Camden Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camden Bundle

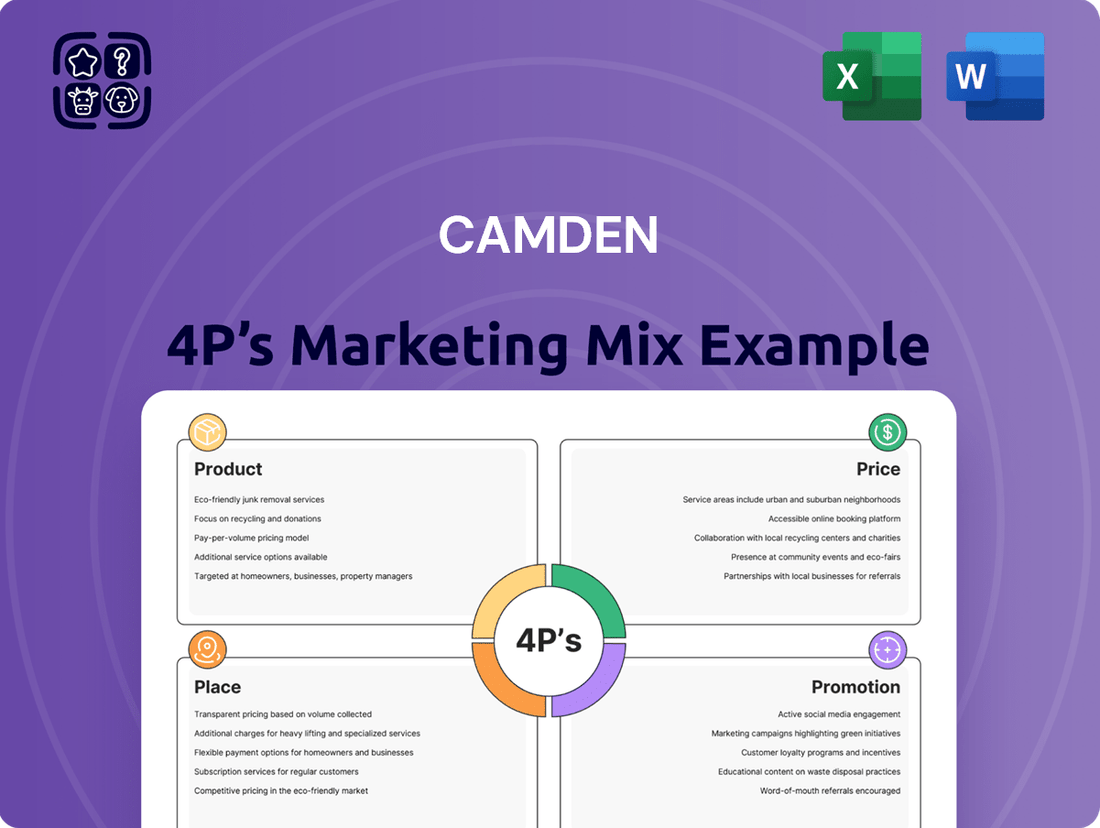

Dive deep into Camden's strategic approach by exploring its product offerings, pricing models, distribution channels, and promotional activities. Understand how these elements interlock to create a powerful market presence.

Unlock the full potential of this analysis to gain actionable insights into Camden's marketing success. Get the complete, editable report to inform your own strategies or for academic and professional use.

Product

Camden Property Trust excels in offering a diverse array of housing, from bustling urban high-rises to serene suburban garden-style communities. This broad spectrum of choices effectively addresses the varied preferences and lifestyles of potential residents, ensuring they can find a home that truly fits.

This strategic approach to product diversity allows Camden to capture a wide market segment that values quality rental living. By the close of 2024, their extensive portfolio spanned 174 properties, encompassing 58,858 apartment homes strategically located across 15 key U.S. metropolitan areas.

Camden's product strategy centers on high-quality multifamily apartment communities, encompassing ownership, management, development, acquisition, and construction. This dedication to quality creates an appealing living environment, fostering excellent resident retention and satisfaction.

