Broadway Industrial Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broadway Industrial Group Bundle

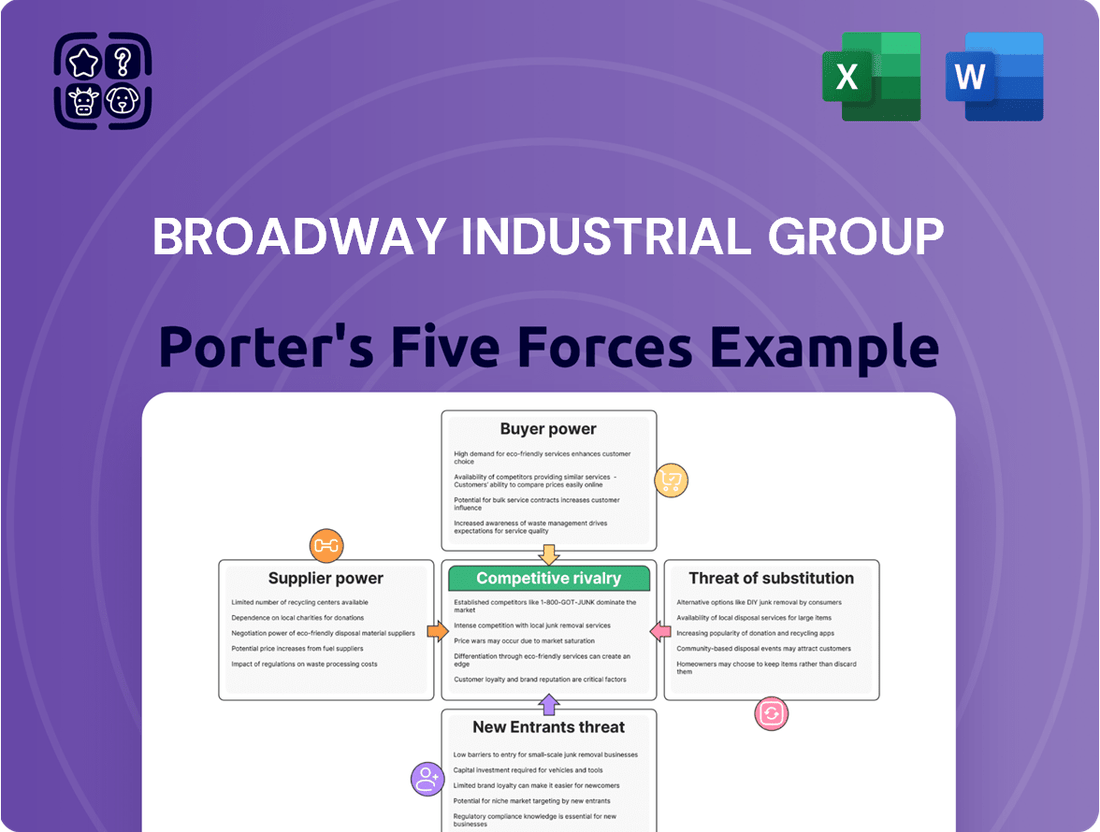

Broadway Industrial Group navigates a competitive landscape shaped by moderate supplier power and the ever-present threat of substitutes. Understanding these dynamics is crucial for strategic advantage.

The complete report reveals the real forces shaping Broadway Industrial Group’s industry—from buyer power to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for Broadway Industrial Group's key raw materials, like specialized metals and advanced composites, is a significant factor. For instance, in 2024, the global market for high-grade titanium, a critical component for certain industrial applications, was dominated by a handful of major producers, giving them considerable pricing leverage.

When few suppliers control essential inputs, they gain the power to set higher prices or impose stricter terms. This directly impacts Broadway Industrial Group's production costs and can create instability in their supply chain, ultimately affecting their profit margins and ability to meet demand consistently.

The uniqueness of components and technologies supplied to Broadway Industrial Group significantly influences supplier power. If suppliers possess proprietary technologies or hold patents on critical, specialized parts, their leverage increases substantially. This can make it challenging and costly for Broadway to find alternative sources, thereby strengthening the supplier's position.

