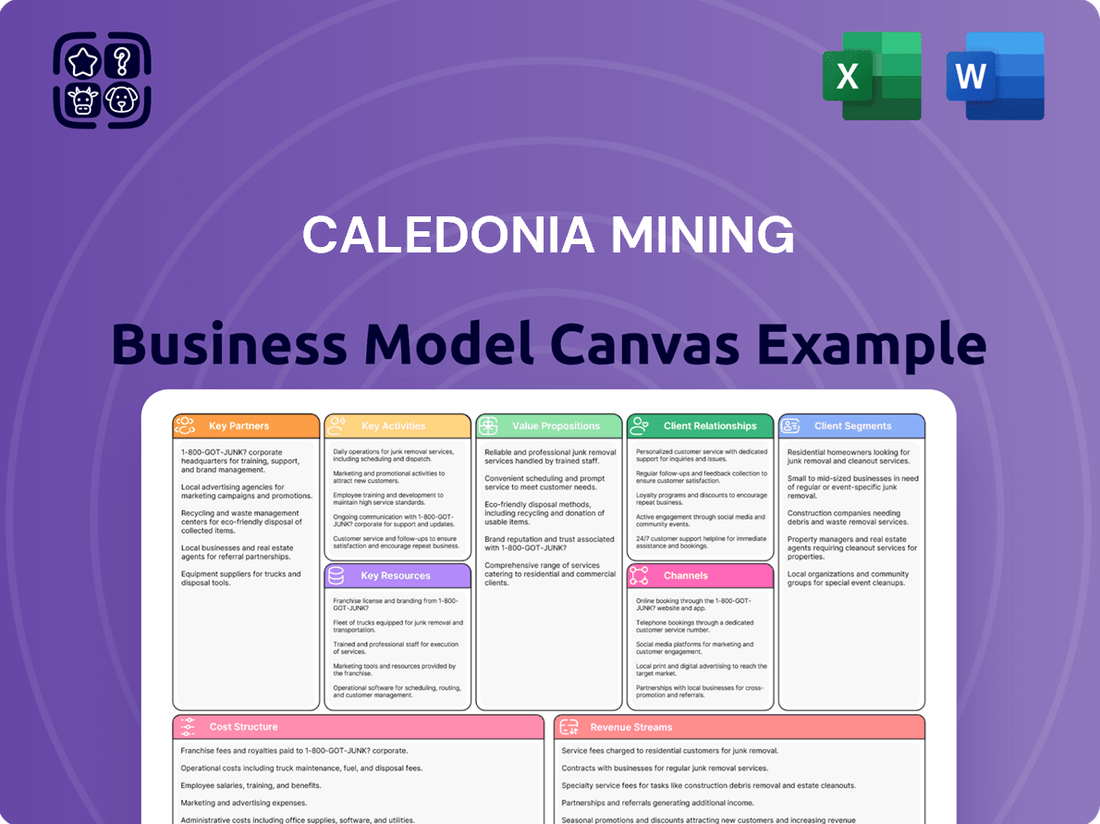

Caledonia Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Unlock the full strategic blueprint behind Caledonia Mining's business model. This in-depth Business Model Canvas reveals how the company drives value through its efficient Blanket Mine operations and captures market share in the gold mining sector. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a resilient mining operation.

Dive deeper into Caledonia Mining’s real-world strategy with the complete Business Model Canvas. From its unique value propositions centered on operational excellence to its cost structure driven by efficient processing, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in leveraging its existing infrastructure.

Want to see exactly how Caledonia Mining operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations by illustrating its key resources and revenue streams.

Gain exclusive access to the complete Business Model Canvas used to map out Caledonia Mining’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies by understanding its customer relationships and key partnerships.

Transform your research into actionable insight with the full Business Model Canvas for Caledonia Mining. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components, including its channels and cost drivers, in one place to understand its competitive edge.

Partnerships

Caledonia Mining Corporation plc maintains a vital partnership with the Zimbabwean government, specifically engaging with the Ministry of Mines and Mining Development. This collaboration is fundamental for securing and maintaining essential operating licenses and permits. Adherence to the country's mining legislation, including environmental and safety regulations, is paramount for the company’s continued legal and compliant operations.

Caledonia Mining actively cultivates relationships with local communities surrounding the Blanket Mine, recognizing this as fundamental to its social license to operate. By engaging directly, the company addresses community concerns and actively contributes to local development initiatives. For instance, Caledonia has supported projects like solar energy installations for schools and clinics, aiming to improve essential services in the region.

Prioritizing local procurement is a cornerstone of Caledonia's strategy to foster economic growth within the surrounding areas. This approach not only supports regional businesses but also creates employment opportunities and strengthens the local economy. For example, in 2023, Caledonia reported that approximately 75% of its procurement spend was with local Zimbabwean suppliers, underscoring its commitment to community economic upliftment.

Caledonia Mining Corporation plc relies heavily on its partnerships with financial institutions and investors to fuel its growth and operations. These relationships are crucial for securing the necessary capital for exploration, development, and expansion projects. Banks provide essential credit facilities and working capital, while investment firms and brokers are key to facilitating stock exchange listings and managing the company's financial activities.

The company actively cultivates relationships with major stock exchanges, including its listing on the NYSE American and the AIM market of the London Stock Exchange. These listings are vital for attracting a broad base of investors and ensuring liquidity for its shares. For instance, in 2024, Caledonia continued to leverage these exchanges to access capital markets, aiming to support its strategic objectives.

Furthermore, Caledonia engages with financial advisors to orchestrate investor presentations and capital raises. These advisors play a critical role in communicating the company's value proposition to potential investors and ensuring successful fundraising rounds. As of early 2024, the company was actively pursuing further investment to advance its Blanket Mine expansion and exploration initiatives, underscoring the ongoing importance of these financial partnerships.

Suppliers and Service Providers

Caledonia Mining’s operational success hinges on strong relationships with its suppliers and service providers, a critical element of its business model. These partnerships are fundamental for acquiring and maintaining the necessary mining machinery, advanced technology, and essential services that keep operations running smoothly and efficiently. For instance, collaborations with equipment manufacturers ensure access to state-of-the-art machinery, while partnerships with energy solution providers, particularly in solar power, are vital for cost-effective and sustainable operations.

The company actively engages with a diverse range of service providers, including those offering IT infrastructure support, crucial for data management and operational oversight. These relationships are not just about procurement; they are about fostering innovation and ensuring Caledonia Mining remains at the forefront of mining technology and efficiency. In 2024, Caledonia Mining continued its focus on optimizing its supply chain and service provider network to enhance operational resilience and reduce costs.

