Caixa Seguridade PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caixa Seguridade Bundle

Unlock critical insights into Caixa Seguridade's operational landscape with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are shaping its strategic direction. Download the full report to gain a competitive edge and make informed decisions.

Political factors

Caixa Seguridade's performance is closely tied to the Brazilian government's fiscal policies, given its affiliation with Caixa Econômica Federal. The government's commitment to a zero fiscal deficit in 2024 and a projected 0.5% surplus in 2025 will shape public spending and, by extension, the demand for insurance products sold via Caixa's vast distribution channels.

Shifts in government expenditure on social initiatives or infrastructure development can directly or indirectly affect Caixa Seguridade's customer base and overall economic activity, thereby influencing its financial results. For instance, increased public investment in healthcare infrastructure might indirectly boost demand for health insurance products.

Brazil's insurance sector operates under a dynamic regulatory framework, with SUSEP, the Superintendence of Private Insurance, consistently issuing new rules and outlining a regulatory plan for 2025. This includes the ongoing implementation of the new Brazilian Insurance Act (Law No. 15,040/2024), which is set to redefine the operational landscape for private insurance companies.

Key areas of focus for SUSEP in 2024 and 2025 include new regulations for universal life insurance and the expansion of open insurance initiatives. These developments present both potential hurdles and avenues for growth for Caixa Seguridade, necessitating agile adjustments to its product portfolio, operational procedures, and adherence to compliance standards.

The Brazilian government, spearheaded by entities like the Central Bank, actively pursues financial inclusion, a key political factor influencing Caixa Seguridade. This commitment is evident in ongoing efforts to broaden access to financial products and services for all citizens.

Caixa Seguridade's core mission to democratize financial protection resonates deeply with these governmental aims. Leveraging its extensive distribution channels through Caixa Econômica Federal, the company is well-positioned to capitalize on policies designed to boost financial literacy and service accessibility, particularly for previously underserved segments of the population.

For instance, initiatives like Pix, launched by the Central Bank of Brazil, have significantly accelerated digital payments and financial inclusion, with over 130 million users by early 2024. Such advancements create a more fertile ground for companies like Caixa Seguridade to expand their reach and offerings.

Political Stability and Government Intervention

Political stability in Brazil is a crucial element influencing investor sentiment and the broader economic landscape, directly affecting the insurance sector. For Caixa Seguridade, a stable political environment fosters confidence, encouraging investment and predictable market conditions.

Increased government intervention, observed in Brazil during 2024, presents potential uncertainties for businesses like Caixa Seguridade. These interventions can manifest in various ways, potentially impacting operational strategies and market dynamics within the financial services industry.

Such government actions could directly influence key aspects of the insurance business, including:

- Pricing regulations: Government decisions might affect how insurance products are priced, impacting profitability.

- Competitive landscape: New policies could alter the competitive balance among insurers.

- Strategic alliances: Intervention might influence the feasibility or structure of partnerships and acquisitions within the sector.

International Relations and Global Economic Policies

Brazil's active participation in international forums, such as the G20, shapes its global economic policies. For instance, Brazil's commitment to climate change initiatives, like hosting COP30 in Belém in 2025, signals a potential shift towards greener economic practices. This can influence regulatory frameworks and investment opportunities within the financial sector, impacting companies like Caixa Seguridade.

These international engagements often translate into the adoption of global best practices and new policy directions. For Caixa Seguridade, this could mean adapting to evolving international standards for financial reporting, risk management, and sustainability. The country's stance on global trade agreements and its relationships with major economic blocs also play a crucial role in the broader economic outlook.

- G20 Presidency Influence: Brazil's role in the G20 can steer global economic policy discussions, potentially impacting trade, investment flows, and regulatory harmonization relevant to the insurance sector.

- COP30 Impact: Hosting COP30 in 2025 highlights Brazil's focus on climate action, which may lead to new regulations or incentives for sustainable finance and insurance products.

- Trade Agreements: Brazil's participation in and negotiation of international trade agreements can affect market access for financial services and the overall competitiveness of the domestic insurance market.

- Global Economic Stability: Brazil's contributions to discussions on global financial stability and its relationships with international financial institutions influence the broader economic environment in which Caixa Seguridade operates.

The Brazilian government's fiscal targets, aiming for a zero deficit in 2024 and a 0.5% surplus in 2025, directly influence public spending and demand for insurance products distributed by Caixa Econômica Federal. Government initiatives promoting financial inclusion, such as the widely adopted Pix payment system with over 130 million users by early 2024, create significant opportunities for Caixa Seguridade to expand its reach. Furthermore, Brazil's hosting of COP30 in 2025 underscores a growing emphasis on climate action, potentially leading to new regulations and incentives for sustainable financial products.

