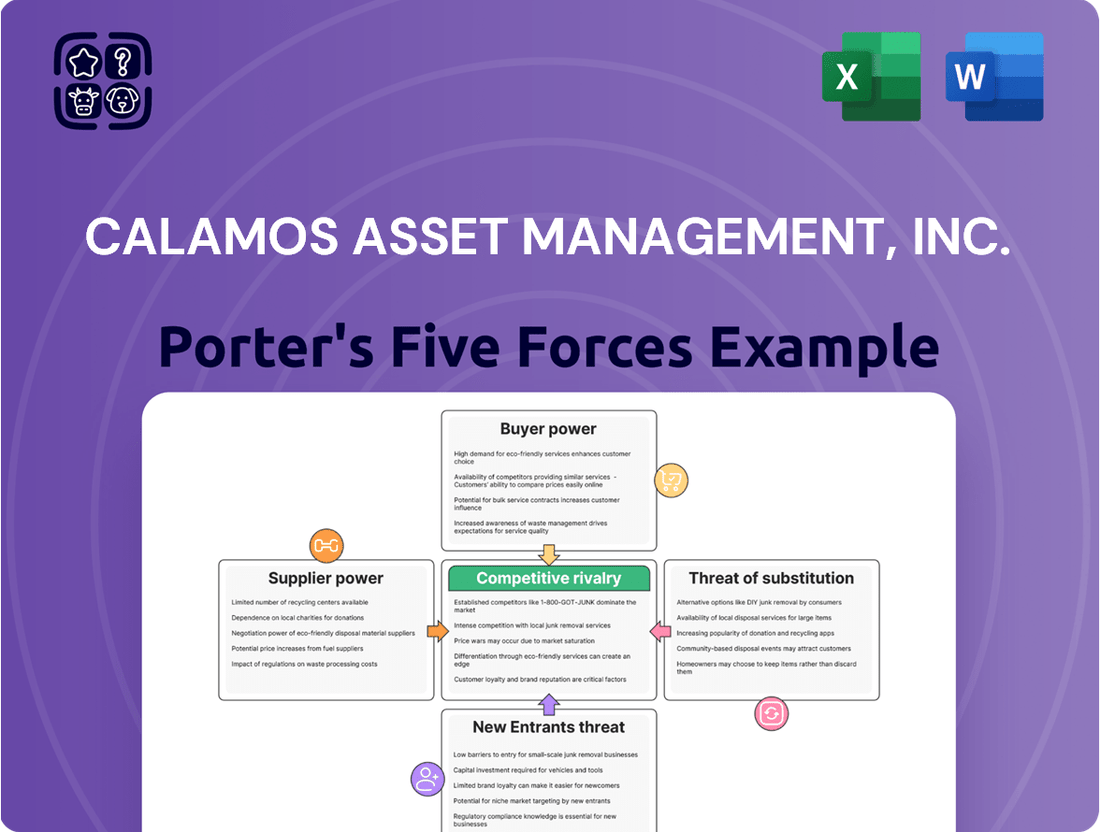

Calamos Asset Management, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calamos Asset Management, Inc. Bundle

Calamos Asset Management, Inc. faces a dynamic competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes within the asset management industry. Understanding the intensity of rivalry and the influence of suppliers is crucial for navigating this market.

The complete report reveals the real forces shaping Calamos Asset Management, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The asset management sector's growing dependence on advanced analytics, AI, and cloud computing significantly boosts the bargaining power of specialized data and technology providers. Calamos Investments, for instance, relies heavily on these vendors for crucial market data, advanced analytical platforms, and essential IT infrastructure to refine investment strategies and streamline operations.

The high cost and complexity associated with developing and maintaining proprietary technology create substantial switching costs for asset managers. This dependency on specialized, often unique, technological solutions grants these suppliers considerable leverage in negotiations, as finding and integrating suitable alternatives is both time-consuming and expensive.

The ability of Calamos Investments to secure and keep highly skilled professionals is paramount to its success as an active asset management firm. This includes attracting seasoned portfolio managers, sharp research analysts, adept risk management specialists, and crucially, professionals skilled in data science and artificial intelligence.

