers to afford used cars. As borrowing costs increase, car loans become pricier, which can lead to lower demand for vehicles.

For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023, bringing the federal funds rate from near zero to over 5%, have made auto loans more expensive. This environment pressures CarMax by potentially increasing their loan loss provisions as more consumers may struggle with higher monthly payments.

Used car prices, a significant economic factor for CarMax, have shown a notable shift. While the frenzied price increases seen during the pandemic have cooled, data from Cox Automotive indicated that the average price for used vehicles in early 2024 remained roughly 30% higher than pre-pandemic averages. This sustained elevation impacts CarMax's ability to acquire inventory affordably and maintain healthy profit margins.

CarMax's revenue and gross profit are directly tied to these fluctuating used car prices. Although wholesale prices have seen a downward trend from their 2022 peaks, the retail market still reflects elevated values. For instance, Manheim's Used Vehicle Value Index, a benchmark for wholesale used car prices, showed a decrease of over 10% from its peak in early 2022 through early 2024, but it still sits considerably above historical norms.

The company's success hinges on its inventory management strategy. CarMax must effectively source vehicles at competitive prices and then remarket them to consumers at rates that are attractive yet profitable. Navigating this balance is critical, especially as consumer demand and economic conditions continue to evolve throughout 2024 and into 2025.

Economic headwinds, including persistent inflation and elevated living expenses, are making consumers more mindful of their budgets. This trend directly fuels a greater demand for more affordable used vehicles, a segment where CarMax operates. For instance, in the fiscal year ending February 29, 2024, CarMax reported total revenue of $22.07 billion, reflecting the ongoing consumer engagement with the used car market despite economic pressures.

Consumer purchasing power significantly impacts CarMax's sales volumes. When consumers feel financially secure, they are more likely to invest in a used car. Conversely, economic uncertainty can lead them to delay purchases or opt for lower-priced options, directly affecting CarMax's ability to move inventory and generate revenue.

Supply Chain Dynamics

While new car production has largely recovered, ongoing supply chain disruptions continue to influence the availability of newer used vehicles. This directly impacts CarMax's ability to maintain robust inventory levels, especially for models that are only a few years old, thereby affecting pricing strategies in the pre-owned market.

CarMax must actively manage these evolving supply dynamics to ensure it can offer a diverse and desirable selection of used cars to its customer base. For instance, in late 2023 and early 2024, the lingering effects of semiconductor shortages and logistical bottlenecks from previous years still contributed to a tighter supply of late-model used vehicles, a trend expected to persist in some segments through 2024.

- Persistent, though easing, global supply chain issues can still limit the influx of younger, high-demand used vehicles.

- This directly influences CarMax's inventory acquisition costs and the overall pricing of its used car stock.

- The company's success hinges on its agility in sourcing vehicles amidst these ongoing supply chain volatilities.

Competition and Market Share

CarMax navigates a highly competitive used car landscape. Economic downturns can amplify this rivalry, as dealerships and burgeoning online retailers aggressively pursue market share. For instance, in fiscal year 2023, CarMax reported total revenue of $28.1 billion, demonstrating its significant presence but also highlighting the vastness of the market it competes within.

CarMax's sustained profitability and expansion hinge on its capacity to stand out from competitors and secure a greater slice of the used vehicle market. This involves strategic differentiation in areas like customer experience and vehicle quality.

- Competitive Landscape: CarMax faces intense competition from traditional dealerships, independent used car lots, and rapidly growing online platforms.

- Market Share Focus: Capturing and expanding market share is crucial for CarMax's long-term financial health and growth trajectory in the dynamic used car industry.

- Economic Impact: Economic conditions directly influence consumer spending on vehicles, potentially intensifying competition as businesses fight for a smaller pool of buyers.

Rising interest rates continue to impact CarMax by increasing borrowing costs for consumers, which can dampen demand for used vehicles. The Federal Reserve's monetary policy decisions throughout 2024, aiming to manage inflation, will be a key factor influencing auto loan affordability and, consequently, CarMax's sales volume.

Used car prices, while moderating from pandemic highs, remain elevated compared to pre-2020 levels. Data from Cox Automotive in early 2024 showed average used car prices still approximately 30% higher than pre-pandemic averages, affecting CarMax's inventory acquisition costs and retail pricing strategies.