The regulatory landscape, overseen by SUSEP, is evolving with the implementation of the new Brazilian Insurance Act (Law No. 15,040/2024) and updated rules for universal life insurance and open insurance in 2024-2025. Political stability remains a key factor, fostering investor confidence and predictable market conditions essential for Caixa Seguridade's operations. However, increased government intervention in 2024 could introduce uncertainties regarding pricing, competition, and strategic partnerships within the financial services sector.

| Political Factor | Impact on Caixa Seguridade | 2024/2025 Data/Trend |

|---|---|---|

| Fiscal Policy | Influences public spending and demand for insurance. | Target: Zero deficit (2024), 0.5% surplus (2025). |

| Financial Inclusion Initiatives | Expands customer base and market access. | Pix users exceeded 130 million by early 2024. |

| Regulatory Changes (SUSEP) | Redefines operational landscape and compliance. | New Brazilian Insurance Act (Law No. 15,040/2024), focus on universal life and open insurance. |

| Political Stability | Affects investor sentiment and market predictability. | Crucial for confidence and investment. |

| Government Intervention | Potential impact on pricing, competition, and strategy. | Increased intervention observed in 2024. |

| International Commitments (COP30) | Drives focus on sustainable finance and insurance. | Brazil hosts COP30 in Belém in 2025. |

What is included in the product

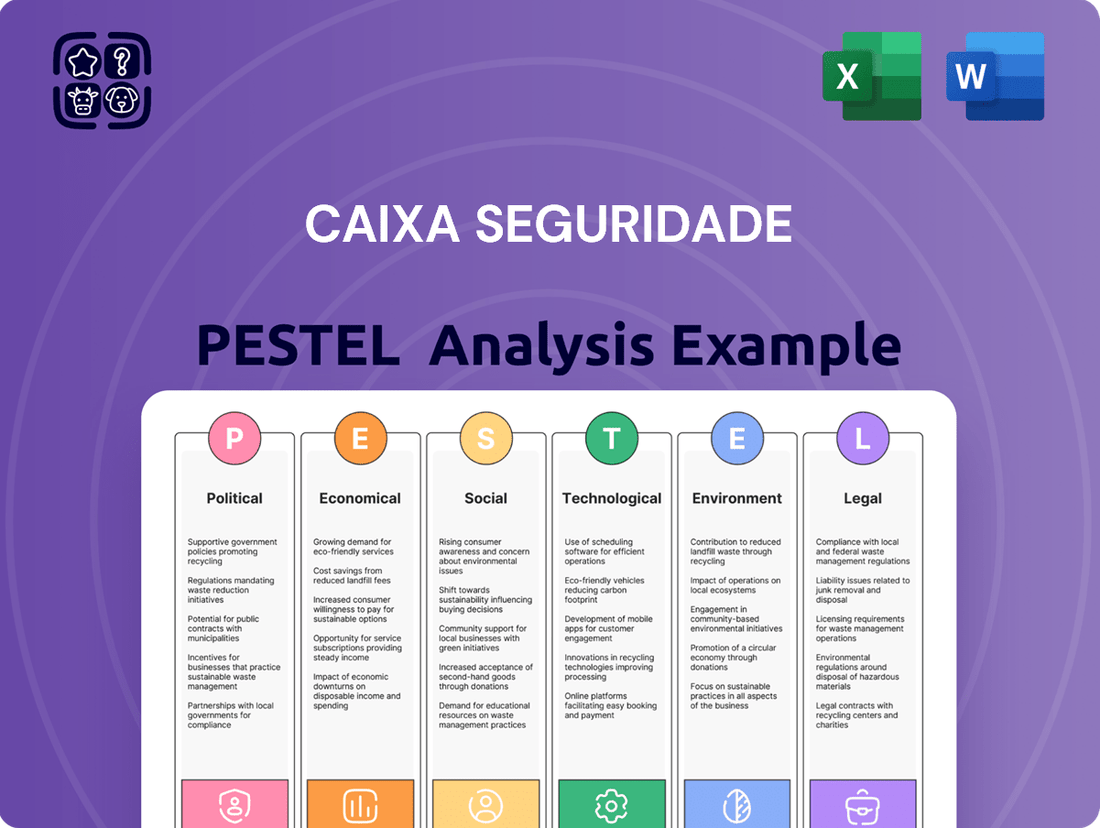

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Caixa Seguridade across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by identifying key trends and their implications for the company's future growth and risk management.

