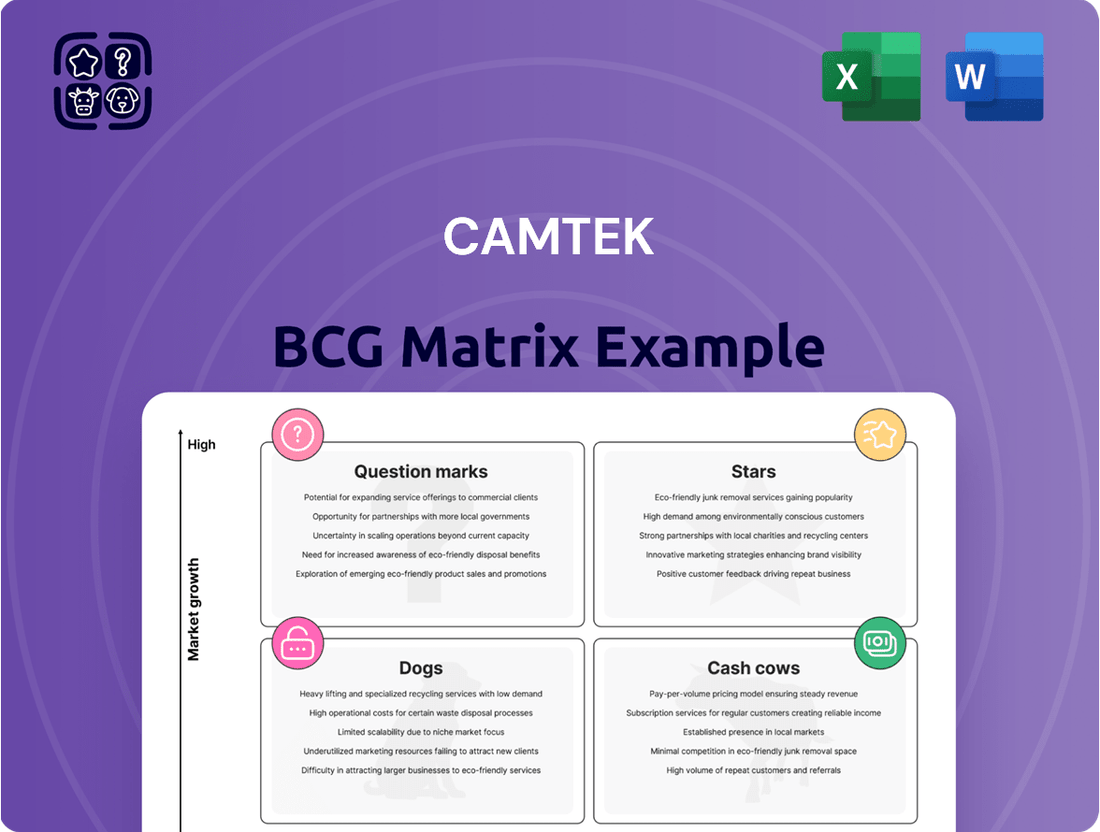

Camtek Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

Understand the strategic positioning of this company's product portfolio with our insightful BCG Matrix. See at a glance which products are driving growth and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your investments.

Stars

Camtek's advanced packaging inspection systems are pivotal to its growth, especially those catering to High-Performance Computing (HPC) and AI. The Eagle G5 and Hawk platforms are engineered for the demanding requirements of 3D wafer inspection, High Bandwidth Memory (HBM), and Chiplet integration, crucial for next-generation semiconductors.

These sophisticated systems are designed to handle the intricate and miniaturized structures characteristic of advanced semiconductor manufacturing. By addressing these complexities, Camtek solidifies its position in a rapidly expanding market segment, vital for the continued innovation in AI and HPC technologies.

Camtek holds a commanding position in the High Bandwidth Memory (HBM) inspection market, evidenced by substantial orders and ongoing growth. This sector is booming, fueled by the insatiable demand for advanced computing power in AI. Camtek's inspection and metrology systems are indispensable for HBM manufacturing, establishing them as the preferred technology for leading companies in this dynamic field.

The Eagle G5 System, introduced in late 2024, represents a significant advancement for Camtek within the advanced packaging inspection and 3D metrology sector. This system is designed to bolster Camtek's competitive position by offering enhanced optical resolution and exceptional wafer throughput, directly addressing the evolving needs of the market and anticipating future customer requirements.

This technological leap is projected to be a key driver for Camtek's expansion in 2025. Given the critical role of advanced packaging in the semiconductor industry's growth, the Eagle G5 is well-positioned to capture market share and contribute to revenue growth, potentially solidifying its status as a Star in Camtek's business portfolio.

