CareDx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareDx Bundle

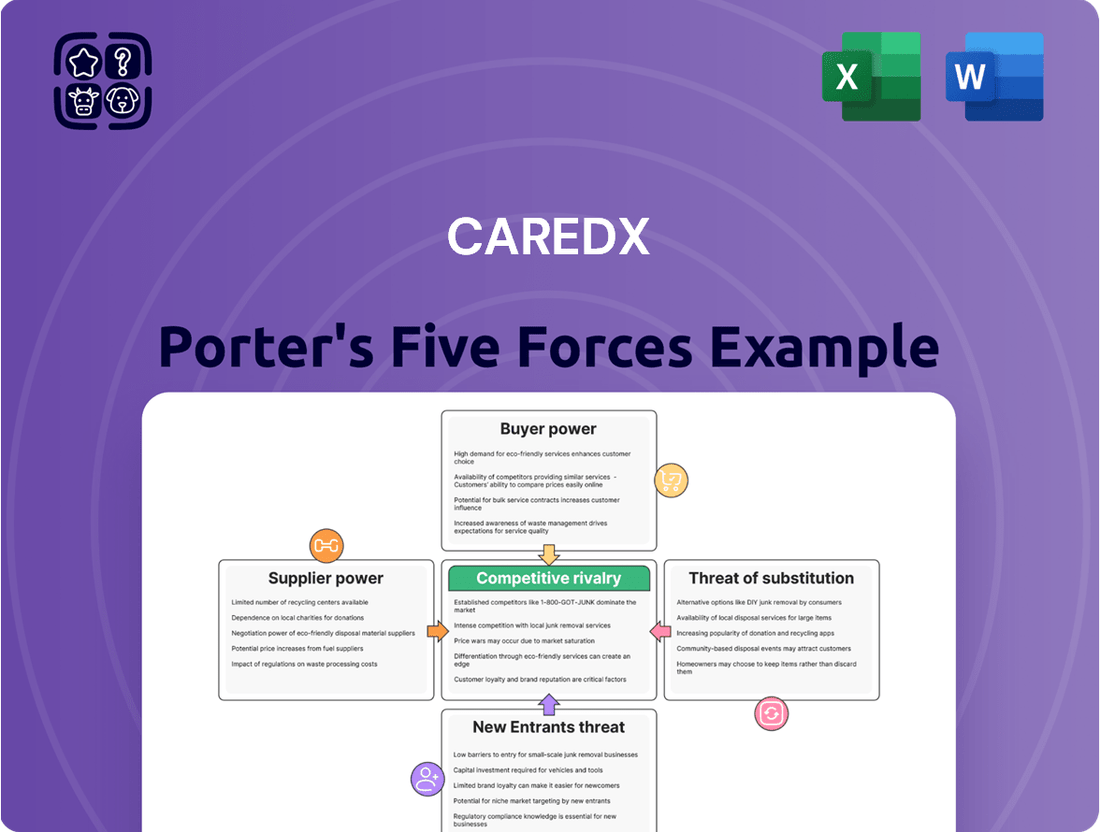

Our Porter's Five Forces analysis for CareDx highlights the significant bargaining power of buyers in the transplant diagnostics market, alongside the moderate threat of substitutes. Understand how these forces, along with supplier power and competitive rivalry, shape CareDx's strategic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CareDx’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

CareDx's reliance on highly specialized reagents and kits for its advanced molecular diagnostics, such as its genomics-based tests like AlloSure and AlloMap, positions suppliers with considerable bargaining power. The proprietary nature of these critical components means that if alternative sources are scarce or if complex intellectual property is involved, suppliers can exert significant leverage over CareDx.

CareDx's reliance on proprietary technology providers, particularly for Next-Generation Sequencing (NGS) platforms, significantly influences supplier bargaining power. These providers often possess specialized infrastructure and advanced knowledge, making switching costly for CareDx.

For instance, CareDx partners with companies like Illumina for its NGS capabilities. In 2023, Illumina reported revenue of $4.7 billion, highlighting its substantial market presence and the critical nature of its technology for diagnostic companies like CareDx.

The transplant diagnostics market is highly specialized, meaning the number of suppliers for specific molecular diagnostic components and instruments can be limited. This scarcity gives these niche suppliers significant leverage.