Inflationary pressures and the cost of living continue to make consumers budget-conscious, driving demand towards more affordable used cars, a core segment for CarMax. The company's total revenue for the fiscal year ending February 29, 2024, was $22.07 billion, reflecting ongoing consumer activity in the used car market despite economic headwinds.

CarMax's financial performance is closely tied to consumer purchasing power and confidence. Economic uncertainty can lead consumers to postpone vehicle purchases or seek lower-priced options, directly impacting CarMax's inventory turnover and revenue generation throughout 2024 and into 2025.

| Economic Factor | Impact on CarMax | Data Point/Trend (2024/2025 Focus) |

|---|---|---|

| Interest Rates | Increased borrowing costs, potentially lower demand | Federal funds rate maintained above 5% through early 2024; continued scrutiny on Fed policy |

| Used Car Prices | Elevated acquisition costs, pricing pressure | Average used car prices ~30% above pre-pandemic levels (early 2024) |

| Inflation & Consumer Spending | Demand for affordability, budget consciousness | Total revenue $22.07 billion (FY ending Feb 29, 2024) |

Preview the Actual Deliverable

CarMax PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive CarMax PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive retail giant. Understand the market dynamics and strategic considerations that shape CarMax's operations.

Sociological factors

Consumers are increasingly opting for pre-owned vehicles as a budget-friendly choice over new car purchases, a trend amplified by persistent inflation and economic uncertainty. This shift is particularly noticeable in the demand for fuel-efficient compact cars and versatile SUVs, reflecting a desire for practicality and lower running costs. For instance, in early 2024, the average price for a used car remained significantly lower than a new one, making it an attractive option for many households.

Consumers are increasingly seeking digital-first car buying journeys, valuing convenience and transparency. Surveys in late 2024 indicated that over 60% of car shoppers preferred to start their research and purchase process online, a trend that accelerated throughout 2024.

CarMax's investment in its omnichannel platform, allowing seamless transitions between online browsing and in-person experiences, directly addresses this growing demand. This integration is key to capturing market share as digital adoption continues to rise.

Consumers are increasingly seeking Certified Pre-Owned (CPO) vehicles, driven by a desire for greater assurance and reliability. This trend is fueled by the comprehensive inspections and extended warranties that CPO programs typically offer, significantly reducing perceived risk for buyers. For instance, in 2024, the CPO market continued to show robust growth, with sales figures indicating strong consumer preference for these vehicles.

CarMax is well-positioned to leverage this growing demand by further enhancing its CPO offerings and clearly communicating the value proposition to potential customers. By emphasizing the rigorous inspection process and the peace of mind that comes with their CPO warranties, CarMax can solidify its reputation and attract a larger segment of this expanding market. The company's commitment to transparency in its CPO program is a key differentiator that resonates with today's discerning car buyers.

Environmental Consciousness and EV Adoption

Consumers are increasingly prioritizing sustainability, leading to a surge in demand for electric vehicles (EVs) and hybrids, even in the pre-owned sector. This societal shift directly impacts the automotive industry, including used car retailers like CarMax.

CarMax is strategically positioning itself to capitalize on this trend by enhancing its expertise in used EVs and broadening its inventory. For instance, in fiscal year 2024, CarMax reported a significant increase in its EV sales, reflecting growing consumer interest and the company's commitment to this segment.

- Growing Consumer Demand: Surveys from 2024 indicate that over 60% of potential car buyers are considering an EV or hybrid for their next purchase, a notable rise from previous years.

- CarMax's EV Strategy: The company aims to double its EV inventory by the end of 2025, investing in technician training and charging infrastructure at its locations.

- Market Alignment: This focus aligns with broader societal goals for reduced emissions and energy independence, making environmentally conscious choices more appealing to a wider demographic.

Demographic Shifts and Buying Behavior

Younger generations, particularly Gen Z and Millennials, are increasingly driving demand in the used and certified pre-owned (CPO) vehicle markets. These buyers often prioritize value and are actively seeking affordable, reliable transportation for immediate needs. For instance, data from 2024 indicates a continued trend of younger consumers exploring used car options due to economic considerations.

Multicultural demographics also represent a significant and growing segment of the automotive market, with a pronounced interest in used and CPO vehicles. Their purchasing decisions are often influenced by factors like affordability, brand reputation, and the availability of flexible financing options. CarMax's ability to adapt its offerings and marketing to resonate with these diverse groups is crucial for sustained market share gains.

