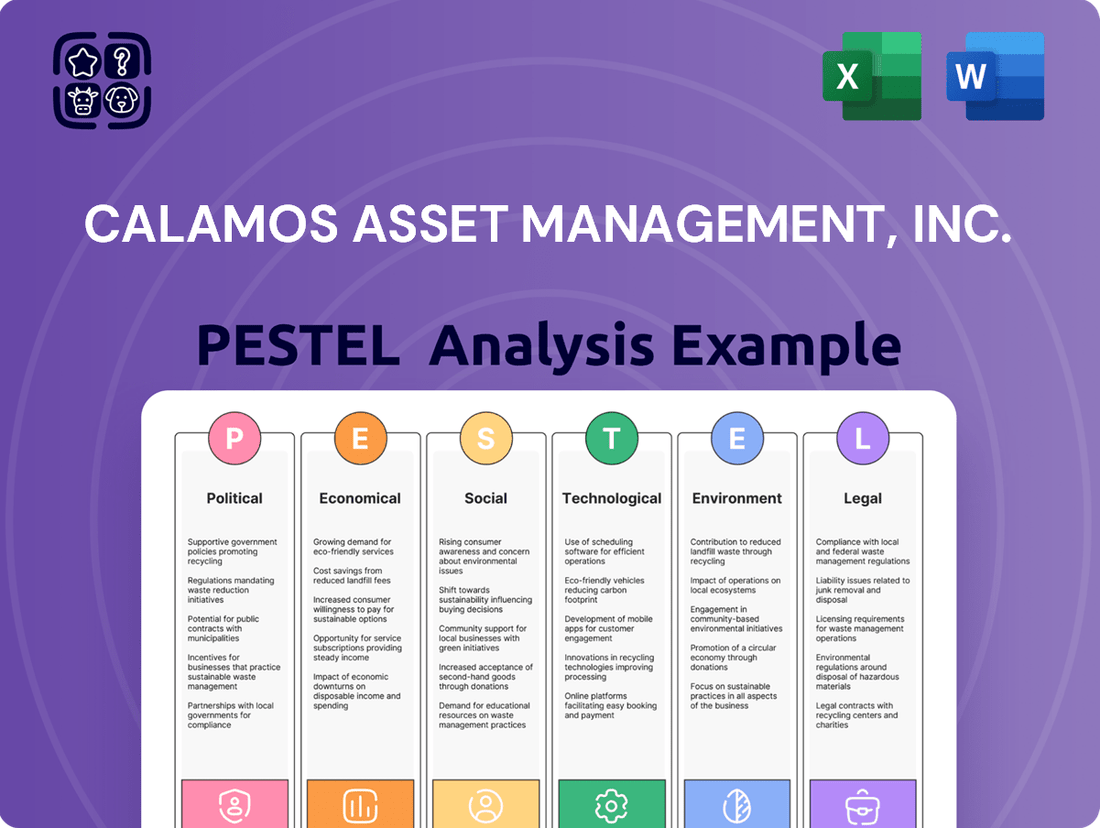

Calamos Asset Management, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calamos Asset Management, Inc. Bundle

Uncover how political shifts, economic volatility, and evolving social trends are directly impacting Calamos Asset Management, Inc.'s strategic direction. Our meticulously researched PESTLE analysis provides a critical look at these external forces, offering actionable intelligence for investors and strategists alike. Don't get left behind; download the full version now to gain a competitive edge and make informed decisions.

Political factors

The political climate and shifts in regulatory bodies like the SEC are crucial for asset managers. For instance, the SEC's focus on enhanced disclosure requirements, as seen in its proposed rules for cybersecurity risk management and incident reporting in 2023, directly affects how firms like Calamos operate and communicate.

New leadership or evolving priorities within regulatory agencies can reshape enforcement. Consider the SEC's increased scrutiny of ESG (Environmental, Social, and Governance) investing, with enforcement actions and guidance issued throughout 2023 and into 2024, impacting how investment products are marketed and managed.

These changes can influence key areas such as fiduciary standards, marketing practices, and the adoption of new technologies like artificial intelligence in investment strategies. For example, the SEC's ongoing examination of AI in financial services, with industry roundtables and proposed guidance in late 2023 and early 2024, signals a proactive regulatory stance that will shape future operational frameworks.

