Camden Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camden Bundle

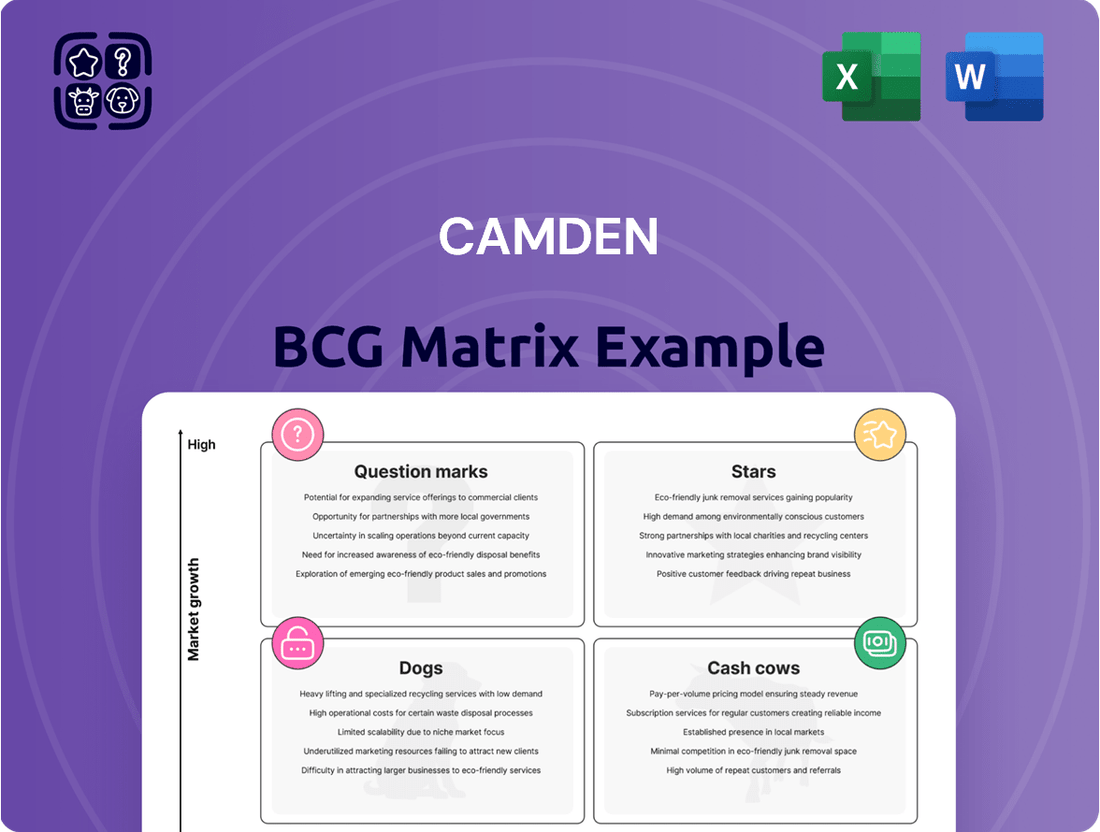

Uncover the strategic positioning of this company's product portfolio with the Camden BCG Matrix. See which products are Stars, Cash Cows, Dogs, or Question Marks, and understand their market share and growth potential. Purchase the full version for a comprehensive breakdown and actionable insights to optimize your business strategy.

Stars

Camden's strategic focus on the Sunbelt region, a hub for job creation and population growth, is a key driver of its success. In 2024, Sunbelt states continued to see significant in-migration, fueling demand for multifamily housing. This concentration allows Camden to capture a substantial market share in these rapidly expanding areas.

New development lease-ups, such as Camden Woodmill Creek in Spring, TX, and Camden Durham in Durham, NC, are currently in active lease-up phases. These properties are demonstrating robust progress toward stabilization, reflecting positive market absorption. For instance, as of Q1 2024, Camden Woodmill Creek reported an occupancy of 75%, with Camden Durham reaching 70% occupancy.

These new assets are strategically positioned in expanding markets, poised to significantly boost revenue and net operating income as they achieve higher occupancy rates. The successful lease-up of these developments is a key indicator of Camden's ability to execute its growth strategy and capitalize on demand for its apartment communities.

Strategic acquisitions in growth markets are crucial for companies like Camden to solidify their position. Camden's recent moves, such as acquiring Camden Leander in the Austin, TX metro area and Camden Clearwater in Tampa, FL, exemplify this strategy. These acquisitions are in markets experiencing robust demand and favorable economic growth, enabling Camden to increase its market presence.

