Camtek Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camtek Bundle

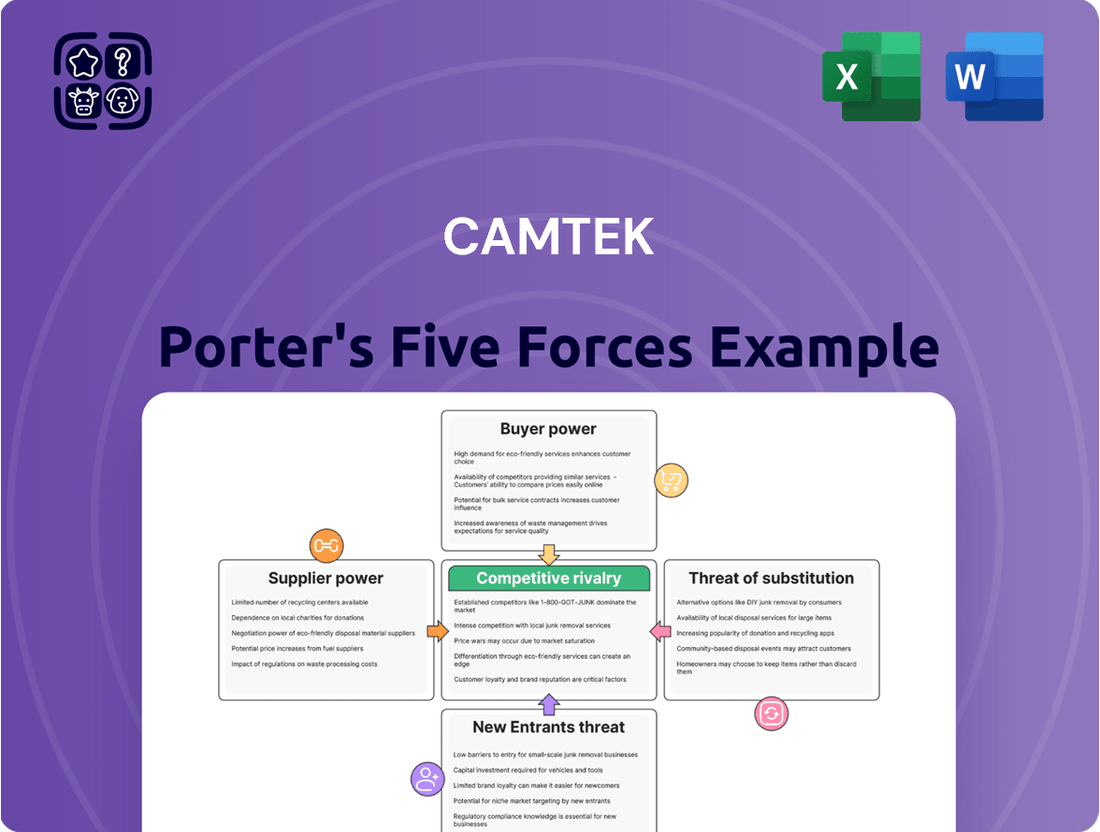

Camtek's competitive landscape is shaped by the interplay of five key forces, revealing both opportunities and challenges. Understanding the intensity of rivalry, the power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic planning.

The complete report reveals the real forces shaping Camtek’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Camtek's reliance on a specialized global supply chain for high-precision components and raw materials grants significant bargaining power to its suppliers. The unique nature of these components, especially those critical for advanced semiconductor manufacturing, means only a select few suppliers can meet Camtek's stringent requirements. This limited supplier pool, coupled with potential geopolitical factors and trade restrictions impacting availability and cost, amplifies supplier leverage over Camtek.

High switching costs for Camtek's specialized components significantly bolster supplier bargaining power. When a supplier provides highly specialized or custom-designed parts, transitioning to a new vendor incurs substantial expenses. These can include re-qualification processes, re-tooling machinery, and the risk of production delays, all of which make it costly for Camtek to change suppliers.

The deeply integrated nature of components within semiconductor equipment design further entrenches this dependency. Because these parts are often intricately woven into the very fabric of Camtek's systems, finding and implementing alternatives becomes a complex and resource-intensive undertaking. This intricacy directly limits Camtek's leverage in negotiations, as suppliers understand the difficulty and expense involved in replacement.

