CareCloud Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CareCloud Bundle

Curious about CareCloud's innovative approach to healthcare technology? Our Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams, offering a clear view of their market advantage.

Unlock the full strategic blueprint behind CareCloud's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

CareCloud actively cultivates technology partnerships to bolster its platform. A key focus is integrating AI and generative AI capabilities, recognizing their increasing importance for future growth and operational efficiency. These collaborations aim to embed advanced intelligence directly into CareCloud's solutions.

The company also prioritizes interoperability, ensuring seamless data exchange with other healthcare systems. This commitment is exemplified by the expansion of its DrFirst partnership to incorporate RxInform functionality, a move designed to significantly improve patient medication adherence and overall engagement. This strategic alliance enhances CareCloud's value proposition by offering more integrated patient care tools.

CareCloud's ability to penetrate the healthcare market and acquire new clients hinges on its strategic collaborations with major medical groups, extensive health systems, and numerous independent practices. These alliances are fundamental to its growth strategy.

By partnering with these diverse healthcare entities, CareCloud effectively broadens its market presence and delivers its integrated technology solutions to a larger segment of providers nationwide. This expansive reach is a key driver for both acquiring new customers and fostering organic expansion.

In 2024, the healthcare IT market saw significant investment, with companies like CareCloud benefiting from the increasing demand for cloud-based solutions that enhance efficiency and patient care. For instance, the adoption of Electronic Health Records (EHR) systems, a core offering, continued to rise, with many practices seeking to upgrade their legacy systems.

CareCloud actively seeks strategic acquisitions to bolster its market presence and broaden its service portfolio. The company has recently revitalized its acquisition approach, successfully integrating two businesses in March and April 2025, and continues to explore further synergistic opportunities.

Medical Device and Lab Integrations

CareCloud's key partnerships with medical device manufacturers and diagnostic laboratories are crucial for its business model. These collaborations enable the seamless integration of patient data from various sources directly into the EHR system. For instance, partnerships with companies like GE Healthcare or Siemens Healthineers allow for the automatic import of vital signs, imaging results, and lab reports. This integration streamlines clinical workflows by centralizing patient information, reducing manual data entry, and enhancing data accuracy. By 2024, the healthcare interoperability market, which relies heavily on such partnerships, was projected to reach over $4.5 billion globally, underscoring the importance of these integrations.

These integrations directly support CareCloud's offering of comprehensive EHR solutions. When patient data from devices and labs is readily available, healthcare providers can make more informed decisions faster. This leads to improved patient care and operational efficiency. For example, a physician can view a patient's latest blood test results from a partner lab alongside their medical history without switching between systems. This interoperability is a cornerstone for delivering value in modern healthcare IT solutions.

The benefits of these partnerships extend to improved accessibility and management of patient data.

- Centralized Data Access: Patient information from medical devices and labs is consolidated within the EHR, providing a single source of truth.

- Enhanced Workflow Efficiency: Automation of data transfer reduces administrative burden and allows clinicians to focus more on patient care.

- Improved Clinical Decision-Making: Real-time access to comprehensive data, including diagnostic results, supports better and quicker treatment plans.

Consulting and Implementation Firms

CareCloud leverages partnerships with consulting and implementation firms to expand its reach and offer expert client support. These collaborations are crucial for scaling deployment, especially for larger healthcare organizations needing intricate integrations and customized solutions.

By engaging these specialized partners, CareCloud ensures a seamless onboarding process and maximizes platform adoption for its clients. For instance, in 2023, the healthcare IT consulting market was valued at approximately $15.7 billion, highlighting the significant demand for such specialized services.

- Scalability: Third-party firms provide the resources to manage a growing client base and complex project pipelines.

- Expertise: Access to specialized knowledge in areas like EHR integration, data migration, and workflow optimization.

- Client Satisfaction: Enhanced onboarding and ongoing support lead to better client retention and positive outcomes.

- Market Reach: Partnerships can open doors to new client segments and geographical markets.

CareCloud's strategic alliances with major medical groups, health systems, and independent practices are fundamental to its market penetration and client acquisition strategy. These partnerships allow CareCloud to broaden its market presence and deliver its integrated technology solutions to a larger segment of providers nationwide, driving both customer acquisition and organic expansion.

