CareCloud Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

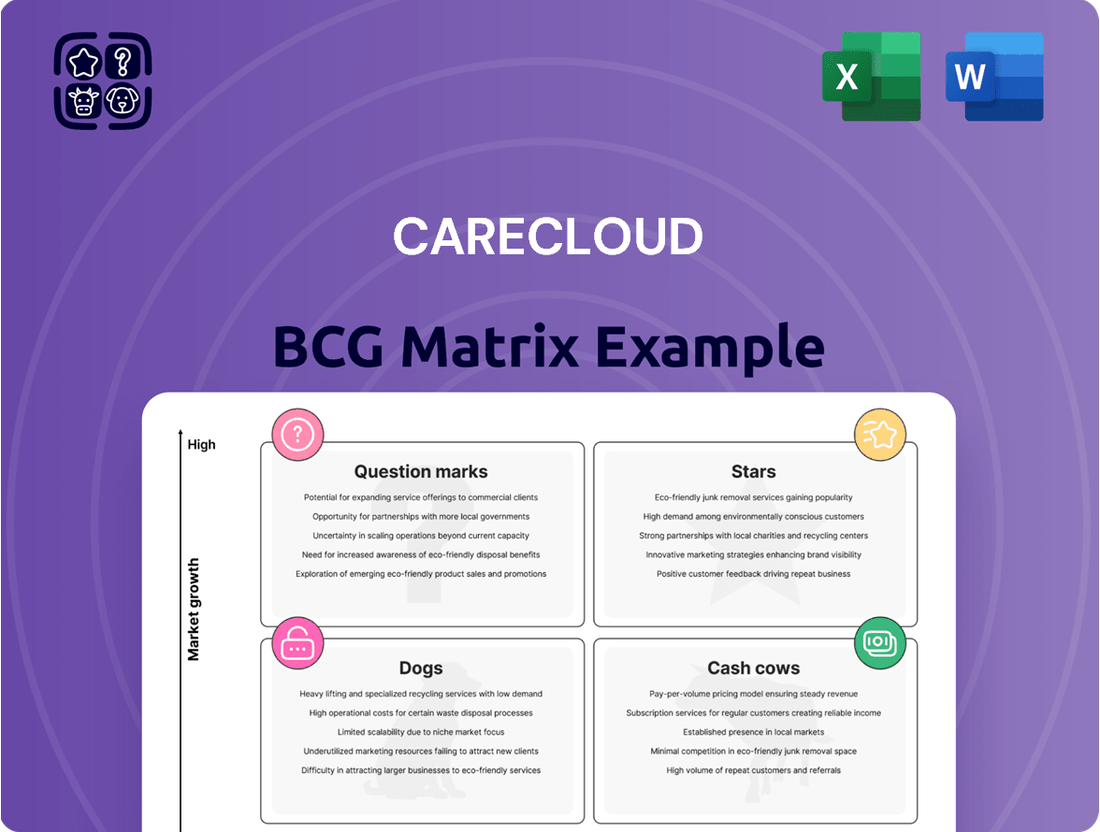

Uncover the strategic positioning of CareCloud's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are poised for growth (Stars), which are generating consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into CareCloud's market performance, but the full BCG Matrix report provides the detailed quadrant placements, data-driven insights, and actionable recommendations you need to make informed investment and product development decisions. Purchase the full version to unlock your strategic advantage.

Stars

CareCloud's AI-driven solutions are poised for significant growth, earning them a spot as a Star in the BCG Matrix. The company's substantial investment in its AI Center of Excellence, with plans to grow to 500 AI specialists by Q4 2025, underscores this commitment.

These solutions are engineered to streamline operations through workflow automation, proactively identify and mitigate claim denial risks, and foster deeper patient engagement. This focus on efficiency and improved patient outcomes positions CareCloud favorably in the burgeoning healthcare AI sector.

CareCloud anticipates that its AI initiatives will be a key driver of increased profitability in 2025. By making operational processes faster, smarter, and more efficient, the company expects to see a tangible boost in its financial performance.

CareCloud's Revenue Cycle Management (RCM) services, especially those augmented by AI and robotic process automation, position it as a Star in the BCG matrix. These advanced RCM solutions boast impressive metrics, with denial rates consistently below 3% and first-pass claims approval rates reaching 94-97%. This efficiency directly translates to improved cash flow for healthcare providers, demonstrating a strong market position in a sector experiencing escalating demand for streamlined financial operations.