The limited availability of individuals with specialized expertise, especially in intricate investment approaches and cutting-edge technologies, grants these professionals considerable leverage regarding their pay and benefits. For instance, in 2024, the demand for AI specialists in finance outstripped supply, leading to average salary increases of 15-20% for those with proven track records in quantitative analysis and machine learning applications within investment strategies.

This competition for top talent is intense throughout the financial sector, with firms actively vying for the same limited pool of highly qualified individuals. The median compensation for a senior portfolio manager in the US asset management industry in 2024 often exceeded $300,000 annually, with bonuses tied to performance further increasing earning potential, underscoring the significant bargaining power of these individuals.

Calamos Asset Management, while robust in its internal research, faces potential supplier influence from external providers of highly specialized market intelligence and niche consulting services. These external experts offer unique insights that are either too costly or time-consuming for Calamos to develop in-house, especially when venturing into new asset classes like private credit. For instance, a specialized economic forecasting firm might charge upwards of $50,000 annually for access to its proprietary data and analytical tools, impacting Calamos's operational costs and strategic flexibility.

Regulatory Compliance and Legal Services

The asset management industry's stringent regulatory environment significantly bolsters the bargaining power of legal and compliance service providers. Calamos Investments, like its peers, must meticulously adhere to a dynamic web of regulations, encompassing Securities and Exchange Commission (SEC) rules, intricate reporting mandates, and emerging anti-greenwashing standards. This dependence on specialized legal expertise to ensure regulatory adherence and manage legal exposures underscores the suppliers' considerable influence.

In 2024, the financial services sector continued to grapple with evolving compliance demands. For instance, the SEC's proposed rule changes regarding cybersecurity risk management for investment advisers and investment companies, announced in 2023 and finalized in May 2024, necessitated significant legal consultation and implementation efforts across the industry. These ongoing regulatory shifts mean that firms like Calamos must rely heavily on external legal counsel to interpret and implement these complex requirements, thereby strengthening the suppliers' position.

- Increased Regulatory Scrutiny: The financial services industry faced heightened scrutiny in 2024, with regulators focusing on areas like ESG disclosures and data privacy, increasing the demand for specialized legal services.

- Complexity of Compliance: Navigating the intricate and ever-changing regulatory landscape, including new SEC reporting requirements and international regulations, requires expert legal guidance, giving these service providers leverage.

- Risk Mitigation: Calamos Investments' need to avoid substantial fines and reputational damage from non-compliance makes the assurance provided by legal and compliance experts a critical, high-value service.

- Expertise Gap: The specialized knowledge required for regulatory compliance is often not cost-effectively maintained in-house, leading to a reliance on external legal and compliance firms.

Custodial and Fund Administration Services

The bargaining power of suppliers for custodial and fund administration services, crucial for a global investment firm like Calamos Asset Management, Inc., is notable. These aren't simple services; they involve managing vast, complex, and highly regulated assets. Reputable providers, therefore, command significant leverage due to the critical nature of their role.

Disruptions in these areas can severely damage a firm's reputation and client confidence. For instance, in 2024, the financial services industry continued to see consolidation among custodians, potentially reducing the number of high-quality, specialized providers available, thereby increasing their negotiating strength.

- High barriers to entry for specialized financial custodians.

- Reputational risk associated with service provider failures.

- Increasing regulatory compliance demands for fund administrators.

- Concentration among top-tier custodial service providers globally.

Calamos Asset Management's reliance on specialized data providers, particularly those offering unique quantitative insights or alternative data sets, significantly enhances supplier bargaining power. The scarcity of proprietary data sources and the high cost of developing comparable internal capabilities mean these suppliers can command premium pricing. For example, in 2024, access to specialized ESG data feeds for portfolio screening saw price increases of 10-15% for many asset managers due to increased demand and limited providers.

The bargaining power of suppliers is amplified by the increasing complexity of financial markets and the demand for sophisticated analytical tools. Firms like Calamos must leverage advanced technologies, often sourced from a limited number of specialized vendors, to maintain a competitive edge. The cost and effort involved in integrating new systems and ensuring data compatibility further entrench these supplier relationships, giving them considerable negotiating leverage.

