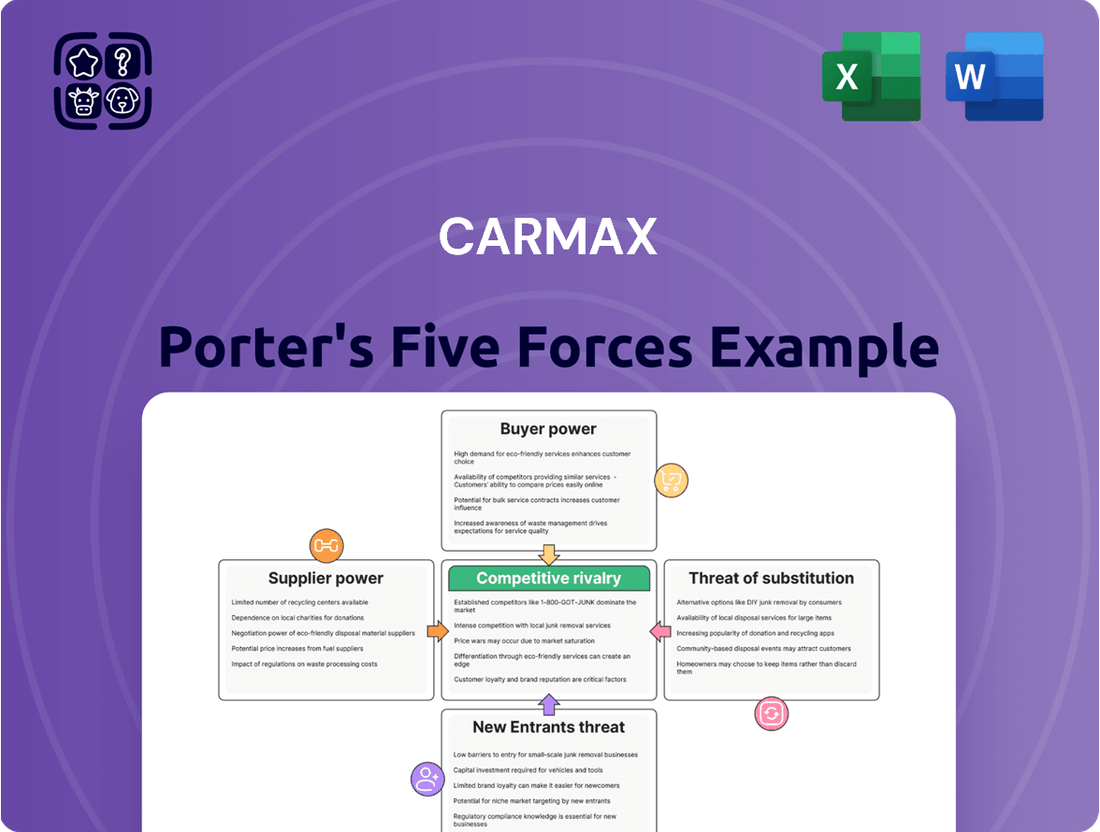

CarMax Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CarMax Bundle

CarMax navigates a dynamic automotive retail landscape where buyer power is significant due to readily available alternatives and price sensitivity. The threat of new entrants is moderate, requiring substantial capital and established brand trust to compete effectively.

The complete report reveals the real forces shaping CarMax’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CarMax benefits from diverse vehicle sourcing channels, mitigating supplier bargaining power. They acquire vehicles through customer trade-ins, wholesale auctions, and direct purchases from both consumers and dealers. This multi-pronged strategy means CarMax isn't overly dependent on any one source.

For example, in fiscal year 2024, CarMax successfully purchased 1.1 million vehicles directly from consumers and dealers. This substantial volume highlights their ability to tap into various supply streams, further solidifying their position against individual suppliers looking to exert undue influence.

The bargaining power of suppliers for CarMax is significantly weakened by a highly fragmented supplier base. This includes individual car owners selling their vehicles, numerous independent dealerships, and various auction houses.

This wide dispersion of sources means that CarMax is not reliant on any single supplier or a small group of suppliers, effectively limiting their ability to dictate terms or prices.