The bargaining power of suppliers for Broadway Industrial Group is significant, particularly when specialized materials are involved. High switching costs, encompassing re-qualification, re-tooling, and potential production downtime, solidify suppliers' leverage. For instance, in 2024, industries relying on custom-engineered components or materials with stringent aerospace or medical certifications often face supplier switching costs that can range from 10% to 25% of the annual procurement value, making a change economically prohibitive.

Supplier Power 4

The bargaining power of suppliers for Broadway Industrial Group is a significant consideration. A key risk arises if suppliers, particularly those providing precision components, were to engage in forward integration and begin manufacturing these components themselves. This move would directly challenge Broadway's core business of assembly, potentially diminishing its market share and profitability.

For instance, if a major supplier that currently provides specialized metal stampings or machined parts decides to enter the assembly market, Broadway would face direct competition from a party that already controls a critical input. This scenario could lead to reduced pricing power for Broadway and a squeeze on its margins, especially if the supplier leverages its cost advantage in component production. In 2024, the industrial manufacturing sector saw increased vertical integration efforts by some key component suppliers aiming to capture more value chain profit, a trend that could impact companies like Broadway.

- Threat of Forward Integration: Suppliers moving into assembly directly competes with Broadway, reducing market opportunities.

- Erosion of Market Share: A supplier becoming a direct competitor can significantly impact Broadway's existing customer base.

- Impact on Profitability: Forward integration by suppliers can lead to price wars and reduced margins for Broadway.

- Supplier Control: Suppliers with advanced manufacturing capabilities hold leverage, potentially dictating terms or entering Broadway's space.

Supplier Power 5

The bargaining power of suppliers for Broadway Industrial Group hinges significantly on Broadway's importance as a customer. If Broadway Industrial Group constitutes a small fraction of a supplier's overall sales, that supplier might be less inclined to offer favorable pricing or flexible terms. Conversely, if Broadway is a substantial client, it can leverage its purchasing volume to negotiate better conditions.

For instance, in 2024, a key supplier to Broadway Industrial Group reported that Broadway accounted for approximately 15% of their total revenue. This level of dependency suggests Broadway has a moderate degree of leverage. However, if Broadway were to represent less than 5% of a supplier's business, the supplier's power would likely increase, potentially leading to less favorable terms for Broadway.

- Broadway's customer importance: A higher percentage of a supplier's revenue derived from Broadway enhances Broadway's bargaining power.

- Supplier flexibility: Suppliers with less reliance on Broadway may exhibit less flexibility on pricing and contract terms.

- Impact of scale: Broadway's ability to consolidate purchases or engage in long-term contracts can strengthen its negotiating position.

- Industry benchmarks: In the industrial manufacturing sector, customers representing over 10% of a supplier's revenue are often considered significant, granting them a noticeable, though not dominant, level of influence in 2024.

The bargaining power of suppliers is a critical factor for Broadway Industrial Group, especially concerning specialized inputs. When only a few suppliers can provide essential, high-quality materials like advanced composites or precision-engineered metal parts, their ability to dictate terms and prices increases significantly. This concentration was evident in 2024, with a limited number of global manufacturers controlling the supply of certain critical alloys, giving them substantial pricing leverage.

High switching costs further amplify supplier power. These costs can include the expense of re-qualifying new suppliers, retooling manufacturing processes, and potential disruptions to production schedules. For instance, in 2024, industries requiring components with strict certifications, such as those for aerospace or medical devices, often faced switching costs that could represent 10% to 25% of their annual procurement value, making a change economically unfeasible.

