Camtek PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

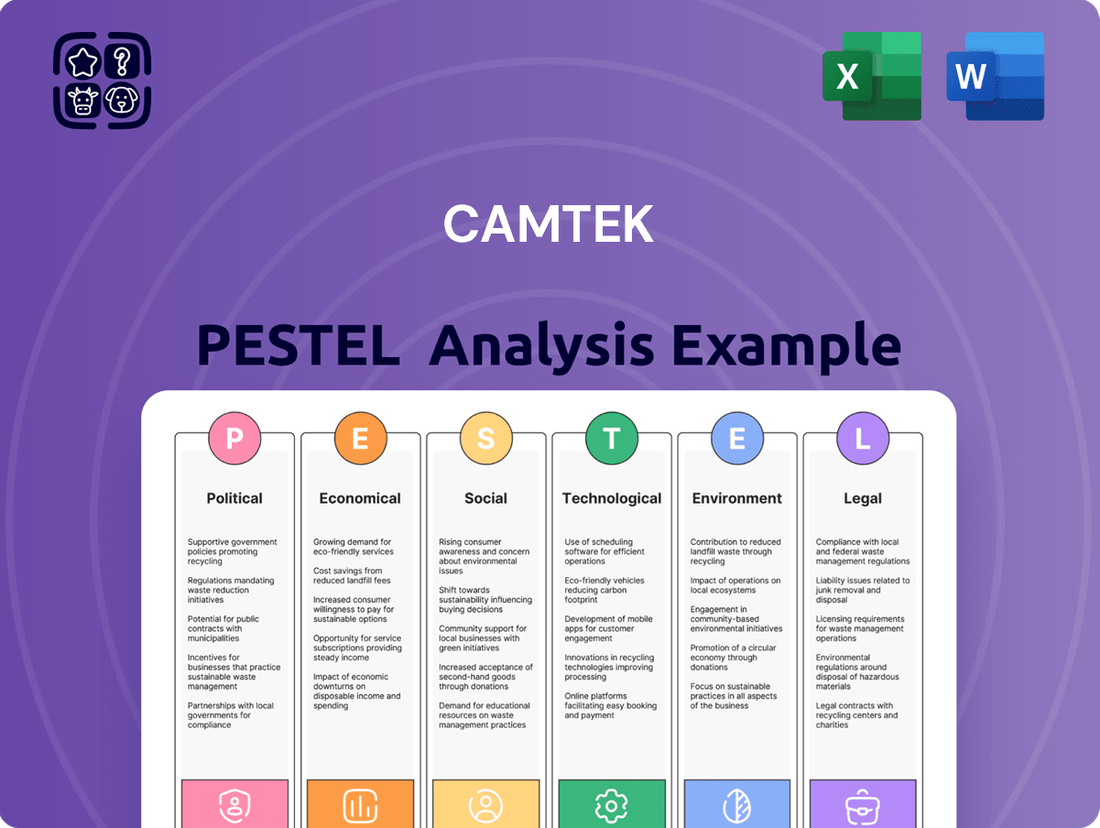

Unlock the hidden forces shaping Camtek's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for the company. Equip yourself with the critical intelligence needed to make informed strategic decisions and gain a competitive advantage. Download the full PESTLE analysis now and navigate the future with confidence.

Political factors

Global geopolitical tensions, especially between the US and China, continue to shape the semiconductor landscape, impacting supply chains and trade policies. These tensions can lead to export controls or tariffs, directly affecting Camtek's access to key markets and component sourcing, thus influencing its revenue streams and operational resilience.

In 2024, the ongoing scrutiny of technology transfers and national security concerns surrounding advanced manufacturing equipment means Camtek must navigate a complex web of regulations. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) continues to implement export controls that could impact sales of sophisticated inspection tools in strategically sensitive regions, potentially limiting market reach.

Governments globally are channeling substantial funds into bolstering domestic semiconductor production. The US CHIPS and Science Act, for instance, allocated $52.7 billion through 2032 to boost domestic manufacturing and research, creating a fertile ground for companies like Camtek. Similar legislative efforts in Europe and Asia are also driving significant investment in new fabrication plants, directly increasing the need for advanced inspection and metrology equipment.

Governments worldwide are increasingly viewing semiconductor manufacturing as critical for national security, prompting robust industrial policies. For instance, the United States' CHIPS and Science Act, signed in 2022, allocated over $52 billion to boost domestic semiconductor production and research, aiming to reduce reliance on foreign suppliers. This policy directly benefits companies like Camtek, which provides advanced inspection and metrology solutions essential for high-volume semiconductor manufacturing.

