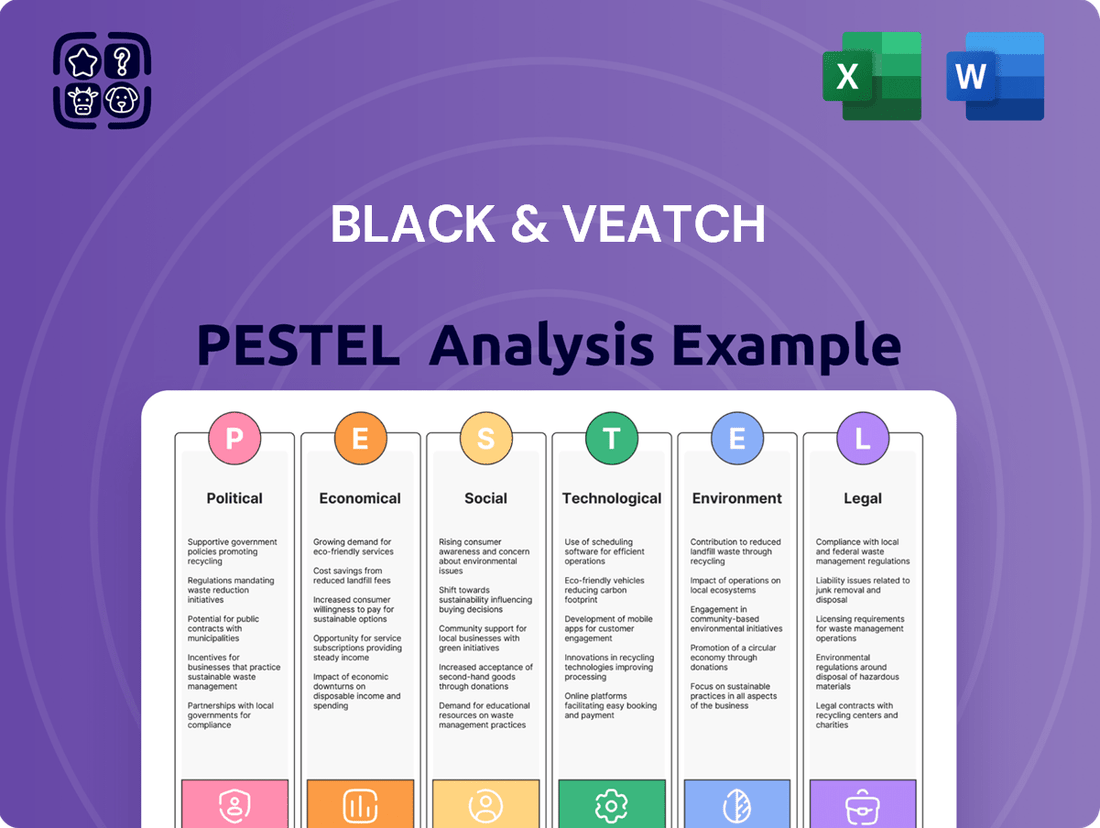

Black & Veatch PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Black & Veatch's trajectory. Our PESTLE analysis provides the critical intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full, expertly crafted report now to gain a decisive advantage.

Political factors

Government infrastructure spending significantly impacts Black & Veatch's business. In 2024, the U.S. government allocated substantial funds towards infrastructure renewal, with the Bipartisan Infrastructure Law continuing to drive projects in areas like water systems and energy grids. This increased public investment directly translates into more opportunities for engineering and consulting firms like Black & Veatch, particularly in grid modernization and water treatment upgrades.

Policy decisions around infrastructure development are crucial. For instance, the push for renewable energy integration and the modernization of aging water infrastructure in many developed nations, including significant initiatives in the UK and Canada throughout 2024-2025, create a robust project pipeline. Black & Veatch is well-positioned to capitalize on these trends, as their expertise aligns with the growing demand for sustainable and resilient infrastructure solutions.

Policy shifts significantly impact Black & Veatch's project pipeline. For instance, the Inflation Reduction Act of 2022 in the United States, with its substantial clean energy tax credits, is driving unprecedented investment in renewable energy projects, a key area for Black & Veatch.

Stricter water quality standards, such as those being implemented or considered by the EPA in 2024-2025 for emerging contaminants like PFAS, necessitate new treatment technologies and infrastructure upgrades, creating opportunities for specialized engineering services.