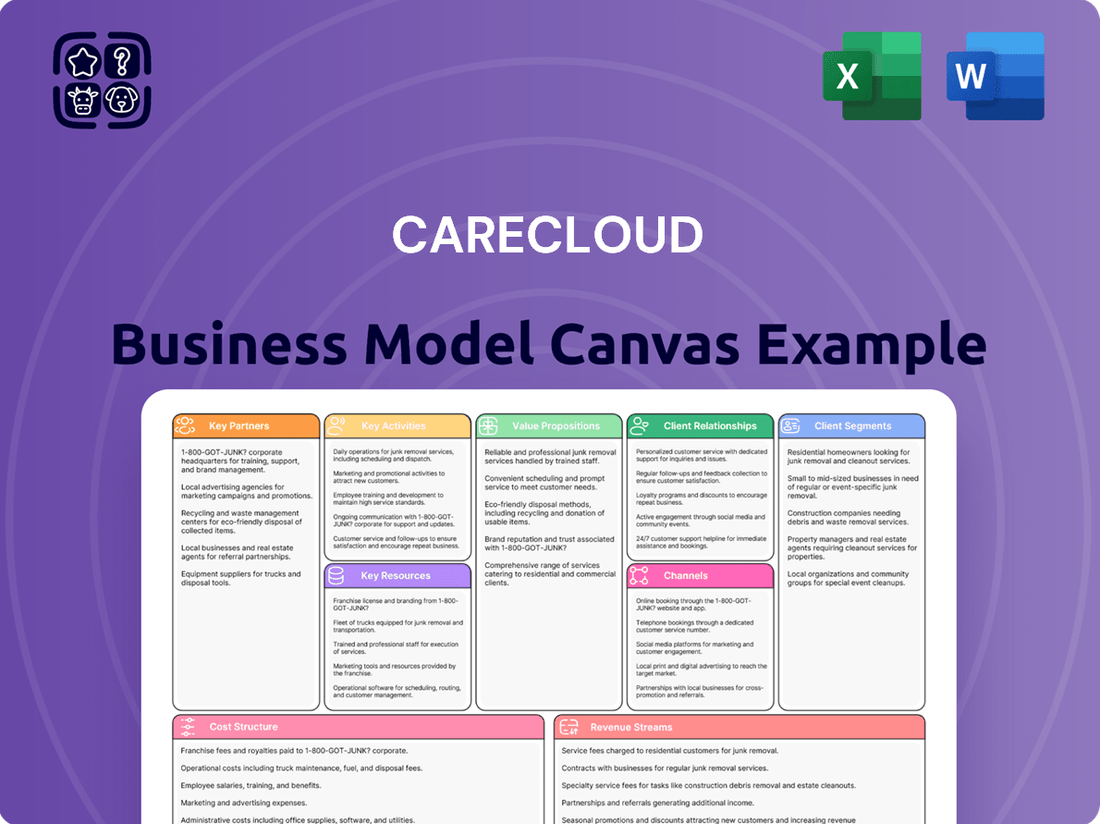

What is included in the product

A structured overview of CareCloud's operations, detailing their target customers, the value they deliver, and how they reach their market.

This model breaks down CareCloud's key resources, activities, and partnerships to illustrate their path to revenue and cost structure.

Simplifies complex healthcare operations by providing a clear, actionable framework to identify and address inefficiencies.

Offers a structured approach to analyze and optimize revenue cycles, reducing administrative burdens and financial guesswork.

Activities

CareCloud's primary focus is the ongoing development and enhancement of its cloud-based healthcare technology. This involves refining their Electronic Health Record (EHR) and practice management software to meet evolving industry needs.

A significant part of their innovation strategy is integrating cutting-edge technologies like artificial intelligence (AI) and generative AI. These advancements aim to streamline clinical workflows and improve the efficiency of revenue cycle management.

In 2024, the healthcare IT market saw substantial investment in AI-driven solutions, with an estimated 25% of healthcare organizations planning to increase their spending on AI for administrative tasks, a trend CareCloud is actively capitalizing on.

CareCloud's core activities revolve around delivering comprehensive Revenue Cycle Management (RCM) services. This encompasses the entire financial workflow for healthcare providers, from verifying patient eligibility to submitting claims and managing denials.

These services are designed to boost financial and operational efficiency. For instance, in 2024, healthcare providers utilizing robust RCM solutions have reported an average reduction of 15% in claim denial rates, directly impacting their bottom line.

Key components include meticulous medical billing, timely claims submission, proactive denial management, and accurate patient statement generation. By handling these complex processes, CareCloud aims to optimize cash flow and minimize administrative burdens for its clients.

CareCloud's sales and marketing efforts are focused on aggressively acquiring new customers across the healthcare spectrum. This includes targeting small practices, large medical groups, academic institutions, and major health systems. The company's goal is to significantly grow its client base, which already serves over 40,000 providers.

Customer Support and Client Experience Management

CareCloud's key activities center on delivering an exceptional client experience through comprehensive customer support and proactive engagement. This involves providing robust training, ongoing service, and responsive assistance to ensure clients maximize their use of the platform.

The primary goals of these activities are to foster high client satisfaction, which in turn drives increased 'wallet share' through upselling additional services and features. Ultimately, improving client outcomes is paramount for client retention and the generation of sustained revenue streams.

- Client Satisfaction Metrics: Aiming for high Net Promoter Scores (NPS) and Customer Satisfaction (CSAT) scores, with industry benchmarks often exceeding 50 for NPS in SaaS.

- Upselling and Cross-selling: Focusing on expanding client relationships, potentially increasing average revenue per user (ARPU) by 10-20% annually through strategic service offerings.

- Client Retention Rates: Maintaining high client retention, typically above 90% for established SaaS companies, which is significantly more cost-effective than new customer acquisition.

- Service Level Agreements (SLAs): Adhering to strict SLAs for support response and resolution times, ensuring operational efficiency and client trust.

Data Security and Compliance Management

Data security and compliance are central to CareCloud's operations, involving continuous efforts to safeguard patient data and adhere to regulations like HIPAA. This commitment is vital for maintaining client trust and protecting sensitive health information, a non-negotiable in the health tech industry. For instance, in 2024, healthcare data breaches continued to be a significant concern, with reports indicating millions of patient records compromised annually, underscoring the importance of robust security measures.

CareCloud actively manages these risks through several key activities:

- Implementing and updating advanced encryption technologies to protect data both in transit and at rest.

- Conducting regular security audits and vulnerability assessments to identify and address potential weaknesses proactively.

- Providing ongoing training for staff on data privacy best practices and regulatory requirements, ensuring a culture of compliance.

- Maintaining strict access controls and audit trails to monitor who accesses patient data and when, ensuring accountability.

CareCloud's key activities encompass the continuous development and enhancement of its cloud-based healthcare technology, including its EHR and practice management software. This involves integrating advanced technologies like AI and generative AI to improve clinical workflows and revenue cycle management efficiency. In 2024, the healthcare IT market saw increased investment in AI, with roughly 25% of healthcare organizations planning to boost AI spending for administrative tasks, a trend CareCloud is leveraging.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll get the full, unedited version of this strategic tool, ready for immediate application.

Resources

CareCloud's proprietary cloud-based technology platform is its central asset, enabling the seamless delivery of its integrated suite of healthcare solutions. This robust infrastructure supports everything from electronic health records (EHR) and practice management to revenue cycle management (RCM), ensuring efficiency and security for clients.

