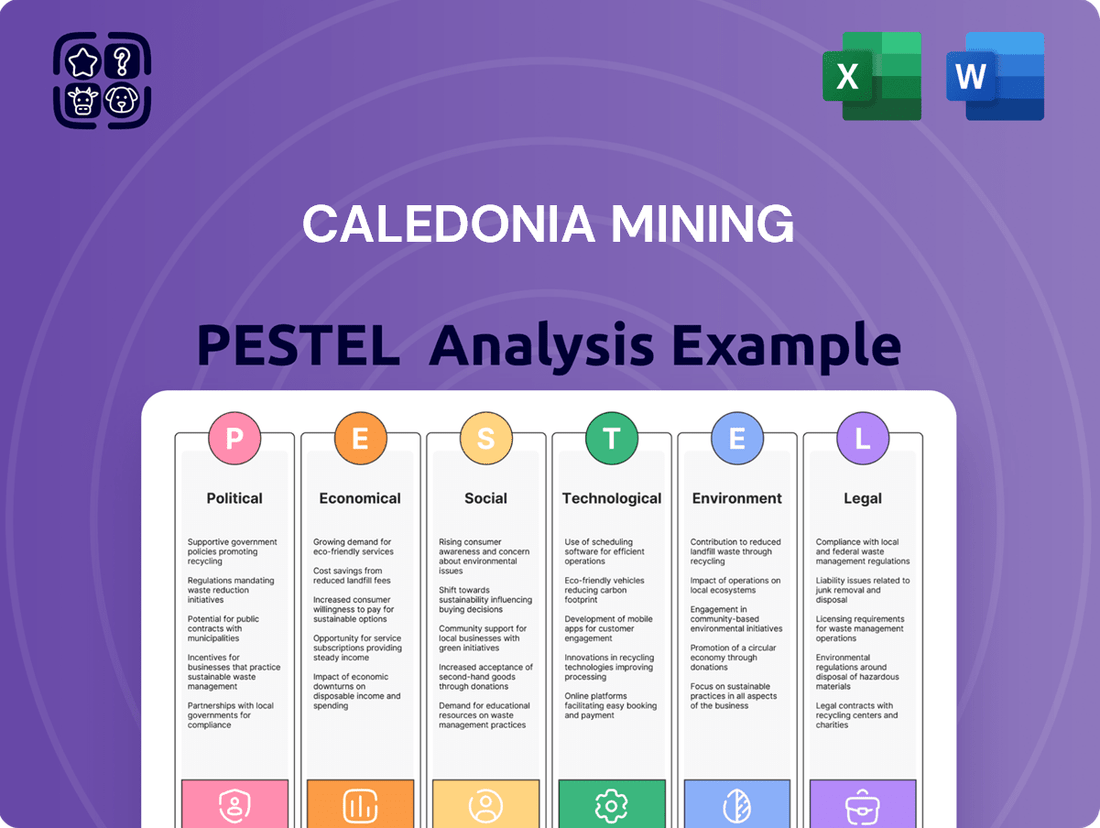

Caledonia Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Caledonia Mining. Discover how political stability in Zimbabwe, economic fluctuations, and technological advancements in mining are shaping the company’s future. Understand the social impact of mining operations and the crucial environmental regulations it must adhere to. Use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Caledonia Mining's operations are deeply intertwined with Zimbabwe's political landscape, making government stability a critical factor. Any shifts in leadership or governance can directly impact the predictability of mining regulations.

Policy consistency, particularly concerning mining legislation, taxation structures, and foreign exchange management, is paramount for Caledonia. For instance, the Zimbabwean government's approach to foreign currency retention policies has a direct effect on the company's ability to repatriate earnings and manage its costs. In 2023, the Reserve Bank of Zimbabwe continued to manage foreign currency availability, a key consideration for mining firms.

Caledonia has explicitly stated that a stable policy environment is a prerequisite for its planned capital expenditures. This highlights the company's need for assurance that its investments will not be jeopardized by sudden regulatory changes. The company's forward-looking investment plans, such as the Blanket Mine's expansion, hinge on this predictability.

The Zimbabwean government's commitment to attracting foreign investment through stable legal frameworks and predictable fiscal policies will continue to be a significant driver or deterrent for Caledonia's growth. The country's efforts to improve its Ease of Doing Business ranking, which stood at 139 out of 190 economies in the World Bank's 2020 report, remain an ongoing area of focus for the government.

Zimbabwe's indigenization policies have historically required significant local ownership in mining ventures, notably demanding a 51% stake for indigenous Zimbabweans. Caledonia Mining Corporation has navigated these regulations by ensuring compliance, which fosters local partnerships but can also present challenges for foreign direct investment. For example, the Indigenisation and Economic Empowerment Act, though revised over time, has shaped the ownership structure of many mining operations.