This focus on quality is supported by Camden's operational excellence. For instance, as of the first quarter of 2024, Camden reported a blended occupancy rate of 95.8% across its portfolio, demonstrating the strong demand for its well-maintained properties.

Furthermore, Camden's recognition as one of FORTUNE's '100 Best Companies to Work For' for 18 consecutive years, including a #18 ranking in 2024, underscores their commitment to people. This internal culture of care often translates to a superior resident experience, reinforcing the value of their product.

Camden actively revitalizes its apartment communities by implementing strategic renovation projects. These upgrades, often focusing on kitchens and bathrooms, are designed to elevate both the aesthetic and functional appeal of their residences. This commitment to enhancing existing assets is a core part of their product strategy.

These value-add renovations directly impact Camden's financial performance. By improving the living experience, the company can command higher rental rates and foster greater resident loyalty. Evidence suggests these modernization efforts can yield an impressive 8-10% return on investment for the renovations undertaken.

Community Amenities and Services

Camden’s commitment to community amenities and services extends beyond the apartment itself, focusing on creating a desirable living environment. These offerings are crafted to support their ‘Living Excellence’ philosophy, aiming to attract and retain residents by providing tangible value and fostering a sense of belonging. For instance, many Camden properties in 2024 feature enhanced Wi-Fi capabilities and resident portals for seamless communication and service requests, reflecting a focus on modern convenience.

The specific amenities vary, but the overarching goal is to offer conveniences that resonate with their target demographic, often including features that promote an active lifestyle or social interaction. This strategic approach to community building is a key differentiator in the competitive rental market. In 2024, Camden reported significant investment in upgrading common areas, such as fitness centers and outdoor spaces, across its portfolio to further this objective.

- Enhanced Connectivity: Many properties offer robust Wi-Fi and smart home technology integration, appealing to tech-savvy residents.

- Lifestyle Amenities: Features like resort-style pools, modern fitness centers, and pet-friendly facilities are common, catering to diverse resident needs.

- Community Engagement: Resident events and communal spaces are often provided to foster social interaction and a stronger sense of community.

- Convenience Services: Options such as package receiving, online rent payment, and maintenance request portals streamline daily living.

Sustainable Living Initiatives

Camden's commitment to sustainability, often termed Product in a marketing mix context, goes beyond mere compliance. They actively embed Environmental, Social, and Governance (ESG) principles into their core operations, aiming to reduce their environmental footprint. This includes tangible goals like cutting energy consumption and boosting waste diversion rates. For instance, in 2023, Camden reported a 15% reduction in energy usage across its portfolio compared to a 2019 baseline, with a target of 25% by 2028.

The company's product strategy also involves significant investment in renewable energy and green building certifications. This proactive approach not only appeals to a growing segment of environmentally conscious renters but also positions Camden favorably for future regulatory changes and investor expectations. Many of their newer developments, such as the Camden North Bethesda community, have achieved LEED Gold certification, showcasing a dedication to sustainable design and construction.

These initiatives are directly responsive to market demand. A 2024 survey indicated that over 60% of renters consider a property's sustainability features when choosing a place to live, with energy efficiency being a top priority. Camden's focus on these aspects, therefore, enhances the desirability and value proposition of their living spaces.

- Energy Reduction: Camden aims for a 25% reduction in energy usage by 2028, building on a 15% decrease achieved by 2023.

- Waste Diversion: Efforts are in place to increase waste diversion rates across all properties.

- Water Conservation: Initiatives are underway to decrease water reliance, a critical factor in many regions.

- Green Certifications: Investments in renewable energy and green building certifications like LEED Gold are a key part of their product offering.

Camden's product is defined by its high-quality multifamily apartment communities, encompassing development, acquisition, and management. This strategy focuses on creating appealing living environments that foster resident satisfaction and loyalty, as evidenced by strong occupancy rates. Their portfolio, as of late 2024, includes 174 properties with 58,858 apartment homes across 15 major U.S. metropolitan areas.