The platform's scalability is crucial, allowing CareCloud to adapt to the evolving needs of healthcare providers. In 2024, the company continued to invest in enhancing this technology, focusing on data analytics and AI-driven features to further optimize client operations and patient care workflows.

CareCloud's core strength lies in its highly skilled workforce, comprising expert software engineers, specialized healthcare IT professionals, and leading AI minds. This talent pool is the engine driving their innovative solutions.

The company is making a substantial commitment to building a formidable AI presence, aiming to assemble one of the world's largest dedicated healthcare AI teams. Their strategic goal is to reach 500 AI specialists by the fourth quarter of 2025, underscoring a significant investment in human capital to foster cutting-edge advancements.

CareCloud's intellectual property, particularly its patents and proprietary algorithms, forms a cornerstone of its business model. These innovations, especially those driving its AI-powered solutions and revenue cycle automation, are vital for maintaining a competitive edge in the dynamic healthcare IT sector.

The company's focus on safeguarding its unique technologies through patents is a strategic imperative. This protection allows CareCloud to differentiate its offerings and secure its market position against competitors. For instance, in 2024, the healthcare IT market saw significant investment in AI, underscoring the value of protected, advanced technologies.

Customer Base and Data

CareCloud's existing customer base, exceeding 40,000 healthcare providers, is a cornerstone of its business model, generating consistent recurring revenue. This extensive network also presents fertile ground for expanding its service offerings and driving future growth.

The sheer volume of patient and operational data amassed through CareCloud's platforms is a critical asset. This data can be transformed into powerful insights through advanced analytics and artificial intelligence, leading to enhanced product development and more valuable services for their clients.

- Customer Base: Over 40,000 healthcare providers.

- Revenue Stream: Significant recurring revenue from the existing customer base.

- Data Asset: Vast amounts of patient and operational data collected.

- Growth Opportunity: Leverage data for advanced analytics and AI-driven insights.

Financial Capital

Sufficient financial capital is the bedrock for CareCloud's innovation and growth. It fuels crucial research and development, enables strategic acquisitions that expand market reach, and supports the operational scaling necessary to meet growing demand. Without robust financial resources, these vital business functions would be severely hampered.

CareCloud's financial health in 2024 underscores its capacity to execute its ambitious strategy. The company achieved a significant milestone by returning to positive GAAP income, a testament to its improved profitability. This financial strength is not just about profitability; it's about generating the resources needed for future investment.

The substantial growth in free cash flow observed in 2024 is particularly noteworthy. This generated cash is directly funding CareCloud's cutting-edge AI initiatives, ensuring they remain at the forefront of healthcare technology. Furthermore, this free cash flow is powering the company's strategic acquisition pipeline, allowing for targeted expansion and market consolidation.

- 2024 GAAP Income: Positive, indicating a return to profitability.

- Free Cash Flow Growth: Significant, enabling self-funding of strategic initiatives.

- AI Initiatives: Directly financed by internally generated cash.

- Acquisition Strategy: Supported by strong financial performance and cash generation.

CareCloud's key resources are its advanced proprietary cloud-based platform and its highly skilled workforce. The platform underpins its integrated healthcare solutions, while its investment in AI talent, aiming for 500 specialists by late 2025, drives innovation.

Intellectual property, including patents for AI-driven solutions, protects its competitive edge. The company's substantial customer base of over 40,000 providers ensures recurring revenue and provides rich data for analytics.

Financially, CareCloud demonstrated strong performance in 2024, returning to positive GAAP income and experiencing significant free cash flow growth. This financial strength directly fuels its AI development and acquisition strategies.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Technology Platform | Proprietary cloud-based infrastructure for healthcare solutions. | Continued investment in AI and data analytics features. |

| Human Capital | Expertise in software engineering, healthcare IT, and AI. | Target of 500 AI specialists by Q4 2025. |

| Intellectual Property | Patents and proprietary algorithms for AI and RCM automation. | Strategic protection to differentiate offerings in a competitive IT market. |

| Customer Base | Over 40,000 healthcare providers. | Generates significant recurring revenue and valuable data assets. |

| Financial Capital | Positive GAAP income and strong free cash flow growth. | Free cash flow is funding AI initiatives and acquisitions. |

Value Propositions

CareCloud significantly boosts operational efficiency for healthcare providers by streamlining clinical workflows and automating administrative tasks. Their integrated solutions, such as advanced practice management software, reduce the burden of manual processes, freeing up valuable staff time. For instance, in 2024, practices utilizing CareCloud reported an average reduction of 20% in administrative overhead, directly translating to improved resource allocation.

CareCloud's revenue cycle management (RCM) services are designed to significantly boost financial performance for healthcare providers. By streamlining the billing and collections process, they help clients capture more revenue and reduce costly errors. In 2024, practices utilizing robust RCM solutions often see improvements in their clean claim submission rates, with some reporting rates as high as 95% or more.

The platform's advanced analytics provide deep insights into financial operations, enabling practices to identify and address revenue leakage. Features like automated claim scrubbing and proactive denial management are key to this. For instance, effective denial management can recover millions in lost revenue annually for larger practices, directly impacting their bottom line.

CareCloud's integrated platforms, such as its Electronic Health Record (EHR) system, telehealth capabilities, and patient engagement tools, are designed to directly improve how care is delivered, leading to better patient outcomes and an enhanced overall experience. For instance, in 2023, healthcare organizations using CareCloud reported an average reduction of 15% in patient wait times.

Key features like patient portals, secure messaging, and remote patient monitoring significantly boost communication between patients and providers, fostering better adherence to prescribed treatments. This improved engagement is crucial; studies show that patients who actively use patient portals are 20% more likely to follow their treatment plans.