Geopolitical instability, such as ongoing conflicts and rising international tensions, directly impacts financial markets by introducing volatility. For Calamos Asset Management, this means global events can disrupt investment strategies and necessitate robust risk management. For instance, the ongoing conflicts in Eastern Europe and the Middle East have contributed to elevated oil prices and supply chain disruptions, affecting various sectors and asset classes throughout 2024 and into early 2025.

These geopolitical shifts also influence trade patterns and capital flows, requiring firms like Calamos to be agile. Changes in trade agreements or the imposition of sanctions can alter investment opportunities and increase the complexity of cross-border investments. As of mid-2025, the global trade landscape continues to be shaped by these geopolitical considerations, with many nations reassessing their trade dependencies and supply chain resilience.

Government fiscal policies, such as changes in spending and taxation, alongside monetary policies enacted by central banks, like adjustments to interest rates, significantly shape the economic landscape. These shifts directly influence investment climates, presenting both opportunities and hurdles for asset management firms like Calamos.

Looking ahead to 2025, investors and asset managers are closely monitoring potential interest rate cuts by major central banks, such as the Federal Reserve. This anticipation is coupled with ongoing concerns regarding government deficits in key economies, which could impact inflation and economic stability.

Trade Relations and Protectionism

Calamos Asset Management, Inc. must navigate a global landscape increasingly shaped by shifting governmental stances on international trade. Heightened protectionist policies, including the potential for increased tariffs, directly impact global market dynamics and the performance of international investments. This trend necessitates a strategic re-evaluation for firms like Calamos with global operational footprints.

For instance, the World Trade Organization (WTO) reported that the value of world merchandise trade volume was projected to grow by 2.6% in 2024, a slight deceleration from 3.3% in 2023, reflecting ongoing trade frictions. This slowdown signals a more cautious approach by many nations, potentially leading to higher costs for imported goods and services, and impacting cross-border investment flows that Calamos manages.

- Tariff Escalation: The risk of retaliatory tariffs between major economies can disrupt supply chains and increase operational costs for multinational corporations, affecting their profitability and investment valuations.

- Trade Agreements: Changes in the terms or formation of trade agreements can alter market access and competitive advantages for companies operating internationally, influencing investment strategies.

- Geopolitical Tensions: Broader geopolitical rivalries can spill over into trade disputes, creating uncertainty and volatility in financial markets where Calamos seeks to generate returns.

Sustainable Finance Policy Development

Governments worldwide are accelerating sustainable finance policies, creating a dynamic regulatory landscape. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) continues to shape how asset managers like Calamos classify and report on sustainability characteristics of their funds, with ongoing updates expected throughout 2024 and 2025. This focus necessitates robust data collection and reporting mechanisms to ensure compliance and transparency.

These evolving frameworks present both compliance hurdles and significant investment opportunities. Asset managers must adapt their strategies to meet new disclosure requirements, such as those mandated by the SEC's climate-related disclosure rules, which are being implemented in phases starting in 2024. Simultaneously, the growing demand for ESG-aligned investments, projected to reach $33.9 trillion globally by 2026 according to Bloomberg Intelligence, offers a compelling avenue for growth.

- Regulatory Evolution: Continued implementation and refinement of SFDR, SEC climate disclosures, and similar international regulations throughout 2024-2025.

- Disclosure Demands: Increased pressure on asset managers for granular, standardized reporting on ESG metrics and fund impact.

- ESG Investment Growth: Anticipated continued expansion of assets under management in sustainable and ESG-focused investment products.

- Compliance Costs: Investment required in technology and expertise to navigate complex and evolving sustainable finance regulations.

Political factors significantly influence Calamos Asset Management through regulatory changes and geopolitical events. The SEC's ongoing focus on cybersecurity and ESG disclosures, with new rules implemented in 2024 and expected updates in 2025, mandates enhanced operational and reporting frameworks.

Geopolitical instability, such as ongoing international conflicts, continues to inject market volatility and impact global trade patterns, requiring agile risk management and strategic adjustments to cross-border investments. For instance, trade frictions contributed to a projected 2.6% growth in world merchandise trade volume for 2024, down from 3.3% in 2023.

Government fiscal and monetary policies, including anticipated interest rate adjustments by central banks in 2025 and concerns over government deficits, directly shape the investment climate. Furthermore, evolving sustainable finance policies, like the EU's SFDR and the SEC's climate disclosure rules, create compliance demands and investment opportunities, with global ESG assets projected to reach $33.9 trillion by 2026.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Calamos Asset Management, Inc.

It provides a comprehensive understanding of the external landscape to inform strategic decision-making and identify potential growth avenues.

