Broadway Industrial Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadway Industrial Group Bundle

Broadway Industrial Group boasts strong operational efficiency and a diversified product portfolio, positioning them well in a competitive market. However, understanding the full scope of their competitive advantages and potential market vulnerabilities requires a deeper dive.

Discover the complete picture behind Broadway Industrial Group's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Broadway Industrial Group excels in precision-machined components and offers integrated manufacturing services, covering everything from tooling and machining to surface treatment and final assembly. This deep expertise ensures the delivery of high-quality parts tailored for industries with stringent requirements.

The company's manufacturing footprint is strategically positioned across Asia, with facilities in China, Thailand, and Vietnam. These sites collectively span 83,000 square meters, providing substantial capacity and operational flexibility to meet diverse client needs.

Broadway Industrial Group has strategically expanded its business beyond its historical reliance on the Hard Disk Drive (HDD) market. This diversification into sectors like aerospace, medical, and automotive significantly mitigates risks associated with any single industry's downturn.

These new ventures are already showing promise, with the Precision Engineering (PE) segment, which caters to these high-growth industries, being a primary driver for future expansion. This strategic pivot is designed to unlock new revenue streams and enhance overall market resilience.

Broadway Industrial Group showcased remarkable financial resilience in FY2024, with revenue surging by 36.2% to S$352.2 million, up from S$258.7 million in FY2023. This substantial growth was underpinned by an improved gross profit margin, which climbed from 5.4% to 9.0%, reflecting optimized manufacturing operations.

The company achieved a net income of SGD 8.75 million for the first half of 2024, a significant positive shift from the net loss reported in the corresponding period of the previous year. This financial turnaround highlights effective cost management and enhanced operational efficiency.

Established Global Presence and Customer Base

Broadway Industrial Group boasts a significant global manufacturing presence, with five facilities strategically located across China, Thailand, and Vietnam. This extensive operational network, established since 1994, allows for efficient production and supply chain management. By 2024, the company's manufacturing capacity is a key asset in serving its diverse clientele.

The company has cultivated a robust and loyal global customer base, a testament to its reliability and quality. Broadway Industrial Group is a preferred partner for numerous industry leaders, particularly within the demanding Hard Disk Drive (HDD) sector. This deep integration with major players underscores its established market position and the trust it has earned.

Key strengths stemming from this established global presence and customer base include:

- Diversified Manufacturing Footprint: Operations across multiple countries mitigate geopolitical and logistical risks, ensuring business continuity.

- Strong Customer Relationships: Long-standing partnerships with industry giants provide stable revenue streams and valuable market insights.

- Market Credibility: Being a trusted supplier to recognized leaders, especially in the competitive HDD market, validates Broadway's capabilities and product quality.

Commitment to Sustainability and Corporate Governance

Broadway Industrial Group places a strong emphasis on robust corporate governance and ethical business practices, as detailed in their Investor Relations Policy. This commitment extends to environmental stewardship and community investment, with annual sustainability reports transparently outlining their progress and initiatives.

Their dedication to sustainability is not just about compliance; it’s a strategic advantage. For instance, in their 2023 Sustainability Report, they highlighted a 15% reduction in water consumption across their manufacturing facilities and a 10% increase in renewable energy sourcing. This focus can significantly bolster brand reputation and attract a growing segment of socially responsible investors.

- Enhanced Brand Image: Demonstrating a genuine commitment to ESG principles can differentiate Broadway Industrial Group in a competitive market.

- Investor Attraction: Growing investor interest in sustainable companies means this focus can broaden the pool of potential capital.

- Risk Mitigation: Strong governance and environmental practices can reduce regulatory and reputational risks.

Broadway Industrial Group's diversified manufacturing footprint across Asia, encompassing 83,000 square meters of operational space, provides significant capacity and flexibility. This global presence, established since 1994, mitigates geopolitical and logistical risks, ensuring business continuity. Their strong customer relationships, particularly with industry leaders in the HDD sector, translate into stable revenue streams and valuable market insights, validating their capabilities.

