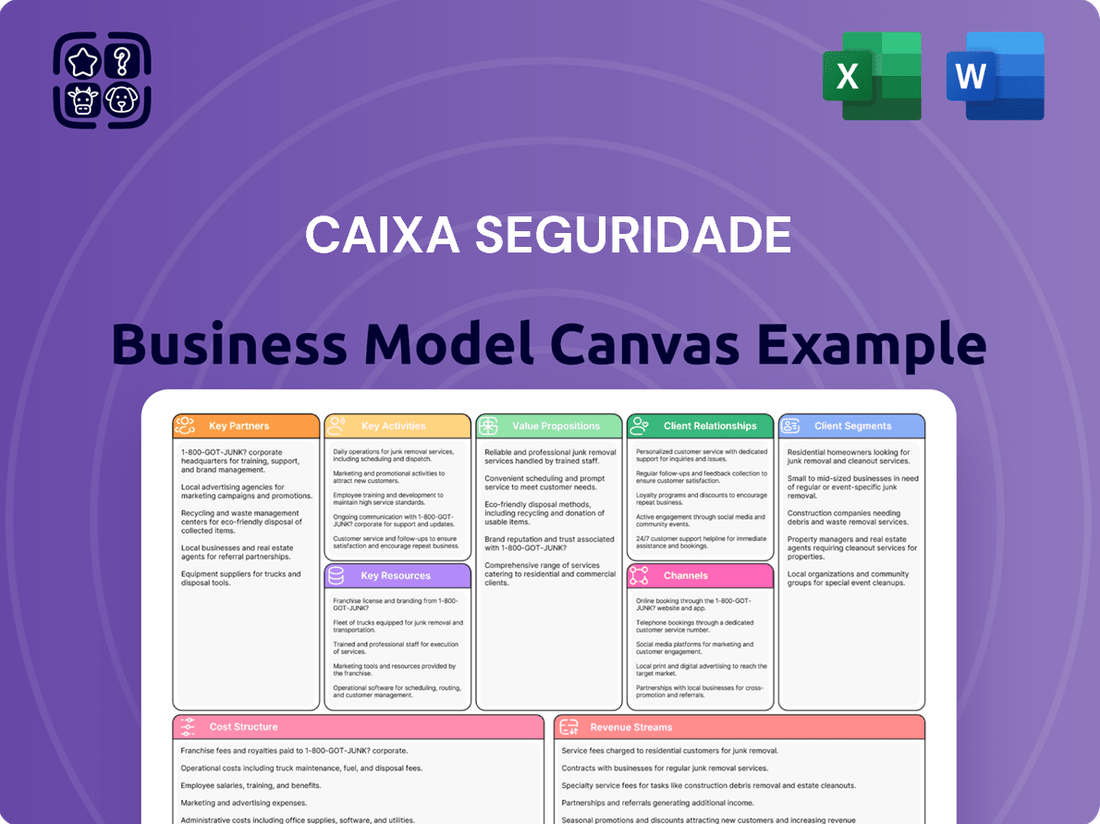

Caixa Seguridade Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caixa Seguridade Bundle

Unlock the strategic blueprint of Caixa Seguridade's success with our comprehensive Business Model Canvas. This detailed analysis reveals their customer relationships, revenue streams, and key resources, offering invaluable insights for your own ventures. Download the full version to gain a competitive edge.

Partnerships

Caixa Econômica Federal is Caixa Seguridade's cornerstone partner, vital for its distribution strategy. This relationship grants access to an unparalleled network of over 4,000 branches, 21,000 lottery outlets, and numerous banking correspondents, facilitating broad product reach across Brazil.

The exclusive rights to leverage the highly recognized Caixa brand name provide a significant competitive advantage, fostering customer trust and enhancing market penetration. This brand association is instrumental in building credibility for Caixa Seguridade's insurance and capitalization products.

In 2023, Caixa Econômica Federal reported total assets exceeding R$1.5 trillion, underscoring the immense scale of the customer base accessible to Caixa Seguridade. This vast network ensures efficient customer acquisition and service delivery for insurance and related financial products.

Caixa Seguridade's strategic alliance with CNP Assurances, inked in 2021 for a 25-year term, is a cornerstone of its business model, specifically targeting life insurance, credit life, and pension plans. This collaboration leverages CNP Assurances' established leadership and deep-seated expertise within the French insurance market, directly bolstering Caixa Seguridade's product portfolio and streamlining its operational capabilities.

This partnership is designed to enhance Caixa Seguridade's competitive edge by integrating CNP Assurances' proven track record and specialized knowledge in critical insurance sectors. For instance, in 2023, the life insurance segment, heavily influenced by such strategic partnerships, saw significant growth, with premiums in Brazil's private pension market alone reaching R$165.2 billion, according to data from FenaPrevi, highlighting the sector's robust potential.

Caixa Seguridade's partnership with Tokio Marine Seguradora S.A., established in 2021 for a 20-year term, is a cornerstone for its mortgage and homeowner insurance offerings. This alliance is designed to enhance Caixa Seguridade's competitive edge in the Brazilian housing insurance market by integrating Tokio Marine's extensive international expertise and innovative product development capabilities.

Icatu Seguridade S.A.

Caixa Seguridade has established a significant partnership with Icatu Seguridade S.A., Brazil's leading independent insurer in life, pension, and prize-linked bonds. This collaboration, formalized through a 20-year agreement that commenced in 2021, specifically targets the premium bonds (capitalização) segment.

Through this alliance, Caixa Seguridade leverages Icatu's expertise to offer specialized capitalization products, enhancing its product portfolio and reach within the Brazilian market. This strategic move allows Caixa Seguridade to tap into a well-established player’s capabilities, thereby strengthening its competitive position.