The threat of forward integration by suppliers also poses a risk. If a supplier of key components decides to enter Broadway's assembly market, it creates direct competition. This was a growing trend observed in the industrial manufacturing sector in 2024, where some component suppliers aimed to capture more of the value chain, potentially impacting Broadway's market share and profitability.

| Factor | Impact on Broadway Industrial Group | 2024 Data/Observation |

|---|---|---|

| Supplier Concentration | Increased pricing power for suppliers, potential supply chain instability. | Limited global producers for specialized metals (e.g., titanium) dominated the market. |

| Switching Costs | Deters Broadway from changing suppliers, solidifying existing relationships and terms. | Costs can range from 10-25% of annual procurement value for certified components. |

| Threat of Forward Integration | Direct competition from suppliers, potentially eroding market share and margins. | Observed trend in industrial manufacturing sector for suppliers to enter assembly markets. |

| Broadway's Customer Importance | Greater leverage for Broadway if it represents a significant portion of a supplier's revenue. | Broadway accounted for ~15% of a key supplier's revenue in 2024, indicating moderate leverage. |

What is included in the product

Uncovers the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Broadway Industrial Group's profitability and strategic positioning.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic interventions.

Customers Bargaining Power

The historical hard disk drive (HDD) industry has been characterized by a high concentration of customers, with a few major players dictating terms. This concentration grants these large customers substantial bargaining power, allowing them to exert significant pressure on suppliers like Broadway Industrial Group.

These dominant customers, by placing substantial volume orders, are able to negotiate for lower prices and more favorable contract terms. For instance, in 2023, the top five HDD manufacturers accounted for over 90% of global shipments, demonstrating this customer concentration.

This leverage translates into demands for enhanced quality standards and customized solutions, further intensifying the pressure on Broadway to optimize its production and cost structures to meet these exacting requirements and maintain profitability.

Broadway Industrial Group's diversification into aerospace, medical, and automotive sectors means dealing with large Original Equipment Manufacturers (OEMs). These major players, even with Broadway's broader reach, continue to hold significant bargaining power due to their substantial purchasing volume and critical role in the supply chain.

These demanding customers impose rigorous quality standards and lengthy qualification procedures, often locking suppliers into multi-year agreements. This structure naturally intensifies price negotiations, as OEMs can leverage their long-term commitment and market influence to secure more favorable terms.

For instance, in the automotive sector, a single OEM contract can represent a significant portion of a supplier's revenue, giving that OEM considerable leverage in pricing discussions. In 2024, the automotive industry continued its focus on cost optimization, putting further pressure on component suppliers like those within Broadway Industrial Group.

Customer sensitivity to price significantly impacts Broadway Industrial Group, particularly in established markets like hard disk drive (HDD) components. In these mature segments, commoditization often leads to intense price competition, directly pressuring Broadway's profit margins.

Even within faster-growing sectors, if Broadway's components lack strong differentiation, customers will naturally gravitate towards the most economical options. This dynamic forces Broadway to constantly evaluate its pricing strategies to remain competitive against alternatives.

Buyer Power 4

The bargaining power of customers for precision-machined components is a significant factor for Broadway Industrial Group. When customers can readily find alternative suppliers for similar parts, their ability to negotiate prices and terms with Broadway increases substantially. This is because lower switching costs empower them to move to a competitor if Broadway's offerings are not sufficiently competitive.

In the current market, the availability of numerous manufacturers capable of producing precision-machined components means customers often have multiple viable options. This competitive landscape directly translates to greater leverage for buyers. For instance, if a major automotive manufacturer can easily source comparable components from three different suppliers, they are in a strong position to demand lower prices from each, including Broadway Industrial Group.

- High Availability of Alternatives: The market for precision-machined components is characterized by a broad base of suppliers, reducing the dependency on any single manufacturer.

- Low Switching Costs: Customers face minimal financial or operational hurdles when changing suppliers for standard precision-machined parts.

- Price Sensitivity: In many sectors served by Broadway, components represent a significant cost, making customers highly sensitive to price fluctuations and keen on negotiation.

- Industry Benchmarking: Buyers often benchmark prices and quality across multiple suppliers, using this information to drive down costs with their preferred partners.

Buyer Power 5

Broadway Industrial Group faces a significant threat from buyer power, especially if its major clients consider backward integration. This means customers could start producing precision components themselves, directly impacting Broadway's revenue. For less complex parts, this risk is even higher, potentially shrinking Broadway's market share.

