CareDx Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareDx Bundle

Curious about CareDx's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Unlock the full strategic advantage by purchasing the complete BCG Matrix for in-depth analysis and actionable insights to guide your investment decisions.

Stars

AlloSure Kidney Surveillance Testing is a clear star for CareDx, showing robust growth in a burgeoning transplant diagnostics sector. Its increasing adoption underscores CareDx's market leadership.

This product is a key driver of CareDx's testing services revenue, which achieved $249.4 million in 2024, a 19% jump from 2023. This upward trend continued into Q1 2025.

The sustained demand for non-invasive kidney transplant monitoring is evident in AlloSure's rising test utilization. Testing services volume grew 14% year-over-year in Q4 2024 and 12% year-over-year in Q1 2025, reflecting its strong market position.

AlloMap Heart testing, a key component for CareDx, is experiencing a significant boost in its market position. In Q4 2024, its payer coverage expanded to include an additional 21 million commercial lives, extending its utility from month 6 to month 2 post-transplant.

This expansion is a clear indicator of AlloMap's growing competitive edge in the crucial heart transplant surveillance market. It highlights a trend where the medical community is increasingly adopting advanced diagnostic tools to improve patient care and outcomes following transplants.

CareDx's core testing services, featuring AlloSure and AlloMap, are the company's largest and most rapidly expanding business area. This segment has demonstrated remarkable resilience, achieving seven consecutive quarters of sequential volume growth.

This comprehensive testing portfolio firmly establishes CareDx as a leader in the global transplant diagnostics market. Projections indicate this market will experience substantial growth, with a compound annual growth rate (CAGR) between 7.3% and 10.92% from 2025 to 2035, underscoring its position as a high-growth, high-market share offering.

AlloSure Plus AI-Driven Platform

AlloSure Plus AI-Driven Platform represents a significant advancement for CareDx, positioned within the high-growth potential quadrant of the BCG matrix. This platform, recently validated in an international study, leverages AI to enhance its existing AlloSure donor-derived cell-free DNA (dd-cfDNA) analysis, a key differentiator in the transplant diagnostics market.

The integration of AI into AlloSure Plus targets a rapidly expanding segment of advanced diagnostics. This technological enhancement is crucial for maintaining a competitive edge and capturing market share in a field that demands continuous innovation.

With planned integration into EMR systems like EPIC Aura at select sites in Q3 2025, AlloSure Plus is poised for swift market adoption. This strategic move is expected to solidify its position as a leader in AI-powered transplant care, even as a relatively new offering in the market.

- Market Potential: Targeting the high-growth advanced diagnostics sector.

- AI Integration: Enhancing dd-cfDNA analysis for improved transplant outcomes.

- EMR Integration: Planned rollout with EPIC Aura in Q3 2025 for rapid market penetration.

- Competitive Edge: Aiming for a leading position in AI-powered transplant care.

Genomics-Based Information Leadership

CareDx stands out as a leader in genomics-based information for transplant patients, utilizing its unique technologies to provide valuable solutions throughout the entire transplant process. This strong position in a rapidly expanding area of precision medicine highlights its market influence and ongoing commitment to innovation, which are crucial for sustaining its star status in a tech-driven industry.

The company’s focus on the transplant market, a segment experiencing significant growth, is a key driver of its star rating. For instance, the organ transplant market is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, fueled by advancements in medical technology and increasing demand for personalized treatments.

- Market Leadership: CareDx is a recognized leader in the niche of genomics-based diagnostics for organ transplantation.

- Proprietary Technology: Its strength lies in proprietary technologies that offer clinically differentiated solutions for pre- and post-transplant care.

- High-Growth Niche: Operating in the precision medicine space, particularly for transplant patients, positions CareDx in a high-growth market.

- Innovation Focus: Continuous innovation is vital for maintaining its star position, driven by rapid technological advancements in the field.