Supplier concentration significantly impacts Camtek's bargaining power. When a few dominant suppliers control critical components, they gain leverage. For instance, the global semiconductor industry, a key market for Camtek, often sees reliance on a limited number of specialized foundries and material providers. This concentration means these suppliers can dictate terms, potentially increasing costs and influencing delivery timelines for Camtek.

Technological Advancements by Suppliers

Suppliers who are leading the charge in technological innovation for crucial components or materials can wield more influence. Camtek relies on these innovations to stay ahead in the inspection and metrology market, particularly for advanced applications like sophisticated chip packaging and artificial intelligence processors.

This reliance on supplier technological progress strengthens their bargaining position, as Camtek needs these advancements to maintain its competitive edge. For instance, in 2024, the semiconductor industry saw significant investment in next-generation inspection technologies, with specialized suppliers driving these developments.

- Technological Leadership: Suppliers at the forefront of innovation for critical sub-systems or materials possess greater bargaining power.

- Camtek's Dependency: Camtek's competitive edge in inspection and metrology, especially for advanced applications, hinges on these supplier advancements.

- Enhanced Supplier Position: This technological reliance inherently elevates the suppliers' leverage in negotiations.

- Industry Trends: In 2024, the semiconductor sector's focus on advanced packaging and AI chips amplified the importance of suppliers offering cutting-edge metrology solutions.

Potential for Forward Integration by Suppliers

While less common in highly specialized fields like inspection equipment, the theoretical threat of a key component supplier integrating forward to develop their own inspection solutions could indeed boost their bargaining power. This scenario, though rare, would allow suppliers to capture more of the value chain.

However, this potential is significantly tempered by the substantial research and development investment, coupled with the deep market expertise required to compete effectively in Camtek's specific niche. Developing advanced inspection technology demands specialized knowledge and a proven track record, which many component suppliers may lack.

- Potential for Forward Integration: Suppliers might consider developing their own inspection equipment, directly competing with Camtek.

- Barriers to Entry for Suppliers: Significant R&D costs and specialized market knowledge are crucial for success in this sector.

- Mitigating Factor: The high technical and market entry barriers limit the practical threat of supplier forward integration.

Camtek's reliance on a select group of suppliers for highly specialized components, particularly for advanced semiconductor inspection and metrology, grants these suppliers considerable bargaining power. The unique technical specifications and the limited number of manufacturers capable of producing these critical parts mean Camtek has few alternatives. This dependency is amplified by the high costs associated with qualifying new suppliers, including rigorous testing and integration processes.

The concentration of suppliers in niche markets, such as those providing advanced optical sensors or specialized wafer handling mechanisms, further strengthens their position. For instance, in 2024, the market for certain high-resolution imaging components used in semiconductor metrology remained dominated by a few key players, allowing them to command premium pricing and influence delivery schedules.

Camtek's dependence on supplier innovation is a critical factor. Suppliers who are leaders in developing next-generation technologies, essential for meeting the evolving demands of chip manufacturing, hold significant leverage. This is evident in the 2024 push for AI-driven metrology solutions, where suppliers of advanced algorithms and specialized processing units were in high demand.

The bargaining power of Camtek's suppliers is substantial due to the specialized nature of components, high switching costs, and supplier concentration in critical technology areas. This is particularly true for suppliers at the forefront of innovation, as demonstrated by the 2024 semiconductor industry trends in advanced packaging and AI chip inspection.

| Factor | Impact on Camtek | Example (2024 Context) |

|---|---|---|

| Component Specialization | Limited supplier options, increasing leverage | High-precision optical sensors for advanced defect detection |

| Switching Costs | High expenses for re-qualification and integration | Re-tooling and validation for new wafer stage components |

| Supplier Concentration | Few dominant players dictate terms | Limited foundries for critical semiconductor materials |

| Technological Dependency | Camtek needs supplier innovation for competitiveness | Suppliers of AI-enabled metrology software and hardware |

What is included in the product

This analysis dissects the competitive forces impacting Camtek, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, and their implications for Camtek's profitability and strategic positioning.

Instantly visualize competitive intensity with a dynamic, interactive dashboard, allowing for rapid assessment of market pressures.

