Camden Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camden Bundle

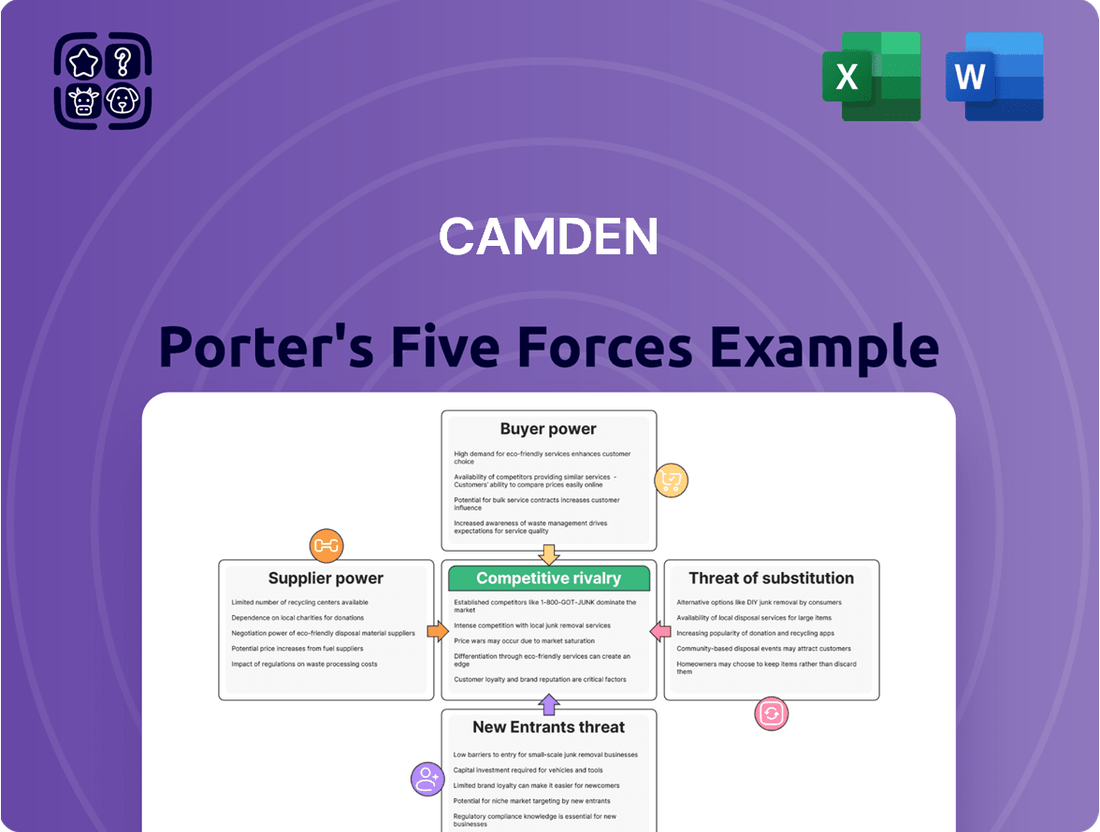

Camden's competitive landscape is shaped by five key forces, revealing the underlying pressures and opportunities within its market. Understanding these dynamics is crucial for strategic planning and identifying areas of strength and vulnerability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Camden’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Camden Property Trust is notably shaped by the availability and specialization of construction materials and skilled labor. When unique building technologies or highly sought-after construction expertise are in limited supply, these suppliers gain leverage to increase prices. This directly impacts Camden's development and ongoing maintenance expenditures for its extensive portfolio of apartment communities.

The availability of suitable land parcels in desirable major markets gives landowners significant bargaining power. In 2024, for instance, the median price for commercial land in prime U.S. metropolitan areas saw an increase, reflecting this scarcity and driving up acquisition costs for developers like Camden.

Landowners in these sought-after urban and suburban locations hold considerable leverage because their assets are both finite and strategically crucial for development. This limited supply, coupled with high demand from various industries, allows them to command premium prices.

Key service providers like general contractors, architects, and specialized consultants hold significant bargaining power. Their reputation, unique expertise, and the overall demand for their skills directly influence project terms and costs for companies like Camden. For instance, in 2024, the construction industry faced a shortage of skilled labor, driving up wages and increasing the leverage of experienced contractors.