The ability of customers to produce components in-house is a key factor in assessing buyer power. If a substantial portion of Broadway's revenue comes from a few large clients, their decision to manufacture internally could be devastating. For instance, if a major automotive manufacturer, a key sector for precision component suppliers, decided to bring 20% of its current outsourced component manufacturing in-house, it could represent a significant loss of business for suppliers like Broadway.

- Customer Threat: Customers producing components in-house directly reduces Broadway Industrial Group's sales volume.

- Market Presence Impact: Backward integration by key clients can diminish Broadway's market share, particularly for standardized parts.

- Industry Vulnerability: Industries with high capital for manufacturing setup and a need for cost control are more prone to backward integration.

- Strategic Response: Broadway must focus on innovation and value-added services to mitigate the risk of customers opting for in-house production.

Customers possess considerable bargaining power, especially when they represent a large portion of Broadway Industrial Group's sales or can easily switch suppliers. This is particularly true in sectors like precision-machined components where numerous alternatives exist, and switching costs are low. For example, in 2024, the automotive sector, a key market for precision components, continued its emphasis on cost reduction, increasing pressure on suppliers to offer competitive pricing.

| Factor | Impact on Broadway Industrial Group | Example/Data |

|---|---|---|

| Customer Concentration | High power for large clients | Top 5 HDD manufacturers controlled >90% of shipments in 2023. |

| Availability of Alternatives | Increased negotiation leverage | Numerous precision component manufacturers exist, allowing buyers choice. |

| Switching Costs | Low costs empower customers | Minimal financial/operational hurdles for standard precision parts. |

| Price Sensitivity | Direct pressure on margins | Automotive sector's 2024 focus on cost optimization impacts component pricing. |

Preview the Actual Deliverable

Broadway Industrial Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Broadway Industrial Group's competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Rivalry Among Competitors

Broadway Industrial Group operates in a precision machining and components manufacturing sector characterized by a large number of global and regional competitors. This crowded market means companies are constantly vying for business, leading to intense competition. For instance, in 2024, the global precision machining market was estimated to be worth over $100 billion, with many players contributing to this figure.

The rivalry manifests in a fierce battle over price, quality standards, and the speed of delivery. Companies are also heavily investing in and competing on their technological capabilities, seeking to offer more advanced solutions. This intense competition directly impacts Broadway's profitability by putting downward pressure on margins as companies strive to win contracts.

The competitive rivalry within the industrial manufacturing sector, particularly for companies like Broadway Industrial Group, is notably intense. This intensity is partly driven by high fixed costs tied to specialized precision manufacturing equipment and extensive facility operations. To maximize the utilization of these significant investments, companies often feel compelled to operate at or near full capacity, which can lead to aggressive pricing strategies simply to secure new business and maintain production levels.

This pressure to fill capacity can easily devolve into price wars. In 2024, many industrial manufacturers reported tighter margins as competitors engaged in price-cutting to gain market share. For example, reports from industry analysts indicated that average profit margins for precision metal fabrication businesses hovered around 8-12% in the first half of 2024, a figure that can be significantly eroded by aggressive discounting. This environment directly impacts Broadway Industrial Group, forcing it to constantly balance the need for market presence with the imperative to protect its profitability.

The traditional hard disk drive (HDD) component market is experiencing slow growth, even decline, which naturally heats up competition. When the overall market isn't expanding, companies like Broadway Industrial Group are forced to fight harder for every customer and every sale. This intense rivalry means players are constantly looking for ways to gain an edge, whether through pricing, innovation, or securing key contracts.

This pressure to capture market share in a contracting sector is a significant driver for Broadway to explore new avenues. For instance, if the HDD market represents a smaller portion of the overall tech landscape, diversifying into areas like solid-state drives (SSDs) or other electronic components becomes crucial for sustained revenue. The need to offset potential losses in traditional HDD business segments necessitates strategic expansion into more robust or emerging markets.

