CarMax Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CarMax Bundle

CarMax revolutionizes the used car market with a unique product offering of inspected, warrantied vehicles and a transparent, no-haggle pricing strategy. Their innovative place strategy, featuring large, accessible retail locations combined with a robust online presence, ensures convenience for every customer. Discover how their integrated promotion efforts build trust and drive sales.

Ready to unlock the full strategic blueprint? Get instant access to our comprehensive CarMax 4Ps Marketing Mix Analysis, packed with actionable insights and real-world examples, perfect for business professionals and students alike.

Product

CarMax's core offering revolves around the sale of meticulously inspected used vehicles, catering to a broad spectrum of customer needs and budgets. Their commitment to quality is evident in their rigorous 125-point inspection process, ensuring a reliable purchase for consumers.

This focus on transparency and customer satisfaction, particularly their no-haggle pricing model, sets them apart in the competitive used car market. For fiscal year 2025, CarMax achieved a significant sales volume, moving 789,050 used vehicles at the retail level.

CarMax Auto Finance (CAF) is a crucial component of CarMax's product strategy, offering integrated financing that simplifies the car-buying process for customers. This allows CarMax to capture a larger share of the transaction by providing a one-stop shop for both vehicle purchase and funding. CAF's ability to serve diverse credit needs, from excellent to subprime, broadens the potential customer base for CarMax vehicles.

The financial performance of CAF directly impacts CarMax's overall profitability. In fiscal year 2024, CAF originated over $8 billion in receivables, demonstrating its significant contribution to the company's revenue through interest and fees. By fiscal year 2025, this portfolio had grown to nearly $18 billion, highlighting CAF's expanding role and financial impact.

CarMax's commitment extends beyond the initial sale with robust vehicle reconditioning, ensuring each car meets high standards of quality and reliability for buyers. This meticulous process is a cornerstone of their value proposition.

Post-purchase service is integral to CarMax's strategy, fostering customer satisfaction and building long-term loyalty through ongoing support and maintenance options.

For fiscal year 2025, CarMax reported a significant increase in service gross profit, a result of effective cost management, growth in retail vehicle sales, and operational efficiencies implemented across their service centers.

Extended Protection Plans (EPP)

CarMax's Extended Protection Plans (EPP) represent a key element in their marketing strategy, offering customers peace of mind by extending coverage beyond the initial limited warranty. These plans are designed to bolster customer trust and encourage long-term loyalty.

The financial impact of EPPs is substantial for CarMax. For the fourth quarter of fiscal year 2025, the company reported an impressive EPP margin of $580 per retail unit sold. This highlights EPPs as a significant profit driver.

- Product: Extended Protection Plans (EPP) offer customers additional vehicle coverage beyond the standard warranty.

- Profitability: EPPs are a strong contributor to CarMax's revenue, with a reported margin of $580 per retail unit in Q4 fiscal year 2025.

- Customer Focus: The emphasis on these plans aims to increase customer confidence in their purchase and foster repeat business.

Wholesale Vehicle Sales

CarMax strategically utilizes its wholesale auctions to sell vehicles that don't meet its stringent retail quality standards to licensed dealers. This segment is a vital component of their business, demonstrating how they manage inventory efficiently across different channels.

The wholesale channel significantly contributes to CarMax's profitability. In fiscal year 2025, it accounted for a substantial 19% of the company's total gross profit. This highlights the financial importance of effectively managing and remarketing inventory, even those vehicles not destined for their retail lots.

The scale of CarMax's wholesale operations is considerable. For fiscal year 2024, they sold 760,426 wholesale units, generating $4.7 billion in revenue. This demonstrates a robust secondary market presence and a key revenue stream beyond their primary retail sales.

Key data points for CarMax's Wholesale Vehicle Sales:

- Fiscal Year 2025 Gross Profit Contribution: 19% of total gross profit.