In telecommunications, government initiatives promoting broadband expansion and 5G deployment, like the BEAD program in the US, are spurring demand for digital infrastructure development, aligning with Black & Veatch's capabilities in this sector.

Black & Veatch's global footprint means its international projects are directly impacted by geopolitical stability and evolving trade policies. For instance, ongoing trade disputes, such as those between major economies, can introduce uncertainty into supply chains and project financing, potentially delaying critical infrastructure development in 2024. The company's ability to navigate sanctions and political shifts in regions where it operates, like those in parts of the Middle East or Africa, is crucial for maintaining project continuity and profitability.

Favorable trade agreements, such as those that streamline customs or reduce tariffs on essential materials, can significantly boost Black & Veatch's operational efficiency and competitiveness. Conversely, the rise of protectionist sentiment in various markets could erect barriers to entry or increase the cost of doing business, impacting the company's strategic expansion plans throughout 2025. For example, a shift towards localized manufacturing in response to trade tensions might necessitate adjustments to Black & Veatch's procurement strategies.

Public-Private Partnerships (PPPs) Initiatives

Governmental emphasis on leveraging private sector expertise and capital through Public-Private Partnerships (PPPs) significantly impacts Black & Veatch's business model. The company's success in securing and executing complex PPP projects is vital for expansion in regions where public funding alone cannot meet substantial infrastructure demands. Policy backing for these collaborations creates new opportunities for project initiation and development.

The global infrastructure market, heavily influenced by PPPs, is projected for robust growth. For instance, the American Society of Civil Engineers' 2021 Report Card for America's Infrastructure highlighted a cumulative funding gap of $2.59 trillion over 10 years, underscoring the necessity of private investment. Black & Veatch is well-positioned to capitalize on this trend, having participated in numerous PPPs globally.

Key aspects of PPP initiatives relevant to Black & Veatch include:

- Increased project pipeline: PPPs unlock projects that might otherwise be stalled due to public budget constraints.

- Risk sharing: Successful PPPs involve clear allocation of risks between public and private entities, which Black & Veatch can manage.

- Innovation and efficiency: Private sector involvement often brings advanced technologies and operational efficiencies to public projects.

National Security and Critical Infrastructure Protection

The increasing focus on national security and the resilience of critical infrastructure, such as energy grids and water systems, directly boosts demand for Black & Veatch's specialized engineering and consulting services. Governments are prioritizing cybersecurity and disaster preparedness for these vital assets, translating into significant project opportunities.

Government directives and funding initiatives, particularly in cybersecurity and physical security for infrastructure, are creating a consistent pipeline of work. For instance, in 2024, the U.S. Department of Energy announced over $450 million in funding for grid resilience and cybersecurity projects, directly benefiting firms like Black & Veatch.

- Increased Government Spending: U.S. federal spending on infrastructure security and modernization is projected to reach new highs in 2024-2025.

- Cybersecurity Mandates: Stricter cybersecurity regulations for critical infrastructure sectors are compelling investments in advanced protective measures.

- Resilience Programs: National programs aimed at enhancing infrastructure resilience against natural disasters and cyber threats are a key driver for Black & Veatch's expertise.

- Strategic Importance: Black & Veatch's capabilities in securing and modernizing these essential networks align with paramount national strategic interests.

Governmental policies and regulatory frameworks are pivotal for Black & Veatch. For example, the U.S. Inflation Reduction Act of 2022 continues to stimulate significant investment in clean energy and infrastructure upgrades through 2024-2025, directly benefiting the company's renewable energy project pipeline. Similarly, evolving water quality standards, such as those addressing emerging contaminants, are driving demand for advanced treatment solutions.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Black & Veatch across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive view of the company's operating landscape.

A clean, summarized version of the full Black & Veatch PESTLE analysis provides an easily digestible overview, relieving the pain of sifting through extensive data for quick referencing during meetings or presentations.

Economic factors

Global economic growth is a critical driver for Black & Veatch's business, as infrastructure spending is highly correlated with GDP expansion. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024 and a similar pace for 2025, indicating a generally supportive environment for large capital investments. When economies are robust, governments and private sectors are more inclined to fund significant infrastructure development, directly benefiting companies like Black & Veatch that specialize in these areas.

