Calamos Asset Management, Inc. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calamos Asset Management, Inc. Bundle

Discover the strategic brilliance behind Calamos Asset Management, Inc.'s marketing efforts. This analysis delves into their product offerings, pricing models, distribution channels, and promotional campaigns, revealing how they capture and retain client trust in a competitive financial landscape.

Go beyond the surface-level understanding and gain access to a comprehensive, ready-made 4Ps Marketing Mix Analysis for Calamos Asset Management, Inc. Ideal for finance professionals, students, and consultants seeking actionable strategic insights.

Save valuable time and leverage expert research. This pre-written report provides a structured, in-depth look at Calamos Asset Management, Inc.'s marketing mix, perfect for benchmarking, business planning, or client presentations.

Product

Calamos Investments provides a wide spectrum of investment strategies, encompassing equities, fixed income, alternatives, and multi-asset solutions. This breadth allows them to serve a diverse clientele, from large institutions to individual investors, by aligning with their unique risk tolerances and financial objectives.

For instance, as of Q1 2024, Calamos reported over $48 billion in assets under management, with a significant portion allocated across these varied strategies, demonstrating their capacity to manage substantial and diverse portfolios effectively.

Calamos' actively managed portfolios are designed to outperform market benchmarks through dynamic adjustments. This strategy, a core tenet of their offering, relies on fundamental analysis and a keen eye for market shifts to identify and exploit inefficiencies. As of Q1 2024, Calamos managed over $40 billion in assets, with a significant portion allocated to these actively managed strategies, highlighting client trust in their approach.

Calamos's specialized funds and solutions are the core of its product offering, catering to diverse investor needs. They provide a wide array of investment vehicles, including mutual funds, closed-end funds, ETFs, interval funds, private funds, and UCITS funds. This broad spectrum allows for tailored approaches to liquidity, distribution, and investment focus, such as structured protection ETFs and private market opportunities.

As of the first quarter of 2024, Calamos reported approximately $48.6 billion in assets under management, with a significant portion allocated to these specialized strategies. For instance, their convertible securities strategies have historically attracted substantial inflows, demonstrating investor confidence in their niche expertise. The firm's commitment to innovation is evident in offerings like structured protection ETFs, designed to provide downside mitigation while participating in market upside.

Risk Management Emphasis

Calamos Asset Management, Inc. distinguishes its product offering through a robust emphasis on risk management, deeply embedded within their investment philosophy. This commitment is designed to deliver client solutions that prioritize not only potential return enhancement but also the diligent management of downside risks, notably through their expertise in alternative and structured product offerings.

This risk-aware approach is crucial in today's volatile markets. For instance, as of Q1 2024, the S&P 500 experienced significant fluctuations, highlighting the need for strategies that can navigate uncertainty. Calamos's focus on managing potential downsides aims to provide a more stable investment experience for clients.

- Integrated Risk Management: Risk management is a core component of Calamos's investment strategies, not an afterthought.

- Downside Protection Focus: Strategies are designed to mitigate potential losses, offering clients a degree of capital preservation.

- Alternative and Structured Products: Calamos leverages these specialized products to achieve specific risk-return profiles and manage volatility.

- Client-Centric Approach: The emphasis on risk management directly addresses client needs for secure and potentially enhanced returns in diverse market conditions.

Tailored Wealth Management Services

Calamos Asset Management’s tailored wealth management services extend beyond traditional investment products, focusing on personalized advice and comprehensive financial planning for high-net-worth individuals and private foundations. This holistic approach aims to manage and grow wealth effectively, incorporating trust and lending solutions to meet diverse client needs. For instance, as of Q1 2024, Calamos reported managing approximately $37 billion in assets under management, a significant portion of which is attributed to its wealth management division serving sophisticated clientele.

The wealth management offering is designed to provide a sophisticated client experience, emphasizing deep understanding of individual financial goals and circumstances. This includes strategic asset allocation, tax-efficient investing, and estate planning, all crucial components for preserving and enhancing substantial wealth. The firm's commitment to personalized strategies is reflected in its client-advisor ratio, which remains competitive within the ultra-high-net-worth segment, ensuring dedicated attention.

- Personalized Financial Planning: Customized strategies for individuals and foundations.

- Holistic Wealth Management: Integrates investment, trust, and lending solutions.

- High-Net-Worth Focus: Services tailored for affluent clients and private foundations.

- Asset Growth and Preservation: Emphasis on long-term wealth management objectives.