The company's strategic pivot into aerospace, medical, and automotive sectors is a key strength, with the Precision Engineering (PE) segment driving future expansion. This diversification reduces reliance on any single industry, enhancing overall market resilience. Financially, Broadway Industrial Group demonstrated remarkable resilience in FY2024, with revenue surging by 36.2% to S$352.2 million, and a net income of SGD 8.75 million in H1 2024, a significant turnaround from the prior year's loss.

| Metric | FY2023 | FY2024 | Change |

|---|---|---|---|

| Revenue (S$ million) | 258.7 | 352.2 | +36.2% |

| Gross Profit Margin | 5.4% | 9.0% | +3.6 pp |

| Net Income (H1 2024) | (Loss) | SGD 8.75 million | Positive Turnaround |

What is included in the product

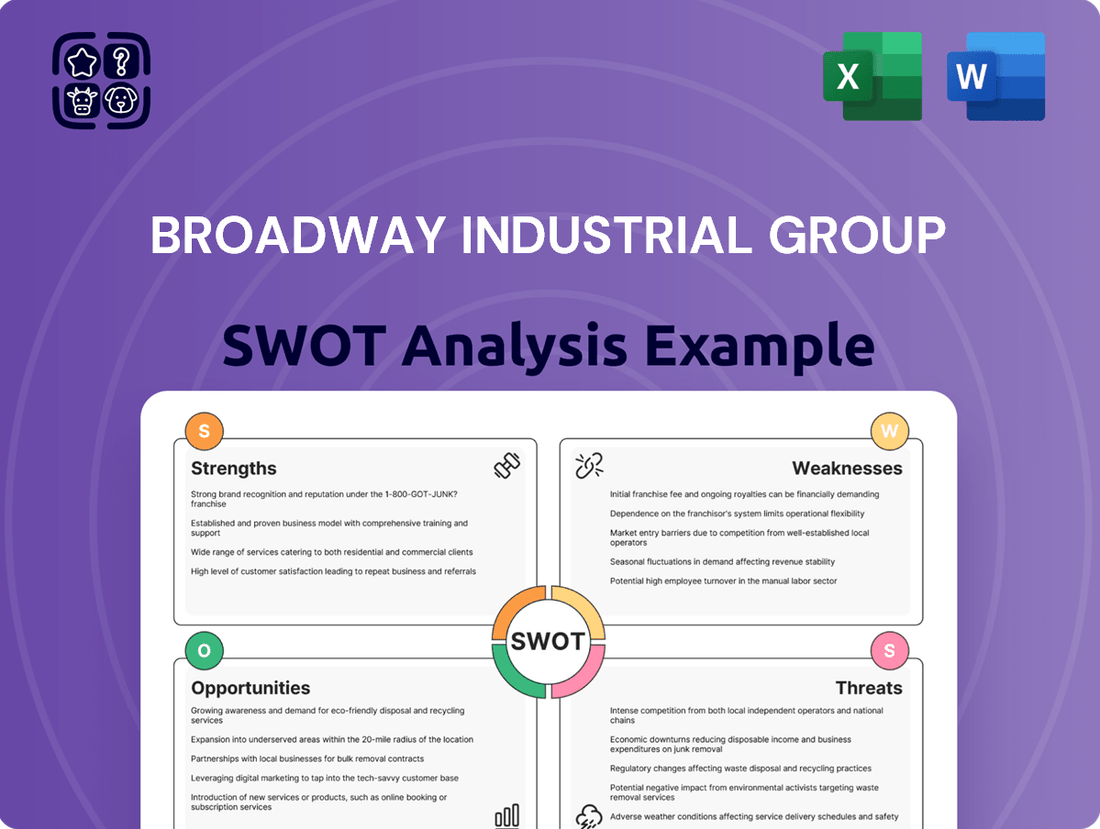

Delivers a strategic overview of Broadway Industrial Group’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Broadway Industrial Group's strategic challenges.

Weaknesses

Broadway Industrial Group's historical deep ties to the Hard Disk Drive (HDD) sector have presented a significant weakness. This concentration meant that downturns in HDD demand, such as the shift towards solid-state drives (SSDs) impacting traditional HDD volumes, directly translated into revenue challenges for the company. For instance, while specific 2024/2025 revenue breakdowns are not publicly available, the broader semiconductor industry, which includes HDD components, saw varying performance based on global supply chain dynamics and consumer electronics demand throughout 2024.

Broadway Industrial Group's diversification into aerospace, medical, and automotive sectors, while promising for growth, presents significant competitive challenges. These industries are dominated by well-established players with deep expertise and existing market share, demanding substantial capital for new technology adoption, regulatory compliance, and market entry.

The intense competition in these diversified sectors could pressure Broadway Industrial Group's profit margins and hinder its ability to quickly gain market traction. For instance, the automotive sector alone saw global revenues of approximately $3.4 trillion in 2023, with established giants like Toyota and Volkswagen holding considerable sway.