- Fiscal Year 2024 Wholesale Units Sold: 760,426 units.

- Fiscal Year 2024 Wholesale Revenue: $4.7 billion.

CarMax's product offering is built on a foundation of quality used vehicles, complemented by integrated financial services and extended protection plans. This comprehensive approach aims to provide a seamless and trustworthy car-buying experience.

The company's commitment to quality is underscored by its rigorous inspection process and robust reconditioning efforts, ensuring customer satisfaction and long-term vehicle reliability.

CarMax Auto Finance (CAF) plays a pivotal role, originating nearly $18 billion in receivables by fiscal year 2025, and Extended Protection Plans (EPP) contribute significantly to profitability, with a margin of $580 per retail unit in Q4 fiscal year 2025.

Furthermore, CarMax effectively manages its inventory through wholesale auctions, which accounted for 19% of the company's total gross profit in fiscal year 2025, selling 760,426 wholesale units in fiscal year 2024.

| Product Aspect | Description | Fiscal Year 2025 Data Point | Fiscal Year 2024 Data Point |

|---|---|---|---|

| Retail Vehicle Sales | Meticulously inspected used vehicles | 789,050 units sold | N/A |

| CarMax Auto Finance (CAF) | Integrated financing solutions | ~$18 billion in receivables | >$8 billion originated |

| Extended Protection Plans (EPP) | Additional vehicle coverage | $580/unit margin (Q4 FY25) | N/A |

| Wholesale Auctions | Remarketing vehicles not meeting retail standards | 19% of total gross profit | 760,426 units sold, $4.7 billion revenue |

What is included in the product

This analysis provides a comprehensive overview of CarMax's marketing strategies, examining its product offerings, pricing models, distribution channels, and promotional activities.

It's designed for professionals seeking to understand CarMax's market positioning and competitive advantages.

Simplifies the complex CarMax 4Ps into actionable insights, alleviating the pain of overwhelming marketing data for busy executives.

Provides a clear, concise overview of CarMax's marketing strategy, easing the burden of understanding their competitive advantage.

Place

CarMax boasts an extensive physical store network, a cornerstone of its marketing mix. As of February 2025, the company operates over 250 locations strategically positioned throughout the United States. These physical touchpoints are crucial for customer engagement, offering opportunities for browsing, test drives, and the finalization of purchases.

This vast network not only facilitates direct customer interaction but also supports CarMax's ongoing strategy of market penetration. By continually expanding its physical footprint, CarMax aims to make its services accessible to a broader customer base, reinforcing its brand presence and facilitating sales across diverse geographic regions.

CarMax’s robust online platform, carmax.com, is central to its customer experience. It enables comprehensive vehicle browsing, instant online appraisals, streamlined financing applications, and flexible delivery or pickup options. This digital integration is crucial for modern car buying.

The digital strategy is clearly paying off. In fiscal year 2025, online retail sales represented a significant portion of CarMax's business, making up 15% of retail unit sales in the second, third, and fourth quarters, and 14% in the first quarter. This demonstrates a strong and growing customer preference for their digital channels.

CarMax excels in providing an omnichannel customer experience, allowing seamless transitions between online research and in-store visits. This flexibility empowers customers to engage with the car buying process on their own terms, enhancing convenience and accessibility. In fiscal year 2025, CarMax reported that 66% of its approximately 800,000 retail units sold were part of its omnichannel program, demonstrating the significant adoption of this integrated approach.

The company's digital capabilities are a cornerstone of its omnichannel strategy, supporting over 80% of sales in the fourth quarter of fiscal year 2025. This high percentage underscores CarMax's commitment to leveraging technology to streamline the customer journey, from initial browsing to final purchase, whether online or in a physical location.