Calamos' product strategy centers on a diverse range of actively managed investment vehicles, including mutual funds, ETFs, and interval funds, designed to meet varied investor needs and risk appetites. Their offerings are built on a foundation of deep research and a commitment to identifying market opportunities, particularly in areas like convertible securities and structured products.

The firm's product development prioritizes innovation and risk management, aiming to provide downside protection alongside return potential. This is evident in their structured protection ETFs and specialized alternative strategies, which cater to clients seeking more sophisticated solutions in volatile markets.

As of Q1 2024, Calamos managed over $48 billion in assets, with a significant portion allocated across these specialized products, underscoring client confidence in their ability to deliver differentiated investment outcomes.

Their product suite is continually refined to address evolving market dynamics and client demands, ensuring relevance and competitive positioning within the asset management landscape.

What is included in the product

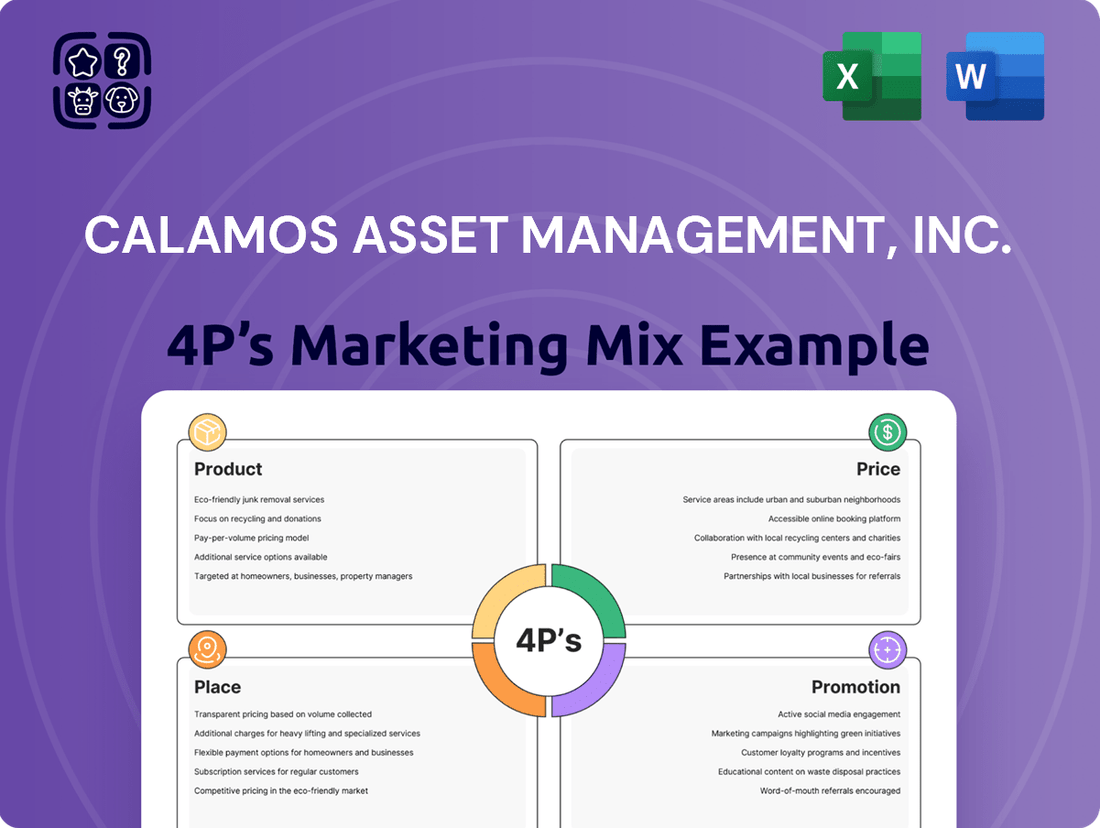

This analysis provides a comprehensive deep dive into Calamos Asset Management, Inc.'s marketing strategies, examining their Product offerings, Pricing structures, Place (distribution) channels, and Promotion tactics.

It's designed for professionals seeking to understand Calamos's market positioning and competitive approach, grounded in real-world practices and strategic implications.

Calamos Asset Management's 4Ps analysis addresses the pain point of unclear marketing strategy by providing a concise, actionable framework for understanding their product, price, place, and promotion. This allows for focused efforts and better alignment across the organization.