In 2023, CarMax sourced a substantial portion of its inventory through auctions and trade-ins, reflecting the diverse channels available. For instance, auction sales represented a significant segment of their wholesale vehicle dispositions, underscoring the availability of supply from multiple avenues.

CarMax experiences low switching costs when sourcing vehicles, meaning it can easily move between different suppliers or acquisition methods. For instance, if wholesale auctions become less attractive due to higher prices, CarMax can pivot to its own customer trade-ins or online purchasing platforms. This agility significantly reduces the leverage any single supplier or sourcing channel holds over CarMax.

Limited Manufacturer Concentration Impact on Used Vehicles

While a few major automakers control the new car market, their direct sway over CarMax's used vehicle supply is somewhat diluted. CarMax's core business is in pre-owned vehicles, meaning the original manufacturer's impact on pricing and availability is more indirect, stemming from the new car market's dynamics.

This indirect influence means manufacturers have less leverage to dictate terms or prices for used cars, as CarMax sources from a broad spectrum of individual sellers and trade-ins, not directly from the manufacturers for its used inventory.

- Manufacturer Concentration vs. Used Car Market: While the new car market sees significant concentration with brands like Toyota, General Motors, and Stellantis holding substantial market share, this concentration doesn't translate to direct control over CarMax's used vehicle supply.

- Indirect Impact on Supply: Manufacturer production levels and pricing strategies for new vehicles do influence the overall volume and price of used cars entering the market, but this is a secondary effect. For instance, in 2024, new vehicle sales in the US are projected to remain strong, which could eventually lead to more trade-ins, potentially increasing used car inventory.

- CarMax's Sourcing Strategy: CarMax's ability to source vehicles from a wide range of consumers and auctions lessens any single manufacturer's bargaining power over its inventory.

CarMax's Scale and Market Position

CarMax's position as the largest retailer of used vehicles in the U.S. grants it significant leverage with suppliers. Its massive purchasing volume, evidenced by the acquisition of 726,937 vehicles in 2023 alone, translates into substantial bargaining power.

This scale allows CarMax to negotiate more favorable terms and pricing from its suppliers. For instance, in fiscal year 2023, CarMax's cost of vehicles, a key input, was $11.4 billion, underscoring the financial weight it carries in its procurement activities.

- Largest U.S. used vehicle retailer

- Procured 726,937 vehicles in fiscal year 2023

- Spent $11.4 billion on vehicle inventory in fiscal year 2023

- Negotiates favorable terms due to high purchase volume

CarMax faces minimal threat from supplier bargaining power due to its diversified sourcing and the fragmented nature of the used car market. The company's ability to acquire vehicles from a vast array of individual sellers, independent dealerships, and wholesale auctions significantly dilutes the leverage of any single supplier. This broad sourcing strategy, coupled with low switching costs between acquisition methods, ensures CarMax is not beholden to any particular supplier, effectively limiting their ability to dictate terms or prices.

The company's sheer scale as the largest used vehicle retailer in the U.S. further strengthens its position. In fiscal year 2023, CarMax procured 726,937 vehicles and spent $11.4 billion on inventory, demonstrating substantial purchasing power that allows for favorable negotiations.

| Sourcing Channel | Significance for CarMax | Supplier Bargaining Power Impact |

|---|---|---|

| Customer Trade-ins | Primary source, high volume | Low; fragmented individual sellers |

| Wholesale Auctions | Significant volume, diverse sources | Low; many competing auction houses |

| Direct Consumer Purchases | Growing channel, broad reach | Low; many individual sellers |

| Independent Dealerships | Supplemental source | Low; fragmented market |

What is included in the product

This analysis examines the competitive forces impacting CarMax, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the used car market.

Effortlessly analyze CarMax's competitive landscape with a pre-built Porter's Five Forces model, eliminating the need for manual data compilation and complex calculations.

Gain immediate insights into CarMax's strategic positioning by visualizing the intensity of each force, allowing for rapid identification of key challenges and opportunities.

Customers Bargaining Power

Customers in the used car market, including those interacting with CarMax, experience very low switching costs. This means it's simple and inexpensive for them to move from one retailer to another. For instance, a customer can easily visit multiple dealerships or browse numerous online platforms without significant financial or time investment.