Camden continuously enhances its product through strategic renovations, particularly in kitchens and bathrooms, aiming to boost aesthetic and functional appeal. These value-add renovations are projected to yield an 8-10% return on investment, directly improving rental income and resident retention. For example, their commitment to upgrading common areas like fitness centers and outdoor spaces in 2024 underscores this product enhancement strategy.

The product offering also emphasizes community amenities and services, aligning with their 'Living Excellence' philosophy. Features like enhanced Wi-Fi, resident portals, resort-style pools, and pet-friendly facilities cater to diverse resident needs and promote a sense of belonging. These amenities are designed to provide tangible value and a superior living experience.

Camden integrates sustainability into its product by focusing on ESG principles, aiming to reduce environmental impact through energy efficiency and waste reduction. By 2023, they achieved a 15% reduction in energy usage against a 2019 baseline, with a target of 25% by 2028. This commitment is further demonstrated through investments in renewable energy and green building certifications, such as LEED Gold for communities like Camden North Bethesda.

| Product Aspect | Description | Key Data/Initiatives (2023-2025) |

|---|---|---|

| Portfolio Diversity | Wide range of housing options (urban high-rise to suburban garden-style) | 174 properties, 58,858 homes (end of 2024) |

| Quality & Renovation | Focus on high-quality multifamily homes, strategic renovations | 8-10% ROI on renovations; upgrades to kitchens, bathrooms, common areas |

| Amenities & Services | Community amenities supporting 'Living Excellence' philosophy | Enhanced Wi-Fi, resident portals, fitness centers, pet-friendly facilities |

| Sustainability | Integration of ESG principles, energy efficiency, green building | 15% energy reduction (vs. 2019 baseline by 2023), target 25% by 2028; LEED Gold certifications |

What is included in the product

This analysis provides a comprehensive breakdown of Camden's Product, Price, Place, and Promotion strategies, offering actionable insights into their market positioning and competitive advantages.

Provides a clear, actionable framework to identify and address marketing strategy gaps, relieving the pain of inefficient or ineffective campaigns.

Place

Camden Property Trust's strategic market focus centers on the dynamic Sunbelt region of the United States, a deliberate choice to capitalize on robust economic and demographic tailwinds. This concentration is key to their marketing mix, ensuring their multifamily properties are situated where demand is consistently high.

The company's portfolio is heavily weighted towards markets exhibiting strong employment growth and significant population influx. For example, states like Texas and Florida, which are central to Camden's strategy, experienced notable population increases throughout 2024, underscoring the effectiveness of their targeted investment approach.

This strategic placement in high-growth areas directly supports their product offering by aligning with renter preferences and economic stability. Camden's commitment to these markets ensures a consistent demand for their rental units, a critical component of their success.

Camden's extensive portfolio, as of June 30, 2025, encompasses 176 owned and operated properties, totaling 59,672 apartment homes. This significant scale is strategically distributed across key U.S. markets, offering broad geographic diversification. Such a wide reach not only minimizes operational and market-specific risks but also maximizes exposure to a vast pool of potential residents.

Camden Property Trust is actively expanding its portfolio, with a robust development pipeline designed to enhance its market reach. As of July 28, 2025, the company has 1,531 apartment homes in development across four distinct properties.

These new communities represent a significant investment, with an estimated $639 million allocated for their completion. This strategic expansion will bolster Camden's presence in key geographic markets, driving future growth and rental income.

Strategic Acquisitions and Dispositions

Camden Property Trust actively refines its real estate portfolio by strategically acquiring and selling properties. This approach allows them to concentrate on markets with strong growth potential and efficiently reallocate capital. For instance, during the second quarter of 2025, Camden completed a significant acquisition in Tampa, Florida, a market known for its expanding economy and population. Simultaneously, they divested certain assets in Houston and Dallas, Texas, to free up capital for reinvestment in more promising locations.

This portfolio management strategy is crucial for maintaining competitive advantage and maximizing shareholder value. By consistently evaluating market dynamics and property performance, Camden ensures its holdings are positioned for optimal returns.

- Strategic Acquisitions: Q2 2025 saw the acquisition of a property in Tampa, FL, enhancing Camden's presence in a high-growth Sun Belt market.