A PESTLE analysis for Calamos Asset Management, Inc. provides a structured framework to identify and address external factors that could impact their business, offering a proactive approach to mitigating potential risks and capitalizing on opportunities.

Economic factors

The trajectory of interest rates is a significant economic factor for Calamos Asset Management. Anticipated rate cuts by major central banks, such as the Federal Reserve and the European Central Bank, are expected throughout 2024 and into 2025. For instance, the Federal Reserve's dot plot as of mid-2024 suggested multiple potential rate cuts by year-end.

These shifts directly influence the attractiveness of various asset classes, impacting Calamos's fixed income and multi-asset portfolios. Lower rates generally make bonds more appealing relative to equities, while also reducing borrowing costs for corporations, potentially boosting their performance.

Furthermore, the overall market liquidity is affected by interest rate movements. A more accommodative monetary policy environment, characterized by lower rates, often leads to increased liquidity, which can support asset prices and provide opportunities for growth-oriented strategies within Calamos's offerings.

Ongoing inflationary pressures remain a key concern for 2024 and into 2025. While the US CPI saw a notable deceleration from its 2022 peaks, with figures around 3.0% by mid-2024, persistent core inflation suggests the path back to the Federal Reserve's 2% target may be gradual. This environment directly impacts corporate earnings by increasing input costs and can dampen consumer spending as purchasing power erodes.

The pace of economic growth is equally critical, with ongoing debate surrounding a potential 'soft landing' versus a 'hard landing' for the US economy. Projections for 2024 GDP growth hover around 2.0% to 2.5%, a slowdown from previous years but potentially avoiding a sharp contraction. Calamos must closely monitor these indicators, as a recession would likely lead to reduced investment returns and increased market volatility, affecting all of its diverse strategies.

Global Assets Under Management (AUM) are on a strong upward trajectory, with projections indicating a reach of approximately $145 trillion by 2025, a significant increase from earlier years. This robust growth signals a healthy global economy and a favorable environment for asset management firms like Calamos.

This expansion in AUM is fueled by several key factors, including rising disposable incomes in emerging markets and a growing trend of individuals and institutions investing more actively in financial markets. For Calamos, this translates to a larger pool of potential clients and a demand for diverse investment products and services.

Market Volatility and Investor Sentiment

Market volatility, a constant in financial landscapes, significantly shapes investor sentiment. In 2024, for instance, the S&P 500 experienced notable swings, influenced by inflation data and central bank policy shifts. These fluctuations directly affect client behavior, leading to shifts in investment flows as investors react to perceived risks and opportunities.

Calamos Asset Management, with its core focus on risk management, must adeptly navigate these dynamic market conditions. The firm's strategy aims to deliver long-term performance by mitigating downside risk while capturing upside potential. This involves a deep understanding of how economic uncertainties, such as persistent inflation or potential recessions, and geopolitical events, like ongoing international conflicts, can trigger sharp movements in market sentiment and, consequently, asset allocations.

- Investor sentiment can be a powerful driver of short-term market movements, often amplifying volatility.

- In Q1 2024, the VIX index, a key measure of market volatility, averaged around 14.5, indicating a relatively calm period compared to previous years, though spikes occurred due to specific economic news.

- Calamos's approach to managing client assets during periods of heightened volatility is crucial for retaining assets under management and attracting new capital.

- Shifts in investor sentiment, whether driven by fear or greed, can lead to rapid capital flows into or out of different asset classes, impacting portfolio performance.

Competition and Consolidation in the Industry

The asset management sector is a hotbed of activity, with ongoing mergers and acquisitions shaping the competitive landscape. This consolidation trend, driven by the pursuit of scale and efficiency, directly impacts firms like Calamos. Investor demand for lower-cost investment vehicles, such as ETFs, and a growing appetite for alternative assets are forcing traditional managers to adapt. For instance, the U.S. ETF market saw significant inflows in 2024, reaching record levels, underscoring this shift.

Calamos, like its peers, must navigate this evolving environment by focusing on differentiation and innovation. The pressure to offer competitive fees while delivering alpha is immense. Key strategies include developing specialized products, enhancing client service, and leveraging technology to improve operational efficiency. The industry's continued evolution demands agility and a keen understanding of shifting investor priorities to maintain market relevance.

- Industry Consolidation: Mergers and acquisitions remain a dominant theme, with larger players often acquiring smaller, specialized firms to expand their product offerings or client base.

- Investor Preferences: A clear shift towards lower-fee products, particularly passive and semi-passive strategies, continues to challenge traditional active management fees.