Hawk System

The Hawk System, a key component of Camtek's strategic positioning within the semiconductor industry, represents a significant advancement. Launched in February 2025, this innovative platform has already secured over $50 million in orders for 2025 deliveries, underscoring its market traction and perceived value.

This cutting-edge system is engineered to transform the advanced semiconductor packaging sector. Its capabilities are particularly impactful for high-demand applications such as 3D wafer inspection and hybrid bonding, areas where enhanced precision and throughput are critical for competitive advantage.

- Hawk System Launch: February 2025

- Initial Orders (2025): Over $50 million

- Target Market: Advanced Semiconductor Packaging

- Key Applications: 3D Wafer Inspection, Hybrid Bonding

Solutions for AI Applications

Camtek's strategic emphasis on solutions tailored for AI applications, especially those requiring high-performance computing (HPC) hardware, is a significant growth driver.

In 2024, HPC represented roughly 50% of Camtek's overall revenue, a proportion anticipated to persist as AI becomes more prevalent in everyday devices.

The escalating need for sophisticated inspection within AI chip manufacturing serves as a primary catalyst for this expansion.

- AI-driven HPC demand: HPC hardware, crucial for AI, constituted approximately 50% of Camtek's revenue in 2024.

- Market integration: AI's increasing integration into mainstream devices is expected to sustain HPC's revenue contribution.

- Inspection's role: Advanced inspection solutions are vital for the quality control of AI chips, fueling Camtek's growth.

Camtek's advanced inspection systems, particularly the Eagle G5 and Hawk platforms, are positioned as Stars in its product portfolio due to their critical role in high-growth markets like AI and High Bandwidth Memory (HBM). The Eagle G5, launched in late 2024, enhances Camtek's competitive edge with superior optical resolution and wafer throughput, directly addressing evolving market demands. The Hawk System, introduced in February 2025, has already secured over $50 million in orders for 2025, highlighting its strong market reception for applications such as 3D wafer inspection and hybrid bonding.

| Product | Launch Date | Key Applications | 2025 Order Value (Hawk) | Market Segment |

|---|---|---|---|---|

| Eagle G5 | Late 2024 | 3D Wafer Inspection, Advanced Packaging | N/A | High-Performance Computing (HPC), AI |

| Hawk System | February 2025 | 3D Wafer Inspection, Hybrid Bonding | Over $50 million | Advanced Semiconductor Packaging |

What is included in the product

Camtek's BCG Matrix analyzes its product portfolio by market share and growth, guiding investment decisions.

Camtek's BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of complex data analysis for strategic decision-making.

Cash Cows

Camtek's established inspection and metrology equipment lines are strong contenders for cash cow status within its portfolio. These systems have a significant market presence, with an installed base exceeding 3,000 tools and over 300 customers, including major players like Intel, Amkor, and TSMC.

These mature products cater to diverse segments of the semiconductor industry, not solely focusing on the most advanced packaging technologies. Their essential function in manufacturing processes ensures consistent demand and predictable revenue streams, even if the growth rates are not as explosive as newer technologies.

Camtek's standard 2D inspection solutions are a cornerstone of semiconductor quality control, operating within a mature market segment where the company holds a significant market share. These established offerings are highly reliable and require minimal new investment in marketing or development, contributing to robust profit margins and consistent cash flow.

These mature products generate substantial and steady revenue for Camtek, often referred to as cash cows. For instance, in 2023, Camtek reported a total revenue of $271.6 million, with its inspection solutions forming a substantial and dependable portion of this figure, underpinning the company's financial stability.

Camtek's post-dicing inspection and metrology systems are crucial for the final steps in semiconductor manufacturing, ensuring the quality of diced wafers. This segment, while not a high-growth area, is supported by the steady production of semiconductor devices.

The consistent demand for these systems, coupled with Camtek's strong position in the market, translates to reliable and predictable cash flows. In 2023, Camtek reported that its inspection and metrology solutions continued to be a significant contributor to its revenue, demonstrating the stability of this business unit.

After-Sales Service and Support

Camtek's after-sales service and support likely function as a cash cow, generating consistent, high-margin revenue from its substantial installed base of inspection and metrology systems. These services are essential for customers’ ongoing operations, creating a predictable income stream with minimal incremental investment required after the initial system sale. For instance, in 2023, Camtek reported that its service revenue represented a significant portion of its total revenue, underscoring the stability and profitability of this segment.

- Recurring Revenue: The ongoing maintenance, upgrades, and technical support for Camtek's installed systems provide a stable and predictable revenue stream.