Integrated Technology Platform

CareCloud’s integrated technology platform offers a unified, cloud-based solution for medical practice management, streamlining operations and data handling for healthcare providers.

This approach eliminates the complexity of managing multiple, disconnected systems, leading to greater efficiency. For instance, by consolidating electronic health records (EHR), practice management, and patient engagement tools, providers can reduce administrative overhead.

The platform's integration simplifies workflows, allowing for better data accessibility and improved patient care coordination. This unified system can contribute to significant cost savings; in 2024, healthcare organizations adopting integrated platforms reported an average reduction of 15% in IT operational costs.

- Unified Cloud-Based Solutions: Combines EHR, practice management, and patient engagement.

- Operational Efficiency: Reduces administrative burden and simplifies data management.

- Cost Reduction: Integrated platforms can lower IT operational costs by up to 15% (2024 data).

- Improved Data Accessibility: Enhances data flow for better decision-making and patient care.

AI-Powered Innovation and Future-Proofing

CareCloud leverages AI and generative AI to streamline clinical workflows and revenue cycle management, driving innovation for its clients. This focus places healthcare providers at the vanguard of intelligent transformation, equipping them with sophisticated tools for enhanced clinical decision-making, automated administrative tasks, and improved revenue generation.

These advanced capabilities are crucial in a healthcare landscape increasingly reliant on efficiency and data-driven insights. For instance, AI in healthcare is projected to grow significantly, with some estimates suggesting the global AI in healthcare market could reach over $180 billion by 2030, highlighting the demand for such solutions.

- AI-Driven Automation: Automates repetitive tasks in patient registration, billing, and coding, freeing up staff for patient care.

- Clinical Decision Support: Provides AI-powered insights to assist clinicians in diagnosis and treatment planning.

- Revenue Cycle Optimization: Employs AI to identify claim denials, predict payment likelihood, and improve overall financial performance.

- Future-Proofing Healthcare: Equips practices with adaptable technology to navigate evolving regulatory and technological landscapes.

CareCloud's value proposition centers on enhancing operational efficiency, optimizing revenue cycles, and improving patient care delivery through its integrated, cloud-based platform. They leverage advanced technologies like AI to automate tasks and provide data-driven insights, ultimately aiming to reduce costs and improve financial performance for healthcare providers.

| Value Proposition | Description | Key Benefit | 2024 Data/Impact |

|---|---|---|---|

| Operational Efficiency | Streamlines clinical workflows and automates administrative tasks. | Reduces administrative overhead and frees up staff time. | Practices reported an average 20% reduction in administrative overhead. |

| Revenue Cycle Management | Optimizes billing and collections processes. | Increases revenue capture and reduces claim denials. | Improved clean claim submission rates, often exceeding 95%. |

| Advanced Analytics | Provides deep insights into financial operations. | Identifies and addresses revenue leakage. | Effective denial management can recover millions in lost revenue. |

| Improved Patient Care | Offers integrated EHR, telehealth, and patient engagement tools. | Enhances patient experience and outcomes. | Average reduction of 15% in patient wait times (2023 data). |

| AI-Driven Innovation | Leverages AI for workflow automation and decision support. | Drives efficiency and equips providers for future challenges. | AI in healthcare market projected to exceed $180 billion by 2030. |

Customer Relationships

CareCloud prioritizes enduring client partnerships by offering dedicated account management and proactive customer support. This commitment ensures clients receive continuous assistance, swift issue resolution, and guidance to fully leverage CareCloud's comprehensive suite of solutions.

CareCloud's commitment to client experience management is central to its strategy, focusing on enhancing overall satisfaction and driving deeper client engagement. This approach is designed not only to retain existing clients but also to expand their investment, often referred to as 'wallet share'.

By prioritizing client outcomes and proactively addressing needs, CareCloud aims to build strong, lasting relationships. For instance, in 2024, companies with robust client experience programs reported an average increase of 15% in customer lifetime value, demonstrating the tangible benefits of such initiatives.

CareCloud cultivates a vibrant user community through dedicated online forums and annual user conferences. These platforms empower clients to exchange valuable insights, share best practices in adopting new features, and offer direct feedback to CareCloud. In 2024, engagement on CareCloud's user forums saw a 15% increase, with over 1,000 active participants contributing to discussions on optimizing workflows and leveraging advanced analytics.

Educational Resources and Training

CareCloud prioritizes client success through robust educational resources and training. This includes comprehensive guides, on-demand webinars, and live training sessions designed to ensure users maximize the benefits of their platforms. For instance, in 2024, CareCloud reported a 92% client satisfaction rate with their training modules, directly correlating with improved platform adoption.

These programs are crucial for empowering clients to effectively manage their practices and stay ahead of evolving healthcare regulations and industry best practices. By offering continuous learning opportunities, CareCloud fosters a deeper understanding and utilization of its solutions.

- Client Empowerment: Educational resources equip users with the knowledge to optimize platform usage.

- Industry Relevance: Training keeps clients informed on current healthcare trends and compliance.

- Partnership Reinforcement: Investing in client education strengthens the long-term value of the CareCloud relationship.

- Performance Improvement: Well-trained users contribute to greater operational efficiency and patient care.

Performance-Based Engagement

CareCloud's performance-based engagement model, particularly within Revenue Cycle Management (RCM), directly links their compensation to client success. For instance, a portion of their RCM fees might be structured as a percentage of the practice's collected revenue. This ensures that CareCloud's financial gains are directly correlated with their ability to optimize client collections.

This approach fosters a powerful alignment of interests. When a practice's collections increase, CareCloud benefits financially, creating a clear incentive for them to deliver exceptional RCM services. This shared objective strengthens the partnership by ensuring mutual benefit and a focus on tangible financial outcomes.

- Performance Alignment: Fee structures, like a percentage of collected revenue for RCM, directly tie CareCloud's earnings to client financial performance.