Vehicle Transfer Services

CarMax's vehicle transfer service is a cornerstone of its offering, significantly enhancing the customer experience. This service allows buyers to view virtually any used car from CarMax's extensive national inventory at their preferred local dealership. In 2023, CarMax reported that its transfer service facilitated a substantial portion of its sales, with over 200,000 vehicles transferred between locations to meet customer demand, demonstrating its critical role in expanding choice and convenience.

This capability directly addresses a key customer pain point in traditional car buying: limited local inventory. By leveraging its nationwide network, CarMax effectively offers a virtual showroom that dwarfs that of most competitors. This broadens the customer's options, increasing the likelihood of finding the perfect vehicle without the need to travel extensively, a significant differentiator in the used car market.

- Expanded Inventory Access: Customers can browse and transfer over 50,000 vehicles from CarMax's national stock to their local store.

- Customer Convenience: Reduces the need for customers to travel to distant dealerships to view specific vehicles.

- Sales Driver: The transfer service is a key enabler of sales, allowing CarMax to capitalize on demand across its entire inventory.

- Competitive Advantage: Offers a wider selection than most traditional dealerships, improving customer satisfaction and purchase conversion rates.

Stand-Alone Reconditioning and Auction Centers

CarMax leverages stand-alone reconditioning and auction centers to boost efficiency and inventory management. These specialized facilities are crucial for getting vehicles ready for customers and handling wholesale transactions smoothly.

The company expanded its reconditioning capacity by opening its second dedicated center in Richland, Mississippi, in the first quarter of fiscal year 2025. This strategic move is part of CarMax's ongoing effort to streamline operations and enhance its ability to process a high volume of vehicles.

- Operational Efficiency: These centers allow for specialized processes, speeding up vehicle preparation for retail.

- Inventory Flexibility: They enable CarMax to efficiently manage both retail-ready inventory and vehicles destined for wholesale.

- Strategic Expansion: The opening of the Richland, Mississippi facility in Q1 FY2025 signifies investment in infrastructure to support growth.

CarMax's physical store network, numbering over 250 locations as of February 2025, serves as a critical physical touchpoint for customers. These stores facilitate browsing, test drives, and purchase completion, reinforcing brand presence and accessibility across the United States.

The company's digital platform, carmax.com, is integral to its modern car-buying approach, enabling browsing, appraisals, and financing. This digital integration is a key driver, with online retail sales accounting for 14-15% of retail unit sales in fiscal year 2025, highlighting a strong customer preference for digital channels.

CarMax's omnichannel strategy effectively bridges online and in-store experiences, offering significant customer convenience. In fiscal year 2025, 66% of its approximately 800,000 retail units sold were part of this integrated program, with digital capabilities supporting over 80% of sales in Q4 FY2025.

The vehicle transfer service allows customers to access virtually any car from CarMax's national inventory at their local dealership. This service is a significant sales driver, with over 200,000 vehicles transferred in 2023 to meet demand, expanding customer choice and offering a competitive advantage over traditional dealerships.

| Metric | Value (as of Feb 2025/FY2025) | Significance |

|---|---|---|

| Number of Stores | Over 250 | Extensive physical presence for customer interaction |

| Online Retail Sales % of Total | 14-15% (FY2025 Q1-Q4) | Demonstrates strong customer adoption of digital channels |

| Omnichannel Sales % | 66% of ~800,000 units (FY2025) | Highlights seamless integration of online and physical experiences |

| Digital Support of Sales % | Over 80% (FY2025 Q4) | Indicates technology's crucial role in the customer journey |

| Vehicles Transferred | Over 200,000 (2023) | Key enabler of sales by expanding inventory access and convenience |