Caixa Seguridade's PESTLE analysis acts as a pain point reliever by offering a clear, summarized version of external factors, enabling swift identification of opportunities and threats for strategic decision-making.

Economic factors

Brazil has grappled with persistent inflation, leading the Central Bank to maintain elevated interest rates. Projections suggest these high rates will continue into 2025, presenting a significant challenge for companies like Caixa Seguridade.

The elevated interest rate environment directly impacts Caixa Seguridade by increasing its cost of capital, making borrowing more expensive and potentially reducing the profitability of its financial investments. This necessitates a strategic approach to capital management and investment portfolio optimization.

Furthermore, ongoing inflationary pressures pose a risk to premium rates and claims costs within the insurance sector. Caixa Seguridade must meticulously manage its underwriting and pricing strategies to offset these inflationary impacts and maintain healthy profit margins.

Brazil's GDP growth is a key driver for Caixa Seguridade's business. A stronger economy means more disposable income for Brazilians, which directly translates to higher demand for insurance and private pension products. For instance, in early 2024, Brazil's economy showed encouraging signs of activity.

However, projections suggest a moderation in GDP growth as 2025 approaches. This anticipated slowdown could temper the expansion of the financial services sector. Nevertheless, a generally robust economic environment typically boosts sales across various insurance lines, particularly those linked to housing and consumer financing.

Brazil's expanding middle class and increasing disposable incomes are significant tailwinds for the insurance sector. As more Brazilians have more money to spend after essential expenses, they are more likely to invest in life and non-life insurance products. This trend directly benefits companies like Caixa Seguridade, which can leverage its strong ties to Caixa Econômica Federal's vast customer base to capture this growing demand.

In 2024, Brazil's real disposable income is projected to see moderate growth, supported by a stable labor market and controlled inflation. For instance, projections suggest a potential increase of around 2-3% in real terms for the year, which translates into greater purchasing power for households. This enhanced spending capacity is a critical factor for Caixa Seguridade, as it directly influences the uptake of its insurance offerings.

However, economic volatility and persistent inflationary pressures remain key risks. If inflation outpaces wage growth, consumer spending power can erode, potentially leading individuals to postpone or reduce non-essential purchases, including insurance premiums. Caixa Seguridade must navigate these economic uncertainties by offering flexible and value-driven products to maintain its market position.

Financial Market Liquidity and Investment Climate

Financial market liquidity in Brazil, a key determinant of Caixa Seguridade's investment climate, is significantly shaped by interest rate policies and foreign investment rules. For instance, the Central Bank of Brazil's Selic rate, which stood at 10.50% as of May 2024, directly influences borrowing costs and the attractiveness of fixed-income investments, impacting Caixa Seguridade's portfolio performance.

Efforts to streamline access for international investors to Brazilian markets, such as potential regulatory adjustments in 2024-2025, could broaden investment avenues and capital-raising capabilities for companies like Caixa Seguridade. The company's financial health is intrinsically linked to the returns generated by its invested capital, making market liquidity a critical operational factor.

- Interest Rate Influence: The Selic rate's trajectory directly affects the yield on Caixa Seguridade's fixed-income assets and the cost of capital.

- Foreign Investment Trends: Changes in regulations governing foreign capital inflows can impact market depth and investment opportunities.

- Portfolio Performance: The ability to deploy capital efficiently and profitably hinges on the liquidity and stability of Brazil's financial markets.

Competition and Market Consolidation

The Brazilian insurance sector is seeing a wave of mergers and acquisitions (M&A) as companies aim to grow larger and operate more efficiently. This heightened M&A activity underscores a fiercely competitive environment. Caixa Seguridade must consistently enhance its product offerings and distribution channels to safeguard its standing in the market.

For example, in 2023, the Brazilian insurance market witnessed several significant deals. While specific aggregate M&A value figures for the entire market in late 2024 or early 2025 are still emerging, the trend of consolidation is clear. Major players are actively pursuing strategic acquisitions to expand their reach and capabilities, increasing pressure on all participants.

The influx of new entrants and the aggressive expansion of established insurers further intensify the battle for market share. This dynamic necessitates continuous adaptation and innovation from Caixa Seguridade to remain competitive.

- Market Consolidation: Brazilian insurance firms are actively pursuing M&A to achieve economies of scale and operational efficiencies.

- Competitive Pressure: This consolidation trend intensifies competition, forcing companies like Caixa Seguridade to innovate product development and distribution strategies.