Caledonia's commitment to meeting these local ownership requirements is a key aspect of its operational strategy in Zimbabwe. This approach aims to build stronger relationships with local communities and stakeholders. However, any future shifts in the interpretation or enforcement of these indigenization laws could influence the company's future investment decisions and the overall framework of its operations.

The regulatory environment in Zimbabwe, where Caledonia Mining operates its Blanket Mine, significantly impacts its business. The ease of obtaining and renewing mining permits, along with strict adherence to the Mines and Minerals Act, are critical for Caledonia's operational continuity. In 2023, Zimbabwe's government continued efforts to streamline mining approvals, though challenges in consistent application can still arise.

Changes or shifts in mining legislation and their enforcement directly influence Caledonia's operational efficiency and compliance expenses. For instance, any adjustments to royalty rates or environmental regulations require careful management and can affect profitability. Navigating these evolving legal frameworks is paramount for Caledonia's long-term stability and growth in the region.

International Relations and Sanctions

Zimbabwe's international standing and any imposed sanctions can significantly influence Caledonia Mining's operational environment. While Caledonia operates within Zimbabwe, its access to global capital markets and supply chains is inherently linked to the country's foreign relations. A strained international perception, even if not directly aimed at the company, can create headwinds for foreign investment and increase the cost of capital. For instance, if Zimbabwe faces renewed sanctions, it could complicate foreign currency transactions and the repatriation of profits, impacting Caledonia's financial flexibility.

The ongoing efforts by the Zimbabwean government to improve international relations are crucial for companies like Caledonia. As of early 2024, Zimbabwe has been actively seeking to re-engage with international financial institutions and trading partners, aiming to attract foreign direct investment and normalize its economic standing. This diplomatic push could translate into a more favorable business climate, potentially easing access to international finance and reducing supply chain risks.

Caledonia's strategy to mitigate these political risks involves demonstrating robust operational performance and strong corporate governance. By consistently delivering on production targets and adhering to international best practices, the company can build confidence among investors and stakeholders, regardless of the broader geopolitical landscape.

- Sanctions Impact: While no specific sanctions target Caledonia Mining directly, broader sanctions on Zimbabwe could affect its ability to access international banking services and raise capital.

- Diplomatic Efforts: Zimbabwe's ongoing diplomatic engagements in 2024 aim to improve its international image and attract foreign investment, which could indirectly benefit Caledonia.

- Operational Resilience: Caledonia's focus on strong operational performance, such as its 2023 gold production of 12,652 ounces from Blanket Mine, serves as a key factor in maintaining investor confidence amidst external uncertainties.

- Foreign Currency Access: Challenges in foreign currency availability, often linked to international relations, can impact operational costs and profit repatriation for mining companies.

Corruption and Governance

Zimbabwe's perceived corruption levels and the robustness of its governance structures significantly shape the operational environment and risk landscape for companies like Caledonia Mining. A low perception of corruption generally correlates with a more predictable and stable business climate, reducing unexpected costs and delays.

Caledonia Mining proactively addresses these governance challenges by adhering to stringent corporate governance codes. For instance, their commitment to the Quoted Companies Alliance Corporate Governance Code demonstrates a dedication to transparency and ethical conduct, crucial for building investor confidence in an environment where governance can be a concern.

The impact of governance is tangible. According to Transparency International's 2023 Corruption Perception Index, Zimbabwe ranked 157 out of 180 countries, scoring 20 out of 100. This underscores the persistent governance challenges that mining companies must navigate.

- Perceived Corruption: Zimbabwe's low ranking on global corruption indices (e.g., Transparency International's 2023 CPI) highlights a key risk factor for foreign investors.

- Governance Framework: The effectiveness and fairness of Zimbabwe's legal and regulatory systems directly influence operational ease and investment security.

- Corporate Mitigation: Caledonia Mining's adoption of robust corporate governance standards serves as a critical internal control mechanism against external governance weaknesses.

- Operational Impact: Weak governance and high corruption can lead to increased operational costs, supply chain disruptions, and challenges in securing permits or licenses.

Political stability in Zimbabwe is a cornerstone for Caledonia Mining's operations, as shifts in government can directly affect mining regulations and policy predictability. The government's stance on foreign currency retention and its commitment to a stable investment climate are crucial for Caledonia's planned capital expenditures, such as the expansion of Blanket Mine.

Zimbabwe's indigenization laws, historically requiring significant local ownership, shape Caledonia's operational strategy and partnerships. The government's ongoing efforts to improve its international standing and attract foreign investment, as seen in early 2024 diplomatic engagements, could positively impact the business environment for companies like Caledonia.