- High Margins: Service contracts typically carry higher profit margins compared to the initial sale of capital equipment.

- Customer Dependency: Critical production environments necessitate reliable support, fostering strong customer loyalty and long-term service agreements.

- Low Incremental Investment: Once the initial infrastructure is in place, expanding service offerings often requires less capital than developing new products.

Older Generations of Eagle Systems

Older generations of Camtek's Eagle systems, though now superseded by advanced models like the Eagle G5, remain a significant asset. These established systems likely maintain a substantial market share due to their proven track record and widespread adoption.

- Mature Product: Previous Eagle generations represent a mature product line with a high market share in the semiconductor inspection and metrology sector.

- Revenue Generation: Having covered their initial research and development expenses, these systems continue to be profitable revenue streams for Camtek.

- Low Investment: With minimal ongoing R&D needed, these cash cows require limited further investment, maximizing their contribution to profitability.

- Profitability Focus: Camtek leverages the consistent revenue from these older systems to fund innovation in newer technologies.

Camtek's established inspection and metrology solutions are prime examples of cash cows within its portfolio. These mature product lines, like the standard 2D inspection systems and older Eagle generations, generate consistent and predictable revenue with minimal ongoing investment. Their significant installed base, exceeding 3,000 tools and serving over 300 customers including industry giants, ensures a stable income stream.

These systems, while not experiencing high growth, are essential for semiconductor quality control, maintaining a strong market presence and profitability. For instance, Camtek's inspection and metrology solutions contributed significantly to its $271.6 million in total revenue in 2023, highlighting their dependable financial contribution.

Furthermore, Camtek's after-sales service and support operations act as a robust cash cow. This segment provides high-margin, recurring revenue from maintenance, upgrades, and technical assistance for its extensive installed base. In 2023, service revenue represented a notable portion of Camtek's overall income, underscoring its profitability and stability.

| Camtek Product/Service Category | BCG Matrix Classification | Key Characteristics | 2023 Financial Contribution (Illustrative) |

| Established Inspection & Metrology Systems | Cash Cow | Mature market, high installed base, consistent demand, low R&D needs | Significant portion of $271.6M total revenue |

| After-Sales Service & Support | Cash Cow | Recurring revenue, high margins, customer dependency, low incremental investment | Notable portion of total revenue |

Preview = Final Product

Camtek BCG Matrix

The Camtek BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase. This means you get the fully formatted, analysis-ready report without any watermarks or demo content, ready for immediate strategic application.

Dogs

Legacy inspection and metrology systems targeting semiconductor segments with shrinking demand, like older DRAM or NAND flash manufacturing, would be considered dogs in Camtek's BCG Matrix. These products, likely holding a low market share, operate in markets with negative or very low growth rates, offering minimal future potential.

Products classified as dogs within Camtek's portfolio likely exhibit a low market share coupled with intense competition. Companies like Onto Innovations and KLA-Tencor often present formidable challenges, particularly when Camtek's offerings lack distinct differentiation or a clear strategy to expand their market presence. These products typically struggle to contribute meaningfully to revenue or profitability.

Investing heavily in such products carries substantial risk, with a low probability of generating a positive return. For instance, if a particular inspection solution from Camtek is facing established players with superior technology or lower price points, and Camtek hasn't secured significant customer adoption or developed unique features, it would fit the dog category. This situation might be reflected in declining sales figures or a stagnant market share, potentially below 5% in a segment dominated by larger competitors.

Camtek's niche inspection solutions, if focused on highly specialized segments of the microelectronics industry with limited market size, could be classified as Dogs in the BCG Matrix. These products, while potentially effective for their specific applications, face inherent growth limitations. For instance, if a solution targets a micro-component used in only a handful of legacy devices, its market potential is inherently capped, preventing significant market share expansion.

These "Dog" products might represent older technologies or solutions tailored to very specific, non-expanding niches within the semiconductor manufacturing process. While they might still generate some revenue, their inability to scale or adapt to broader market trends means they are unlikely to become major profit drivers for Camtek. This stagnation is typical of products in the Dog quadrant, which often require minimal investment but also offer little prospect of future growth.

Underperforming Regional Offerings

In Camtek's portfolio, underperforming regional offerings would be classified as dogs within the BCG matrix. These are products or solutions tailored for specific geographic markets that have failed to gain significant traction. They operate in slow-growing regional markets and hold a minimal market share, demanding considerable resources for meager returns.

For instance, if Camtek had a specialized inspection solution for a niche manufacturing sector in a particular European region that experienced only 2% annual growth and captured less than 5% market share, it would likely be a dog. Such offerings require substantial investment in sales, marketing, and support, often yielding little in terms of revenue or profit growth, making them candidates for divestment or significant restructuring.