These national security-driven policies can create significant opportunities for companies like Camtek by stimulating demand for their sophisticated equipment as nations invest heavily in building out their domestic semiconductor ecosystems. However, these same policies can also introduce complexities, such as export controls or restrictions on certain suppliers, which could impact global market access and necessitate careful navigation of varying international regulatory landscapes.

Regulatory Stability and Business Environment

Camtek's operations are significantly shaped by the political and regulatory landscapes in its primary markets, particularly Israel, the United States, and Asia. A stable political climate fosters predictability, which is crucial for long-term investment and strategic planning. For instance, the Israeli government's continued support for the high-tech sector, including R&D incentives, has historically benefited companies like Camtek.

Conversely, political instability or abrupt regulatory shifts can introduce considerable risk. Changes in trade policies, tariffs, or export controls, especially between major economic blocs, could impact Camtek's supply chain and market access. The company's reliance on global markets means that geopolitical tensions or protectionist measures in key regions, such as potential tariffs on semiconductor equipment, could affect sales volumes and profitability.

- Regulatory Stability: Predictable regulatory frameworks in countries like the U.S. and Israel encourage investment in advanced manufacturing technologies, benefiting Camtek.

- Trade Relations: Tensions between major economies, such as the U.S. and China, can lead to shifts in semiconductor supply chains, influencing demand for inspection and metrology solutions.

- Government Support: Government initiatives promoting domestic semiconductor manufacturing, as seen in the U.S. CHIPS Act, could indirectly boost demand for advanced equipment.

- Geopolitical Risk: Regional conflicts or political instability in areas with significant manufacturing presence could disrupt operations or affect customer spending.

International Cooperation and Standards

International cooperation on technology standards, like those for semiconductor manufacturing equipment, directly impacts Camtek's ability to operate globally. Harmonized standards reduce the complexity and cost of ensuring products meet diverse market requirements, potentially boosting sales in 2024 and beyond. For instance, ongoing discussions within bodies like the International Organization for Standardization (ISO) regarding advanced manufacturing processes could streamline Camtek's R&D and market access.

Intellectual property rights (IPR) agreements are crucial. Strong international IPR protection, as seen in recent updates to trade agreements in 2024, safeguards Camtek's proprietary inspection and metrology technologies. Conversely, weak or inconsistent IPR enforcement in certain regions can lead to increased compliance costs and potential market barriers, impacting Camtek's revenue streams.

- Harmonized Standards: Facilitate smoother market entry and product development for Camtek's advanced inspection solutions.

- IPR Protection: Safeguards Camtek's technological innovations, crucial for its competitive edge in the global semiconductor market.

- Regulatory Alignment: Reduces compliance burdens and operational complexities for multinational sales and support.

- Trade Agreements: Influence market access and the cost of doing business across different international territories for Camtek.

Government policies aimed at strengthening domestic semiconductor supply chains, such as the US CHIPS and Science Act of 2022 with its $52.7 billion allocation, directly boost demand for advanced inspection and metrology equipment like Camtek's. Geopolitical tensions, particularly between the US and China, continue to influence trade policies and export controls, potentially impacting Camtek's market access and component sourcing in 2024 and 2025.

Regulatory stability in key markets like Israel and the US provides a predictable environment for Camtek's long-term investments and strategic planning. Conversely, political instability or shifts in trade agreements could introduce risks by affecting supply chains and customer spending on sophisticated manufacturing tools.

International standards and intellectual property rights (IPR) agreements play a crucial role in ensuring Camtek's global competitiveness and protecting its technological innovations. Harmonized standards reduce compliance costs, while robust IPR protection safeguards its proprietary technologies against infringement.

| Policy/Factor | Impact on Camtek | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| US CHIPS and Science Act | Increased demand for semiconductor manufacturing equipment | $52.7 billion allocated through 2032; driving investment in US fabs |

| US-China Trade Tensions | Potential market access restrictions, supply chain disruptions | Ongoing export controls on advanced technology impacting sales in certain regions |

| National Security Focus on Semiconductors | Stimulates government investment in domestic production | Governments worldwide prioritizing semiconductor independence, increasing need for advanced metrology |

| Regulatory Stability (Israel/US) | Supports R&D and long-term investment | Continued government support for high-tech sectors in Israel |

What is included in the product

The Camtek PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Camtek's operations and strategic positioning.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic discussion.

Economic factors

The global semiconductor market is experiencing robust growth, with projections indicating a significant expansion driven by widespread digitalization. This trend directly impacts Camtek, as increased chip demand necessitates more advanced inspection and metrology solutions.

Key growth drivers include the rapid adoption of Artificial Intelligence (AI), the rollout of 5G networks, the expanding Internet of Things (IoT) ecosystem, and the burgeoning automotive electronics sector. These advancements are fueling a surge in demand for higher-volume and more sophisticated chip production, translating into increased capital expenditure on advanced manufacturing equipment.

