Broadway Industrial Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadway Industrial Group Bundle

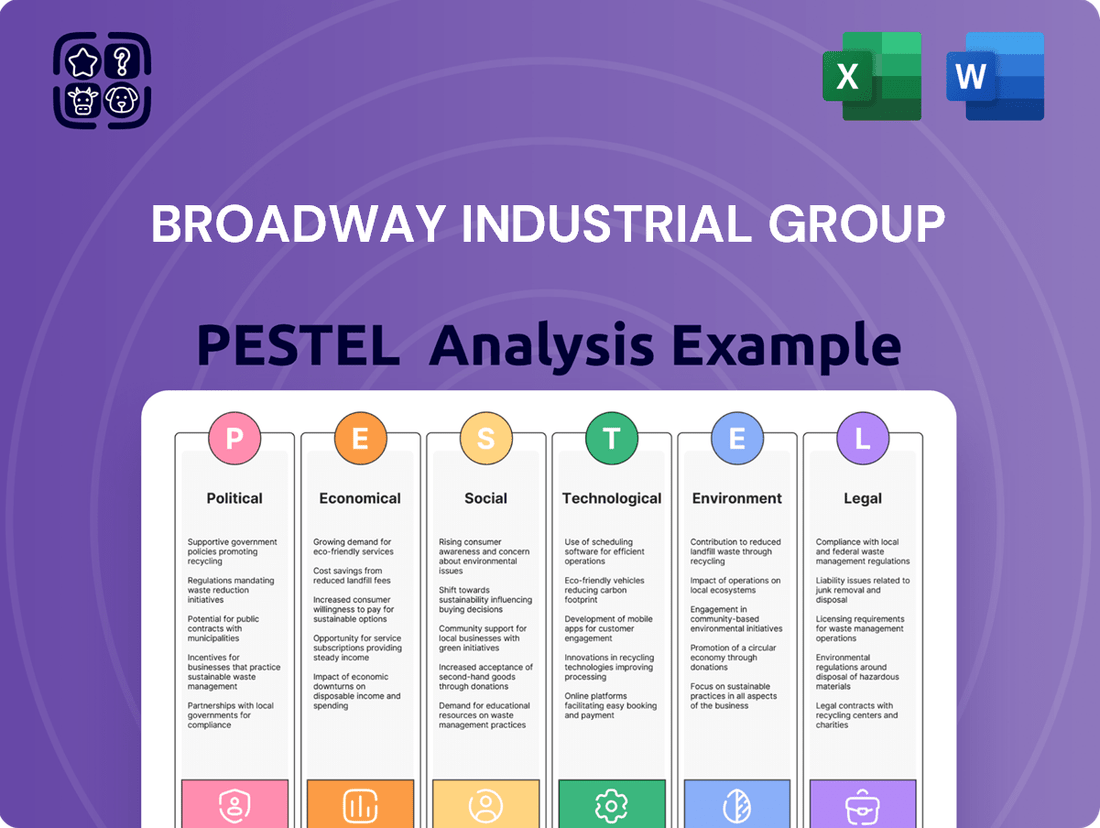

Unlock critical insights into Broadway Industrial Group's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future success. Gain a strategic advantage by downloading the full, actionable report today.

Political factors

Global geopolitical complexities, including ongoing trade disputes and rising protectionism, present significant hurdles for industrial manufacturing firms like Broadway Industrial Group. These tensions frequently translate into higher tariffs, which directly impact the cost of raw materials and finished goods, and can severely disrupt established supply chains. For instance, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures implemented by member economies in 2023, a trend continuing into 2024.

Consequently, companies must proactively re-evaluate their geographic footprints, potentially shifting production closer to key end markets to mitigate risks associated with tariffs and logistical disruptions. The inherent unpredictability of these political landscapes can also lead to a cautious approach to investment and strategic development, as companies await greater clarity on future trade policies and international relations.

Governments in key Asian operating regions for Broadway Industrial Group are heavily investing in advanced manufacturing, a trend expected to continue through 2025. For instance, South Korea's Ministry of Trade, Industry and Energy announced a 2024 budget increase of 15% for AI and semiconductor research, aiming to boost domestic high-tech sectors. This proactive stance translates into direct support for companies like Broadway Industrial Group looking to integrate AI into their manufacturing processes and develop specialized talent.

Broadway Industrial Group, like all manufacturers, operates within a complex web of regulations that differ significantly across global markets. Navigating these rules, which cover everything from worker safety and environmental impact to product standards, demands constant vigilance. For instance, in 2024, the European Union continued to strengthen its emissions standards for industrial machinery, potentially increasing compliance costs for manufacturers exporting to the region.

