CareCloud Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

CareCloud operates within a dynamic healthcare IT landscape, facing significant pressures from established competitors and emerging digital disruptors. Understanding the intensity of these forces is crucial for strategic planning and identifying growth opportunities.

The complete report reveals the real forces shaping CareCloud’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CareCloud's reliance on a limited number of critical suppliers, such as major cloud infrastructure providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, presents a significant challenge. The concentration of these providers means they hold substantial sway in dictating terms and pricing. For instance, in 2023, the global cloud computing market was dominated by these top three providers, collectively holding over 60% of the market share, underscoring their concentrated power.

Suppliers providing unique or proprietary technologies crucial for CareCloud's integrated healthcare solutions wield significant bargaining power. If these specialized components, like advanced AI algorithms for diagnostics or secure patient data management systems, are difficult for CareCloud to replicate or find alternatives for, these suppliers gain considerable leverage. For instance, a supplier of a novel, FDA-approved telemedicine platform component that is integral to CareCloud's telehealth offerings would possess high bargaining power due to its essential and hard-to-substitute nature.

The bargaining power of suppliers for CareCloud is significantly influenced by switching costs, which can be substantial. These costs encompass not only the technical challenges of data migration and re-integration but also the investment in retraining staff and the potential for service disruptions during a transition. For instance, if a critical software supplier for CareCloud's Electronic Health Record (EHR) system were to change, the expense and time involved in moving patient data and ensuring seamless operation could run into millions of dollars.

High switching costs inherently strengthen a supplier's position by making it less feasible for CareCloud to seek alternative providers. This increased reliance on existing relationships means suppliers can potentially command higher prices or dictate more favorable terms. In 2024, the healthcare IT sector continued to see consolidation, meaning fewer specialized EHR vendors, further concentrating power among remaining suppliers and increasing the burden on healthcare providers like CareCloud to switch.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into CareCloud's market is a significant factor influencing their bargaining power. If suppliers possess the capability and a strong incentive to offer similar healthcare technology solutions directly to medical practices, they could effectively become direct competitors. This potential scenario compels CareCloud to cultivate robust relationships and negotiate favorable terms to mitigate the risk of losing business to its own suppliers.

This forward integration threat is particularly relevant in the healthcare IT sector. For instance, a company providing specialized electronic health record (EHR) components could, in theory, bundle these into a complete EHR solution, directly challenging CareCloud's core offerings. While the specialized nature of healthcare IT can present a barrier to entry for generic technology suppliers, those with existing healthcare-specific expertise or a strategic vision for the market could pose a more substantial threat.

- Supplier Forward Integration Capability: Suppliers with existing technological infrastructure and a deep understanding of healthcare workflows are better positioned to integrate forward.

- Market Incentive for Suppliers: A growing demand for integrated healthcare IT solutions and the potential for higher profit margins can incentivize suppliers to pursue forward integration.

- Impact on CareCloud: Increased supplier bargaining power due to forward integration can lead to higher input costs or reduced negotiation leverage for CareCloud.

Importance of CareCloud to Suppliers

The bargaining power of suppliers to CareCloud is significantly shaped by CareCloud's importance as a customer. If CareCloud constitutes a substantial portion of a supplier's revenue, that supplier will likely be more amenable to favorable pricing and terms, thus diminishing their leverage. For instance, if a key software provider to CareCloud derives over 20% of its annual income from CareCloud's business, they would be less inclined to impose unfavorable contract changes.

Conversely, if CareCloud represents a minor client for a supplier, the supplier has less incentive to prioritize CareCloud’s needs or offer concessions. This scenario empowers the supplier to dictate terms, potentially leading to higher costs or less flexible service agreements for CareCloud. For example, a niche hardware component supplier might view CareCloud as just one of many clients, allowing them to maintain firm pricing structures.

- CareCloud's revenue concentration with suppliers: A higher percentage of a supplier's revenue derived from CareCloud weakens the supplier's bargaining power.

- Supplier dependence on CareCloud: If suppliers are highly dependent on CareCloud for a significant portion of their business, they are more likely to offer favorable terms.

- Market position of suppliers: Suppliers with unique or critical offerings to CareCloud, even if CareCloud is a small client, can still wield significant power if alternatives are scarce.