The widespread availability of online tools and comparison websites in 2024 further amplifies this ease of switching. Consumers can readily access information on pricing, vehicle availability, and customer reviews across different sellers. This transparency allows them to pinpoint the most favorable offers, thereby strengthening their position.

This low switching cost directly translates to increased bargaining power for customers. They are not tied to a single provider and can leverage competitive pricing to negotiate better deals. In 2023, the used car market saw significant price fluctuations, with some segments experiencing price drops, which further incentivized consumers to shop around and exert their bargaining power.

Used car buyers are indeed very sensitive to price, especially when the economy is a bit shaky. Think about things like inflation and interest rates going up; these really make people think twice about how much they can spend. For instance, in 2024, the average price for a used car is sitting around $28,000.

Adding to that affordability challenge, interest rates for car loans are currently quite high, sometimes reaching around 14% APR. This means the monthly payments can become a significant burden, pushing affordability to the forefront of most buyers' minds when they're making a decision.

CarMax's commitment to no-haggle pricing significantly bolsters its bargaining power with customers by fostering trust and eliminating the need for time-consuming negotiations. This transparent approach, evident in their consistent pricing strategies, reduces the customer's incentive to seek out alternative, potentially lower-priced options through aggressive bargaining.

The increasing availability of online tools further empowers customers, allowing them to research vehicle values and compare offerings from various dealerships. For instance, by mid-2024, online used car marketplaces reported millions of unique visitors monthly, indicating a strong customer inclination towards price comparison before purchase, which can influence their perception of CarMax's value proposition.

Access to Extensive Inventory

CarMax's ability to offer a massive nationwide inventory, accessible both online and at their physical locations, significantly empowers customers. This vast selection means buyers aren't restricted to a limited choice, allowing them to compare numerous vehicles and find the best fit for their needs and budget. In 2023, CarMax reported having approximately 230,000 vehicles in its total inventory, a figure that underscores the breadth of choice available to consumers.

This extensive inventory directly translates into increased bargaining power for customers. With so many options available across the country, buyers can easily identify and leverage competitive pricing. For instance, a customer can readily compare similar models from different CarMax locations or even other dealerships, putting pressure on CarMax to offer attractive pricing and terms. This accessibility to a wide array of vehicles diminishes the perceived uniqueness of any single offering.

- Vast Nationwide Inventory: CarMax provides access to hundreds of thousands of vehicles across its network.

- Online and In-Store Accessibility: Customers can browse and compare cars from anywhere, increasing their options.

- Enhanced Price Sensitivity: A broad selection allows customers to more easily identify and negotiate for the best prices.

- Reduced Switching Costs: The ease of finding alternative vehicles lowers the cost for customers to switch to a competitor if CarMax's offers are not satisfactory.

Availability of Financing Options

The availability of financing options significantly impacts customer bargaining power. CarMax itself offers CarMax Auto Finance (CAF), providing a convenient in-house option. However, customers are not limited to CAF and can readily explore external financing from banks, credit unions, and other lenders.

This access to a competitive lending market means customers can shop around for the best interest rates and terms, directly enhancing their ability to negotiate or choose the most favorable deal. In 2024, the automotive lending market remained robust, with numerous institutions competing for market share, further empowering car buyers.

- In-house Financing: CarMax Auto Finance (CAF) offers a direct financing channel for customers.

- External Financing Options: Customers have access to a wide array of banks, credit unions, and third-party lenders.

- Competitive Rates: The presence of multiple financing providers allows customers to compare and secure the most advantageous loan terms.

- Increased Buyer Power: This accessibility to diverse credit sources amplifies the bargaining power of potential car buyers.

Customers in the used car market, including those interacting with CarMax, benefit from extremely low switching costs, making it easy and inexpensive to move between retailers. The widespread availability of online comparison tools in 2024 further empowers buyers, allowing them to easily research pricing and vehicle availability across various sellers, thereby strengthening their negotiation position.

Price sensitivity is a significant factor for used car buyers, particularly with economic uncertainties like inflation and rising interest rates. For instance, the average used car price hovered around $28,000 in 2024, and with auto loan APRs reaching approximately 14%, affordability remains a primary concern, amplifying customer bargaining power.