Place

Calamos cultivates direct relationships across its diverse client base, which includes institutional investors, financial advisors, and individual investors. This approach is key to understanding their unique investment objectives and requirements.

By engaging directly, Calamos can offer personalized service and craft bespoke solutions, especially for clients with complex financial needs. For instance, in 2024, the firm reported a significant portion of its assets under management came from direct institutional mandates, highlighting the success of this strategy.

Financial advisor and consultant networks represent a cornerstone distribution channel for Calamos Asset Management. These professionals act as crucial intermediaries, bringing Calamos's investment strategies to a broad base of end clients. By leveraging programs such as wrap-fee and unified managed account (UMA) offerings, Calamos significantly enhances the accessibility of its diverse investment solutions.

Calamos Asset Management leverages its corporate website as a central digital platform, offering comprehensive fund information, market insights, and client resources. This robust online presence, a key component of their marketing strategy, ensures broad accessibility and transparency for investors seeking to understand their diverse investment offerings.

The website serves as a vital tool for disseminating thought leadership content, including research reports and market commentary, reinforcing Calamos' expertise. In 2024, asset managers across the industry saw a significant uptick in digital engagement, with website traffic for leading firms increasing by an average of 15% as investors increasingly relied on online channels for research and decision-making.

Global Reach through UCITS Funds

Calamos Asset Management leverages UCITS (Undertakings for Collective Investment in Transferable Securities) funds to extend its market reach beyond the United States. These European Union-regulated investment vehicles facilitate efficient cross-border distribution, making Calamos's strategies accessible to a broader international investor base.

This strategic offering significantly enhances global market access. As of early 2024, the UCITS market continues to be a cornerstone for global asset managers seeking to tap into diverse investor pools across Europe and beyond. Calamos's participation in this framework underscores its commitment to serving a worldwide clientele.

- UCITS Funds: Regulated investment vehicles enabling seamless cross-border distribution within the EU.

- Global Accessibility: Expands Calamos's investment opportunities beyond the US market.

- Market Penetration: Caters to a growing international investor demand for diversified portfolios.

- Regulatory Compliance: Adheres to stringent EU standards, fostering investor confidence.

Physical Office Locations

Calamos Asset Management, Inc. strategically operates physical offices beyond its Chicago headquarters to foster client engagement and manage regional business. These include key financial hubs like New York City and San Francisco, as well as other significant markets such as Milwaukee, Portland (Oregon), and the Miami area. The firm also maintains an international presence with an office in London.

These locations are crucial for providing localized support and enabling face-to-face interactions, which are vital for building and maintaining strong client relationships. Having a physical presence in these diverse geographic areas allows Calamos to better understand and cater to the specific needs of clients in different regions. For instance, as of early 2024, the firm's commitment to client proximity is evident in its network, supporting a significant portion of its assets under management that originate from these key metropolitan areas.

- New York City: A primary financial center, crucial for institutional client engagement.

- San Francisco: Serves the West Coast market and technology sector clients.

- London: Facilitates European client servicing and global market access.

- Regional Offices (Milwaukee, Portland, Miami): Enhance local market penetration and client relationship management.

Calamos Asset Management's physical presence extends across key financial centers, including New York City and San Francisco, alongside regional hubs like Miami. This strategic network facilitates direct client engagement and localized support, crucial for understanding diverse investment needs. The firm's London office further solidifies its commitment to serving a global clientele and expanding international market access.

Preview the Actual Deliverable

Calamos Asset Management, Inc. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Calamos Asset Management, Inc. 4P's Marketing Mix Analysis is complete and ready for your immediate use.

Promotion

Calamos leverages thought leadership as a key promotional tool, disseminating market outlooks, investment team insights, and specific investment ideas across its website and platforms like Seeking Alpha. This strategy aims to position Calamos as a knowledgeable authority, thereby educating its audience and highlighting its analytical prowess.

In 2024, for instance, Calamos's investment teams published numerous articles detailing their perspectives on macroeconomic trends and sector-specific opportunities, contributing to a robust content library designed to resonate with a sophisticated investor base seeking informed market commentary.

Calamos Asset Management actively uses public relations through news releases to announce key developments like new fund launches and monthly distributions. This approach aims to secure media coverage, boosting awareness of their products and successes. For instance, in early 2024, Calamos announced the launch of its Global Convertible Bond Fund, a move that garnered attention from financial news outlets.

Calamos Asset Management, Inc. leverages industry awards as a key promotional tool to bolster its market standing. Recognition such as being named Alternative Investment Asset Manager of the Year by WealthManagement.com in 2023 underscores their demonstrated expertise and performance in a competitive landscape.