CareCloud faces considerable supplier bargaining power due to the concentrated nature of critical technology providers. Major cloud infrastructure providers like AWS, Azure, and Google Cloud, which held over 60% of the global cloud market share in 2023, can dictate terms. Furthermore, suppliers of specialized, hard-to-replicate technologies, essential for CareCloud's healthcare solutions, also wield significant influence.

High switching costs, including data migration and retraining, further bolster supplier leverage. In 2024, healthcare IT consolidation means fewer EHR vendors, increasing the power of remaining suppliers. The threat of suppliers integrating forward into CareCloud's market also amplifies their bargaining power, as they could become direct competitors.

| Factor | Impact on CareCloud | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | High Bargaining Power | Top 3 cloud providers held >60% market share in 2023. |

| Switching Costs | High Bargaining Power | Millions of dollars in potential costs for EHR data migration. |

| Forward Integration Threat | High Bargaining Power | EHR component suppliers could bundle solutions, becoming competitors. |

| Customer Dependence | Low Bargaining Power (if CareCloud is minor client) | Niche hardware suppliers may not prioritize CareCloud's needs. |

What is included in the product

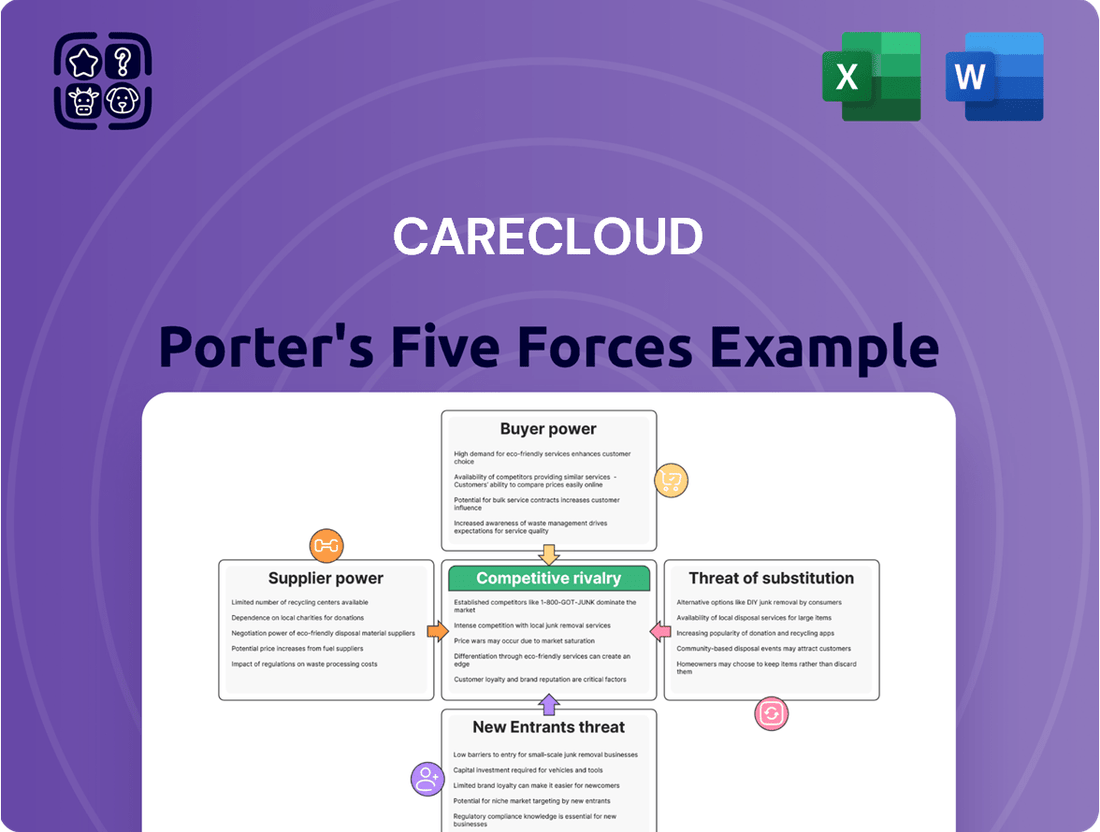

Analyzes the intensity of rivalry, buyer and supplier power, threat of new entrants, and the risk of substitutes within the healthcare IT market for CareCloud.

Instantly visualize competitive pressures with a dynamic, interactive Porter's Five Forces model, simplifying complex market analysis.