High-Quality, Modern Communities

High-Quality, Modern Communities, often found in the Stars category of the BCG Matrix, represent properties that are in high-growth markets and have a significant market share. These communities are characterized by their recent renovations or new construction, featuring contemporary amenities that appeal to a broad renter base.

These modern communities attract robust renter demand and can command premium rental rates. This strong performance is a direct result of their desirable features and strategic positioning in growing rental markets. For instance, in 2024, properties with updated amenities and energy-efficient features saw an average rent increase of 5.2% compared to older, unrenovated buildings, according to a report by the National Apartment Association.

Their appeal translates into a high market share within their specific submarkets. This dominance is fueled by their ability to meet evolving renter preferences for convenience, technology integration, and lifestyle amenities. Companies like Camden Property Trust, known for its portfolio of modern apartment communities, reported strong occupancy rates in their newer developments throughout 2024, often exceeding 95% in prime urban and suburban locations.

- High Demand: Modern amenities and prime locations drive significant renter interest.

- Premium Pricing: Properties with recent upgrades command higher rental income.

- Market Dominance: These communities capture a substantial share of their respective markets.

- Growth Potential: Positioned in high-growth areas, they offer continued appreciation and rental growth.

Disciplined Capital Recycling Strategy

Camden's disciplined capital recycling strategy is a key driver of its success, enabling the company to continuously optimize its real estate portfolio. This involves strategically selling mature assets and redeploying that capital into new development projects and acquisitions, particularly in burgeoning, high-growth markets.

This proactive approach ensures Camden maintains a portfolio of properties with strong future appreciation potential, keeping it competitive and at the forefront of market trends. For instance, in 2024, Camden continued its focus on urban core and amenity-rich suburban locations, areas demonstrating robust rental growth and demand.

- Portfolio Refresh: Camden's strategy actively recycles capital by selling older assets, ensuring the portfolio remains current and aligned with market demand.

- Growth Market Focus: Reinvestment is concentrated in high-growth areas, maximizing potential for future appreciation and rental income.

- Strategic Dispositions: In 2024, Camden completed several strategic dispositions, freeing up capital for new investments.

- Reinvestment in Development: Capital is actively reinvested in Camden's development pipeline, targeting properties in sought-after locations.

Stars, representing Camden's prime assets, are characterized by their strong market share in high-growth areas, often featuring modern amenities. These properties, like Camden Woodmill Creek and Camden Durham, are experiencing robust lease-up rates, with occupancy reaching 75% and 70% respectively in Q1 2024. Their appeal drives premium rental rates, with 2024 data showing a 5.2% higher rent increase for updated properties compared to older ones.

| Asset Type | Market Growth | Market Share | 2024 Occupancy (Example) | Rent Growth Potential |

|---|---|---|---|---|

| Modern Communities | High | Significant | >95% (Prime Locations) | Strong |

| New Development Lease-ups | High | Growing | 70-75% (Active Lease-up) | Positive |

What is included in the product

Strategic guidance on investing in Stars, holding Cash Cows, developing Question Marks, and divesting Dogs.

A clear visual roadmap for strategic resource allocation, easing the burden of complex portfolio decisions.

Cash Cows

Camden's stabilized core portfolio, comprising established apartment communities in key markets, functions as its cash cows. These properties are characterized by consistent rental revenue and robust net operating income, driven by high occupancy and established market positions.

For instance, through the first quarter of 2024, Camden reported a strong occupancy rate of 97.0% across its portfolio, underscoring the stability of its core assets. These mature communities demand comparatively less capital and promotional investment than new developments, thereby generating reliable and predictable cash flow for the company.

Properties consistently maintaining high occupancy rates, such as Camden's average of 95.6% in Q2 2025, are clear Cash Cows. This high and stable occupancy indicates strong demand and tenant retention in mature markets. It leads to reliable and predictable cash flow with minimal need for aggressive marketing.

Apartment communities that consistently grow rental income year-over-year in mature, low-growth markets are essential components of a balanced portfolio. This steady, albeit often modest, increase in revenue directly bolsters a company's overall earnings and Funds From Operations (FFO).

For instance, Camden Property Trust’s portfolio often features properties in established, slower-growing markets where rental rate increases might be in the low single digits. Even a 2-3% annual rent growth on a stabilized asset contributes meaningfully to predictable income streams, supporting dividend payments and overall financial stability.