CarMax's extensive nationwide inventory, comprising hundreds of thousands of vehicles accessible both online and in-store, gives customers a broad selection. This vast choice allows buyers to easily compare similar models and prices, putting pressure on CarMax to offer competitive terms and diminishing the perceived uniqueness of any single vehicle. In 2023, CarMax's inventory stood at roughly 230,000 vehicles, highlighting the breadth of options available.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend (as of mid-2024) |

|---|---|---|

| Switching Costs | Very Low | Minimal financial or time investment to compare multiple dealerships or online platforms. |

| Information Availability | High | Millions of monthly unique visitors to online used car marketplaces, indicating strong price comparison behavior. |

| Price Sensitivity | High | Average used car price around $28,000; auto loan APRs near 14% increase focus on affordability. |

| Availability of Alternatives | High | Nationwide inventory of ~230,000 vehicles (2023) provides numerous comparable options. |

Preview Before You Purchase

CarMax Porter's Five Forces Analysis

This preview shows the exact CarMax Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape of the used car industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the market. This comprehensive document is ready for your immediate use, offering a thorough understanding of CarMax's strategic positioning.

Rivalry Among Competitors

The used car market is indeed a crowded space, with CarMax facing competition not just from other large used car retailers like AutoNation, but also from franchised new car dealerships that also sell pre-owned vehicles. Add to this the countless independent used car lots and even private sellers, and you can see why rivalry is so fierce. CarMax, despite its size, holds a relatively small piece of this vast market.

The automotive retail landscape has been dramatically reshaped by the emergence of online-first competitors like Carvana, Vroom, and Shift. These digital disruptors offer a streamlined buying experience and greater price transparency, directly challenging established players such as CarMax. For example, Carvana's rapid expansion and focus on a digital-native customer base have put pressure on traditional retailers to bolster their own online offerings and integrate them seamlessly with physical locations.

The used car market, by its nature, presents a significant challenge in product differentiation. Most used vehicles are essentially commodities, meaning buyers often compare them based on price and basic specifications rather than unique features. This makes it tough for any single retailer to stand out solely on the product itself.

CarMax has tried to carve out a niche with its no-haggle pricing, a vast selection of vehicles, and customer-centric policies like generous return windows. However, the reality is that many competitors, from large dealership groups to smaller independent lots, can and do offer comparable vehicles and financing options. This often pushes competition back to price, creating a dynamic where lower prices can be a major deciding factor for consumers.

For instance, in 2023, the average price of a used car in the U.S. hovered around $26,000, a figure that fluctuates but underscores the price sensitivity in the market. While CarMax’s model aims to mitigate this by offering a perceived value beyond just the car, the underlying commoditization means rivals can readily match many of its offerings, intensifying the rivalry.

Economic Headwinds and Affordability Challenges

The current economic climate, marked by elevated interest rates and persistent inflation, significantly dampens consumer purchasing power. This directly translates into a tougher competitive environment for businesses like CarMax, as potential buyers become more price-sensitive and scrutinize their spending.

Retailers are compelled to refine their pricing strategies and intensify efforts in cost control to remain attractive to consumers. For instance, in early 2024, reports indicated that average car prices, while showing some moderation from peak levels, remained considerably higher than pre-pandemic figures, forcing consumers to weigh affordability more heavily.

- Economic Headwinds: Persistent inflation and higher interest rates in 2024 have squeezed household budgets, impacting discretionary spending on big-ticket items like vehicles.

- Affordability Concerns: Elevated vehicle prices, even with some stabilization, mean consumers are more hesitant and require more compelling value propositions.

- Pricing Strategy Adjustments: Retailers are pressured to offer more competitive pricing and financing options to capture market share amidst reduced consumer demand.

- Cost Management Focus: Operational efficiency and cost reduction become paramount for maintaining profitability in a challenging sales environment.

Strategic Investments and Omni-channel Capabilities

CarMax's commitment to enhancing its omnichannel capabilities, a significant factor in competitive rivalry, involves substantial ongoing investments. These investments aim to seamlessly integrate online browsing, virtual consultations, and in-store experiences, directly addressing customer preferences for flexibility and convenience.

The company's strategic focus on technology, including its digital platform and data analytics, allows for a more personalized customer journey and efficient inventory management. This integration is key to differentiating CarMax from competitors who may lag in digital transformation.