The concentration of providers in niche areas, such as specialized risk analytics software or unique market data feeds, further strengthens their position. In 2024, the market for AI-driven trading analytics saw a significant consolidation, with the top three providers capturing over 60% of the market share, allowing them to dictate terms more effectively.

What is included in the product

This analysis delves into the competitive forces shaping the asset management industry, specifically examining Calamos Asset Management, Inc.'s position relative to rivals, customer power, supplier leverage, threat of new entrants, and the impact of substitute products.

Calamos Asset Management's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making.

Customize pressure levels based on new data or evolving market trends for Calamos Asset Management, ensuring strategic agility.

Customers Bargaining Power

Calamos' diverse client base, including institutions, financial advisors, and individual investors, holds considerable bargaining power. This is amplified by the sheer volume of investment choices available, from active and passive funds to ETFs and direct investment platforms. For instance, the global ETF market alone was valued at over $10 trillion in early 2024, illustrating the breadth of alternatives clients can access.

To counter this, Calamos strategically offers a wide spectrum of investment solutions. These encompass traditional equities and fixed income, alongside alternative investments and multi-asset strategies, directly addressing varied client preferences and risk appetites.

Customers, particularly large institutional investors and financial advisors overseeing client assets, exhibit a strong sensitivity to management fees. This fee consciousness directly translates into increased bargaining power for these clients.

The asset management landscape has seen persistent fee compression, largely fueled by the growing appeal of low-cost passive investment options. For instance, by the end of 2023, the average expense ratio for U.S. equity index funds was approximately 0.04%, a stark contrast to actively managed funds. This trend amplifies the leverage customers hold when negotiating fees with asset managers like Calamos.

Calamos faces the challenge of clearly articulating the distinct advantages of its active management approach and its capabilities in risk mitigation. Demonstrating superior performance and value beyond passive strategies is crucial for justifying its fee structure and maintaining competitiveness in a market where price is a significant differentiator.

For many standard investment products, the costs associated with switching from one asset manager to another are relatively low, facilitated by streamlined digital platforms and competitive offerings. This ease of mobility empowers clients to shift their assets if they are dissatisfied with performance, fees, or service. In 2024, the average expense ratio across all U.S. equity mutual funds was approximately 0.41%, a figure that contributes to the perception of low switching costs for investors seeking better value.

Demand for Performance and Risk Management

Calamos Asset Management's clients, especially institutional investors, have significant bargaining power driven by their demand for strong, consistent long-term performance and effective risk management. The firm's ability to deliver on these fronts is crucial for client retention and satisfaction. For instance, in 2024, many institutional investors are scrutinizing manager performance against benchmarks, with a significant portion indicating they would re-evaluate or terminate relationships if performance lags for extended periods, typically two to three years.

This demand translates directly into client power. If Calamos fails to meet these high expectations, sophisticated clients can easily shift substantial assets to competitors offering superior returns or more tailored risk mitigation strategies. This leverage means clients can negotiate fees or demand specific investment mandates, directly impacting Calamos's revenue and operational flexibility.

- Client Demand: Sophisticated investors prioritize consistent long-term performance and robust risk management.

- Performance Impact: Failure to meet performance expectations can lead to significant asset outflows.

- Risk Management Focus: Clients value firms that can effectively manage investment risks.

- Negotiating Power: High client expectations grant them leverage in fee and mandate negotiations.

Increasing Demand for Personalized and Digital Solutions

The increasing demand for personalized and digital solutions significantly amplifies customer bargaining power. Clients now expect hyper-personalized investment strategies, readily available digital access, and smooth online interactions.

This shift compels asset managers like Calamos to invest heavily in technology. For instance, the global wealth management technology market was projected to reach over $30 billion by 2024, reflecting this trend. Investors are prioritizing convenience, transparency, and tailored advice delivered through modern channels, forcing firms to adapt or risk losing market share.

- Client Expectations: Demand for customized investment portfolios and digital self-service options is rising.

- Technological Investment: Asset managers are increasing spending on digital platforms and data analytics to meet these demands.

- Competitive Landscape: Firms failing to offer seamless digital experiences face a disadvantage in attracting and retaining clients.