Key aspects of these partnerships include:

- Equipment Manufacturers: Ensuring access to reliable and advanced mining machinery for extraction and processing.

- Technology Providers: Integrating new technologies for improved efficiency, safety, and data analytics.

- Energy Solutions Providers: Particularly those specializing in renewable energy like solar, to lower operational costs and environmental impact.

- Logistics and Maintenance Services: Critical for timely delivery of supplies and upkeep of machinery.

Exploration and Development Partners

Caledonia Mining Corporation Plc actively pursues strategic alliances with other mining entities and specialized exploration companies to fuel its expansion. These partnerships often take the form of joint ventures or earn-in agreements, particularly for new project acquisitions. This collaborative approach is crucial for sharing both the substantial capital investment required and the specialized technical expertise needed to successfully evaluate and develop promising gold deposits across southern Africa. For instance, the Maligreen project exemplifies this strategy, showcasing how Caledonia leverages external partnerships to unlock new resource potential.

These collaborations are vital for de-risking exploration and development activities. By sharing the financial burden and combining diverse technical capabilities, Caledonia can more effectively identify and advance a broader pipeline of potential gold-bearing assets. This diversification of risk and reward is a cornerstone of their growth strategy, allowing for greater operational flexibility and access to a wider range of geological opportunities. In 2024, the company continued to explore such avenues, aiming to solidify its position in key mining regions.

The benefits extend beyond financial and technical sharing. These partnerships can also provide access to established infrastructure, logistical networks, and critical local knowledge, which are invaluable in the complex operating environments of southern Africa. Such integrated support systems can significantly accelerate project timelines and improve the overall efficiency of resource development. Caledonia’s ongoing engagement with potential partners underscores its commitment to a growth-oriented, collaborative business model.

- Joint Ventures: Caledonia partners with established mining and exploration firms, sharing capital and expertise to develop new gold projects.

- Earn-in Agreements: These arrangements allow Caledonia to gain stakes in promising projects by meeting specific development milestones, often in partnership.

- Risk Mitigation: Collaborations help spread the financial and operational risks associated with exploration and development in challenging regions.

- Expertise Sharing: Access to specialized geological, engineering, and operational knowledge from partners enhances project success rates.

Caledonia Mining's key partnerships are crucial for operational continuity and strategic expansion. These include strong ties with the Zimbabwean government for licenses, local communities for social license, and financial institutions for capital access. Collaborations with equipment and technology providers ensure operational efficiency, while strategic alliances with other mining firms de-risk exploration and development. For instance, in 2023, approximately 75% of Caledonia's procurement spend was with local Zimbabwean suppliers, demonstrating a commitment to community economic upliftment.

What is included in the product

This Business Model Canvas provides a strategic overview of Caledonia Mining's operations, detailing its value proposition, customer segments, and key resources focused on gold extraction and sales.

It outlines the company's revenue streams, cost structure, and partnerships necessary for sustainable mining and growth in its target markets.

Caledonia Mining's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operational strategy, simplifying complex information for stakeholders.

It addresses the pain of information overload by condensing Caledonia Mining's intricate gold mining operations and value proposition into an easily digestible and shareable format.

Activities

Caledonia Mining's core activities revolve around aggressively exploring for new gold deposits and meticulously delineating its existing mineral resource base. This commitment to growth is evident in its ongoing exploration efforts at the Blanket Mine, a key operational asset, and the promising Motapa project.

Furthermore, Caledonia is diligently advancing feasibility studies for significant projects like Bilboes. This strategic focus on resource expansion and development is fundamental to its overarching multi-asset growth strategy, aiming to secure future production and shareholder value.

Caledonia Mining's business model hinges on the ongoing development and expansion of its mining infrastructure, a capital-intensive endeavor. This includes crucial activities like sinking new shafts, excavating tunnels, and upgrading processing plants to boost efficiency and output.

A prime example is Caledonia's significant investment in the Blanket Mine's Central Shaft project. This strategic development aimed to virtually double the mine's production capacity and substantially extend its operational lifespan, underscoring the importance of infrastructure for long-term viability.

Caledonia Mining's central operations revolve around extracting gold ore from its Blanket Mine. This involves the physical removal of ore from underground deposits. This raw material then undergoes a series of crucial physical and chemical transformations to yield a valuable product.

Following extraction, the gold ore is subjected to crushing and milling processes. These steps break down the larger ore particles into finer sizes, increasing the surface area. This preparation is vital for the subsequent stages of gold recovery, making the valuable metal more accessible.

The processed ore then enters the metallurgical plant for further treatment to extract the gold. This typically involves chemical processes designed to separate the gold from the surrounding rock. The end product of this stage is gold doré, a semi-pure form of gold.

The Blanket Mine showcased strong operational performance in 2024, successfully meeting its production targets. It yielded 76,656 ounces of gold during the year. This consistent output highlights the effectiveness of Caledonia Mining's extraction and processing activities.

Sales, Marketing, and Distribution

Caledonia Mining's sales, marketing, and distribution activities are centered on selling its produced gold doré to international refiners and bullion dealers. This process requires meticulous management of sales agreements, ensuring secure and efficient logistics for transporting the precious metal, and strict adherence to global trade regulations governing precious metals. For instance, in 2023, Caledonia Mining achieved a significant milestone by increasing its gold production, with a substantial portion of this output being prepared for sale into the international market, reflecting the company's commitment to expanding its reach and sales channels.

The company focuses on building strong relationships with key buyers in the global precious metals market. These relationships are crucial for securing favorable sales terms and ensuring consistent demand for its gold doré. Effective marketing efforts highlight the quality and provenance of Caledonia's gold, differentiating it in a competitive international landscape. Distribution involves coordinating with specialized logistics providers to guarantee the safe and insured transit of gold from the mine site to international refining facilities.

- International Sales: Gold doré is sold to refiners and bullion dealers on the international market.

- Contract Management: Sales contracts are managed to ensure timely delivery and payment.

- Logistics and Security: Secure transportation is arranged, adhering to stringent security protocols for precious metals.

- Regulatory Compliance: Operations comply with international trade regulations for precious metals.

Corporate Governance and Compliance

Caledonia Mining Corporation PLC's key activities include maintaining strong corporate governance, which is fundamental to its operations. This involves rigorous adherence to the listing rules of both the NYSE American and the AIM markets. For instance, in 2024, the company continued to focus on transparent financial reporting and robust ESG (Environmental, Social, and Governance) disclosures, aligning with evolving investor expectations and regulatory requirements.