Key aspects of this partnership include:

- Strategic Focus: Concentrates on the capitalização (premium bonds) market, a key area for financial savings and investment products in Brazil.

- Long-Term Commitment: A 20-year agreement underscores a deep commitment and shared vision for growth in the insurance sector.

- Expertise Alignment: Caixa Seguridade benefits from Icatu's extensive experience as Brazil's largest independent insurer in life, pension, and prize-linked bonds.

- Product Enhancement: Enables Caixa Seguridade to offer more sophisticated and specialized capitalization products to its broad customer base.

Tempo Assist

Tempo Assist stands as a crucial partner for Caixa Seguridade, specifically for delivering essential assistance services. A significant 20-year agreement was inked in 2021, solidifying this collaboration. This long-term commitment ensures a consistent and reliable provision of support services, a vital component of Caixa Seguridade's offering.

This partnership directly supports Caixa Seguridade's strategy to bundle value-added services with its core insurance products. By integrating Tempo Assist's capabilities, Caixa Seguridade can offer a more complete customer experience. This approach aims to boost customer satisfaction and foster greater loyalty, differentiating them in a competitive market.

- Key Partnership: Tempo Assist

- Service Provided: Assistance services

- Agreement Duration: 20 years

- Agreement Year: 2021

Caixa Seguridade's key partnerships are foundational to its distribution and product development. The exclusive relationship with Caixa Econômica Federal provides access to an extensive network of over 4,000 branches and 21,000 lottery outlets, leveraging the trusted Caixa brand for market penetration. Strategic alliances with CNP Assurances, Tokio Marine, and Icatu Seguridade S.A. bolster expertise in life insurance, mortgage, and premium bonds, respectively, with long-term agreements ensuring sustained collaboration and product enhancement.

These collaborations are crucial for offering a comprehensive suite of insurance and financial products. For example, the Brazilian private pension market, where Caixa Seguridade is active through its partnerships, saw premiums reach R$165.2 billion in 2023, indicating the significant market opportunity these alliances help capture.

| Partner | Focus Area | Agreement Duration | Agreement Year |

|---|---|---|---|

| Caixa Econômica Federal | Distribution, Brand Leverage | Exclusive & Ongoing | N/A |

| CNP Assurances | Life Insurance, Credit Life, Pensions | 25 Years | 2021 |

| Tokio Marine Seguradora S.A. | Mortgage, Homeowner Insurance | 20 Years | 2021 |

| Icatu Seguridade S.A. | Capitalização (Premium Bonds) | 20 Years | 2021 |

| Tempo Assist | Assistance Services | 20 Years | 2021 |

What is included in the product

A comprehensive, pre-written business model tailored to Caixa Seguridade’s strategy, detailing customer segments, channels, and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Caixa Seguridade's Business Model Canvas offers a clear, one-page snapshot to pinpoint and address operational inefficiencies, acting as a powerful pain point reliever for strategic planning.

Activities

Caixa Seguridade is deeply engaged in creating and refining a diverse portfolio of financial protection products. This includes everything from life and non-life insurance policies to private pension plans, capitalization bonds, and consortium management services, demonstrating a broad approach to financial security.

The company prioritizes ongoing innovation to adapt to changing market needs and regulatory landscapes. A key focus for Caixa Seguridade is the development of inclusive insurance products, aiming to broaden access to financial protection for a wider segment of the population.

In 2024, Caixa Seguridade continued to emphasize its product development pipeline, with a particular eye on digital integration and customer-centric design. This strategic push aims to streamline the customer journey and enhance the appeal of its offerings in a competitive market.

Caixa Seguridade’s key activity revolves around managing and optimizing its vast distribution network, largely leveraging the extensive reach of Caixa Econômica Federal. This involves overseeing sales operations across a multitude of touchpoints, ensuring its insurance and capitalization products are readily available to a broad customer base.

This network encompasses traditional bank branches, busy lottery outlets, and a growing presence through banking correspondents and digital channels. In 2023, Caixa Econômica Federal reported over 26,000 points of service nationwide, a critical asset for Caixa Seguridade’s product distribution and customer engagement.

Caixa Seguridade actively manages and cultivates its strategic alliances with specialized insurers, including key players like CNP Assurances, Tokio Marine, and Icatu. This ongoing engagement ensures that these collaborations remain synergistic and productive.

The company focuses on maintaining close alignment with partners, effectively leveraging their unique expertise across diverse product lines such as life insurance, pension plans, and property and casualty insurance. This strategic coordination is vital for maximizing the mutual benefits of these relationships.

In 2024, Caixa Seguridade's commitment to robust partner management was evident in its continued growth, with the insurance segment contributing significantly to the group's overall financial performance. For instance, the company reported substantial growth in its insurance premiums, underscoring the success of its partnership-driven distribution model.

Investment and Portfolio Management

Caixa Seguridade actively manages its investment portfolio, a crucial component of its business model. This involves generating equity income from its stakes in jointly controlled and associated companies, directly impacting its financial performance.

In 2024, Caixa Seguridade's investment and portfolio management activities are central to its profitability. The company's strategy focuses on optimizing returns from these strategic investments, ensuring they contribute positively to the overall financial health of the organization.

- Portfolio Diversification The company diversifies its investments across various sectors and geographies to mitigate risk and enhance returns.

- Equity Income Generation A significant portion of Caixa Seguridade's revenue is derived from the equity income generated by its holdings in associated and jointly controlled entities.

- Performance Monitoring Continuous monitoring and evaluation of investment performance are key activities to ensure alignment with strategic objectives and market conditions.