CareCloud's renewed focus on strategic acquisitions, marked by two key deals in March and April 2025, positions it firmly in the Star quadrant of the BCG Matrix. These moves are designed to accelerate revenue growth and capture market share.

The company's strategy involves not just organic expansion but also acquiring smaller, less efficient competitors, thereby broadening its customer reach and solidifying its market position. This aggressive approach targets high-growth opportunities.

Cloud-Based Electronic Health Records (EHR) with AI

CareCloud's cloud-based Electronic Health Records (EHR) system, enhanced with AI for real-time clinical note generation and automated documentation, is a prime example of a Star in the BCG matrix. This segment benefits from the robust growth of the EHR market, which is expected to reach approximately $38.5 billion by 2025, with cloud-based solutions driving a significant portion of this expansion. CareCloud's strategic investment in AI within its EHR platform directly addresses the increasing demand for efficient and intelligent healthcare management solutions, positioning it for sustained high market share and growth.

- Market Growth: The global EHR market is experiencing consistent expansion, projected to continue its upward trajectory.

- AI Integration: CareCloud's AI-powered EHRs offer advanced features like real-time clinical note generation, enhancing efficiency.

- Cloud Adoption: The shift towards cloud-based EHR solutions is a key trend, indicating strong future demand for CareCloud's offerings.

- Strategic Positioning: By focusing on workflow streamlining and improved patient care, CareCloud is well-positioned for continued leadership in this high-growth segment.

Patient Engagement Tools with Digital Front-Door Solutions

CareCloud's patient engagement tools, encompassing mobile and web-ready solutions for appointment check-in, payment collection, and remote patient monitoring, are firmly positioned as a Star in the BCG matrix.

The market for patient engagement solutions is experiencing robust expansion. This growth is fueled by the increasing demand for personalized healthcare experiences and the continuous drive to enhance patient outcomes. Projections indicate a rapid market expansion from 2024 through 2029, highlighting the strategic importance of these digital front-door offerings.

- Market Growth: The patient engagement solutions market is expected to see significant growth, with forecasts suggesting a compound annual growth rate (CAGR) of over 15% between 2024 and 2029.

- Key Features: CareCloud's solutions facilitate seamless appointment check-ins, streamline payment collection processes, and enable effective remote patient monitoring, all contributing to improved patient satisfaction.

- Strategic Alignment: These offerings are vital for healthcare providers aiming to modernize their operations and adapt to evolving patient expectations for convenient, accessible digital interactions.

- Competitive Advantage: By investing in these digital front-door capabilities, healthcare organizations can differentiate themselves and build stronger patient relationships in a competitive landscape.

CareCloud's AI-powered Revenue Cycle Management (RCM) solutions are a clear Star, demonstrating high growth and market share. These solutions are achieving impressive results, with denial rates below 3% and first-pass claims approval rates between 94% and 97%. This efficiency directly translates to better cash flow for healthcare providers in a market that increasingly demands streamlined financial operations.

CareCloud's strategic acquisitions in early 2025, aimed at accelerating revenue and capturing market share, further solidify its Star status. By integrating smaller competitors, the company is expanding its customer base and strengthening its competitive position in high-growth segments of the healthcare technology market.

The company's cloud-based Electronic Health Records (EHR) system, enhanced with AI for features like real-time clinical note generation, is a prime example of a Star. This segment benefits from the EHR market's projected growth to approximately $38.5 billion by 2025, with cloud adoption being a major driver.

CareCloud's patient engagement tools are also Stars, capitalizing on a market expected to grow at a CAGR exceeding 15% from 2024 to 2029. These tools, including mobile check-in and remote patient monitoring, enhance patient satisfaction and operational efficiency.

| CareCloud Product Segment | BCG Matrix Quadrant | Key Growth Drivers | Market Share Indicator | Strategic Rationale |

|---|---|---|---|---|

| AI-Powered RCM | Star | Denial rate below 3%, 94-97% first-pass approval | High efficiency, improved cash flow | Streamlining financial operations |

| Strategic Acquisitions | Star | Accelerated revenue growth, market share capture | Expanding customer base | Consolidating market position |

| AI-Enhanced EHR | Star | EHR market growth to $38.5B by 2025, cloud adoption | Real-time note generation | Addressing demand for intelligent solutions |

| Patient Engagement Tools | Star | 15%+ CAGR (2024-2029) in patient engagement market | Enhanced patient satisfaction | Meeting evolving patient expectations |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

The CareCloud BCG Matrix offers a clear, visual representation of your business units, simplifying complex strategic decisions.