AlloSure Kidney Surveillance Testing and AlloMap Heart testing are CareDx's stars, driving significant revenue growth in the transplant diagnostics market. The company's testing services revenue surged 19% to $249.4 million in 2024, with continued strong performance into Q1 2025. This robust growth, coupled with expanding payer coverage and increasing test utilization, solidifies CareDx's leadership in this high-growth sector.

AlloSure Plus AI-Driven Platform is also positioned as a star, leveraging AI for enhanced dd-cfDNA analysis. Planned integration with EMR systems like EPIC Aura in Q3 2025 is expected to accelerate its market adoption. This technological advancement targets the rapidly growing advanced diagnostics segment, aiming to solidify CareDx's leadership in AI-powered transplant care.

| Product | BCG Category | Key Growth Drivers | 2024 Revenue Contribution (Testing Services) | Market Outlook |

|---|---|---|---|---|

| AlloSure Kidney Surveillance Testing | Star | Increasing adoption, strong demand for non-invasive monitoring | Significant contributor to $249.4M testing revenue | Transplant diagnostics sector CAGR 7.3%-10.92% (2025-2035) |

| AlloMap Heart Testing | Star | Expanded payer coverage (21M lives in Q4 2024), extended utility | Key component of testing services revenue | Growing competitive edge in heart transplant surveillance |

| AlloSure Plus AI-Driven Platform | Star | AI integration, planned EMR integration (EPIC Aura Q3 2025) | Emerging contributor, high growth potential | Advanced diagnostics segment, AI-powered transplant care |