Supplier Power 4

Utility providers and infrastructure companies, even when regulated, wield considerable power. Their essential services like electricity, water, and internet are non-negotiable for operating apartment communities, creating a significant cost center for companies like Camden Property Trust. For instance, in 2024, average residential electricity prices in the US hovered around $0.17 per kilowatt-hour, a figure that can significantly impact operating expenses.

Camden Property Trust, like most apartment operators, faces limited substitutes for these fundamental utilities. This lack of alternatives means these costs are largely fixed and difficult to negotiate down, directly influencing the company's bottom line and potentially constraining profitability. The inability to switch providers easily solidifies the suppliers' strong bargaining position.

- Essential Services: Electricity, water, and internet are critical for all apartment operations, giving providers leverage.

- Limited Alternatives: Few substitute options exist for core utility services, reducing Camden's ability to negotiate.

- Fixed Cost Impact: These essential services represent a significant fixed cost that impacts overall profitability.

- Regulatory Influence: While regulated, utility providers still maintain substantial power due to the indispensable nature of their offerings.

Supplier Power 5

Financial institutions, acting as suppliers of capital, wield significant power over Camden. Their terms for debt and equity financing, including interest rates and lending conditions, directly influence Camden's capacity for acquisitions, development projects, and refinancing existing properties. For instance, in the first quarter of 2024, the average interest rate for commercial real estate loans saw an uptick, potentially increasing Camden's cost of capital.

When credit markets tighten or interest rates climb, the bargaining power of these capital suppliers intensifies. This can lead to less favorable loan covenants or higher borrowing costs for Camden, impacting its overall financial flexibility and strategic growth initiatives.

- Supplier Power: Capital Providers

- Impact on Camden: Affects cost of capital, acquisition funding, and refinancing options.

- Key Factor: Credit market conditions and prevailing interest rates.

- 2024 Data Point: Rising interest rates in early 2024 increased borrowing costs for many real estate firms.

The bargaining power of suppliers is a critical factor for Camden Property Trust, influencing its development and operational costs. Key suppliers include those providing construction materials, skilled labor, land, essential utilities, and capital. When these inputs are specialized, scarce, or in high demand, suppliers can command higher prices and dictate terms, impacting Camden's profitability and growth strategies.

In 2024, the real estate sector continued to grapple with supply chain disruptions and labor shortages, particularly in skilled trades. This environment amplified the bargaining power of construction material providers and specialized contractors. For example, the cost of lumber and concrete saw fluctuations, directly affecting development budgets. Similarly, the demand for experienced project managers and specialized construction workers remained high, allowing these professionals to negotiate more favorable rates.

| Supplier Type | Impact on Camden | 2024 Trend/Data |

|---|---|---|

| Construction Materials | Increased development costs | Price volatility for key materials like lumber and concrete |

| Skilled Labor | Higher labor expenses, project delays | Shortage of skilled trades leading to wage increases |

| Land | Elevated acquisition costs in prime markets | Continued high land prices in desirable urban and suburban areas |

| Utilities (Electricity, Water) | Increased operating expenses | Average residential electricity prices around $0.17/kWh |

| Capital (Financing) | Higher cost of capital, reduced financial flexibility | Rising interest rates on commercial real estate loans in early 2024 |

What is included in the product

This analysis dissects the competitive landscape for Camden by examining the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products.

Instantly identify and prioritize competitive threats with a visual representation of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

The bargaining power of Camden's customers, primarily renters, hinges on the local multifamily housing market's supply and demand. When there's an abundance of apartments or weak demand, tenants gain leverage, often leading to negotiations for reduced rents or added perks. This can directly impact Camden's revenue streams.

Tenant mobility and the associated switching costs significantly influence customer power within the apartment rental market. While relocating incurs expenses and effort, the availability of numerous comparable apartment options in a given market allows tenants to switch to a competitor more readily. This ease of switching empowers tenants to negotiate for better pricing and higher service standards from property managers like Camden.

In 2024, the rental market in many urban areas saw increased vacancy rates, giving tenants more leverage. For instance, in some major metropolitan areas, average apartment vacancy rates approached 6-7%, a notable increase from previous years, providing renters with a wider selection and thus amplifying their bargaining power against landlords.

Customer bargaining power significantly impacts landlords like Camden. Economic conditions, such as the unemployment rate and wage growth, directly influence a tenant's ability to afford rent and their willingness to pay. For instance, if unemployment rises, tenants have less disposable income and are more likely to seek cheaper alternatives, thereby strengthening their negotiating position.