- Alternative Investments Growth: Demand for private equity, private credit, and real estate funds is robust, presenting opportunities for asset managers with expertise in these areas.

- Technological Adoption: Investment in AI, machine learning, and data analytics is becoming crucial for operational efficiency and client engagement.

Economic factors are pivotal for Calamos Asset Management, influencing everything from investment strategies to client behavior. The anticipated interest rate cuts in 2024 and 2025 by central banks like the Federal Reserve directly affect the attractiveness of asset classes, impacting Calamos's fixed income and multi-asset portfolios. Persistent inflation, though decelerating, continues to pressure corporate earnings and consumer spending, necessitating careful risk management.

The global economic growth trajectory, with projections for US GDP around 2.0%-2.5% for 2024, presents a mixed outlook that requires constant monitoring for potential recessions. Global Assets Under Management are expected to reach approximately $145 trillion by 2025, signaling a favorable environment for asset managers like Calamos, driven by rising disposable incomes and increased market participation.

Market volatility, evidenced by swings in indices like the S&P 500 in 2024, directly influences investor sentiment and capital flows. Calamos's expertise in risk management is crucial for navigating these fluctuations and maintaining client trust. The asset management industry itself is consolidating, with a strong investor preference for lower-fee products and a growing demand for alternative investments, pushing firms like Calamos to innovate and differentiate.

| Economic Factor | 2024 Projection/Data | Impact on Calamos |

|---|---|---|

| Interest Rates (Fed Funds Rate) | Mid-2024: ~5.25-5.50% (anticipated cuts) | Influences bond yields, borrowing costs, and asset class attractiveness. |

| US Inflation (CPI) | Mid-2024: ~3.0% (decelerating but above target) | Impacts corporate margins, consumer spending, and real returns. |

| US GDP Growth | 2024: ~2.0%-2.5% | Affects investment opportunities and market risk appetite. |

| Global AUM | Projected $145 trillion by 2025 | Indicates growth opportunities and increased competition. |

| Market Volatility (VIX) | Q1 2024 Average: ~14.5 | Requires active risk management and influences investor sentiment. |

Same Document Delivered

Calamos Asset Management, Inc. PESTLE Analysis

The preview shown here is the exact Calamos Asset Management, Inc. PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the external forces shaping Calamos's strategic landscape.

Sociological factors

Significant demographic shifts are actively reshaping the investment landscape. Younger generations, particularly Gen Z and Millennials, are increasingly influential, showing a pronounced openness to technology-driven financial advice and a growing interest in alternative investments. For instance, by the end of 2023, Gen Z and Millennials were projected to control over $6 trillion in investable assets in the US alone, a figure expected to climb significantly in the coming years.

Calamos Asset Management must therefore adapt its product development and client engagement strategies to effectively serve these evolving preferences. This includes enhancing digital platforms, offering accessible educational resources on newer asset classes, and tailoring communication to resonate with the values and digital habits of these demographics, ensuring continued relevance and growth in a changing market.

Investors are increasingly seeking investment strategies tailored to their unique financial situations and ethical considerations, moving away from one-size-fits-all approaches. This shift is particularly pronounced among affluent demographics who expect asset managers to deliver hyper-personalized portfolios. For instance, a 2024 survey by Cerulli Associates indicated that over 60% of financial advisors believe demand for customized investment solutions will continue to rise significantly.

Societal awareness and demand for Environmental, Social, and Governance (ESG) investing are significantly reshaping the financial landscape. By the end of 2024, global ESG assets were projected to exceed $30 trillion, demonstrating a clear shift in investor priorities. This growing consciousness means firms like Calamos Asset Management must actively integrate ESG factors into their investment strategies and reporting to align with client expectations and attract capital.

Financial Literacy and Investor Education

Financial literacy levels vary significantly across demographics, impacting investment approaches. For instance, a 2023 FINRA study found that only 57% of Americans could answer basic financial literacy questions correctly, highlighting a persistent need for enhanced investor education. This gap directly influences how individuals, including potential clients for Calamos, engage with financial markets and products.

Younger generations, particularly Gen Z and Millennials, are demonstrating an earlier interest in personal finance and investing. Data from a 2024 report by the National Financial Educators Council indicated that over 60% of individuals aged 18-24 have started investing, often through digital platforms. This trend underscores the necessity for financial institutions like Calamos to offer accessible, user-friendly tools and educational resources tailored to these emerging investors.