For instance, the semiconductor industry is expected to reach approximately $600 billion in revenue in 2024, with continued growth anticipated through 2025, according to industry analysts. This expanding market size creates a fertile ground for companies like Camtek that provide essential tools for ensuring chip quality and performance.

Camtek's revenue is intrinsically linked to the capital expenditure (CapEx) cycles of its primary customers in the semiconductor, PCB, and IC substrate industries. These sectors often experience boom-and-bust periods, directly impacting their willingness to invest in new manufacturing equipment.

For instance, during economic slowdowns or when existing capacity is underutilized, manufacturers tend to postpone or cancel CapEx plans, which can significantly delay or reduce Camtek's equipment orders. This cyclicality means Camtek's sales performance can fluctuate considerably based on broader economic conditions and industry-specific demand.

Conversely, periods of robust demand and the need for capacity expansion typically trigger substantial CapEx from these customers. In 2024, the semiconductor industry, despite some headwinds, saw renewed investment in advanced packaging and specialized chip production, which benefited equipment suppliers like Camtek. Analysts projected a rebound in semiconductor CapEx for 2025, driven by AI demand and government incentives, suggesting a potentially strong year for Camtek's order book.

Rising inflation in 2024 and 2025 presents a significant challenge for Camtek, directly impacting its operational costs. Expenses for raw materials, energy, and skilled labor have seen upward pressure, potentially squeezing profit margins. For instance, global inflation averaged around 5.9% in 2024, a figure that remained elevated in many economies entering 2025, impacting component sourcing and energy bills for manufacturing.

Camtek's position in a high-value niche offers some pricing power, but sustained cost escalations necessitate agile pricing strategies. If Camtek cannot fully pass on increased costs to customers, its profitability could be negatively affected. Effective supply chain management and strategic procurement become critical to mitigate these inflationary impacts and maintain competitive pricing.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Camtek, a global company with international sales and operations. Changes in currency values directly impact its financial performance and competitive positioning across various markets. For instance, if Camtek reports its earnings in US dollars, a strengthening dollar can make its advanced inspection and measurement solutions more expensive for customers in countries with weaker currencies. This can potentially dampen demand in those regions.

Conversely, a stronger dollar can also reduce the reported value of revenues earned in foreign currencies when those amounts are translated back into USD. This can negatively affect Camtek's reported profitability and margins. For example, in late 2023 and early 2024, the US dollar experienced periods of strength against several major currencies, which would have been a key consideration for Camtek's international revenue streams.

- Impact on Pricing: A strong USD can increase the local currency price of Camtek's products, potentially affecting sales volume in non-USD markets.

- Revenue Translation: Fluctuations can reduce the USD value of international sales, impacting reported revenue and profit margins.

- Competitive Landscape: Exchange rates can alter the relative cost competitiveness of Camtek versus its international rivals.

- Hedging Strategies: Camtek likely employs financial instruments to mitigate some of the risks associated with currency volatility.

Interest Rates and Access to Capital

Fluctuations in global interest rates directly impact Camtek's cost of capital and its customers' investment capacity. For instance, the US Federal Reserve's decision to maintain its benchmark interest rate in the 2.25%-2.50% range through early 2025, following a series of hikes in 2023-2024, presents a scenario where borrowing costs remain elevated for manufacturers. This can lead to a slowdown in capital expenditures by Camtek's clients, consequently dampening demand for inspection and metrology equipment.

Higher borrowing costs also affect Camtek's own operational and strategic financial flexibility. If interest rates remain high, the cost of financing research and development or potential acquisitions increases, potentially impacting the company's growth trajectory and competitive positioning.

- Impact on Customer Investment: Elevated interest rates, such as those observed in the 2.25%-2.50% range for the US Federal Reserve's benchmark rate in early 2025, can deter manufacturers from undertaking significant capital expansions, thereby reducing their need for new inspection and metrology equipment.

- Camtek's Financing Costs: Increased borrowing expenses directly affect Camtek's ability to finance its operations, invest in R&D, or pursue strategic growth initiatives, potentially impacting its profitability and market competitiveness.

- Demand Sensitivity: The semiconductor industry, a key market for Camtek, is capital-intensive. Higher interest rates can exacerbate the cyclical nature of this industry by making large-scale investments less attractive, leading to more volatile demand patterns for Camtek's products.

The global economic landscape in 2024 and 2025 presents a mixed bag for Camtek. While the semiconductor industry's underlying growth drivers remain strong, factors like inflation and interest rates create headwinds. Camtek's performance is closely tied to the capital expenditure cycles of its key clients, making it susceptible to economic downturns that curb investment in new manufacturing equipment.