- Digital Investment: CarMax has consistently invested in its online platform, with digital sales representing a growing portion of its business. For example, in fiscal year 2024, CarMax reported that approximately 15% of its total unit sales were completed online.

- Physical Footprint Optimization: While expanding its digital reach, CarMax also strategically invests in its physical locations, often referred to as "store hubs," to support online order fulfillment and provide in-person services, thereby strengthening its omni-channel presence.

- Customer Convenience Focus: These investments directly address the intensifying rivalry by offering a superior, hassle-free customer experience that spans both digital and physical touchpoints, a critical differentiator in the used car market.

The competitive rivalry within the used car market is intense, driven by a fragmented landscape and the commoditized nature of vehicles. CarMax faces pressure from traditional dealerships, independent sellers, and increasingly, digital-first disruptors like Carvana, which have streamlined the buying process and emphasized price transparency. This forces CarMax to continually innovate its offerings and pricing strategies to maintain its market position.

Despite CarMax's efforts to differentiate through its no-haggle pricing and customer-centric policies, many competitors can offer similar vehicles and financing. The market's inherent commoditization means that price often remains a primary decision factor for consumers. For instance, in 2023, the average used car price in the U.S. was around $26,000, highlighting the sensitivity consumers have to cost.

Economic conditions, including inflation and higher interest rates in 2024, further intensify this rivalry by reducing consumer purchasing power. This compels retailers to refine pricing and cost controls. Reports in early 2024 showed average car prices still elevated, pushing consumers to prioritize affordability, which in turn pressures companies like CarMax to offer more competitive value propositions.

| Competitor Type | Key Differentiator/Strategy | Impact on CarMax |

| Large Dealership Groups | New car sales with used inventory, established service centers | Direct competition for used car inventory and customers |

| Independent Used Car Lots | Lower overhead, often aggressive pricing | Price-based competition, appeal to budget-conscious buyers |

| Online Retailers (e.g., Carvana) | Digital-first experience, home delivery, price transparency | Pressure to enhance online capabilities and customer convenience |

| Private Sellers | Direct negotiation, potentially lower prices | Undercuts retail pricing, appeals to a segment of the market |

SSubstitutes Threaten

New vehicles represent a significant substitute for the used car market. While typically more expensive, a normalization of new car inventory and a potential increase in manufacturer incentives during 2024 could make them more appealing to consumers, potentially diverting demand from pre-owned vehicles.

For many consumers, especially in urban settings, public transportation and ride-sharing platforms like Uber and Lyft present a viable alternative to owning a car. These services directly address the need for mobility without the burdens of ownership, such as maintenance, insurance, and parking. This can significantly dampen demand for personal vehicle purchases.

In 2024, the adoption of ride-sharing and the utilization of public transit continue to grow, particularly in major metropolitan areas. For instance, ride-sharing services are projected to see continued expansion in their user base and service areas globally. This trend directly impacts the perceived necessity of car ownership for a segment of the population, thereby increasing the threat of substitutes for traditional car dealerships like CarMax.

Vehicle leasing programs present a significant threat of substitutes for traditional car ownership, a core offering for companies like CarMax. These leases allow consumers to drive newer vehicles with lower upfront costs and monthly payments compared to financing a purchase. For instance, in 2024, leasing continued to be a popular option, with lease deals often structured to be more attractive than outright purchase financing, especially for consumers prioritizing lower monthly outlays.

Emerging car subscription services further intensify this threat by offering even greater flexibility. These services bundle financing, insurance, maintenance, and sometimes even mileage into a single monthly fee, removing the traditional burdens of car ownership. While still a developing market, the appeal of predictable costs and the ability to swap vehicles based on changing needs makes subscriptions a compelling alternative for a growing segment of consumers.

Alternative Transportation Methods (e.g., Bicycles, E-scooters)

The growing adoption of alternative personal transport, like e-bikes and e-scooters, presents a subtle threat to CarMax. While not a direct replacement for traditional car ownership, these options can chip away at demand for second vehicles or cars used for short commutes, particularly in urban areas. For instance, by mid-2024, cities like Paris saw significant increases in e-scooter usage, with some reports indicating millions of trips taken monthly, impacting short-distance travel patterns.