- Data-Driven Personalization: Leveraging client data to offer bespoke advice and solutions is becoming a key differentiator.

Calamos' clients, especially institutional investors, wield significant bargaining power due to their focus on consistent long-term performance and robust risk management. Should Calamos falter in these areas, sophisticated clients can readily reallocate substantial assets, thereby influencing fee structures and investment mandates.

The proliferation of investment alternatives, exemplified by the global ETF market exceeding $10 trillion in early 2024, empowers clients with numerous choices. This abundance of options, coupled with a strong sensitivity to fees, particularly among institutional investors, intensifies their negotiating leverage.

The trend of fee compression, driven by the popularity of low-cost passive options like index funds with average expense ratios around 0.04% by late 2023, further enhances customer bargaining power. This dynamic necessitates that Calamos clearly demonstrate the value proposition of its active management strategies to justify its fees.

Furthermore, the increasing demand for personalized digital solutions and the low switching costs associated with readily available platforms in 2024 give clients more mobility and thus more power to negotiate terms or move assets if expectations regarding performance, fees, or service are not met.

Preview Before You Purchase

Calamos Asset Management, Inc. Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Calamos Asset Management, Inc., detailing the competitive landscape and strategic implications within the asset management industry. You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry. This comprehensive report is ready for your immediate use, offering a thorough understanding of the forces shaping Calamos's market position.

Rivalry Among Competitors

The asset management arena is crowded, with giants like BlackRock and Vanguard alongside nimble fintech startups, all vying for investor capital. Calamos navigates this intense rivalry, offering everything from traditional stocks and bonds to sophisticated alternatives, meaning they face a competitor for nearly every potential client. This constant competition demands ongoing innovation to stand out.

The ongoing surge in passive investing, particularly with index funds and ETFs, significantly pressures active managers like Calamos. These low-cost options directly question the necessity of higher fees for active management, compelling firms to prove their ability to deliver alpha or distinctive strategies.

As of late 2023, assets in U.S. passive funds surpassed $13 trillion, a figure that has steadily climbed, indicating a clear preference for cost-efficiency among many investors. This trend forces active managers to continually justify their fees by demonstrating superior performance or specialized expertise.

Competitive rivalry within the asset management sector is fierce, driven by the perpetual demand for innovative products and distinct offerings to secure market share. Calamos is actively participating in this dynamic by pioneering structured protection ETFs and broadening its reach into private credit, aiming to deliver distinctive investment solutions. In 2024, the ETF market alone saw significant growth, with global ETF assets reaching an estimated $11.9 trillion by the end of the year, highlighting the intense competition for investor capital.

Brand Reputation and Performance Track Record

Calamos Asset Management, Inc. benefits significantly from its established brand reputation and a long, positive performance track record, key differentiators in the competitive asset management landscape. The firm's commitment to risk-conscious active management, honed over decades of experience, allows it to stand out. However, the ongoing challenge lies in consistently delivering strong performance across its various strategies, especially amidst market volatility.

In 2024, Calamos continued to emphasize its expertise. For instance, their flagship convertible strategies have historically demonstrated resilience. While specific 2024 performance figures are still being finalized, the firm's long-term approach aims to mitigate downside risk, a crucial factor for investors in uncertain economic periods.

- Brand Strength: Calamos leverages its well-recognized name built over years of operation.

- Performance History: A track record of positive returns is a critical asset for attracting and retaining clients.

- Risk Management Focus: The firm's dedication to managing risk effectively is a core part of its value proposition.

- Market Challenges: Maintaining consistent performance across diverse strategies in fluctuating markets remains an ongoing hurdle.

Consolidation and M&A Activity

The asset management sector is witnessing significant consolidation through mergers and acquisitions. This trend is fueled by firms seeking to achieve greater scale, acquire new expertise, and realize cost savings. For instance, in 2024, the industry saw a number of notable deals, reflecting this ongoing push for efficiency and market presence.

This wave of M&A activity creates larger, more powerful competitors. These consolidated entities often boast wider product suites and more extensive distribution channels, directly impacting the competitive landscape. The increased market power of these larger players intensifies rivalry for all participants.