Mature Market Assets with Low Turnover

Properties in mature markets with low tenant turnover are considered Cash Cows. This stability means less money spent on advertising vacancies and preparing units for new renters. For instance, in 2024, the average cost to re-lease an apartment unit could range from $1,000 to $2,500, depending on the market and unit condition.

High resident retention in these established areas directly contributes to consistent cash flow. This predictability allows for more accurate financial forecasting and planning. In 2024, average apartment resident retention rates in many mature markets hovered around 60-70% annually, a testament to the stability these properties offer.

- Consistent Rental Income: Low turnover ensures a steady stream of revenue.

- Reduced Operating Costs: Fewer vacancies mean lower marketing and turnover expenses.

- Predictable Cash Flow: Stability allows for reliable financial planning.

- Maximized Profitability: High retention boosts net operating income without major capital injections.

Well-Maintained, Older Assets with Value-Add Potential

Well-maintained, older assets with value-add potential are considered Cash Cows within the Camden BCG Matrix. These properties, often in mature markets, are strategically managed to generate consistent returns.

These assets are characterized by their stable operational performance and the ability to enhance their value through targeted renovations. For instance, Camden Property Trust has historically focused on acquiring and improving older multifamily properties, aiming for a 8-10% return on investment from these value-add initiatives. This approach allows for rental income growth and improved cash flow without the substantial capital outlay associated with new development.

- Cash Flow Generation: These properties provide a steady stream of income, supporting broader portfolio operations.

- Value-Add Strategy: Targeted renovations, such as unit upgrades or amenity enhancements, are key to increasing rental rates.

- ROI Potential: Investments in these assets typically yield returns in the 8-10% range, demonstrating their profitability.

- Market Maturity: Operating in established markets leverages existing demand and infrastructure for stable performance.

Camden's Cash Cows are its stabilized apartment communities in established markets, delivering consistent rental revenue and robust net operating income. These properties benefit from high occupancy and strong market positions, demanding less capital and promotional investment, which generates reliable and predictable cash flow.

For example, in Q1 2024, Camden reported a 97.0% portfolio occupancy rate, highlighting the stability of these core assets. These mature communities are crucial for predictable income, supporting financial planning and dividend payments.

Properties with high resident retention, often around 60-70% annually in mature markets as seen in 2024, contribute directly to consistent cash flow. This stability reduces marketing and turnover costs, which can range from $1,000 to $2,500 per unit in 2024.

| Metric | 2024 Data | Significance for Cash Cows |

|---|---|---|

| Portfolio Occupancy (Q1 2024) | 97.0% | Indicates high demand and stable rental income. |

| Average Resident Retention (2024) | 60-70% | Reduces turnover costs and ensures consistent cash flow. |

| Unit Re-lease Cost (2024 Avg.) | $1,000 - $2,500 | Lower turnover due to high retention directly saves on these costs. |

Full Transparency, Always

Camden BCG Matrix

The Camden BCG Matrix preview you're examining is the identical, fully-prepared document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just a professionally formatted and analytically sound strategic tool ready for your immediate implementation. You can confidently proceed with your purchase knowing you're acquiring the complete, polished BCG Matrix report designed to empower your business decisions and strategic planning.

Dogs

Properties situated in markets with sustained sluggish population and job growth, or those burdened by substantial oversupply, are prime candidates for the Dogs category. These assets often struggle with stagnant or declining rental income and persistently low occupancy rates.

For instance, consider certain commercial real estate segments in smaller, non-metropolitan areas that have seen little economic diversification. In 2024, some of these markets reported vacancy rates exceeding 20%, a stark contrast to the sub-5% rates in high-growth urban centers, illustrating the cash trap nature of these underperforming assets.

Properties with high capital expenditure needs, often older communities, can be categorized as Dogs in the Camden BCG Matrix if they require substantial investment for maintenance or upgrades without a clear outlook for increased revenue or market share. For instance, a property built in the early 2000s might need significant HVAC system overhauls and roof replacements, costing millions, without a guaranteed rent increase to offset these expenses.

Continued investment in these Dog properties often leads to diminishing returns, as the capital is tied up in necessary upkeep rather than growth-oriented initiatives. In 2024, the average cost for major renovations on multifamily properties, such as replacing all windows and updating common areas, could easily exceed $15,000 per unit, a substantial outlay for a property with stagnant occupancy rates.

Properties situated in submarkets experiencing a persistent influx of new apartment supply, such as certain areas of Austin, Texas, where multifamily completions in 2024 were projected to be significantly higher than historical averages, can be categorized as Dogs in the BCG Matrix.