Digital Content and Social Media Engagement

Calamos Asset Management actively leverages digital platforms like LinkedIn, Twitter, and Instagram to share timely market news, expert insights, and company updates. This strategy significantly amplifies their message, reaching a broad spectrum of financial professionals and individual investors.

Their social media engagement aims to build a community, fostering dialogue and providing valuable content. For instance, as of early 2024, Calamos's LinkedIn presence saw consistent growth in follower engagement, with posts on economic trends and investment strategies often garnering hundreds of interactions.

- Platform Reach: Utilizes LinkedIn, Twitter, and Instagram for broad audience engagement.

- Content Focus: Disseminates market news, investment insights, and company updates.

- Engagement Goal: Fosters community and dialogue with financial professionals and investors.

- Performance Indicator: Early 2024 data shows strong follower interaction on LinkedIn for economic and investment strategy content.

Conferences and Webinars

Calamos Asset Management leverages conferences and webinars as a key component of its promotion strategy, directly engaging with financial advisors and institutional clients. These events facilitate in-depth discussions and product presentations, fostering valuable connections within the financial community. For instance, in 2024, Calamos actively participated in and hosted numerous educational webinars covering market outlooks and investment strategies, attracting thousands of attendees. This direct outreach is crucial for disseminating their expertise and building trust.

These platforms serve as vital touchpoints for networking and sharing insights on their investment solutions. Calamos’ commitment to education is evident in their frequent webinars, which often feature their portfolio managers discussing current market trends and specific investment vehicles. In the first half of 2025, they are scheduled to host over 20 such events, with an average attendance of 300 professionals per session, highlighting their active presence in the educational space.

The firm's participation in industry conferences further amplifies their reach and brand visibility. These gatherings provide opportunities to showcase their capabilities and connect with a broader audience of potential clients and partners. Calamos has confirmed participation in at least five major financial industry conferences throughout 2024 and early 2025, aiming to solidify their position as a thought leader and trusted asset manager.

- Direct Client Engagement: Webinars and conferences allow for face-to-face or virtual interaction with financial advisors and institutional investors.

- Thought Leadership: Presenting market insights and strategies positions Calamos as an expert in the asset management field.

- Product Education: These events are ideal for detailing their investment products and their benefits to a targeted audience.

- Networking Opportunities: Conferences, in particular, offer valuable chances to build relationships within the financial industry.

Calamos Asset Management actively promotes its expertise through a multi-faceted approach, including thought leadership content, public relations, digital engagement, and direct client interaction via conferences and webinars.

In 2024, the firm amplified its digital presence, with LinkedIn engagement showing hundreds of interactions on posts discussing economic trends and investment strategies, underscoring their commitment to community building and information dissemination.

Their strategic use of industry awards, such as the 2023 WealthManagement.com recognition, along with participation in key financial conferences throughout 2024 and early 2025, reinforces their market standing and brand visibility.

Calamos's proactive webinar schedule, with over 20 sessions planned for the first half of 2025, aims to educate financial professionals and institutional clients, averaging 300 attendees per session, demonstrating a strong commitment to direct engagement and product education.

| Promotional Activity | Key Channels | 2024/2025 Focus | Impact/Goal |

|---|---|---|---|

| Thought Leadership | Website, Seeking Alpha | Macroeconomic outlooks, sector analysis | Establish expertise, educate investors |

| Public Relations | News Releases | New fund launches, distribution announcements (e.g., Global Convertible Bond Fund launch early 2024) | Secure media coverage, boost product awareness |

| Digital Engagement | LinkedIn, Twitter, Instagram | Market news, expert insights, company updates | Amplify message, build community, foster dialogue |

| Direct Engagement | Conferences, Webinars | Market outlooks, investment strategies (20+ webinars H1 2025, avg. 300 attendees; 5+ major conferences 2024/2025) | Direct client interaction, product education, networking |

Price

Calamos Asset Management, Inc. structures its pricing through management fees and expense ratios, which are crucial components of its product offering. These fees, varying by fund and share class, directly fund portfolio management expertise and essential administrative services, impacting an investor's ultimate net return.

For instance, Calamos's various mutual funds and ETFs typically exhibit expense ratios ranging from around 0.50% to over 1.50% as of late 2024, depending on the specific investment strategy and asset class. These costs, clearly outlined in each fund's prospectus, are a key consideration for investors evaluating potential performance.