- New Entrants: The potential entry of new players and the expansion of existing ones will further fragment and challenge market share dynamics.

- Strategic Imperative: Maintaining market position requires Caixa Seguridade to adapt proactively to these evolving competitive forces.

Brazil's economic landscape in 2024-2025 is characterized by persistent inflation, prompting the Central Bank to maintain high interest rates, with the Selic rate at 10.50% as of May 2024. While GDP growth showed promise in early 2024, projections indicate a moderation, potentially impacting the financial services sector. However, a growing middle class and increasing disposable income, with real disposable income expected to grow moderately by 2-3% in 2024, provide a positive outlook for insurance demand.

| Economic Indicator | Value/Projection | Impact on Caixa Seguridade |

|---|---|---|

| Inflation Rate | Persistent high levels | Increases cost of capital, impacts premium and claims costs |

| Selic Rate (May 2024) | 10.50% | Affects investment yields and borrowing costs |

| GDP Growth | Moderating in 2025 | Could temper expansion of financial services |

| Real Disposable Income Growth (2024 Projection) | 2-3% | Boosts demand for insurance and pension products |

Same Document Delivered

Caixa Seguridade PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Caixa Seguridade PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. Gain immediate access to this in-depth report to understand the external landscape influencing Caixa Seguridade's future success.

Sociological factors

Brazil's demographic landscape is undergoing significant transformation, with a notable aging population. Projections indicate that individuals aged 65 and over will constitute 11.3% of the total population by 2025. This trend directly influences consumer needs, boosting demand for products like personal accident and health insurance, alongside private pension schemes.

Caixa Seguridade's product portfolio is well-positioned to address these evolving demands. The increasing proportion of older adults translates into a greater need for financial security and healthcare coverage. Adapting product offerings and marketing strategies to resonate with this growing segment is vital for sustained growth.

Growing financial literacy and awareness among Brazilians is a significant sociological driver. As more people understand the importance of financial planning and protection, the demand for insurance and savings products naturally rises. This trend is particularly strong in 2024 and projected to continue into 2025.

Caixa Seguridade is well-positioned to leverage this shift. By focusing on making financial services more accessible and using its extensive distribution channels, the company can effectively educate its customer base. This approach allows Caixa Seguridade to offer tailored solutions that meet the evolving needs of an increasingly financially savvy population.

Caixa Seguridade actively pursues social inclusion and the reduction of inequalities, mirroring its parent company's dedication to public policy. This commitment is evident in initiatives designed to improve accessibility for individuals with disabilities, a crucial step in ensuring broader participation in financial services. For instance, in 2023, Caixa Seguridade continued its focus on digital accessibility, aiming to meet evolving regulatory standards and user expectations for inclusive online platforms.

The company's efforts extend to fostering diversity and inclusion within its corporate structure. By promoting a diverse workforce, Caixa Seguridade not only strengthens its internal culture but also enhances its ability to understand and serve a wider range of customers. This focus on inclusivity can significantly boost brand reputation and open doors to new market segments, contributing to sustained growth and customer loyalty.

Impact of Health and Public Security Issues

Public health crises, like the dengue fever outbreak in Brazil in early 2024, can disrupt economic activity and consequently affect demand for insurance products. This situation might lead to increased demand for health-related insurance and potentially impact the claims landscape for life and disability products.

Concerns about public security, including prevalent issues like gender-based violence, can shape the types of insurance solutions that are most relevant and needed by the population. Caixa Seguridade may need to consider product development and social responsibility programs that address these societal challenges.

- Dengue Fever Impact: Early 2024 saw a significant surge in dengue cases across Brazil, with over 1 million reported by March 2024, potentially affecting workforce productivity and healthcare system strain.

- Public Security Concerns: Reports from organizations like the Brazilian Forum on Public Security highlight persistent challenges with violence, which can influence consumer risk perception and insurance uptake.

- Product Relevance: The need for robust health coverage and potentially specialized insurance addressing personal safety could rise in response to these societal issues.

Consumer Behavior and Digital Adoption

The Brazilian population is increasingly embracing digital channels for various services, including financial ones. In 2023, approximately 80% of Brazilians used the internet, with a significant portion of this demographic being younger and more tech-oriented. This trend fuels a demand for insurance products that are easily accessible and manageable online, pushing companies like Caixa Seguridade to innovate in their product offerings and distribution methods.