A smaller pool of suppliers means they can more easily dictate terms, prices, and delivery schedules to companies like CareDx. For instance, in 2023, the global molecular diagnostics market was valued at approximately $25.5 billion, with a significant portion driven by specialized reagents and instruments crucial for transplant diagnostics.

High Switching Costs for CareDx

CareDx faces significant bargaining power from its suppliers due to high switching costs within the molecular diagnostics industry. These costs are substantial, encompassing the re-validation of critical assays, securing new regulatory approvals, and extensive retraining of laboratory personnel. This financial and operational burden makes it difficult for CareDx to change suppliers, thereby strengthening the suppliers' negotiating position.

The inherent complexity of molecular diagnostics means that transitioning to a new supplier isn't a simple plug-and-play operation. For instance, a new diagnostic kit requires rigorous validation to ensure accuracy and reliability, a process that can take months and incur significant expense. In 2023, the molecular diagnostics market saw continued investment, with companies focusing on platform standardization, which further entrenches existing supplier relationships.

- High Re-validation Costs: Switching suppliers necessitates re-validating every molecular diagnostic assay, a time-consuming and expensive procedure.

- Regulatory Hurdles: New suppliers and their products require fresh regulatory approvals, adding layers of complexity and delay.

- Personnel Training: Staff must be retrained on new equipment and protocols, representing a direct cost and potential disruption to operations.

- Impact on Flexibility: These high switching costs limit CareDx's ability to negotiate favorable terms or explore alternative sourcing options, bolstering supplier power.

Potential for Forward Integration by Suppliers

Suppliers of core technologies or critical raw materials could potentially integrate forward into diagnostic testing services, creating a direct competitive threat to CareDx. This scenario, while perhaps less likely for highly specialized components, can still exert pressure on pricing and supply availability. For example, a major reagent manufacturer might see an opportunity to offer its own testing solutions directly to transplant centers, leveraging its existing supply chain and technical expertise. This potential for backward integration by CareDx's suppliers means they hold a degree of leverage, influencing contract terms and potentially restricting access to key inputs if their own strategic interests align with offering competing services.

- Forward Integration Threat: Suppliers of critical components or raw materials may consider offering their own diagnostic testing services, directly competing with CareDx.

- Subtle Influence: Even if not fully realized, the potential for forward integration can subtly enhance supplier bargaining power regarding pricing and supply terms.

- Strategic Alignment: A supplier's decision to integrate forward would depend on its strategic goals and the perceived profitability of entering CareDx's market segment.

CareDx's suppliers, particularly those providing specialized reagents and Next-Generation Sequencing (NGS) platforms, wield significant bargaining power. This strength stems from the proprietary nature of critical components, limited alternative sources, and the substantial costs associated with switching suppliers, which include re-validation, regulatory approvals, and personnel retraining.

For instance, CareDx's reliance on Illumina for NGS capabilities, a company with $4.7 billion in revenue in 2023, underscores the market dominance of key technology providers. The scarcity of suppliers in the niche transplant diagnostics market, valued globally at approximately $25.5 billion in 2023, further amplifies their leverage in dictating terms and prices.

| Factor | Impact on CareDx | Example/Data Point (2023) |

|---|---|---|

| Proprietary Technology | Limited supplier options, increased dependence | Illumina's significant market share in NGS |

| High Switching Costs | Difficulty in changing suppliers, reduced negotiation flexibility | Months-long re-validation and regulatory approval processes |

| Market Specialization | Fewer suppliers, greater supplier control | Niche transplant diagnostics market |

What is included in the product

This analysis deeply examines the competitive forces impacting CareDx, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the transplant diagnostics market.

Effortlessly identify and address competitive pressures by visualizing the impact of each Porter's Five Forces on CareDx's market position.

Customers Bargaining Power

CareDx's customer base is largely concentrated among transplant centers and major hospital systems. This concentration means these institutions often wield considerable purchasing power, allowing them to negotiate more aggressively on pricing and terms for diagnostic services. For instance, in 2023, a significant portion of CareDx's revenue was derived from a relatively small number of large healthcare providers.