Competitive Rivalry 4

Competitive rivalry within Broadway Industrial Group's sector, particularly in precision manufacturing, is intense. Many firms offer comparable services and capabilities, making it difficult to truly differentiate. This often drives competition towards price and operational efficiency, especially for core machining services which can be seen as commoditized.

Broadway's integrated service model aims to mitigate this, but the underlying machining operations still face significant price pressure. For instance, in 2024, the average profit margin for precision machining companies in North America hovered around 5-8%, highlighting the thin margins and the need for exceptional cost control.

- High degree of similarity in core machining services

- Competition primarily driven by cost and efficiency

- Integrated services offer some differentiation, but core operations remain vulnerable to price wars

- Industry profit margins necessitate aggressive cost management

Competitive Rivalry 5

Broadway Industrial Group operates within a precision manufacturing sector characterized by substantial exit barriers. These barriers, including the high cost of specialized machinery and significant investments in employee retraining, make it challenging and expensive for companies to leave the market. Consequently, even when industry conditions are unfavorable, firms are often compelled to remain active, intensifying the competitive landscape.

This persistent presence of existing players means that Broadway Industrial Group faces ongoing pressure from competitors who are determined to maintain their market share. For instance, in 2024, the average utilization rate for advanced manufacturing equipment across the industry remained above 80%, indicating a strong commitment from companies to keep their operations running and assets employed, even amidst potential economic headwinds.

- High Exit Barriers: Specialized assets and retraining costs lock companies into the precision manufacturing market.

- Sustained Competition: Companies remain active even in downturns, leading to continuous rivalry for available business.

- Industry Data: In 2024, advanced manufacturing equipment utilization rates averaged over 80%, reflecting a commitment to ongoing operations.

- Impact on Broadway: This environment forces Broadway Industrial Group to constantly vie for contracts and market position against entrenched competitors.

The competitive rivalry within Broadway Industrial Group's precision machining sector is fierce due to a high number of global and regional players. This intensity is fueled by significant investments in technology and a constant battle for market share, often leading to price wars and squeezed profit margins. For instance, in 2024, the global precision machining market, valued at over $100 billion, saw many companies struggling with average profit margins between 5-8% in North America, necessitating aggressive cost management.

The pressure to maintain high utilization rates for expensive, specialized equipment, with industry-wide averages exceeding 80% in 2024, compels companies to accept lower margins to secure business. This dynamic, coupled with slow growth in traditional markets like HDDs, forces companies like Broadway to continuously innovate and seek diversification to remain profitable against entrenched competitors.

SSubstitutes Threaten

The threat of substitution for Broadway Industrial Group's historical Hard Disk Drive (HDD) component business is significant, primarily from Solid State Drives (SSDs). SSDs provide superior speed and enhanced durability compared to traditional HDDs.

This technological shift directly impacts Broadway, as the declining demand for HDD components due to the market's embrace of SSDs diminishes the need for their core offerings. For instance, in 2024, the global SSD market was projected to continue its robust growth, further marginalizing the HDD segment and its component suppliers.

Advanced manufacturing technologies, such as additive manufacturing or 3D printing, present a growing threat to traditional precision-machined components. These technologies are particularly adept at producing prototypes and intricate geometries, offering an alternative production pathway.

While 3D printing is not yet a universal substitute for all mass-produced parts, its increasing sophistication and adoption represent a significant long-term challenge. For instance, in 2024, the global 3D printing market was valued at approximately $20 billion, with significant growth projected, indicating a tangible shift in manufacturing capabilities.

The threat of substitutes for Broadway Industrial Group's precision-machined components is a significant concern, particularly as advancements in materials science and product design continue. For instance, in the aerospace and automotive industries, the adoption of novel composite materials or entirely new integrated designs could drastically reduce the number of individual machined parts needed. This shift would directly diminish the demand for Broadway's core services, impacting revenue streams.

Threat of Substitution 4

Customers might choose standard, readily available components over Broadway Industrial Group's custom-machined parts, particularly for less demanding applications. This shift towards off-the-shelf solutions represents a significant threat.