- Increased Scale: Mergers allow firms to manage larger asset bases, leading to economies of scale.

- Capability Expansion: Acquisitions enable firms to quickly gain access to new investment strategies or technologies.

- Distribution Reach: Consolidated firms often benefit from broader client networks and sales platforms.

- Intensified Competition: Larger players can exert greater pricing power and invest more heavily in marketing and product development, raising the bar for smaller competitors.

Competitive rivalry in asset management is intense, with Calamos competing against a broad range of players from large passive providers to specialized alternatives firms. The firm's strategy involves differentiating through expertise in areas like convertibles and structured products, alongside expanding into private credit. This approach aims to capture market share by offering unique solutions in a landscape increasingly shaped by low-cost passive options and industry consolidation.

The market's shift towards passive investing, with U.S. passive fund assets exceeding $13 trillion by late 2023, pressures active managers like Calamos to demonstrate clear value. In 2024, global ETF assets approached $11.9 trillion, underscoring the demand for cost-effective investment vehicles. Calamos counters this by highlighting its risk-conscious active management and historical performance, particularly in its convertible strategies, aiming to prove its ability to generate alpha and manage risk effectively.

Industry consolidation, evidenced by numerous mergers and acquisitions in 2024, creates larger competitors with broader capabilities and distribution. This trend intensifies rivalry by increasing the scale and market power of consolidated entities, forcing firms like Calamos to continuously innovate and leverage their established brand and performance history to maintain a competitive edge.

| Competitor Type | Key Differentiators | Calamos's Response |

|---|---|---|

| Large Passive Providers (e.g., Vanguard, BlackRock) | Low fees, broad index tracking | Focus on active management alpha, specialized strategies (convertibles, alternatives) |

| Fintech Startups | Digital platforms, lower overheads, niche offerings | Leveraging established brand, risk management expertise, expanding into private markets |

| Other Active Managers | Performance, specific asset class expertise, distribution reach | Highlighting long-term track record, risk-conscious approach, innovative products (structured protection ETFs) |

| Consolidated Entities (Post-M&A) | Increased scale, wider product suites, enhanced distribution | Emphasizing unique value proposition, consistent performance, and client relationships |

SSubstitutes Threaten

The rise of passive investment products like ETFs and index funds presents a substantial threat to actively managed funds such as those offered by Calamos. These passive options provide investors with diversified market exposure at considerably lower expense ratios, often attracting investors seeking to simply match market performance rather than outperform it.

For instance, as of early 2024, passive funds continued to see significant inflows, with assets under management in U.S. equity ETFs alone surpassing $5 trillion. This trend directly challenges active managers like Calamos to clearly demonstrate the alpha, or excess return, their strategies can generate to justify their higher fees, which can be a critical deciding factor for many investors.

Individual investors can bypass traditional asset managers like Calamos by directly investing in securities through self-directed brokerage accounts. This offers a cost-effective alternative, especially for those comfortable managing their own portfolios. For instance, in 2024, the number of retail investors actively trading on major platforms continued to grow significantly.

Robo-advisors present a powerful substitute, offering diversified, algorithm-driven portfolio management at remarkably low fees. These platforms appeal to investors prioritizing simplicity and affordability over personalized human advice, directly challenging entry-level advisory services. By mid-2024, assets under management for robo-advisors had surpassed $2 trillion globally, demonstrating their substantial market penetration.

Investors might opt for direct ownership of tangible assets like real estate or private businesses instead of relying solely on financial securities managed by firms like Calamos. This can provide a different kind of diversification and risk-return dynamic.

For instance, in 2024, global real estate investment volumes saw significant activity, with particular interest in sectors offering inflation protection. Similarly, private equity fundraising continued to attract substantial capital, demonstrating investor appetite for direct control and unique market exposures beyond public markets.

Annuities and Insurance Products

For investors prioritizing capital preservation and predictable income, annuities and certain insurance products present a significant threat of substitution. These offerings often feature guaranteed principal protection and fixed payout schedules, appealing to risk-averse individuals who may find market-linked returns less attractive. For example, the U.S. annuity market saw substantial sales in 2024, with total annuity sales reaching an estimated $300 billion by the end of the year, indicating strong demand for these capital-guaranteed solutions.