In 2024, the U.S. unemployment rate remained low, hovering around 3.9% for much of the year, which generally supports rental demand. However, persistent inflation, with the Consumer Price Index (CPI) showing an annual increase of 3.1% as of January 2024, continues to erode purchasing power. This can lead tenants to become more price-sensitive and exert greater pressure on rental prices.

When tenants face economic hardship, they may delay moving or negotiate for lower rents, especially in markets with abundant vacant units. This collective action by renters can force landlords to be more flexible on lease terms and pricing to maintain occupancy rates, directly affecting Camden's revenue and profitability.

Customer Power 4

The bargaining power of customers for Camden Porter is significantly influenced by the availability and appeal of alternative housing solutions. If potential renters can easily find attractive single-family homes for rent or purchase a property outright, their leverage increases. For instance, in mid-2024, a surge in housing inventory in many markets, coupled with relatively stable mortgage rates compared to earlier in the year, could encourage some individuals to shift from renting to owning, thereby diminishing the renter pool and empowering those who remain.

When mortgage rates remain accessible and home prices are perceived as reasonable, the option of homeownership becomes a more potent substitute for renting. This dynamic directly impacts Camden Porter by potentially reducing demand for rental units. For example, if the average 30-year fixed mortgage rate hovers around 6.5% in a given region and starter home prices are within reach for a significant portion of the population, more individuals might choose to buy rather than rent, impacting Camden's tenant acquisition efforts.

- Substitute Options: The attractiveness of single-family rentals and homeownership directly competes with Camden Porter's offerings.

- Homeownership Affordability: Lower mortgage rates and accessible home prices empower potential renters to consider purchasing a home instead.

- Impact on Tenant Pool: A shift towards homeownership reduces the number of prospective tenants available to Camden Porter, increasing renter leverage.

- Market Conditions: Mid-2024 housing market trends, including inventory levels and mortgage rates, play a crucial role in determining customer bargaining power.

Customer Power 5

Customer power is significantly amplified by the widespread availability of information, particularly through online platforms. In 2024, the rental market has seen a surge in transparency, with sites like Zillow, Apartments.com, and even local social media groups providing detailed property listings, virtual tours, and crucially, tenant reviews. This accessibility allows potential renters to easily compare rental rates, property amenities, and landlord responsiveness across multiple locations. For instance, a renter can quickly ascertain the average rent for a two-bedroom apartment in a specific Camden neighborhood and cross-reference this with reviews of property management companies. This knowledge empowers them to negotiate more effectively or seek out properties offering better value, thereby increasing pressure on landlords to maintain competitive pricing and service standards.

The ease of information access directly translates into a stronger bargaining position for customers. In 2024, a renter can readily access data on vacancy rates and average lease terms in Camden, understanding the landlord's potential need to fill units quickly. This insight allows them to leverage their options, perhaps by offering to sign a longer lease in exchange for a reduced monthly rent or upgraded amenities. The collective voice of renters, amplified through online reviews and forums, also shapes perceptions and can influence demand for specific properties or landlords. A consistent pattern of negative reviews, for example, can deter potential tenants, forcing landlords to address issues or risk prolonged vacancies.

- Increased Information Transparency: Online platforms provide renters with access to market rates, property features, and landlord reputations, enabling informed comparisons.

- Enhanced Negotiation Power: Raters can leverage knowledge of market conditions and reviews to negotiate rental prices and terms.

- Impact of Online Reviews: Tenant feedback on platforms influences property desirability and landlord accountability.

- Data-Driven Decisions: In 2024, renters utilize readily available data to make strategic choices, increasing their bargaining leverage.

The bargaining power of Camden's customers, primarily renters, is shaped by market dynamics and their ability to switch. When supply outstrips demand, or when switching costs are low, tenants gain leverage, potentially leading to rent negotiations and impacting Camden's revenue.

Tenant mobility and the cost associated with moving significantly influence customer power. Despite relocation expenses, the availability of numerous comparable apartments empowers tenants to negotiate for better pricing and service, directly affecting landlords like Camden.

In 2024, increased vacancy rates in many urban rental markets, sometimes reaching 6-7%, amplified renter bargaining power by offering a wider selection. This market condition allows tenants to more readily compare options and negotiate terms.