Stability of Operating Regions

The political stability in China, Thailand, and Vietnam, where Broadway Industrial Group operates manufacturing facilities, directly impacts its business. For instance, China's political landscape, while generally stable, has seen shifts in trade relations and regulatory environments that can affect manufacturing costs and market access. Thailand has experienced periods of political uncertainty, which could potentially disrupt supply chains or impact foreign investment sentiment.

Vietnam, conversely, has maintained a relatively stable political environment, fostering growth and attracting foreign direct investment, which is beneficial for Broadway's operations there. However, even in stable regions, changes in government policies, such as labor laws or environmental regulations, can introduce new operational challenges and costs for Broadway Industrial Group. The World Bank's 2024 Ease of Doing Business report, for example, often highlights how political stability and regulatory predictability influence a country's attractiveness for industrial investment.

- China: Political stability supports Broadway's extensive manufacturing base, though evolving trade policies require constant monitoring.

- Thailand: Past political transitions have underscored the need for Broadway to develop contingency plans for potential operational disruptions.

- Vietnam: A consistent political climate has facilitated Broadway's expansion, offering a more predictable environment for long-term capital deployment.

International Trade Agreements and Alliances

Changes in international trade agreements and economic alliances significantly affect Broadway Industrial Group's global operations. For instance, the renegotiation of trade deals like the USMCA (United States-Mexico-Canada Agreement) can alter sourcing costs and market access for components and finished goods. These shifts directly influence import/export expenses and Broadway's competitive positioning in key markets.

The ongoing evolution of global trade frameworks presents both opportunities and challenges. For example, the European Union's continued focus on trade liberalization with bloc members streamlines operations, but potential tariffs on goods from non-EU countries could increase costs. Broadway Industrial Group must remain agile in adapting to these dynamic international trade policies to maintain efficient supply chains and market penetration.

- Impact on Sourcing: Trade pacts influence the cost and availability of raw materials and components sourced internationally.

- Market Access: Alliances can open new markets or restrict access based on preferential trade terms.

- Competitive Landscape: Shifting trade policies can alter the cost advantages of competitors.

- Regulatory Compliance: Adherence to evolving trade regulations is crucial for uninterrupted global business.

Geopolitical shifts and trade policies continue to shape Broadway Industrial Group's operational landscape, with ongoing trade disputes impacting raw material costs. For example, the International Monetary Fund (IMF) projected a slowdown in global trade growth for 2024 compared to 2023, citing protectionist measures as a key factor.

Government investments in advanced manufacturing, particularly in Asia, offer strategic advantages. South Korea's commitment to AI research, with a reported 15% budget increase for 2024, exemplifies this trend, potentially benefiting Broadway's technological integration.

Regulatory environments, such as the EU's tightening emissions standards for industrial machinery in 2024, necessitate continuous adaptation and compliance investments for Broadway.

Political stability in key operational regions like Vietnam fosters growth, while areas like Thailand require contingency planning due to past political uncertainties, as noted in various geopolitical risk assessments throughout 2023-2024.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces—Political, Economic, Social, Technological, Environmental, and Legal—that influence the Broadway Industrial Group's strategic landscape.

It provides actionable insights into potential threats and opportunities, enabling informed decision-making for stakeholders.

The Broadway Industrial Group PESTLE analysis provides a crucial external context, acting as a pain point reliever by clearly outlining the political, economic, social, technological, environmental, and legal factors impacting the business, thereby enabling more informed strategic decisions.

Economic factors

Global economic uncertainty is a major hurdle for industrial manufacturers. The possibility of recessions could dampen demand for manufactured products, leading to decreased consumer spending and slower business investment, which directly impacts Broadway Industrial Group's revenue and profit margins.

In late 2024 and early 2025, many economists are forecasting a potential slowdown. For instance, the International Monetary Fund (IMF) has revised global growth projections downwards multiple times, citing persistent inflation and geopolitical tensions as key drivers of this uncertainty. This cautious economic climate forces companies like Broadway Industrial Group to adopt a more conservative investment strategy.

The hard disk drive (HDD) market, a traditional stronghold for Broadway Industrial Group, is facing a significant downturn. This contraction is largely driven by the rapid advancement and widespread adoption of Solid State Drives (SSDs), which offer superior speed and durability, alongside a general decrease in demand for older HDD-reliant technologies.

While the demand for high-capacity HDDs within data centers and for emerging AI workloads remains a niche but important segment, the broader market trajectory clearly indicates a decline. For instance, global HDD shipments saw a notable year-over-year decrease in 2023, with projections for 2024 and 2025 continuing this trend, underscoring the urgent need for Broadway Industrial Group to strategically diversify its product and service offerings to mitigate risks associated with this shrinking market.