Inflationary pressures in 2024 and 2025 are increasing Camtek's operational costs, from raw materials to labor. The company must navigate these rising expenses carefully, balancing potential price increases with market competitiveness. Currency fluctuations also pose a risk, impacting the value of international sales and the cost of products in different markets.

Interest rate policies, particularly in major economies, directly influence the cost of capital for Camtek's customers. Higher borrowing costs can lead to postponed or reduced capital spending by semiconductor and electronics manufacturers, directly affecting Camtek's order pipeline. This economic sensitivity underscores the importance of agile financial management and strategic market positioning for Camtek.

| Economic Factor | 2024-2025 Trend | Impact on Camtek | Key Data Point/Example |

| Semiconductor Market Growth | Robust Expansion | Increased demand for inspection/metrology solutions | Industry revenue projected near $600 billion in 2024 |

| Inflation | Elevated | Increased operational costs, potential margin pressure | Global inflation averaged ~5.9% in 2024 |

| Interest Rates | Elevated/Stable | Reduced customer CapEx, higher financing costs for Camtek | US Fed rate range of 2.25%-2.50% in early 2025 |

| Currency Exchange Rates | Volatile | Impacts revenue translation and international pricing competitiveness | Strong USD periods in late 2023/early 2024 affected international sales |

Preview the Actual Deliverable

Camtek PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Camtek PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises regarding Camtek's PESTLE factors.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive PESTLE analysis of Camtek.

Sociological factors

Camtek's success hinges on access to a robust pool of specialized talent, especially engineers and technicians proficient in optics, software, and semiconductor manufacturing. These skills are vital for their advanced inspection and metrology solutions. For instance, the global semiconductor industry faced a significant talent gap in 2023, with estimates suggesting a need for hundreds of thousands of new workers by 2030, impacting companies like Camtek's ability to recruit and retain top engineers.

A scarcity of these highly skilled professionals can directly impede Camtek's research and development efforts, potentially slowing down innovation cycles and the introduction of new technologies. Furthermore, increased competition for this limited talent can drive up labor costs, affecting profitability. In 2024, the demand for AI and machine learning engineers, crucial for Camtek's software development, continued to outstrip supply, leading to competitive salary offerings and retention challenges.

Societal trends show a growing dependence on sophisticated consumer electronics, from smartphones to electric vehicles. This increasing reliance directly fuels the demand for components that enable these devices, indirectly benefiting companies like Camtek that provide crucial inspection solutions for their manufacturing.

As consumers increasingly desire more powerful, feature-rich, and compact electronic devices, the pressure on manufacturers to innovate and improve yields intensifies. This push for miniaturization and higher performance necessitates advanced packaging techniques and robust, high-yield production processes, areas where Camtek's inspection technologies play a vital role.

The global market for consumer electronics is projected to reach approximately $1.1 trillion in 2024, with continued growth expected. This expansion, driven by consumer demand for connected and smart devices, translates into a sustained need for the precision manufacturing and quality control solutions that Camtek offers.

Societal expectations for workforce diversity and inclusion are increasingly shaping corporate strategies. Camtek's commitment to these principles can impact its recruitment, retention, and overall brand perception, especially as global markets demand more equitable representation. For instance, in 2024, companies with strong DEI initiatives often see a 10-15% increase in employee engagement and a wider talent reach.

Embracing a diverse workforce offers tangible benefits, fostering innovation and a broader perspective that can lead to better problem-solving. This also enhances employee morale and loyalty, crucial for long-term success. A 2025 report by McKinsey highlighted that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability.

Public Perception of Technology and Manufacturing

Societal attitudes toward industrial technology are evolving, with a growing emphasis on sustainability and ethical manufacturing practices. For instance, a 2024 survey indicated that 65% of consumers are more likely to purchase from brands demonstrating strong environmental responsibility in their production processes. This sentiment directly impacts the semiconductor industry, which relies heavily on advanced manufacturing. Public acceptance of automation and its role in job creation or displacement is also a key consideration, shaping the regulatory landscape and the industry's social license to operate.

The environmental footprint of manufacturing, particularly in high-tech sectors like semiconductors, is under increasing scrutiny. Concerns about energy consumption, waste generation, and the use of hazardous materials can lead to public backlash and stricter governmental oversight. For example, in 2025, several European nations are proposing extended producer responsibility laws for electronics, which could affect supply chain costs and manufacturing locations. A positive public perception, often driven by transparent reporting and demonstrable efforts in green manufacturing, can therefore be a significant advantage for companies like Camtek.

- Public Demand for Sustainability: A 2024 Deloitte survey found that 50% of consumers consider sustainability a key factor in their purchasing decisions, influencing brand loyalty and market share.

- Automation Perception: While automation can boost efficiency, public opinion is divided; a 2025 Pew Research study noted that 45% of Americans are concerned about job losses due to AI and robotics.