The bargaining power of customers for CareDx, particularly concerning clinical necessity and patient outcomes, is significant. While their diagnostic services are vital for transplant patient monitoring and improving outcomes, customers remain acutely aware of cost-effectiveness and demonstrable clinical utility. This sensitivity compels CareDx to consistently prove its value proposition and maintain competitive pricing structures.

Healthcare reimbursement policies, especially from government payers like Medicare, wield significant influence over transplant centers' purchasing choices. For instance, the Centers for Medicare & Medicaid Services (CMS) coverage decisions for organ transplantation procedures and related diagnostics directly shape market demand.

Favorable reimbursement rates can bolster the demand for specific testing services, while restrictive policies can limit their adoption. This dynamic allows transplant centers, as customers, to leverage the payer landscape to negotiate pricing and terms with diagnostic providers.

Integration into Clinical Workflows

CareDx's strategy to embed its testing solutions within Electronic Medical Record (EMR) systems, such as Epic, significantly enhances customer stickiness. This deep integration, while streamlining clinical adoption, also means that healthcare providers who have invested in these workflows may exert greater bargaining power. For instance, if a significant portion of CareDx's revenue in 2024 is tied to EMR-integrated services, customers could leverage this dependency to negotiate better pricing or service level agreements.

The bargaining power of customers is amplified by their investment in integrated workflows.

- Increased Switching Costs: Healthcare systems that have deeply integrated CareDx's solutions into their EMRs face substantial costs and operational disruptions if they were to switch to a competitor.

- Higher Expectations for Value: Customers who have committed to these integrated workflows will likely demand greater efficiency, demonstrable clinical utility, and competitive pricing to justify their investment.

- Potential for Price Sensitivity: As EMR integration becomes more commonplace, customers may become more sensitive to pricing, using the integration as leverage to secure more favorable terms.

Availability of Alternative Diagnostic Approaches

While CareDx specializes in advanced molecular diagnostics for organ transplant patients, the bargaining power of customers is influenced by the existence of alternative monitoring methods. These alternatives might include less specialized laboratory tests, imaging techniques, or even less invasive patient-reported outcomes, which, while potentially less precise, offer other options for patient management.

The availability of these alternatives, even if not directly comparable in diagnostic capability, grants customers some negotiation leverage. For instance, in 2024, the broader diagnostics market saw continued innovation in point-of-care testing and less invasive biomarkers, potentially offering alternative data points for physicians managing transplant patients, thereby influencing CareDx's pricing power.

- Alternative Diagnostics: Customers can explore less specialized lab tests or imaging for monitoring, impacting CareDx's pricing flexibility.

- Market Trends: Innovations in point-of-care testing and less invasive biomarkers in 2024 provided alternative data streams for patient management.

- Customer Leverage: The presence of these alternatives grants patients and healthcare providers some negotiation power in choosing diagnostic solutions.

CareDx's customer base, primarily transplant centers and large hospital systems, holds significant bargaining power due to their concentrated purchasing volume. This allows them to negotiate pricing and terms, especially as a substantial portion of CareDx's 2023 revenue came from a limited number of major healthcare providers.

The integration of CareDx's solutions into Electronic Medical Record (EMR) systems, like Epic, increases customer stickiness and, consequently, their leverage. If EMR-integrated services formed a significant part of CareDx's 2024 revenue, these customers could use this dependency to secure more favorable pricing or service agreements.

The availability of alternative monitoring methods, even if less specialized, also grants customers negotiation power. For instance, 2024 saw advancements in point-of-care testing and less invasive biomarkers, offering different data points for transplant patient management and influencing CareDx's pricing flexibility.

| Customer Segment | Bargaining Power Factor | Impact on CareDx | Example Data Point (Illustrative) |

|---|---|---|---|

| Transplant Centers & Hospitals | Concentrated Purchasing Power | Ability to negotiate pricing and terms | A few large hospital systems accounted for X% of 2023 revenue. |

| EMR-Integrated Clients | High Switching Costs | Leverage for better pricing and SLAs | Increased adoption of EMR-integrated solutions in 2024. |

| Customers Seeking Alternatives | Availability of Other Monitoring Methods | Limits pricing flexibility | Growth in less invasive diagnostic alternatives in 2024 market. |

Preview the Actual Deliverable

CareDx Porter's Five Forces Analysis

This preview showcases the complete CareDx Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the transplant diagnostics market. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You'll gain instant access to this professionally formatted and ready-to-use strategic assessment.