Broadway Industrial Group's strategic diversification into aerospace, medical, and automotive sectors places it at the forefront of industries anticipated to experience robust expansion. These sectors are increasingly reliant on precision-engineered components, a market segment projected to see substantial growth. For instance, the global aerospace market alone was valued at approximately $800 billion in 2023 and is forecast to reach over $1 trillion by 2030, underscoring the significant opportunities for suppliers of high-accuracy parts.

The demand for miniaturized and high-accuracy components within these diversified sectors is a key driver for the precision parts market. This trend is fueled by advancements in technology, such as the increasing use of complex electronics in vehicles and the development of sophisticated medical devices. The automotive sector, in particular, is undergoing a transformation with the rise of electric vehicles and autonomous driving systems, both of which require highly precise and specialized components, creating new revenue streams for companies like Broadway Industrial Group.

Supply Chain Disruptions and Inflation

Global supply chains remain a significant concern, with ongoing geopolitical tensions and trade policy shifts contributing to volatility. These disruptions directly impact raw material costs and delivery times, placing pressure on manufacturers like Broadway Industrial Group. For instance, the average shipping cost from Asia to the US West Coast saw a notable increase in late 2024, impacting the landed cost of components.

In response, businesses are actively working to mitigate these risks. Strategies include increasing inventory levels to cushion against unexpected delays and broadening their supplier networks to reduce reliance on single sources. This proactive approach aims to build greater resilience into their operations.

- Increased Lead Times: Delays in component delivery, averaging 15-20% longer than pre-pandemic levels for certain electronics, continue to affect production schedules.

- Rising Input Costs: The price of key industrial metals, such as aluminum and copper, experienced a 10% year-over-year increase by mid-2025, directly impacting manufacturing expenses.

- Supplier Diversification Efforts: Companies are investing in nearshoring and reshoring initiatives, with a reported 25% increase in domestic sourcing for critical components in the automotive sector during 2024.

- Inventory Management Adjustments: A survey of manufacturing CFOs indicated that 60% plan to maintain higher inventory buffers throughout 2025 to ensure production continuity.

Currency Fluctuations and Exchange Rates

As a global manufacturer, Broadway Industrial Group faces significant risks from currency fluctuations. For instance, a stronger Singapore Dollar (SGD) against the Euro could increase the cost of raw materials sourced from Europe, impacting Broadway's cost of goods sold. Conversely, a weaker SGD would make its exports to countries using the Euro more competitive.

These exchange rate movements directly affect Broadway's financial performance. For example, if the company generates substantial revenue in U.S. Dollars (USD) and the USD weakens against the SGD, the translated value of those earnings will be lower when reported in its financial statements. This volatility can make financial planning and forecasting more challenging.

The impact is tangible. In 2024, many manufacturing companies experienced margin pressures due to volatile exchange rates. For example, the USD experienced periods of strength against Asian currencies, potentially benefiting companies with significant USD-denominated costs but hurting those with predominantly local currency costs exporting to the US.

- Impact on Raw Material Costs: Fluctuations in the USD/SGD exchange rate can directly alter the cost of imported components, affecting Broadway's production expenses.

- Export Competitiveness: Changes in exchange rates, such as the EUR/SGD, influence the price of Broadway's products in international markets, impacting sales volume.

- Translation of Foreign Earnings: The profitability of overseas subsidiaries is affected when their financial results are converted back into Singapore Dollars, introducing accounting gains or losses.

- Hedging Strategies: Broadway may employ financial instruments to mitigate currency risks, but these strategies themselves carry costs and complexities.

The global economic landscape in late 2024 and early 2025 presents a mixed outlook, with persistent inflation and geopolitical tensions continuing to fuel uncertainty. Many economists anticipate a slowdown, with global growth projections being revised downwards by institutions like the IMF. This cautious environment necessitates a more conservative approach to investment and strategic planning for companies like Broadway Industrial Group.

The hard disk drive (HDD) market, a traditional area for Broadway Industrial Group, is experiencing a contraction driven by the increasing adoption of Solid State Drives (SSDs) and a general decline in demand for older HDD-reliant technologies. While niche markets like high-capacity HDDs for data centers remain, overall HDD shipments saw a notable year-over-year decrease in 2023, with projections for 2024 and 2025 indicating a continuation of this trend.

Broadway Industrial Group's strategic diversification into aerospace, medical, and automotive sectors positions it to capitalize on anticipated robust expansion in these industries, which are increasingly reliant on precision-engineered components. The global aerospace market, valued at approximately $800 billion in 2023, is forecast to exceed $1 trillion by 2030, highlighting significant opportunities for suppliers of high-accuracy parts.