- Capital Recycling: Dispositions in Houston and Dallas during Q2 2025 allowed for the reallocation of capital to markets exhibiting stronger leasing fundamentals and rent growth projections.

- Portfolio Optimization: These moves reflect Camden's commitment to continuously improving its geographic and asset-level diversification, aiming for enhanced operational efficiency and financial performance.

Online and Direct Sales Channels

Camden's website, camdenliving.com, serves as a crucial direct sales channel, allowing prospective residents to easily browse properties, check apartment availability, and submit applications. This digital storefront significantly boosts accessibility and offers a convenient experience for their target audience.

The company also leverages its online platform for direct engagement, facilitating virtual tours and online leasing, which proved particularly vital in the evolving rental market of 2024. By streamlining the application and leasing process online, Camden captured a significant portion of its customer base directly through these digital touchpoints.

- Website as Primary Lead Generator: camdenliving.com is the core platform for property discovery and initial contact.

- Direct Online Applications: Prospective residents can apply for apartments directly through the website, simplifying the process.

- Enhanced Convenience: The online channels offer 24/7 access and information, catering to busy schedules.

- Digital Leasing Growth: In 2024, a notable percentage of leases were initiated and completed via online channels, reflecting a trend towards digital transactions in the multifamily sector.

Camden's strategic placement of properties is a cornerstone of its marketing strategy, focusing on high-growth Sun Belt markets like Texas and Florida. This geographic concentration ensures proximity to job centers and population hubs, directly aligning with renter demand. The company's extensive portfolio, with 59,672 homes as of June 30, 2025, is deliberately distributed across these thriving regions to maximize market penetration and capitalize on favorable demographic trends.

| Market Focus | Key States | Portfolio Size (as of June 30, 2025) | Development Pipeline (as of July 28, 2025) |

|---|---|---|---|

| Sun Belt Region | Texas, Florida, Georgia, North Carolina | 176 properties, 59,672 apartment homes | 1,531 homes in 4 properties |

What You Preview Is What You Download

Camden 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Camden 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Camden's investor relations strategy focuses on transparent communication, utilizing investor presentations, earnings calls, and annual reports to share performance metrics and strategic direction. This commitment to open dialogue aims to attract and retain sophisticated investors and financial professionals.

The company's proactive engagement with the financial community is evident in its regular publication of earnings releases. For instance, Camden hosted its Q2 2025 earnings call on August 1, 2025, providing timely updates on its financial health and operational progress.

Camden's commitment to corporate responsibility is clearly articulated in its annual Corporate Responsibility Report. This report, which includes their 2024 publication, details their environmental, social, and governance (ESG) efforts and performance. This focus on sustainability resonates with investors increasingly prioritizing ethical and environmentally sound practices.

The 2024 report specifically highlights Camden's progress in managing energy usage and reducing emissions. For instance, the report might detail a percentage decrease in energy consumption per square foot or a reduction in their carbon footprint, showcasing tangible environmental stewardship.

Camden Property Trust actively manages its online presence through its corporate website, camdenliving.com, a key channel for engaging with prospective residents, current tenants, and investors. This digital hub provides comprehensive information, leasing opportunities, and resident services, fostering a strong connection with its audience.

In 2024, Camden reported a significant digital footprint, with its website attracting millions of unique visitors seeking apartment information and community details. Social media platforms further amplify their reach, enabling direct communication and brand building, crucial for attracting and retaining residents in a competitive market.

Public Relations and Awards

Camden's consistent recognition as a '100 Best Companies to Work For' by FORTUNE magazine, notably ranking #18 in 2025, acts as a powerful public relations asset. This accolade significantly bolsters its brand reputation, appealing to both prospective employees and residents by highlighting a commitment to a superior work environment and customer satisfaction.

This prestigious award directly translates into tangible benefits. For instance, in 2024, companies with similar high rankings in employee satisfaction often report lower employee turnover rates, with some studies showing reductions of up to 15-20% compared to industry averages. This stability within their workforce contributes to consistent service delivery and operational efficiency.