Customer Service and Relationship Management

Caixa Seguridade's customer service and relationship management are central to its operations. This involves providing robust after-sales support, efficiently processing claims, and effectively managing customer inquiries to foster satisfaction and loyalty. A key focus is on streamlining the sales process and enhancing complaint resolution.

In 2024, Caixa Seguridade continued to invest in digital channels for customer interaction. For instance, their app saw a significant increase in user engagement for claim submissions and policy inquiries, reflecting a commitment to making these processes more accessible. This digital push aims to reduce resolution times and improve overall customer experience.

- Streamlined Claims Processing: Efforts in 2024 focused on reducing the average claims settlement time, with significant improvements noted in the auto insurance segment.

- Enhanced Digital Support: The company saw a 25% year-over-year increase in customer queries resolved through their online portal and mobile application in 2024.

- Customer Feedback Integration: Caixa Seguridade actively uses customer feedback to refine its service protocols, leading to a 15% improvement in customer satisfaction scores related to complaint handling in the first half of 2024.

Caixa Seguridade's key activities center on product development, distribution network management, strategic alliance cultivation, and investment portfolio oversight. The company continuously refines its diverse financial protection products, leveraging the extensive reach of Caixa Econômica Federal's service points, which numbered over 26,000 in 2023, to ensure broad customer access. Furthermore, maintaining strong relationships with specialized insurers like CNP Assurances and Tokio Marine is crucial for product innovation and market penetration. In 2024, the company's insurance premiums saw substantial growth, highlighting the effectiveness of these partnerships.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Product Development & Innovation | Creating and updating a wide range of financial protection products. | Focus on digital integration and customer-centric design; continued development of inclusive insurance. |

| Distribution Network Management | Leveraging Caixa Econômica Federal's extensive network for product sales. | Over 26,000 service points in 2023; increased customer engagement through digital channels. |

| Strategic Alliance Management | Cultivating partnerships with specialized insurers for product expertise. | Substantial growth in insurance premiums reported, demonstrating successful partnership-driven distribution. |

| Investment Portfolio Management | Generating equity income from strategic holdings and optimizing returns. | Central to profitability; focus on optimizing returns from strategic investments. |

Full Document Unlocks After Purchase

Business Model Canvas

The Caixa Seguridade Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited version, ready for your immediate use. Upon completing your order, you will gain full access to this exact same comprehensive analysis of Caixa Seguridade's business strategy.

Resources

Caixa Seguridade leverages Caixa Econômica Federal's extensive distribution network, a cornerstone of its business model. This network includes over 4,000 bank branches, providing a physical presence in virtually every municipality in Brazil.

Beyond branches, the network extends to 21,000 lottery outlets, banking correspondents, and a robust digital infrastructure encompassing internet banking and ATMs. This multi-channel approach ensures broad accessibility to a diverse client base across the nation.

In 2024, this vast reach facilitated significant customer engagement, allowing Caixa Seguridade to offer its insurance and pension products effectively. The physical and digital touchpoints are crucial for customer acquisition and service delivery, reinforcing its market position.

The Caixa brand is a cornerstone of Caixa Seguridade's business model, representing a powerful intangible asset. Its deep-rooted trust and widespread recognition across Brazil significantly reduce customer acquisition costs and boost product adoption rates.

Caixa Seguridade's exclusive rights to leverage this brand are crucial. In 2024, this brand equity translates into a distinct competitive advantage, allowing the company to command premium pricing and achieve higher market penetration compared to competitors with less established identities.

Caixa Seguridade's business model hinges on exclusive access to Caixa Econômica Federal's vast customer base, a critical resource. This grants them a pre-established market, allowing for efficient product placement and cross-selling of insurance and financial protection offerings.

In 2024, Caixa Econômica Federal boasts over 150 million customers across Brazil. This immense reach provides Caixa Seguridade with an unparalleled advantage in identifying and engaging potential clients for its diverse product portfolio, significantly reducing customer acquisition costs.

Specialized Human Capital

Caixa Seguridade's specialized human capital is a cornerstone of its business model. This includes a highly skilled team with deep expertise across insurance, pension plans, capitalization products, and brokerage services. Their knowledge is critical for innovating and refining the product offerings to meet evolving market demands.

The sales force, integrated within Caixa's extensive banking network, represents another vital human resource. This widespread presence allows for direct engagement with a vast customer base, driving product adoption and fostering strong client relationships. Their effectiveness directly impacts revenue generation and market penetration.

- Insurance and Pension Expertise: Professionals adept at designing and managing complex insurance and pension products.

- Capitalization Product Specialists: Experts in developing and marketing capitalization bonds, a key component of their financial solutions.

- Brokerage and Sales Network: A robust sales team leveraging Caixa's branch network for effective customer outreach and sales execution.

- Customer Service Excellence: Staff dedicated to providing high-quality support, crucial for customer retention and satisfaction in the financial services sector.

Strategic Partnerships and Joint Ventures

Caixa Seguridade’s strategic partnerships and joint ventures are foundational to its business model. These collaborations provide access to specialized expertise and a broader product portfolio. For instance, its long-standing alliance with CNP Assurances, a major global insurer, has been instrumental in developing and distributing life insurance and pension products. This partnership, which has seen renewals and adjustments over the years, allows Caixa Seguridade to leverage CNP's international experience and product innovation.

These alliances are not merely transactional; they represent a deep integration of capabilities. The joint venture with Tokio Marine, for example, focuses on the auto and residential insurance segments, bringing Tokio Marine’s renowned underwriting expertise and global network to the Brazilian market. Similarly, the partnership with Icatu Seguros strengthens Caixa Seguridade’s offerings in specific insurance lines, enhancing its competitive edge.