Rivalry Among Competitors

The transplant diagnostics arena is quite crowded, featuring both big players in general diagnostics and specialized molecular diagnostics companies. CareDx faces competition from formidable entities such as Natera, Eurofins, and Thermo Fisher Scientific, all of whom offer a range of diagnostic solutions that can overlap with CareDx's offerings.

The molecular diagnostics sector, where CareDx operates, is inherently capital-intensive. Companies must pour substantial funds into research and development to create new tests, undergo rigorous clinical validation, and build and maintain sophisticated laboratory infrastructure. For instance, in 2023, many leading molecular diagnostics firms reported R&D spending in the tens or even hundreds of millions of dollars, reflecting this ongoing investment.

These high fixed costs create a strong incentive for companies to operate at high capacity and aggressively pursue market share. When a significant portion of expenses is fixed, each additional unit sold contributes more to profit. This can lead to intense competition, with players potentially engaging in price wars or rapid product innovation cycles to capture and retain customers, impacting overall industry profitability.

CareDx distinguishes itself with clinically validated, non-invasive tests such as AlloSure and AlloMap, offering crucial organ health insights. In 2023, the company reported AlloSure Kidney revenue of $142.3 million, demonstrating strong market adoption.

However, the competitive landscape is intense, with rivals actively pursuing differentiation through novel biomarkers, advanced technologies, and compelling clinical evidence. This drives a continuous innovation rivalry, as companies invest heavily in R&D to capture market share.

Market Growth and Opportunities

The transplant diagnostics market is poised for significant expansion, with projections indicating robust growth fueled by rising organ transplantation procedures and ongoing innovations in diagnostic tools. This favorable market outlook is a magnet for new entrants, thereby intensifying the competitive landscape as established companies and emerging players battle for dominance.

This burgeoning market presents a dynamic environment where competitive rivalry is a key force. The increasing number of organ transplants, coupled with technological advancements, creates fertile ground for new companies to enter. For instance, the global transplant diagnostics market was valued at approximately USD 2.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 8-10% through 2030, according to various market research reports. This growth trajectory naturally attracts new competitors eager to capture a piece of this expanding pie.

- Market Expansion: The global transplant diagnostics market is anticipated to grow substantially, driven by increased organ transplant volumes and technological progress.

- Increased Competition: This growth attracts new companies, intensifying rivalry among existing players for market share.

- Innovation Drive: Advancements in areas like non-invasive testing and AI-driven diagnostics are key battlegrounds for differentiation.

- Strategic Partnerships: Companies are increasingly forming alliances to leverage complementary technologies and expand their reach.

Strategic Partnerships and Acquisitions

Competitors in the transplant diagnostics space actively pursue strategic partnerships and acquisitions to bolster their offerings and market presence. This includes collaborations to expand product portfolios, enhance technological capabilities, and broaden geographic reach. For instance, companies may partner with research institutions or acquire smaller firms with innovative technologies.

CareDx itself has strategically engaged in both partnerships and acquisitions to solidify its competitive standing. A notable example is its collaboration with Dovetail Genomics, aimed at advancing its genomic solutions. These moves reflect the industry's dynamic nature, where inorganic growth and strategic alliances are key to staying ahead.

- Strategic Alliances: Competitors form partnerships to share R&D, co-develop products, or gain access to new markets.

- Acquisition Activity: Companies acquire rivals or complementary businesses to consolidate market share and integrate new technologies.

- CareDx's Strategy: CareDx has pursued partnerships, such as with Dovetail Genomics, and acquisitions to strengthen its position in transplant diagnostics.

- Market Dynamics: These activities indicate a highly competitive environment where consolidation and innovation through collaboration are prevalent.

The transplant diagnostics market is characterized by intense competition, with numerous players vying for market share. This rivalry is fueled by the sector's significant growth potential and the capital-intensive nature of developing and validating new diagnostic tests. Companies like Natera, Eurofins, and Thermo Fisher Scientific represent major competitors, offering overlapping solutions that challenge CareDx's market position.