Compliance with Zimbabwean mining and environmental laws is another critical activity. This ensures the company operates legally and responsibly within its primary operating jurisdiction. The company's commitment extends to implementing and upholding ethical business practices across all facets of its business, from exploration to production and community engagement.

- Maintaining robust corporate governance Adherence to international best practices and regulatory requirements.

- Adhering to listing rules Compliance with NYSE American and AIM exchange regulations.

- Complying with Zimbabwean laws Following mining, environmental, and labor legislation in Zimbabwe.

- Ensuring ethical business practices Implementing and upholding integrity across all operations and stakeholder interactions.

Key activities encompass the exploration and delineation of gold deposits, exemplified by ongoing work at Blanket Mine and the Motapa project. Furthermore, Caledonia is advancing feasibility studies for significant projects like Bilboes, underscoring its multi-asset growth strategy.

Core operations involve the extraction and processing of gold ore, transforming it into gold doré. The Blanket Mine demonstrated strong performance in 2024, producing 76,656 ounces of gold, highlighting the effectiveness of these processes.

Sales and distribution involve selling gold doré to international refiners and bullion dealers, managing sales contracts, and ensuring secure logistics and regulatory compliance.

Maintaining robust corporate governance, adhering to listing rules (NYSE American, AIM), complying with Zimbabwean laws, and upholding ethical business practices are also critical activities.

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas preview you're seeing is the actual document you will receive upon purchase. This means all the key components, such as value propositions, customer segments, revenue streams, and cost structures for Caledonia Mining, are presented exactly as they will be in the final file. You're getting a direct look at the comprehensive analysis that will be yours to use immediately.

Resources

Caledonia Mining's core asset comprises its gold mineral reserves and resources, primarily located at the Blanket Mine in Zimbabwe. As of the end of 2023, Blanket Mine's reserves were estimated to support an extended mine life to 2034, with approximately 360,000 ounces of gold reserves. This makes it a cornerstone of Caledonia's operational strategy.

Beyond Blanket, Caledonia holds substantial resources at its other key projects. The Bilboes project, for instance, boasted a significant resource base as of late 2023, with measured and indicated resources totaling around 5.1 million tonnes at 2.3 grams per tonne of gold, yielding approximately 378,000 ounces. This diversification strengthens the company's long-term potential.

The Motapa and Maligreen projects further contribute to Caledonia's resource portfolio. Motapa, in particular, showed promising exploration results in 2023, with initial resource estimates indicating a substantial gold deposit. These projects represent future growth opportunities and are crucial for expanding the company's overall mineral asset base.

Caledonia Mining's Blanket Mine relies heavily on its underground mining infrastructure, most notably the Central Shaft, which is vital for hoisting ore to the surface. This physical asset, alongside the processing plant and a fleet of heavy machinery and vehicles, forms the backbone of their gold extraction operations.

The efficiency of these assets directly impacts Caledonia's ability to extract, mill, and recover gold. In 2024, the company continued its focus on maintaining and optimizing these critical components to ensure consistent production levels and cost-effectiveness.

These tangible resources are the primary drivers of Caledonia's operational capacity. The ongoing investment in and upkeep of this infrastructure are essential for meeting production targets and achieving their strategic goals in the gold mining sector.

Caledonia Mining's operations heavily rely on a skilled workforce comprising geologists, mining engineers, metallurgists, and experienced mine operators. This expertise is crucial for ensuring both the safety and efficiency of its mining activities.

The company's management team is instrumental in charting the strategic direction and providing vital operational oversight across its various projects. Their experience guides Caledonia's path through the complexities of the mining sector.

In 2024, Caledonia reported that its Blanket Mine had achieved a significant milestone by producing 75,101 ounces of gold in the first nine months of the year, underscoring the effectiveness of its skilled teams in driving production targets.

Capital and Financial Reserves

Caledonia Mining's access to capital, including its cash reserves and available credit facilities, is a cornerstone of its business model. This financial strength directly fuels ongoing operations, essential capital expenditures, and ambitious exploration initiatives. For example, as of the first quarter of 2024, Caledonia reported a robust cash balance, providing a solid foundation for its strategic growth plans.

The company's operating cash flow is a key driver for its investment pipeline, particularly for projects slated for 2025. This consistent generation of cash allows Caledonia to self-fund a significant portion of its development activities, reducing reliance on external financing and enhancing financial flexibility. The company's management has consistently highlighted its commitment to maintaining a healthy liquidity position to support its expansion.

- Access to Capital: Caledonia leverages its healthy cash reserves and lines of credit to fund operations, capital expenditures, and exploration.

- 2024 Financial Strength: The company's financial position was strengthened in early 2024, providing the necessary resources for planned investments.

- Operating Cash Flow Support: Consistent operating cash flow generation directly supports Caledonia's investment plans, particularly those extending into 2025.

- Investment Funding: These financial resources are critical for advancing projects like the Blanket Mine's ongoing development and potential future acquisitions.

Licenses, Permits, and Intellectual Property

Caledonia Mining Corporation's ability to operate hinges on its possession of crucial licenses and permits. These include valid mining licenses, such as the one for the Blanket Mine, which is central to its operations, and necessary environmental permits that allow for responsible resource extraction. These legal authorizations are fundamental to the company’s ongoing activities and regulatory compliance.

Beyond legal permissions, Caledonia Mining also leverages proprietary mining techniques and valuable geological data as key intangible resources. These technical assets provide a significant competitive edge, enabling more efficient and effective extraction processes. Protecting this intellectual property is vital for maintaining their market position and ensuring long-term profitability.

- Mining Licenses: Caledonia Mining holds the primary license for the Blanket Mine, a key asset underpinning its revenue generation.

- Environmental Permits: Compliance with environmental regulations is secured through various permits, enabling sustainable mining practices.

- Proprietary Techniques: The company benefits from specialized knowledge in underground mining operations, enhancing efficiency.

- Geological Data: Exclusive access to detailed geological surveys and data for its concessions provides critical operational insights.

Caledonia Mining's core strength lies in its substantial gold mineral reserves and resources, particularly at the Blanket Mine in Zimbabwe, which had an estimated life of mine to 2034 with approximately 360,000 ounces of gold reserves at the end of 2023. The Bilboes project, as of late 2023, added around 378,000 ounces to its resource base, while the Motapa and Maligreen projects represent significant future growth avenues with promising exploration results in 2023.