What You Preview Is What You Download

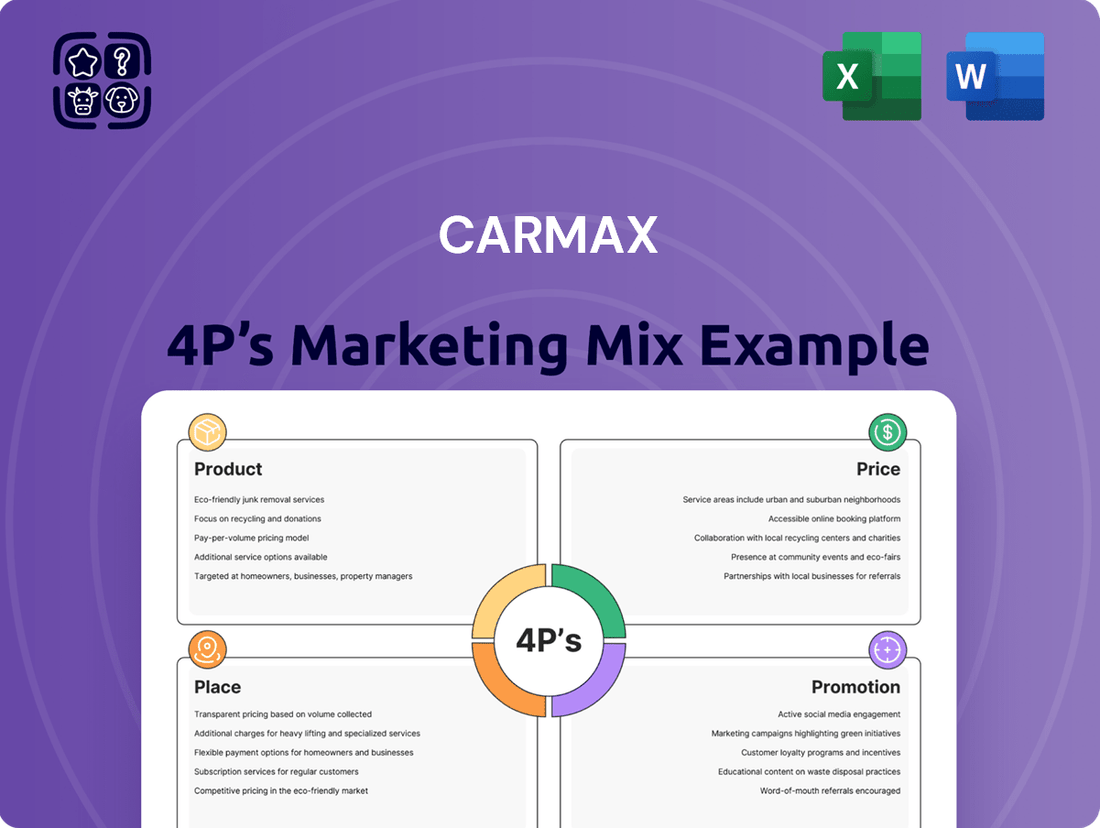

CarMax 4P's Marketing Mix Analysis

The preview shown here is the actual CarMax 4P's Marketing Mix analysis you’ll receive instantly after purchase—no surprises. This comprehensive document details CarMax's strategies across Product, Price, Place, and Promotion, offering valuable insights into their business model. You're viewing the exact version of the analysis you'll receive, fully complete and ready for your immediate use.

Promotion

CarMax leverages integrated marketing campaigns across national TV, online video, and social media to consistently communicate its core value propositions of transparent pricing and a hassle-free buying experience. This multi-channel approach ensures a broad reach and reinforces brand messaging to potential customers.

A prime example of this strategy is the 'BeetleMax: The Way Car Buying Shouldn't Be' campaign, a collaboration with Warner Bros. Pictures launched in August 2024. This campaign effectively tied CarMax's brand promise to a popular cultural moment, aiming to capture attention and drive engagement.

CarMax channels significant resources into digital advertising and search engine optimization (SEO) to enhance its online visibility. This strategic focus ensures potential customers easily discover CarMax when searching for used vehicles online, driving substantial organic traffic to their platform.

In 2023, CarMax reported a 12% increase in digital marketing spend, reaching $350 million, as they aimed to capture a larger share of the online used car market. Their commitment to SEO is evident in their consistent top rankings for key search terms related to car buying and selling.