Customers Bargaining Power

CareCloud's customer base is characterized by its fragmentation, primarily comprising individual medical practices and smaller healthcare provider groups. This lack of customer concentration means that no single client holds substantial sway over CareCloud's revenue streams.

With a dispersed customer base, the bargaining power of individual customers is inherently limited. This fragmentation provides CareCloud with greater flexibility in negotiating pricing and contractual terms, as the loss of any one customer would not significantly impact overall business performance.

For instance, in 2024, the healthcare IT market saw continued growth, with many small to medium-sized practices adopting new technologies. This trend reinforces the fragmented nature of CareCloud's customer landscape, further diminishing individual customer leverage.

Healthcare practices encounter substantial costs when transitioning between Electronic Health Record (EHR) and practice management systems. These costs stem from the intricate process of data migration, the necessity for comprehensive staff retraining on new software and workflows, and the inherent disruption to daily operations. The critical nature of patient data further amplifies these switching barriers.

For CareCloud, these high customer switching costs translate into a significant advantage. They effectively diminish the bargaining power of existing clients, as the effort and expense involved in moving to a competitor, even for minor dissatisfactions, become considerable deterrents. This sticky customer base provides CareCloud with a more stable revenue stream and greater pricing power.

Medical practices, especially smaller ones, often operate on thin margins, making them acutely sensitive to price. For instance, in 2024, many independent practices reported that technology investments represented a significant portion of their capital expenditure, often exceeding 10% of annual revenue, making cost a primary driver in their decision-making process.

While CareCloud offers valuable integrated solutions, the sheer cost can be a barrier. This price sensitivity directly impacts CareCloud by creating downward pressure on their pricing strategies, particularly for their more accessible, entry-level software packages.

Availability of Substitute Products/Services

The healthcare technology market, particularly for Electronic Health Records (EHR), practice management, and revenue cycle management (RCM) solutions, is characterized by a significant number of competing vendors. This abundance of alternatives directly empowers customers, giving them considerable leverage. They can readily compare offerings based on features, pricing structures, and the quality of customer support provided by various companies.

This intense competition means that providers like CareCloud must constantly strive to differentiate themselves and deliver superior value. For instance, in 2024, the EHR market alone was projected to reach over $30 billion globally, indicating a highly fragmented and competitive space where customer choice is paramount. The ease with which a healthcare practice can switch between different EHR systems, or the availability of specialized RCM services, directly influences their negotiation power.

- Wide Vendor Choice: The healthcare IT sector features numerous EHR, practice management, and RCM solution providers, offering customers a broad spectrum of choices.

- Competitive Differentiation: Customers can easily benchmark features, pricing, and support services across different vendors, forcing companies like CareCloud to innovate and offer competitive value propositions.

- Market Size and Fragmentation: With the global EHR market valued in the tens of billions of dollars in 2024, the sheer number of players underscores the customer's strong bargaining position due to readily available alternatives.

Threat of Backward Integration by Customers

The threat of healthcare providers integrating backward by developing their own in-house technology solutions is generally low for smaller to mid-sized practices, which represent a significant portion of CareCloud's customer base. The substantial capital, specialized technical expertise, and continuous investment needed for compliant Electronic Health Record (EHR) and Revenue Cycle Management (RCM) systems are often prohibitive for these entities. For instance, the average cost to develop a custom EHR system can range from $50,000 to over $500,000, excluding ongoing maintenance and updates, making it an unfeasible option for most. This limited capacity for backward integration consequently reduces the bargaining power of these customers.

The high barrier to entry for developing proprietary healthcare IT solutions directly impacts customer leverage. Smaller practices, in particular, lack the financial and technical resources to replicate the sophisticated functionalities and regulatory compliance that established vendors like CareCloud offer. This reliance on external providers for essential technology means customers have less power to negotiate terms or demand significant concessions. In 2024, the healthcare IT market continues to see consolidation and increasing complexity, further raising the stakes for any practice considering in-house development.

Consequently, the bargaining power of customers is mitigated by the significant challenges and costs associated with backward integration.

- Low Threat of Backward Integration: Most smaller to mid-sized healthcare practices lack the capital and technical expertise to develop their own EHR/RCM systems.

- High Development Costs: Building compliant healthcare technology can cost hundreds of thousands of dollars, making it impractical for many practices.