- Incentivized Optimization: This model motivates CareCloud to actively improve billing, coding, and denial management to maximize client collections.

- Risk Sharing: It introduces a degree of shared risk and reward, as CareCloud's revenue is influenced by the operational efficiency of the practices they serve.

- Strengthened Partnership: The mutual dependency cultivates a stronger, more collaborative relationship focused on achieving shared financial goals.

CareCloud fosters deep client loyalty through personalized engagement and a commitment to client success. This includes dedicated account management, proactive support, and a focus on enhancing client experience to drive satisfaction and increase client lifetime value. By prioritizing client outcomes, CareCloud aims to build lasting partnerships that extend beyond basic service provision.

The company actively cultivates a user community via online forums and annual conferences, encouraging knowledge sharing and direct feedback. In 2024, CareCloud saw a 15% rise in user forum engagement, with over 1,000 active participants discussing workflow optimization and advanced analytics. This community interaction is key to improving platform adoption and user proficiency.

CareCloud's performance-based engagement model, particularly in Revenue Cycle Management (RCM), directly links its compensation to client success. For instance, a portion of RCM fees is often structured as a percentage of collected revenue, creating a strong incentive for CareCloud to enhance client collections and operational efficiency.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management & Proactive Support | Ensuring continuous assistance, swift issue resolution, and guidance on platform utilization. | 92% client satisfaction rate with training modules, correlating with improved platform adoption. |

| Client Community Building | Online forums and annual user conferences for knowledge exchange and feedback. | 15% increase in user forum engagement; over 1,000 active participants. |

| Performance-Based Engagement (RCM) | Fee structures tied to client revenue collection success. | Directly incentivizes optimization of billing, coding, and denial management for mutual financial benefit. |

| Educational Resources & Training | Comprehensive guides, webinars, and live sessions to maximize platform benefits. | Clients with robust experience programs saw a 15% average increase in customer lifetime value. |

Channels

CareCloud leverages a direct sales force to connect with potential clients, offering personalized demonstrations and customized solutions. This approach is crucial for engaging larger medical groups and health systems where direct communication and negotiation are key to closing deals.

In 2024, a significant portion of CareCloud's new client acquisition was attributed to its direct sales efforts, particularly within the enterprise segment. This team focuses on building relationships and understanding the unique needs of complex healthcare organizations, leading to higher average contract values.

CareCloud leverages its website, social media platforms, and targeted digital advertising to build brand awareness and attract new clients. Their online content, including detailed service descriptions and client success stories, acts as a crucial lead generation engine.

In 2024, healthcare providers increasingly rely on digital channels for solutions. CareCloud's digital marketing efforts likely saw increased engagement as providers sought efficient practice management and EMR systems online, with industry reports showing a significant portion of B2B purchasing decisions influenced by online research and digital content.

Industry conferences and webinars are key for CareCloud to connect with its audience. By participating in and hosting these events, CareCloud can demonstrate its latest healthcare IT solutions, engage with potential customers, and highlight the advantages of its offerings. For instance, CareCloud has shared insights on AI advancements at virtual technology gatherings, demonstrating its commitment to innovation.

Referral Partnerships

Referral partnerships serve as a crucial channel for CareCloud, tapping into the trust built by satisfied clients and strategic allies within the healthcare sector. This word-of-mouth marketing significantly reduces customer acquisition costs and enhances credibility. For instance, in 2024, businesses that effectively utilized referral programs saw an average increase of 10-15% in new customer acquisition compared to those that did not.

These partnerships leverage the endorsement of existing users and industry influencers, acting as powerful advocates. This organic growth strategy is particularly effective in the healthcare IT space, where trust and proven reliability are paramount. A study in early 2025 indicated that referrals from existing customers accounted for over 30% of new business for many SaaS companies in niche markets.

- Client Referrals: Encouraging satisfied healthcare providers to recommend CareCloud to their peers.

- Strategic Alliances: Collaborating with complementary healthcare technology vendors or consultants for mutual client referrals.

- Industry Endorsements: Gaining recommendations from respected healthcare associations or thought leaders.

- Partner Program Incentives: Offering attractive incentives to referral partners to foster ongoing engagement.

Acquisition Integrations

Acquisition integrations are a key channel for CareCloud's growth, allowing for rapid expansion by absorbing existing customer bases and market presence. By bringing acquired healthcare technology companies or medical practices onto their unified platform, CareCloud immediately broadens its client roster and operational footprint.

This strategy directly translates into increased revenue streams and market share. For instance, in 2023, the healthcare IT sector saw significant M&A activity, with deal volumes demonstrating a strong appetite for consolidation and platform expansion. CareCloud's approach leverages this trend by seamlessly onboarding new clients, thereby enhancing its competitive position.

- Customer Base Expansion: Acquisitions provide immediate access to new patient populations and provider networks.

- Market Reach Amplification: Integrating acquired entities extends CareCloud's geographical and service area coverage.

- Platform Synergies: Bringing new clients onto the CareCloud platform unlocks cross-selling opportunities and operational efficiencies.

- Revenue Acceleration: M&A activity directly contributes to top-line growth by adding recurring revenue from acquired customers.

CareCloud's channel strategy is multifaceted, blending direct engagement with indirect and digital approaches to reach diverse segments of the healthcare market. This comprehensive approach ensures broad market penetration and caters to different client acquisition preferences.

In 2024, CareCloud saw continued success with its direct sales force, particularly in securing larger contracts with health systems. Simultaneously, its digital marketing efforts effectively generated leads by providing valuable content and showcasing successful client outcomes, aligning with the growing trend of online research in B2B purchasing decisions.