The automotive sector's transformation, particularly with the rise of electric and autonomous vehicles, demands highly precise and specialized components, creating new revenue avenues for Broadway. This trend is mirrored in the medical sector with sophisticated device development, both contributing to substantial growth in the precision parts market.

| Economic Factor | 2023 Data/Trend | 2024 Forecast/Trend | 2025 Forecast/Trend | Impact on Broadway Industrial Group |

|---|---|---|---|---|

| Global Economic Growth | Slowdown observed, IMF revisions downwards | Continued uncertainty, potential for recession in some regions | Mixed outlook, dependent on inflation and geopolitical stability | Reduced consumer and business spending, impacting demand for manufactured goods. |

| HDD Market Demand | Notable year-over-year decrease in shipments | Projected continuation of decline | Continued decline, with niche growth in specific applications | Reduced revenue from traditional HDD segment, necessitating diversification. |

| Precision Parts Market Growth | Steady growth driven by technology adoption | Strong growth projected, especially in aerospace and automotive | Continued robust expansion | Opportunities for increased revenue and market share in diversified sectors. |

What You See Is What You Get

Broadway Industrial Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Broadway Industrial Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview for informed decision-making.

Sociological factors

The manufacturing sector, especially advanced manufacturing, is grappling with a significant and ongoing skills shortage. This directly impacts Broadway Industrial Group's capacity to recruit and retain the specialized workforce needed for intricate production lines and the implementation of cutting-edge technologies. For instance, a 2024 report indicated that over 70% of manufacturers struggle to find workers with the necessary technical skills.

This deficit in skilled labor can hinder operational efficiency and slow down the adoption of new, innovative manufacturing processes. To counteract this, significant investment in robust training and continuous talent development programs is essential for companies like Broadway Industrial Group to bridge this gap and ensure future competitiveness.

Consumers and regulators are pushing manufacturers towards sustainable practices, with a growing emphasis on environmental and social responsibility. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions.

Investors are increasingly prioritizing Environmental, Social, and Governance (ESG) factors. Globally, ESG assets under management are projected to reach $33.9 trillion by 2026, highlighting the financial impact of these expectations on companies like Broadway Industrial Group.

Evolving workplace safety regulations are a significant sociological factor impacting manufacturers like Broadway Industrial Group. For instance, Singapore's Ministry of Manpower has been increasingly emphasizing manufacturer and supplier responsibility for machinery safety, particularly concerning risks such as combustible dust. This shift means companies must proactively ensure their products and processes meet higher safety benchmarks.

Compliance with these stricter standards necessitates continuous investment. Broadway Industrial Group, like its peers, must allocate resources for enhanced safety equipment, comprehensive employee training programs, and meticulous record-keeping to demonstrate adherence. These investments are crucial not only for legal compliance but also for fostering a safe working environment, which is a growing societal expectation.

Ethical Sourcing and Labor Practices

Increasingly, consumers and investors are scrutinizing global supply chains for human rights violations and unethical labor practices. Broadway Industrial Group, operating international manufacturing facilities, must ensure ethical sourcing of materials and uphold fair labor standards to maintain its reputation and meet evolving international compliance expectations. For instance, in 2024, reports highlighted that over 50% of consumers indicated they would switch brands if they discovered unethical labor practices in their supply chains, a significant increase from previous years.

This heightened awareness necessitates robust due diligence and transparency. Broadway Industrial Group's commitment to ethical sourcing and labor practices is crucial for several reasons:

- Reputation Management: Negative publicity surrounding labor issues can severely damage brand image and customer loyalty.

- Regulatory Compliance: Many regions are implementing stricter regulations regarding supply chain transparency and labor standards, with potential fines for non-compliance.

- Investor Confidence: Environmental, Social, and Governance (ESG) factors are increasingly important for investors, with sustainable labor practices being a key component.

- Risk Mitigation: Proactively addressing labor concerns helps prevent disruptions caused by worker strikes or supply chain interruptions.

Impact of Automation on Employment

The increasing integration of robotics and AI in manufacturing, a trend accelerating through 2024 and projected to continue into 2025, presents a dual-edged sword for employment. While these technologies significantly enhance productivity and operational efficiency, they also raise valid concerns about job displacement for human workers in traditional roles.

Broadway Industrial Group must proactively manage these societal shifts. This involves strategic investment in reskilling and upskilling programs to equip its workforce with the competencies needed for new, technology-centric roles. Clear communication regarding the long-term advantages of automation, such as enhanced safety and the creation of higher-value jobs, will be crucial for maintaining employee morale and public perception.

- Job Displacement Concerns: Studies in 2024 indicated that up to 30% of manufacturing tasks could be automated by 2030, impacting roles focused on repetitive assembly and manual labor.

- Upskilling Initiatives: Companies like Siemens reported a 15% increase in demand for digitally skilled workers in their manufacturing divisions in 2024, highlighting the need for targeted training.