Broadway Industrial Group's recent delisting from the Singapore Exchange, following a mandatory cash offer making it a subsidiary of Patec Group, presents a significant weakness. This move, driven by non-compliance with free float requirements, limits its public visibility and access to capital markets. For instance, as of its delisting, the company's free float was below the exchange's minimum threshold, impacting investor liquidity.

The delisting directly curtails Broadway Industrial Group's ability to raise funds through public equity offerings, potentially hindering future growth initiatives. While the company is exploring options to potentially relist, the current lack of a public trading platform restricts its financial flexibility and may affect its valuation perception among potential partners or lenders.

Potential for Operational Inefficiencies During Transition

Broadway Industrial Group's strategic moves, like optimizing its Shenzhen factory due to low utilization and setting up new operations in Vietnam, could create temporary operational snags. These shifts demand considerable management focus and resources to integrate new workflows and get products ready for diverse markets.

Specifically, the Vietnam facility is projected to contribute minimally to overall revenue in 2025, highlighting the initial ramp-up period. This means that while the long-term strategy is diversification, the short-term reality involves managing the complexities of these transitions.

- Operational Challenges: Integrating new manufacturing processes and qualifying products for new customer segments in different industries can strain resources and management bandwidth.

- Vietnam Factory Contribution: The new Vietnam factory is expected to represent a small fraction of Broadway Industrial Group's total revenue in 2025, indicating a gradual build-up rather than immediate impact.

- Resource Allocation: Significant management attention and financial resources will be required to navigate these operational adjustments, potentially diverting focus from other core activities.

Vulnerability to Global Economic Headwinds

Broadway Industrial Group, despite its recent financial successes, remains susceptible to broader global economic downturns. Factors like inflation and interest rate hikes, which have been prominent in 2024, could dampen demand for its precision components across various industries. Geopolitical instability further exacerbates this risk, potentially leading to order volatility and supply chain disruptions that impact profitability.

The company's diversification efforts, while strategic, do not entirely insulate it from these external pressures. Sectors like automotive and aerospace, key markets for precision parts, are themselves sensitive to global economic sentiment. For instance, a slowdown in new vehicle production, a trend observed in early 2025 projections, could directly translate to fewer orders for Broadway Industrial Group's offerings.

- Economic Headwinds: Persistent inflation and rising interest rates in 2024-2025 could reduce consumer and business spending, impacting demand for durable goods that utilize precision components.

- Geopolitical Tensions: Ongoing international conflicts and trade disputes can disrupt global supply chains, increasing lead times and costs for raw materials and finished goods.

- Sectoral Sensitivity: Key customer industries, such as automotive and aerospace, are cyclical and can experience significant demand fluctuations based on macroeconomic conditions.

- Operational Costs: Supply chain disruptions and inflationary pressures can lead to higher manufacturing and logistics expenses, squeezing profit margins.

Broadway Industrial Group's historical reliance on the Hard Disk Drive (HDD) market represents a significant weakness. This concentration made the company vulnerable to shifts in consumer electronics, particularly the rise of Solid State Drives (SSDs), which reduced demand for traditional HDD components. While specific 2024/2025 revenue figures for this segment are not detailed, the broader semiconductor industry faced fluctuating demand throughout 2024.

The company's recent delisting from the Singapore Exchange due to non-compliance with free float requirements is a notable weakness. This action limits its public visibility and access to capital markets, hindering its ability to raise funds through equity offerings and potentially impacting its valuation perception. For instance, its free float fell below the exchange's minimum threshold prior to delisting.

Broadway Industrial Group faces intense competition in its diversified sectors like aerospace, medical, and automotive. These markets are dominated by established players, requiring substantial investment in technology and regulatory compliance, which could pressure profit margins and slow market penetration. The automotive sector alone generated approximately $3.4 trillion globally in 2023.

Operational adjustments, such as optimizing its Shenzhen factory and establishing new facilities in Vietnam, introduce temporary weaknesses. These transitions demand significant management focus and resources, potentially diverting attention from core activities. The Vietnam factory, for example, is projected to contribute minimally to overall revenue in 2025, indicating an initial ramp-up period.

Same Document Delivered

Broadway Industrial Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt from the complete Broadway Industrial Group SWOT analysis. Purchase now to access the full, detailed report, offering comprehensive insights into their strategic positioning.

Opportunities

Broadway Industrial Group is strategically expanding into high-growth precision engineering markets, including aerospace, medical, and automotive sectors. These industries are experiencing robust demand driven by technological innovation and increasing global needs for specialized components.