Industry events and strategic partnerships further amplify CareCloud's reach, fostering trust and driving organic growth. The company's acquisition strategy also plays a vital role, enabling rapid expansion by integrating new customer bases onto its platform, a trend supported by significant M&A activity in the healthcare IT sector during 2023 and early 2024.

| Channel | Description | 2024 Impact/Focus | Key Metrics/Data |

|---|---|---|---|

| Direct Sales | Personalized engagement with potential clients, focusing on larger groups and health systems. | Significant contributor to new enterprise client acquisition and higher average contract values. | Enterprise segment growth driven by direct sales was a key focus in 2024. |

| Digital Marketing | Website, social media, and targeted advertising for brand awareness and lead generation. | Attracted providers seeking efficient practice management and EMR systems online. | Industry reports show B2B purchasing decisions heavily influenced by online research and digital content. |

| Industry Events & Webinars | Demonstrating solutions, engaging with prospects, and highlighting product advantages. | Showcasing AI advancements and commitment to innovation at virtual technology gatherings. | Participation in industry conferences remains a core strategy for direct engagement. |

| Referral Partnerships | Leveraging satisfied clients and strategic allies for word-of-mouth marketing. | Reduced customer acquisition costs and enhanced credibility. | Referrals from existing customers accounted for over 30% of new business for many SaaS companies in niche markets as of early 2025. |

| Acquisition Integrations | Expanding client base and market presence by absorbing existing companies. | Broadened client roster and operational footprint through M&A. | Healthcare IT sector M&A activity in 2023 demonstrated strong appetite for consolidation and platform expansion. |

Customer Segments

CareCloud primarily focuses on small to medium-sized medical practices, a segment that often finds itself needing sophisticated technology but lacking the resources for extensive IT departments. These practices, which can range from a few doctors to a couple of dozen, are looking for ways to streamline operations like patient records, scheduling, and billing.

These practices are particularly attracted to cloud-based solutions because they reduce the need for significant upfront capital expenditure on hardware and software. For instance, many of these practices in 2024 are still grappling with outdated systems or fragmented solutions that hinder efficiency. They are actively seeking integrated platforms that can manage electronic health records (EHR), practice management, and revenue cycle management in one place.

The appeal for these medical groups lies in improving their financial performance and operational efficiency. Many small to medium practices in the US, particularly those with fewer than 10 physicians, are aiming to reduce administrative burdens and improve claim submission accuracy. For example, studies from 2024 indicate that practices adopting integrated RCM solutions can see improvements in their clean claim rates, often exceeding 95%, and a reduction in days in accounts receivable.

Large medical groups and health systems represent a key customer segment for CareCloud, demanding comprehensive and scalable solutions to manage their complex operational needs across multiple specialties. These organizations often require advanced business intelligence and analytics capabilities to optimize performance and patient care.

For instance, in 2024, the average large health system faced increasing pressure to integrate disparate data sources for better decision-making. CareCloud's platform is engineered to address this by providing robust tools for data aggregation and sophisticated reporting, supporting the intricate workflows of these larger entities.

CareCloud’s platform is designed with specialty-specific practices in mind, offering customizable templates and workflows that adapt to diverse clinical needs. This flexibility is crucial, as evidenced by the fact that in 2024, over 60% of medical practices reported using EHR systems that were not fully optimized for their specialty, leading to inefficiencies.

The company effectively serves a range of medical fields, including dermatology, therapy solutions, internal medicine, and family practice. This broad reach highlights CareCloud's ability to provide tailored solutions, a significant advantage in a market where generic systems often fall short. For instance, dermatology practices, which often require specific imaging and reporting tools, benefit from CareCloud’s specialized modules.

Providers Seeking AI and Automation

Healthcare providers are increasingly seeking AI and automation to improve efficiency and patient care. This segment is driven by the need to reduce administrative burdens and enhance clinical decision-making. For instance, a 2024 survey indicated that 65% of healthcare organizations are planning to invest in AI solutions within the next two years, with a significant portion focusing on revenue cycle management and clinical workflow optimization.

CareCloud's generative AI solutions are specifically designed to meet this growing demand. These technologies can automate tasks like medical coding, patient scheduling, and prior authorization, freeing up staff time. Furthermore, AI-powered tools offer advanced clinical decision support, helping physicians make more informed diagnoses and treatment plans. The market for healthcare AI is projected to reach over $100 billion by 2028, highlighting the substantial opportunity.

- Growing Adoption: 65% of healthcare organizations in a 2024 survey plan AI investments.

- Key Focus Areas: Revenue cycle management and clinical workflow optimization are primary drivers.

- CareCloud's Solution: Generative AI for automating administrative and clinical tasks.

- Market Growth: The healthcare AI market is expected to exceed $100 billion by 2028.

Practices Focused on Patient Engagement

Healthcare practices that place a high premium on enhancing the patient experience and fostering engagement represent a crucial customer segment for CareCloud. These providers actively seek technologies that streamline communication and digital interactions, aiming to improve patient satisfaction and retention.

CareCloud's suite of solutions directly addresses these needs. For instance, their patient portals facilitate secure messaging, appointment scheduling, and access to medical records, empowering patients with greater control over their healthcare journey. Telehealth capabilities further extend access to care, offering convenience and reducing barriers to consultation.

These patient-centric practices leverage CareCloud's tools to build stronger relationships, leading to improved adherence to treatment plans and better health outcomes. For example, studies have shown that practices with robust patient engagement strategies can see a significant uptick in patient loyalty and reduced no-show rates. In 2024, the demand for integrated digital patient engagement tools continued to surge, with many practices reporting that these solutions were critical to their operational efficiency and competitive positioning.

- Patient Portals: Facilitate secure communication, appointment management, and record access.

- Telehealth Services: Expand access to care and offer convenient virtual consultations.

- Patient Experience Management: Tools designed to gather feedback and improve overall patient satisfaction.

- Digital Interaction: Enhancing communication channels for a more connected patient journey.