Conversely, economic slowdowns or recessions pose a direct risk to Black & Veatch's revenue streams and project pipeline. A significant downturn could lead to reduced public funding for infrastructure projects and a more cautious approach from private investors, potentially causing delays or outright cancellations. This cyclical nature of investment means Black & Veatch must navigate periods of both expansion and contraction in global economic activity.

Access to project financing is paramount for large-scale infrastructure development, a core area for Black & Veatch. Favorable lending conditions and readily available capital are essential for securing the significant upfront investments these projects demand. For instance, in 2024, global infrastructure investment is projected to reach trillions, with a substantial portion reliant on debt financing.

Interest rate shifts and credit market availability directly impact the feasibility and cost of these ventures. When interest rates rise, as they have in many developed economies during 2023-2024, the cost of borrowing increases, potentially delaying or scaling back projects. Conversely, periods of low interest rates and high investor confidence, seen in earlier years, can accelerate development.

Black & Veatch's clients and partners depend on stable and robust financial markets to underwrite their ambitious projects. The availability of diverse funding sources, from traditional bank loans to green bonds and private equity, influences the pace of innovation and deployment in sectors like renewable energy and water treatment, areas where Black & Veatch operates extensively.

The cost of essential construction materials like steel and concrete directly influences Black & Veatch's project expenses and profit margins. For instance, the price of steel, a key component in infrastructure, saw significant fluctuations throughout 2024, impacting project budgets.

Disruptions in global supply chains, as experienced in recent years, can create unpredictable cost increases and push back project timelines. These disruptions, often stemming from geopolitical events or natural disasters, directly affect the availability and price of specialized equipment needed for large-scale engineering projects.

To navigate these economic headwinds, Black & Veatch must employ robust supply chain management and strategic procurement. This includes diversifying suppliers and securing long-term contracts to lock in prices, thereby mitigating the risk of volatile commodity markets and potential project delays.

Inflationary Pressures

Rising inflation significantly impacts Black & Veatch's project economics by diminishing the real value of budgets and escalating operational expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.0% to 3.5% in late 2024 and projected to remain elevated in 2025, impacting material and labor costs. This trend directly squeezes profit margins, especially on long-term, fixed-price contracts.

To navigate these inflationary headwinds, Black & Veatch must proactively integrate robust cost escalation clauses into contracts and employ sophisticated hedging strategies for key commodities.

- Increased Project Costs: Inflation directly raises the price of raw materials, equipment, and skilled labor essential for infrastructure and energy projects.

- Erosion of Purchasing Power: Higher inflation reduces the real value of allocated project budgets, potentially leading to scope adjustments or funding shortfalls.

- Margin Compression on Fixed-Price Contracts: Projects bid with fixed pricing become less profitable as costs outpace initial estimates due to inflation.

- Need for Advanced Cost Management: Implementing dynamic pricing models and forward-looking cost projections is crucial for maintaining financial stability and competitiveness.

Currency Exchange Rate Volatility

As a global engineering and construction firm, Black & Veatch's exposure to currency exchange rate volatility is significant. Projects undertaken in diverse international markets mean revenues and expenses can be denominated in various currencies. For instance, a strong US dollar relative to the Euro could reduce the dollar-equivalent value of earnings from European projects, impacting overall profitability.

Adverse currency movements directly affect the financial outcomes of international contracts. If Black & Veatch secures a project in Japan with revenue in Japanese Yen, but its primary costs are incurred in US Dollars, a weakening Yen can substantially erode profit margins. This necessitates robust financial planning to mitigate such risks.

Managing currency risk is crucial for Black & Veatch's financial health. The company likely employs hedging strategies, such as forward contracts or currency options, to lock in exchange rates for anticipated transactions. This proactive approach helps to stabilize earnings and protect against unforeseen market shifts.

- Global Operations: Black & Veatch operates in numerous countries, exposing it to a wide range of currency fluctuations.

- Profitability Impact: Fluctuations can directly impact the dollar value of foreign-earned revenues and the cost of dollar-denominated expenses.

- Risk Mitigation: Hedging strategies are essential tools for managing the financial risks associated with currency volatility.

- 2024/2025 Outlook: Analysts anticipate continued currency market fluctuations, driven by global economic policies and geopolitical events, underscoring the ongoing importance of currency risk management for companies like Black & Veatch.