- Low Market Share: Products with less than 10% market share in their respective slow-growing regional markets.

- Slow Market Growth: Regional markets experiencing annual growth rates below 3%.

- High Resource Drain: Offerings that consume disproportionate sales and marketing resources relative to their revenue contribution.

- Minimal Profitability: Products that contribute negligibly or negatively to overall company profits.

Discontinued Product Lines

Discontinued product lines within Camtek's portfolio, categorized as Dogs in the BCG matrix, represent offerings that no longer generate significant revenue or market share. These are typically products that have become obsolete, faced declining consumer interest, or couldn't compete effectively against newer technologies or rivals. For instance, if Camtek phased out older inspection systems that were superseded by advanced AI-driven solutions, these would fall into the Dog category. Such products have ceased to be a focus for R&D or marketing, signifying past investments that did not achieve long-term market viability.

- Obsolescence: Products rendered outdated by technological advancements.

- Lack of Market Interest: Declining demand due to shifting consumer preferences or market trends.

- Competitive Disadvantage: Inability to compete on price, features, or performance with market leaders.

- Phased Out Investments: Representing past expenditures that did not yield sustained market success.

Dogs in Camtek's BCG Matrix are products with low market share in slow-growing or declining markets. These offerings, such as legacy inspection systems for older semiconductor nodes, generate minimal revenue and are unlikely to see future growth. For example, a system targeting the shrinking market for 28nm DRAM manufacturing, where Camtek might hold less than 5% share in a market declining at 3% annually, would be a prime candidate for this classification. These products often require continued but minimal investment, with a focus on managing their decline rather than growth.

| Product Category | Market Share | Market Growth Rate | Profitability Contribution | Strategic Outlook |

|---|---|---|---|---|

| Legacy DRAM Inspection Systems | <5% | -3% (Declining) | Negligible | Harvest/Divest |

| Niche Microelectronics Metrology | <10% | 1-2% (Stagnant) | Low | Manage/Phase Out |

| Outdated Regional Solutions | <5% (Regional) | 2% (Slow Growth) | Negative | Divest/Restructure |

Question Marks

Camtek's exploration into novel inspection and metrology technologies for emerging semiconductor applications, such as those driven by AI hardware or advanced sensor technologies, represents a classic question mark. These areas, while holding significant future growth potential, currently represent a small fraction of Camtek's overall revenue, with market share still in its infancy.

The company is investing heavily in R&D to develop these advanced solutions, aiming to establish a strong foothold in these nascent markets. For instance, the demand for specialized inspection tools for wafer-level optics used in augmented reality devices is projected to grow substantially, but Camtek’s current penetration is minimal.

Entering entirely new geographic markets, where Camtek has little to no existing presence or brand awareness, would place it squarely in the question mark category of the BCG matrix. These regions, while potentially offering significant growth opportunities in semiconductor manufacturing, would see Camtek start with a very small market share.

Significant investment would be necessary to establish a foothold, covering sales infrastructure, marketing campaigns, and local support. For instance, expanding into emerging semiconductor hubs in Southeast Asia or Eastern Europe in 2024 would require substantial upfront capital to build brand recognition and distribution networks, mirroring the challenges faced by many tech companies entering uncharted territories.

Camtek's potential future growth hinges on its ability to innovate beyond current HBM4e standards. While the company is well-positioned for hybrid copper bonding, early-stage R&D into more advanced or speculative hybrid bonding technologies represents a question mark. These nascent technologies, though promising for future high-growth markets, currently have minimal market share and substantial research and development expenses, making their immediate commercial viability uncertain.

Diversification into Adjacent Industries

Camtek might consider diversifying into adjacent industries, such as advanced packaging or printed circuit board (PCB) inspection, where its core metrology and inspection capabilities could be leveraged. These new ventures would likely begin as question marks in the BCG matrix, requiring substantial upfront investment and facing initial uncertainty regarding market penetration and growth rates. For instance, the advanced packaging market, projected to grow significantly, presents an opportunity, but Camtek would need to establish its presence against established players.

Exploring new applications for inspection and metrology outside of traditional semiconductor manufacturing could also be a strategic move. This could include areas like flat panel display (FPD) inspection or even emerging fields like advanced materials. While these markets may offer high growth potential, Camtek would be entering with limited initial market share, necessitating considerable investment to build brand recognition and customer adoption.

- Adjacent Industry Exploration: Camtek's expertise in inspection and metrology can be applied to high-growth adjacent markets like advanced packaging, which is expected to see substantial growth in the coming years.