- Reduced Customer Leverage: The inability to develop in-house solutions limits customers' power to negotiate pricing or terms with vendors like CareCloud.

- Market Complexity: The evolving and complex nature of healthcare IT in 2024 further discourages in-house development efforts by individual practices.

CareCloud's customer base is largely fragmented, consisting of numerous individual medical practices and smaller healthcare groups. This dispersion means no single client can significantly influence CareCloud's revenue. While price sensitivity is high for these practices, especially in 2024 where technology investments often exceeded 10% of revenue for independent clinics, the substantial costs and complexity of switching EHR systems—including data migration and retraining—create high switching barriers. This significantly limits their bargaining power.

| Factor | Impact on Customer Bargaining Power | CareCloud's Position |

|---|---|---|

| Customer Concentration | Low (Fragmented Base) | High leverage due to dispersed clients. |

| Switching Costs | High (Data migration, retraining) | Strong customer retention, reduced negotiation leverage. |

| Price Sensitivity | High (Thin margins for practices) | Downward pressure on pricing, especially entry-level. |

| Vendor Competition | High (Numerous EHR/RCM providers) | Requires continuous value differentiation and competitive pricing. |

| Backward Integration Threat | Low (High development costs for practices) | Customers reliant on external solutions, limiting negotiation power. |

Full Version Awaits

CareCloud Porter's Five Forces Analysis

This preview showcases the complete CareCloud Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the healthcare IT sector. The document you see here is precisely what you will receive immediately after purchase, providing a fully formatted and ready-to-use strategic assessment. Understand the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry, all presented in this exact file.

Rivalry Among Competitors

The healthcare IT sector, especially for Electronic Health Record (EHR) and practice management systems, is incredibly crowded. Think of it like a bustling marketplace with many vendors, from big names like Epic and Oracle Health to many smaller, niche providers. This sheer number and variety of competitors mean rivalry is fierce as everyone tries to capture a piece of the market. CareCloud really needs to find ways to stand out in this busy space.

The healthcare IT sector is experiencing robust growth, projected to reach $116.7 billion by 2024 according to Grand View Research. This expansion, fueled by digitalization and regulatory requirements, intensifies competition as companies vie for market share. The need for constant innovation to meet evolving client demands and the potential for slower growth in niche areas can trigger aggressive pricing and heightened rivalry among established players.

CareCloud's product differentiation in its cloud-based EHR, practice management, revenue cycle management, and patient engagement solutions significantly influences competitive rivalry. By offering unique features, a superior user experience, or seamless integration, CareCloud can reduce direct price-based competition.

However, the healthcare IT market is crowded with many similar offerings, meaning rivalry remains intense, often centering on feature sets and overall cost-effectiveness. For instance, in 2024, the EHR market is projected to reach over $30 billion, indicating a highly competitive landscape where differentiation is key to standing out.

Switching Costs for Customers

High switching costs in the Electronic Health Record (EHR) market, while beneficial for retaining existing clients, present a significant hurdle for CareCloud in attracting new customers. This dynamic fuels fierce competition for new client acquisition, where companies often employ aggressive sales strategies and attractive onboarding packages to entice practices away from established EHR providers.

The intense rivalry for new customer acquisition is a defining characteristic of the EHR landscape. For instance, in 2024, healthcare providers are increasingly evaluating EHR systems based on ease of integration and data migration, making the initial onboarding process a critical differentiator. Companies like CareCloud must invest heavily in demonstrating superior value and support to overcome the inertia associated with existing EHR investments.

- Customer Lock-in: High switching costs, often involving data migration complexities and retraining staff, create strong customer loyalty for incumbent EHR providers.

- Acquisition Challenges: For CareCloud, these barriers mean a substantial effort is required to convince new clients to switch, often necessitating aggressive pricing or enhanced service offerings.

- Competitive Tactics: The battle for new market share involves significant investment in sales and marketing, with introductory discounts and comprehensive implementation support being common strategies in 2024.

Exit Barriers

High exit barriers in the healthcare IT sector, driven by specialized assets and lengthy customer contracts, mean companies often stay in the market even when profits are slim. This reluctance to leave intensifies rivalry, as firms maintain capacity and competitive pressure rather than exiting. For instance, the average contract length for Electronic Health Record (EHR) systems can be 5-10 years, making early termination costly.