Customers Bargaining Power

Camtek's customer base is concentrated within the high-end semiconductor industry, serving major Integrated Device Manufacturers (IDMs), Outsourced Semiconductor Assembly and Test (OSAT) companies, and foundries. This concentration means that a few large clients can wield significant bargaining power.

Customers in rapidly growing sectors like High-Performance Computing (HPC) and High Bandwidth Memory (HBM) are particularly influential. For instance, in 2023, the HBM market saw substantial growth, with demand from AI accelerators driving significant order volumes for semiconductor manufacturers, who in turn are key customers for Camtek.

High customer switching costs significantly bolster Camtek's bargaining power. The substantial investment in integrating Camtek's advanced inspection and metrology systems into a customer's production line, coupled with the intricate calibration required, creates a strong lock-in effect. For instance, the semiconductor industry, a key market for Camtek, relies on highly specialized equipment where downtime for replacement or recalibration can cost millions.

Camtek's inspection and metrology equipment plays a crucial role in the microelectronic fabrication process, directly influencing customer production efficiency and product quality. For instance, in 2023, the semiconductor industry experienced significant shifts, with global chip sales projected to reach approximately $520 billion, highlighting the immense pressure on manufacturers to maintain high yields and stringent quality control.

This essential nature of Camtek's solutions means customers are heavily reliant on their performance to meet demanding standards, particularly in advanced node manufacturing. The ability to achieve high yields, a direct benefit of Camtek's technology, translates into substantial cost savings and competitive advantage for their clients, thereby granting Camtek a degree of bargaining power.

Customer Demand for Advanced Solutions

Customers in the semiconductor industry are constantly pushing for more sophisticated inspection and metrology tools. This is driven by the relentless trend towards smaller, more intricate chip designs. For instance, the increasing complexity of advanced packaging technologies requires metrology solutions capable of measuring features at sub-micron levels with extreme accuracy.

Camtek's commitment to innovation directly addresses this demand. By developing and offering advanced systems like the Eagle G5 for wafer inspection and the Hawk for advanced packaging, the company stays ahead of evolving customer requirements. This ability to provide cutting-edge technology is crucial for maintaining strong customer loyalty in a highly competitive market.

- Demand for Precision: Semiconductor manufacturers require metrology solutions that can detect defects and measure critical dimensions at ever-smaller scales, often in the nanometer range.

- Innovation as a Differentiator: Camtek's investment in R&D allows it to introduce new technologies that meet these stringent demands, differentiating it from competitors.

- Customer Retention: By consistently delivering advanced solutions that solve complex manufacturing challenges, Camtek strengthens its relationships with key customers, fostering repeat business and long-term partnerships.

Customer's Ability to Demand Customization and Support

Customers in the semiconductor inspection and metrology market, where Camtek operates, often possess significant bargaining power due to the high-value and critical nature of the equipment. This means they frequently demand extensive customization to meet specific production needs and require robust ongoing support and rapid service to minimize downtime. For example, a leading semiconductor manufacturer might negotiate specific software features or integration protocols for a new inspection system.

Camtek's ability to deliver tailored solutions and maintain a strong reputation for quality can, however, mitigate this customer power. Receiving accolades such as the Intel EPIC Supplier Award in 2023 for outstanding performance demonstrates Camtek's commitment to customer satisfaction and technical excellence. This can foster customer loyalty and reduce their inclination to switch suppliers or exert excessive price pressure, thereby strengthening Camtek's position.

- High Equipment Value: Semiconductor inspection equipment can cost millions of dollars, making each purchase a significant investment for customers.

- Critical Role in Production: This equipment is essential for ensuring yield and quality in semiconductor manufacturing, meaning any disruption can be extremely costly.

- Demand for Customization: Customers often require specific software algorithms, hardware configurations, or integration with existing factory systems.

- Service and Support Expectations: Rapid response times for technical issues and continuous software updates are crucial for maintaining production efficiency.

Camtek's customers, primarily major players in the semiconductor industry, hold considerable bargaining power. This is amplified by the critical nature of Camtek's inspection and metrology equipment, where even minor disruptions can lead to substantial financial losses. For instance, the semiconductor industry's global sales were estimated around $520 billion in 2023, underscoring the high stakes involved in maintaining production efficiency.