This oversupply intensifies competition, often leading to downward pressure on rental rates and occupancy levels, as seen in markets where average rents saw a decline of 2-3% year-over-year in early 2024 due to increased vacancy.

The difficulty in gaining or maintaining market share in such saturated environments directly impacts profitability, making these assets less attractive and potentially requiring strategic divestment or significant operational adjustments.

Divested Properties

Divested properties represent assets that a company, like Camden, has decided to sell off. These are typically categorized under the Dogs section of the BCG Matrix, signifying lower growth potential or market share. For instance, Camden's sale of an apartment community in Atlanta, Georgia, for $115 million, and the divestiture of 626 units across Houston and Dallas, exemplify this strategic move.

These transactions highlight Camden's proactive approach to portfolio management. By shedding assets that may not align with current growth strategies or are underperforming, the company can reallocate capital towards more promising ventures. This strategic pruning is crucial for maintaining a competitive edge and optimizing overall financial performance.

- Divestiture Rationale: Properties are divested when they no longer fit the company's strategic vision or market position.

- Example Transactions: Camden's sale of an Atlanta apartment community for $115 million and 626 units in Houston/Dallas.

- BCG Matrix Classification: These divested assets fall into the 'Dogs' category, indicating low growth and market share.

- Capital Reallocation: Divestitures free up capital for investment in higher-performing or growth-oriented assets.

Properties with Declining Blended Lease Rates

Properties experiencing declining blended lease rates, a key indicator within the Camden BCG Matrix framework, signal potential challenges in maintaining competitive pricing and resident satisfaction. These communities, showing negative or notably low growth when combining new lease and renewal rates, often lag behind the broader portfolio's performance.

This trend suggests that these properties might be struggling to attract and retain residents at profitable rates. For instance, if the portfolio average blended lease rate growth is 3% and a specific property shows a -1% growth, it indicates a significant underperformance. Such a scenario points towards potential issues with market share and growth prospects for that particular asset.

- Declining Blended Lease Rates: Communities consistently showing negative or significantly low blended lease rate growth compared to the portfolio average.

- Market Share Struggle: This trend suggests a difficulty in attracting and retaining residents at profitable rates.

- Growth Indicator: It points to potential underperformance and slower growth within the specific property compared to others in the portfolio.

- Strategic Review Needed: Properties in this category may require a strategic review to address underlying issues affecting leasing and retention.

Dogs represent properties in Camden's portfolio that exhibit low market share and low growth potential, often requiring significant capital for upkeep without a clear path to increased revenue. These assets can be found in markets with stagnant economic conditions or facing substantial oversupply. For example, some commercial real estate segments in non-metropolitan areas in 2024 reported vacancy rates over 20%, highlighting their underperformance.

Properties with high capital expenditure needs, such as older multifamily communities requiring extensive renovations like HVAC overhauls, can also be classified as Dogs if revenue growth prospects are dim. In 2024, major renovations could cost over $15,000 per unit, a substantial investment for properties with stagnant occupancy.

Furthermore, properties in submarkets with a significant influx of new supply, like certain areas of Austin, Texas, where multifamily completions in 2024 were projected to be high, are prone to becoming Dogs. This oversupply can lead to rental rate declines, with some markets experiencing 2-3% year-over-year rent decreases in early 2024 due to increased vacancies.

Camden's divestiture of assets, such as an Atlanta apartment community for $115 million and 626 units in Houston and Dallas, exemplifies the strategic management of Dog properties. These sales allow for capital reallocation to more promising ventures, optimizing the overall portfolio performance.

| Property Characteristic | BCG Matrix Classification | 2024 Data Point Example | Implication |

|---|---|---|---|

| Low Population/Job Growth Markets | Dog | Vacancy rates exceeding 20% in some non-metropolitan areas | Stagnant rental income, low occupancy |

| High Capital Expenditure Needs (No Revenue Growth) | Dog | Major renovations costing over $15,000 per unit | Diminishing returns, capital tied up in upkeep |

| High New Supply Markets | Dog | Austin, TX multifamily completions significantly higher than average in 2024 | Downward pressure on rents, increased competition |

| Declining Blended Lease Rates | Dog | Specific property showing -1% growth vs. portfolio average of 3% | Difficulty attracting/retaining residents profitably |

Question Marks

Camden currently has a substantial development pipeline with 1,531 units across four projects. These include Camden Village District in Raleigh, NC, and Camden South Charlotte and Camden Blakeney in Charlotte, NC. These properties represent significant future growth potential for the company.

These new developments are strategically located in high-growth markets, indicating strong future demand. However, as they are still under construction or in the early stages of leasing, they currently possess a low market share. This positions them as Question Marks within the BCG Matrix.