The substantial investments in research and development, coupled with deeply entrenched customer relationships, further solidify these exit barriers. Companies might have invested millions in developing proprietary software or building strong integration with hospital workflows. In 2024, the average R&D spending as a percentage of revenue for healthcare IT firms was approximately 15%, highlighting the significant capital commitment that discourages departure.

- Specialized Assets: Healthcare IT firms often possess unique hardware or software tailored to specific medical needs, which have limited resale value outside the industry.

- Long-Term Contracts: Commitments with hospitals and clinics can span many years, creating financial penalties for early withdrawal.

- High Fixed Costs: Significant upfront investments in infrastructure, software development, and regulatory compliance contribute to the cost of exiting.

- Customer Relationships: The deep integration of IT solutions into clinical operations and the trust built with healthcare providers make switching providers difficult and expensive.

The competitive rivalry within the healthcare IT sector, particularly for EHR and practice management systems, is intense due to a crowded market with numerous providers, ranging from large enterprises to specialized niche players. This high degree of competition necessitates continuous innovation and strategic differentiation for companies like CareCloud to capture and retain market share, especially as the market is projected to reach over $30 billion in 2024.

| Key Competitor Type | Market Share Example (Illustrative) | Competitive Tactic Example |

| Large Integrated EHR Vendors | 30-40% | Bundled solutions, extensive feature sets, enterprise-level support. |

| Mid-Sized Practice Management Specialists | 10-20% | Focus on specific specialties, competitive pricing, agile development. |

| Niche Cloud-Based Solutions (e.g., CareCloud) | 5-15% | User experience, cloud-native architecture, integrated RCM and patient engagement. |

| Emerging Startups | <5% | Disruptive technology, novel business models, specific unmet needs. |

SSubstitutes Threaten

While digital solutions dominate, manual or paper-based systems remain a substitute threat for some smaller, traditional medical practices. These systems bypass initial software expenses but are significantly less efficient and accurate, and struggle with modern compliance needs. For instance, in 2024, the healthcare industry continued its push towards electronic health records (EHRs), with over 90% of office-based physicians utilizing some form of EHR, making paper systems increasingly impractical and risky.

Practices might choose standalone software for electronic health records (EHR), billing, and patient scheduling instead of an all-in-one solution like CareCloud. This approach bypasses a single vendor commitment but introduces significant integration hurdles, data fragmentation, and operational slowdowns. For example, a practice using separate systems for EHR and billing in 2024 might spend an average of 20% more on administrative tasks due to manual data transfer and reconciliation.

The threat of generic business software as a substitute for specialized healthcare platforms like CareCloud is relatively low. While some practices might consider using off-the-shelf accounting, CRM, or scheduling tools due to perceived cost savings, these solutions fundamentally lack the critical healthcare-specific functionalities. For instance, generic software cannot handle the intricate billing codes, patient data privacy regulations (like HIPAA), or clinical workflow integrations essential for modern healthcare operations.

In 2024, the healthcare industry's increasing reliance on interoperability and compliance makes generic software a poor fit. A survey of healthcare IT professionals indicated that over 85% prioritize solutions with built-in regulatory compliance features. Furthermore, the cost of integrating and customizing generic software to meet healthcare needs often negates any initial savings, making them a less viable alternative compared to dedicated platforms.

In-house Developed Solutions

Large healthcare systems or highly specialized practices may opt to build their own software, a significant substitute offering complete control. However, the substantial investment in development, ongoing maintenance, and the complexities of regulatory compliance mean this is only feasible for a very limited market segment, thus posing a low threat to CareCloud's core customer base.

Developing in-house solutions requires substantial upfront capital, often running into millions of dollars, and a dedicated IT team. For instance, a large hospital system might spend upwards of $5-10 million to develop a custom EHR system, a cost far beyond the reach of most practices. This high barrier to entry ensures that such custom solutions remain a niche alternative.

- High Development Costs: Custom software development can cost millions, making it prohibitive for most.

- Maintenance and Support Burden: Ongoing upkeep and updates require significant internal resources.

- Regulatory Compliance Challenges: Ensuring compliance with HIPAA and other regulations is complex and costly.

- Limited Scalability: In-house solutions may struggle to adapt to future growth and changing needs compared to commercial offerings.

Outsourced Services (Non-Software)

Practices might opt to outsource non-software functions like revenue cycle management or medical billing to third-party providers. These providers leverage their own systems, effectively substituting the direct need for CareCloud's software. This choice often stems from a cost-benefit assessment comparing software ownership against service fees.