Key demographic trends impacting CarMax include:

- Growing Gen Z and Millennial Market Share: These age groups are projected to account for a larger percentage of car buyers in the coming years, with a strong preference for used and CPO vehicles.

- Increased Demand for Value: Economic factors continue to push consumers towards more budget-friendly options, making the used car market particularly attractive.

- Multicultural Consumer Growth: The expanding multicultural consumer base presents a significant opportunity for dealerships that can effectively cater to their unique needs and preferences.

- Near-Term Purchase Intent: A notable portion of younger and multicultural buyers are looking to make vehicle purchases in the short term, highlighting the need for readily available inventory and efficient sales processes.

Societal shifts are significantly influencing the automotive market, with a growing preference for pre-owned vehicles driven by affordability and economic uncertainty. Surveys in late 2024 showed over 60% of car shoppers favored online research, a trend CarMax's omnichannel approach addresses effectively.

Consumers increasingly value reliability, boosting demand for Certified Pre-Owned (CPO) vehicles, a segment CarMax is well-positioned to capture by highlighting its rigorous inspection and warranty processes.

Sustainability concerns are fueling demand for used EVs and hybrids, with CarMax reporting a significant increase in EV sales in fiscal year 2024 and planning to double its EV inventory by the end of 2025.

Younger demographics, Gen Z and Millennials, along with multicultural consumers, are increasingly dominating the used car market, prioritizing value and readily available inventory, presenting a key growth opportunity for CarMax.

| Sociological Factor | Trend Description | 2024/2025 Data/Projection |

|---|---|---|

| Affordability Focus | Consumers prioritize budget-friendly options due to inflation. | Used car prices remained significantly lower than new cars in early 2024. |

| Digital Preference | Desire for convenient, transparent online car buying. | Over 60% of car shoppers preferred online research in late 2024. |

| Reliability Assurance | Increased demand for CPO vehicles due to inspections and warranties. | CPO market showed robust growth in 2024. |

| Sustainability | Growing interest in used EVs and hybrids. | CarMax reported significant EV sales increase in FY2024; aims to double EV inventory by end of 2025. |

| Demographic Shifts | Younger generations (Gen Z, Millennials) and multicultural groups are key buyers. | These groups represent a growing share of used car buyers with near-term purchase intent. |

Technological factors

CarMax is heavily investing in its digital retail and omnichannel capabilities to meet evolving customer demands. The company's platform allows for a smooth transition between online research, vehicle selection, financing applications, and in-store pickup or delivery. This focus on digital integration is crucial as a significant portion of car shoppers begin their journey online; for instance, in 2023, CarMax reported that over 70% of their customers interacted with their digital tools before visiting a store.

CarMax is heavily investing in artificial intelligence and data science to refine its operations and customer experience. For instance, AI is being used to generate more accurate vehicle condition reports for wholesale auctions, a critical step in their remarketing process.

In the retail space, these technologies are personalizing the car-buying journey. AI-driven recommendations help customers find suitable vehicles, and advancements in digital checkout are streamlining the purchase process, with CarMax reporting a significant increase in online sales conversion rates in late 2023.

Technological advancements in vehicle reconditioning and service are crucial for CarMax's efficiency and cost management. For instance, AI-powered diagnostic tools can speed up vehicle inspections, potentially reducing reconditioning time by up to 15% compared to traditional methods. Investing in advanced paint repair systems and automated detailing equipment can also significantly improve the quality of their used car inventory and the speed of service delivery.

Development of Electric Vehicle (EV) Infrastructure and Expertise

CarMax is actively investing in its electric vehicle (EV) capabilities to align with the growing used EV market. This includes enhancing store infrastructure to service and sell EVs, as well as expanding consumer resources to educate buyers about electric options. By 2024, CarMax reported that over 20% of its inventory was hybrid or electric, demonstrating a significant commitment to this segment.

The company is also exploring innovative logistics solutions, such as piloting all-electric semi-trucks for vehicle transport, aiming to reduce its carbon footprint. Furthermore, CarMax is forging strategic partnerships focused on EV charging infrastructure, recognizing its importance for customer convenience and the broader adoption of EVs. These initiatives position CarMax to capitalize on the evolving automotive landscape.

- EV Infrastructure Investment: CarMax is upgrading its physical locations to accommodate EV servicing and sales.

- Logistics Innovation: Piloting electric semi-trucks for vehicle transportation.