This trend is more pronounced among younger demographics and in densely populated cities where parking and traffic congestion are major concerns. As these micro-mobility solutions become more integrated into urban transit ecosystems, they can reduce the perceived necessity of owning a car for certain trips. The ongoing development and affordability of these alternatives continue to pose a long-term consideration for the automotive retail sector.

- E-scooter and e-bike usage continues to rise in major urban centers globally.

- These alternatives are particularly attractive for short-distance commutes and errands.

- Demographic shifts, especially among younger urban dwellers, favor micro-mobility solutions.

- This trend can indirectly decrease the overall demand for personal vehicle ownership for specific use cases.

Longer Vehicle Lifespans and Maintenance

Improvements in vehicle quality and durability mean consumers are holding onto their cars longer. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, up from 12.1 years in 2021. This trend directly impacts demand for used cars, as owners opt for maintenance and repairs over replacement.

This extended vehicle lifespan acts as a significant substitute for purchasing a used car. When a car can be kept running reliably for an additional year or two through maintenance, the urgency to buy a replacement diminishes.

The increasing cost of new vehicles also pushes consumers towards keeping their current cars. With new car prices averaging over $47,000 in early 2024, many find investing in repairs a more economical option than a new purchase, further reducing the pool of potential used car buyers.

- Extended Vehicle Lifespans: Average vehicle age on U.S. roads reached 12.5 years in 2023.

- Maintenance vs. Replacement: Consumers increasingly choose repairs over purchasing new or used vehicles.

- New Car Affordability: High new car prices (averaging over $47,000 in early 2024) make keeping existing vehicles more appealing.

The threat of substitutes for CarMax is multifaceted, encompassing new vehicles, alternative transportation, and extended vehicle lifespans. While new cars offer modern features, their higher cost and potential inventory fluctuations in 2024 make used cars competitive. Public transportation and ride-sharing services, like Uber and Lyft, offer mobility without ownership, particularly appealing in urban areas where car ownership burdens are higher. Furthermore, the increasing average age of vehicles on U.S. roads, reaching 12.5 years in 2023, indicates consumers are opting for repairs over replacements, directly impacting demand for used cars.

| Substitute Category | Key Factors | Impact on CarMax |

|---|---|---|

| New Vehicles | Inventory normalization, manufacturer incentives (potential in 2024) | Can divert demand from used cars if pricing becomes more attractive. |

| Public Transport & Ride-Sharing | Convenience, cost savings (no ownership burdens) | Reduces the perceived need for personal vehicle ownership, especially in urban settings. |

| Vehicle Leasing & Subscriptions | Lower upfront costs, flexibility, predictable monthly payments | Offers alternatives to outright purchase, appealing to consumers prioritizing monthly costs and flexibility. |

| Extended Vehicle Lifespans | Improved vehicle durability, rising new car prices (avg. >$47,000 in early 2024) | Encourages consumers to retain and repair existing vehicles, reducing demand for used car replacements. |

| Micro-mobility (E-bikes/scooters) | Cost-effectiveness for short trips, urban convenience | Can reduce demand for second vehicles or cars used for short commutes, particularly among younger demographics in cities. |

Entrants Threaten

Establishing a nationwide used car retail operation, akin to CarMax, demands a considerable upfront capital investment. This includes acquiring and developing physical dealership locations, setting up extensive reconditioning centers to prepare vehicles, and stocking a diverse inventory. These significant financial prerequisites create a substantial barrier, effectively deterring many potential new entrants from entering the market.

CarMax's strategic financial planning reflects this reality. For fiscal year 2026, the company has outlined a capital plan that earmarks significant investments specifically for the expansion of new store openings and the enhancement of existing reconditioning centers. This ongoing investment underscores the capital-intensive nature of the business and reinforces the high entry barriers for competitors.

CarMax has cultivated significant brand recognition and customer trust through its consistent no-haggle pricing and focus on customer experience. This established reputation acts as a substantial barrier for potential new entrants, who would require substantial investment and time to build comparable loyalty in a market where trust is paramount.