- Environmental Regulations: Anticipated stricter environmental regulations in 2025, such as carbon pricing mechanisms, could increase operational costs for semiconductor manufacturers by an estimated 5-10%.

- Technological Trust: Public trust in new technologies is crucial; a 2024 Gartner report highlighted that 70% of individuals are wary of technologies they don't fully understand, underscoring the need for clear communication from the industry.

Education and STEM Focus

The increasing global emphasis on STEM education is a significant sociological factor for companies like Camtek, which operates in the advanced semiconductor inspection and metrology sector. A robust pipeline of engineers and scientists is crucial for innovation and growth.

Governments worldwide are investing heavily in STEM initiatives to foster technological advancement and economic competitiveness. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, includes substantial funding for STEM education and workforce development, aiming to bolster domestic manufacturing capabilities, including in the semiconductor industry.

This societal focus translates into a greater pool of talent available for high-tech roles. In 2023, the U.S. Bureau of Labor Statistics projected that employment in STEM occupations is expected to grow 10.8% from 2022 to 2032, much faster than the average for all occupations.

- Growing Demand: The semiconductor industry relies heavily on specialized skills in areas like electrical engineering, materials science, and computer science.

- Government Support: Initiatives such as the CHIPS and Science Act in the United States aim to boost domestic semiconductor manufacturing and research, indirectly supporting STEM education.

- Talent Pipeline: A strong STEM education system ensures a continuous supply of qualified professionals for companies like Camtek.

- Innovation Driver: Societal investment in STEM fosters an environment conducive to the research and development that Camtek's advanced metrology solutions support.

Societal trends highlight a growing demand for sophisticated electronics, directly fueling the need for advanced manufacturing and quality control solutions like those Camtek provides. This increasing reliance on technology, from smartphones to electric vehicles, means a sustained market for precision components and, consequently, for Camtek's inspection technologies. For instance, the global consumer electronics market was projected to reach approximately $1.1 trillion in 2024, underscoring this trend.

Technological factors

Semiconductor manufacturing is constantly pushing boundaries, with processes like shrinking transistors to 2nm nodes and integrating 3D stacking becoming more common. This relentless innovation demands equally advanced inspection and metrology tools to ensure quality and yield. Camtek's success hinges on its capacity to develop solutions for these complex, next-generation fabrication techniques, particularly in areas like advanced packaging and memory chips, which are critical for staying ahead in the market.

Camtek's strategic focus on integrating Artificial Intelligence (AI) and Machine Learning (ML) into its inspection and metrology solutions is a significant technological driver. These advancements are crucial for enhancing defect detection accuracy, minimizing false alarms, and ultimately boosting manufacturing throughput. For instance, AI-powered algorithms can analyze vast amounts of imaging data far more efficiently than traditional methods, leading to quicker identification of even minute anomalies on semiconductor wafers and printed circuit boards.

Camtek's commitment to developing AI-driven software and sophisticated algorithms for its inspection equipment directly translates to tangible benefits for its clientele. Customers can expect improved yields and a faster path towards more automated and autonomous manufacturing processes. This technological edge is particularly important in the rapidly evolving semiconductor industry, where precision and speed are paramount. By leveraging AI, Camtek empowers its customers to achieve higher quality outputs and streamline their production lines, a critical factor in maintaining competitiveness in 2024 and beyond.

The manufacturing sector's accelerating adoption of automation and Industry 4.0 principles is a significant technological driver. This shift towards smart factories, where interconnected systems and AI optimize production, directly fuels the need for sophisticated, real-time inspection solutions like those offered by Camtek. For instance, the global industrial automation market was valued at approximately $220 billion in 2023 and is projected to grow substantially, indicating a strong demand for technologies that enhance efficiency and quality control within these automated environments.

Camtek's success hinges on its ability to integrate seamlessly into these advanced manufacturing workflows. Their inspection systems need to act as intelligent nodes within automated lines, providing immediate data analysis and actionable feedback. This real-time capability is crucial for optimizing production processes, minimizing defects, and reducing reliance on manual oversight, aligning perfectly with the core tenets of Industry 4.0.

Data Analytics and Yield Management

Camtek's technological edge in data analytics and yield management is crucial. Their ability to gather and interpret extensive data from inspection processes allows for sophisticated yield management and process control, a significant advantage in the semiconductor industry.

The company's software provides customers with actionable insights, enabling them to pinpoint process variations and boost production yields. This focus on data-driven improvements is highly valued by semiconductor manufacturers aiming to optimize their operations.

- Data-Driven Yield Optimization: Camtek's systems capture critical data points throughout the inspection process, enabling precise identification of yield detractors.

- Actionable Insights for Process Improvement: The software translates raw data into clear, actionable recommendations for customers to enhance their manufacturing processes.