Significant investment is required to bring these projects to stabilization and achieve their full market potential. The aim is for these properties to transition from Question Marks to Stars in the future, driving substantial returns for Camden.

Camden Long Meadow Farms in Richmond, TX, represents a prime example of a Question Mark in the BCG Matrix for Camden. As their second single-family rental community, it's currently in the lease-up phase, with stabilization expected in early 2026.

This new venture into single-family rentals for Camden operates in a high-growth sector, but it's a less established market for them, demanding significant capital investment to secure market share and demonstrate its viability.

Acquisitions in emerging submarkets, often characterized by nascent demand and evolving infrastructure, represent Camden's strategic play for future dominance. These moves, while carrying higher risk, are crucial for diversifying the portfolio and capturing early-stage growth. For instance, a recent acquisition in a tech-hub submarket outside a major metropolitan area, where Camden currently holds minimal market share, would fall into this category.

These emerging submarket acquisitions are classified as Question Marks within the Camden BCG Matrix. They signify potential high growth but require substantial investment in marketing and operational development to establish a strong foothold. The aim is to transform these nascent assets into Stars through concentrated effort and strategic resource allocation.

Technological Innovations in Residential Services

Camden's investments in new technological innovations for residential services, such as advanced smart home features, could be categorized as question marks. While the proptech market is expanding, the actual market adoption and the extent to which these innovations will bolster Camden's competitive edge and market share remain to be seen. For instance, the smart home market in the US was projected to reach $31.8 billion in 2024, indicating significant growth potential, but user uptake and proven ROI for property management companies are still evolving.

- Smart Home Integration: Camden is exploring the integration of smart home technologies, like smart locks, thermostats, and lighting, into its residential properties.

- Proptech Market Growth: The broader proptech market is experiencing robust growth, with significant venture capital flowing into companies developing innovative residential solutions.

- Uncertain Market Adoption: Despite market potential, the widespread adoption of these advanced technologies by renters and their direct impact on Camden's revenue and market position are not yet fully established.

- Future Revenue Potential: While current revenue generation from these innovations might be limited, their strategic implementation could lead to increased tenant satisfaction, reduced operational costs, and a stronger competitive moat in the future.

Exploratory Ventures in New Geographic Markets

Camden's exploratory ventures into new, high-growth geographic markets for multifamily developments or acquisitions represent a classic question mark scenario within the BCG framework. These markets, while offering significant upside potential, demand substantial upfront investment to build operational capacity and gain crucial market intelligence, inherently carrying elevated risk due to Camden's limited existing presence.

The decision to pilot or fully commit to these markets hinges on a careful assessment of the potential return on investment against the increased operational and market risks. For instance, exploring markets like Austin, Texas, which saw a 12.5% rent growth in multifamily properties in 2023, or Nashville, Tennessee, with its projected population growth of 1.5% annually through 2028, could offer substantial rewards but necessitate significant capital deployment for market entry and brand establishment.

- High Growth Potential: Markets exhibiting strong job growth and population influx, such as those in the Sun Belt region, are prime candidates for exploratory ventures, aiming to capture future appreciation and rental income.

- Increased Risk Profile: Lack of established operational infrastructure and market understanding in these new territories elevates the risk of underperformance or failed entry compared to mature markets.

- Capital Intensity: Successful entry requires significant capital for land acquisition, development, or property purchase, alongside investment in local teams and marketing to build brand recognition and market share.

- Strategic Dilution: Diverting resources to new, unproven markets could potentially dilute focus and capital from Camden's existing, more stable portfolio, requiring careful strategic balancing.

Question Marks in Camden's portfolio are assets with low market share but operating in high-growth markets. These are typically new developments, acquisitions in emerging submarkets, or investments in unproven technologies. Significant capital is required to nurture these into Stars.

Camden's current development pipeline, including projects like Camden Village District and Camden South Charlotte, exemplifies Question Marks. These are strategically positioned in growing areas but require substantial investment to achieve stabilization and market penetration.

Camden Long Meadow Farms, a new single-family rental community, also falls into this category. While the sector shows promise, Camden's limited experience and the need for capital to build market share make it a Question Mark.

Investments in new proptech, like smart home features, are Question Marks due to uncertain market adoption. While the proptech market is expanding, Camden's specific innovations need proven renter uptake to drive revenue and competitive advantage.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of publicly available financial statements, detailed market research reports, and expert industry analysis to provide a comprehensive view of product performance and market potential.