- Workforce Adaptation: The World Economic Forum’s 2024 Future of Jobs Report suggests that while some jobs will be lost, new roles requiring human-machine collaboration will emerge, necessitating adaptable skill sets.

Societal expectations around ethical business practices are intensifying, directly influencing how companies like Broadway Industrial Group operate. Consumers and investors are increasingly demanding transparency and accountability throughout supply chains, particularly concerning labor standards. For instance, a 2024 survey revealed that over 65% of consumers are more likely to purchase from brands demonstrating strong ethical sourcing, a notable rise from previous years.

This heightened awareness necessitates robust due diligence and proactive engagement with suppliers to ensure fair labor practices and human rights are upheld. Failure to do so can lead to significant reputational damage and loss of market share, as consumers are quick to penalize perceived ethical lapses. Broadway Industrial Group must therefore prioritize clear communication and demonstrable commitment to these principles to maintain trust and competitiveness.

The rapid integration of automation and AI in manufacturing, a trend significantly accelerating through 2024 and into 2025, is reshaping the workforce landscape. While these advancements boost productivity, they also raise societal concerns about job displacement for workers in traditional roles. For example, by 2030, up to 30% of manufacturing tasks could be automated, impacting repetitive assembly jobs.

| Societal Factor | Impact on Broadway Industrial Group | Supporting Data (2024/2025) |

|---|---|---|

| Ethical Consumerism & Supply Chain Scrutiny | Reputational risk, brand loyalty, potential market share loss | 65% of consumers prefer brands with ethical sourcing (2024 survey) |

| Automation and Job Displacement | Need for workforce reskilling, potential employee morale issues, new job creation | 30% of manufacturing tasks may be automated by 2030; 15% increase in demand for digitally skilled workers (2024) |

| Workplace Safety Expectations | Increased operational costs for compliance, enhanced safety culture | Stricter regulations on machinery safety, including combustible dust risks |

Technological factors

Asia's manufacturing sector is heavily investing in Industry 4.0, with smart manufacturing adoption accelerating. This integration of AI, IoT, and big data analytics is boosting efficiency and enabling real-time insights.

By 2024, it's projected that 70% of Asian manufacturers will have adopted at least one smart manufacturing technology, significantly impacting operational costs and output quality. This digital evolution is key for Broadway Industrial Group to maintain its competitive edge.

The drive for better performance and efficiency is pushing manufacturers, especially in automotive and aerospace, to embrace advanced materials and nanotechnology. Broadway Industrial Group's expertise in precision machining positions them well to utilize these innovations for creating lighter, stronger components.

For instance, the global advanced materials market was valued at approximately $210 billion in 2023 and is projected to grow significantly. Nanotechnology's integration into materials can yield benefits like enhanced durability and reduced weight, directly impacting sectors where Broadway operates.

Additive manufacturing, or 3D printing, is transforming how components are made. It allows for quicker creation of prototypes and cost-effective production of small batches, even enabling intricate designs previously impossible. For Broadway Industrial Group, this technology presents a significant opportunity to boost its precision component manufacturing.

The global 3D printing market was valued at approximately $17.9 billion in 2023 and is projected to reach $75.3 billion by 2030, growing at a compound annual growth rate of 22.5%. This rapid expansion highlights the increasing adoption of additive manufacturing across various industries, including automotive and aerospace, where Broadway Industrial Group operates.

Robotics and Automation Integration

The increasing integration of robotics and automation in Asian manufacturing, a trend that has been ongoing for years, is directly impacting productivity and efficiency gains. For Broadway Industrial Group, this means potential for significant operational improvements.

Specifically, the adoption of collaborative robots (cobots) and autonomous mobile robots (AMRs) is already seen to be streamlining production lines and boosting precision. These advancements can directly translate to more efficient manufacturing processes for Broadway Industrial Group.

- Productivity Boost: Global industrial robot installations reached 500,000 units in 2023, a 7% increase from 2022, highlighting the growing reliance on automation.

- Efficiency Gains: Studies indicate that automation can reduce manufacturing cycle times by up to 40%, leading to substantial cost savings.

- Precision Enhancement: Robotic systems offer a precision level that human operators cannot consistently match, reducing errors and waste in production.

- Cobot Growth: The collaborative robot market is projected to grow at a compound annual growth rate (CAGR) of over 30% through 2027, signaling strong adoption for flexible manufacturing.

Decline of HDD Technology and Emergence of AI-driven Storage Demand

While the broader Hard Disk Drive (HDD) market is experiencing a general decline, a significant counter-trend is emerging: a surge in demand for high-capacity HDDs. This demand is primarily fueled by the insatiable appetite of artificial intelligence (AI) models and the exponential growth of data centers. These technologies require massive storage capabilities, creating a specific niche for advanced HDD solutions.