- CNP Assurances: A key partner for life insurance and pension products, contributing significant international expertise.

- Tokio Marine: Collaborates on auto and residential insurance, bringing global underwriting capabilities.

- Icatu Seguros: Enhances product diversification and market reach in specialized insurance areas.

Caixa Seguridade's key resources are its extensive distribution network, the powerful Caixa brand, exclusive access to Caixa Econômica Federal's customer base, specialized human capital, and strategic partnerships. These elements collectively enable broad market reach, strong customer trust, efficient customer acquisition, product innovation, and enhanced competitive offerings.

The distribution network is a significant asset, comprising over 4,000 bank branches and 21,000 lottery outlets as of 2024. Caixa Econômica Federal's customer base exceeds 150 million individuals nationwide in 2024, providing a vast pool for cross-selling insurance and pension products. Strategic alliances, such as the one with CNP Assurances, bolster product development and market penetration.

| Key Resource | Description | 2024 Impact/Data |

|---|---|---|

| Distribution Network | Caixa's extensive physical and digital channels | 4,000+ branches, 21,000+ lottery outlets |

| Brand Strength | Deep-rooted trust and widespread recognition of the Caixa brand | Reduces acquisition costs, boosts product adoption |

| Customer Base Access | Exclusive access to Caixa Econômica Federal's clients | 150 million+ customers, enabling efficient cross-selling |

| Human Capital | Specialized expertise in insurance, pensions, and sales | Drives product innovation and effective sales execution |

| Strategic Partnerships | Collaborations with leading insurers like CNP Assurances | Enhances product offerings and international expertise |

Value Propositions

Caixa Seguridade provides extensive financial protection, encompassing life, non-life, mortgage, residential, auto, and credit life insurance. This broad offering ensures individuals and families are safeguarded against a multitude of potential risks.

Beyond traditional insurance, Caixa Seguridade also offers private pension plans, capitalization bonds, and consortium management. This diversified portfolio aims to secure long-term financial well-being and asset growth for its clients.

In 2023, Caixa Seguridade reported a net income of R$5.5 billion, demonstrating its robust financial health and capacity to deliver these comprehensive protection solutions. The company's commitment to a holistic approach underscores its value proposition.

Caixa Seguridade's accessibility is a cornerstone of its business model, directly leveraging Caixa Econômica Federal's vast banking infrastructure. This means insurance and pension products are readily available through over 4,000 Caixa branches and a robust digital platform, reaching millions of Brazilians daily.

This extensive physical and digital reach ensures unparalleled convenience for a diverse customer base, including those in remote or underserved regions. In 2024, Caixa Econômica Federal reported serving over 150 million customers, a testament to the sheer scale of this accessible distribution network.

Caixa Seguridade leverages the immense trust and long-standing reputation of Caixa Econômica Federal, a pillar of the Brazilian financial system. This deep-rooted credibility instills a profound sense of security and reliability in its customer base, a crucial advantage in the insurance sector.

This strong institutional backing is not merely a reputational asset but a tangible differentiator, particularly in a market where customer confidence is paramount. For instance, in 2023, Caixa Econômica Federal maintained a robust customer base of over 150 million individuals and businesses, a testament to its enduring presence and trustworthiness.

Tailored Solutions for Diverse Needs

Caixa Seguridade crafts a diverse portfolio to cater to a wide array of customer needs. This spans from fundamental insurance coverage to more intricate private pension and capitalization products, ensuring a fit for various life stages and financial goals.

The company actively refines its product suite and customer interaction pathways. This commitment to continuous improvement is evident in their strategic focus on enhancing the customer journey, making financial planning more accessible and user-friendly.

- Product Breadth: Offering everything from basic life and auto insurance to specialized capitalization bonds and private pension plans.

- Customer Segmentation: Tailoring offerings to distinct demographic and economic groups within the Brazilian market.

- Innovation Focus: Regularly updating and developing new products and services to meet evolving consumer demands.

- Digital Enhancement: Investing in digital platforms to streamline customer onboarding and management of policies.

Social and Inclusive Impact

Caixa Seguridade actively works to make financial protection accessible to everyone, not just a select few. This commitment extends to developing insurance products designed for a wider range of people, aiming to foster social development. In 2023, Caixa Seguridade's social impact initiatives reached over 1.5 million beneficiaries.

Beyond financial products, the company invests in social and environmental projects. This demonstrates a dedication to creating value for society as a whole, going beyond purely financial gains. For instance, their support for sustainable agriculture projects in Brazil in 2024 is expected to improve the livelihoods of thousands of rural families.

Their approach includes:

- Democratizing access to financial protection through innovative and affordable insurance solutions.

- Supporting social development initiatives that address community needs and promote well-being.

- Investing in environmental projects that contribute to sustainability and ecological preservation.

Caixa Seguridade's value proposition centers on broad financial protection, covering life, auto, and mortgage insurance, alongside private pensions and capitalization bonds. This comprehensive offering ensures clients are well-protected across various life events and financial aspirations.

A key differentiator is the unparalleled accessibility through Caixa Econômica Federal's extensive network, reaching millions. In 2024, Caixa Econômica Federal served over 150 million customers, making Caixa Seguridade's products readily available nationwide.

The company builds on the deep trust and reputation of Caixa Econômica Federal, a pillar of Brazil's financial system. This institutional backing provides a strong foundation of confidence for customers, especially crucial in the insurance sector.