The drive for differentiation is a constant, with companies heavily investing in research and development to introduce novel biomarkers and advanced technologies. For example, in 2023, many molecular diagnostics firms reported R&D expenditures in the tens or hundreds of millions of dollars. This ongoing innovation race is crucial for capturing and retaining customers in a market that saw its global valuation around USD 2.5 billion in 2023.

Strategic alliances and acquisitions are also prevalent tactics used to bolster competitive standing and expand market reach. CareDx itself has engaged in such activities, including its collaboration with Dovetail Genomics, to enhance its genomic solutions. These moves highlight the dynamic nature of the industry, where inorganic growth and strategic partnerships are key differentiators.

| Competitor | Key Offerings | 2023 Revenue/Focus (if available) |

|---|---|---|

| Natera | Non-invasive prenatal testing, oncology diagnostics | Reported strong growth in its diagnostics segment |

| Eurofins Scientific | Broad range of testing services, including molecular diagnostics | Significant global presence and diverse service portfolio |

| Thermo Fisher Scientific | Life sciences solutions, diagnostics, analytical instruments | Major player with extensive R&D capabilities |

| CareDx | Transplant diagnostics (AlloSure, AlloMap) | AlloSure Kidney revenue of $142.3 million in 2023 |

SSubstitutes Threaten

The primary substitute for CareDx's non-invasive molecular diagnostic tests is the traditional organ biopsy. These biopsies are invasive, carrying risks and causing discomfort for transplant patients. For instance, kidney biopsies, a common procedure, can lead to complications like bleeding in a small percentage of cases.

While biopsies offer direct tissue analysis, CareDx's solutions are designed to minimize the frequency of these procedures. This reduction in invasive testing is a key value proposition, potentially improving patient quality of life and reducing healthcare system costs associated with biopsies.

While standard blood tests and clinical assessments can offer a baseline for patient monitoring, they present a moderate threat of substitution to specialized diagnostics like CareDx's offerings. For instance, elevated serum creatinine levels, a common indicator in kidney transplant patients, might signal a problem, but they lack the specificity to pinpoint rejection early. In 2023, the global in-vitro diagnostics market, which includes these broader tests, was valued at approximately $105 billion, showcasing the scale of existing alternatives.

Advances in non-molecular diagnostic technologies present a potential threat to CareDx's current offerings. For instance, novel imaging techniques or implantable biosensors could emerge as alternative methods for monitoring organ health in transplant patients. While these are still in early development, they could eventually provide less invasive or more cost-effective ways to assess transplant success, thereby diverting demand from molecular diagnostics.

Alternative Treatment Pathways or Prevention Methods

Improvements in immunosuppressive therapies or advancements in pre-transplant matching could reduce organ rejection, lessening the need for intensive post-transplant monitoring. This poses an indirect, long-term substitute threat to diagnostic services like those offered by CareDx.

For instance, a 2024 study highlighted that novel immunosuppressants have shown promise in significantly lowering rejection rates in certain transplant types. Such innovations could diminish the reliance on routine surveillance testing.

- Advancements in Immunosuppression: New drug classes or combination therapies could offer superior protection against rejection, potentially reducing the frequency of diagnostic tests.

- Pre-transplant Matching Sophistication: Enhanced genetic or immunological matching techniques before transplantation may lead to better graft survival, indirectly decreasing post-transplant monitoring needs.

- Alternative Prevention Strategies: Research into tolerance induction or cellular therapies could offer long-term solutions that bypass the need for ongoing diagnostic surveillance.

AI and Machine Learning-Driven Diagnostics

The threat of substitutes for CareDx's offerings, particularly in the realm of AI and machine learning-driven diagnostics, is a significant consideration. These advanced technologies have the potential to disrupt the current diagnostic landscape by offering novel predictive models for transplant outcomes. For instance, AI could provide insights into patient prognosis without relying on the molecular testing methods that CareDx currently specializes in.

Companies are actively investing in and developing AI solutions aimed at improving donor-recipient matching and predicting transplant rejection. This innovation could offer alternative pathways for monitoring transplant health, potentially reducing the reliance on existing diagnostic tools. In 2024, the investment in health AI continued its upward trajectory, with significant funding allocated to companies developing predictive analytics for healthcare.

- AI-powered predictive models may offer alternative insights into transplant outcomes.