This presents a dual challenge and opportunity for Broadway Industrial Group's HDD segment. The company must navigate the overall contraction while capitalizing on this specialized demand. Success hinges on a strategic focus on developing and supplying high-capacity, performance-oriented HDD components tailored for these cutting-edge applications.

Key data points illustrate this shift:

- AI and Big Data Growth: The global big data market was valued at approximately $231.5 billion in 2023 and is projected to reach $658.7 billion by 2030, a compound annual growth rate (CAGR) of 16.1%. This directly translates to increased demand for storage infrastructure.

- Data Center Expansion: Hyperscale data center construction saw significant investment in 2024, with global spending expected to exceed $300 billion. These facilities are primary consumers of high-capacity HDDs.

- HDD Market Segmentation: While the overall HDD market may shrink, the enterprise and data center segments, particularly those requiring high-density storage, are expected to remain robust, with some analysts predicting continued growth in exabyte shipments for these specific applications through 2025.

- Technological Advancements: Manufacturers are pushing the boundaries of HDD technology, with HAMR (Heat-Assisted Magnetic Recording) and MAMR (Microwave-Assisted Magnetic Recording) technologies enabling drives with capacities exceeding 30TB, making them crucial for AI workloads.

The pervasive integration of AI and IoT across manufacturing is reshaping operational paradigms. By 2024, a significant majority of Asian manufacturers are expected to adopt smart manufacturing technologies, driving efficiency and real-time data utilization.

Advanced materials and nanotechnology are becoming critical for performance gains, particularly in automotive and aerospace sectors. Broadway Industrial Group's precision machining capabilities align well with leveraging these innovations for lighter, stronger components.

Additive manufacturing, or 3D printing, is transforming production, enabling rapid prototyping and cost-effective small-batch runs. The global 3D printing market's projected growth to $75.3 billion by 2030 underscores its increasing importance for intricate component manufacturing.

Robotics and automation continue to enhance productivity and precision in manufacturing, with collaborative robots (cobots) streamlining production lines. Global industrial robot installations saw a 7% increase in 2023, reaching 500,000 units.

Legal factors

Singapore's upcoming workplace safety regulations, effective January 1, 2025, will introduce stricter rules for machinery and combustible dust. These changes broaden the definition of high-risk machinery and clarify accountability for manufacturers and suppliers, making compliance a key concern for businesses like Broadway Industrial Group.

New environmental regulations in Singapore, effective August 1, 2025, will impose stricter controls on persistent chemicals like LC-PFCAs and MCCPs under the Environmental Protection and Management Act. This directly impacts Broadway Industrial Group, particularly its chemical manufacturing and materials divisions, necessitating adaptation of production processes and supply chain management to ensure compliance with these evolving standards.

Changes in international trade policies, such as those enacted by the US and EU in 2024 concerning renewable energy components, directly impact Broadway Industrial Group's sourcing and sales. For instance, new tariffs on certain manufactured goods could increase raw material costs, potentially affecting profit margins by 2-5% depending on the product line. Adapting to these evolving trade landscapes is crucial for maintaining competitive pricing and market access.

Data Privacy and Cybersecurity Laws

The increasing digitalization of manufacturing operations, including the use of IoT devices and interconnected supply chains, places Broadway Industrial Group under stringent data privacy and cybersecurity regulations. Failure to comply can result in significant penalties. For instance, the GDPR, which came into full effect in 2018, can impose fines up to 4% of global annual turnover or €20 million, whichever is higher, for data breaches. Similarly, the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), grant consumers more control over their personal information and impose compliance obligations on businesses, with potential fines for violations. As of 2024, cybersecurity threats continue to escalate, with ransomware attacks alone costing the global economy an estimated $265 billion annually, highlighting the critical need for robust protective measures.

Broadway Industrial Group must prioritize the implementation of comprehensive cybersecurity strategies and ensure strict adherence to data protection laws to shield its operations, proprietary information, and sensitive customer data from evolving threats. This includes investing in advanced threat detection, data encryption, and regular security audits. The financial services sector, for example, saw cybersecurity spending increase by an average of 12% in 2024, reflecting the growing urgency. Manufacturers are expected to follow suit to mitigate risks associated with intellectual property theft and operational disruption.

Key considerations for Broadway Industrial Group include:

- Compliance with evolving global data privacy regulations like GDPR and CCPA/CPRA.

- Implementing robust cybersecurity frameworks to protect intellectual property and operational data.

- Safeguarding customer data against breaches, which can lead to reputational damage and financial penalties.

- Staying abreast of emerging cybersecurity threats and investing in proactive defense mechanisms.