Caixa Seguridade's strategic emphasis on digital transformation is crucial for aligning with these evolving consumer behaviors. By investing in digital platforms and enhancing online accessibility, the company aims to capture a larger share of the market. For instance, by 2024, digital sales channels are projected to account for a substantial portion of new insurance policies, underscoring the importance of this digital shift.

- Digital Penetration: Internet usage in Brazil reached over 80% by late 2023, with a growing segment of the population preferring online interactions for financial services.

- Younger Demographics: A younger, digitally native population is driving demand for innovative, user-friendly insurance products and digital sales platforms.

- Caixa Seguridade's Strategy: The company's focus on digital transformation and improving online accessibility is key to meeting these changing consumer preferences and remaining competitive.

Brazil's aging population is a significant sociological factor, with individuals aged 65 and over expected to represent 11.3% of the total population by 2025. This demographic shift increases the demand for products like personal accident and health insurance, as well as private pension plans. Caixa Seguridade's product offerings are well-aligned with these growing needs, emphasizing financial security and healthcare coverage for an older demographic.

Rising financial literacy in Brazil is a key driver, with more citizens understanding the importance of financial planning and protection, boosting demand for insurance and savings products through 2024 and into 2025. Caixa Seguridade can capitalize on this by enhancing product accessibility and leveraging its distribution network to educate consumers, offering tailored solutions for an increasingly informed populace.

Caixa Seguridade's commitment to social inclusion and reducing inequality, mirroring its parent company's public policy focus, is crucial. Initiatives for individuals with disabilities, such as improved digital accessibility in 2023, ensure broader participation in financial services. Promoting workforce diversity also strengthens internal culture and enhances the company's ability to serve a wider customer base, boosting brand reputation and market reach.

Public health concerns, like the dengue fever outbreak in early 2024 which saw over 1 million cases by March, can impact economic activity and insurance demand, potentially increasing the need for health-related coverage. Similarly, persistent public security issues, including gender-based violence, influence consumer risk perception and the demand for relevant insurance solutions and social responsibility programs.

| Sociological Factor | Trend/Impact | Caixa Seguridade Relevance |

|---|---|---|

| Aging Population | 11.3% of population aged 65+ by 2025 | Increased demand for health, accident, and pension products. |

| Financial Literacy | Growing awareness of financial planning and protection. | Opportunity for increased uptake of insurance and savings products. |

| Digital Adoption | Over 80% internet penetration by late 2023. | Demand for accessible online insurance products and services. |

| Social Inclusion | Focus on accessibility for disabled individuals. | Enhances market reach and brand reputation. |

| Public Health & Security | Dengue outbreak (1M+ cases by Mar 2024), ongoing security concerns. | Potential for increased demand for health and personal safety insurance. |

Technological factors

Caixa Seguridade is making significant strides in its digital transformation, a key technological factor influencing its operations. This initiative focuses on modernizing internal processes and enriching the customer journey. By embracing new technologies, the company seeks to boost operational efficiency and broaden access to its diverse insurance and pension products.

The company's digital push is designed to streamline product distribution channels and make services more readily available to a wider audience. This aligns with a broader trend in the Brazilian financial sector, which is increasingly prioritizing technological adoption to drive market advancements and improve overall outcomes for consumers.

Brazil's fintech and insurtech sectors are experiencing robust growth, attracting significant investment. In 2024, venture capital funding in Brazilian fintechs reached an estimated $1.5 billion, signaling strong investor confidence in the ecosystem's potential.

Caixa Seguridade must actively monitor and consider integrating insurtech solutions to maintain its competitive edge and introduce novel products. The digital transformation of insurance distribution, including the rise of embedded finance, is fundamentally altering how insurance is offered and accessed by consumers.

The Open Insurance initiative, a key component of Brazil's financial sector modernization, aims to boost transparency and foster customer-focused innovation within the insurance market. Caixa Seguridade needs to navigate these evolving regulations, especially as implementation deadlines are extended, impacting how data is shared and how products are developed and offered across different insurance segments.

This regulatory shift encourages greater competition and allows consumers to access and share their insurance data more freely, potentially leading to more tailored and competitive product offerings. By mid-2024, regulatory bodies were still refining specific technical standards for data exchange, indicating a gradual but significant transformation is underway.

Data Analytics and Artificial Intelligence

The growing need for advanced data analytics is paramount for Caixa Seguridade, particularly in evaluating and mitigating risks influenced by evolving climate patterns. By harnessing AI and sophisticated analytical tools, the company can significantly enhance its risk assessment capabilities, tailor product offerings to individual customer needs, and improve the detection of fraudulent activities.