The threat of substitutes in this category is significant. For instance, a medical practice might find it more economical to contract with a specialized billing company, which handles all aspects of revenue cycle management, rather than purchasing and implementing a comprehensive software solution like CareCloud. This bypasses the need for the software entirely.

- Cost-Effectiveness: Outsourcing can be cheaper than investing in and maintaining proprietary software, especially for smaller practices.

- Specialized Expertise: Third-party providers often offer deep expertise in specific areas like billing and compliance, which can be difficult to replicate in-house.

- Reduced IT Burden: Outsourcing eliminates the need for internal IT support and infrastructure management related to the outsourced function.

- Focus on Core Competencies: Practices can redirect resources towards patient care rather than administrative tasks.

The threat of substitutes for CareCloud's integrated healthcare management platform is primarily driven by alternative software solutions and outsourced services. While manual systems are largely obsolete, standalone EHRs, billing software, or scheduling tools present a fragmented substitute. Generic business software, though cheaper initially, lacks the essential healthcare-specific features and compliance capabilities, making it a poor substitute for specialized platforms. Building custom in-house software is a significant undertaking with high costs, limiting its viability as a widespread substitute.

Outsourcing functions like revenue cycle management directly substitutes the need for CareCloud's software. Many practices find it more cost-effective and efficient to use specialized third-party providers for these tasks, leveraging their expertise and reducing the internal IT burden. This approach allows practices to focus on core patient care rather than managing complex administrative software and processes.

| Substitute Type | Description | Key Considerations | 2024 Relevance |

|---|---|---|---|

| Standalone Software | Using separate systems for EHR, billing, scheduling. | Integration challenges, data fragmentation, higher admin costs. | Practices using separate systems in 2024 faced ~20% higher admin costs due to manual data transfer. |

| Generic Business Software | Off-the-shelf accounting, CRM, or scheduling tools. | Lacks healthcare-specific functions, compliance issues, high customization costs. | Over 85% of healthcare IT professionals prioritized built-in regulatory compliance in 2024. |

| In-house Development | Building custom software solutions internally. | Extremely high development and maintenance costs, complex regulatory compliance. | Custom EHR development can cost $5-10 million, making it feasible only for large systems. |

| Outsourced Services | Contracting third-party providers for RCM, billing, etc. | Cost-effectiveness, specialized expertise, reduced IT burden. | A significant portion of practices opt for outsourced billing, bypassing software investment. |

Entrants Threaten

Entering the healthcare technology sector, particularly with integrated Electronic Health Record (EHR) and Revenue Cycle Management (RCM) systems, demands a significant upfront capital outlay. Developing, deploying, and maintaining these complex platforms necessitates substantial investment in research and development, secure IT infrastructure, and navigating stringent regulatory compliance, such as HIPAA. For instance, in 2024, companies launching new healthcare IT solutions often report initial development costs exceeding $5 million, with ongoing operational expenses for security and updates adding millions more annually. This high financial threshold acts as a powerful deterrent for potential new competitors seeking to enter the market.

The healthcare technology sector faces substantial regulatory hurdles, acting as a significant barrier to new entrants. For instance, compliance with the Health Insurance Portability and Accountability Act (HIPAA) and the HITECH Act is non-negotiable, demanding robust data privacy and security measures. Failure to comply can result in severe financial penalties, with HIPAA fines potentially reaching millions of dollars annually for repeated violations.

Healthcare providers are inherently risk-averse, especially concerning patient data and essential operational systems. This cautiousness creates a significant barrier for new entrants. For instance, a data breach in healthcare can lead to severe regulatory penalties and irreparable damage to a provider's reputation, making them hesitant to adopt unproven solutions.

Newcomers struggle to match the established trust, reputation, and proven track record that incumbent players like CareCloud have cultivated over years of reliable service. Building this crucial credibility is a lengthy and arduous journey, often requiring extensive validation and successful implementations before significant market penetration is possible.

The healthcare industry heavily relies on referrals and long-standing relationships. Providers often choose solutions recommended by trusted peers or partners, a network that new entrants are unlikely to possess initially. This makes it challenging for new companies to break into established customer bases without a demonstrable history of success.