Customers often demand extensive customization and robust support, reflecting the high value and essential role of Camtek's solutions in their advanced manufacturing processes. This need for tailored performance and minimal downtime means clients can exert pressure on pricing and service levels.

However, Camtek mitigates this power through innovation and customer loyalty, evidenced by awards like Intel's EPIC Supplier Award in 2023. By consistently delivering cutting-edge technology that addresses evolving demands, such as the need for sub-micron feature measurement in advanced packaging, Camtek strengthens its relationships and reduces customer reliance on competitors.

Preview the Actual Deliverable

Camtek Porter's Five Forces Analysis

This preview showcases the complete Camtek Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape including supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

The semiconductor metrology and inspection arena is intensely competitive, with formidable global players like KLA Corporation, Applied Materials Inc., and Onto Innovation Inc. holding significant sway. These established giants often boast deeper pockets, benefit from substantial economies of scale, and offer broader product lines, creating a challenging landscape for any market participant.

The semiconductor inspection industry demands significant upfront capital for advanced manufacturing facilities and ongoing, substantial investment in research and development. This creates a high barrier to entry for new players. For instance, in 2023, Camtek reported R&D expenses of $47.9 million, highlighting the continuous need to innovate and stay ahead in a rapidly evolving technological landscape.

Camtek's commitment to R&D is essential for maintaining its competitive edge. By consistently developing new inspection technologies and software solutions, the company addresses the dynamic needs of its semiconductor manufacturing clients, ensuring its offerings remain relevant and valuable in a market driven by constant technological progress.

The semiconductor metrology and inspection equipment market is booming, with projections indicating robust growth fueled by the insatiable demand for AI and high-performance computing. Advanced packaging technologies are also a significant catalyst, pushing the need for sophisticated measurement solutions. This expanding pie naturally attracts more participants, intensifying the rivalry among existing players and new entrants alike as they battle for dominance in these high-growth areas.

Product Differentiation and Technological Innovation

Competitive rivalry in the semiconductor inspection and metrology market is heavily influenced by product differentiation. Companies actively compete by developing solutions that offer enhanced performance, reduced total cost of ownership, and improved reliability. This focus on distinct product features allows them to capture market share and command premium pricing.

Camtek’s strategic emphasis on technological innovation is a key driver of its competitive stance. The company’s recent introductions, such as the Eagle G5 and Hawk systems, are specifically engineered for emerging technologies like advanced packaging and hybrid bonding. These advanced systems aim to provide superior inspection capabilities, directly addressing the evolving needs of semiconductor manufacturers.

- Product Differentiation: Competition hinges on offering superior performance, lower cost of ownership, and higher reliability in inspection and metrology solutions.

- Technological Innovation: Camtek’s new systems, like Eagle G5 and Hawk, target advanced packaging and hybrid bonding, showcasing a commitment to innovation for competitive advantage.

- Market Focus: Differentiation strategies are crucial for capturing market share and meeting the specialized demands of advanced semiconductor manufacturing processes.

Geopolitical Factors and Regional Market Dynamics

Geopolitical tensions and national initiatives, like the U.S. CHIPS Act, are reshaping semiconductor supply chains and manufacturing investments. These policies aim to bolster domestic production, potentially leading to increased competition in specific regional markets. For instance, the CHIPS and Science Act allocated approximately $52.7 billion in funding to boost U.S. semiconductor manufacturing, research, and development, directly impacting global market dynamics.

These shifts can create new opportunities for localized manufacturing but also introduce complexities. Companies must navigate varying regulatory environments and national priorities, which can affect market access and operational costs. The drive for supply chain resilience is leading to significant capital expenditures in new fabrication facilities across different geographies.

- U.S. CHIPS Act: Allocated $52.7 billion to strengthen domestic semiconductor manufacturing and R&D.

- Regional Investment: Increased government incentives are driving new fab construction in the U.S., Europe, and Asia.

- Supply Chain Diversification: Geopolitical considerations are prompting companies to diversify manufacturing locations, potentially increasing regional competition.

- Market Dynamics: National initiatives can alter competitive landscapes by favoring local players and influencing global pricing and availability.