Cash Cows

CareCloud's core revenue cycle management (RCM) services, the foundational elements of their offerings, are strong contenders for Cash Cows. These services, which handle the essential tasks of medical billing and claims processing, are vital for healthcare providers. They generate a steady stream of income because the demand for these services is constant in the healthcare industry.

These traditional RCM services likely represent a substantial part of CareCloud's overall revenue, contributing reliably to its cash flow. The healthcare market, while evolving, still relies heavily on these established processes, making them a stable, albeit less explosive, revenue source. For instance, in 2024, the global RCM market was valued at approximately $10.9 billion, with a projected compound annual growth rate (CAGR) of around 10.5% through 2030, indicating a mature but consistently growing sector.

CareCloud's practice management software is a prime example of a Cash Cow within the healthcare technology sector. This mature product boasts a significant market share, serving as a critical tool for healthcare providers aiming to streamline their operations and enhance efficiency. Its essential nature for medical practices ensures consistent demand and stable revenue generation, minimizing the need for extensive marketing efforts.

In 2024, the demand for robust practice management solutions remained high, with healthcare providers increasingly focused on optimizing revenue cycles and administrative tasks. CareCloud's offering, known for its comprehensive features and user-friendliness, has solidified its position as a leader in this space, contributing substantially to the company's overall financial health. The predictable cash flow generated by this segment allows CareCloud to invest in other growth areas.

CareCloud's legacy EHR implementations, while not featuring the latest AI advancements, represent a significant cash cow. These established client relationships generate consistent, recurring revenue through maintenance, support services, and existing workflow subscriptions. In 2024, the EHR market, while mature, continues to see steady demand for reliable systems, with many healthcare providers prioritizing stability and proven functionality over cutting-edge, unproven technologies.

Professional Services and Staffing

CareCloud's professional services and staffing arm, focused on healthcare IT and workforce augmentation, operates as a strong Cash Cow. These offerings capitalize on established expertise and existing client connections, generating consistent revenue streams. Healthcare entities continuously seek assistance with IT modernization and operational efficiency, particularly in revenue cycle management (RCM) and clinical workflow enhancements.

The demand for these services remains robust, as evidenced by the ongoing need for specialized IT support within the healthcare sector. For instance, the healthcare IT market was projected to reach over $300 billion globally by 2024, with a significant portion driven by demand for consulting and staffing services to manage complex systems and digital transformations.

- Steady Revenue Generation: Leverages existing infrastructure and client base for predictable income.

- Low Investment Needs: Benefits from established processes and skilled personnel, requiring minimal new capital outlay.

- Market Demand: Addresses persistent needs in healthcare for IT support, RCM optimization, and staffing.

- Profitability: Generates substantial profits due to high demand and efficient service delivery.

Interoperability Solutions for Existing Clients

CareCloud's interoperability solutions for its existing client base are a prime example of a Cash Cow within the BCG Matrix. These offerings facilitate smooth data exchange across different platforms, a critical need for healthcare providers already invested in CareCloud's ecosystem.

These solutions are instrumental in solidifying existing client relationships by ensuring their systems continue to function efficiently and integrate seamlessly with evolving healthcare data requirements. This focus on maintaining and enhancing the value of current partnerships directly translates into stable, recurring revenue streams.

- Stable Revenue: Interoperability solutions contribute to predictable recurring revenue, a hallmark of Cash Cows.

- Client Retention: Enhanced data flow improves client satisfaction, reducing churn and supporting long-term contracts.

- Market Demand: The healthcare industry's increasing emphasis on data exchange makes these solutions highly valued by existing clients.

- Low Investment: As established offerings, they require minimal new investment compared to products in other BCG quadrants.