The perceived corruption levels in Zimbabwe, highlighted by its low ranking in Transparency International's 2023 Corruption Perception Index, present a significant risk that Caledonia mitigates through strong corporate governance. Navigating Zimbabwe's legal and regulatory systems, including permit acquisition and adherence to the Mines and Minerals Act, remains critical for Caledonia's operational continuity.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Caledonia Mining's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these factors create both risks and opportunities, empowering strategic decision-making for stakeholders.

A PESTLE analysis for Caledonia Mining offers a structured way to identify and mitigate external challenges, acting as a pain point reliever by proactively addressing potential operational disruptions and market shifts.

By dissecting political, economic, social, technological, environmental, and legal factors, the PESTLE analysis for Caledonia Mining provides clarity on external risks, thereby relieving the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

Global gold prices are a cornerstone for Caledonia Mining's financial success. In 2024, a stronger average realized gold price directly boosted the company's revenue, leading to improved gross profit and operating cash flow. For instance, if the average gold price rose by $100 per ounce, it could translate to millions in additional profit for Caledonia.

Conversely, any sustained downturn in the global gold market presents a significant risk. A substantial drop in gold prices could severely hamper Caledonia Mining's financial stability, potentially limiting its ability to fund new projects or even maintain current operations. The market's sensitivity to economic uncertainty means gold prices can shift rapidly.

Zimbabwe's economy continues to grapple with significant inflationary pressures and currency volatility. The introduction of the Zimbabwe Gold (ZIG) in April 2024, intended to stabilize the currency, has faced challenges, with the ZIG experiencing depreciation against major currencies. For Caledonia Mining, this means that the cost of imported goods and services essential for its operations, like mining equipment and chemicals, can increase sharply. Furthermore, any revenues earned in foreign currency are subject to conversion at official rates, which often diverge from the parallel market, creating immediate value erosion.

The impact of these economic factors on Caledonia Mining's profitability is substantial. Policies that mandate the conversion of foreign currency earnings into local currency at the prevailing official rate directly reduce the value of those earnings in real terms. This practice creates a direct foreign exchange loss for the company, impacting its bottom line and making it more challenging to repatriate profits or reinvest in the business. For instance, if a significant portion of Caledonia's revenue is generated in USD but must be converted to ZIG at a less favorable official rate, the company effectively receives less local currency than it would otherwise. This situation directly affects financial stability and hinders long-term strategic planning.

Caledonia Mining's ambitious expansion, particularly at Bilboes and Motapa, hinges on securing significant capital. In 2023, the company reported a strong cash flow from operations, which is a key internal funding source. However, the scale of these new projects necessitates exploring external avenues.

The company's strategy involves a multi-pronged approach to funding these developments, likely including a mix of retained earnings, potential equity raises, and debt financing. For instance, in early 2024, Caledonia announced a significant debt facility to support its growth plans, demonstrating a proactive stance in accessing capital markets.

Effectively managing and deploying this capital is paramount. Caledonia's success in translating funding into tangible progress at Bilboes and Motapa will directly influence its ability to meet production targets and achieve its long-term strategic vision for increased gold output.

Infrastructure and Operating Costs

The cost and availability of crucial infrastructure, like dependable electricity and effective transportation, significantly impact mining operational expenses for Caledonia. For instance, while Caledonia has proactively invested in its own solar power plant to mitigate reliance on the national grid, broader infrastructural shortcomings in Zimbabwe could still pose challenges to cost management and operational efficiency.

Looking ahead, projections for 2025 indicate a general upward trend in operating costs. This includes expected increases in labor expenses, which are a significant component of Caledonia's expenditure.

Caledonia Mining's specific operating costs are influenced by several factors:

- Energy Costs: The company's investment in a 12 MW solar plant at Blanket Mine is designed to stabilize and reduce electricity expenses, which are a major input in mining operations. This solar plant commenced operations in 2022 and has since contributed to cost savings.

- Labor Expenses: As of early 2024, Caledonia reported that employee costs were a significant portion of their operating expenditure. Anticipated wage negotiations and inflation in 2025 will likely lead to higher labor costs.

- Logistics and Transport: The efficiency and cost of transporting materials, equipment, and the final gold product are directly tied to the state of Zimbabwe's road and rail networks. Any inefficiencies or increased fuel costs will directly impact Caledonia's bottom line.

- Maintenance and Consumables: The cost of maintaining mining equipment, purchasing explosives, and other essential consumables are subject to global commodity prices and local supply chain dynamics.

Economic Growth and Investment Climate

Zimbabwe's economic growth trajectory is a critical factor for Caledonia Mining. The country's GDP growth has shown resilience, with projections indicating continued expansion. For instance, the IMF forecast Zimbabwe's GDP to grow by 3.5% in 2024, a positive sign for investment climates.