Product Liability and Quality Standards

Broadway Industrial Group, as a manufacturer of precision-machined components for critical sectors like aerospace and medical, operates under intense scrutiny regarding product liability and quality. These industries have rigorous standards, such as those set by the Federal Aviation Administration (FAA) for aerospace or the Food and Drug Administration (FDA) for medical devices, which dictate acceptable tolerances and manufacturing processes. Failure to meet these exacting requirements can lead to severe penalties, including costly recalls, lawsuits, and significant damage to brand reputation. For instance, in 2023, a single product recall in the automotive sector, a related industry, cost manufacturers an average of $30 million, highlighting the financial impact of quality failures.

Adherence to these stringent quality standards is not merely a matter of compliance but a fundamental pillar for maintaining customer trust and market access. The aerospace industry, for example, relies on certifications like AS9100, which emphasizes defect prevention and reduction of variation and waste in the supply chain. Similarly, the medical device sector mandates compliance with ISO 13485, focusing on the effectiveness of the quality management system. In 2024, companies with robust quality management systems often report lower warranty costs and fewer customer complaints, directly impacting their profitability and competitive edge.

- Aerospace Quality Standards: Compliance with FAA regulations and AS9100 certification is critical for component suppliers.

- Medical Device Quality Standards: Adherence to FDA guidelines and ISO 13485 is essential for market entry and continued sales.

- Financial Impact of Non-Compliance: Product recalls and liability claims can result in substantial financial losses, estimated in the tens of millions for significant failures.

- Reputational Risk: Maintaining high-quality standards is paramount for preserving customer trust and brand image in high-stakes industries.

Broadway Industrial Group faces evolving legal landscapes concerning workplace safety and environmental protection in Singapore, with new regulations effective in 2025 impacting machinery use and chemical handling.

International trade policies enacted in 2024 by major economies like the US and EU are introducing tariffs on components, potentially affecting Broadway's raw material costs and pricing strategies by an estimated 2-5% per product line.

The company must navigate stringent data privacy and cybersecurity laws, such as GDPR and CCPA/CPRA, with non-compliance potentially leading to fines of up to 4% of global annual turnover, underscoring the critical need for robust data protection measures.

In high-stakes sectors like aerospace and medical devices, Broadway Industrial Group is subject to rigorous quality and product liability standards, where non-compliance can result in recalls costing an average of $30 million, as seen in related industries in 2023.

| Legal Factor | Impact on Broadway Industrial Group | Key Data/Regulation |

| Workplace Safety (SG) | Stricter machinery and dust regulations from Jan 1, 2025 | Broadened definition of high-risk machinery |

| Environmental Regulations (SG) | Controls on persistent chemicals (LC-PFCAs, MCCPs) from Aug 1, 2025 | Environmental Protection and Management Act updates |

| International Trade Policies | Tariffs on renewable energy components (2024) | Potential 2-5% impact on raw material costs |

| Data Privacy & Cybersecurity | GDPR, CCPA/CPRA compliance | Fines up to 4% of global turnover for breaches |

| Product Liability & Quality | Aerospace (FAA, AS9100), Medical (FDA, ISO 13485) | Recalls can cost $30 million (automotive sector example) |

Environmental factors

Consumers and regulators are increasingly pushing manufacturers towards greener operations. This translates to a demand for reduced waste, better energy usage, and ethical material sourcing. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, a significant jump from previous years.

Broadway Industrial Group's proactive stance, as evidenced by its ESG and sustainability reports, demonstrates an understanding of this critical shift. Their investment in energy-efficient machinery and waste reduction programs, which began in earnest in 2023, aims to align with these growing expectations and potentially capture market share from less sustainable competitors.

Manufacturing processes, including those at Broadway Industrial Group, are significant contributors to global greenhouse gas emissions. In 2023, industrial sectors accounted for approximately 24% of direct CO2 emissions globally, highlighting the substantial environmental impact. Broadway Industrial Group must prioritize reducing its carbon footprint by optimizing energy consumption and exploring renewable energy adoption across its operations to align with increasing sustainability mandates and mitigate climate change risks.

Broadway Industrial Group's environmental impact isn't confined to its own factories; it stretches across its entire supply chain. This includes the environmental toll of sourcing raw materials, often from diverse global locations, and the carbon emissions generated through extensive transportation networks. For instance, the global manufacturing sector's supply chains are estimated to contribute significantly to greenhouse gas emissions, with transportation alone accounting for a substantial portion of this impact.

To address this, Broadway Industrial Group needs to actively assess and manage this extended environmental footprint. This involves setting clear environmental standards for its suppliers and implementing robust traceability initiatives to ensure that materials are sourced and processed responsibly. Companies are increasingly pressured by consumers and regulators to demonstrate this accountability, with many adopting frameworks like ISO 14001 for environmental management systems.