CarMax leverages platforms like Facebook, Twitter, and Instagram to foster a vibrant online community. In 2024, their social media efforts focused on showcasing customer testimonials and promoting special offers, aiming to build trust and brand loyalty.

'No-Haggle' Pricing Emphasis

CarMax's 'no-haggle' pricing is a cornerstone of their promotional strategy, directly addressing the common anxiety surrounding car negotiations. This transparent approach simplifies the buying process, making it a significant draw for consumers who prefer a predictable and less confrontational transaction.

The consistent emphasis on this policy in their marketing reinforces CarMax's commitment to customer ease and trust. This clear differentiator sets them apart in a market often characterized by price uncertainty and adversarial bargaining.

- Reduced Buyer Stress: The 'no-haggle' model eliminates the pressure of negotiation, fostering a more relaxed shopping environment.

- Price Transparency: Customers know the price upfront, building confidence and simplifying the decision-making process.

- Brand Differentiation: This policy is a key element that distinguishes CarMax from traditional dealerships.

- Customer Loyalty: A straightforward and fair pricing system can lead to increased customer satisfaction and repeat business.

Customer-Centric Messaging

CarMax's promotional strategies are deeply rooted in a customer-centric philosophy, aiming to alleviate common car-buying anxieties. Their messaging consistently highlights convenience and the assurance of a no-haggle pricing model, which simplifies the transaction process. This focus on a smooth customer journey is a cornerstone of their brand identity.

To further build trust and provide peace of mind, CarMax prominently features its robust warranty and return policies in its promotions. For instance, the 10-day money-back guarantee and the 90-day/4,000-mile limited warranty are frequently communicated. These offerings directly address consumer concerns about making a significant purchase, reinforcing CarMax's commitment to customer satisfaction.

- Customer Convenience: Emphasis on no-haggle pricing and streamlined online browsing.

- Peace of Mind: Highlighting the 10-day money-back guarantee and 90-day/4,000-mile limited warranty.

- Personalized Experience: Promoting features that cater to individual customer needs and preferences.

CarMax's promotional efforts center on building trust and simplifying the car buying journey. Their consistent messaging around a no-haggle pricing model and robust warranties aims to alleviate common consumer anxieties. This customer-centric approach, amplified through integrated digital and traditional media, drives brand awareness and preference.

| Marketing Tactic | Key Message | 2024/2025 Focus |

|---|---|---|

| National TV & Online Video | Hassle-free buying, transparent pricing | Reinforcing brand promise, broad reach |

| Digital Advertising & SEO | Easy online discovery, competitive market presence | Increased digital spend, capturing online market share |

| Social Media | Customer testimonials, special offers, community building | Enhancing trust and loyalty through engagement |

| Warranty & Return Policies | Peace of mind, risk reduction | Prominent feature of 10-day money-back guarantee and 90-day/4,000-mile warranty |

Price

CarMax's no-haggle pricing model sets a fixed price for its vehicles, removing the traditional negotiation process. This approach simplifies the buying experience, offering transparency and reducing customer anxiety. For instance, in fiscal year 2024, CarMax reported total revenue of $22.3 billion, with their pricing strategy contributing to a consistent customer perception of value and ease.

CarMax employs a market-based pricing strategy, leveraging proprietary data to set vehicle prices that reflect current demand and ensure consistency across its vast inventory. This approach allows them to remain competitive in the used car market while upholding their no-haggle pricing model.

This dynamic pricing is crucial for CarMax's strategy, enabling them to adjust prices based on real-time market conditions. For instance, during periods of high demand for specific models in 2024, their pricing algorithms would have automatically adjusted to reflect that scarcity, ensuring they capture optimal value.