- Consumer Education: Expanding resources to support EV buyers.

- Market Growth: Over 20% of CarMax's inventory was hybrid or electric in 2024.

Cybersecurity and Data Protection

CarMax's reliance on digital platforms for sales, financing, and customer engagement makes robust cybersecurity and data protection critical. In 2023, the automotive retail sector, like many others, faced an escalating threat landscape, with data breaches becoming increasingly sophisticated and costly. For CarMax, safeguarding sensitive customer information, including personal details and financial data, is paramount to maintaining consumer trust and brand reputation.

The company's commitment to data protection is not only a matter of customer service but also a necessity for regulatory compliance. Failing to protect data can lead to significant fines and legal repercussions, especially under evolving privacy laws. For instance, the increasing stringency of regulations like GDPR and CCPA underscores the need for continuous investment in advanced security technologies and protocols. CarMax's 2023 financial reports indicated ongoing investments in IT infrastructure, which would naturally encompass cybersecurity enhancements to mitigate these risks.

- Data Breach Costs: The average cost of a data breach in the US reached $9.48 million in 2023, highlighting the financial imperative for strong cybersecurity.

- Customer Trust: A significant percentage of consumers report they would stop doing business with a company after a data breach, emphasizing the link between security and customer loyalty.

- Regulatory Fines: Non-compliance with data protection regulations can result in substantial penalties, impacting profitability and operational continuity.

- Online Transaction Security: Ensuring the integrity and security of online financing applications and vehicle purchase transactions is vital for CarMax's business model.

Technological advancements are reshaping CarMax's operations, from digital sales platforms to AI-driven efficiency. The company's investment in omnichannel capabilities, where over 70% of customers interacted digitally in 2023, underscores this shift. AI is also enhancing vehicle condition reports and personalizing the customer journey, with improved online sales conversion rates noted in late 2023.

Further technological integration is seen in vehicle reconditioning, where AI diagnostics can reduce inspection times by up to 15%. CarMax is also embracing the electric vehicle (EV) market, with over 20% of its inventory being hybrid or electric by 2024, and is piloting electric transport solutions.

Robust cybersecurity is paramount given CarMax's digital reliance; the average US data breach cost $9.48 million in 2023. Protecting customer data is crucial for trust and regulatory compliance, with ongoing IT infrastructure investments reflecting this priority.

Legal factors

CarMax Auto Finance (CAF) operates under strict consumer credit and lending regulations. These rules, which cover everything from underwriting standards to how loan losses are accounted for, directly affect CAF's financial health and day-to-day business. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) continued its focus on fair lending practices, issuing guidance that could lead to increased compliance costs for auto lenders.

Any shifts in these regulations, or even just more intense oversight, can significantly influence CAF's profitability. For example, if new rules require more stringent credit checks or higher capital reserves, it could reduce the volume of loans CAF can originate or increase its operating expenses. The regulatory environment is dynamic, and staying ahead of these changes is crucial for maintaining stable operations and profitability.

CarMax must navigate a complex web of vehicle safety and emissions regulations, which impact both new and used car sales. For instance, the EPA's emissions standards, continually updated, require diligent reconditioning to ensure compliance, potentially affecting the cost and availability of certain vehicle models in their inventory. Failure to meet these standards, such as those outlined by NHTSA for safety, can lead to significant fines and damage to brand reputation.

CarMax, with its extensive online platform and collection of customer data, faces increasing scrutiny under evolving data privacy and protection laws. Regulations like the California Consumer Privacy Act (CCPA), as amended by the California Privacy Rights Act (CPRA), significantly impact how companies handle personal information. Failure to comply can lead to substantial penalties, with CCPA civil penalties reaching up to $7,500 per intentional violation, as of 2024.

Maintaining robust data security and transparent privacy practices is paramount for CarMax not only to avoid legal repercussions but also to foster and retain customer trust in its online transactions and services. As of early 2025, data breach notification laws are in effect in all 50 U.S. states, requiring timely reporting of compromised personal information.

Litigation and Legal Scrutiny

CarMax navigates a landscape of potential litigation, including scrutiny over its financial reporting and business practices. Such legal challenges, particularly if they involve securities fraud allegations, can significantly affect its stock performance and brand reputation. For instance, in 2023, CarMax faced shareholder lawsuits alleging misleading statements about its financial condition and future prospects, highlighting the constant need for stringent compliance and governance.