Operational capacity is built upon the Blanket Mine's critical underground infrastructure, including the Central Shaft for ore hoisting, the processing plant, and essential mining machinery. These tangible assets are fundamental to Caledonia's gold extraction efficiency, with ongoing efforts in 2024 focused on their maintenance and optimization to ensure consistent production and cost-effectiveness.

The company's human capital, comprising skilled geologists, engineers, metallurgists, and operators, is vital for safe and efficient mining. Management's strategic guidance is equally crucial. In the first nine months of 2024, Blanket Mine produced 75,101 ounces of gold, demonstrating the effectiveness of these human resources in meeting production targets.

Caledonia's financial health, evidenced by its robust cash reserves and credit facilities, underpins its operations, capital expenditures, and exploration. A strong cash balance in early 2024 provided a solid foundation for growth, with operating cash flow consistently supporting its investment pipeline extending into 2025, reducing reliance on external financing.

Crucial licenses and permits, including mining and environmental permits for the Blanket Mine, are fundamental to Caledonia's operations and regulatory compliance. Furthermore, proprietary mining techniques and exclusive geological data for its concessions provide a significant competitive advantage, enhancing operational efficiency and profitability.

| Resource/Asset | Location | Status/Details | Key Metric | Date Reference |

|---|---|---|---|---|

| Gold Mineral Reserves | Blanket Mine, Zimbabwe | Estimated life of mine to 2034 | ~360,000 ounces | End of 2023 |

| Gold Mineral Resources | Bilboes Project, Zimbabwe | Measured & Indicated Resources | ~378,000 ounces (5.1M tonnes @ 2.3 g/t Au) | Late 2023 |

| Underground Mining Infrastructure | Blanket Mine, Zimbabwe | Includes Central Shaft, processing plant, machinery | Essential for ore hoisting and processing | Ongoing (2024 focus) |

| Skilled Workforce | Across all projects | Geologists, engineers, metallurgists, operators | Crucial for safety and efficiency | Ongoing (e.g., 75,101 oz gold production Jan-Sep 2024 at Blanket) |

| Cash Reserves & Credit Facilities | Corporate | Financial strength for operations and investment | Robust balance in Q1 2024 | First Quarter 2024 |

| Mining Licenses | Blanket Mine, Zimbabwe | Primary operational authorization | Valid mining license | Current |

Value Propositions

Caledonia Mining offers investors a reliably consistent source of gold production. The Blanket Mine, a key asset, has a track record of meeting or exceeding its operational guidance. For instance, in 2024, the mine delivered strong operational results, and this positive momentum has carried into the early part of 2025, providing a stable foundation for predictable shareholder returns.

Caledonia's multi-asset approach in Zimbabwe fuels significant growth prospects. By developing projects like Bilboes and exploring at Motapa, the company is actively expanding its operational footprint beyond the established Blanket Mine. This diversification is key to increasing overall gold production and de-risking its revenue streams.

The company's strategic focus on multi-asset development is projected to substantially boost its gold output. For instance, the Bilboes project, acquired in 2022, is anticipated to contribute significantly to Caledonia's production profile once fully operational. This expansion is a core driver for achieving higher overall volumes and enhancing financial performance.

Caledonia's commitment to a multi-asset strategy in Zimbabwe is designed to unlock considerable growth. The ongoing exploration at Motapa, for example, aims to identify and develop new gold resources, further broadening the company's asset base. This proactive exploration and development pipeline is crucial for long-term value creation.

Caledonia Mining is focused on delivering robust financial performance, directly translating into enhanced shareholder value. This commitment is demonstrated through a strategy aimed at boosting gross profit and operating cash flow, underpinning the company's ability to reward its investors.

A cornerstone of Caledonia's shareholder return strategy is its consistent quarterly dividend policy. This provides a predictable income stream for investors, reflecting the company's confidence in its ongoing profitability and operational stability.

In 2024, Caledonia Mining reported a significant net attributable profit of $17.9 million. This financial achievement underscores the company's operational efficiency and its success in generating earnings that can be reinvested or distributed to shareholders.

Responsible Mining and ESG Commitment

Caledonia Mining is deeply committed to responsible mining and robust ESG principles. This dedication is crucial for attracting socially conscious investors and securing the company's long-term operational health. The company actively assesses climate change risks and prioritizes energy efficiency across its operations.

Community development is a cornerstone of Caledonia's approach, fostering positive relationships and contributing to local well-being. These initiatives are not just ethical imperatives but also strategic advantages in today's investment landscape.

- ESG Focus: Caledonia's commitment to Environmental, Social, and Governance standards appeals to a growing segment of investors seeking sustainable and ethical investments.

- Climate Risk Management: Proactive assessment of climate change impacts ensures operational resilience and adaptability.

- Energy Efficiency Initiatives: Driving down energy consumption not only reduces environmental impact but also lowers operational costs, a key financial benefit. For instance, in 2024, the company continued its focus on optimizing power usage at its Blanket Mine.

- Community Development Programs: Investment in local communities builds social license to operate and contributes to regional stability, which directly supports sustained operations.

Cost Efficiency and Optimized Operations

Caledonia Mining is committed to driving down costs through operational modernization. By investing in efficiency improvements, they aim to lower on-mine costs and all-in sustaining costs per ounce. This focus on optimization directly enhances profitability.

Key initiatives include energy-saving measures, which are crucial for reducing operational expenses in the mining sector. Improved mining flexibility also plays a significant role in cost reduction.

- Reduced Cost Per Ounce: Caledonia's efforts in 2024 aim to significantly lower their all-in sustaining costs, making their gold production more competitive.

- Energy Efficiency Investments: The company is actively investing in technologies and practices to reduce energy consumption, a major cost driver in mining.

- Operational Flexibility: Enhancements in mining methods allow for greater adaptability, leading to more efficient resource extraction and cost savings.

- Enhanced Profitability: These combined cost-efficiency measures directly contribute to improved financial performance and shareholder value.

Caledonia Mining offers a compelling investment proposition through its consistent gold production and a clear strategy for expansion. The company's flagship Blanket Mine reliably meets operational targets, as seen in its strong 2024 performance, providing a stable base for dividends.

The company's strategic expansion in Zimbabwe, including projects like Bilboes and Motapa, is designed to significantly increase gold output. This multi-asset approach diversifies revenue and enhances long-term growth potential.

Caledonia is committed to delivering robust financial results, focusing on increasing gross profit and operating cash flow. This operational efficiency directly translates into enhanced shareholder value through a consistent dividend policy.