For instance, the market for generic fasteners or basic metal stampings, often sourced from large, high-volume manufacturers, offers a lower-cost alternative to Broadway's specialized services. In 2024, the global industrial components market saw continued growth in standardized offerings, driven by efficiency demands.

- Threat of Substitution: Customers may opt for standardized, off-the-shelf components instead of Broadway's custom-machined parts.

- Impact on Broadway: Simpler applications can be met by lower-cost, readily available alternatives, especially in non-critical uses.

- Market Trend: The demand for standardized industrial components, particularly in 2024, has been influenced by a focus on cost-efficiency and faster turnaround times.

Threat of Substitution 5

The increasing adoption of software-centric and integrated electronic solutions across various sectors poses a significant threat of substitution for Broadway Industrial Group. Industries are increasingly prioritizing intelligent software over complex mechanical components, which could diminish demand for Broadway's traditional offerings.

For instance, the automotive industry, a key market for precision components, is rapidly shifting towards electric vehicles (EVs) and autonomous driving systems. These advancements rely heavily on advanced electronics and software, potentially reducing the need for certain mechanical parts that Broadway might supply. In 2024, the global automotive market saw continued strong growth in EV sales, with projections indicating a substantial increase in their market share by 2030, directly impacting the demand for traditional internal combustion engine components.

- Software Integration: Industries are valuing software-driven functionality, potentially replacing the need for specialized mechanical parts.

- Industry Evolution: As sectors like automotive and aerospace embrace digitalization, the demand shifts from hardware to embedded systems and intelligent controls.

- Value Proposition Shift: The core value is moving from intricate mechanical precision to the efficiency and capabilities offered by sophisticated software.

The threat of substitutes for Broadway Industrial Group is multifaceted, impacting both its legacy HDD component business and its precision-machined parts. The rapid advancement of Solid State Drives (SSDs) directly replaces the need for HDD components, a trend clearly visible in 2024's robust SSD market growth.

Furthermore, emerging manufacturing technologies like 3D printing, valued at around $20 billion globally in 2024, offer alternative production methods for intricate parts, challenging traditional machining. The increasing integration of software and electronics in sectors like automotive, with strong EV growth in 2024, also reduces reliance on certain mechanical components.

Customers are also increasingly opting for standardized, off-the-shelf components over custom solutions, driven by cost and speed, particularly in less critical applications.

| Substitute Category | Key Characteristics | Impact on Broadway | 2024 Market Context |

|---|---|---|---|

| Solid State Drives (SSDs) | Higher speed, improved durability | Reduces demand for HDD components | Continued robust market growth |

| 3D Printing (Additive Manufacturing) | Prototyping, complex geometries | Alternative to precision machining | Market valued ~ $20 billion |

| Software-Centric Solutions | Integrated electronics, digital functionality | Decreases need for certain mechanical parts | Strong EV growth in automotive sector |

| Standardized Components | Lower cost, readily available | Threat to custom-machined parts | Growth in standardized industrial offerings |

Entrants Threaten

The threat of new entrants for Broadway Industrial Group is moderate, largely due to the substantial capital investment required. Establishing state-of-the-art precision machining facilities demands significant upfront costs for advanced CNC machines, specialized tooling, and rigorous quality control systems. For instance, a single high-end CNC machining center can cost upwards of $500,000 to $1 million, with comprehensive setups easily reaching several million dollars.

The threat of new entrants for Broadway Industrial Group is significantly mitigated by the extensive technical expertise and highly skilled workforce required for precision manufacturing, especially in demanding sectors like aerospace and medical. Building this talent pool and the associated institutional knowledge is a lengthy and capital-intensive process, effectively acting as a substantial barrier to entry for potential newcomers.

The threat of new entrants for Broadway Industrial Group is significantly mitigated by stringent regulatory requirements and necessary certifications, particularly within the aerospace and medical sectors. These industries demand rigorous compliance, making it a lengthy and expensive undertaking for newcomers to gain the required approvals and establish operational legitimacy. For instance, in aerospace, certifications like AS9100 are mandatory, a process that can take years and substantial investment to achieve.