- Growing Demand for Accessible Financial Education: As more young people invest, there's an increased need for clear, digestible financial information.

- Digital Savvy Investors: Younger demographics are comfortable with technology, expecting seamless online experiences for learning and investing.

- Impact on Investment Product Adoption: Financial literacy directly correlates with the understanding and adoption of complex investment strategies and products.

Evolving Client Relationships and Digital Engagement

The way asset management firms like Calamos connect with clients is rapidly changing, with a strong lean towards digital platforms. This shift means embracing technologies like artificial intelligence for more personalized interactions and streamlining onboarding through digital channels. For instance, a 2024 survey indicated that over 70% of investors prefer digital communication for account updates and performance reports.

To stay competitive, firms must invest in tools that offer clients instant access to information and a smoother service experience. This includes developing intuitive mobile apps and robust online portals. The adoption of AI in client service is projected to grow significantly, with financial services firms expected to increase their AI spending by 20% in 2025, according to industry analysts.

- Digital Preference: A majority of investors now favor digital channels for communication and account management.

- AI Integration: AI tools are becoming essential for enhancing client engagement and providing personalized insights.

- Onboarding Efficiency: Digital onboarding processes are crucial for improving client acquisition and retention rates.

- Service Quality: Technology adoption directly impacts the perceived quality and accessibility of financial services.

Societal expectations are increasingly influencing investment decisions, with a growing emphasis on ethical and sustainable practices. This trend is particularly evident in the rise of ESG investing, which by the end of 2024, was projected to encompass over $30 trillion globally, signaling a significant shift in investor priorities and demanding that firms like Calamos integrate these factors.

Financial literacy remains a critical societal factor, as a 2023 FINRA study showed only 57% of Americans could answer basic financial literacy questions correctly, highlighting a persistent need for accessible investor education. This gap directly impacts how individuals engage with financial markets and products, influencing their investment choices and the types of services they seek from asset managers.

The increasing digital fluency of younger generations, with over 60% of 18-24 year olds investing by early 2024 according to a National Financial Educators Council report, necessitates user-friendly digital platforms and educational resources. Calamos must cater to these emerging investors who expect seamless online experiences and readily available information.

Technological factors

Advancements in Artificial Intelligence and Machine Learning are fundamentally reshaping asset management. These technologies are enabling firms like Calamos to refine investment strategies, improve operational efficiency, and enhance risk management. For instance, AI-powered tools can analyze vast datasets far quicker than humans, leading to more sophisticated portfolio optimization and real-time market adjustments.

The impact is tangible, with AI and ML driving significant improvements in areas such as predictive analytics for market trends and enhanced fraud detection systems. This technological leap allows for more accurate risk assessments and faster, data-driven decision-making, crucial for maintaining a competitive edge in the dynamic financial landscape. By leveraging these capabilities, Calamos can potentially unlock new avenues for alpha generation and client service.

The financial services industry, including firms like Calamos Asset Management, is a prime target for increasingly sophisticated cyber threats. Ransomware attacks, distributed denial-of-service (DDoS) assaults, and vulnerabilities within the supply chain pose significant risks, impacting operational continuity and client data integrity. For instance, IBM's 2024 Cost of a Data Breach Report indicated that the average cost of a data breach in the financial sector reached $5.72 million, underscoring the financial implications of inadequate security.

Calamos must therefore place paramount importance on implementing and continuously enhancing robust cybersecurity measures and data protection protocols. Safeguarding sensitive client information, financial records, and proprietary trading strategies is critical not only for regulatory compliance but also for maintaining the trust and confidence of its investors and partners. A proactive approach to threat detection, incident response, and employee training is essential in this evolving landscape.

Fintech innovation is fundamentally altering the asset management landscape, with digital transformation accelerating the expansion of investable asset classes. For instance, the global fintech market size was valued at approximately $112.5 billion in 2023 and is projected to grow significantly, indicating a strong trend towards digital solutions.

This digital shift is redefining how firms like Calamos engage with clients, leveraging digital tools for personalized communication and service delivery. The integration of technologies like distributed ledger technology (DLT) also promises to streamline operations and create new opportunities within asset management.

Cloud Computing Adoption

Calamos Asset Management, like other firms in the financial sector, is navigating the increasing adoption of cloud computing. This shift promises enhanced scalability and operational efficiency, crucial for managing vast amounts of financial data and executing complex trading strategies. However, it also introduces significant cybersecurity challenges. A misconfigured cloud environment or a successful breach could have severe repercussions, impacting client trust and regulatory compliance.