- Competitive Advantage through Software: In 2024, the semiconductor industry's increasing reliance on advanced analytics underscores the importance of Camtek's software capabilities in maintaining a competitive edge.

Research and Development Investment

Camtek's commitment to research and development is a cornerstone of its strategy, particularly given the swift technological evolution in microelectronics. The company consistently allocates substantial resources to R&D to maintain its competitive edge.

In 2023, Camtek reported R&D expenses of $35.1 million, representing approximately 13.5% of its total revenue. This investment fuels the development of advanced inspection and metrology systems designed to meet the industry's evolving demands.

Key areas of focus include:

- Development of solutions for new semiconductor materials and complex 3D structures.

- Enhancing throughput capabilities to meet higher manufacturing demands.

- Innovating in artificial intelligence and machine learning for improved defect detection and analysis.

- Expanding metrology capabilities for advanced packaging and heterogeneous integration.

This ongoing investment is crucial for Camtek to anticipate and address future manufacturing challenges, ensuring its product pipeline remains relevant and innovative for long-term growth.

Technological advancements in semiconductor manufacturing, particularly the push towards 2nm nodes and 3D stacking, necessitate sophisticated inspection and metrology tools. Camtek's ability to innovate in areas like advanced packaging and memory chips is critical for its market position.

Camtek's integration of AI and ML into its solutions enhances defect detection and manufacturing throughput. For instance, AI algorithms can process imaging data more efficiently, identifying minute anomalies on wafers and PCBs, which is vital for customers aiming for higher yields and automation.

The growing adoption of Industry 4.0 and smart factories drives demand for real-time inspection solutions. The global industrial automation market, valued at around $220 billion in 2023, highlights the need for technologies that improve efficiency and quality control within these automated environments.

Camtek's R&D investment, $35.1 million in 2023 (13.5% of revenue), focuses on AI, new materials, and advanced packaging metrology to maintain its competitive edge in a rapidly evolving sector.

| Key Technological Factors | Impact on Camtek | Supporting Data/Trends |

| Semiconductor Miniaturization & Complexity | Requires advanced inspection and metrology solutions for new processes. | Push towards 2nm nodes and 3D stacking in chip manufacturing. |

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhances defect detection accuracy, reduces false alarms, and boosts throughput. | AI-powered algorithms analyze vast imaging data for faster anomaly identification. |

| Industry 4.0 & Automation | Drives demand for real-time inspection within smart factories. | Global industrial automation market projected for substantial growth from its 2023 valuation of ~$220 billion. |

| Research & Development Investment | Crucial for developing innovative solutions and maintaining competitiveness. | Camtek invested $35.1 million in R&D in 2023, representing 13.5% of revenue. |

Legal factors

Camtek's reliance on proprietary inspection and metrology technologies makes robust intellectual property (IP) protection, including patents, trademarks, and trade secrets, absolutely vital. Strong legal frameworks that ensure IP enforcement in crucial markets are therefore indispensable for Camtek to prevent infringement and sustain its technological edge, thereby protecting its significant research and development expenditures.

Camtek, a significant player in the global high-tech equipment market, navigates a complex web of international trade laws. These regulations, including export controls and sanctions, are critical for its operations. Failure to comply can lead to severe legal repercussions and jeopardize its ability to conduct business worldwide.

For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) oversees export controls, impacting the sale of advanced technologies. In 2023, the BIS continued to update its Entity List, a key tool for export control, affecting numerous companies and countries. Camtek must diligently monitor these evolving lists and regulations to ensure its export activities remain compliant, particularly concerning sensitive technologies.

Camtek must strictly adhere to product liability and safety regulations across all its operational regions, a critical aspect for maintaining market presence and customer confidence. Failure to comply can lead to severe consequences, including costly lawsuits and product recalls, impacting its financial standing and brand reputation.

In 2024, the global product recall market saw significant activity, with industries heavily reliant on advanced equipment facing increased scrutiny. For Camtek, ensuring its inspection and metrology solutions meet stringent safety certifications, such as CE marking in Europe and UL certification in North America, is paramount to avoid penalties and maintain trust. This proactive approach safeguards against potential litigation, which could otherwise divert resources and attention from innovation and growth.

Data Privacy and Cybersecurity Laws

Camtek's operations, which involve handling sensitive manufacturing data, are significantly impacted by evolving data privacy and cybersecurity laws. Adherence to regulations like the EU's General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is paramount. These laws mandate strict data handling protocols, impacting how Camtek stores, processes, and protects customer information. Failure to comply can result in substantial fines and reputational damage.