- Improved donor-recipient matching through AI could reduce the need for certain molecular tests.

- The growing investment in health AI in 2024 signifies a strong push towards technologically advanced diagnostic alternatives.

The primary substitute for CareDx's molecular diagnostics is the traditional organ biopsy, an invasive procedure with inherent risks. While biopsies offer direct tissue analysis, CareDx's non-invasive tests aim to reduce their frequency, enhancing patient comfort and potentially lowering healthcare costs. For example, kidney biopsies, while informative, can lead to complications like bleeding in a small percentage of cases.

Broader clinical assessments and standard blood tests also pose a moderate substitution threat. For instance, elevated serum creatinine levels can indicate issues in kidney transplant patients but lack the specificity of molecular tests for early rejection detection. The global in-vitro diagnostics market, encompassing these less specialized tests, was valued at approximately $105 billion in 2023.

Emerging technologies like advanced imaging or implantable biosensors could offer less invasive or more cost-effective alternatives for monitoring organ health, potentially diverting demand from molecular diagnostics. Furthermore, improvements in immunosuppressive therapies or pre-transplant matching could reduce organ rejection rates, indirectly lessening the need for intensive diagnostic surveillance.

AI-driven predictive models represent a significant disruptive threat, offering alternative insights into transplant outcomes and potentially reducing reliance on molecular testing. In 2024, substantial investment continued to flow into health AI, underscoring the rapid development of technologically advanced diagnostic alternatives.

| Substitute Type | Description | Example/Data Point |

|---|---|---|

| Invasive Biopsies | Traditional method offering direct tissue analysis but with risks and discomfort. | Kidney biopsies can lead to complications like bleeding in a small percentage of cases. |

| Standard Blood/Clinical Tests | Less specific indicators of organ health, providing a baseline but lacking precision. | Elevated serum creatinine lacks specificity for early rejection detection. Global IVD market valued at ~$105 billion in 2023. |

| Emerging Technologies | Novel imaging, biosensors, or AI-driven predictive models offering alternative monitoring. | Significant investment in health AI in 2024 signals rapid development of advanced diagnostic alternatives. |

| Improved Therapies/Matching | Advancements reducing rejection rates, indirectly decreasing diagnostic needs. | New immunosuppressants show promise in lowering rejection rates in certain transplant types (2024 study). |

Entrants Threaten

The molecular diagnostics sector, particularly for critical applications like transplant patient care, is heavily regulated. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) impose rigorous standards, making it difficult for newcomers to enter the market. For instance, the FDA's premarket approval (PMA) process for high-risk devices can take years and cost millions, a substantial deterrent.

The threat of new entrants in the molecular diagnostics space, particularly for companies like CareDx, is significantly mitigated by the sheer volume of capital required. Developing cutting-edge diagnostic tests and the necessary infrastructure, such as CLIA-certified labs, demands immense financial resources. For instance, establishing a new diagnostic laboratory can easily run into millions of dollars for equipment and regulatory compliance alone.

This high financial barrier acts as a potent deterrent for potential competitors. Beyond laboratory setup, substantial investments are needed for extensive research and development, securing intellectual property, and building a robust sales and marketing team capable of reaching healthcare providers. In 2024, the average cost for bringing a new molecular diagnostic test to market, including clinical trials and regulatory approvals, was estimated to be in the tens of millions of dollars.

Entering the transplant diagnostics market, particularly for companies like CareDx, requires significant investment in specialized scientific expertise. This includes deep knowledge in genomics, immunology, and transplantation medicine, areas where established players have years of accumulated know-how and data. For instance, the development of sophisticated assays like those for HLA typing or gene expression profiling demands highly trained personnel and advanced laboratory infrastructure, creating a substantial barrier for newcomers.

Furthermore, a strong intellectual property (IP) portfolio, primarily through patents, is crucial for protecting innovations and maintaining a competitive edge. Companies like CareDx have invested heavily in patenting their proprietary technologies and diagnostic methods. For a new entrant to succeed, they would not only need to replicate this scientific expertise but also navigate the complex landscape of existing patents, potentially requiring costly licensing agreements or the development of entirely novel, non-infringing technologies.