Threat of New Entrants 4

The threat of new entrants for Broadway Industrial Group is moderate. Established relationships with key customers and a proven track record of quality and reliability are significant barriers in Broadway's target markets. Newcomers must invest heavily to build trust and displace incumbent suppliers, a particularly challenging feat with risk-averse clients in sectors like aerospace and defense, where supplier certification processes can be lengthy and stringent.

Building brand recognition and demonstrating consistent performance requires substantial time and capital. For instance, in the industrial manufacturing sector, the average time for a new supplier to gain significant market share can exceed five years, often involving extensive testing and qualification phases. This lengthy integration period acts as a deterrent for many potential new entrants.

- High Capital Investment: New entrants often need considerable upfront capital for manufacturing facilities, R&D, and marketing to compete with established players like Broadway.

- Customer Loyalty and Switching Costs: Broadway's long-standing relationships and the technical integration required by its customers create high switching costs, making it difficult for new firms to gain traction.

- Regulatory Hurdles: Certain industries Broadway serves have strict regulatory requirements and certifications that new entrants must obtain, adding to the cost and time to market.

- Economies of Scale: Broadway likely benefits from economies of scale in production and procurement, which can allow for more competitive pricing than smaller, new entrants can offer.

Threat of New Entrants 5

The threat of new entrants in the industrial sector, particularly for companies like Broadway Industrial Group, is significantly mitigated by substantial economies of scale. Established players benefit from lower per-unit costs due to high production volumes and streamlined operations. For instance, in 2024, major industrial manufacturers often reported operating margins that were several percentage points higher than those of smaller, emerging companies, directly attributable to these scale advantages.

Newcomers face a steep uphill battle to match these cost efficiencies. Building the necessary infrastructure and achieving comparable production output to compete on price would require immense capital investment. This barrier makes it difficult for new entrants to gain immediate traction and profitability in a market where price competitiveness is a key factor.

Furthermore, the industrial landscape often involves significant capital requirements for plant, property, and equipment. For example, the average cost to establish a new mid-sized manufacturing facility in 2024 could range from $50 million to over $200 million, depending on the industry and scale. This high entry cost acts as a formidable deterrent.

- Economies of Scale: Broadway Industrial Group leverages large production volumes to achieve lower per-unit costs, a significant advantage over new entrants.

- Capital Investment: The substantial capital required for manufacturing facilities and technology presents a high barrier to entry.

- Cost Disadvantage for Newcomers: New entrants struggle to match the cost efficiencies of established players, impacting their ability to compete on price.

- Market Share: Established firms often hold a significant portion of the market, making it challenging for new companies to capture meaningful share quickly.

The threat of new entrants for Broadway Industrial Group remains moderate, primarily due to the significant capital investment needed for advanced manufacturing capabilities and the high cost associated with acquiring specialized talent. Furthermore, established customer relationships and stringent industry certifications create considerable switching costs and regulatory hurdles, making market entry challenging for newcomers.

Economies of scale also play a crucial role, allowing established players like Broadway to achieve lower per-unit costs. For instance, in 2024, the average operating margin for large industrial manufacturers was notably higher than for smaller firms, a direct benefit of scale. New entrants would need substantial investment to match these efficiencies and gain market traction.

| Barrier | Impact on New Entrants | Broadway's Advantage |

| Capital Investment | High (e.g., $50M-$200M for a new facility in 2024) | Established infrastructure and operational capacity |

| Technical Expertise | Requires extensive training and recruitment | Deeply ingrained workforce knowledge |

| Regulatory Compliance | Time-consuming and costly (e.g., AS9100 certification) | Existing certifications and compliance processes |

| Customer Relationships | Difficult to establish trust and displace incumbents | Long-standing, reliable supplier status |

| Economies of Scale | Higher per-unit costs initially | Lower production costs and competitive pricing |

Porter's Five Forces Analysis Data Sources

Our Broadway Industrial Group Porter's Five Forces analysis is built upon a robust foundation of industry reports from leading market research firms, publicly available financial statements, and competitor analysis derived from trade publications and industry news.