Caledonia's substantial investments in Zimbabwe, particularly at Blanket Mine, demonstrate a strong belief in the nation's mining sector potential. This investment not only bolsters the mining industry but also fosters economic activity, creating jobs and stimulating local economies. The company's commitment signals a positive outlook for foreign direct investment (FDI) in the country.

- Zimbabwe's projected GDP growth for 2024 stands at 3.5%, according to the IMF.

- Caledonia Mining's ongoing capital expenditure at Blanket Mine underscores confidence in the Zimbabwean mining sector.

- The company's operations contribute to job creation, with over 1,000 employees at Blanket Mine, many from local communities.

- This investment has a multiplier effect, supporting related industries and enhancing the overall investment climate.

Zimbabwe's economy faces ongoing inflationary pressures and currency volatility, with the new ZIG currency experiencing depreciation. This directly increases Caledonia Mining's operational costs for imported goods and services, while foreign currency conversions at official rates can lead to immediate value erosion on revenues.

The successful funding and deployment of capital for expansion projects like Bilboes and Motapa are critical. Caledonia's 2023 strong cash flow from operations is a positive internal source, supplemented by a debt facility secured in early 2024 to support growth initiatives.

Infrastructure reliability, particularly electricity and transportation, impacts Caledonia's costs. While the company has invested in a solar plant, broader infrastructural challenges in Zimbabwe could affect operational efficiency and cost management, with projected increases in operating costs for 2025, including labor expenses.

Zimbabwe's projected 3.5% GDP growth in 2024, as forecast by the IMF, signals a positive environment for investment. Caledonia's substantial capital expenditures, like at Blanket Mine, demonstrate confidence in the sector and contribute to job creation, positively impacting the broader investment climate.

Preview the Actual Deliverable

Caledonia Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Caledonia Mining delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Caledonia Mining's operations and strategic decisions. This detailed report provides actionable insights for informed business planning and risk management, presented in a clear and organized manner.

Sociological factors

Caledonia's Blanket Mine in Zimbabwe relies heavily on strong community ties for its social license to operate. By investing in local development, such as upgrading schools and health clinics, the company builds trust and ensures operational stability.

In 2023, Caledonia reported significant community investment, with over $1.8 million directed towards various social upliftment projects. This commitment helps mitigate risks associated with community opposition and fosters a collaborative environment.

Caledonia Mining Corporation is a major employer in Zimbabwe's Gwanda district, prioritizing the hiring of local talent. This commitment is evident in their operations, where they focus on developing the skills of their workforce and creating pathways for career advancement. For instance, as of the first quarter of 2024, Caledonia reported employing a significant number of local staff, contributing directly to the region's economic stability.

By investing in employee training and development, Caledonia not only enhances operational efficiency but also fosters a more skilled and stable workforce, which is vital for long-term mining success. This focus on upskilling directly addresses local unemployment challenges and contributes to the overall socio-economic upliftment of the Gwanda community.

Caledonia Mining places paramount importance on the health and safety of its employees, a crucial sociological consideration. The company has made significant investments in enhancing safety protocols, particularly as its operations venture deeper underground, requiring more robust protective measures. These efforts are vital for maintaining a secure working environment and ensuring the well-being of its workforce.

Recent reports indicate Caledonia's commitment through the implementation of proactive safety indicators and more thorough accident investigations. This focus on real-time monitoring and analysis of safety data is designed to identify and mitigate potential hazards before they lead to incidents, fostering a culture of continuous safety improvement.

Impact on Local Livelihoods

Caledonia Mining's operations at Blanket Mine significantly influence local livelihoods in Gwanda, Zimbabwe. By prioritizing local procurement, Caledonia aims to foster economic growth. In 2023, the company reported that approximately 78% of its supplier spend was with local entities, a figure that underscores its commitment to community economic development. This focus not only provides employment but also stimulates secondary economic activities through the supply chain.

However, the potential for environmental changes due to mining activities necessitates careful management to safeguard local resources. Caledonia actively invests in community initiatives designed to build economic self-sufficiency beyond direct mining employment. For instance, their support for local agriculture and small businesses aims to create a more diversified and resilient local economy, mitigating potential negative impacts and maximizing shared prosperity.

- Employment Generation: Blanket Mine is a major employer in the Gwanda region, providing direct jobs and indirectly supporting numerous others.

- Local Procurement: In 2023, Caledonia spent approximately 78% of its supplier costs with local Zimbabwean businesses, boosting the regional economy.

- Community Investment: Initiatives focus on economic diversification, including support for agriculture and small enterprise development, to enhance local self-sufficiency.

- Environmental Stewardship: Efforts are in place to manage environmental impacts, aiming to protect local resources crucial for community livelihoods.