By leveraging its core precision engineering expertise, Broadway Industrial Group can tap into these lucrative markets, which offer substantial growth potential. For instance, the global aerospace market is projected to reach over $1.07 trillion by 2032, according to some analyses, indicating a significant opportunity for suppliers of high-precision parts.

This diversification allows the company to access new revenue streams that are less saturated than its traditional hard disk drive (HDD) market, mitigating risks associated with market fluctuations and technological obsolescence in legacy sectors.

Despite the ongoing transition in some areas, the need for substantial data storage, especially in enterprise-grade and nearline Hard Disk Drives (HDDs), is projected for continued moderate growth through 2025. This trend is largely fueled by the expansion of cloud services and the burgeoning generative AI sector, both of which demand efficient and economical data storage.

For Broadway Industrial Group, a crucial supplier of components, this presents a significant opportunity to leverage the increasing demand within these specialized HDD segments. The global HDD market, while facing shifts, is still anticipated to reach approximately $70 billion by 2025, with enterprise and nearline segments showing resilience and growth.

The acquisition by Patec Group presents a significant opportunity for Broadway Industrial Group to tap into combined expertise and resources. This synergy allows for accelerated innovation and the development of higher-value products, particularly in the automotive sector where Patec has a strong presence in stamping components for automobiles and motorcycles. This strategic alignment is expected to bolster Broadway's diversification efforts within the automotive industry, creating a more robust product portfolio.

This integration is poised to enhance Broadway's overall capabilities, expanding its market reach through Patec's established network. The combined entity can achieve greater operational efficiencies, potentially leading to cost savings and improved profitability. For instance, by sharing manufacturing technologies and supply chains, Broadway could see a reduction in production costs, a common benefit observed in such acquisitions, as demonstrated by the automotive industry's trend towards consolidation for competitive advantage.

Geographic Expansion and Supply Chain Optimization

Broadway Industrial Group's strategic establishment of sales operations in South Korea and new factory operations in Vietnam are key opportunities. These moves aim to deeply integrate into local supply chains and capitalize on emerging market potential. The Vietnam facility has already commenced shipping, demonstrating tangible progress in this expansion strategy.

This geographic diversification is crucial for bolstering resilience against regional disruptions and significantly improving market access. By expanding its physical footprint, Broadway Industrial Group can tap into new customer bases and potentially reduce logistical costs. For instance, Vietnam's manufacturing sector saw a 6.5% growth in industrial production in the first half of 2024, highlighting the favorable operational environment.

- South Korean Market Entry: Establishing sales operations to tap into a technologically advanced and affluent market.

- Vietnam Manufacturing Hub: Leveraging Vietnam's competitive manufacturing costs and growing export infrastructure, with initial shipments already underway.

- Supply Chain Integration: Becoming a vital component within local supply chains, enhancing efficiency and responsiveness.

- Market Diversification: Reducing reliance on single markets and increasing overall business stability.

Focus on Research & Development and Advanced Manufacturing

Broadway Industrial Group has a significant opportunity to bolster its market position by increasing investment in research and development (R&D) and embracing advanced manufacturing techniques. This strategic focus is key to unlocking innovation, developing next-generation products, and refining production processes for greater efficiency. For instance, in 2024, companies within the industrial manufacturing sector that prioritized R&D saw an average of 10% higher revenue growth compared to their peers, according to industry analysis.

By adopting technologies like AI-driven design, robotics, and additive manufacturing, Broadway Industrial Group can streamline operations and enhance product quality. This technological leap is not just about efficiency; it’s about creating a competitive advantage. The global advanced manufacturing market is projected to reach over $1.5 trillion by 2028, highlighting the substantial growth potential in this area.

Key areas for opportunity include:

- Developing proprietary technologies that differentiate Broadway Industrial Group's offerings.

- Implementing automation and smart factory solutions to reduce lead times and operational costs.

- Exploring new material science applications for enhanced product performance.

- Securing new contracts by demonstrating superior technological capabilities and innovative solutions.

Broadway Industrial Group can capitalize on the growing demand in precision engineering sectors like aerospace and medical, with the global aerospace market anticipated to exceed $1.07 trillion by 2032. The company can also leverage continued moderate growth in enterprise and nearline HDD segments, projected to reach around $70 billion by 2025, fueled by cloud services and generative AI. The acquisition by Patec Group offers synergies for innovation and market expansion, particularly in automotive components where Patec has a strong foothold.