CarMax Auto Finance (CAF) offers competitive rates and adaptable loan durations, typically from 24 to 72 months, to support customers financing their vehicle purchases. While exact Annual Percentage Rates (APRs) aren't always immediately visible, CAF enables pre-qualification without affecting a customer's credit score, and provides a three-day window to switch financing if a more favorable rate is secured elsewhere.

For the second quarter of Fiscal Year 2025, CAF's weighted average contract rate stood at 11.5%. This figure saw a slight adjustment in the subsequent quarter, with the weighted average contract rate for Q3 Fiscal Year 2025 reported at 11.2%.

Trade-in Offers

CarMax's trade-in offers are a cornerstone of their customer-centric approach, providing instant, no-haggle valuations for vehicles, regardless of whether a new purchase is made. This transparent process, with offers typically valid for seven days, significantly simplifies the selling experience for consumers.

This strategy directly addresses a common pain point in car sales: the negotiation process. By offering a firm, upfront price, CarMax builds trust and efficiency. In fiscal year 2024, CarMax reported selling approximately 790,000 vehicles, with a significant portion likely involving trade-ins, showcasing the broad appeal of their streamlined offer system.

- Instant Offers: CarMax provides immediate, no-obligation quotes for vehicle trade-ins.

- No-Haggle Policy: The offered price is final, eliminating the stress of negotiation.

- Seven-Day Validity: Customers have a week to decide, offering flexibility.

- Standalone Purchases: Offers are extended even if the customer isn't buying another car, broadening service.

Extended Protection Plan Pricing

The pricing of CarMax's Extended Protection Plans (EPPs) is a key component of their revenue strategy, adding to the overall value proposition for customers. While exact pricing structures aren't publicly disclosed, the substantial growth in profit margins per retail unit sold highlights the significant financial contribution of these optional, customizable plans. For instance, CarMax reported a notable increase in gross profit per retail unit in recent quarters, partly attributable to the uptake of these add-on services.

These EPPs are designed to be flexible, allowing customers to tailor coverage to their specific needs and budgets. This customization likely influences the final price point, making it a variable factor in the overall transaction. The strategic importance of EPPs is underscored by their role in enhancing profitability and customer retention.

- Revenue Contribution: EPPs are a significant driver of CarMax's profitability.

- Margin Enhancement: Increased gross profit per unit often reflects EPP sales.

- Customer Customization: Pricing varies based on chosen coverage levels and duration.

- Optional Nature: Customers choose whether to purchase an EPP, impacting its direct price visibility.

CarMax's pricing strategy is built on transparency and market competitiveness, with their no-haggle approach simplifying the car buying journey. This commitment to upfront pricing fosters customer trust and streamlines the sales process, contributing to their overall market appeal.

The company leverages proprietary data to ensure its prices are aligned with current market conditions, allowing for dynamic adjustments. This data-driven approach helps maintain competitive pricing across their extensive inventory, reinforcing their value proposition.

CarMax's financing arm, CarMax Auto Finance (CAF), offers competitive rates, with weighted average contract rates reported at 11.5% for Q2 FY2025 and 11.2% for Q3 FY2025. These rates, coupled with flexible loan terms, support customer purchasing power.

Furthermore, CarMax's Extended Protection Plans (EPPs) are a key revenue driver, with pricing customized to customer needs, contributing to enhanced profit margins per unit sold.

| Metric | FY2024 Data | Q2 FY2025 Data | Q3 FY2025 Data |

|---|---|---|---|

| Total Revenue | $22.3 billion | N/A | N/A |

| Vehicles Sold | ~790,000 | N/A | N/A |

| CAF Weighted Avg. Contract Rate | N/A | 11.5% | 11.2% |

4P's Marketing Mix Analysis Data Sources

Our CarMax 4P's analysis leverages a comprehensive blend of internal company data, including sales figures and inventory management systems, alongside external market research and competitor pricing intelligence. We also incorporate customer feedback and online review data to inform our product and promotion insights.