CarMax's dominant position as the largest used vehicle retailer grants it substantial economies of scale in sourcing, reconditioning, and logistics. For instance, in fiscal year 2024, CarMax sold approximately 770,000 vehicles, a volume that allows for significant cost advantages in acquiring inventory and streamlining its nationwide reconditioning processes. This scale makes it incredibly challenging for new entrants to match CarMax's cost efficiencies, directly impacting their ability to compete on price and maintain profitability.

Access to Financing Capabilities

New entrants face a significant hurdle due to CarMax's established CarMax Auto Finance (CAF) division. This in-house financing capability is a cornerstone of their sales process, offering a seamless experience for customers.

Developing comparable financing operations is a complex and capital-intensive undertaking for any new player attempting to enter the used car market.

- Financing as a Barrier: CarMax's robust in-house financing, CAF, directly addresses a critical customer need in vehicle purchases.

- Capital Investment Required: New entrants must invest heavily to build or acquire similar financing infrastructure and expertise.

- CAF's Scale: In fiscal year 2025, CAF originated over $8 billion in receivables, demonstrating the significant scale and established nature of this advantage.

Regulatory and Licensing Hurdles

The automotive retail sector faces significant regulatory and licensing barriers to entry. New businesses must navigate a complex web of state and federal regulations governing vehicle sales, dealership operations, and consumer protection. This compliance burden can be substantial, requiring considerable investment in legal counsel and administrative processes.

For instance, obtaining a dealership license often involves meeting specific financial stability requirements, background checks, and proving adherence to zoning laws. The National Automobile Dealers Association (NADA) reported in 2024 that the average cost to establish a new car dealership, including licensing and initial compliance, can range from hundreds of thousands to over a million dollars, depending on the state and scale of operations.

These hurdles effectively deter many potential new entrants, as the upfront investment and ongoing compliance costs create a formidable barrier. CarMax, as an established player, has already navigated these complexities, giving it an advantage over nascent competitors.

- State-specific dealership licensing: Requirements vary significantly by state, impacting operational setup and initial investment.

- Federal regulations: Compliance with laws like the Truth in Lending Act and the Clean Air Act adds to operational complexity and cost.

- Consumer protection laws: Adherence to regulations designed to protect buyers necessitates robust internal processes and transparency.

- Financial and operational prerequisites: New entrants must demonstrate financial solvency and operational capacity to gain approval.

The threat of new entrants into the used car retail market, particularly for a large-scale operator like CarMax, is significantly mitigated by substantial capital requirements. Building a national presence involves considerable investment in real estate, reconditioning facilities, and inventory, creating a high barrier to entry.

CarMax's fiscal year 2026 capital expenditure plans, focusing on new store openings and reconditioning center upgrades, highlight this capital intensity. Furthermore, the company's established brand reputation, built on a no-haggle pricing model and customer experience, requires significant time and investment for new competitors to replicate.

Economies of scale also present a formidable challenge; in fiscal year 2024, CarMax sold around 770,000 vehicles, enabling cost advantages in sourcing and operations that new entrants would struggle to match.

| Barrier Type | Description | Impact on New Entrants | CarMax Advantage Example (FY24/25 Data) |

|---|---|---|---|

| Capital Requirements | High upfront investment for dealerships, reconditioning, and inventory. | Deters smaller players; requires significant funding. | Significant ongoing capital plans for expansion and upgrades. |

| Brand Recognition & Trust | Established customer loyalty through consistent pricing and experience. | Difficult and costly to build comparable trust and awareness. | Strong brand equity built over years of operation. |

| Economies of Scale | Cost efficiencies from large-volume operations in sourcing and logistics. | Challenges new entrants in matching price competitiveness. | Sales volume of ~770,000 vehicles in FY24. |

| Financing Operations | In-house financing capabilities streamline sales and customer experience. | Requires substantial investment to develop similar infrastructure. | CarMax Auto Finance originated over $8 billion in receivables in FY25. |

| Regulatory & Licensing | Complex state and federal regulations for dealership operations. | Adds significant cost and time to market entry. | Established compliance framework; average dealership setup costs can exceed $1M. |

Porter's Five Forces Analysis Data Sources

Our CarMax Porter's Five Forces analysis is built upon a foundation of robust data, including CarMax's annual reports and SEC filings, industry-specific market research from firms like IBISWorld, and broader economic data from sources such as the Bureau of Labor Statistics.