In 2024, the insurance industry saw a significant uptick in AI adoption for risk management. For instance, a report indicated that insurers leveraging AI for underwriting experienced a 15% reduction in claims leakage. This trend is expected to continue, with AI-powered analytics playing a crucial role in pricing policies accurately and identifying emerging risks for Caixa Seguridade.

- AI-driven risk assessment: Predictive models can identify high-risk policyholders and geographical areas, allowing for proactive mitigation strategies.

- Personalized product development: Analyzing customer data enables the creation of bespoke insurance products that better meet individual needs and preferences.

- Enhanced fraud detection: Machine learning algorithms can identify suspicious patterns in claims, reducing financial losses due to fraud.

- Climate risk modeling: Advanced analytics are essential for understanding and pricing the impact of climate change on insurance portfolios.

Cybersecurity and Data Privacy

As financial services increasingly move online, cybersecurity and data privacy are absolutely crucial for Caixa Seguridade. Protecting sensitive customer information is no longer optional; it's a core operational necessity. This digital shift means significant investment in advanced security infrastructure is a must to prevent breaches and maintain customer confidence.

Caixa Seguridade needs to prioritize robust security measures to safeguard customer data and uphold trust. A strong defense against cyber threats is vital in the current digital landscape. Failure to do so can lead to severe reputational damage and financial penalties.

Compliance with data protection regulations is essential for mitigating risks. For instance, Brazil's General Data Protection Law (LGPD) imposes strict requirements on how companies handle personal data. Adhering to these mandates helps Caixa Seguridade avoid hefty fines and maintain its license to operate.

- Cybersecurity Investment: Caixa Seguridade must allocate substantial resources to advanced threat detection, encryption, and secure data storage solutions.

- Data Privacy Compliance: Strict adherence to regulations like Brazil's LGPD is non-negotiable, requiring clear data handling policies and consent mechanisms.

- Customer Trust: Demonstrating a commitment to data security is paramount for retaining and attracting customers in an increasingly digital financial market.

Caixa Seguridade is actively engaged in a significant digital transformation to enhance its operational efficiency and customer experience. This strategic move involves modernizing internal systems and expanding access to its wide array of insurance and pension products, reflecting a broader trend in Brazil's financial sector towards technological adoption.

The growth of fintech and insurtech in Brazil, evidenced by an estimated $1.5 billion in venture capital funding for fintechs in 2024, underscores the importance of innovation. Caixa Seguridade's integration of insurtech solutions and adaptation to digital distribution models, including embedded finance, are crucial for maintaining competitiveness.

The Open Insurance initiative in Brazil, aimed at increasing transparency and customer-centric innovation, requires Caixa Seguridade to navigate evolving data-sharing regulations. By mid-2024, regulatory bodies were still refining technical standards for data exchange, indicating a gradual but impactful market shift.

Advanced data analytics, particularly AI, is vital for Caixa Seguridade to improve risk assessment, personalize product offerings, and detect fraud. Insurers using AI for underwriting saw a 15% reduction in claims leakage in 2024, highlighting AI's impact on profitability and risk management.

| Technological Factor | Impact on Caixa Seguridade | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Digital Transformation | Enhanced operational efficiency, broader product access, improved customer journey. | Brazil's financial sector prioritizes tech adoption; Caixa Seguridade modernizing processes. |

| Insurtech & Fintech Growth | Need to integrate innovative solutions, adapt to new distribution models (e.g., embedded finance). | $1.5 billion estimated VC funding for Brazilian fintechs in 2024; robust insurtech sector growth. |

| Open Insurance Initiative | Navigating new data sharing regulations, fostering competition and tailored products. | Regulatory bodies refining technical standards for data exchange (mid-2024); gradual market transformation. |

| AI & Data Analytics | Improved risk assessment, personalized products, fraud detection, climate risk modeling. | Insurers using AI for underwriting saw 15% claims leakage reduction (2024); AI adoption for risk management increasing. |

| Cybersecurity & Data Privacy | Crucial for customer trust and regulatory compliance (LGPD). | LGPD mandates strict data handling; significant investment in advanced security infrastructure required. |

Legal factors

The Brazilian Insurance Act, Law No. 15,040/2024, enacted in December 2024, ushers in substantial legal changes for the insurance industry. SUSEP is slated to oversee its comprehensive regulation throughout 2025, setting the stage for a new operational landscape.

This pivotal legislation is expected to reshape norms for private insurance, influencing critical aspects like product development, the precise wording of policy terms, and the overall market dynamics for entities like Caixa Seguridade.