Technological Complexity and Integration

The development of integrated cloud-based EHR, practice management, and RCM solutions demands profound expertise in healthcare workflows, clinical data management, intricate billing codes, and critical interoperability standards. This technical sophistication is a significant hurdle for potential entrants.

Furthermore, the challenge of seamlessly integrating these new systems with existing legacy infrastructure, laboratories, pharmacies, and other vital healthcare entities introduces substantial complexity. This intricate integration requirement necessitates specialized talent and substantial investment, acting as a strong deterrent to new competitors.

- High Barrier to Entry: The significant technical expertise and capital required to develop and integrate robust healthcare IT solutions create a formidable barrier for new entrants.

- Specialized Talent Demand: Companies need highly skilled professionals with deep knowledge of healthcare IT, data security, and regulatory compliance, which are not easily acquired.

- Integration Complexity: Successfully connecting with diverse healthcare systems, from hospital EHRs to individual lab portals, requires overcoming significant technical and operational challenges.

Economies of Scale and Network Effects

Established players in the healthcare IT sector, like CareCloud, often benefit from significant economies of scale. This means they can spread their high fixed costs for software development, customer support, and sales across a larger customer base, leading to lower per-unit costs. For instance, in 2024, major EHR vendors reported substantial R&D investments, with some allocating over 15% of their revenue to innovation, a level difficult for new entrants to match initially.

Network effects also create a formidable barrier. As more healthcare providers adopt a platform like CareCloud's, the value proposition grows. This includes a larger pool of integrated third-party applications, a more robust user community for shared best practices and troubleshooting, and enhanced data analytics capabilities derived from a wider dataset. For example, platforms with extensive partner ecosystems in 2024 saw higher customer retention rates, as switching costs increased due to the loss of these integrated functionalities.

New entrants face the daunting task of replicating these scale and network advantages. They must invest heavily to achieve comparable cost efficiencies and build a critical mass of users to generate meaningful network effects. Without this, their offerings may be perceived as less valuable or more expensive, hindering their ability to gain traction against entrenched competitors.

- Economies of Scale: Lower per-unit costs for established players due to high fixed cost absorption.

- R&D Investment: Incumbents can outspend new entrants on innovation, as seen with significant R&D budgets in 2024.

- Network Effects: Increased platform value with more users, leading to higher switching costs for customers.

- Market Penetration Challenge: New entrants struggle to quickly match the scale and network advantages of established firms.

The threat of new entrants in the healthcare technology market, particularly for integrated EHR and RCM systems, is significantly low. This is primarily due to the substantial capital investment required for development, deployment, and ongoing maintenance, often exceeding $5 million in initial costs for new ventures in 2024. Furthermore, navigating stringent regulatory landscapes like HIPAA and HITECH, which carry potential multi-million dollar annual fines for non-compliance, presents a formidable barrier. The inherent risk aversion of healthcare providers, coupled with the need for established trust and proven track records, further deters newcomers from challenging established players like CareCloud.

The technical expertise and integration complexity inherent in healthcare IT solutions also act as significant deterrents. Developing systems that seamlessly interface with diverse legacy infrastructures, laboratories, and pharmacies demands specialized talent and considerable investment. This intricate integration requirement, alongside the demand for deep knowledge in healthcare workflows and data security, makes it challenging for new companies to achieve market penetration without a demonstrable history of success and robust partner ecosystems.

| Barrier Type | Description | Example Impact (2024 Data) |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, infrastructure, and compliance. | New entrants face initial development costs often exceeding $5 million. |

| Regulatory Hurdles | Strict compliance with HIPAA, HITECH, and other healthcare regulations. | Non-compliance fines can reach millions annually, deterring risk-taking. |

| Technical Expertise | Need for specialized knowledge in healthcare IT, data security, and interoperability. | Difficulty in acquiring talent to manage complex integration with existing systems. |

| Brand Loyalty & Trust | Established reputation and proven track record of incumbents. | Providers are risk-averse, preferring trusted and validated solutions. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to larger customer bases. | Established firms can invest over 15% of revenue in R&D, outpacing newcomers. |

| Network Effects | Increased platform value with a larger user base and integrated partners. | Higher switching costs for customers due to extensive integrated functionalities. |

Porter's Five Forces Analysis Data Sources

Our CareCloud Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial filings from publicly traded healthcare IT companies, and insights from reputable healthcare consulting firms.