The increasing connectivity of manufacturing equipment, often referred to as the Industrial Internet of Things (IIoT), amplifies cybersecurity risks. Camtek must implement robust cybersecurity measures to safeguard customer data against breaches. This includes secure software development practices, regular security audits, and incident response plans. As of early 2025, the global cybersecurity market is projected to reach over $200 billion, highlighting the significant investment and focus required in this area.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million, whichever is higher.

- CCPA Impact: Businesses must provide consumers with the right to know what personal information is collected and the right to request deletion.

- IIoT Security Spending: Investments in IIoT security are expected to grow significantly, with many companies allocating 15-20% of their IIoT budget to security measures.

- Data Breach Costs: The average cost of a data breach in 2024 was estimated to be over $4.5 million globally, emphasizing the financial imperative for strong cybersecurity.

Labor Laws and Employment Regulations

Camtek must navigate a complex web of labor laws and employment regulations across its global operations. This includes adhering to country-specific rules on minimum wage, working hours, employee benefits, and anti-discrimination policies. For instance, in 2024, many European countries continued to update their labor codes, focusing on remote work rights and enhanced worker protections, which could impact Camtek's operational costs and HR strategies.

Compliance is not just a legal necessity but a strategic imperative. Failure to comply can lead to significant fines, reputational damage, and disruptions to operations. For example, a 2023 report indicated that labor law violations cost businesses an average of $50,000 per incident. Camtek's commitment to fair labor practices bolsters employee morale and retention, contributing to a more stable and productive workforce.

- Wage and Hour Laws: Ensuring compliance with minimum wage, overtime pay, and record-keeping requirements in all operating jurisdictions.

- Working Conditions: Adhering to regulations concerning workplace safety, health standards, and reasonable working hours.

- Non-Discrimination and Equal Opportunity: Implementing policies that prevent discrimination based on race, gender, age, religion, or other protected characteristics.

- Employee Benefits and Leave: Complying with mandates for statutory benefits such as paid time off, sick leave, and parental leave, which vary significantly by country.

Camtek's legal landscape is shaped by intellectual property rights, necessitating strong patent and trademark protection to safeguard its technological innovations. International trade laws, including export controls and sanctions, also present significant compliance challenges for its global operations. Adherence to product liability and safety regulations is crucial to maintain market trust and avoid costly repercussions.

Data privacy and cybersecurity laws, such as GDPR and CCPA, are increasingly impacting how Camtek handles customer information, requiring robust data protection measures. Furthermore, labor laws and employment regulations across different countries demand careful attention to ensure fair practices and avoid legal penalties. These legal factors collectively influence Camtek's operational strategies and risk management.

| Legal Factor | Impact on Camtek | Key Considerations/Data |

| Intellectual Property (IP) Protection | Safeguarding proprietary technologies and R&D investments. | Robust patent filings are critical; infringement can lead to significant financial losses. |

| International Trade Laws | Navigating export controls, sanctions, and trade agreements. | Compliance with BIS regulations is vital; 2023 saw continuous updates to the Entity List. |

| Product Liability & Safety | Ensuring product compliance and avoiding recalls/lawsuits. | CE and UL certifications are essential; product recall costs can be substantial. |

| Data Privacy & Cybersecurity | Protecting customer data and complying with privacy regulations. | Adherence to GDPR/CCPA is mandatory; average data breach cost in 2024 exceeded $4.5 million. |

| Labor Laws & Employment | Managing workforce compliance and employee relations. | Varying regulations globally; labor law violations averaged $50,000 per incident in 2023. |

Environmental factors

The manufacturing of semiconductor equipment, like that produced by Camtek, and the operation of semiconductor fabrication plants (fabs) are inherently energy-intensive. This means that energy consumption and efficiency are significant environmental factors for the industry.

With growing global attention on industrial energy use, Camtek must focus on the energy efficiency of its own manufacturing processes and the power consumption of its inspection and metrology solutions. This commitment is crucial for reducing its carbon footprint and meeting sustainability goals, especially as the semiconductor industry aims to align with broader climate targets.

Camtek's manufacturing and service operations inherently involve materials that require careful waste management, including potentially hazardous substances. For instance, the electronics industry, where Camtek operates, often deals with chemicals used in circuit board production and cleaning, which must be handled according to strict protocols.

Navigating environmental regulations for waste disposal and hazardous material handling is paramount. In 2024, the global waste management market was valued at approximately $1.6 trillion, underscoring the significant compliance and operational costs involved. Failure to adhere to these rules, such as those enforced by the EPA in the US or REACH in Europe, can lead to substantial fines and reputational damage.

Growing pressure for corporate environmental responsibility now extends to the entire supply chain. Camtek must actively assess and manage the environmental footprint of its suppliers, from raw material sourcing through component manufacturing. This is crucial for maintaining its reputation and adhering to customer-driven sustainability mandates.