The financial services industry, in particular, is a prime target for cyberattacks due to the sensitive nature of the data it handles. Reports from 2024 indicate a rise in sophisticated cloud-based attacks. For instance, a significant percentage of financial institutions experienced at least one cloud security incident in the past year. This underscores the critical need for robust cloud security protocols, including stringent access controls, data encryption, and continuous vulnerability assessments. The potential for catastrophic data loss or service disruption necessitates proactive risk management strategies specifically tailored to cloud environments.

- Increased Reliance on Cloud Infrastructure: Financial firms are migrating more workloads to public, private, and hybrid cloud models to leverage flexibility and cost savings.

- Cybersecurity Risks: Cloud adoption amplifies the attack surface, making secure configurations and diligent monitoring paramount to prevent breaches.

- Regulatory Scrutiny: Regulators are closely examining how financial institutions manage data security and privacy in cloud environments, with potential penalties for non-compliance.

- Operational Resilience: Ensuring business continuity in the event of a cloud outage or security incident is a key concern for asset managers.

Data Analytics and Big Data Utilization

Calamos Asset Management's ability to harness data analytics and big data is paramount for navigating today's complex financial landscape. By processing immense datasets, the firm can uncover subtle market trends and investor behaviors that might otherwise go unnoticed. This analytical power is key to making smarter investment choices.

Leveraging advanced analytics allows Calamos to move beyond traditional methods. For instance, in 2024, the asset management industry saw a significant increase in the adoption of AI-driven analytics, with many firms reporting enhanced predictive accuracy. Calamos can use these tools to refine its quantitative models, leading to more robust strategies for generating alpha. This includes optimizing trading execution and risk management.

- Data-driven insights: Enabling more informed and precise investment decisions.

- Pattern recognition: Identifying market opportunities and potential risks through advanced algorithms.

- Model optimization: Continuously improving trading strategies and financial forecasting.

- Competitive edge: Differentiating Calamos by offering superior analytical capabilities in a crowded market.

Technological advancements, particularly in AI and cloud computing, are revolutionizing asset management. Calamos can leverage these tools for sophisticated data analysis, predictive modeling, and enhanced operational efficiency. However, the increasing reliance on cloud infrastructure also amplifies cybersecurity risks, demanding robust protection measures to safeguard sensitive client data and maintain operational resilience.

The financial sector faces escalating cyber threats, with data breaches costing financial institutions an average of $5.72 million in 2024. Calamos must prioritize advanced cybersecurity protocols, including encryption and continuous vulnerability assessments, to protect against sophisticated attacks and maintain client trust. This focus on security is critical for regulatory compliance and business continuity in an increasingly digital environment.

Fintech innovation is expanding investable asset classes and redefining client engagement, with the global fintech market projected for significant growth. Calamos can capitalize on this trend by integrating digital tools for personalized client service and exploring opportunities presented by emerging technologies like distributed ledger technology (DLT) to streamline operations.

Legal factors

The regulatory environment for asset management is in constant flux, with agencies like the Securities and Exchange Commission (SEC) frequently introducing new rules and amendments. These changes often target disclosure requirements, fiduciary duties, and reporting standards, directly impacting firms like Calamos Asset Management. For instance, the SEC's proposed rules around cybersecurity risk management for investment advisers, discussed heavily in 2023 and expected to see further action in 2024, underscore the increasing focus on operational resilience and data protection.

Calamos must maintain a high degree of vigilance and adaptability to navigate this evolving landscape effectively. Failure to comply with these dynamic regulations can lead to significant penalties, reputational damage, and enforcement actions. Staying ahead of these changes, such as understanding the implications of the SEC's Marketing Rule which came into full effect in late 2022 and continues to shape how firms communicate performance, is crucial for sustained operational integrity.

The evolving landscape of data privacy laws, such as the California Privacy Rights Act (CPRA) and potential federal legislation, significantly impacts how Calamos Asset Management handles client information. Adherence requires stringent protocols for data collection, storage, and processing, including obtaining explicit consent for sensitive data and implementing advanced security measures to prevent breaches.