The semiconductor metrology and inspection market is characterized by intense rivalry, with established giants like KLA Corporation and Applied Materials Inc. dominating. Camtek competes by focusing on technological innovation and product differentiation, particularly in areas like advanced packaging. The market's growth, driven by AI and high-performance computing, attracts new entrants, further intensifying competition.

| Company | 2023 R&D Expenses (Millions USD) | Key Focus Areas |

|---|---|---|

| Camtek | $47.9 | Advanced Packaging, Hybrid Bonding |

| KLA Corporation | $1,150 (approx. FY23) | Process Control, Yield Management |

| Applied Materials Inc. | $2,450 (approx. FY23) | Semiconductor Equipment, Services |

| Onto Innovation Inc. | $215 (approx. FY23) | Metrology, Inspection, Lithography |

SSubstitutes Threaten

While direct substitutes for comprehensive inspection systems like those offered by Camtek are not abundant, the threat lies in the ongoing development of alternative metrology and inspection technologies. These emerging solutions aim to address specific inspection needs, potentially fragmenting the market.

Advancements in areas such as optical coherence tomography (OCT) and advanced X-ray techniques offer new ways to probe materials and detect defects, sometimes at a lower cost or with specialized capabilities. For instance, the global metrology market was valued at approximately $6.5 billion in 2023 and is projected to grow, indicating significant investment in diverse metrology solutions.

Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) into defect detection and process control is a key disruptor. Companies are increasingly leveraging AI-powered visual inspection systems, which can learn and adapt to identify anomalies more efficiently than traditional methods. This trend is particularly evident in industries like semiconductor manufacturing, where precision is paramount.

Customers are increasingly exploring ways to minimize their dependence on specialized inspection equipment. This shift is driven by the growing adoption of advanced in-line process control systems, which integrate quality checks directly into the manufacturing workflow. For instance, the global market for industrial automation, which includes these advanced control systems, was projected to reach over $200 billion in 2024, indicating a significant investment in smarter manufacturing processes.

Furthermore, the integration of Artificial Intelligence (AI) and predictive analytics is becoming a key strategy. These technologies enable manufacturers to identify potential defects and anomalies much earlier in the production cycle. By predicting and preventing issues before they occur, the reliance on extensive post-process inspection, often performed by dedicated equipment, can be significantly reduced. The AI in manufacturing market alone is expected to see substantial growth, with some estimates placing its value at over $30 billion by 2025, highlighting the industry's commitment to these predictive capabilities.

The threat of substitutes for specialized inspection and metrology tools, like those offered by Camtek, is growing as major manufacturing equipment suppliers explore deeper integration. Companies such as Applied Materials and KLA are increasingly embedding inspection and metrology functionalities directly into their advanced fabrication equipment. This trend could significantly diminish the demand for standalone inspection systems if customers opt for these bundled, all-in-one solutions, potentially impacting Camtek's market share.

Cost-Effectiveness of Alternative Methods

The effectiveness of substitute technologies in the semiconductor inspection market hinges significantly on their cost-effectiveness and their capacity to match the exacting precision and reliability standards demanded by sophisticated chip manufacturing. While alternative inspection methods might emerge, their widespread adoption is often tempered by the need to achieve comparable results to established solutions.

As semiconductor devices continue their relentless march towards miniaturization and increased complexity, the requirement for highly specialized and exceptionally accurate inspection tools, such as those offered by Camtek, remains robust. This trend underscores the persistent demand for advanced metrology solutions that can reliably identify defects at increasingly microscopic scales.

- Cost-Effectiveness: The financial viability of alternative inspection methods is a primary determinant of their competitive threat.

- Precision and Reliability: Substitutes must demonstrate comparable or superior accuracy and consistency to meet the stringent demands of advanced semiconductor fabrication.

- Technological Advancement: The ongoing miniaturization and complexity of semiconductor devices necessitate specialized inspection capabilities that may be difficult for substitutes to replicate cost-effectively.

- Market Demand: The enduring need for high-precision inspection tools in leading-edge manufacturing environments supports the value proposition of established players like Camtek.