What is included in the product

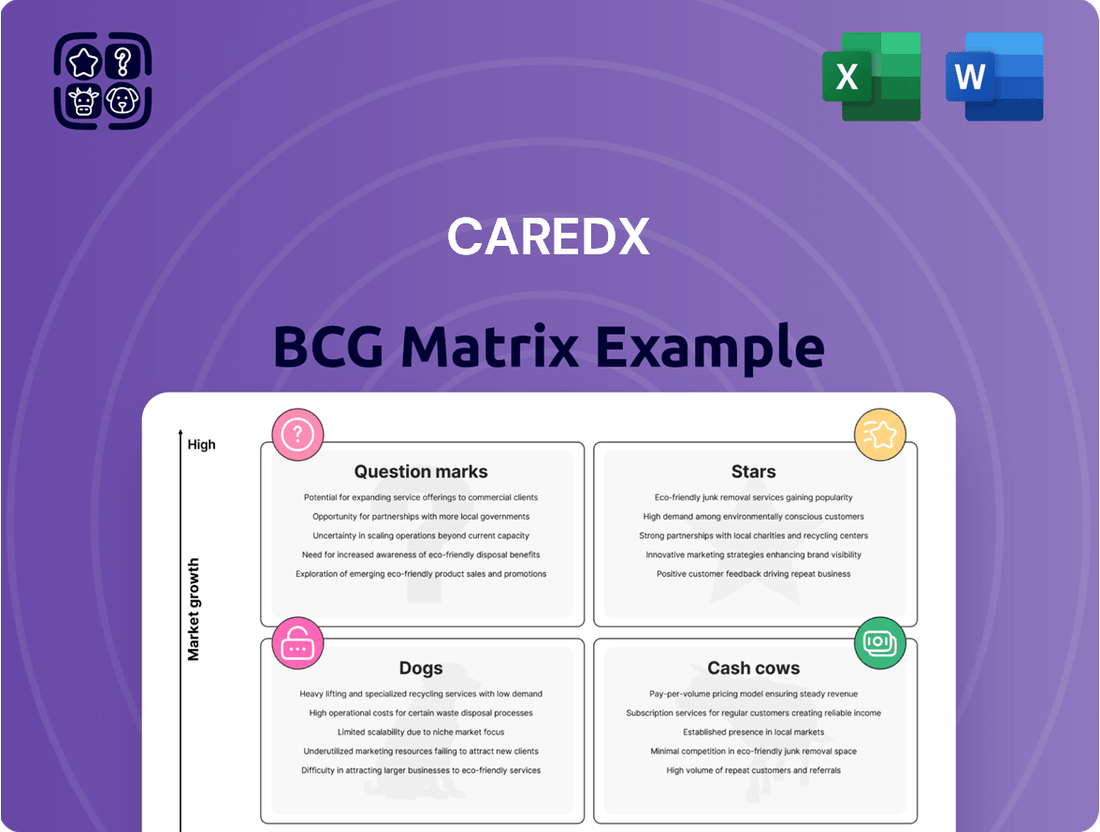

The CareDx BCG Matrix analyzes its product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide strategic decisions.

The CareDx BCG Matrix offers a clear, visual roadmap, simplifying complex portfolio decisions and alleviating strategic planning headaches.

Cash Cows

AlloSure Kidney testing, a cornerstone of CareDx's offerings, acts as a prime cash cow by providing consistent revenue through its established use in routine kidney transplant surveillance. This reliable income stream is crucial for funding the company's research and development into newer, more innovative diagnostic solutions.

The market for kidney transplant diagnostics is expanding, but the established segments where AlloSure Kidney is widely adopted represent mature markets. This maturity translates into predictable cash flow, meaning CareDx can generate substantial revenue from these areas with comparatively lower investment needed for market expansion compared to its nascent product lines.

Routine AlloMap Heart Monitoring is a cornerstone for CareDx, representing a mature product with a solid market position. Its consistent revenue generation, driven by established clinical utility in post-heart transplant patient management, makes it a reliable cash cow for the company.

In 2023, CareDx reported that AlloMap testing contributed significantly to its revenue, underscoring its role as a primary revenue driver. The predictable demand and high profit margins associated with this service allow it to consistently generate substantial cash flow, supporting other company initiatives.

CareDx's Patient and Digital Solutions Suite, encompassing workflow management, regulatory reporting, medication management, and remote patient monitoring, acts as a significant cash cow. These offerings, including products like Ottr, MedActionPlan PRO, and AlloHome, leverage established infrastructure and recurring service fees to deliver consistent revenue.

This segment demonstrated robust financial performance, generating $43.6 million in revenue for the full year 2024, marking an impressive 18% increase compared to 2023. Furthermore, the suite contributed $12.0 million in revenue during the first quarter of 2025, a substantial 24% rise year-over-year, underscoring its stable and growing cash-generating capabilities.

Standard Lab Products

Standard Lab Products, encompassing lab consumables and kits, are a significant contributor to CareDx's financial health. This segment demonstrated robust growth, with revenue climbing 22% to $40.8 million for the full year 2024.

Further strengthening its position, the first quarter of 2025 saw a 26% revenue increase in this category, reaching $10.8 million. These established products likely benefit from consistent market demand, translating into reliable sales and a healthy gross margin without the need for substantial new market development investment.

- Revenue Growth: 22% increase in 2024 to $40.8 million.

- Q1 2025 Performance: 26% revenue increase to $10.8 million.

- Market Position: Well-established, providing steady sales.

- Financial Contribution: Contributes to overall gross margin.

Optimized Revenue Cycle Management

Optimized revenue cycle management and expanded payer coverage for CareDx’s established tests, like AlloSure and AlloMap, are key to maximizing cash flow. This focus on efficient payment collection for services already delivered directly boosts the profitability of their high-market-share offerings. For instance, in 2023, CareDx reported a significant increase in revenue from their testing solutions, underscoring the impact of these operational improvements.

- Enhanced Cash Flow: Streamlined billing and collections for existing tests ensure prompt payment, directly improving liquidity.

- Increased Profitability: Operational efficiencies in revenue cycle management reduce costs associated with payment processing and denials.