The evolving landscape of environmental, social, and governance (ESG) disclosure requirements presents a significant legal factor for Calamos Asset Management. Regulations like the EU's Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR) are mandating greater transparency from asset managers, pushing them to enhance their reporting practices. For instance, the CSRD, which began applying to large companies in fiscal year 2024, requires extensive sustainability reporting, impacting the data Calamos needs to collect and disclose about its investments.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

Anti-money laundering (AML) and counter-terrorism financing (CTF) regulations are becoming more stringent, increasingly encompassing investment advisers. For instance, the U.S. Bank Secrecy Act, a cornerstone of AML efforts, now explicitly includes many investment advisers within the definition of financial institutions. This mandates the establishment of robust AML/CTF programs, including customer due diligence and suspicious activity reporting (SAR) mechanisms.

Calamos Asset Management, Inc. must therefore maintain and continually update its compliance frameworks to align with these evolving legal obligations. Failure to do so can result in significant penalties. In 2023, the Financial Crimes Enforcement Network (FinCEN) reported over 2.7 million SARs filed, highlighting the scale of regulatory oversight. Ensuring adherence means investing in technology and training to identify and report illicit financial activities effectively.

- Regulatory Scope Expansion: Investment advisers are increasingly classified as financial institutions under laws like the Bank Secrecy Act.

- Programmatic Requirements: This necessitates the development and maintenance of comprehensive AML and CTF programs.

- Suspicious Activity Reporting: A key component involves establishing procedures for identifying and reporting suspicious transactions.

- Compliance Imperative: Calamos must ensure its internal frameworks are consistently updated to meet these growing regulatory demands.

Fiduciary Duty and Investor Protection Standards

Regulators are increasingly focused on upholding fiduciary duty for investment advisors, a trend that significantly impacts firms like Calamos Asset Management. This means ensuring all actions are genuinely in the client's best interest. For instance, the SEC's Regulation Best Interest, implemented in 2020, continues to shape how firms advise retail investors, emphasizing disclosure and care.

Key areas of regulatory scrutiny include managing conflicts of interest and maintaining transparent investment practices. In 2024, the industry saw continued emphasis on clear communication regarding fees and potential conflicts, with many firms updating their disclosures. This heightened oversight aims to bolster investor confidence and protect against practices that could disadvantage clients.

The ongoing enforcement of these standards means that firms must demonstrate robust compliance frameworks. This includes:

- Proactive identification and mitigation of potential conflicts of interest.

- Clear and comprehensive disclosure of all investment strategies and associated risks.

- Adherence to best execution principles for client trades.

- Regular training for all personnel on fiduciary responsibilities.

The legal framework governing asset management is dynamic, with regulators like the SEC continuously updating rules. These changes, impacting disclosure, fiduciary duties, and reporting, require constant adaptation from firms like Calamos. For example, the SEC's ongoing focus on cybersecurity, with proposed rules in 2024, highlights the need for robust data protection measures.

Data privacy laws, such as the California Privacy Rights Act (CPRA), necessitate stringent protocols for handling client information, including consent and advanced security. Furthermore, evolving ESG disclosure mandates, driven by regulations like the EU's CSRD, require enhanced transparency in reporting sustainability data, affecting investment analysis and client communication.

Calamos Asset Management must also navigate stricter anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, which increasingly encompass investment advisers. The Bank Secrecy Act, for instance, now clearly defines many investment advisers as financial institutions, demanding comprehensive AML/CTF programs, including customer due diligence and suspicious activity reporting.

| Regulatory Area | Key Developments (2023-2025) | Impact on Calamos |

|---|---|---|

| Cybersecurity | SEC proposed rules on cybersecurity risk management for investment advisers (2024). | Requires enhanced operational resilience and data protection protocols. |

| Data Privacy | Continued enforcement of CPRA; potential federal legislation. | Mandates stringent client data handling, consent, and security measures. |

| ESG Disclosure | EU's CSRD and SFDR implementation. | Requires greater transparency in sustainability reporting, impacting data collection and disclosure. |

| AML/CTF | Increased scrutiny under Bank Secrecy Act for investment advisers. | Necessitates robust AML/CTF programs, including customer due diligence and SARs. |

Environmental factors

Climate change is a major concern globally, prompting governments and businesses to act, creating both risks and opportunities for investors like Calamos. Integrating climate-related risks into investment strategies is crucial, alongside exploring opportunities in sustainable and green investments. For instance, the global green bond market reached an estimated $1.5 trillion in 2023, highlighting significant investor interest in climate-friendly assets.

The global shift towards a low-carbon economy is fundamentally reshaping investment landscapes. This transition directly impacts capital allocation, favoring sectors aligned with sustainability and potentially diminishing the viability of carbon-intensive industries. For asset managers like Calamos, this necessitates a strategic reevaluation of portfolios to capture growth in green technologies and renewable energy, a trend amplified by increasing investor demand for ESG (Environmental, Social, and Governance) compliant assets.