A strong emphasis on ESG principles underpins Caledonia's operations, attracting socially conscious investors and ensuring long-term sustainability. This includes proactive climate risk management and community development initiatives.

| Value Proposition | Description | Key Data/Fact |

|---|---|---|

| Reliable Gold Production | Consistent output from established mines provides predictable revenue. | Blanket Mine met or exceeded operational guidance in 2024. |

| Growth Through Expansion | Developing new projects diversifies assets and increases production volume. | Bilboes and Motapa projects are key to future output growth. |

| Shareholder Returns | Focus on operational efficiency and profitability to deliver consistent dividends. | Net attributable profit of $17.9 million in 2024. |

| ESG Commitment | Adherence to strong Environmental, Social, and Governance standards. | Active focus on energy efficiency and community development. |

Customer Relationships

Caledonia Mining Corporation PLC prioritizes robust investor relations, engaging with both institutional and retail shareholders through a consistent flow of information. This includes quarterly and annual financial reports, detailed investor presentations, and direct communication channels to ensure transparency.

In 2024, Caledonia continued its commitment to proactive engagement, with management actively participating in investor conferences and roadshows to discuss operational updates and strategic initiatives. For instance, the company's July 2024 investor update highlighted continued progress at Blanket Mine, reinforcing its commitment to delivering value.

This approach fosters a high degree of trust and provides stakeholders with timely, accurate insights into the company's performance, operational progress, and future strategy. Such open communication is crucial for maintaining investor confidence and supporting the company's valuation.

Caledonia Mining Corporation maintains direct sales relationships with gold refiners and bullion dealers, a crucial element of its business model. These interactions are primarily transactional, emphasizing the efficient and secure transfer of gold doré, the unrefined gold produced at its Blanket Mine in Zimbabwe.

These partnerships are typically solidified through long-term, high-volume contracts. Such agreements are vital for ensuring consistent revenue streams and are underpinned by adherence to established industry standards for gold purity and pricing mechanisms, providing predictability for both Caledonia and its clients.

For instance, Caledonia's production of approximately 78,000 ounces of gold in 2023 directly feeds into these relationships. The company's strategy relies on these established channels to convert its mined output into marketable product, underscoring the importance of robust relationships with key industry participants.

Caledonia Mining Corporation's relationship with the Zimbabwean government and its various regulatory bodies is crucial for its operations. This engagement primarily revolves around ensuring strict compliance with all mining laws and regulations. For instance, in 2024, Caledonia continued its focus on maintaining its mining licenses and permits, which are essential for its Blanket Mine operations.

Formal channels are utilized for all interactions, including discussions on mining policy and potential legislative changes. This proactive approach helps Caledonia navigate the regulatory landscape and fosters a stable operating environment. The company actively participates in dialogues concerning the future of mining in Zimbabwe, aiming to align its strategies with national economic development goals.

This structured engagement ensures that Caledonia remains a compliant and contributing entity within Zimbabwe's mining sector. By adhering to licensing requirements and participating in policy discussions, the company mitigates risks associated with regulatory shifts. In 2023, Caledonia reported significant progress in its engagement with the Ministry of Mines and Mining Development regarding various operational aspects.

Community Engagement and Social Dialogue

Caledonia Mining's approach to community relations centers on open dialogue and a commitment to shared value. This means actively engaging with local populations to foster understanding and collaboration. For instance, in 2024, the company continued its investment in community development programs, focusing on areas like education and healthcare, which are crucial for building trust and ensuring long-term social acceptance.

These initiatives are designed to directly benefit the communities where Caledonia operates, reinforcing the company's role as a responsible corporate citizen. By creating tangible shared value, Caledonia aims to solidify its social license to operate, which is essential for mitigating operational risks and maintaining a stable environment for its mining activities.

Key aspects of this relationship management include:

- Dialogue and Transparency: Maintaining open channels of communication with community leaders and residents.

- Shared Value Creation: Implementing programs that offer direct economic and social benefits, such as job creation and infrastructure improvements.

- Community Investment: Allocating resources to specific projects that address local needs and priorities, as demonstrated by ongoing investments in 2024.

- Risk Management: Proactively addressing social concerns to prevent potential disruptions and build a strong foundation of community support.

Supplier and Partner Management

Caledonia Mining Corporation Plc manages its supplier and partner relationships through formal agreements, emphasizing performance metrics and joint issue resolution. This structured approach is crucial for securing a consistent flow of vital mining inputs, including machinery, materials, and expert technical support.

These relationships are foundational to operational efficiency and risk mitigation. For instance, in 2024, Caledonia continued its focus on strengthening ties with key equipment providers and service companies to ensure the reliability of its Blanket Mine operations.

- Supplier Contracts: Formal agreements detail terms, delivery schedules, and quality standards for consumables and capital equipment.

- Performance Monitoring: Key Performance Indicators (KPIs) are tracked to ensure suppliers meet contractual obligations, impacting operational uptime.

- Collaborative Problem-Solving: Joint efforts with strategic partners address logistical challenges and technical requirements, fostering mutual growth.

- Risk Mitigation: Diversifying the supplier base and building strong partnerships helps mitigate supply chain disruptions, a critical factor in mining.

Caledonia Mining’s customer relationships are primarily with gold refiners and bullion dealers, built on direct, transactional sales of gold doré. These partnerships are reinforced by high-volume contracts that ensure stable revenue, with pricing and purity adhering to industry standards.

| Customer Type | Relationship Type | Key Aspects | 2023 Output Relevance |

|---|---|---|---|

| Gold Refiners & Bullion Dealers | Direct, Transactional | High-volume contracts, adherence to purity and pricing standards | Approx. 78,000 ounces of gold doré sold |

Channels

Caledonia Mining Corporation Plc's shares are primarily traded on the NYSE American under the ticker symbol CMCL, the AIM market of the London Stock Exchange (LSE) as CMCL, and the Victoria Falls Stock Exchange (VFEX) in Zimbabwe as VFV. These listings serve as the crucial conduits for investors to buy and sell Caledonia's stock, directly impacting its market capitalization and liquidity.

The NYSE American and AIM listings provide Caledonia with access to a broad base of international investors and financial institutions, enhancing its global visibility and investment appeal. As of early 2024, the mining sector on AIM, for instance, continues to be a significant hub for junior and mid-tier resource companies, offering a platform for growth-oriented businesses.

The VFEX listing is particularly noteworthy as it aims to attract foreign investment into Zimbabwe's burgeoning mining sector, offering potential tax incentives and a more streamlined regulatory environment. This dual listing strategy positions Caledonia to leverage diverse capital markets, supporting its operational expansion and strategic objectives, especially as the VFEX aims to become a leading frontier market exchange.