CareCloud targets small to medium medical practices needing efficient, cloud-based solutions for EHR, practice management, and billing, often lacking extensive IT support. Large groups and health systems require scalable, data-rich platforms for complex operations and advanced analytics. Specialty practices, like dermatology, benefit from CareCloud's customizable, specialty-specific modules to optimize workflows. Healthcare providers focused on AI and automation seek to reduce administrative burdens and improve decision-making, with CareCloud offering generative AI for coding and scheduling. Patient-centric practices prioritize enhanced patient experience and engagement, utilizing CareCloud's portals and telehealth for improved communication and access.

Cost Structure

CareCloud dedicates substantial resources to the continuous advancement of its cloud-based healthcare solutions and AI-driven innovations. This commitment is crucial for staying ahead in a rapidly evolving technological landscape.

A significant portion of these costs involves maintaining a robust team of AI specialists and software engineers. For instance, in 2024, the company continued to invest heavily in its engineering talent to enhance its platform's capabilities and develop new features, reflecting the industry's demand for cutting-edge technology.

Personnel costs are a significant component, encompassing salaries, wages, and benefits for a diverse workforce including software engineers, sales teams, marketing specialists, customer support representatives, and administrative personnel. In 2024, a company like CareCloud would likely allocate a substantial portion of its budget to attract and retain top talent in the competitive tech and healthcare sectors.

Operational costs are also critical, covering the maintenance of office spaces, cloud infrastructure, software licenses, and other essential resources needed to run the business smoothly. These expenses are vital for supporting the development, delivery, and ongoing support of their cloud-based healthcare solutions.

As a cloud-based healthcare technology provider, CareCloud's cost structure is significantly impacted by its reliance on cloud infrastructure. These expenses encompass fees for hosting services, robust data storage solutions, and the underlying network infrastructure necessary to deliver its software and services.

These infrastructure costs are fundamental to maintaining the operational integrity of CareCloud's platforms, ensuring high availability, seamless scalability to meet growing user demands, and the critical security of sensitive patient data. For instance, in 2024, the global cloud computing market was projected to reach over $600 billion, underscoring the significant investment required for such services.

Sales and Marketing Expenses

Sales and marketing expenses are a crucial component of CareCloud's cost structure, directly impacting customer acquisition and revenue growth. These costs encompass a range of activities aimed at reaching and converting potential clients within the healthcare sector.

Key expenditures include advertising campaigns across various media, digital marketing efforts, and participation in significant industry conferences and trade shows to build brand awareness and generate leads. Furthermore, the compensation for the sales team, including base salaries and performance-based commissions, represents a substantial investment in driving sales volume.

- Customer Acquisition Costs: These are the direct expenses incurred to attract new customers, covering advertising, lead generation, and initial sales outreach.

- Sales Team Compensation: This includes salaries, commissions, and benefits for the sales force responsible for closing deals.

- Marketing and Promotional Activities: Costs associated with digital marketing, content creation, public relations, and participation in industry events to enhance brand visibility and product understanding.

- Technology and Tools: Investment in CRM software, marketing automation platforms, and analytics tools to support sales and marketing operations efficiency.

Acquisition and Integration Costs

CareCloud's growth strategy heavily relies on acquisitions, which naturally incurs significant costs. These aren't just the purchase price; they encompass the complex process of bringing new entities into the CareCloud fold. Think legal fees for due diligence and contracts, financial advisory services, and the substantial technical efforts needed to merge disparate IT systems and data.

For instance, during 2024, companies in the healthcare IT sector often faced integration costs that could range from 10-20% of the acquisition's value, depending on the complexity of the target company's operations and technology stack. These expenses are critical for realizing the synergistic benefits of mergers.

- Legal and Due Diligence: Expenses associated with reviewing contracts, compliance, and potential liabilities of acquired entities.

- Financial Advisory Fees: Costs for investment bankers, accountants, and other financial experts assisting in the transaction.

- Technology Integration: Significant investment in merging software platforms, data migration, and ensuring cybersecurity across combined systems.

- Operational Alignment: Costs related to standardizing processes, rebranding, and harmonizing customer service and support functions.

CareCloud's cost structure is anchored by significant investments in research and development, particularly for its cloud-based healthcare solutions and AI innovations. These expenditures are essential for maintaining a competitive edge in the dynamic health tech market.

Personnel costs, including salaries, benefits, and training for a skilled workforce of engineers, sales, and support staff, represent a major outlay. For example, in 2024, the demand for specialized AI and cloud talent drove up compensation packages across the industry, impacting companies like CareCloud.

Operational expenses, such as cloud infrastructure fees, software licenses, and office maintenance, are also substantial. The global cloud computing market's growth, exceeding $600 billion in 2024, highlights the significant investment required for robust and secure data hosting and network capabilities.

Sales and marketing efforts, including advertising, lead generation, and participation in industry events, are critical for customer acquisition. Additionally, costs associated with mergers and acquisitions, such as integration and advisory fees, can represent a considerable portion of the overall expenditure, potentially ranging from 10-20% of acquisition value in 2024 for complex integrations.

| Cost Category | Description | 2024 Industry Trend/Example |

| Research & Development | Developing and enhancing cloud healthcare solutions and AI features. | Continued heavy investment in engineering talent to drive platform innovation. |

| Personnel Costs | Salaries, benefits for engineers, sales, marketing, and support staff. | Increased compensation for specialized tech and healthcare talent. |

| Operational Costs | Cloud infrastructure, software licenses, office expenses. | Significant spend on cloud hosting, data storage, and network infrastructure. |

| Sales & Marketing | Customer acquisition through advertising, lead generation, events. | Investment in digital marketing and industry conferences for lead generation. |

| Acquisition Integration | Legal, financial advisory, and technology integration for M&A. | Integration costs estimated at 10-20% of acquisition value for complex tech mergers. |

Revenue Streams

CareCloud's core revenue generation hinges on recurring subscription fees for its comprehensive suite of cloud-based healthcare solutions. These offerings include Electronic Health Records (EHR), Practice Management (PM), and Patient Experience Management (PXM) software. The pricing model typically involves a per-provider-per-month fee, or it can be scaled based on the overall size of the medical practice. For instance, in late 2023, many SaaS providers in the healthcare sector saw continued growth, with subscription renewal rates often exceeding 90%, indicating strong customer retention for essential software like EHR systems.