Mounting concerns over resource scarcity, particularly in critical materials like rare earth elements and water, are projected to significantly increase operational costs for many industries. For instance, the International Energy Agency (IEA) reported in its 2024 "Critical Minerals Market Review" that demand for minerals essential for clean energy technologies could grow by over 40% by 2040, potentially straining supply chains and driving up prices. This reality directly impacts the investment viability of companies reliant on these resources.

Stricter environmental regulations, such as carbon pricing mechanisms and mandates for sustainable sourcing, are also becoming more prevalent globally. In 2024, the European Union's Carbon Border Adjustment Mechanism (CBAM) began its transitional phase, requiring companies importing certain goods to pay a carbon price, directly affecting manufacturing and export costs. Calamos Asset Management must proactively assess how these evolving regulatory landscapes influence the profitability and long-term sustainability of its portfolio companies.

Increased Focus on Environmental Reporting

Regulatory bodies and investor sentiment are increasingly pushing for greater transparency in corporate environmental reporting. This trend directly impacts asset managers like Calamos, who must now scrutinize environmental, social, and governance (ESG) disclosures to evaluate a company's sustainability and long-term viability.

The demand for robust environmental data is escalating. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, widely adopted globally, aim to standardize climate risk reporting. By mid-2024, many major stock exchanges are expected to mandate TCFD-aligned reporting for listed companies, creating a significant data flow for analysis.

Calamos, in its investment process, will likely need to integrate and analyze this expanding environmental data. This includes assessing how portfolio companies manage their carbon footprint, water usage, and waste management. A 2024 survey indicated that over 70% of institutional investors consider ESG factors material to their investment decisions, underscoring the financial relevance of environmental performance.

- Growing Investor Demand: Over 70% of institutional investors in 2024 cited ESG factors as material to their investment decisions.

- Regulatory Push: The widespread adoption of TCFD recommendations by mid-2024 is standardizing climate-related financial disclosures.

- Data Analysis Requirement: Asset managers like Calamos must analyze environmental data to assess company sustainability and risk.

- Focus Areas: Key environmental metrics include carbon emissions, water consumption, and waste reduction strategies.

Sustainable Investment Product Development

The growing emphasis on environmental concerns is a significant catalyst for creating and selling sustainable investment products. Investors are increasingly looking for ways to align their portfolios with environmental, social, and governance (ESG) principles.

Calamos can leverage this shift by broadening its range of environmentally themed funds and investment strategies. This expansion directly addresses the escalating demand from investors seeking to support eco-friendly initiatives through their capital. For instance, the global sustainable investment market reached an estimated $37.4 trillion in 2024, with a notable portion dedicated to environmental solutions.

- Growing Investor Demand: Over 70% of investors surveyed in a 2024 report indicated that ESG factors influence their investment decisions.

- Product Expansion Opportunities: Calamos can develop new funds focused on renewable energy, clean technology, and water management.

- Market Growth: The sustainable investment sector is projected to grow by 10-15% annually through 2025, presenting a substantial opportunity.

- Competitive Advantage: Offering a robust suite of sustainable products can differentiate Calamos in an increasingly crowded asset management landscape.

The increasing focus on climate change and resource scarcity presents both risks and opportunities for Calamos. Growing investor demand for ESG-compliant assets, with over 70% of institutional investors in 2024 considering ESG factors material, necessitates a strategic approach to portfolio management. Stricter environmental regulations, like the EU's CBAM, and the push for greater transparency in corporate reporting, exemplified by TCFD recommendations, require diligent analysis of environmental performance.

| Environmental Factor | Impact on Calamos | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change & Transition | Risk mitigation, opportunity in green investments | Global green bond market estimated $1.5 trillion in 2023; investor demand for ESG assets growing. |

| Resource Scarcity | Increased operational costs for portfolio companies | IEA: Demand for critical minerals for clean energy could grow over 40% by 2040. |

| Environmental Regulations | Compliance costs, market access implications | EU CBAM transitional phase began 2024; TCFD reporting mandates expected by mid-2024. |

| Environmental Data & Reporting | Need for robust ESG analysis and transparency | Over 70% of institutional investors in 2024 consider ESG factors material. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Calamos Asset Management, Inc. is informed by a comprehensive review of data from reputable financial news outlets, government economic reports, and industry-specific publications. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting the firm.