- Maximized Existing Assets: Focus on getting the most out of current, high-demand tests rather than developing new ones.

- Improved Gross Margins: Efficient revenue collection contributes to a healthier gross profit margin on established products.

CareDx's Patient and Digital Solutions Suite, including products like Ottr and MedActionPlan PRO, functions as a cash cow, generating consistent revenue through established infrastructure and recurring service fees. This segment saw significant growth, with revenue reaching $43.6 million in 2024, an 18% increase year-over-year, and $12.0 million in Q1 2025, up 24%.

Standard Lab Products, such as consumables and kits, also represent a cash cow due to consistent market demand and healthy gross margins. This category experienced a 22% revenue increase in 2024, totaling $40.8 million, and a further 26% rise in Q1 2025 to $10.8 million.

These mature offerings, like AlloSure Kidney testing and AlloMap Heart Monitoring, provide predictable revenue streams with lower investment needs for expansion. Their established clinical utility and high market share allow them to generate substantial cash flow, supporting CareDx's overall financial health and investment in innovation.

Optimizing the revenue cycle for these established tests, ensuring efficient payment collection, directly boosts their profitability and liquidity. This focus on maximizing existing assets contributes to healthier gross margins without the need for substantial new market development.

| Product Segment | 2024 Revenue | 2024 Growth | Q1 2025 Revenue | Q1 2025 Growth |

|---|---|---|---|---|

| Patient & Digital Solutions | $43.6 million | 18% | $12.0 million | 24% |

| Standard Lab Products | $40.8 million | 22% | $10.8 million | 26% |

Delivered as Shown

CareDx BCG Matrix

The CareDx BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—just the complete, professionally designed strategic analysis ready for your immediate use. You can confidently assess its value, knowing the final product will be exactly as presented, enabling swift integration into your business planning and decision-making processes.

Dogs

CareDx might have older diagnostic tests that aren't keeping up with newer, more advanced methods. These legacy products, if they exist, would likely have a small piece of the market because the field is changing so quickly. This could make them fall into the 'dog' category, meaning they are less relevant and not contributing much to the company's growth.

In the transplant diagnostics market, CareDx might have products in highly fragmented or commoditized sub-segments where it doesn't hold a distinct technological or market edge. These offerings, if lacking significant differentiation or market share, could be classified as 'dogs' in the BCG matrix.

For instance, if a particular assay for a less common transplant type has seen limited adoption and faces numerous competitors with similar performance, it might fall into this category. Such products could consume resources without delivering substantial strategic value or generating significant returns, potentially impacting the company's overall resource allocation.

Within CareDx's Patient and Digital Solutions segment, certain digital features may be classified as dogs in a BCG matrix. These are components that, despite the overall segment's growth, show low user adoption and minimal impact on clinical workflows. For instance, a digital tool with low engagement rates might drain resources without contributing significantly to revenue or strategic goals.

These underperforming features represent a challenge, as they incur development and maintenance costs but fail to generate substantial returns or user value. Their limited integration means they aren't essential to daily operations, making them candidates for divestiture or significant overhaul if they don't show potential for improvement.

Non-Core, Stagnant Product Lines

Non-core, stagnant product lines for CareDx, those outside its primary focus on transplant diagnostics, could be classified as dogs in the BCG matrix. These might be legacy products from acquisitions that haven't integrated well or failed to gain traction, consuming resources without significant profit. For instance, if CareDx acquired a tangential business in 2023 that has shown minimal revenue growth and a declining market share, it would represent a dog.

These types of products often represent a drain on capital and management attention. In 2024, companies are increasingly scrutinizing such assets to streamline operations and reinvest in high-growth areas. A hypothetical example could be a diagnostic test for a rare disease that CareDx acquired but which has seen its market shrink due to new therapeutic advancements, leading to negligible sales.

- Stagnant Revenue: Product lines with minimal or negative year-over-year revenue growth.