Caixa Seguridade also emphasizes social development by offering accessible financial solutions and investing in community and environmental projects, aiming to improve lives and promote sustainability.

| Value Proposition Aspect | Description | Supporting Data/Fact |

|---|---|---|

| Comprehensive Protection | Offers a wide range of insurance and financial products. | Includes life, non-life, mortgage, auto, credit life, private pensions, and capitalization bonds. |

| Unmatched Accessibility | Leverages Caixa Econômica Federal's vast distribution network. | Caixa Econômica Federal served over 150 million customers in 2024, with over 4,000 branches. |

| Institutional Trust | Benefits from the long-standing reputation of Caixa Econômica Federal. | Caixa Econômica Federal's customer base of over 150 million in 2023 highlights its enduring credibility. |

| Social Impact | Focuses on democratizing access and supporting community initiatives. | Caixa Seguridade's social initiatives reached over 1.5 million beneficiaries in 2023. |

Customer Relationships

The core customer relationship for Caixa Seguridade's bancassurance model is built upon the deep-seated trust and extensive existing customer base of Caixa Econômica Federal. This integration allows for the direct sale of insurance products within the bank's established channels, making the process incredibly convenient for customers.

This direct integration means that insurance offerings are presented to customers at opportune moments, such as during loan applications or account openings, fostering a seamless and often impulse-driven purchase experience. For instance, in 2023, Caixa Seguridade reported significant growth in its insurance segment, benefiting from this embedded relationship model.

Caixa Seguridade leverages its vast network of Caixa Econômica Federal branches and banking correspondents to offer highly personalized customer service. This extensive reach ensures that clients can access face-to-face assistance, crucial for navigating complex insurance and pension products. In 2024, Caixa Seguridade continued to emphasize this channel, with a significant portion of its customer interactions occurring within these physical locations, fostering trust and deeper understanding.

Caixa Seguridade leverages digital channels like internet banking and ATMs to offer robust self-service options. These platforms allow customers to easily manage policies, make inquiries, and even initiate new sales, providing convenience and 24/7 accessibility. This digital-first approach is crucial for engaging with the growing segment of tech-savvy consumers.

Post-Sale Support and Claims Handling

Caixa Seguridade places significant emphasis on robust post-sale support, recognizing its critical role in customer retention. This includes a streamlined and efficient claims handling process, designed to minimize customer frustration during potentially stressful times. For instance, in 2023, the company continued to invest in digital tools to expedite claim resolutions.

The company also utilizes an ombudsman service to address customer grievances effectively. This dedicated channel helps resolve disputes and ensures fair treatment, contributing to overall customer satisfaction. Efforts are consistently made to reduce the number of complaints, fostering a more positive customer experience and building long-term loyalty.

Caixa Seguridade's commitment to continuous improvement in these customer relationship areas is evident. By focusing on efficient claims processing and accessible dispute resolution, they aim to enhance customer trust and satisfaction. This strategic focus is key to maintaining a strong customer base and driving repeat business.

- Efficient Claims Processing: Caixa Seguridade aims to resolve claims swiftly and transparently, reducing customer wait times and improving satisfaction.

- Ombudsman Services: Providing a dedicated channel for dispute resolution ensures fairness and builds trust, addressing customer concerns proactively.

- Customer Satisfaction: Continuous improvements in post-sale support are directly linked to higher customer satisfaction rates and reduced complaint volumes.

- Long-Term Loyalty: By prioritizing efficient service and effective grievance handling, Caixa Seguridade cultivates lasting customer relationships and loyalty.

Targeted Campaigns and Programs

Caixa Seguridade actively engages its network through sales incentive programs and targeted campaigns. A prime example is the 'Time de Vendas' program, designed to motivate partners and employees, directly impacting customer acquisition and retention efforts. This strategic approach also encompasses continuous product enhancements and the introduction of new investment funds to meet evolving market demands.

- Sales Incentives: Programs like 'Time de Vendas' drive partner and employee engagement.

- Targeted Campaigns: Focused initiatives aim to boost customer acquisition and retention.

- Product Development: Continuous improvement and new fund offerings are key to customer relationships.

Caixa Seguridade's customer relationships are deeply intertwined with the Caixa Econômica Federal's vast network, fostering trust through direct sales at opportune banking moments. This bancassurance model prioritizes convenience, with significant customer interactions occurring in physical branches in 2024, reinforcing personal service.

Digital channels offer 24/7 self-service, complementing robust post-sale support, including efficient claims processing and an ombudsman service to address grievances. Sales incentive programs like 'Time de Vendas' further motivate partners, driving customer acquisition and retention.

| Metric | 2023 Data | 2024 Outlook/Activity |

|---|---|---|

| Customer Interactions | High volume through bank branches | Continued emphasis on physical locations for trust-building |

| Digital Engagement | Growing use of internet banking and ATMs | Focus on tech-savvy consumers via digital platforms |

| Claims Processing | Investment in digital tools for efficiency | Streamlined process to minimize customer frustration |

| Customer Satisfaction | Linked to improved post-sale support | Aiming for higher satisfaction and reduced complaints |

Channels

The extensive physical branch network of Caixa Econômica Federal stands as Caixa Seguridade's most crucial channel, offering direct engagement with millions of Brazilians. This widespread presence facilitates face-to-face sales, personalized consultations, and essential customer support, building trust and accessibility.

As of December 2023, Caixa Econômica Federal operated over 4,000 branches nationwide, a testament to its deep penetration into diverse communities. This physical infrastructure is instrumental in driving product adoption and providing a tangible touchpoint for financial services.

Caixa Seguridade leverages an expansive network of over 21,000 lottery outlets and banking correspondents. This extensive reach is crucial for providing localized access to financial services, especially in regions where traditional bank branches are scarce.

These outlets act as vital touchpoints, offering convenience and accessibility to a broad customer base. In 2024, this network continued to be a cornerstone of Caixa Seguridade's strategy to penetrate diverse markets and offer essential financial solutions.