Economic factors like unemployment and wage growth directly affect a tenant's ability and willingness to pay rent. In 2024, while unemployment remained low at around 3.9%, inflation at 3.1% (CPI, Jan 2024) eroded purchasing power, making renters more price-sensitive and increasing their negotiating leverage.

The availability of attractive substitute housing, such as single-family rentals or homeownership, also strengthens customer bargaining power. In mid-2024, a rise in housing inventory and stable mortgage rates made purchasing a home a more viable alternative for some, potentially reducing the renter pool and empowering remaining tenants.

Information transparency, amplified by online platforms in 2024, empowers renters to compare rates, amenities, and landlord reputations. This knowledge allows them to negotiate more effectively for better value, increasing pressure on landlords to maintain competitive pricing and service standards.

| Factor | 2024 Impact on Customer Bargaining Power | Example |

|---|---|---|

| Vacancy Rates | Increased | Urban vacancy rates approaching 6-7% in some areas. |

| Inflation | Increased Price Sensitivity | CPI at 3.1% (Jan 2024) erodes purchasing power. |

| Substitute Housing (Homeownership) | Increased Attractiveness | Stable mortgage rates (around 6.5% for 30-yr fixed) and rising inventory. |

| Information Access | Enhanced Negotiation Leverage | Online platforms provide easy comparison of rents and reviews. |

Preview Before You Purchase

Camden Porter's Five Forces Analysis

This preview showcases the complete Camden Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. You are viewing the exact document that will be delivered to you instantly upon purchase, ensuring no discrepancies or missing information. This professionally formatted analysis is ready for immediate use, providing valuable strategic insights without any placeholders or sample content.

Rivalry Among Competitors

The multifamily real estate investment trust (REIT) sector in the United States is a crowded arena. Camden Property Trust faces robust competition from a multitude of large, publicly traded REITs, aggressive private equity firms, and agile individual developers all seeking to capture market share. This dynamic landscape means Camden is constantly contending with well-funded players who also own, manage, and develop similar premium apartment communities in key U.S. metropolitan areas.

Competitive rivalry in the real estate sector is fierce, particularly when it comes to securing prime land and existing properties in sought-after areas. This intense competition to acquire the best development sites or income-generating assets often inflates acquisition costs. For instance, in 2024, major metropolitan areas saw significant bidding wars for developable land, pushing prices up by an average of 15-20% compared to the previous year, directly impacting potential returns for investors.

Competitive rivalry in the multifamily sector, particularly for companies like Camden Property Trust, is intense due to the inherent difficulty in differentiating properties. Many apartment complexes offer very similar amenities and unit designs, especially within comparable market segments.

While Camden aims for high-quality living experiences, competitors frequently adopt successful features, diminishing unique selling propositions. This constant imitation necessitates ongoing investment in property enhancements and superior customer service to sustain pricing power and market share.

For instance, in 2024, the multifamily vacancy rate in the U.S. hovered around 5.5%, indicating ample supply and a need for operators to actively compete for tenants through various means, including pricing and amenity packages.

Competitive Rivalry 4

Competitive rivalry within the real estate sector, particularly for entities like Camden, is significantly shaped by market growth dynamics. In regions experiencing slower growth or oversupply, such as certain secondary markets in the US during 2024, competition intensifies. This often leads to aggressive pricing, with rental concessions becoming more prevalent to secure and retain tenants. For example, reports from late 2023 and early 2024 indicated a rise in concessions in some Sun Belt markets, directly impacting revenue per available unit (RevPAR) for many apartment operators.

This heightened competition can manifest in several ways:

- Aggressive Pricing: Competitors may lower rental rates or offer significant move-in specials, directly challenging Camden's pricing strategies and potentially impacting occupancy rates.

- Increased Marketing Spend: To stand out in slower markets, companies like Camden might need to allocate more resources to marketing and advertising, increasing operational costs.

- Tenant Retention Focus: With more options available, tenants are more likely to switch providers, forcing companies to invest more in resident services and amenities to maintain loyalty.

- Erosion of Profit Margins: The cumulative effect of these strategies can lead to compressed profit margins across the industry, as the cost of acquiring and retaining tenants rises while rental income growth slows.

Competitive Rivalry 5

Camden Property Trust operates across various U.S. markets, each presenting a unique competitive intensity. This means their rivalry isn't uniform; some areas are packed with numerous smaller apartment operators, while others are dominated by a few major Real Estate Investment Trusts (REITs). For instance, in 2024, the multifamily sector saw varied occupancy rates across different regions, directly influenced by the local competitive pressures Camden navigates.