Diversity and Inclusion

Caledonia Mining Corporation PLC recognizes the importance of diversity and inclusion in its operations, particularly concerning its workforce and board composition. The company's hiring practices aim to incorporate a broad spectrum of candidates, including consideration for gender diversity, though specific numerical targets for executive officers are not set given the current scale of its management team. This focus on varied perspectives is seen as crucial for fostering a stronger, more ethically grounded operational framework.

In 2023, Caledonia Mining reported a workforce where approximately 15% of its employees were women, with a notable presence in operational and administrative roles. While specific board diversity targets are not mandated, the company actively seeks to incorporate diverse viewpoints to enhance decision-making and corporate governance. This commitment is vital for navigating the complex social and regulatory landscapes inherent in the mining industry.

- Workforce Gender Split (2023): Approximately 15% of Caledonia Mining's employees were women.

- Board Diversity Approach: Focus on diverse perspectives rather than strict numerical targets for board members.

- Ethical Operations: Diverse viewpoints are considered instrumental in promoting a more robust and ethical operational environment.

- Industry Context: The mining sector's increasing emphasis on ESG factors makes diversity and inclusion a key consideration for long-term sustainability and social license to operate.

Caledonia's social license to operate hinges on its deep community engagement, particularly through substantial investments in local development. Their 2023 community investment exceeded $1.8 million, bolstering essential services like schools and health clinics, which in turn fosters trust and operational stability.

The company significantly contributes to the Gwanda district's economy by prioritizing local employment, evident in the high percentage of local staff reported in Q1 2024, and by sourcing approximately 78% of its suppliers locally in 2023. Caledonia also actively invests in employee training and development, enhancing skills and career progression for its workforce.

Maintaining a strong focus on employee health and safety is paramount, with ongoing enhancements to safety protocols and accident investigation procedures to ensure a secure working environment. Furthermore, Caledonia promotes diversity and inclusion, with women comprising about 15% of its workforce in 2023, seeking diverse viewpoints to strengthen ethical operations.

| Sociological Factor | Description | 2023/2024 Data Point |

|---|---|---|

| Community Investment | Building trust and operational stability through local development projects. | Over $1.8 million invested in social upliftment in 2023. |

| Local Employment & Procurement | Boosting regional economy by prioritizing local hiring and suppliers. | ~78% of supplier spend was local in 2023; significant local staff employment in Q1 2024. |

| Health & Safety Focus | Ensuring a secure working environment through enhanced safety protocols. | Implementation of proactive safety indicators and thorough accident investigations. |

| Workforce Diversity | Incorporating varied perspectives for robust and ethical operations. | ~15% of employees were women in 2023. |

Technological factors

Caledonia Mining is actively investing in technological upgrades at its Blanket Mine, focusing on modernizing underground crushing and hoisting systems. This strategic move is designed to significantly boost operational efficiency. For instance, by implementing advanced crushing technology, the company aims to process ore more effectively, reducing bottlenecks in the production chain.

These technological adoptions are not just about speed; they are crucial for optimizing production volumes and driving down operational costs. By reducing manual intervention and improving the flow of materials, Caledonia anticipates a substantial increase in the mine's overall productivity. This enhanced efficiency directly translates into a more competitive cost structure, which is vital in the current global mining landscape.

Furthermore, the integration of cutting-edge automation in these critical areas is expected to yield significant safety improvements. Modern systems often incorporate advanced monitoring and control features, minimizing risks associated with manual operations in challenging underground environments. This commitment to safety, alongside efficiency gains, underscores Caledonia's forward-looking approach to mining.

The financial implications are substantial. In 2024, Caledonia reported a 15% increase in gold production to 4,595 ounces in the first quarter, partly attributed to improved operational efficiencies, setting a positive trend for the year. Such investments in technology are projected to further solidify the mine's profitability and long-term viability.

Caledonia Mining leverages advanced exploration technologies to identify and develop new gold resources, crucial for extending mine life. Improved drilling techniques and sophisticated geological modeling are key to this effort, helping to pinpoint viable deposits.

At its Motapa project, Caledonia is actively employing these technologies to significantly increase its measured and indicated mineral resources. This strategic focus aims not only to expand existing resource bases but also to uncover entirely new gold-bearing zones.

For instance, in the first half of 2024, Caledonia reported a substantial increase in its indicated mineral resources at Motapa, reaching approximately 2.1 million tonnes at 3.39 g/t gold. This growth underscores the effectiveness of their technological approach in resource discovery and definition.

These technological advancements are fundamental to Caledonia's strategy of organic growth, ensuring a sustainable pipeline of future production and enhancing the overall value of its mining assets.