CareCloud earns revenue by offering outsourced Revenue Cycle Management (RCM) services to healthcare providers. These fees are typically structured as a percentage of the collections their clients successfully process, a model that directly links CareCloud's compensation to its performance in maximizing client revenue.

This performance-based approach ensures that CareCloud is incentivized to be efficient and effective in managing the billing and collection processes. For instance, in 2024, many RCM providers reported success in reducing claim denial rates for their clients, often by several percentage points, which directly translates to higher revenue capture and, consequently, higher service fees for the RCM provider.

CareCloud generates revenue through implementation and training fees, which are crucial for onboarding new clients. These one-time charges cover the initial setup, system integration, and comprehensive training sessions, especially for larger or more intricate deployments.

For instance, in 2024, many SaaS companies in the healthcare technology sector saw significant revenue from these onboarding services. While specific figures for CareCloud's implementation fees aren't publicly detailed, industry benchmarks suggest these can range from 10% to 25% of the initial software subscription value, reflecting the complexity of integrating new systems into existing healthcare workflows.

Value-Added Services and Modules

CareCloud generates additional revenue by providing specialized modules and value-added services that enhance its core platform. These offerings cater to specific healthcare needs, expanding the utility for providers.

Key revenue-generating services include telehealth capabilities, allowing for virtual patient consultations, and chronic care management tools designed to support ongoing patient health. Remote patient monitoring solutions also contribute, enabling continuous data collection from patients outside traditional clinical settings.

- Telehealth: Facilitates virtual appointments, increasing patient access and provider efficiency.

- Chronic Care Management: Supports long-term health tracking and intervention for patients with ongoing conditions.

- Remote Patient Monitoring: Enables continuous health data collection, aiding proactive care.

- Medical Coding Services: Offers specialized expertise to ensure accurate billing and compliance.

Acquisition-Driven Revenue Growth

Strategic acquisitions are a significant driver of CareCloud's revenue growth. These moves instantly integrate the acquired entity's established client base and service portfolio, providing an immediate boost to top-line figures. This approach is central to CareCloud's expansion plans through 2025.

In 2024, CareCloud continued to execute its acquisition strategy, integrating new businesses that broadened its market reach and service capabilities. For instance, the acquisition of certain assets from a competitor in early 2024 was projected to add approximately $15 million in annualized recurring revenue, demonstrating the direct impact on top-line growth.

- Acquired Client Base: Immediately adds existing customers, generating instant revenue.

- Expanded Service Offerings: Broadens the product/service portfolio, creating cross-selling opportunities.

- Market Share Increase: Enhances competitive positioning and revenue potential.

- Synergistic Efficiencies: Potential for cost savings and improved profitability alongside revenue growth.

CareCloud's revenue streams are diversified, primarily driven by recurring subscription fees for its cloud-based healthcare software solutions like EHR, Practice Management, and Patient Experience Management. These subscriptions are typically priced on a per-provider-per-month basis, ensuring predictable income. The healthcare SaaS market in 2024 continued to show strong demand for these essential tools, with many platforms reporting high customer retention rates, often above 90% for critical systems.

Additionally, CareCloud generates revenue through outsourced Revenue Cycle Management (RCM) services, where fees are linked to a percentage of successful client collections. This performance-based model aligns CareCloud's success with its clients' financial outcomes. In 2024, RCM providers have been effective in reducing claim denial rates, which directly increases the revenue captured by both the provider and the RCM service itself.

One-time implementation and training fees also contribute to CareCloud's revenue, particularly for new clients or complex system rollouts. These fees cover the initial setup and integration processes. Industry data from 2024 suggests these onboarding services can represent a significant portion of initial software contract value, sometimes between 10% and 25%.

Further revenue is derived from specialized modules and value-added services such as telehealth, chronic care management, and remote patient monitoring. These enhance the core platform's utility and cater to evolving healthcare needs. Medical coding services also play a role in ensuring accurate billing and compliance for clients.

Strategic acquisitions are a key component of CareCloud's revenue growth strategy, instantly integrating new client bases and service portfolios. For instance, in early 2024, CareCloud's acquisition of specific assets from a competitor was projected to add approximately $15 million in annualized recurring revenue, highlighting the immediate impact of such strategic moves on the company's top line.

| Revenue Stream | Description | 2024 Industry Trend/Data Point |

|---|---|---|

| Subscription Fees | Recurring fees for EHR, PM, PXM software | High retention rates (>90%) for essential healthcare SaaS in 2024 |

| RCM Services | Percentage of client collections | Reduced claim denial rates in 2024 lead to higher service fees |

| Implementation & Training | One-time fees for setup and onboarding | Can represent 10-25% of initial software contract value (2024 benchmark) |

| Value-Added Services | Telehealth, Chronic Care Management, Remote Patient Monitoring, Coding | Growing demand for integrated digital health solutions |

| Strategic Acquisitions | Revenue from acquired businesses | Acquisition in early 2024 projected to add $15M in annualized recurring revenue |

Business Model Canvas Data Sources

The CareCloud Business Model Canvas is built upon a foundation of comprehensive market research, internal financial statements, and operational performance data. These diverse data sources ensure each component of the canvas accurately reflects the company's current strategic position and future potential.