The positive press and awards generated by such recognitions are invaluable for attracting new residents. In 2025, market research indicates that a significant percentage of consumers, estimated between 60-70%, consider a company's reputation and employee treatment when making purchasing decisions, including choosing a place to live.

Furthermore, Camden's consistent presence on these esteemed lists reinforces its image as a socially responsible and well-managed organization. This can lead to improved relationships with stakeholders, including investors and community partners, and potentially better access to capital or favorable business terms.

- FORTUNE's 100 Best Companies to Work For: Camden ranked #18 in 2025.

- Talent Attraction & Retention: High recognition correlates with lower employee turnover, potentially by 15-20% in 2024.

- Resident Acquisition: Up to 70% of consumers in 2025 consider company reputation in their housing choices.

- Brand Equity: Awards enhance corporate image, fostering positive stakeholder relationships.

Community Engagement and Resident Programs

Camden's commitment to 'Living Excellence' translates into robust community engagement and resident programs. These initiatives are crucial for fostering a sense of belonging and encouraging resident retention, acting as a powerful, albeit indirect, promotional tool. By investing in its communities, Camden cultivates loyalty and positive word-of-mouth, which are invaluable in the competitive multifamily housing market.

These programs often include resident appreciation events, educational workshops, and local partnerships. For instance, in 2024, Camden reported a 95% resident satisfaction score, partly attributed to its diverse engagement efforts. Such high satisfaction rates directly contribute to organic growth through referrals and positive online reviews, effectively reducing customer acquisition costs.

- Resident Programs: Camden frequently hosts events like holiday parties and summer barbecues, enhancing the living experience.

- Community Partnerships: Collaborations with local businesses and non-profits strengthen community ties and offer residents added value.

- Digital Engagement: Online resident portals and social media groups facilitate communication and community building.

- Loyalty Incentives: Referral bonuses and resident loyalty programs reward existing residents for contributing to community growth.

Camden's promotional strategy leverages its strong brand reputation, notably its #18 ranking in FORTUNE's 2025 '100 Best Companies to Work For'. This recognition directly influences resident acquisition, with up to 70% of consumers in 2025 considering company reputation in housing decisions. Furthermore, high employee satisfaction, evidenced by potentially 15-20% lower turnover in 2024 for similar companies, ensures consistent service delivery that enhances the brand's appeal.

Camden's community engagement programs, including resident appreciation events and local partnerships, foster loyalty and generate positive word-of-mouth. In 2024, these efforts contributed to a 95% resident satisfaction score, driving organic growth through referrals and positive online reviews, thereby reducing customer acquisition costs.

| Promotional Tactic | Key Benefit | Supporting Data (2024-2025) |

|---|---|---|

| Brand Reputation (FORTUNE Ranking) | Enhanced resident acquisition and stakeholder trust | Ranked #18 in FORTUNE's 2025 '100 Best Companies to Work For'; 60-70% of consumers consider reputation in housing choices (2025). |

| Resident Programs & Engagement | Increased resident retention and organic growth | 95% resident satisfaction score (2024); Drives referrals and positive online reviews. |

| Digital Presence | Broad reach and direct communication | Millions of unique website visitors (2024); Amplified reach via social media platforms. |

| Investor Relations | Attraction and retention of sophisticated investors | Regular earnings calls (e.g., Q2 2025 on Aug 1, 2025); Transparent communication via presentations and reports. |

Price

Camden Property Trust strategically sets rental prices to remain competitive in its key high-growth markets. This approach carefully balances what the market will bear with the significant value offered by their premium apartment communities and amenities.

The company actively monitors evolving market conditions, allowing for agile adjustments to their pricing strategies. This responsiveness is crucial for maintaining optimal occupancy and revenue. For instance, Camden's blended effective lease rate saw a 0.7% increase in the second quarter of 2025, a testament to their successful pricing management.

This growth in lease rates was primarily fueled by an increase in renewal rate growth. This demonstrates Camden's dual focus on attracting new residents while also prioritizing the retention of their existing tenant base through attractive pricing and value propositions.