The specific nature of competition in each market demands tailored strategies from Camden. Intense local rivalry can directly affect their ability to maintain high occupancy levels and achieve desired rental rate increases. This dynamic is crucial because, as of early 2024, national average multifamily occupancy rates hovered around 94%, but regional variations, driven by local competition, could be substantial, impacting Camden's revenue streams.

- Diverse Market Competition: Camden faces fragmented markets with many small operators and concentrated markets with a few large REITs.

- Adaptive Strategy Needs: Local competitive dynamics require Camden to adjust its approach in each distinct market.

- Impact on Performance: Localized rivalry directly influences occupancy rates and the potential for rental growth.

- 2024 Market Context: National multifamily occupancy was around 94% in early 2024, with significant regional differences due to competition.

Competitive rivalry is a significant force for Camden Property Trust, characterized by a crowded marketplace with numerous large REITs, private equity firms, and individual developers vying for market share. This intense competition often drives up acquisition costs for prime real estate, as seen in 2024 with bidding wars for land in major metropolitan areas leading to an estimated 15-20% price increase. The similarity in amenities and unit designs across many apartment complexes further fuels this rivalry, necessitating continuous investment in property enhancements and customer service to maintain a competitive edge and pricing power.

The intensity of competition varies by market, impacting Camden's ability to maintain occupancy and rental growth. For instance, in 2024, while national multifamily occupancy was around 94%, regional variations, influenced by local competitive pressures, were substantial. In slower-growth or oversupplied markets during 2024, rental concessions became more common, directly affecting revenue per available unit. This dynamic forces companies to adapt strategies, potentially increasing marketing spend and focusing on tenant retention, which can compress profit margins.

| Metric | 2024 Data Point | Implication for Competition |

|---|---|---|

| Land Acquisition Cost Increase (Major Metros) | 15-20% | Inflates development costs, favoring well-capitalized competitors. |

| National Multifamily Occupancy Rate (Early 2024) | ~94% | Indicates ample supply, intensifying competition for tenants. |

| Rental Concessions (Certain Sun Belt Markets) | Increased prevalence | Directly impacts revenue, forcing competitive pricing strategies. |

SSubstitutes Threaten

The primary substitute for renting an apartment from Camden Property Trust is homeownership, like buying a single-family house or a condo. The appeal of buying a home versus renting is heavily influenced by things like mortgage interest rates, the cost of houses, and how easy it is to get a loan. When owning a home becomes cheaper or easier to do, the threat from these substitutes goes up.

In 2024, the average 30-year fixed mortgage rate hovered around 6.5% to 7.5%, a significant factor affecting affordability. For instance, a 1% increase in mortgage rates can add hundreds of dollars to a monthly payment, making renting a more attractive option for many. Conversely, if rates were to drop substantially, or if home prices cooled significantly in key Camden markets, the substitution threat would intensify.

Single-family rental homes are emerging as a significant substitute for apartment living, offering tenants greater space, enhanced privacy, and often the coveted yard, particularly appealing to families or those desiring a suburban lifestyle. This trend directly impacts apartment operators like Camden.

The increasing presence of institutional investors in the single-family rental sector, managing portfolios of homes for rent, presents a professionally organized alternative to traditional apartment complexes. For instance, in 2024, the single-family rental market continued its expansion, with institutional investors acquiring a notable share of available homes, directly competing for tenants who might otherwise consider apartment options.

Alternative rental housing models, including co-living spaces and extended-stay hotels, present a threat of substitutes for traditional apartment rentals. These options can attract specific demographics or cater to short-term needs, diverting potential tenants. For instance, the short-term rental market, particularly in urban centers, directly competes for transient residents and even longer-term stays, impacting demand for conventional leases.

4

While manufactured housing or mobile homes cater to a different market, their affordability in certain regions can present a substitute threat. For instance, in 2024, the average cost of a new manufactured home was around $120,000, significantly lower than traditional site-built homes in many areas. This price difference makes them a viable alternative for budget-conscious consumers seeking shelter, thereby impacting demand for more conventional housing options.

This availability broadens the housing choices, especially for individuals prioritizing cost over traditional construction. The lower entry price point for manufactured homes can divert potential buyers who might otherwise consider entry-level single-family homes or apartments. This segment of the market, though distinct, represents a tangible alternative, particularly in areas with high housing costs.