Caledonia's official website acts as the primary digital gateway, offering a wealth of information including financial reports, crucial news updates, and detailed investor presentations. This platform ensures direct and transparent access to comprehensive company data for everyone from individual shareholders to institutional investors.

Beyond general information, the dedicated investor portal within the website is meticulously designed to cater to the specific needs of financial stakeholders. It provides easy navigation to historical performance data, annual reports, and sustainability disclosures, facilitating thorough due diligence.

In 2024, Caledonia Mining continued to leverage its website as a key communication channel, with investor relations sections frequently updated with market-sensitive information and operational highlights. For instance, updates regarding the Blanket Mine's production figures and expansion projects are readily available, offering real-time insights.

This digital presence is vital for building trust and providing consistent, accessible information, supporting Caledonia's commitment to transparency and good corporate governance. The site’s accessibility is crucial for a global investor base seeking to understand the company's strategic direction and financial health.

Caledonia Mining Corporation's business model leverages financial media and news outlets to broadcast key information. In 2024, the company continued to issue press releases detailing operational updates and financial results, aiming to inform a diverse investor base. These outlets serve as a crucial channel for disseminating news about their flagship Blanket Mine in Zimbabwe, ensuring market awareness of their performance and strategic direction.

Investor Presentations and Conferences

Caledonia Mining Corporation Plc actively engages with the investment community through dedicated investor presentations and participation in key industry conferences. These platforms are crucial for transparently sharing operational updates, financial performance, and strategic outlooks directly with analysts and potential investors.

In 2024, Caledonia continued its robust engagement strategy. For instance, the company hosted several conference calls throughout the year, providing real-time updates on production figures, exploration successes, and the ongoing Blanket mine expansion project. These calls often included detailed question-and-answer sessions, allowing for direct clarification of investor queries.

Participation in major mining and investment conferences offers Caledonia a broader reach. These events are invaluable for fostering relationships and showcasing the company's value proposition to a wider audience of financial professionals. For example, at the 2024 Mines and Money London conference, Caledonia’s management team highlighted its significant progress in increasing gold production and its commitment to sustainable mining practices.

- Direct Communication: Investor presentations and conference calls facilitate direct dialogue with analysts and investors, ensuring clear dissemination of company information.

- Transparency: These channels provide an avenue for in-depth discussions on operational performance, financial results, and future strategies, fostering investor confidence.

- Industry Visibility: Participation in industry conferences enhances Caledonia's profile and offers networking opportunities with a diverse range of stakeholders.

- Q&A Opportunities: Structured question-and-answer sessions during these events allow for immediate clarification of complex issues and investor concerns.

Direct Sales Network (for Gold)

Caledonia Mining Corporation utilizes a direct sales network for its gold, primarily engaging with established gold refiners and bullion dealers. This business-to-business channel streamlines the process of selling its produced gold, ensuring both efficiency and security in each transaction.

This direct approach allows Caledonia to maintain closer relationships with its buyers, potentially leading to more favorable pricing and consistent demand. For instance, in 2024, Caledonia reported that its Blanket Mine in Zimbabwe, its flagship operation, continued to be a significant contributor to its gold output, with production figures closely watched by its direct sales network partners.

- Direct Sales Network Focus: Caledonia targets established gold refiners and bullion dealers.

- B2B Transactions: This channel facilitates business-to-business sales, ensuring secure and efficient gold transfers.

- Relationship Building: Direct engagement fosters stronger partnerships with key market players.

- Market Responsiveness: This network allows for quicker feedback on market conditions and demand.

Caledonia Mining's channels primarily consist of its stock exchange listings (NYSE American, LSE AIM, and VFEX) for investor access, its official website for comprehensive company data, and financial media for broader news dissemination. Direct engagement through investor presentations and industry conferences allows for crucial dialogue with stakeholders.

The company also utilizes a direct sales network for its gold, primarily engaging with gold refiners and bullion dealers, ensuring efficient and secure transactions. These channels collectively support Caledonia's market presence and investor relations efforts, particularly highlighting operations like the Blanket Mine.

In 2024, Caledonia Mining continued to emphasize its digital presence through its website, providing timely updates on operational performance and financial results. The VFEX listing remained a key channel for attracting foreign investment into Zimbabwe's mining sector.

Caledonia's engagement in 2024 included participation in conferences like Mines and Money London, where management discussed production increases and sustainable practices. Direct sales partners, such as gold refiners, rely on consistent production data from mines like Blanket.

Caledonia Mining's 2024 performance highlights the importance of its multi-faceted channel strategy:

| Channel | Key Function | 2024 Relevance | Example Metric |

|---|---|---|---|

| Stock Exchanges (NYSE, LSE, VFEX) | Investor access and liquidity | Facilitated trading and market valuation | CMCL share price fluctuations |

| Official Website | Information dissemination | Provided financial reports, news, and investor presentations | Website traffic to investor relations section |

| Financial Media | News broadcasting | Disseminated operational updates and financial results | Press release pickups |

| Investor Presentations/Conferences | Direct stakeholder engagement | Facilitated dialogue on production, strategy, and ESG | Attendance at conference calls and industry events |

| Direct Sales Network | Gold sales | Ensured efficient transactions with refiners and dealers | Volume of gold sold to refiners |

Customer Segments

Institutional investors, such as large investment funds and asset managers, represent a key customer segment for Caledonia Mining. These sophisticated investors are actively seeking opportunities within the gold mining sector, particularly those offering growth potential in emerging markets. For instance, as of early 2024, many pension funds and sovereign wealth funds have maintained or increased their allocations to commodities, including gold, as a hedge against inflation and geopolitical uncertainty.

These institutions are primarily driven by long-term value creation, robust financial performance, and strong corporate governance. They meticulously analyze a company's production levels, cost structures, and reserve life. Caledonia Mining's consistent production growth, exemplified by its Blanket Mine operations, which achieved record underground ore throughput in the first quarter of 2024, appeals to this segment's focus on operational efficiency and financial stability.

Retail investors are individuals who buy shares on stock exchanges, often drawn to Caledonia Mining by its dividend payouts and the prospect of their investment growing in value. In 2024, Caledonia Mining continued to offer a consistent dividend, a key attraction for this segment seeking regular income from their holdings.

These investors typically gather information through readily available channels like financial news outlets, the company's official website, and the platforms provided by their stockbrokers, allowing them to stay informed about the company's performance and market sentiment.