Threats

While demand for enterprise Hard Disk Drives (HDDs) shows resilience, the broader market for legacy HDD segments, particularly those used in desktops and laptops, is experiencing a consistent downturn. This shift is driven by the increasing adoption of Solid State Drives (SSDs), which offer superior performance and are becoming more cost-effective. For Broadway Industrial Group, this transition poses a direct threat to revenue streams historically reliant on these declining personal computing storage segments.

As Broadway Industrial Group diversifies into sectors like aerospace, medical, and automotive, it encounters formidable competition from deeply entrenched incumbents. These established companies often boast superior market penetration, significantly larger research and development budgets, and long-standing customer loyalty, posing a substantial hurdle for Broadway to capture meaningful market share and achieve its profit targets.

Ongoing global economic headwinds, including inflation and potential recessions in key markets, coupled with escalating geopolitical tensions, present a substantial threat to Broadway Industrial Group. For instance, the International Monetary Fund (IMF) projected in April 2024 that global growth would slow to 3.2% in 2024, down from 3.5% in 2023, reflecting these persistent challenges.

These conditions can directly disrupt supply chains, as seen with ongoing shipping delays and increased freight costs impacting manufacturers worldwide. Furthermore, heightened geopolitical instability, such as the conflicts in Eastern Europe and the Middle East, can lead to volatile raw material prices, with oil prices, a key input for many industrial processes, experiencing significant fluctuations throughout 2024.

The combined effect of these factors can dampen both consumer and industrial demand, directly affecting Broadway Industrial Group's sales volumes. Additionally, unpredictable exchange rate movements, exacerbated by global economic uncertainty, can negatively impact the profitability of international transactions and the repatriation of foreign earnings.

Technological Obsolescence and Rapid Industry Changes

Broadway Industrial Group operates in sectors like electronics and precision engineering, which are known for their swift technological evolution. For instance, the global electronics manufacturing market was projected to reach over $2.7 trillion in 2024, highlighting the speed of innovation.

Failing to adapt to emerging technologies, new materials, or advanced manufacturing techniques poses a significant risk of product obsolescence. This could erode Broadway Industrial Group's market position and competitive edge. In 2023, companies in the semiconductor industry, a key area for precision engineering, saw R&D spending increase by an average of 8% to stay ahead.

The need for ongoing investment in research and development, along with continuous technology upgrades, is critical. However, this also represents a substantial financial commitment. For example, major players in the industrial automation sector, closely related to precision engineering, typically allocate between 5% to 10% of their revenue to R&D.

- Risk of Product Obsolescence: The fast-paced nature of the electronics and precision engineering sectors means products can quickly become outdated if not continuously improved.

- Competitive Disadvantage: Companies that don't invest in new technologies risk falling behind competitors who do, potentially losing market share.

- High R&D Costs: Staying current requires significant and ongoing investment in research, development, and upgrading manufacturing capabilities.

Regulatory Compliance and Trade Barriers

Operating in China, Thailand, Vietnam, and South Korea means Broadway Industrial Group must navigate a complex web of differing regulations and potential trade hurdles. For instance, China's evolving environmental protection laws, which saw significant updates impacting manufacturing in late 2023 and early 2024, could necessitate costly adjustments to production processes. Similarly, shifts in tariff structures, like those potentially impacting electronics trade between South Korea and other Asian nations, could directly affect Broadway's cost of goods sold and competitiveness.

These diverse regulatory landscapes demand substantial investment in compliance monitoring and legal expertise. Failure to adapt to new trade policies or environmental standards, such as Vietnam's increasing focus on sustainable manufacturing practices which gained momentum in 2024, can lead to fines, production delays, or even market exclusion. Staying ahead of these changes is critical for maintaining operational efficiency and market access.

The company faces risks from:

- Evolving environmental regulations: Increased stringency in countries like China and Vietnam may require capital outlays for updated equipment or processes.

- Trade policy fluctuations: Changes in tariffs or import/export restrictions, particularly within the ASEAN bloc or between South Korea and its trading partners, could impact profitability.

- Compliance costs: Maintaining adherence to varying legal and safety standards across multiple jurisdictions requires ongoing financial and human resource allocation.

Broadway Industrial Group faces significant threats from the declining demand in legacy HDD segments due to the rise of SSDs, impacting revenue from personal computing. Additionally, intense competition in its diversified growth sectors, such as aerospace and automotive, from established players with greater R&D budgets and market penetration presents a substantial challenge to market share acquisition.

SWOT Analysis Data Sources

This Broadway Industrial Group SWOT analysis is built upon a foundation of robust data, incorporating publicly available financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded strategic perspective.