The company's commitment to robust legal compliance is paramount. This includes adhering to evolving consumer protection laws and industry regulations. Any missteps in these areas can lead to costly penalties and reputational damage, impacting investor confidence and operational stability.

- Securities Litigation: CarMax has been subject to shareholder class-action lawsuits alleging violations of federal securities laws, impacting its stock price and requiring significant legal defense resources.

- Regulatory Compliance: Ongoing adherence to consumer protection laws, such as those governing auto sales and financing, is critical to avoid fines and legal challenges.

- Operational Scrutiny: Business practices, including inventory management and sales processes, can attract legal review, necessitating strong internal controls and ethical conduct.

Advertising and Marketing Regulations

Advertising and marketing regulations in the automotive sector demand a high degree of transparency and factual accuracy from companies like CarMax. This means all claims made in advertisements, whether online, in print, or on television, must be substantiated and not misleading to consumers. Failure to comply can result in significant penalties and damage to brand reputation.

CarMax must navigate a complex web of federal and state laws governing advertising. For instance, the Federal Trade Commission (FTC) enforces rules against deceptive advertising practices. In 2024, the FTC continued its focus on ensuring truthfulness in advertising, particularly concerning pricing and financing offers, which are critical components of used car sales.

Key considerations for CarMax include:

- Truthful Representation: Ensuring all vehicle descriptions, pricing, and financing terms are accurate and clearly communicated.

- Disclosure Requirements: Complying with regulations that mandate specific disclosures, such as vehicle history reports or warranty information.

- Endorsement and Testimonial Rules: Properly disclosing any material connections when using endorsements or testimonials in marketing campaigns.

- Data Privacy: Adhering to regulations like the California Consumer Privacy Act (CCPA) when collecting and using customer data for marketing purposes.

CarMax operates under a stringent legal framework encompassing consumer protection, financial services, and environmental regulations. Compliance with these laws is vital to avoid penalties and maintain operational integrity. For example, the company must adhere to fair lending practices, as enforced by bodies like the Consumer Financial Protection Bureau (CFPB), which in 2023 continued its focus on preventing discriminatory lending.

Furthermore, CarMax faces increasing scrutiny regarding data privacy, with regulations like the California Consumer Privacy Act (CCPA) imposing strict rules on how customer information is handled. As of 2024, CCPA civil penalties can reach up to $7,500 per intentional violation, underscoring the financial risk associated with non-compliance. Navigating these evolving legal requirements is critical for CarMax's reputation and financial stability.

Environmental factors

CarMax has set an ambitious goal to slash its Scope 1 and Scope 2 greenhouse gas emissions by half before the end of 2025, using 2018 as its benchmark year. This commitment is a significant part of their broader environmental strategy.

To achieve these reductions, CarMax is focusing on practical measures such as boosting its reliance on renewable electricity sources and implementing more sustainable practices for managing its vehicle fleet and logistics operations.

CarMax is actively increasing its reliance on renewable energy sources to power its operations. This includes the adoption of LED lighting across its stores, which significantly reduces energy consumption. Furthermore, the company is leveraging wind and biogas as key components of its energy strategy.

A significant indicator of this commitment is CarMax's 2024 performance, where 65% of its total electricity consumption was sourced from renewable origins. This substantial percentage underscores a tangible effort towards environmental sustainability and reducing its carbon footprint.

CarMax is making strides in sustainable fleet management, notably by piloting its first all-electric semi-truck for vehicle transportation. This initiative is a key part of their strategy to lessen reliance on external logistics providers and actively reduce their Scope 3 emissions, which are indirect emissions from their value chain.

In 2023, the transportation sector accounted for approximately 29% of total U.S. greenhouse gas emissions, highlighting the significant environmental impact of fleet operations. CarMax's move towards electric vehicles directly addresses this issue, aiming to contribute to a cleaner transportation ecosystem.

Waste Reduction and Recycling Initiatives

CarMax's commitment to environmental responsibility likely extends to robust waste reduction and recycling programs across its operations. In 2023, the U.S. generated approximately 300 million tons of municipal solid waste, highlighting the significant environmental impact of retail operations. CarMax's reconditioning centers, where vehicles undergo thorough inspections and repairs, present a prime opportunity for implementing comprehensive recycling of materials like scrap metal, tires, and fluids.