CareCloud's established revenue cycle management (RCM) services are clear Cash Cows. These services, crucial for healthcare providers, generate consistent income due to the industry's ongoing need for efficient billing and claims processing. The global RCM market was valued at approximately $10.9 billion in 2024, with a projected CAGR of 10.5% through 2030, underscoring the mature but stable nature of this segment.

The company's practice management software also fits the Cash Cow profile. It holds a significant market share, streamlining operations for healthcare providers and ensuring a predictable revenue stream with minimal marketing investment. In 2024, the demand for such solutions remained high as healthcare organizations focused on operational efficiency.

Legacy EHR implementations, while not the newest technology, contribute to CareCloud's Cash Cow status. They generate recurring revenue through maintenance and support, benefiting from stable client relationships. The EHR market in 2024 continued to see demand for reliable, proven systems.

CareCloud's professional services and staffing for healthcare IT are also strong Cash Cows. These offerings leverage existing expertise and client relationships, addressing the persistent need for IT modernization and operational efficiency in healthcare. The healthcare IT market was projected to exceed $300 billion globally by 2024, with consulting and staffing being key drivers.

Interoperability solutions for existing clients also function as Cash Cows. They ensure seamless data exchange, enhancing the value of current partnerships and leading to stable, recurring revenue. The healthcare industry's increasing focus on data exchange makes these solutions highly valued by existing clients.

| CareCloud Offering | BCG Quadrant | Key Characteristics | 2024 Market Context |

|---|---|---|---|

| Revenue Cycle Management (RCM) | Cash Cow | Steady, predictable revenue; low investment needs; high market demand. | Global RCM market ~$10.9 billion in 2024. |

| Practice Management Software | Cash Cow | Significant market share; essential for operations; stable revenue. | High demand for optimization solutions in 2024. |

| Legacy EHR Implementations | Cash Cow | Recurring revenue from support; stable client base; proven functionality. | Continued demand for reliable EHR systems in 2024. |

| Professional Services & Staffing | Cash Cow | Leverages expertise; consistent revenue; addresses IT modernization needs. | Healthcare IT market >$300 billion globally in 2024. |

| Interoperability Solutions | Cash Cow | Enhances existing client value; stable recurring revenue; critical for data exchange. | Increasing industry emphasis on data exchange. |

Full Transparency, Always

CareCloud BCG Matrix

The CareCloud BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content will be present; you’ll get a ready-to-use strategic tool for analyzing CareCloud's product portfolio.

Dogs

Legacy software modules within CareCloud that haven't seen recent updates or integration into newer systems and exhibit low market adoption fall into the Dogs category. These offerings often struggle with limited growth potential and a small market share. For instance, if a module developed in the early 2010s, like an older EHR interface component, hasn't been enhanced with AI-driven patient engagement tools or cloud-native architecture, its market relevance diminishes significantly.

These products may demand considerable resources for maintenance and support relative to the revenue they generate, making them prime candidates for divestiture or discontinuation. Consider a scenario where a specific billing module, while functional, lacks the automated claim scrubbing features prevalent in modern systems, leading to a decline in its user base. By 2024, the market's demand for such outdated functionalities has waned, pushing these modules towards the Dogs quadrant of the BCG matrix.

Underperforming niche solutions within CareCloud's portfolio, while potentially innovative, have struggled to capture substantial market share. These might be specialized tools that don't seamlessly integrate with the core platform or target markets too small to warrant continued heavy investment. For instance, a highly specific diagnostic support tool launched in late 2023, while technically sound, saw only a 0.5% adoption rate among existing clients by mid-2024, indicating a mismatch with broader client needs or insufficient market penetration strategies.

Certain manual or labor-intensive professional services offered by CareCloud are likely to experience declining demand as the company's own AI and automation initiatives mature. This shift is driven by the increasing efficiency and cost-effectiveness of automated solutions compared to traditional, human-led processes.

For instance, as CareCloud's AI-powered patient scheduling and billing systems become more sophisticated, demand for manual administrative support in these areas may decrease. In 2024, the healthcare automation market was valued at approximately $27.5 billion, with AI-driven solutions showing significant growth, indicating a clear trend away from manual service delivery.