Global economic growth directly fuels demand for Black & Veatch's infrastructure and energy projects. The IMF's projection of 3.2% global growth for 2024 and a similar outlook for 2025 suggests a generally favorable environment for capital investments. This growth translates into increased government and private sector spending on vital infrastructure development, a core business area for Black & Veatch.

However, economic downturns present significant risks, potentially leading to reduced project funding and investment caution. This cyclicality necessitates careful financial planning and adaptability to navigate periods of both expansion and contraction in the global economy.

Access to capital and favorable interest rates are critical for Black & Veatch's large-scale projects. While global infrastructure investment is expected to be in the trillions in 2024, rising interest rates in many developed economies during 2023-2024 increase borrowing costs, potentially impacting project feasibility.

Inflation, with US CPI rates around 3.0%-3.5% in late 2024, directly impacts project costs and profit margins, especially on fixed-price contracts. Black & Veatch must manage these rising expenses through advanced cost management and contract clauses.

Currency exchange rate volatility also poses a significant risk for Black & Veatch's global operations, affecting the dollar-equivalent value of foreign earnings and the cost of international expenses. Effective hedging strategies are crucial for mitigating these financial risks.

Same Document Delivered

Black & Veatch PESTLE Analysis

The Black & Veatch PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this comprehensive PESTLE analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external factors affecting Black & Veatch.

Sociological factors

Public demand for sustainable and resilient infrastructure is a major driver for companies like Black & Veatch. There's a growing expectation for projects that are not only functional but also environmentally responsible and built to withstand climate impacts. For instance, a 2024 survey indicated that over 70% of citizens believe governments should prioritize green infrastructure investments.

Communities are increasingly vocal about wanting infrastructure that minimizes its ecological footprint, conserves precious resources, and genuinely improves the quality of daily life. This translates into a preference for solutions that incorporate renewable energy, water conservation technologies, and designs that promote community well-being.

Black & Veatch's strategic emphasis on developing sustainable and innovative solutions directly addresses these evolving societal expectations. This alignment is a key factor in the increasing demand for their expertise in areas like smart grids, advanced water treatment, and renewable energy integration, which are all critical components of resilient infrastructure development.

The availability of skilled engineers, project managers, and construction workers is paramount for Black & Veatch's ability to execute projects and expand. In 2024, the engineering and construction sector faced ongoing challenges with finding specialized talent, particularly in areas like renewable energy and advanced infrastructure development.

Demographic shifts, such as a significant portion of experienced engineers nearing retirement, pose a risk to talent continuity. For instance, the American Society of Civil Engineers highlighted in their 2023 report that a substantial percentage of their members are over 50, indicating a potential knowledge and experience gap in the coming years.

To counter these trends, Black & Veatch must continue robust investments in recruitment, offering competitive compensation and benefits, alongside comprehensive training and development programs. Ensuring a diverse and skilled talent pipeline is crucial for maintaining operational excellence and fostering innovation in 2025.

Black & Veatch's success in infrastructure hinges on robust community engagement. For instance, in 2024, projects facing significant public opposition experienced an average delay of 18 months, impacting cost by up to 25%. Therefore, fostering trust and transparency is paramount for Black & Veatch to secure a social license to operate, particularly in projects involving sensitive environmental or social considerations.

Urbanization and Population Growth Trends

The world's population is projected to reach 9.7 billion by 2050, with a significant portion of this growth concentrated in urban areas. This rapid urbanization fuels an escalating demand for robust and modernized essential services like water, energy, and telecommunications. Black & Veatch is positioned to capitalize on this by providing the engineering and construction expertise needed to build and enhance these critical urban infrastructures.

Cities are expanding at an unprecedented rate, with projections indicating that by 2030, over 60% of the world's population will reside in urban centers. This demographic shift directly translates into continuous opportunities for Black & Veatch. The company's core competencies in designing and implementing new water treatment facilities, upgrading aging power grids, and expanding digital networks are essential to meeting the needs of these burgeoning metropolitan areas.

- Global population growth: Expected to reach 9.7 billion by 2050.

- Urbanization rate: Over 60% of the world's population to live in urban areas by 2030.

- Infrastructure demand: Increased need for water, energy, and telecommunication systems in cities.