Customer Preference for Hybrid Solutions

Customers are increasingly seeking hybrid solutions that blend various inspection technologies or merge metrology data with other process information for thorough yield management. This trend, while not entirely replacing the need for Camtek's specialized offerings, points to a growing demand for integrated, data-centric approaches.

For instance, in the semiconductor industry, manufacturers are looking for systems that not only perform optical inspection but also seamlessly incorporate electrical test data and process parameters to gain a holistic view of wafer quality. This integration allows for faster root cause analysis and improved process control, making standalone inspection less appealing if it cannot be easily combined with other data streams.

- Customer demand for integrated data platforms is rising across manufacturing sectors.

- Hybrid solutions offer a more comprehensive approach to yield management compared to single-technology offerings.

- The ability to combine inspection data with process and electrical test data is becoming a key differentiator.

The threat of substitutes for Camtek's specialized inspection systems is amplified by the increasing integration of inspection capabilities into broader manufacturing equipment. Leading players in semiconductor fabrication equipment, such as Applied Materials and KLA, are embedding inspection and metrology functions directly into their core machinery. This bundling strategy presents a significant challenge, as customers may opt for these all-in-one solutions, potentially reducing the need for standalone inspection systems.

Furthermore, the rise of AI-powered visual inspection and advanced in-line process control systems offers alternative pathways to quality assurance. These technologies, often integrated into the manufacturing workflow, can identify defects earlier and more efficiently, lessening reliance on post-process inspection. The global industrial automation market, a key indicator of investment in these integrated solutions, was projected to exceed $200 billion in 2024, highlighting the industry's shift towards smarter, more automated quality checks.

While substitutes must demonstrate comparable precision and cost-effectiveness to challenge established solutions, the growing demand for integrated data platforms is undeniable. Customers are increasingly seeking hybrid solutions that combine inspection data with other process and electrical test information for comprehensive yield management. This trend emphasizes the need for specialized inspection providers to offer seamless integration capabilities to remain competitive.

| Key Substitute Threat Factors | Description | 2024 Market Context |

|---|---|---|

| Integrated Fabrication Equipment | Inspection functionalities embedded within primary manufacturing machinery. | Major equipment suppliers are increasingly offering bundled solutions. |

| AI-Powered Visual Inspection | Machine learning systems for defect detection and anomaly identification. | The AI in manufacturing market is expected to grow substantially, potentially exceeding $30 billion by 2025. |

| In-line Process Control | Quality checks integrated directly into the manufacturing workflow. | The global industrial automation market was projected to surpass $200 billion in 2024. |

| Hybrid Data Solutions | Combining inspection data with other process and electrical test data. | Growing customer demand for comprehensive, data-centric yield management platforms. |

Entrants Threaten

The semiconductor equipment industry presents a formidable barrier to new entrants due to its exceptionally high capital intensity. Establishing a new semiconductor fabrication plant, or fab, can easily cost billions of dollars, with estimates for leading-edge facilities frequently exceeding $20 billion. Furthermore, the development and production of the advanced machinery itself requires substantial investment, often in the hundreds of millions of dollars for sophisticated equipment lines. This immense financial commitment acts as a significant deterrent for potential new players seeking to enter the market.

Developing sophisticated inspection and metrology equipment, akin to Camtek's offerings, demands immense investment in research and development, coupled with highly specialized technical knowledge. Newcomers face a formidable barrier in acquiring the deep understanding of intricate semiconductor manufacturing processes essential for creating competitive products.

In 2024, the semiconductor industry continued its rapid innovation cycle, with companies like ASML investing billions in R&D for next-generation lithography. This environment necessitates that any potential entrant into Camtek's space would need to match or exceed such substantial R&D outlays and possess a comparable level of advanced technological acumen to even begin competing.

Camtek, a leader in inspection and metrology solutions, benefits from its robust intellectual property portfolio. These patents, covering advanced optical inspection and measurement technologies, act as a formidable barrier to entry. Developing comparable, non-infringing technologies requires substantial R&D investment, a hurdle many potential new entrants cannot easily overcome.

Long Customer Qualification Cycles and Established Relationships

The semiconductor equipment market presents a significant barrier to entry due to exceptionally long customer qualification cycles. New entrants must navigate rigorous testing and validation processes by major chip manufacturers, which can take years and substantial investment before any orders are placed. For instance, a new metrology tool might require extensive trials and performance verification, delaying revenue generation considerably.