Caixa Seguridade leverages digital channels, including Caixa's robust internet banking and other online platforms, to offer customers a seamless and remote experience for purchasing and managing insurance and pension products. This digital-first approach directly addresses the escalating consumer preference for convenient, accessible financial services, a trend that has been significantly amplified in recent years.

In 2024, Caixa Seguridade reported that a substantial portion of its new business acquisition originated through digital channels. For instance, over 60% of new life insurance policies were initiated online, demonstrating the critical role these platforms play in customer engagement and sales conversion. This digital penetration is key to expanding market reach and operational efficiency.

ATMs

ATMs function as a secondary touchpoint for Caixa Seguridade customers, facilitating specific transactions and information retrieval. This channel enhances customer convenience by providing an alternative to traditional branch services, particularly for routine inquiries and cash-related activities.

In 2024, Caixa Seguridade continued to leverage its extensive ATM network, which is a key component of its distribution strategy. The accessibility of these machines provides a tangible link to the brand, supporting customer engagement and operational efficiency.

- ATM Network Reach: Caixa Seguridade benefits from a widespread ATM network, crucial for customer accessibility.

- Transaction Support: ATMs handle essential transactions, complementing other service channels.

- Customer Convenience: This channel offers a convenient option for customers needing quick access to services.

- Brand Visibility: The physical presence of ATMs reinforces brand visibility and customer trust.

Brokerage Activities and Partnerships

Caixa Seguridade leverages its wholly-owned brokerage, Caixa Corretora, to broaden its product distribution. This subsidiary plays a crucial role in reaching a wider customer base.

Beyond its internal channels, Caixa Seguridade strategically partners with other networks, such as Banco PAN's distribution system. This multi-channel approach significantly expands its market penetration and customer access.

These partnerships are vital for increasing sales volume and diversifying revenue streams. For instance, in 2024, the company continued to focus on strengthening these alliances to drive growth.

- Caixa Corretora: The primary wholly-owned brokerage arm.

- Banco PAN Partnership: A key distribution channel extending reach.

- Market Penetration: Expanded access beyond the core Caixa network.

- 2024 Focus: Continued efforts to strengthen partnership networks for growth.

Caixa Seguridade utilizes a multi-channel distribution strategy, blending its deep physical presence with growing digital capabilities and strategic partnerships. This approach ensures broad market reach and customer accessibility across Brazil.

The company's reliance on the extensive Caixa Econômica Federal branch network, alongside over 21,000 lottery outlets and banking correspondents, provides a robust foundation for sales and customer service. Digital channels, including internet banking, are increasingly vital, driving a significant portion of new business acquisition, such as over 60% of new life insurance policies in 2024.

Furthermore, Caixa Seguridade enhances its reach through its brokerage arm, Caixa Corretora, and strategic alliances with entities like Banco PAN, aiming to maximize sales volume and diversify revenue. ATMs also serve as an important touchpoint for transactions and brand visibility.

| Channel | Description | Key Benefit | 2024 Data/Trend |

|---|---|---|---|

| Caixa Econômica Federal Branches | Extensive physical network | Direct engagement, trust, personalized service | Over 4,000 branches nationwide |

| Lottery Outlets & Banking Correspondents | Vast network of smaller outlets | Localized access, convenience, broad reach | Over 21,000 locations |

| Digital Channels (Internet Banking, etc.) | Online platforms for sales and management | Seamless, remote experience, efficiency | Over 60% of new life insurance policies initiated online |

| ATMs | Automated teller machines | Transaction support, customer convenience, brand visibility | Key component of distribution strategy |

| Caixa Corretora & Partnerships (e.g., Banco PAN) | Wholly-owned brokerage and external alliances | Expanded product distribution, market penetration, diversified revenue | Continued focus on strengthening partnerships for growth |

Customer Segments

Caixa Seguridade serves a vast base of individual clients throughout Brazil, encompassing those looking for fundamental financial security. This segment represents a significant portion of the population seeking accessible insurance solutions.

A key objective is to broaden insurance penetration, particularly among lower-income demographics, making financial protection more attainable. In 2024, Brazil's insurance market continued to show growth, with life and personal insurance segments being particularly robust, reflecting the demand from this mass market.

Caixa Econômica Federal account holders represent a crucial customer segment for Caixa Seguridade, primarily due to the inherent advantage of an integrated bancassurance model. This existing relationship fosters a high degree of trust and familiarity, making it easier to introduce and cross-sell insurance and related financial products.

In 2024, Caixa Econômica Federal reported over 150 million customers, a substantial pool that provides a fertile ground for Caixa Seguridade's offerings. This vast customer base benefits from the convenience of accessing insurance services directly through their established banking channels, streamlining the purchasing process and enhancing customer satisfaction.

Homeowners and mortgage holders represent a core customer segment for Caixa Seguridade, directly benefiting from the company's extensive mortgage offerings. Caixa Econômica Federal's significant share in Brazil's housing finance market, which saw a substantial increase in new loan origination throughout 2024, directly translates into a larger pool of potential insurance customers within this group.

Savers and Investors

Caixa Seguridade specifically targets individuals focused on long-term financial planning and wealth accumulation. These clients are often looking for instruments to secure their future, such as private pension plans, which provide a steady income stream in retirement. For instance, in 2024, the Brazilian private pension market continued to show resilience, with net contributions reaching significant figures, indicating sustained interest from savers.

This segment also encompasses those seeking more sophisticated investment options beyond basic savings accounts. Caixa Seguridade offers capitalization bonds, which combine savings with a chance to win prizes, appealing to a broader range of risk appetites within the saver and investor demographic. The company's product suite is designed to cater to various stages of life, from early career accumulation to pre-retirement planning.