For instance, in 2024, a significant portion of large corporations reported that over 70% of their suppliers had some form of environmental reporting in place, a trend expected to accelerate. Camtek's proactive engagement with its supply chain partners on emissions reduction and waste management will be key to meeting these evolving expectations and potentially unlocking new business opportunities with environmentally conscious clients.

Climate Change and Resource Scarcity

Climate change presents significant long-term risks to Camtek, particularly concerning extreme weather events and potential resource scarcity. These factors can disrupt supply chains and impact operational continuity, a growing concern as global temperatures rise. For instance, the Intergovernmental Panel on Climate Change (IPCC) AR6 Synthesis Report (2023) highlights the increasing frequency and intensity of such events, directly threatening manufacturing operations and logistics.

Camtek's resilience hinges on proactive mitigation strategies. Diversifying sourcing away from climate-vulnerable regions and embedding more sustainable practices into its operations are no longer optional but critical for business continuity. This includes exploring alternative materials and optimizing energy consumption. The World Economic Forum's Global Risks Report 2024 identifies environmental risks, including climate action failure and extreme weather, as the most severe long-term threats.

- Supply Chain Vulnerability: Increased frequency of extreme weather events could disrupt the transport of components and finished goods for Camtek.

- Resource Availability: Potential scarcity of key raw materials due to climate-induced agricultural or industrial impacts could affect production costs.

- Operational Disruption: Direct impacts from floods, droughts, or heatwaves could temporarily halt manufacturing facilities.

- Regulatory Pressure: Growing global focus on climate action may lead to stricter environmental regulations affecting manufacturing processes and material usage.

Environmental, Social, and Governance (ESG) Reporting

Investor and stakeholder scrutiny of Environmental, Social, and Governance (ESG) performance is intensifying, compelling companies like Camtek to bolster their sustainability reporting. This heightened focus directly impacts investor confidence and access to capital.

Camtek's proactive stance and transparent disclosure of its ESG initiatives, particularly its environmental efforts, are crucial for building trust and enhancing its corporate reputation in the market. For instance, in 2023, the global sustainable investment market reached an estimated $37.2 trillion, underscoring the financial significance of ESG factors.

- Growing Investor Demand: A significant majority of institutional investors now integrate ESG criteria into their investment decisions, with over 80% considering ESG factors in their portfolio management.

- Regulatory Tailwinds: Emerging regulations globally are mandating more robust ESG disclosures, pushing companies towards greater transparency.

- Camtek's ESG Impact: Camtek's commitment to reducing its carbon footprint, for example, by optimizing energy consumption in its manufacturing processes, directly influences its attractiveness to sustainability-focused funds.

- Reputational Advantage: Strong ESG performance can differentiate Camtek from competitors, potentially leading to improved brand loyalty and talent acquisition.

Camtek's operations, deeply tied to energy-intensive semiconductor manufacturing, face increasing pressure regarding energy efficiency and carbon footprint reduction. The company must prioritize minimizing power consumption in its inspection and metrology solutions to align with global climate targets and enhance its sustainability profile.

Waste management, particularly concerning potentially hazardous materials used in electronics manufacturing, presents significant compliance challenges and costs. Adherence to stringent disposal regulations, such as those in Europe and the US, is critical to avoid penalties and reputational damage, especially given the global waste management market's substantial valuation.

Climate change introduces tangible risks like extreme weather events and resource scarcity, potentially disrupting Camtek's supply chains and operations. Proactive strategies, including supply chain diversification and embedding sustainable practices, are essential for business continuity, aligning with global risk assessments identifying environmental threats as severe long-term concerns.

Intensifying investor and stakeholder focus on Environmental, Social, and Governance (ESG) performance directly impacts Camtek's market attractiveness and access to capital. Transparent reporting on environmental initiatives, such as reducing its carbon footprint, is vital for building trust and gaining a competitive edge in a market where sustainable investments are rapidly growing.

| Environmental Factor | Impact on Camtek | 2024/2025 Data/Trend |

|---|---|---|

| Energy Consumption | Operational costs, carbon footprint | Growing demand for energy-efficient semiconductor manufacturing equipment. |

| Waste Management | Compliance costs, regulatory risk | Global waste management market valued at ~$1.6 trillion in 2024; strict regulations like REACH and EPA enforcement. |

| Climate Change Risks | Supply chain disruption, operational continuity | World Economic Forum Global Risks Report 2024 highlights extreme weather and climate action failure as top long-term threats. |

| ESG Scrutiny | Investor confidence, access to capital | Sustainable investment market reached ~$37.2 trillion in 2023; over 80% of institutional investors integrate ESG criteria. |

PESTLE Analysis Data Sources

Our Camtek PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable market research firms, and leading economic databases. This ensures that every political, economic, social, technological, legal, and environmental insight is grounded in current, verifiable data.