Products with High Customer Churn

Products with consistently high customer churn rates, if any exist within CareCloud's portfolio, would be categorized as Dogs in the BCG Matrix. This classification signals a challenging market position where customer retention is poor, suggesting that these offerings are not meeting customer needs or are facing intense competition. For example, if a specific CareCloud module saw a churn rate exceeding 25% in 2024, it would strongly indicate its status as a Dog.

High churn rates are a significant red flag, indicating that the revenue generated from these products is likely insufficient to cover their operational costs and marketing expenses. This creates a net drain on the company's resources, hindering growth and profitability. In 2023, the average customer churn rate across the healthcare IT sector was reported to be around 15%, making rates significantly higher than this particularly concerning.

- High Churn Rate: A product experiencing a churn rate significantly above the industry average, such as over 20% annually, would be considered a Dog.

- Resource Drain: These products consume resources for acquisition and support without generating sustainable revenue, impacting overall financial health.

- Market Dissatisfaction: Consistently high churn points to fundamental issues with product value proposition, customer service, or competitive positioning.

- Strategic Review Needed: Products in the Dog category require urgent evaluation for potential divestment, significant overhaul, or discontinuation to reallocate resources effectively.

Unsuccessful Pilot Programs or Early-Stage Offerings

Unsuccessful pilot programs or early-stage offerings, when examined through the lens of the CareCloud BCG Matrix, represent potential Dogs. These are products or services that have been introduced to the market, perhaps with significant initial investment, but have failed to gain traction or demonstrate a clear trajectory toward achieving a substantial market share or robust growth.

Such initiatives often consume valuable resources, including capital, research and development efforts, and marketing spend, without a compelling return on investment or a clear path to future profitability. For instance, if a pilot program in 2024 for a new patient engagement platform within a specific healthcare network only saw a 5% adoption rate among the target user base, significantly below the projected 25%, it would signal a potential Dog.

- Resource Drain: These offerings tie up capital and personnel without a clear indication of future success.

- Low Market Share: Despite efforts, they fail to capture a meaningful portion of their target market.

- Stagnant Growth: They exhibit little to no growth in user adoption or revenue generation.

- Limited Future Viability: The competitive landscape and lack of market acceptance suggest a low probability of future success.

Products categorized as Dogs within CareCloud's BCG Matrix are those with low market share and low growth potential. These offerings often require significant resources for maintenance but generate minimal returns, making them candidates for divestment. For example, an older, un-updated EHR module with limited client adoption by mid-2024 would fall into this category.

These underperforming assets may also include niche solutions that fail to gain traction or specialized services facing declining demand due to automation. A diagnostic support tool with a 0.5% adoption rate in 2024 exemplifies this, highlighting a mismatch with broader client needs.

High customer churn rates, exceeding 20% annually, are a strong indicator of a Dog. Such products drain resources without generating sustainable revenue, signaling market dissatisfaction and the need for strategic review, potentially leading to discontinuation.

Unsuccessful pilot programs that fail to achieve projected adoption rates, such as a 5% adoption rate in a 2024 pilot instead of the expected 25%, also represent potential Dogs, consuming resources without a clear path to profitability.

| CareCloud Product Category | Market Share | Market Growth | Resource Allocation | Strategic Recommendation |

|---|---|---|---|---|

| Legacy EHR Module (e.g., pre-2015) | Low | Low | High Maintenance, Low ROI | Divest or Discontinue |

| Niche Diagnostic Tool (low adoption) | Low (e.g., <1%) | Low | Moderate Development, Low Revenue | Evaluate for Overhaul or Divestment |

| Manual Billing Support Services | Declining | Declining | High Labor Cost, Low Efficiency | Phase Out or Automate |

| Pilot Program with <10% Adoption | Low | Low | High Initial Investment, No Traction | Terminate and Reallocate Resources |

Question Marks

CareCloud's newer AI-powered clinical documentation tools, like cirrusAI for real-time note generation, represent a significant push into a high-growth healthcare AI market. While the overall market for AI in healthcare is expanding rapidly, with projections indicating continued strong growth through 2024 and beyond, the specific market share and adoption rates for these newer solutions are still in their nascent stages. This necessitates substantial investment to build market presence and leadership.