Key considerations regarding this substitute threat include:

- Cost Advantage: Manufactured homes offer a substantially lower upfront cost compared to traditional housing.

- Regional Impact: The threat is more pronounced in regions with a higher cost of living where the price disparity is more significant.

- Consumer Segment: Budget-conscious individuals and families are the primary demographic susceptible to this substitution.

- Market Diversification: The existence of these alternatives diversifies the overall housing market, offering varied solutions.

5

Changes in lifestyle preferences significantly impact the threat of substitutes for Camden's apartment offerings. For example, a societal shift towards multi-generational living or a desire for more rural settings could diminish the demand for traditional urban and suburban apartments. This would, in turn, elevate the attractiveness of alternative housing solutions that cater to these evolving needs, potentially impacting Camden's market share.

Consider the rise of co-living spaces, which offer a different model for urban dwellers seeking community and affordability. In 2024, the co-living market continued its expansion, with reports indicating a steady increase in occupancy rates in major metropolitan areas. This trend presents a direct substitute for traditional apartment rentals, especially for younger demographics prioritizing social interaction and flexible lease terms over individual space.

Furthermore, the increasing popularity of accessory dwelling units (ADUs) or "granny flats" in suburban areas offers another substitute. Homeowners are increasingly converting garages or building small, independent units on their properties. This trend, fueled by a desire for rental income or housing for family members, provides an alternative to renting an apartment, particularly for those seeking more autonomy or a connection to a single-family home environment.

- Shifting Demographics: A growing preference for remote work and decentralized living could reduce the appeal of high-density urban apartment complexes.

- Alternative Housing Models: The rise of co-living, shared housing, and ADUs presents direct competition to traditional apartment rentals.

- Economic Factors: Rising interest rates and housing prices in 2024 made homeownership more challenging, potentially pushing some individuals towards renting, but also increasing the attractiveness of alternative affordable housing solutions.

- Technological Advancements: Innovations in modular construction and smart home technology could make alternative housing options more appealing and cost-effective.

The threat of substitutes for Camden Property Trust's apartment rentals is multifaceted, encompassing homeownership, single-family rentals, and alternative housing models. Factors like mortgage rates and housing prices significantly influence the appeal of buying a home versus renting. For example, in 2024, 30-year fixed mortgage rates averaged between 6.5% and 7.5%, making renting a more accessible option for many compared to the increased monthly costs associated with homeownership.

Single-family rental homes, often featuring more space and privacy, are increasingly competing for tenants, particularly families. This segment saw continued expansion in 2024 with institutional investors acquiring portfolios, directly challenging apartment complexes. Additionally, co-living spaces and extended-stay hotels cater to specific demographics and short-term needs, diverting potential renters. Even manufactured housing, with average costs around $120,000 in 2024, offers a more affordable alternative in high-cost regions.

| Substitute Type | Key Attractors | 2024 Context/Data |

|---|---|---|

| Homeownership | Affordability, equity building | 30-year fixed mortgage rates ~6.5%-7.5% |

| Single-Family Rentals | Space, privacy, yard | Continued institutional investment growth |

| Co-living Spaces | Community, affordability, flexibility | Steady increase in occupancy in major metros |

| Manufactured Housing | Lower upfront cost | Average new home cost ~$120,000 |

Entrants Threaten

The threat of new entrants in the multifamily ownership and development sector, impacting companies like Camden Property Trust, is significantly tempered by the substantial capital required. Aspiring developers must secure considerable funding for land acquisition, construction financing, and the ongoing management of large property portfolios, presenting a formidable financial hurdle for newcomers.

Regulatory hurdles and zoning complexities are significant deterrents for new businesses. For instance, in 2024, the average time to obtain a building permit in major US cities could range from several months to over a year, often involving multiple agency approvals and inspections.

Navigating diverse local zoning laws, securing permits, and adhering to environmental and building codes across different jurisdictions is both time-consuming and expensive. This process can easily add tens of thousands of dollars in compliance costs before a single brick is laid.

Newcomers must allocate substantial resources to legal and planning expertise to successfully penetrate the market. This financial and temporal investment acts as a powerful barrier, effectively slowing down market entry for potential competitors.