Calamos Asset Management, Inc. structures its sales charges to align with different investor needs and intermediary compensation models. Class A shares often feature a front-end sales load, meaning a percentage of the investment is deducted at the time of purchase, typically ranging from 0% to 5.75% depending on the investment amount and specific fund.

Conversely, Class C shares may incorporate a contingent deferred sales charge (CDSC), which is paid when shares are redeemed within a specified period, often one year, with rates commonly around 1%. These loads are designed to remunerate financial advisors and distributors for the guidance and services they provide to clients, a common practice in the mutual fund industry.

Performance-based fees are a key component of Calamos Asset Management's pricing strategy for certain investment products. This structure means that the advisory fee isn't fixed but can fluctuate depending on how well the fund performs compared to a specific market benchmark. For instance, if a fund significantly outperforms its benchmark, the performance fee portion of the advisory charge would increase, directly linking Calamos's compensation to investor success.

This approach is designed to strongly align the interests of Calamos with those of its clients. By tying a portion of their earnings to investment results, Calamos is incentivized to actively manage portfolios and pursue strategies that aim for superior returns. This can be particularly attractive to investors seeking active management and a clear demonstration of value creation.

While specific performance fee structures vary by fund, they often involve a base fee plus an additional percentage if certain return hurdles are met. This model is common in alternative investments and hedge funds, but Calamos applies it selectively across its offerings, reflecting a commitment to performance-driven client relationships.

Minimum Investment Requirements

Calamos Asset Management, Inc. structures its offerings with specific minimum investment requirements to cater to different client needs and investment strategies. These thresholds ensure that clients are appropriately positioned for the complexity and management involved in certain products.

For instance, Calamos's wrap-fee programs often have a starting point of $75,000. This allows a broader range of investors to access professionally managed portfolios.

However, for more specialized strategies or separately managed accounts, the minimum investment can escalate significantly, often beginning at $1 million or more. This reflects the tailored management and resources dedicated to these higher-tier offerings.

- Wrap-fee programs: Typically start at $75,000.

- Separately managed accounts: Minimums can be $1 million or higher, depending on the strategy.

- Targeted clientele: Minimums reflect the level of service and customization offered.

Competitive Fee Structures

Calamos Asset Management aims to provide competitive fee structures, reflecting the value delivered through its active management approach and niche strategies. These fees are transparently outlined in their official prospectuses and reports, allowing for direct comparison with other offerings in the asset management landscape.

For instance, examining Calamos's flagship mutual funds, such as the Calamos Global Dynamic Income Fund (CHYAX), can provide insight. As of early 2024, expense ratios for actively managed funds in comparable categories often range from 0.75% to 1.50%, with Calamos's fees generally falling within this spectrum, demonstrating their commitment to market competitiveness while supporting their investment expertise.

- Competitive Positioning: Calamos's fee structures are designed to be competitive within the active management segment of the asset management industry.

- Transparency: Detailed fee information is readily available in official fund documents, facilitating informed comparisons.

- Value Proposition: Fees are set to balance the costs of specialized research and active portfolio management with client expectations for performance.

- Industry Benchmarking: For context, actively managed equity funds in 2024 often carry expense ratios between 0.50% and 1.20%, with specialized or alternative strategies potentially incurring higher fees.

Calamos Asset Management's pricing strategy incorporates management fees, expense ratios, and sales charges, with expense ratios for their mutual funds and ETFs generally falling between 0.50% and 1.50% as of late 2024. Sales charges can include front-end loads up to 5.75% for Class A shares and contingent deferred sales charges of around 1% for Class C shares redeemed within a year.

Performance-based fees are also utilized for certain products, directly linking Calamos's compensation to exceeding specific market benchmarks, a model common in alternative investments. Minimum investment requirements vary, with wrap-fee programs typically starting at $75,000 and separately managed accounts often requiring $1 million or more.

These fee structures are designed to be competitive within the active management space, with Calamos's flagship funds aligning with industry averages for actively managed funds in 2024, which often range from 0.75% to 1.50%.

The company emphasizes transparency, with all fee details clearly presented in prospectuses, allowing investors to compare offerings and understand the value proposition tied to their specialized research and active management approach.

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Calamos Asset Management, Inc. is grounded in a comprehensive review of their product offerings, fee structures, distribution channels, and marketing communications. We utilize official company filings, investor relations materials, and industry-specific research to ensure accuracy.