SUSEP's regulatory plan for 2025 is set to introduce significant changes across various insurance sectors, focusing on corporate processes, life insurance, transport insurance, and the burgeoning area of sustainable products. Caixa Seguridade must proactively adapt to these evolving guidelines to ensure continued operational integrity.

Compliance with SUSEP's directives is paramount. Failure to adhere to these updated regulations could result in substantial penalties and potentially jeopardize Caixa Seguridade's operating licenses, impacting its market position and financial performance.

Recent Brazilian government decrees in May and June 2025 have raised the Tax on Financial Transactions (IOF) for credit, foreign exchange, and insurance. A notable change is the 5% IOF on individual life insurance contributions exceeding specific limits for survival benefits.

This adjustment directly increases the cost of these insurance products for individuals, potentially affecting consumer purchasing decisions and overall market demand for such offerings.

Regulations on Open Insurance and Digital Services

The legal landscape for open insurance in Brazil is dynamic, with new regulations issued in November 2024. These updates, which included revised implementation timelines and redefined responsibilities within the open insurance ecosystem, directly impact Caixa Seguridade's operational strategy. Adherence to these evolving legal stipulations is crucial for Caixa Seguridade to actively engage in data sharing initiatives and foster customer-focused advancements.

Caixa Seguridade must navigate these legal requirements to fully capitalize on the opportunities presented by Brazil's open insurance framework. This includes ensuring compliance with data privacy laws and adapting to new mandates concerning digital service provision. The regulatory environment shapes how Caixa Seguridade can innovate and compete in the evolving insurance market.

- November 2024 Regulatory Update: New rules published, extending deadlines and clarifying roles in Brazil's Open Insurance.

- Data Sharing Compliance: Caixa Seguridade must align with regulations governing secure and ethical data exchange.

- Customer-Centric Innovation: Legal adherence enables leveraging open insurance for enhanced customer experiences and new product development.

Consumer Protection Laws and Judicial Decisions

Judicial decisions, particularly those from higher courts, significantly shape insurance practices by establishing precedents for claim handling and interpretation. Caixa Seguridade must diligently monitor these legal developments and evolving consumer protection laws to uphold fairness and mitigate legal exposure. For instance, in 2023, Brazil's Superior Court of Justice (STJ) issued several rulings clarifying consumer rights in insurance contracts, impacting areas like indemnity adjustments and dispute resolution, which directly affects how insurers like Caixa Seguridade must operate.

Staying informed about these judicial pronouncements is crucial for Caixa Seguridade to ensure its operations align with current legal interpretations and consumer expectations. This proactive approach helps in minimizing litigation risks and maintaining a reputation for ethical conduct. The company's compliance framework needs to be dynamic, incorporating insights from recent court rulings to preemptively address potential legal challenges and ensure robust consumer protection measures are in place.

- Precedent-Setting Rulings: Higher court decisions in 2023, such as those clarifying coverage for specific health conditions, have set new standards for insurance claim assessments.

- Consumer Protection Evolution: Ongoing legislative reviews and judicial interpretations of consumer protection laws in Brazil are continuously refining the rights of insurance policyholders.

- Risk Mitigation: Caixa Seguridade's adherence to these evolving legal landscapes is vital for minimizing potential fines and legal disputes, safeguarding its financial stability and market standing.

The Brazilian Insurance Act, Law No. 15,040/2024, enacted in December 2024 and to be regulated by SUSEP in 2025, introduces significant legal shifts impacting product development and policy terms for Caixa Seguridade. Recent decrees in May and June 2025 also raised the Tax on Financial Transactions (IOF) for insurance, including a 5% IOF on individual life insurance contributions above certain thresholds, directly affecting product costs.

New regulations for open insurance, issued in November 2024, redefined implementation timelines and responsibilities, requiring Caixa Seguridade to ensure compliance with data sharing and digital service mandates to foster customer-centric advancements.

Judicial decisions, such as those from Brazil's Superior Court of Justice in 2023 clarifying consumer rights in insurance contracts, set precedents for claim handling and dispute resolution, necessitating Caixa Seguridade's diligent monitoring of evolving consumer protection laws to mitigate legal exposure.

Environmental factors

Brazil's susceptibility to climate change is escalating, with recent years marked by severe droughts impacting agricultural output and widespread flooding causing significant damage. For instance, the 2023/2024 period saw extreme weather events across several regions, leading to increased claims in property and casualty insurance. These climatic shifts directly affect the actuarial assumptions underpinning insurance pricing and risk management, posing a challenge for companies like Caixa Seguridade.