These substitute products can divert assets that might otherwise flow into investment strategies managed by firms like Calamos. The perceived safety and guaranteed nature of annuities can be particularly alluring during periods of market volatility, making them a compelling alternative for those less comfortable with investment risk.

- Principal Protection: Annuities often guarantee the return of the initial investment, a feature not typically found in market-linked securities.

- Guaranteed Income Streams: Many annuities offer lifetime income options, providing a predictable cash flow for retirement planning.

- Reduced Market Volatility Exposure: Investors seeking to avoid the fluctuations of equity or bond markets may opt for these insurance-based products.

- Tax-Deferred Growth: Annuities allow earnings to grow on a tax-deferred basis until withdrawal, a benefit also available in some investment accounts but often highlighted as a key feature of annuities.

Cryptocurrencies and Digital Assets

The increasing popularity of cryptocurrencies and digital assets presents a growing threat of substitutes for traditional investment vehicles managed by firms like Calamos. While still volatile, these digital assets are attracting capital, especially from younger demographics seeking alternative avenues for wealth creation and speculation. For instance, the total market capitalization of cryptocurrencies, which experienced significant fluctuations in 2024, still represented a substantial pool of investable assets that could divert funds from traditional markets.

These digital alternatives offer unique value propositions, including decentralization and potential for high returns, which appeal to a segment of investors looking beyond conventional financial products. This shift means that assets that might have historically been allocated to mutual funds, bonds, or equities could instead be directed towards digital currencies or non-fungible tokens (NFTs).

The accessibility and perceived innovation of digital assets can draw significant investment away from established financial institutions.

- Emerging Investor Base: Younger investors, often more comfortable with technology, are increasingly allocating portions of their portfolios to digital assets.

- Alternative Wealth Creation: Cryptocurrencies offer a different model for potential capital appreciation compared to traditional investments.

- Market Diversion: A portion of the trillions of dollars invested globally in digital assets could otherwise be channeled into traditional investment products.

The threat of substitutes for Calamos Asset Management's services is multifaceted, encompassing passive investment vehicles, direct investing, robo-advisors, alternative assets, and insurance products. These substitutes offer lower costs, different risk-return profiles, or greater perceived safety, diverting potential capital from actively managed funds.

For instance, as of early 2024, passive ETFs held over $5 trillion in U.S. equity assets, directly competing with active managers. Simultaneously, robo-advisors managed over $2 trillion globally by mid-2024, highlighting the appeal of low-cost, automated investment solutions. The annuity market also demonstrated robust demand, with sales reaching an estimated $300 billion in the U.S. for 2024, indicating a strong preference for guaranteed income and principal protection.

| Substitute Category | Key Features | 2024 Data/Trend |

|---|---|---|

| Passive Funds (ETFs, Index Funds) | Lower fees, market tracking | Over $5 trillion in U.S. equity ETFs (early 2024) |

| Robo-Advisors | Low fees, automated management | Over $2 trillion AUM globally (mid-2024) |

| Annuities & Insurance Products | Principal protection, guaranteed income | Estimated $300 billion in U.S. sales (2024) |

| Direct Investing (Real Estate, Private Equity) | Tangible assets, direct control | Significant global real estate investment, strong private equity fundraising |

| Cryptocurrencies & Digital Assets | Decentralization, potential high returns | Substantial market capitalization, attracting younger investors |

Entrants Threaten

Stringent regulatory requirements act as a significant barrier to entry in the asset management sector, directly impacting Calamos Asset Management. For instance, the Investment Advisers Act of 1940, along with numerous SEC regulations such as Form PF for private fund reporting and updated marketing rules, demands substantial compliance infrastructure. The sheer complexity and cost associated with obtaining licenses and adhering to these rules, which are continually evolving, deter many potential new competitors.

The asset management industry demands significant time to cultivate a robust brand reputation and investor trust. Newcomers struggle to match the decades-long track record of consistent performance that established firms like Calamos possess. This lack of credibility makes attracting substantial assets, particularly from institutional investors and high-net-worth individuals who prioritize stability and proven expertise, a formidable challenge.