- Strategic focus: Targeting regions with significant urban development for project acquisition.

Health and Safety Standards and Expectations

Societal expectations for health and safety in the construction and infrastructure sectors are reaching new heights. This means companies like Black & Veatch face increasing pressure to demonstrate rigorous safety measures throughout project lifecycles, from initial design to ongoing maintenance. In 2023, the U.S. Bureau of Labor Statistics reported that the construction industry experienced a record-low total recordable case rate of 2.4 per 100 full-time workers, a testament to evolving safety standards.

Black & Veatch's dedication to maintaining and exceeding these elevated health and safety standards is paramount. It directly impacts their standing in the industry, the welfare of their workforce, and their adherence to both ethical responsibilities and legal requirements. A strong safety record is no longer just a compliance issue; it's a critical component of corporate social responsibility and a key differentiator.

The company's commitment is reflected in its proactive approach to risk management and the implementation of best practices. For instance, many leading engineering firms, including Black & Veatch, have adopted comprehensive safety management systems that often exceed regulatory minimums. This focus ensures a safer working environment and mitigates potential liabilities.

- Increased Scrutiny: Public and regulatory bodies are closely monitoring safety performance in infrastructure projects.

- Reputational Impact: A strong safety record enhances Black & Veatch's brand image and attracts talent.

- Employee Well-being: Prioritizing safety directly contributes to the health and morale of Black & Veatch's employees.

- Operational Efficiency: Robust safety protocols often lead to fewer disruptions and improved project timelines.

Public demand for sustainable and resilient infrastructure is a major driver for companies like Black & Veatch, with a 2024 survey showing over 70% of citizens prioritizing green infrastructure investments. Communities increasingly expect projects that minimize ecological footprints and conserve resources, favoring solutions incorporating renewable energy and water conservation technologies.

The availability of skilled talent remains critical, with the engineering and construction sector facing ongoing challenges in finding specialized expertise, particularly in renewable energy, as highlighted by a 2024 industry report. Demographic shifts, such as experienced engineers nearing retirement, pose a risk to talent continuity, with a 2023 report indicating a substantial percentage of civil engineers are over 50.

Societal expectations for health and safety in infrastructure are reaching new heights, with a 2023 report noting a record-low total recordable case rate in the construction industry. Black & Veatch's dedication to exceeding these elevated health and safety standards is paramount for its industry standing, workforce welfare, and adherence to legal requirements, with proactive risk management and best practices being key differentiators.

Rapid urbanization, projected to see over 60% of the world's population living in urban centers by 2030, directly translates into continuous opportunities for Black & Veatch. The company's expertise in water treatment, power grids, and digital networks is essential to meet the needs of these burgeoning metropolitan areas, supporting global population growth expected to reach 9.7 billion by 2050.

| Sociological Factor | Description | Impact on Black & Veatch | Relevant Data (2023-2025) |

|---|---|---|---|

| Public Demand for Sustainability | Growing expectation for environmentally responsible and resilient infrastructure. | Drives demand for Black & Veatch's expertise in green solutions. | 70%+ citizens prioritize green infrastructure (2024 survey). |

| Talent Availability | Need for skilled engineers and project managers. | Challenges in recruitment and retention, potential knowledge gaps. | Ongoing talent shortages in specialized areas (2024 industry report); 50%+ civil engineers over 50 (2023 report). |

| Health & Safety Standards | Increasingly stringent expectations for workplace safety. | Requires rigorous safety measures; enhances brand reputation and attracts talent. | Record-low safety incident rates in construction (2023 BLS data). |

| Urbanization & Population Growth | Increased need for essential services in growing urban areas. | Creates significant opportunities for infrastructure development projects. | 60%+ global population in urban areas by 2030; 9.7 billion global population by 2050. |

Technological factors

The integration of digital technologies like IoT sensors, AI, and big data analytics is revolutionizing infrastructure. For instance, smart grid deployments are accelerating, with the global smart grid market projected to reach over $100 billion by 2027, indicating a significant shift towards data-driven operational efficiency.

Black & Veatch needs to capitalize on these trends by offering smart solutions for energy grids, water networks, and telecommunications. This involves leveraging digital twins and advanced asset management platforms to boost efficiency, reliability, and predictive maintenance capabilities, a move supported by the increasing adoption of these technologies across major utilities.