- Targeting Long-Term Growth: Focus on clients prioritizing wealth accumulation and retirement security.

- Product Offerings: Private pension plans and capitalization bonds are key instruments for this segment.

- Market Engagement: The Brazilian private pension market saw robust activity in 2024, reflecting strong client interest.

- Sophistication Needs: Catering to clients who require more than basic savings solutions.

Small and Medium-sized Enterprises (SMEs)

Caixa Seguridade, while often associated with individual clients, also serves Small and Medium-sized Enterprises (SMEs) by offering a range of tailored insurance and financial solutions. These offerings are crucial for business continuity and employee well-being.

For SMEs, Caixa Seguridade provides essential business protection, including property insurance, liability coverage, and business interruption insurance. These products help mitigate risks associated with unforeseen events, ensuring that businesses can recover and continue operations.

Furthermore, Caixa Seguridade supports SMEs in managing their human capital through comprehensive employee benefit packages. This includes life insurance, accident insurance, and health plans, which are vital for attracting and retaining talent.

- Business Protection: SMEs can access property, liability, and business interruption insurance.

- Employee Benefits: Packages include life, accident, and health insurance.

- Market Reach: Caixa's extensive banking network facilitates access to this segment.

- Economic Impact: Supporting SMEs is crucial for Brazil's economic growth, with SMEs representing over 90% of formal businesses in the country as of 2024.

Caixa Seguridade's customer base is broad, encompassing millions of Brazilians seeking financial security. A significant focus is on mass-market individuals, particularly those in lower-income brackets, aiming to increase insurance penetration. The company leverages its strong ties with Caixa Econômica Federal's extensive customer network, which exceeded 150 million individuals in 2024, to offer accessible insurance solutions.

Cost Structure

Caixa Seguridade incurs significant expenses to utilize and sustain its access to Caixa Econômica Federal's vast distribution channels. These costs encompass remuneration for sales personnel, alongside investments in their material, technological, and administrative infrastructure.

This reliance on a broad network represents a substantial component of Caixa Seguridade's overall cost structure, reflecting the operational demands of reaching a wide customer base through an established banking platform.

Caixa Seguridade's cost structure is significantly shaped by the operating expenses of its subsidiaries and joint ventures. These entities, including Caixa Vida e Previdência, Caixa Residencial, and Caixa Capitalização, incur substantial costs to deliver their respective insurance, housing, and capitalization services.

Key among these expenses are investments in information technology (IT) infrastructure and ongoing maintenance, which are crucial for digital transformation and operational efficiency. Additionally, incentive programs for sales channels and employees play a vital role in driving business growth and are accounted for within these operational costs.

For Caixa Seguridade, a significant cost driver is the payment of claims and benefits. This encompasses payouts across its diverse insurance portfolio, including life, property, auto, and health insurance, as well as pension plan disbursements. These payments are fundamental to its operations as an insurance holding company.

In 2024, the insurance industry, including companies like Caixa Seguridade, continued to navigate a landscape where claim payouts represent a substantial portion of their operating expenses. For instance, the total claims paid by the Brazilian insurance sector in the first half of 2024 reached R$80.7 billion, demonstrating the scale of these outflows for insurers operating in the market.

Administrative and General Expenses

Caixa Seguridade's administrative and general expenses encompass essential operational costs. These include the salaries and benefits for its workforce, the upkeep and development of its technology infrastructure, marketing and advertising efforts to reach customers, and the significant costs associated with ensuring regulatory compliance within the financial services sector.

The company actively seeks to optimize these expenditures. For instance, in the first quarter of 2024, Caixa Seguridade reported administrative expenses of R$ 520.2 million, representing a decrease of 1.3% compared to the same period in 2023, demonstrating a focus on cost efficiency.

- Personnel Expenses: Costs associated with employees, including salaries, benefits, and training.

- Technology Infrastructure: Investments in IT systems, software, and hardware to support operations.

- Marketing and Sales: Expenses related to promoting products and acquiring new customers.

- Regulatory Compliance: Costs incurred to meet legal and regulatory requirements in the insurance and financial services industry.

Financial Expenses

Financial expenses form a key part of Caixa Seguridade's cost structure, particularly those tied to monetary adjustments of mandatory minimum dividends. These expenses are crucial as they directly reflect the cost of capital and financial obligations. For instance, in 2023, Caixa Seguridade reported financial expenses that included interest on financial liabilities and other monetary updates, impacting profitability.

These financial operations are not merely accounting entries; they represent real costs incurred to maintain financial stability and meet regulatory requirements. The company's commitment to distributing a portion of its profits as dividends, often with monetary updates, adds a predictable yet significant financial burden. This ensures shareholder value but directly influences the expense side of the business model.

- Monetary Updates on Dividends: Directly impacts cost of capital.

- Interest on Financial Liabilities: Reflects borrowing costs.

- Impact on Profitability: These expenses reduce net income.

- Financial Stability Costs: Essential for meeting obligations.

Caixa Seguridade's cost structure is heavily influenced by its reliance on Caixa Econômica Federal's distribution network, incurring costs for sales personnel and infrastructure. Significant operational expenses also stem from its subsidiaries, particularly investments in IT for digital transformation and incentive programs. The company's primary cost driver remains the payment of claims and benefits across its diverse insurance and pension offerings, a substantial outflow for any insurer.