- Low Market Share: Offerings that hold a small and ungrowing share in their respective markets.

- Divestment Potential: Products that may be candidates for sale or discontinuation to free up resources.

- Resource Drain: Assets requiring ongoing investment without commensurate returns, impacting overall profitability.

Divested or Phased-Out Offerings

Companies often refine their product lines by selling off or discontinuing items that don't fit their current strategy or aren't performing well. For CareDx, any products identified as 'dogs' in their portfolio would represent offerings with low market share or slow growth, leading to their eventual removal. While specific divestitures for CareDx in 2024 or 2025 haven't been publicly detailed, this process is a common business practice.

These 'dogs' are typically products that have failed to gain significant traction in the market or are no longer profitable. Their divestment or phase-out frees up resources that can be reallocated to more promising areas of the business, such as 'stars' or 'question marks'.

- Portfolio Streamlining: Companies regularly prune their offerings to focus on high-growth, high-return products.

- Strategic Alignment: Products are divested when they no longer fit long-term company goals or market positioning.

- Performance Metrics: Low market share, declining revenue, or unprofitability are key indicators for identifying 'dogs'.

- Resource Reallocation: Removing underperforming assets allows for investment in more promising ventures.

Products classified as 'dogs' within CareDx's portfolio are those with low market share and little to no growth potential. These offerings often require significant resources for maintenance but generate minimal returns, potentially hindering the company's overall financial health.

In 2024, CareDx, like many biotech firms, would be scrutinizing its product lines for such underperformers. A hypothetical 'dog' could be an older diagnostic kit for a niche transplant, facing intense competition and limited adoption, perhaps showing less than 1% year-over-year revenue growth and a declining market share.

The strategic implication for CareDx is to consider divesting or discontinuing these 'dog' products to reallocate capital towards more promising areas, such as their 'stars' or 'question marks', thereby optimizing resource allocation and focusing on future growth drivers.

| Product Category | Market Share | Growth Rate | Strategic Implication |

|---|---|---|---|

| Legacy Transplant Assays | Low (<5%) | Stagnant to Declining | Potential Divestment/Discontinuation |

| Niche Disease Diagnostics | Low (<2%) | Minimal | Resource Drain, Re-evaluation Needed |

| Underutilized Digital Tools | Low User Adoption | Negligible | Consider Overhaul or Sunset |

Question Marks

AlloHeme represents CareDx's strategic entry into the burgeoning field of post-transplant monitoring for hematologic malignancies. This segment of cellular transplantation is complex and expanding, making it a critical area for innovation. As of early 2024, AlloHeme is still navigating clinical trials and data dissemination, meaning its current market penetration is minimal, necessitating continued investment to prove its value.

The development of AlloHeme places it in a position akin to a ‘Question Mark’ on the BCG matrix. Significant resources are being channeled into its research and development, aiming to establish its clinical efficacy and secure a future market position. Successful validation could elevate it to a ‘Star’ product, but its current stage requires substantial capital outlay without guaranteed returns.

AlloCell is a key pipeline development for CareDx, targeting the burgeoning field of allogeneic cell therapy monitoring. This area of precision medicine is experiencing significant growth, positioning AlloCell as a future revenue driver.

Currently, AlloCell is in its early stages, meaning it has a small market share. This necessitates substantial investment to further its clinical development and capture a larger portion of this expanding market.

CareDx's AlloSure, a key component of its diagnostic offerings, has recently expanded its indications to include pediatric heart transplant recipients and simultaneous pancreas-kidney (SPK) transplant patients. These specialized patient groups represent new avenues for AlloSure's application, aiming to enhance patient management in these complex transplant scenarios.

While AlloSure benefits from an existing, robust platform, these newly launched indications are in the early phases of market penetration. Consequently, they currently hold a low market share, underscoring the need for targeted marketing efforts and comprehensive clinical education to foster adoption and integration within these specific transplant communities.