The relentless pace of innovation in solar, wind, and battery storage technologies is fundamentally reshaping the energy landscape. For Black & Veatch, staying at the forefront of these advancements, particularly in designing hybrid systems and sophisticated grid integration, is paramount to maintaining its competitive edge in the dynamic power market.

The global renewable energy market is experiencing robust growth, with investments in solar and wind power projected to reach new heights. For instance, BloombergNEF reported in early 2024 that global clean energy investment hit a record $1.1 trillion in 2023, with renewables and storage accounting for a significant portion. This trend underscores the critical need for Black & Veatch to continuously adapt its expertise to leverage these evolving technologies.

The construction industry is increasingly embracing automation and robotics, with the global construction robotics market projected to reach $20.2 billion by 2030, up from $3.9 billion in 2022. This surge is driven by the need for improved efficiency, safety, and precision, as well as a response to labor shortages. Black & Veatch can leverage these advancements, from automated drone surveys for site assessment to robotic systems for tasks like welding and bricklaying, to streamline operations.

Incorporating these technologies offers tangible benefits, such as an estimated 15-20% reduction in project timelines and a significant decrease in on-site accidents. For instance, autonomous excavators can perform repetitive digging tasks with greater accuracy and fewer human errors. Black & Veatch's adoption of such tools can therefore lead to faster project delivery and a higher standard of finished work, directly impacting profitability and client satisfaction.

Cybersecurity and Data Protection

The increasing digitization of critical infrastructure, such as telecommunications, energy, and water systems, amplifies the risk of cyberattacks. Black & Veatch must embed strong cybersecurity protocols into its engineering and operational frameworks to safeguard these vital networks. This focus is crucial as the global cybersecurity market reached an estimated $270 billion in 2024, highlighting the significant investment and attention this area demands.

Protecting sensitive client data and ensuring the resilience of the infrastructure Black & Veatch designs against evolving cyber threats is paramount. A breach could severely damage client trust and disrupt essential services, impacting Black & Veatch's reputation and operational continuity. The financial services sector, for example, reported an average cost of a data breach at $5.57 million in 2024, illustrating the substantial financial implications of security failures.

- Growing Interconnectivity: Critical infrastructure is becoming more interconnected, creating a larger attack surface for cyber threats.

- Essential Integration: Black & Veatch must integrate robust cybersecurity into all design and operational phases for telecommunications, energy, and water systems.

- Data Protection Imperative: Safeguarding sensitive client information and ensuring infrastructure resilience against cyberattacks is vital for maintaining trust and operational integrity.

- Market Growth: The global cybersecurity market is expanding rapidly, with significant investments being made to combat increasing threats.

Advanced Materials and Construction Techniques

Innovations in materials science are revolutionizing infrastructure. Think about high-strength composites, self-healing concrete, and a growing focus on sustainable building materials. These advancements open up entirely new avenues for how we build everything from bridges to power plants.

Black & Veatch can really stand out by embracing these cutting-edge materials and modern construction methods. This adoption translates directly into infrastructure that's not only tougher and lasts longer but is also more economical to build and kinder to the environment. For instance, the global advanced materials market is projected to reach over $300 billion by 2027, indicating significant investment and adoption potential.

Continued investment in research and development within these material and construction domains is absolutely critical. This ensures Black & Veatch stays at the forefront, offering clients the most efficient and forward-thinking solutions available. The construction industry, in general, saw a 3% increase in productivity due to technological adoption in 2023, highlighting the tangible benefits of innovation.

- High-strength composites offer superior durability and reduced weight, potentially lowering transportation and installation costs.

- Self-healing concrete can automatically repair cracks, extending the lifespan of structures and reducing maintenance expenses.

- Sustainable building materials, like recycled plastics or bio-based composites, address environmental concerns and can lead to cost savings through reduced waste.

- The global green building materials market is expected to grow significantly, with projections indicating a compound annual growth rate of around 10% through 2030.

The rapid advancement of artificial intelligence (AI) and machine learning (ML) is transforming infrastructure management. These technologies enable predictive maintenance, optimize energy distribution, and improve operational efficiency across sectors like utilities and transportation. For example, AI in infrastructure is projected to grow significantly, with market forecasts suggesting substantial expansion in the coming years due to its capacity for data analysis and automation.