In the first quarter of 2024, administrative expenses were R$520.2 million, showing a slight decrease from the previous year, indicating a focus on operational efficiency. Financial expenses, notably monetary adjustments on dividends and interest on liabilities, are also critical components, impacting profitability and financial stability.

| Cost Category | Description | 2024 Data/Trend |

|---|---|---|

| Distribution Network Costs | Remuneration for sales personnel, infrastructure investments | Significant ongoing expense |

| Subsidiary Operations | IT infrastructure, sales incentives | Crucial for efficiency and growth |

| Claims and Benefits Paid | Payouts for life, property, auto, health insurance, pensions | Largest cost driver; H1 2024 Brazilian sector claims: R$80.7 billion |

| Administrative & General Expenses | Salaries, IT upkeep, marketing, compliance | Q1 2024: R$520.2 million (down 1.3% YoY) |

| Financial Expenses | Monetary adjustments on dividends, interest on liabilities | Impacts profitability and financial stability |

Revenue Streams

Caixa Seguridade generates significant revenue through equity income from its subsidiaries and joint ventures. This income stream represents Caixa Seguridade's proportional share of the net profits earned by these associated companies operating in various sectors like insurance, pensions, capitalization, and consortiums.

In the third quarter of 2024, this equity income was a dominant force, accounting for a substantial 57% of Caixa Seguridade's total revenues, underscoring the strategic importance of these partnerships to the company's overall financial performance.

Caixa Seguridade's revenue streams include significant income from brokerage fees and commissions. This revenue is earned when insurance products are sold through Caixa's extensive distribution network. For instance, in 2023, distribution revenues, which heavily rely on these commissions, represented a substantial portion of the company's overall earnings, reflecting the effectiveness of their bancassurance model.

Caixa Seguridade generates significant revenue by allowing its partner, Caixa Econômica Federal (CEF), to leverage its extensive distribution network. This access is crucial for reaching a broad customer base across Brazil.

In addition to network access, Caixa Seguridade also collects fees for the authorized use of the strong and recognizable Caixa brand. This brand association is a powerful marketing tool that drives customer acquisition and trust.

These combined fees represent a stable and predictable revenue stream, directly stemming from the foundational partnership agreement. For instance, in 2023, Caixa Seguridade's net income reached R$3.9 billion, a substantial portion of which is attributable to these strategic partnership revenues.

Premiums from Insurance Products

Premiums from insurance products form the bedrock of Caixa Seguridade's revenue. These direct premiums are collected across a diverse range of insurance lines, encompassing life, mortgage, residential, auto, and credit life policies.

The company's financial performance is directly tied to the growth experienced within these various insurance segments. For instance, a notable expansion in housing and residential insurance offerings has a tangible positive impact on overall revenue generation.

In 2024, Caixa Seguridade reported robust growth in its insurance operations. The company highlighted that premiums from its insurance segment saw a substantial increase, driven by strong performance in its property and casualty lines, including residential and auto insurance.

- Direct Premiums: Revenue generated from sales of life, mortgage, residential, auto, and credit life insurance.

- Growth Drivers: Expansion in segments like housing and residential insurance directly fuels revenue increases.

- 2024 Performance: Caixa Seguridade experienced significant premium growth in 2024, particularly in property and casualty lines.

Contributions from Private Pension Plans and Capitalization Bonds

Caixa Seguridade diversifies its income through contributions to private pension plans, a key component of its accumulation business. This segment consistently expands, bolstering the company's financial foundation.

The sale of capitalization bonds also represents a significant revenue stream for Caixa Seguridade. These products contribute to the overall revenue mix by attracting customer savings and investment.

- Private Pension Plans: These plans are a core element of Caixa Seguridade's accumulation strategy, driving consistent revenue growth.

- Capitalization Bonds: The sale of these bonds offers another avenue for revenue generation, tapping into customer savings.

- Consistent Growth: Both private pension plans and capitalization bonds demonstrate a pattern of steady expansion, contributing positively to the company's financial performance.

Caixa Seguridade's revenue model is multifaceted, drawing income from direct insurance premiums, equity in subsidiaries, and fees related to its distribution network and brand usage. In the third quarter of 2024, equity income from its partnerships was particularly strong, making up 57% of total revenues.

The company also benefits from brokerage fees and commissions earned through the sale of insurance products via Caixa Econômica Federal's vast network. This bancassurance model, leveraging the Caixa brand, provides stable and predictable earnings. For example, in 2023, net income reached R$3.9 billion, with a significant portion attributable to these partnership revenues.

Premiums from a diverse range of insurance products, including life, mortgage, residential, and auto policies, form the core of its income. In 2024, Caixa Seguridade reported substantial growth in premiums, especially in property and casualty lines like residential and auto insurance.

Additionally, contributions to private pension plans and the sale of capitalization bonds are key revenue streams, consistently expanding the company's financial base.

| Revenue Stream | Description | Key Data Point (Q3 2024 or 2023/2024) |

|---|---|---|

| Equity Income | Share of net profits from subsidiaries and joint ventures. | 57% of total revenues (Q3 2024). |

| Brokerage Fees & Commissions | Earned from insurance sales via Caixa's network. | Substantial portion of earnings (2023), reflecting bancassurance effectiveness. |

| Brand & Network Fees | Fees for using Caixa brand and distribution network. | Contributes to stable and predictable revenue. |

| Insurance Premiums | Direct premiums from life, mortgage, residential, auto, credit life. | Significant growth in 2024, especially in property & casualty. |

| Pension Plans & Capitalization Bonds | Contributions to private pension plans and sales of capitalization bonds. | Consistently expanding, bolstering financial foundation. |

Business Model Canvas Data Sources

The Caixa Seguridade Business Model Canvas is built using a combination of internal financial reports, market research on the Brazilian insurance sector, and strategic analyses of competitor activities. These sources provide a comprehensive understanding of the company's operational landscape and market positioning.