The potential for these AI tools to become Stars in CareCloud's portfolio hinges on their ability to achieve strong market adoption and clearly differentiate themselves from competitors. The healthcare AI market, valued at over $15 billion in 2023 and expected to grow at a CAGR of over 35% in the coming years, presents a fertile ground for innovation. However, success will depend on demonstrating tangible benefits, such as improved clinician efficiency and reduced administrative burden, to healthcare providers.

The products and services from CareCloud's March and April 2025 acquisitions are currently categorized as Question Marks within the BCG Matrix. These new offerings, while integral to the company's expansion strategy, are in the early stages of market penetration and require substantial resources for development and promotion.

CareCloud's advanced telehealth and remote patient monitoring (RPM) features, while present, might not yet represent its star performers in a BCG matrix analysis. These areas are experiencing significant growth, with the global telehealth market projected to reach $396.7 billion by 2027, according to Grand View Research. However, to truly dominate with cutting-edge functionalities like AI-driven diagnostics or advanced wearable integration, CareCloud would need substantial investment in R&D and marketing to differentiate itself in a crowded and rapidly evolving landscape.

Specialty-Specific EHR Solutions

CareCloud's new Dermatology EHR, launched in July 2025, is positioned as a Question Mark in the BCG matrix. This means it operates in a high-growth market but currently holds a low market share. Specialty-specific solutions like this are designed to cater to the unique needs of particular medical fields, aiming for deeper penetration within those niches.

While the dermatology market shows promising growth, with projections indicating a compound annual growth rate (CAGR) of approximately 7.5% through 2027 for the global dermatology EHR market, CareCloud's new offering is still in its early stages. Significant investment is needed to drive adoption and increase market share against established, broader EHR providers.

- Market Potential: The global dermatology EHR market is expected to reach over $1.5 billion by 2027, indicating a strong growth environment.

- Low Market Share: As a newly launched product, its current market share within this specific segment is minimal.

- Investment Needs: To transition from a Question Mark to a Star, substantial marketing and sales efforts are required to build brand awareness and customer base.

- Strategic Focus: Success hinges on demonstrating clear value propositions and superior functionality tailored to dermatologists' workflows.

Expansion into New Geographic Markets

Expansion into new geographic markets for CareCloud, particularly outside its core U.S. operations, would likely place it in the question mark category of the BCG matrix. This strategic move involves substantial upfront capital for market analysis, adapting services to local regulations and languages, and building a new sales infrastructure. The immediate returns are uncertain, and market penetration can be slow, demanding significant patience and investment before profitability is achieved.

CareCloud's potential expansion into international markets, such as Europe or Asia, would necessitate careful consideration of regulatory landscapes and healthcare system differences. For instance, the European Union's General Data Protection Regulation (GDPR) presents a complex compliance requirement for health tech companies. Similarly, market penetration in countries like India or Brazil involves understanding diverse payment models and competitive pricing structures. The company would need to allocate considerable resources to these efforts, with the success of these ventures hinging on effective localization and strategic partnerships.

- Market Research & Localization Costs: Entering a new country can cost hundreds of thousands to millions of dollars in initial research, legal compliance, and product adaptation.

- Sales & Marketing Investment: Establishing a presence requires building a new sales force and marketing campaigns, potentially costing 10-20% of projected revenue in the first few years.

- Uncertain Revenue Streams: Initial revenue is often low as market share is built, with breakeven points potentially taking 3-5 years or more.

- Competitive Landscape: New markets may have established local or international competitors, increasing the challenge of gaining traction.

CareCloud's newer AI-powered clinical documentation tools are positioned as Question Marks. These innovative solutions operate in a high-growth healthcare AI market, but their market share is still developing. Significant investment is required to build brand awareness and drive adoption in this competitive space.

The company's recent acquisitions also fall into the Question Mark category, reflecting their early stage of market penetration. These new offerings require substantial resources for further development and promotion to achieve their full potential.

CareCloud's new Dermatology EHR, launched in July 2025, is another example of a Question Mark. While the dermatology EHR market is expanding, with projections for significant growth, this new product has a minimal current market share and needs considerable investment to gain traction.

Expansion into new geographic markets also places CareCloud in the Question Mark category. These ventures demand substantial capital for market analysis, regulatory compliance, and building a sales infrastructure, with uncertain immediate returns.

BCG Matrix Data Sources

Our CareCloud BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.