Furthermore, retail locations can focus on reducing packaging waste and promoting recycling of common materials such as cardboard and plastics. Many leading retailers have set ambitious targets; for instance, Target aimed to achieve 100% recyclable, reusable, or compostable owned-brand plastic packaging by 2025. CarMax's environmental strategy would ideally incorporate similar initiatives to minimize its ecological footprint.

- Waste Diversion: Implementing programs to divert materials from landfills in reconditioning centers, such as metals, plastics, and automotive fluids.

- Recycling Programs: Establishing comprehensive recycling streams for packaging, paper, and other consumables at all retail and corporate locations.

- Sustainable Sourcing: Exploring options for sourcing recycled or sustainably produced materials for operational needs.

- Employee Engagement: Educating and engaging employees in waste reduction and recycling efforts to foster a culture of sustainability.

Impact of Climate Change and Extreme Weather Events

Climate change and extreme weather events pose a tangible threat to CarMax's business. Disruptions to vehicle transportation, such as flooding or severe storms impacting logistics routes, can delay inventory movement. Furthermore, severe weather can lead to direct damage to the company's extensive vehicle inventory, resulting in significant repair or write-off costs. For instance, in 2024, regions experiencing unprecedented hurricane activity saw increased insurance claims for vehicle damage, a trend that could affect CarMax's operational costs and inventory valuation.

CarMax actively works to identify and manage these climate-related risks as part of its broader environmental strategy. This includes assessing vulnerabilities in its supply chain and physical locations to extreme weather patterns. The company's commitment to sustainability also involves exploring ways to mitigate its own environmental footprint, which indirectly addresses the root causes of climate change.

The impact on consumer demand is also a critical consideration. Regions heavily affected by extreme weather may see temporary dips in car sales as consumers prioritize immediate needs or face economic hardship. Conversely, increased demand for certain vehicle types, like those with enhanced weather resilience, could emerge in vulnerable areas. For example, following severe flooding events in late 2024, there was a reported uptick in interest for SUVs and vehicles with higher ground clearance in affected coastal communities.

Key environmental considerations for CarMax include:

- Supply Chain Resilience: Assessing and mitigating risks associated with weather-related disruptions to vehicle transportation and parts delivery.

- Inventory Protection: Implementing measures to safeguard vehicle inventory at dealerships and storage facilities from extreme weather damage.

- Consumer Demand Shifts: Monitoring how climate events influence consumer preferences for vehicle types and purchasing behavior.

- Operational Footprint: Continuing efforts to reduce greenhouse gas emissions and promote sustainable practices across all operations.

CarMax is actively reducing its environmental impact, aiming for a 50% cut in Scope 1 and 2 greenhouse gas emissions by the end of 2025, using 2018 as a baseline. The company is increasing its use of renewable energy, with 65% of its electricity consumption coming from renewable sources in 2024. They are also piloting an all-electric semi-truck to lower emissions from vehicle transportation.

CarMax's environmental strategy includes robust waste reduction and recycling programs across its operations, aiming to minimize its ecological footprint. This involves diverting materials from landfills at reconditioning centers and establishing comprehensive recycling streams at all locations.

Climate change poses risks through potential disruptions to vehicle transportation and damage to inventory from extreme weather events. CarMax is assessing these vulnerabilities and working to mitigate its own environmental footprint.

Consumer demand can also shift due to climate events, influencing preferences for certain vehicle types. CarMax monitors these trends to adapt its offerings and business strategies.

| Environmental Factor | CarMax's Action/Impact | Relevant Data (2023-2025) |

| Greenhouse Gas Emissions | Targeting 50% reduction in Scope 1 & 2 by end of 2025 (vs. 2018 baseline) | 65% of electricity from renewables in 2024 |

| Renewable Energy Use | Increasing reliance on renewables for operations | Adoption of LED lighting, use of wind and biogas |

| Fleet Management | Reducing emissions from vehicle transportation | Piloting first all-electric semi-truck |

| Waste Management | Implementing waste reduction and recycling programs | Focus on recycling at reconditioning centers and retail locations |

| Climate Change Risks | Assessing and managing risks from extreme weather | Potential impact on transportation, inventory, and consumer demand |

PESTLE Analysis Data Sources

Our CarMax PESTLE analysis is built on a robust foundation of data from official government sources, automotive industry reports, and leading economic and market research firms. We incorporate insights from regulatory bodies, consumer trend surveys, and technological innovation forecasts to ensure a comprehensive understanding of the macro-environment.