Gold refiners and bullion dealers are Caledonia Mining's primary direct customers, seeking a consistent and reliable supply of gold doré. These businesses, such as Valcambi or Metalor, are critical for Caledonia as they purchase the unrefined gold for further processing into investment-grade bars and other gold products. For 2024, Caledonia's production targets are key, with the company often reporting its quarterly output, for instance, exceeding 15,000 ounces in Q1 2024.

Financial Analysts and Advisors

Financial analysts and advisors are key stakeholders who scrutinize Caledonia Mining’s performance to inform investment decisions for their clients. They need granular data to assess the company’s financial stability and future prospects. For instance, in 2024, analysts would be keenly interested in Caledonia’s gold production figures, cost per ounce, and any updates on its expansion projects, such as the Blanket Mine’s Central Block project. This segment relies on timely and transparent reporting to conduct their due diligence.

These professionals require:

- Detailed financial statements and quarterly earnings reports.

- Production statistics, including gold ounces produced and grade.

- Management commentary on operational challenges and strategic initiatives.

- Information on capital expenditures and exploration results.

Local Zimbabwean Economy and Workforce

The local Zimbabwean economy and workforce are crucial indirect stakeholders. Caledonia Mining’s operations provide significant employment opportunities, directly contributing to livelihoods and skills development within the region. In 2023, the company reported employing approximately 1,600 people, a substantial number within the Zimbabwean context.

Beyond direct employment, Caledonia’s commitment to local procurement channels a considerable portion of its operational spending back into the Zimbabwean economy. This supports local businesses and suppliers, fostering broader economic activity. For instance, the company actively sources goods and services from Zimbabwean entities, reinforcing its integration within the national economic fabric.

Community development initiatives are also a cornerstone of Caledonia’s engagement with this segment. These programs, focusing on areas like education, health, and infrastructure, enhance the quality of life for local residents. Such investments are vital for maintaining Caledonia's social license to operate and ensuring long-term operational stability and acceptance.

- Employment: Caledonia Mining directly employs a significant portion of the local workforce, contributing to economic stability.

- Local Procurement: The company prioritizes sourcing goods and services from Zimbabwean businesses, stimulating local economic growth.

- Community Development: Investments in education, health, and infrastructure benefit the local population and strengthen community relations.

- Social License: Positive engagement with the local economy and workforce is essential for Caledonia's operational continuity and reputation.

Caledonia Mining’s customer segments are diverse, ranging from large institutional investors seeking exposure to the gold mining sector to individual retail investors drawn by dividends. Additionally, gold refiners are crucial direct buyers of the company's gold doré, while financial analysts and advisors act as intermediaries, influencing investment decisions for their clients.

These segments are united by their need for reliable performance data, transparent reporting, and consistent operational execution. Caledonia’s ability to meet production targets, manage costs effectively, and maintain a stable dividend payout directly impacts its attractiveness to these various groups.

The company's engagement with the local Zimbabwean economy and workforce also forms a critical stakeholder group, influenced by employment numbers, local procurement practices, and community development initiatives. This broad spectrum of customers and stakeholders highlights the multifaceted nature of Caledonia Mining's business model.

| Customer Segment | Key Motivations | 2024 Relevance |

|---|---|---|

| Institutional Investors | Long-term value, growth potential, commodity hedging | Continued interest in gold as inflation hedge; focus on operational efficiency |

| Retail Investors | Dividends, capital appreciation | Consistent dividend payouts remain a key attraction |

| Gold Refiners/Bullion Dealers | Reliable supply of gold doré | Dependence on Caledonia's production output, e.g., >15,000 oz in Q1 2024 |

| Financial Analysts/Advisors | Data for client recommendations | Scrutiny of production stats, costs, and expansion projects |

| Local Zimbabwean Economy/Workforce | Employment, economic contribution, community development | ~1,600 employees in 2023; importance of local sourcing and social license |

Cost Structure

Operating costs, also known as on-mine costs, are the direct expenses incurred in the day-to-day mining process. These include essential elements like wages for the mining workforce, the significant energy required to power operations, and the consumables such as explosives and chemicals vital for extraction.

Maintaining the extensive fleet of mining equipment is another substantial component of these on-mine costs. For Caledonia Mining, a key metric is their on-mine cost per ounce, which stood at $1,073 in 2024. This figure provides a clear benchmark for the efficiency and cost-effectiveness of their production activities.

Capital expenditure, or Capex, represents significant investments Caledonia Mining makes in its operations. This includes developing mines, improving existing infrastructure, and acquiring new machinery. For 2025, the company earmarked $41.8 million for Capex.

A large chunk of this 2025 Capex budget is directed towards the Blanket Mine, ensuring its continued efficient operation. Additionally, exploration projects, such as those at Bilboes and Motapa, are set to receive substantial funding, reflecting Caledonia's commitment to future growth and resource expansion.

Exploration and development costs are a significant component, encompassing activities like geological surveys, drilling programs, and feasibility studies for new gold deposits. These expenses are crucial for identifying and assessing the viability of future mining operations.

Caledonia Mining is actively investing in these areas. For instance, a $2.8 million exploration program was launched for the Motapa project in 2025. This demonstrates a commitment to expanding their resource base and identifying new revenue streams.

Furthermore, the company continues to focus on optimizing the Bilboes project, which likely involves further development costs to enhance its efficiency and profitability. These investments are essential for long-term growth and sustaining operations.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for Caledonia Mining encompass the essential corporate overheads required to run the company. These include costs like executive and administrative salaries, rent and utilities for corporate offices, professional fees for legal and audit services, and other general operating expenses not directly tied to mining production. Effective management of these costs is crucial for maintaining profitability, especially in a capital-intensive industry like mining.

For Caledonia Mining, controlling G&A expenses directly impacts the bottom line. For example, in 2024, the company focused on streamlining its corporate functions to optimize these costs. Efficient G&A management ensures that resources are allocated effectively, allowing more capital to be directed towards exploration and operational improvements.

- Executive and Administrative Salaries: Compensation for the leadership team and support staff.

- Office Expenses: Costs associated with maintaining corporate office space, including rent, utilities, and supplies.

- Professional Fees: Expenditures on legal counsel, auditors, and other external consultants.

- Other Non-Operational Costs: Miscellaneous expenses incurred at the corporate level that support the overall business but are not directly production-related.