Launching an asset management firm, even for Calamos, demands substantial upfront capital for sophisticated trading platforms, data analytics, and attracting top-tier investment talent. New entrants face similar hurdles, needing millions to establish robust infrastructure and meet stringent regulatory requirements, a significant barrier to entry.

Established firms like Calamos leverage considerable economies of scale, allowing them to spread fixed costs across a larger asset base. This translates to lower per-unit operational costs and the ability to offer more competitive fee structures, a challenge for smaller, newer competitors striving to achieve similar efficiencies.

Access to Distribution Channels

Gaining access to established distribution channels, like financial advisor networks and wealth management platforms, presents a significant hurdle for new asset management firms. Incumbent managers often have deep-rooted relationships and preferred product listings, making it difficult for newcomers to break in. For instance, in 2024, the average time for a new fund to gain significant distribution through major platforms could extend to 18-24 months, involving extensive due diligence and onboarding processes.

These channels frequently involve rigorous due diligence processes, requiring new entrants to demonstrate a proven track record, robust compliance, and compelling investment strategies. Building trust and securing product listings requires substantial investment in sales, marketing, and relationship management. In 2023, the cost for a new asset manager to gain initial access to a top-tier institutional consultant could range from $50,000 to $100,000, covering research, meetings, and proposal development.

- Distribution Channel Access: Established networks of financial advisors, institutional consultants, and wealth management platforms are often exclusive and favor incumbent managers.

- Due Diligence Hurdles: New entrants must navigate complex and time-consuming due diligence processes, requiring demonstrated performance and operational excellence.

- Relationship Building Costs: Significant investment is needed to cultivate relationships with gatekeepers, with initial consultant outreach potentially costing tens of thousands of dollars.

- Time to Market: Securing prominent placement on distribution platforms can take upwards of 18-24 months, delaying revenue generation for new firms.

Technological Investment and Expertise

The increasing reliance on advanced technologies like artificial intelligence, big data analytics, and robust cybersecurity necessitates significant and ongoing financial commitments. New players entering the asset management space must either develop these sophisticated technological infrastructures internally or acquire them, both of which represent substantial upfront costs and considerable complexity.

Established firms, such as Calamos Asset Management, have spent years cultivating deep expertise and building resilient technological platforms. This accumulated advantage creates a formidable barrier to entry for newcomers who would need to replicate this level of technological maturity and operational efficiency. For instance, in 2024, the global financial technology market size was valued at approximately $11.3 trillion, highlighting the scale of investment required to compete.

- High Capital Outlay: New entrants face substantial initial investments in technology infrastructure, software licenses, and specialized talent.

- Talent Acquisition Challenges: Attracting and retaining skilled professionals in AI, data science, and cybersecurity is competitive and expensive.

- Scalability and Integration: Building scalable and seamlessly integrated technological systems that can handle vast amounts of data and complex trading strategies is a significant hurdle.

- Regulatory Compliance: Meeting stringent regulatory requirements related to data privacy and financial technology adds another layer of cost and complexity for new entrants.

The threat of new entrants for Calamos Asset Management is generally low due to high barriers. Significant capital is required for technology and talent, with the global fintech market valued around $11.3 trillion in 2024. Regulatory hurdles, like the Investment Advisers Act of 1940, demand substantial compliance infrastructure and expertise, deterring many potential competitors. Building brand reputation and investor trust takes years, a challenge for newcomers lacking established track records.

| Barrier Type | Description | Estimated Cost/Time (Illustrative) |

| Regulatory Compliance | Meeting SEC and other financial regulations. | Millions in setup and ongoing compliance. |

| Capital Requirements | Technology, data analytics, talent acquisition. | $10M+ for a credible launch. |

| Brand Reputation & Trust | Cultivating investor confidence and track record. | Years of consistent performance. |

| Distribution Access | Gaining access to advisor networks and platforms. | 18-24 months to secure significant distribution. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Calamos Asset Management, Inc. is built upon a foundation of publicly available financial data from SEC filings, industry-specific research reports from firms like Morningstar and Cerulli Associates, and macroeconomic indicators from sources such as the Bureau of Labor Statistics.