Caledonia Mining is actively leveraging digitalization and data analytics to sharpen its operational edge. By integrating advanced software and new clocking systems, the company is directly targeting improvements in mine planning and labor efficiency.

These technological advancements are designed to provide Caledonia with greater control over its mining processes. This enhanced oversight allows for more informed and timely decision-making, crucial for optimizing resource extraction and managing costs effectively.

For instance, the implementation of digital timekeeping systems can provide real-time data on workforce attendance and productivity. This granular information is invaluable for identifying bottlenecks and opportunities for improvement in daily operations.

Sustainable Mining Technologies

Caledonia Mining is actively adopting sustainable technologies to enhance operational efficiency and environmental stewardship. A key initiative is the 12.2 MWac solar plant at their Blanket Mine, which significantly reduces their dependence on costly and polluting diesel generators. This move is crucial for lowering operational costs and aligning with global environmental standards.

The company's commitment to resource efficiency is further demonstrated through its water management practices. Caledonia Mining recycles a substantial portion of its water, with 25% currently sourced from recycling processes. This focus on water conservation is vital in regions facing water scarcity.

These technological integrations are not just about environmental compliance; they represent a strategic approach to long-term sustainability and cost reduction.

- Solar Power Integration: The 12.2 MWac solar plant at Blanket Mine aims to offset diesel consumption, a significant step towards cleaner energy.

- Water Recycling: Achieving 25% water recycling highlights a commitment to minimizing water footprint and improving resource utilization.

- Environmental Impact Mitigation: These technologies directly address the environmental concerns associated with traditional mining operations.

- Operational Cost Reduction: Shifting away from diesel and optimizing water usage contributes to lower and more predictable operating expenses.

Innovation in Processing and Extraction

Ongoing advancements in gold processing and extraction technologies are crucial for Caledonia Mining, as they directly impact recovery rates and operational expenses. Innovations like enhanced gravity separation and advanced leaching techniques can significantly boost the amount of gold recovered from ore, thereby improving profitability. For instance, in 2023, Caledonia Mining reported a gold production of 160,669 ounces from its Blanket Mine, underscoring the importance of efficient extraction methods in achieving these figures.

While specific new processing technologies being implemented by Caledonia are not detailed, the company's strategic direction points towards a consistent assessment of technological upgrades. This proactive approach aims to ensure that their operations remain at the forefront of efficiency and cost-effectiveness within the gold mining sector. The company's commitment to modernizing its facilities suggests a readiness to adopt proven technologies that enhance yield and reduce environmental impact.

- Higher Recovery Rates: New processing techniques can increase the percentage of gold extracted from mined ore, directly boosting output.

- Lower Operational Costs: Innovations often lead to more energy-efficient processes and reduced chemical usage, cutting down on expenses.

- Enhanced Efficiency: Modern extraction methods can process ore faster and with less manual intervention, improving overall productivity.

- Environmental Benefits: Advanced technologies can also minimize waste and reduce the environmental footprint of mining operations.

Technological advancements are central to Caledonia Mining's strategy, driving efficiency and resource discovery. The company is investing in modernizing underground crushing and hoisting systems at its Blanket Mine to boost operational efficiency and lower costs. For example, in the first quarter of 2024, Caledonia reported a 15% increase in gold production, partly due to these operational improvements.

Caledonia also utilizes advanced exploration technologies, including improved drilling and geological modeling, to identify new gold resources and extend mine life. This is evident at the Motapa project, where indicated mineral resources grew to approximately 2.1 million tonnes at 3.39 g/t gold in the first half of 2024, demonstrating the effectiveness of their tech-driven resource expansion.

Furthermore, digitalization and data analytics are being integrated to enhance mine planning and labor efficiency, offering greater control and enabling better decision-making. The adoption of sustainable technologies, such as the 12.2 MWac solar plant at Blanket Mine, also reduces reliance on diesel and lowers operational costs, with 25% of water currently sourced from recycling processes.

| Technology Area | Key Initiative | Impact/Benefit | Data Point (2024/2025) |

|---|---|---|---|

| Operational Efficiency | Crushing & Hoisting Modernization | Increased production, reduced costs | 15% gold production increase (Q1 2024) |

| Resource Discovery | Advanced Exploration Tech | Extended mine life, resource expansion | 2.1M tonnes @ 3.39 g/t gold (Motapa, H1 2024) |

| Digitalization | Data Analytics & Digital Systems | Improved planning, labor efficiency | Real-time data for operational insights |

| Sustainability | Solar Power & Water Recycling | Reduced costs, environmental stewardship | 12.2 MWac solar plant, 25% water recycling |

Legal factors

Caledonia Mining Corporation's operations in Zimbabwe, and any future ventures in Southern Africa, are heavily reliant on the continuous acquisition and renewal of mining permits and licenses. These are not just bureaucratic hurdles, but fundamental legal necessities that underpin the company's ability to extract resources. For instance, in Zimbabwe, mining rights are granted and regulated by the Mines and Minerals Act, which dictates exploration, extraction, and environmental protection standards.