Waste Management and Circular Economy Principles

Manufacturers, including those in industrial sectors like Broadway Industrial Group, face growing pressure to adopt circular economy principles. This means focusing on extending product life, cutting down on waste, and relying less on raw materials. For instance, in 2024, the European Union's Circular Economy Action Programme continued to push for more sustainable product design and waste reduction across industries.

Broadway Industrial Group should consider integrating waste reduction, recycling, and material circularity into its manufacturing operations. This could involve redesigning products for easier disassembly and repair, or sourcing recycled materials. The global market for circular economy solutions is projected to reach trillions of dollars in the coming years, highlighting the significant economic opportunity in these practices.

- Waste Reduction Targets: Implementing measurable goals for reducing manufacturing waste, potentially aiming for a 15% reduction by 2026.

- Recycling Infrastructure: Investing in or partnering with facilities that can process industrial by-products and end-of-life products for material recovery.

- Material Circularity: Exploring the use of recycled content in new products, with a target of incorporating 25% recycled materials by 2027.

- Product Lifespan Extension: Designing products for durability, repairability, and upgradability to reduce the frequency of replacement.

Climate Change Risks and Extreme Weather Events

Climate change presents significant environmental hurdles for manufacturers like Broadway Industrial Group. Extreme weather events, such as intensified storms or prolonged droughts, can directly impact production facilities, leading to costly damage and operational downtime. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $170 billion in damages, highlighting the increasing frequency and severity of such events.

These disruptions extend beyond the factory floor, creating ripple effects throughout Broadway Industrial Group's supply chain. Delayed shipments, damaged raw materials, and increased transportation costs are all potential consequences of climate-related disruptions. The World Economic Forum's 2024 Global Risks Report identified extreme weather as the most likely global risk to manifest in the next two years, underscoring the immediate need for adaptation.

To navigate these challenges, Broadway Industrial Group must prioritize the development of resilient infrastructure and robust mitigation strategies. This includes investing in weather-proofing facilities, diversifying supply chain partners to reduce reliance on single-source, climate-vulnerable regions, and exploring renewable energy sources to lessen their carbon footprint. Proactive measures can not only safeguard operations but also enhance long-term sustainability and competitive advantage.

- Infrastructure Resilience: Investing in flood defenses and reinforced structures for manufacturing plants.

- Supply Chain Diversification: Reducing reliance on regions highly susceptible to climate impacts.

- Renewable Energy Adoption: Transitioning to cleaner energy sources to mitigate operational carbon emissions.

- Disaster Preparedness: Implementing comprehensive plans for rapid response and recovery from extreme weather events.

Broadway Industrial Group faces increasing pressure from consumers and regulators to adopt sustainable practices, including waste reduction and ethical material sourcing. Reports from 2024 indicate over 60% of consumers now consider sustainability in their purchasing decisions, a trend Broadway is addressing through ESG initiatives and investments in energy-efficient machinery.

The manufacturing sector, which includes Broadway Industrial Group, is a significant contributor to greenhouse gas emissions, accounting for about 24% of direct CO2 emissions globally in 2023. Therefore, optimizing energy use and exploring renewable energy are crucial for Broadway to align with sustainability mandates and mitigate climate risks.

Broadway Industrial Group's environmental footprint extends to its supply chain, encompassing raw material sourcing and transportation emissions. The company must actively manage this extended impact by setting supplier standards and implementing traceability, a move supported by frameworks like ISO 14001, which many companies are adopting.

The push towards circular economy principles is growing, encouraging manufacturers to extend product life and reduce waste. Broadway Industrial Group should integrate waste reduction and material circularity, such as using recycled content, into its operations, tapping into a global market for circular solutions projected to reach trillions of dollars.

| Environmental Factor | Broadway Industrial Group's Response/Challenge | Key Data/Trend (2023-2025) |

|---|---|---|

| Consumer & Regulatory Pressure | Demand for reduced waste, better energy usage, ethical sourcing. | 60%+ consumers consider sustainability (2024). |

| Greenhouse Gas Emissions | Need to reduce carbon footprint from manufacturing. | Industrial sectors = 24% of direct CO2 emissions (2023). |

| Supply Chain Impact | Managing environmental toll of sourcing and transportation. | Transportation is a significant portion of supply chain emissions. |

| Circular Economy | Integrating waste reduction, recycling, and material circularity. | EU Circular Economy Action Programme active (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Broadway Industrial Group is informed by a robust blend of data from government agencies, international economic organizations, and reputable industry analysis firms. We incorporate official economic indicators, legislative updates, and technological trend reports to ensure comprehensive and accurate insights.