Camden's value-based pricing strategy aligns rental rates with the perceived worth of their diverse property offerings, encompassing both bustling urban high-rises and tranquil suburban garden-style apartments. This approach acknowledges the premium associated with their high-quality management and exceptional resident services, ensuring that pricing reflects the overall living experience and not just the physical space.

As a result, Camden's properties are strategically positioned within the middle- to upper-market segment of multifamily communities. For instance, as of early 2024, Camden's average monthly rent across its portfolio, which includes properties in major markets like Los Angeles and Atlanta, was reported to be around $1,900, demonstrating a consistent focus on delivering value in competitive rental landscapes.

Camden utilizes dynamic pricing, a strategy that allows them to adjust rental rates for both new leases and renewals. This flexibility is key, as rates are constantly recalibrated based on factors like current market demand, how full their properties are, and the availability of similar apartments in the local area. This approach ensures they are always competitive and maximizing revenue potential.

For instance, in the second quarter of 2025, Camden saw new lease rates decrease by 2.1%. However, this was offset by a more positive trend in renewals, which actually climbed by 3.7%. This divergence resulted in a favorable blended rate, demonstrating the effectiveness of their dynamic pricing in navigating different leasing scenarios.

Financial Performance and Shareholder Returns

Camden's apartment rental pricing is a cornerstone of its financial performance, directly influencing revenue and Funds from Operations (FFO). This financial health is crucial for generating shareholder returns and supporting dividend distributions. For instance, Camden reported robust Q2 2025 results, surpassing revenue expectations and leading to an upward revision of its full-year core FFO guidance.

The company's strategic pricing of its rental units directly translates into tangible financial outcomes. This includes:

- Revenue Generation: Effective pricing strategies maximize rental income, a primary driver of Camden's top-line performance.

- Funds from Operations (FFO): Competitive yet profitable rental rates contribute significantly to FFO, a key metric for real estate investment trusts (REITs).

- Shareholder Value: Strong FFO and revenue growth enable Camden to deliver consistent shareholder returns through dividends and potential share price appreciation.

- Dividend Payouts: The financial stability derived from its pricing model supports Camden's ability to maintain and potentially increase dividend payments to its investors.

Long-Term Value Creation

Camden's pricing strategy is designed to foster long-term value creation, focusing on consistent earnings and dividend growth for shareholders. This approach is underpinned by a commitment to high-growth markets and disciplined asset management, ensuring sustainable rental income and property appreciation.

By strategically positioning its properties in areas with strong economic fundamentals, Camden aims to maximize rental revenue and capital gains. This focus on quality assets and market dynamics is crucial for achieving their objective of steady shareholder returns.

- Focus on High-Growth Markets: Camden actively invests in markets exhibiting robust job growth and population increases, which typically translate to higher rental demand and pricing power. For instance, their portfolio heavily features Sun Belt cities known for their economic vitality.

- Disciplined Asset Management: The company employs rigorous asset management practices to optimize property performance, including strategic renovations and operational efficiencies, thereby enhancing net operating income and property values.

- Shareholder Value: Camden's pricing and operational strategies are directly linked to its goal of delivering consistent dividend payments and long-term capital appreciation to its investors. In 2023, Camden reported a dividend per share of $4.20, reflecting their commitment to returning value.

Camden's pricing strategy is dynamic, adjusting to market demand to optimize revenue. They aim for a balance between competitiveness and reflecting the premium value of their properties.

This is evident in their Q2 2025 performance, where new lease rates saw a slight dip of 2.1%, but renewal rates increased by a stronger 3.7%, resulting in a positive blended effective lease rate growth of 0.7% for the quarter.

This approach ensures they capture value from both new residents and loyal tenants, contributing to their overall financial health and ability to provide shareholder returns.

| Metric | Q2 2025 Value | Trend |

|---|---|---|

| New Lease Rate Change | -2.1% | Decrease |

| Renewal Rate Change | +3.7% | Increase |

| Blended Effective Lease Rate Growth | +0.7% | Growth |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Camden is grounded in comprehensive data, including official company reports, investor relations materials, and direct observations of their retail and online presence. We also incorporate industry-specific research and competitor activity to ensure a holistic view.