Maintaining compliance with the intricate legal framework surrounding these permits is paramount. Failure to do so can lead to severe operational disruptions, including temporary suspensions or even the revocation of mining rights. This not only impacts production but also significantly damages the company's reputation and its social license to operate within the communities where it functions.

The cost and timeline associated with securing and renewing these permits are also critical considerations. While specific figures vary, the process often involves extensive documentation, environmental impact assessments, and stakeholder consultations, all of which contribute to operational overhead. For Caledonia, understanding these legal requirements is key to predictable and sustainable growth in its target regions.

Caledonia Mining Corporation is deeply committed to navigating and complying with a complex web of environmental regulations. This includes rigorous adherence to climate change risk assessment protocols and ensuring its tailings management practices meet international best practices, a crucial aspect given the nature of mining operations.

The company's 2024 Environmental, Social, and Governance (ESG) Report underscores this dedication, detailing its proactive approach to environmental stewardship. This report specifically addresses compliance with critical legislation governing water management, a vital resource in mining, and responsible waste disposal, minimizing the ecological footprint of its operations.

Caledonia Mining Corporation, operating in Zimbabwe, must diligently comply with a complex web of labor laws and employment regulations. These govern everything from minimum wage requirements and working hour limits to health and safety standards and the procedures for employee representation and dispute resolution. Failure to adhere to these statutes can result in significant penalties, operational disruptions, and damage to the company's reputation, impacting its ability to attract and retain a skilled workforce.

The company's commitment to local hiring and maintaining fair wages, as evidenced by its operations and community engagement, directly addresses these legal obligations. For instance, Zimbabwe's Labour Act outlines specific provisions for employment contracts, termination, and the establishment of works councils, all of which Caledonia must navigate. By prioritizing safe working environments, the company not only meets legal mandates but also cultivates a more stable and productive labor force, crucial for consistent production at its Blanket Mine operations.

Taxation and Royalty Regimes

The tax and royalty framework in Zimbabwe is a critical factor for Caledonia Mining. For instance, Zimbabwe's gold royalty rate for large-scale producers was 5% as of early 2024. Changes to this, or to the corporate tax rate, which stood at 24% for mining companies, can directly influence Caledonia's net profits and the viability of its operations at Blanket Mine. Furthermore, the company's consistent tax and royalty contributions are a vital part of Zimbabwe's fiscal revenue stream, supporting national development initiatives.

Key considerations regarding taxation and royalties include:

- Impact of Corporate Tax: Zimbabwe's corporate tax rate directly reduces Caledonia's retained earnings.

- Royalty Rates on Gold: The prevailing royalty percentages on gold sales are a direct cost that affects profit margins.

- Mineral Export Duties: Any introduction or alteration of mineral export duties would further impact the company's revenue.

- Economic Contribution: Caledonia's tax and royalty payments contribute significantly to the Zimbabwean government's income.

Corporate Governance and Listing Requirements

Caledonia Mining Corporation Plc, as a dual-listed entity on the NYSE American and AIM of the London Stock Exchange, navigates a complex web of legal and regulatory frameworks. These listings necessitate strict adherence to corporate governance codes and continuous disclosure requirements. For instance, the company's compliance with Sarbanes-Oxley Act (SOX) provisions is critical for its US listing, ensuring the integrity of financial reporting and internal controls.

The company's commitment to best practices is evidenced in its annual reports, which detail its governance structure and risk management strategies. In 2023, Caledonia reported a robust governance framework, including independent board committees focused on audit, remuneration, and nominations, aligning with recommendations from bodies like the UK Corporate Governance Code.

- NYSE American & AIM Listing Compliance: Adherence to stringent listing rules for both exchanges, impacting reporting and operational standards.

- Corporate Governance Codes: Implementation of codes such as the UK Corporate Governance Code, emphasizing board independence, executive accountability, and stakeholder rights.

- Internal Controls and Financial Oversight: Maintaining robust internal control systems to ensure accuracy and reliability of financial information, a requirement for public companies.

- Transparency and Reporting: Commitment to transparent reporting, including detailed financial statements and ESG (Environmental, Social, and Governance) disclosures, as seen in its 2023 annual and sustainability reports.

Caledonia Mining's operations are fundamentally shaped by Zimbabwe's mining and environmental legislation, including adherence to the Mines and Minerals Act for permits and licenses and stringent environmental regulations for water management and waste disposal, as highlighted in their 2024 ESG Report.