The increasing frequency and intensity of extreme weather events, such as the devastating floods experienced in Rio Grande do Sul in May 2024 which caused billions in damages, create substantial financial liabilities for insurers. Caixa Seguridade's exposure is particularly pronounced in its housing and residential insurance portfolios, where claims related to property damage from storms, floods, and fires are likely to rise. This volatility necessitates robust risk modeling and potential adjustments to underwriting strategies to maintain profitability and solvency.

Caixa Seguridade is actively addressing climate change by managing its impacts and transparently reporting greenhouse gas emissions, evidenced by its participation in the Climate Disclosure Project (CDP) and the Brazilian GHG Protocol Program. This commitment extends to its parent company, Caixa, which has established a Sustainable Finance Framework aimed at increasing funding for projects tackling socio-economic and environmental challenges.

The company is increasingly embedding Environmental, Social, and Governance (ESG) principles across its business, from internal operations to the development of its insurance and financial products. This strategic focus reflects a broader industry trend towards sustainable finance, where investors and consumers alike are prioritizing companies with strong ESG credentials.

SUSEP Circular No. 666, focusing on sustainability for insurers, saw key developments throughout 2024 and will continue to introduce new requirements into 2025. This regulation mandates detailed sustainability reporting and the integration of sustainability policies across operations.

Caixa Seguridade must therefore bolster its environmental risk management frameworks and reporting capabilities to comply with these evolving mandates. The circular's phased implementation means ongoing adaptation will be crucial for the company.

Carbon Neutrality and Emission Reduction Targets

Caixa Seguridade, through its subsidiary Caixa Assistência, achieved carbon neutrality in its operations in 2023. This significant environmental milestone involved the acquisition of carbon credits to offset projected emissions through 2027, demonstrating a proactive approach to environmental responsibility.

This commitment to reducing its carbon footprint is a crucial environmental factor for Caixa Seguridade. It aligns with growing global demands for sustainable business practices and signals a dedication to mitigating climate change impacts.

- Carbon Neutrality Achieved: Caixa Assistência became carbon neutral in 2023.

- Emission Offsetting: Carbon credits have been purchased to offset estimated emissions until 2027.

- Environmental Strategy: This initiative underscores a commitment to environmentally responsible operations.

- Market Alignment: The move reflects increasing investor and consumer focus on sustainability.

Natural Catastrophe (NatCat) Event Coverage Demand

The demand for natural catastrophe (NatCat) event coverage is on the rise in Brazil's general insurance market. This surge is directly linked to increasing climate volatility and the growing awareness of potential losses from extreme weather events.

Caixa Seguridade's strategic response to this trend is vital. Offering robust and flexible policies that address these escalating risks will be key to its market position and future expansion. The company's ability to innovate in product development for NatCat events will directly impact its competitive edge.

- Rising Premiums: The Brazilian insurance market has seen a notable increase in premiums for property insurance, particularly those covering natural disasters. For instance, data from SUSEP (Superintendência de Seguros Privados) indicated a significant uptick in property damage claims related to weather events in recent years.

- Climate Impact: Brazil experienced a series of severe weather events in 2023 and early 2024, including intense droughts in the Amazon and heavy rainfall leading to floods in southern regions, directly fueling demand for NatCat coverage.

- Product Adaptation: Insurers are increasingly developing specialized products, such as parametric insurance for drought or flood events, to meet this evolving demand, reflecting a shift towards more tailored risk management solutions.

Brazil's increasing vulnerability to climate change is a significant environmental factor, with extreme weather events like the May 2024 floods in Rio Grande do Sul causing billions in damages, directly impacting insurance claims for Caixa Seguridade. The company is proactively addressing this by integrating ESG principles and achieving carbon neutrality through its subsidiary Caixa Assistência in 2023, offsetting emissions until 2027.

Regulatory shifts, such as SUSEP Circular No. 666 introduced in 2024 and continuing into 2025, mandate enhanced sustainability reporting and operational integration for insurers, requiring Caixa Seguridade to strengthen its environmental risk management and reporting capabilities.

The growing demand for natural catastrophe (NatCat) coverage in Brazil, fueled by climate volatility, presents both challenges and opportunities for Caixa Seguridade, necessitating innovative product development to maintain a competitive edge in the market.

PESTLE Analysis Data Sources

Our Caixa Seguridade PESTLE Analysis is built on a robust foundation of data from official Brazilian government agencies, financial regulatory bodies, and reputable economic research institutions. We incorporate insights from industry-specific reports and market trend analyses to ensure comprehensive coverage.