Early-Stage AI-Powered Diagnostics Beyond AlloSure Plus

CareDx’s early-stage AI-powered diagnostic initiatives beyond AlloSure Plus are categorized as question marks in the BCG matrix. These ventures are in a high-growth market, but their current market share is minimal. Significant investment is needed to assess their future potential and commercial viability.

These AI-driven platforms are designed to enhance diagnostic accuracy and efficiency in areas such as early disease detection and personalized treatment selection. For instance, in 2024, the global AI in healthcare market was projected to reach approximately $20 billion, highlighting the substantial growth potential these early-stage projects aim to tap into.

- High Growth Potential: Targeting the rapidly expanding AI in healthcare sector.

- Low Market Share: Currently possess minimal commercial penetration.

- Capital Intensive: Require substantial R&D funding to prove efficacy and market fit.

- Uncertain Future: Their success hinges on overcoming technological hurdles and achieving market adoption.

Strategic Operations Initiatives for EMR Integration

CareDx is strategically investing in deeper integration with Electronic Medical Record (EMR) systems like EPIC Aura to boost the adoption of its diagnostic testing services. This initiative is designed to tap into the growing demand for healthcare interoperability and streamline the workflow for clinicians.

While this represents a significant growth opportunity, the full impact on CareDx's market share and revenue is still unfolding. This makes EMR integration a strategic 'question mark' investment, necessitating ongoing development and a commitment to achieving widespread adoption.

- Accelerated Growth through EMR Integration: CareDx's focus on EMR integration, including partnerships with major platforms like EPIC, aims to make its testing services more accessible and embedded within routine clinical practice.

- Market Expansion Potential: By enhancing interoperability, CareDx seeks to expand its reach into a larger segment of the healthcare market, driving increased utilization of its specialized diagnostic tests.

- Investment in a High-Growth Area: Healthcare interoperability is a key trend, and CareDx's investment positions it to capitalize on this shift, though the ultimate return on this investment is still being determined.

- Strategic Importance for Future Revenue: Successful EMR integration is crucial for optimizing revenue streams and solidifying CareDx's position in the competitive landscape of transplant diagnostics.

CareDx's AlloHeme, AlloCell, and its early-stage AI initiatives are all positioned as Question Marks on the BCG matrix. These ventures operate in high-growth markets but currently hold minimal market share, requiring substantial investment to prove their efficacy and achieve commercial viability.

The recent expansion of AlloSure's indications into pediatric and SPK transplant recipients also falls into the Question Mark category. While these represent new growth avenues, their current market penetration is low, necessitating targeted efforts to drive adoption.

Similarly, CareDx's strategic investment in EMR integration, including with platforms like EPIC, is a Question Mark. This initiative aims to enhance accessibility and streamline workflows, tapping into the growing demand for healthcare interoperability, but its full impact on market share and revenue is still developing.

| Product/Initiative | BCG Category | Market Growth | Market Share | Investment Needs | Key Considerations |

|---|---|---|---|---|---|

| AlloHeme | Question Mark | High | Low | High (R&D, clinical trials) | Proving clinical efficacy, market adoption |

| AlloCell | Question Mark | High | Low | High (clinical development) | Capturing expanding precision medicine market |

| AI Diagnostic Initiatives | Question Mark | High (Global AI in healthcare market projected ~ $20 billion in 2024) | Minimal | High (R&D, commercialization) | Technological hurdles, market acceptance |

| AlloSure (New Indications) | Question Mark | Moderate to High | Low | Moderate (marketing, education) | Targeted adoption in specialized transplant groups |

| EMR Integration | Question Mark | High (Healthcare interoperability trend) | Developing | Moderate (development, partnerships) | Achieving widespread adoption, optimizing revenue |

BCG Matrix Data Sources

Our CareDx BCG Matrix leverages comprehensive market data, including financial reports, industry analyses, and competitive intelligence, to accurately position each product.