Established players in the semiconductor industry benefit from deep-rooted relationships with leading foundries and integrated device manufacturers (IDMs). These long-standing partnerships are built on trust, reliability, and a proven track record of support and innovation. For example, companies like TSMC, Intel, and Samsung often have preferred supplier agreements or long-term contracts that are challenging for new companies to displace. In 2023, the top five semiconductor equipment suppliers accounted for over 60% of the market share, highlighting the dominance of incumbents.

- Extended Qualification Periods: Semiconductor equipment, particularly for critical process steps, requires extensive validation, often spanning 1-3 years, before adoption.

- Customer Loyalty and Switching Costs: High switching costs for foundries, including re-qualification of processes and potential production disruptions, foster strong customer loyalty to existing suppliers.

- Incumbent Market Dominance: In 2023, the top semiconductor equipment manufacturers like ASML, Applied Materials, and Lam Research held significant market share, making it difficult for newcomers to gain traction.

- R&D Investment Requirements: New entrants need substantial R&D investment to match the technological sophistication and performance of established players, further increasing the entry barrier.

Talent Shortages and Specialized Workforce

The semiconductor equipment manufacturing sector, like much of the advanced technology industry, grapples with a significant global talent shortage. This scarcity is particularly acute for highly specialized roles such as semiconductor process engineers, advanced materials scientists, and precision manufacturing technicians. For instance, a 2024 report indicated that the demand for semiconductor engineers alone outstripped supply by over 70% in key global hubs.

New entrants attempting to establish a foothold in this market would face immense difficulty in assembling a sufficiently skilled workforce. The lengthy and expensive process of recruiting, training, and retaining top engineering and technical talent presents a substantial barrier. This talent deficit directly translates into higher operational costs and extended ramp-up times for new companies, making it challenging to compete with established players who have existing, experienced teams.

- Talent Scarcity: A 2024 industry survey revealed that 85% of semiconductor companies reported challenges in finding qualified engineering talent.

- Recruitment Costs: The average cost to hire a specialized semiconductor engineer in 2024 exceeded $25,000, reflecting the competitive landscape.

- Training Investment: New entrants must factor in significant investment in training programs, as specialized skills often require years of development.

- Competitive Disadvantage: Without an experienced workforce, new entrants are at a disadvantage in terms of innovation speed and product quality.

The threat of new entrants for Camtek is significantly mitigated by the industry's high capital requirements and the substantial R&D investment needed to develop cutting-edge inspection and metrology solutions. Furthermore, established relationships with major chip manufacturers and lengthy customer qualification processes create formidable barriers, making it difficult for new players to gain market traction. The scarcity of specialized talent further compounds these challenges, increasing operational costs and slowing down market entry for any potential competitors.

| Barrier Type | Description | 2024 Data/Impact |

|---|---|---|

| Capital Intensity | Building semiconductor facilities and developing advanced equipment requires billions of dollars. | Leading-edge fab costs often exceed $20 billion; sophisticated equipment lines can cost hundreds of millions. |

| R&D and Technical Expertise | Requires deep understanding of semiconductor processes and significant investment in innovation. | ASML's R&D for next-gen lithography highlights the scale of investment needed; matching technological acumen is crucial. |

| Intellectual Property | Patents on advanced technologies protect incumbents and require significant R&D to replicate. | Camtek's IP portfolio is a key deterrent, demanding substantial R&D for non-infringing alternatives. |

| Customer Qualification & Loyalty | Long validation cycles (1-3 years) and high switching costs foster customer loyalty to established suppliers. | Top 5 equipment suppliers held over 60% market share in 2023, indicating incumbent dominance. |

| Talent Scarcity | Shortage of specialized engineers and technicians increases recruitment costs and training investments. | Demand for semiconductor engineers outstripped supply by over 70% in key hubs in 2024; hiring costs exceeded $25,000 per engineer. |

Porter's Five Forces Analysis Data Sources

Our Camtek Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from Camtek's official investor relations website, SEC filings, and analyst reports. We also leverage industry-specific market research and competitor announcements to provide a comprehensive view of the competitive landscape.