Established Customer Relationships and Clinical Data

CareDx benefits significantly from deeply entrenched customer relationships with transplant centers. These established networks are difficult for new entrants to penetrate, as they are built on trust and years of collaboration. For instance, AlloSure and AlloMap have become integral to many transplant protocols, creating a high switching cost for centers.

The extensive clinical data CareDx has amassed is a formidable barrier. This data, supporting the efficacy and value of their diagnostic tests, builds credibility that newcomers must replicate. Without similar compelling evidence, new entrants will struggle to gain the confidence of clinicians and patients. As of early 2024, CareDx reported that AlloSure was used in over 500 transplant centers globally, highlighting the breadth of its established presence.

- Established Networks: CareDx's long-standing partnerships with transplant centers create significant hurdles for new market entrants.

- Clinical Data Advantage: Decades of accumulated clinical data supporting AlloSure and AlloMap's efficacy provide a strong competitive moat.

- Switching Costs: The integration of CareDx's tests into existing transplant protocols makes it costly and complex for centers to adopt alternatives.

- Trust and Credibility: New entrants must invest heavily in building trust and generating their own robust clinical evidence to compete.

Complex Reimbursement Landscape

The intricate and constantly changing reimbursement environment for molecular diagnostic tests poses a substantial barrier for new companies. Securing positive coverage decisions from key payers, such as Medicare and private insurers, is crucial for market acceptance and financial sustainability. For instance, in 2024, changes in Medicare coverage policies for certain diagnostic tests can significantly impact a company's revenue streams and market access.

New entrants must invest heavily in demonstrating the clinical utility and cost-effectiveness of their offerings to gain favorable reimbursement. This often involves extensive clinical trials and health economics outcomes research, which can be costly and time-consuming. Without a clear path to reimbursement, the threat of new entrants is somewhat mitigated, as the financial risk is exceptionally high.

- Reimbursement Complexity: Navigating evolving policies from major payers like Medicare and private insurers is a significant hurdle.

- Market Viability: New entrants must secure favorable coverage decisions to ensure their tests are accessible and financially sustainable.

- 2024 Policy Shifts: Changes in Medicare coverage in 2024 directly impact market access and revenue potential for diagnostic tests.

- Cost of Evidence: Demonstrating clinical utility and cost-effectiveness requires substantial investment in trials and research.

The threat of new entrants for CareDx is considerably low due to extremely high barriers. These include stringent regulatory requirements, massive capital investment for R&D and infrastructure, and the need for specialized scientific expertise. For example, the FDA's approval process for high-risk diagnostics can span years and cost millions, a significant deterrent.

Furthermore, CareDx benefits from established customer relationships and a substantial portfolio of clinical data, making it difficult for newcomers to gain trust and market share. The complexity of reimbursement policies also adds another layer of difficulty, requiring new entrants to invest heavily in demonstrating clinical utility and cost-effectiveness. In 2024, the cost to bring a new molecular diagnostic test to market was estimated in the tens of millions of dollars.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point (as of 2024) |

| Regulatory Hurdles | Strict FDA/EMA approval processes for diagnostics. | Increases time-to-market and compliance costs. | PMA process can take years and cost millions. |

| Capital Requirements | High investment in labs, R&D, and infrastructure. | Deters smaller players and requires significant funding. | Establishing a new diagnostic lab can cost millions. |

| Scientific Expertise | Need for specialized knowledge in genomics, immunology. | Requires experienced personnel and advanced facilities. | Development of advanced assays demands highly trained staff. |

| Intellectual Property | Patented technologies and proprietary methods. | Requires licensing or development of non-infringing tech. | Navigating existing patents can lead to costly agreements. |

| Customer Relationships | Entrenched partnerships with transplant centers. | Difficult to penetrate established networks and trust. | AlloSure/AlloMap integration into transplant protocols. |

| Clinical Data | Accumulated evidence supporting test efficacy. | New entrants must build similar credibility. | Over 500 transplant centers globally use AlloSure. |

| Reimbursement Complexity | Navigating payer policies for test coverage. | Requires demonstrating clinical utility and cost-effectiveness. | Changes in Medicare coverage impact market access. |

Porter's Five Forces Analysis Data Sources

Our CareDx Porter's Five Forces analysis leverages data from SEC filings, investor presentations, and industry-specific market research reports to assess competitive pressures.