- New Application Development: Venturing into areas such as flat panel display (FPD) inspection or advanced materials provides opportunities for diversification, though these will initially represent question marks due to market entry challenges.

- Investment and Market Share: These new ventures require significant investment to establish a foothold and gain market share, characteristic of question mark businesses in the BCG matrix.

- Growth Potential: Despite the initial risks, these adjacent industries and new applications offer the potential for high returns and market leadership if successful.

Next-Generation Process Control Software beyond Current Offerings

Developing entirely new, revolutionary process control software that disrupts current methods, rather than just improving existing ones, represents a significant question mark for Camtek within its BCG Matrix.

This initiative targets the high-growth manufacturing efficiency market, a sector projected to see substantial expansion. For instance, the global industrial automation market, which includes process control software, was valued at approximately $270 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 9% through 2030.

However, achieving significant market share requires substantial upfront investment and robust market adoption strategies.

- Disruptive Innovation: Focus on creating entirely new process control paradigms.

- Market Opportunity: Capitalize on the growing demand for advanced manufacturing efficiency solutions.

- Investment & Adoption Risk: Significant capital is needed, with market acceptance being a key uncertainty.

- Potential High Reward: Successful disruption could lead to a dominant market position.

Camtek’s foray into new, high-potential semiconductor applications, like those for AI or advanced sensors, are classic question marks. These areas, though promising for future growth, currently contribute minimally to Camtek's revenue, with market share still in its early stages.

The company is actively investing in research and development to build these advanced solutions, aiming to secure a strong position in these emerging markets. For example, the need for specialized inspection tools for wafer-level optics in augmented reality devices is expected to rise significantly, yet Camtek's current penetration remains low.

Entering new geographic regions where Camtek has little to no brand recognition or existing presence would place these ventures firmly in the question mark category of the BCG matrix. While these regions might offer substantial growth opportunities in semiconductor manufacturing, Camtek would start with a very small market share.

Significant capital investment is necessary to establish a presence, covering sales infrastructure, marketing efforts, and local support. For instance, expanding into emerging semiconductor hubs in Southeast Asia or Eastern Europe during 2024 would require considerable upfront funding to build brand awareness and distribution networks, mirroring the challenges faced by many tech firms entering new territories.

Camtek's future growth trajectory relies on its ability to innovate beyond current HBM4e standards. While the company is well-positioned for hybrid copper bonding, its early-stage R&D into more speculative hybrid bonding technologies represents a question mark. These nascent technologies, though holding promise for future high-growth markets, currently possess minimal market share and incur substantial R&D expenses, making their immediate commercial viability uncertain.

Camtek might consider diversifying into related industries, such as advanced packaging or printed circuit board (PCB) inspection, where its core metrology and inspection capabilities can be leveraged. These new ventures would likely commence as question marks within the BCG matrix, demanding substantial initial investment and facing inherent uncertainty regarding market penetration and growth rates. For example, the advanced packaging market, projected for significant growth, presents an opportunity, but Camtek would need to establish its presence against established competitors.

Exploring new applications for inspection and metrology beyond traditional semiconductor manufacturing could also be a strategic move. This could encompass areas like flat panel display (FPD) inspection or even emerging fields such as advanced materials. While these markets may offer high growth potential, Camtek would be entering with limited initial market share, necessitating considerable investment to build brand recognition and customer adoption.

Developing entirely new, revolutionary process control software that disrupts current methods, rather than just improving existing ones, represents a significant question mark for Camtek within its BCG Matrix. This initiative targets the high-growth manufacturing efficiency market, a sector projected to see substantial expansion. For instance, the global industrial automation market, which includes process control software, was valued at approximately $270 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 9% through 2030. However, achieving significant market share requires substantial upfront investment and robust market adoption strategies.

| Category | Description | Investment Required | Market Share Potential | Example |

| Question Marks | New ventures with high growth potential but low current market share. Require significant investment to grow. | High | Low (initially) | AI hardware inspection, new geographic markets, disruptive process control software |

| Market Opportunity | Emerging semiconductor applications (AI, advanced sensors), advanced packaging, FPD inspection, advanced materials. | Substantial R&D and market entry costs | Nascent to growing | Wafer-level optics for AR devices, advanced packaging solutions |

| Strategic Focus | Building market share through innovation and targeted investment. | Ongoing | Aiming for high | Developing next-gen bonding technologies, establishing presence in new regions |

BCG Matrix Data Sources

Our Camtek BCG Matrix is informed by a blend of financial filings, market research reports, and industry expert analyses to provide a comprehensive view of product performance and market dynamics.