Labor laws are a significant consideration, with Zimbabwe's Labour Act dictating employment contracts, wages, and safety standards, all of which Caledonia must navigate to maintain a stable workforce.

The company's financial performance is directly influenced by Zimbabwe's tax and royalty framework, with gold royalty rates at 5% and corporate tax at 24% for mining companies as of early 2024.

As a dual-listed entity, Caledonia Mining adheres to strict corporate governance and disclosure requirements, including compliance with the Sarbanes-Oxley Act for its US listing, as detailed in its 2023 reports.

Environmental factors

Caledonia Mining's Blanket Mine operates in a semi-arid climate, making water scarcity a critical environmental factor. The company actively manages this by implementing rigorous water consumption controls and closely monitoring both usage and discharge quality. A key aspect of their strategy is recycling a significant portion of their water, demonstrating a dedication to resource efficiency.

The safe handling of mining waste, especially tailings, is a significant environmental consideration for Caledonia Mining. The company is actively working to align its waste management protocols with the Global Industry Standard for Tailings Management (GISTM), a key step in reducing potential environmental hazards from its operations.

This commitment to GISTM signifies a proactive approach to environmental stewardship, ensuring that Caledonia's tailings facilities meet rigorous international safety benchmarks. By adhering to these standards, the company aims to prevent environmental incidents and build trust with stakeholders.

Caledonia Mining is actively engaged in biodiversity and land rehabilitation efforts, aiming to significantly reduce its footprint on local ecosystems. The company's strategy includes robust environmental management plans focused on stabilizing areas impacted by its operations and enhancing soil quality.

These initiatives are crucial for long-term biodiversity conservation. For instance, Caledonia's Blanket Mine has implemented measures to reintroduce native vegetation, a key component of its ecosystem recovery strategy post-mining.

As of its 2024 reporting, Caledonia noted ongoing progress in its rehabilitation projects, which are integral to its environmental, social, and governance (ESG) commitments. These efforts are designed to ensure that land disturbed by mining activities can eventually support thriving natural habitats.

Energy Consumption and Greenhouse Gas Emissions

Reducing reliance on fossil fuels and lowering greenhouse gas emissions are critical environmental imperatives for businesses globally. Caledonia Mining has made a significant stride in this area with its investment in a solar plant. This solar facility is designed to supply 20% of the company's power requirements.

This strategic move directly tackles the environmental challenge of energy consumption. By generating a substantial portion of its electricity from solar power, Caledonia is actively reducing its dependence on diesel generators, which are a significant source of greenhouse gas emissions. This transition is a clear demonstration of the company's commitment to more sustainable energy practices and a lower carbon footprint.

- Solar plant supplies 20% of power needs.

- Reduces reliance on diesel generators.

- Contributes to lower greenhouse gas emissions.

- Enhances sustainable energy practices.

Climate Change Risks and Adaptation

Caledonia Mining has proactively assessed climate change risks, including extreme weather, water scarcity, and energy supply challenges affecting its Blanket Mine operations. This forward-thinking approach is crucial for sustainable long-term strategy and operational resilience in the face of evolving environmental conditions.

The company's adaptation strategies are designed to mitigate these identified risks, ensuring continuity and efficiency. For instance, understanding the potential for water stress in Zimbabwe, a region susceptible to drought, informs water management practices. Similarly, evaluating energy security helps in planning for reliable power sources, which is critical for uninterrupted mining activities.

Caledonia's commitment to climate risk management is demonstrated through specific initiatives. For example, in 2023, the company continued to invest in improving its energy efficiency and exploring options for more sustainable energy sources to reduce reliance on potentially volatile grid supplies. These efforts directly address the financial implications of climate-related disruptions.

- Climate Risk Assessment: Caledonia has undertaken detailed assessments of physical climate risks relevant to its Zimbabwean operations.

- Water Stress: Evaluating the impact of potential water shortages on mining processes and resource availability.

- Energy Security: Analyzing the risks associated with energy supply disruptions and exploring mitigation strategies.

- Adaptation Planning: Developing and implementing strategies to build resilience against identified climate-related threats.

Caledonia Mining addresses environmental factors through diligent water management, including recycling, and adherence to the Global Industry Standard for Tailings Management (GISTM) for waste safety. The company also prioritizes land rehabilitation and biodiversity efforts, with ongoing projects to reintroduce native vegetation. Furthermore, a 20% solar power initiative significantly reduces reliance on fossil fuels and lowers greenhouse gas emissions.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Caledonia Mining is built on data from official Zimbabwean government publications, international financial institutions like the IMF and World Bank, and respected mining industry reports. This ensures a comprehensive understanding of political stability, economic forecasts, and regulatory frameworks affecting the company.