Royalties, Taxes, and Environmental Compliance Costs

Caledonia Mining's cost structure includes significant outlays for government royalties, corporate taxes, and environmental compliance. Royalties are typically calculated as a percentage of gold production or revenue, directly impacting profitability. In 2023, Caledonia's Blanket Mine contributed significantly to its revenue, which would have been subject to these royalty payments.

Corporate taxes are another substantial expense, based on the company's taxable income. Adhering to environmental regulations and social responsibility initiatives also incurs costs, ranging from emissions monitoring to community engagement programs. Caledonia's 2024 ESG report emphasizes its ongoing commitment to sustainable operational practices, which necessitates investment in these areas.

- Royalties: Payments to the government based on gold production or revenue.

- Corporate Taxes: Standard taxation on company profits.

- Environmental Compliance: Costs for adhering to environmental regulations, including monitoring and mitigation.

- Social Responsibility: Expenses related to community engagement and sustainable practices, as highlighted in the 2024 ESG report.

Caledonia Mining’s cost structure is dominated by operating expenses, specifically on-mine costs. These are the direct costs of production, including labor, energy, and consumables. In 2024, Caledonia reported an on-mine cost per ounce of $1,073, illustrating the direct cost of extracting gold.

Beyond operational expenses, significant investments are made in capital expenditure (Capex) and exploration. The company planned $41.8 million in Capex for 2025, with a substantial portion allocated to mine development and equipment upgrades. Exploration activities, such as the $2.8 million program at Motapa in 2025, are also key cost drivers aimed at future resource expansion.

| Cost Category | 2024 Data | 2025 Outlook |

|---|---|---|

| On-Mine Cost per Ounce | $1,073 | N/A |

| Capital Expenditure (Capex) | N/A | $41.8 million |

| Exploration Program (Motapa) | N/A | $2.8 million |

Revenue Streams

The primary revenue stream for Caledonia Mining originates from the sale of gold extracted at its Blanket Mine. This operation is the core of the company's financial performance.

In 2024, Caledonia Mining achieved a significant milestone, reporting gross revenue of $183.0 million. This robust financial result was a direct consequence of favorable gold prices and sustained production levels from the Blanket Mine.

Caledonia Mining anticipates significant future revenue from its new projects, notably Bilboes and Motapa. This expansion is a core part of Caledonia's strategic pivot towards becoming a diversified, multi-asset gold producer, moving beyond its flagship Blanket Mine.

The Bilboes project, in particular, represents a substantial opportunity, with a projected average annual production of 168,000 ounces of gold over its initial 10-year mine life, according to Caledonia’s 2024 feasibility study. This projected output is expected to contribute considerably to the company’s overall revenue streams.

Motapa, another key development, is projected to produce an average of 45,000 ounces of gold per year over its first 10 years. These new ventures are designed to complement existing operations and significantly boost Caledonia's gold sales potential in the coming years.

Gold sales from stockpiles represent a crucial revenue stream for Caledonia Mining, offering an immediate source of income and a foundational element for ongoing production. This strategy leverages existing resources, turning previously mined but unprocessed material into cash flow.

Blanket Mine, for instance, concluded 2024 with a substantial surface stockpile, a tangible asset poised to generate revenue in the periods ahead. This stockpile provides a robust starting point for future production cycles, ensuring a degree of financial predictability.

The sale of gold within these stockpiles can significantly bolster early-stage production revenue, offering a strong initial financial base. This approach is particularly beneficial as it requires less initial capital expenditure compared to developing new underground mining operations.

By effectively managing and processing these stockpiles, Caledonia Mining can enhance its overall revenue generation and operational efficiency. The company's strategic focus on these existing gold reserves underscores a pragmatic approach to maximizing asset value and generating consistent income.

By-product Sales (if applicable)

While Caledonia Mining Corporation's primary focus is gold extraction, any by-products recovered during the mining process at Blanket Mine can represent an additional revenue stream. Historically, the mine has produced small quantities of other minerals. For instance, in 2023, Blanket Mine reported the sale of certain metals as by-products, contributing a modest amount to overall revenue.

- Gold as Primary Output: Blanket Mine's operational model is centered on gold production, which constitutes the vast majority of its revenue.

- By-product Potential: The potential exists for revenue generation from the sale of other minerals extracted incidentally during gold mining.

- 2023 By-product Contribution: While specific figures for by-product sales vary, they have historically been a minor component of Caledonia Mining's total revenue, as evidenced by their financial reporting.

- Focus on Gold Value: The company's strategic and financial planning overwhelmingly emphasizes the value and recovery of gold.

Asset Sales and Strategic Divestments

Caledonia Mining may also generate revenue through asset sales and strategic divestments. This includes offloading non-essential assets to bolster financial health. For instance, the sale of the solar plant in April 2025 was a significant move that improved the company's balance sheet.

These transactions represent opportunities to unlock capital and streamline operations. Such divestments are often part of a broader strategy to focus on core business activities and enhance shareholder value.

- Asset Sales: Revenue derived from selling company assets not central to its primary operations.

- Strategic Divestments: Planned sales of business units or assets to improve financial position or focus.

- Solar Plant Sale (April 2025): A specific example of a divestment that positively impacted Caledonia Mining's balance sheet.

- Balance Sheet Strengthening: The financial benefit gained from asset sales, reducing debt or increasing liquidity.

Caledonia Mining's revenue is primarily driven by gold sales from its Blanket Mine. In 2024, the company reported a gross revenue of $183.0 million, reflecting strong production and favorable gold prices. Future revenue streams are expected to be significantly boosted by the development of new projects like Bilboes and Motapa, which are projected to add substantial gold ounces to production.

| Revenue Stream | 2024 Contribution (Approximate) | Key Drivers | Future Outlook |

|---|---|---|---|

| Blanket Mine Gold Sales | $183.0 million (Gross Revenue) | Production volume, gold price | Stable, with ongoing optimization |

| Stockpile Sales | Contributes to early-stage production | Existing gold reserves, processing efficiency | Provides supplementary revenue |

| Bilboes Project | Not yet contributing | Feasibility study projection: 168,000 oz/year (initial 10 years) | Significant future revenue growth |

| Motapa Project | Not yet contributing | Projected production: 45,000 oz/year (initial 10 years) | Adds to diversified production |

| By-product Sales | Minor contribution | Sale of incidental minerals | Minor, opportunistic |

| Asset Sales | One-off events | Strategic divestments (e.g., solar plant sale April 2025) | Opportunistic for capital generation |

Business Model Canvas Data Sources

The Caledonia Mining Business Model Canvas is built using financial disclosures, operational reports, and market analysis from the gold mining sector. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to their operations.