The threat of new entrants in the real estate investment trust (REIT) sector, particularly for companies like Camden Property Trust (CPT), is generally moderate. Newcomers face significant hurdles in establishing a reputable brand and achieving economies of scale in property management and operations. For instance, in 2024, CPT's extensive portfolio of over 160 properties across key markets provides substantial operational efficiencies and bargaining power with vendors, advantages that are difficult for a new entrant to replicate quickly.

New entrants typically lack the established brand recognition and the deep-rooted relationships with contractors and suppliers that established players like Camden have cultivated over years. This makes it challenging for them to compete effectively on cost or service quality from the outset. The capital-intensive nature of acquiring and developing significant real estate portfolios also acts as a substantial barrier, requiring considerable upfront investment that new firms may struggle to secure.

Threat of New Entrants 4

The threat of new entrants in real estate development is significantly influenced by the difficulty in accessing specialized talent. Building a team with expertise in development, property management, and financial structuring is not a quick process. For instance, in 2024, the demand for experienced real estate professionals remained high, with many firms reporting extended hiring timelines for critical roles.

Assembling seasoned teams is a major hurdle for newcomers. Proven track records are often a prerequisite for securing the substantial financing required for development projects and for attracting reliable tenants. This creates a barrier, as new entities lack the established history that lenders and tenants often seek. The competitive talent market further exacerbates this, making it challenging for new players to attract and retain the necessary expertise.

New entrants face a steep learning curve in navigating complex regulations, market dynamics, and operational intricacies. This learning curve, combined with the competitive talent landscape, means that establishing a foothold and achieving profitability can take considerable time and resources. In 2023, reports indicated that over 30% of new real estate development projects faced delays attributed to talent acquisition and management challenges.

- Talent Acquisition Challenges: Difficulty in finding and hiring skilled professionals in real estate development, property management, and finance.

- Financing Barriers: The necessity of a proven track record to secure capital, which new entrants typically lack.

- Tenant Attraction: The need for established credibility to attract and retain quality tenants, a challenge for new developments.

- Market Learning Curve: The significant time and effort required for new companies to understand and adapt to real estate market complexities and regulations.

Threat of New Entrants 5

The real estate sector's inherent cyclicality and lengthy development cycles act as significant barriers to entry. Projects launched during peak market conditions can easily encounter a downturn by their completion, impacting profitability and discouraging newcomers. For instance, the National Association of Realtors reported that in Q1 2024, the median existing-home sales price increased by 5.0% year-over-year, highlighting a market that can shift rapidly.

This volatility demands a substantial appetite for risk and a long-term strategic outlook, which often deters less seasoned investors or developers. The capital intensive nature of real estate development, coupled with the extended period before realizing returns, further solidifies this deterrent. In 2023, construction costs for new residential buildings saw an average increase of 5.8% according to the Bureau of Labor Statistics, adding another layer of financial challenge.

- Cyclical Market Risks: Real estate's boom-and-bust cycles mean projects can become unprofitable if market conditions worsen during development.

- Long Development Timelines: The time from planning to completion can span several years, increasing exposure to market fluctuations and financing risks.

- High Capital Requirements: Significant upfront investment is needed for land acquisition, construction, and financing, creating a substantial barrier for new entrants.

- Regulatory Hurdles: Navigating zoning laws, permits, and environmental regulations adds complexity and cost, further discouraging new players.

The threat of new entrants for companies like Camden Property Trust is generally moderate due to high capital requirements, stringent regulatory environments, and the need for specialized talent. For example, in 2024, securing financing for large-scale multifamily development often requires a proven track record and substantial equity, a hurdle most new players cannot easily clear. Furthermore, navigating zoning laws and obtaining permits across different municipalities can add significant time and cost, with some projects experiencing delays of over a year.

| Barrier | Description | 2024 Impact/Data Point |

|---|---|---|

| Capital Requirements | Substantial upfront investment for land, construction, and operations. | Average multifamily development project cost can range from $20 million to over $100 million, depending on scale and location. |

| Regulatory Hurdles | Complex zoning, permitting, and compliance with building codes. | Average time to obtain a building permit in major US cities in 2024: 6-12 months. |

| Talent & Expertise | Need for experienced development, management, and financial teams. | High demand for skilled real estate professionals in 2024 led to longer hiring timelines. |

| Brand & Relationships | Established reputation and strong ties with contractors, suppliers, and tenants. | CPT's portfolio of over 160 properties in 2024 offers significant economies of scale and bargaining power. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including company annual reports, market research studies, and industry-specific publications. This ensures a comprehensive understanding of competitive dynamics.