Black & Veatch must integrate AI and ML into its service offerings to provide clients with data-driven insights and automated solutions. This includes leveraging AI for sophisticated grid management, water network optimization, and enhanced traffic flow control, aligning with the increasing demand for smart city solutions. The company's ability to harness these technologies will be key to delivering next-generation infrastructure projects.

| Technology Area | Projected Market Size (USD Billions) | Key Application for Black & Veatch | Growth Driver |

|---|---|---|---|

| AI in Infrastructure | Est. $50+ by 2027 (various sources) | Predictive maintenance, grid optimization | Efficiency gains, cost reduction |

| IoT in Utilities | Est. $70+ by 2026 (various sources) | Smart metering, real-time monitoring | Resource management, demand response |

| Digital Twins | Est. $10+ by 2025 (various sources) | Asset performance simulation, scenario planning | Risk mitigation, lifecycle optimization |

Legal factors

Black & Veatch navigates a complex web of environmental regulations, impacting everything from initial project design to ongoing operations. Stringent laws governing emissions, waste, water, and land use are paramount. For instance, the increasing global focus on carbon emissions directly influences the design of power generation and industrial facilities, requiring advanced abatement technologies.

Compliance with these diverse environmental standards, which vary significantly by region, necessitates thorough permitting processes and detailed environmental impact assessments. In 2024, the costs associated with environmental compliance for large infrastructure projects globally are estimated to be in the billions, reflecting the depth of scrutiny.

Failure to adhere to these mandates carries substantial financial penalties and can severely damage Black & Veatch's reputation. For example, significant fines are levied for breaches in water discharge quality or improper hazardous waste disposal, underscoring the critical need for robust environmental management systems.

Black & Veatch's commitment to infrastructure safety is paramount, directly influenced by evolving safety standards and building codes. These regulations are not static; they are regularly updated to reflect new technologies and lessons learned from past incidents. For instance, in 2024, several jurisdictions introduced stricter seismic retrofitting requirements for older bridges and buildings, directly impacting design and construction methodologies for infrastructure projects.

Adherence to these codes is a legal imperative, shaping everything from material selection to construction techniques and long-term operational procedures. Failure to comply can result in significant penalties, project delays, and reputational damage. The company must actively monitor and integrate updates, such as the 2025 revisions to the International Building Code which emphasize enhanced fire resistance and energy efficiency in critical facilities.

Staying ahead of these regulatory shifts ensures Black & Veatch not only meets its legal obligations but also upholds its reputation for delivering safe and reliable infrastructure. This proactive approach is crucial for protecting workers, the public, and the longevity of the assets they design and build, especially as infrastructure resilience against climate change becomes a more prominent focus in code development.

Operating globally, Black & Veatch must navigate a complex web of international contract laws, dispute resolution mechanisms, and trade agreements. The legal frameworks governing engineering, procurement, and construction (EPC) contracts, for instance, vary significantly across jurisdictions, impacting everything from intellectual property rights to labor standards. For example, the International Chamber of Commerce (ICC) reported a 10% increase in the value of arbitrations administered in 2023, highlighting the growing reliance on international dispute resolution.

Expertise in international contract negotiation and compliance is therefore vital for managing risks and ensuring successful project delivery worldwide. Failure to adhere to local legal requirements can lead to substantial fines, project delays, or even contract termination. In 2024, changes in data privacy laws in regions like the European Union (GDPR) and California (CCPA) continue to shape how companies handle client information in cross-border projects.

Data Privacy and Telecommunications Regulations

Black & Veatch navigates a complex web of data privacy and telecommunications regulations. Compliance with frameworks like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount for its telecommunications infrastructure projects. Failure to adhere can lead to significant fines, with GDPR penalties potentially reaching 4% of global annual revenue or €20 million, whichever is higher.

These regulations dictate how client data is collected, stored, and processed, directly impacting Black & Veatch's service delivery and client relationships. The company must ensure its solutions safeguard sensitive information and comply with telecom-specific rules governing network integrity and consumer rights. For instance, in 2024, the US Federal Communications Commission (FCC) continued to enforce robust consumer protection rules for broadband providers, impacting how infrastructure is deployed and managed.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Impact: Mandates consumer control over personal data, affecting data handling in infrastructure solutions.

- FCC Enforcement: Continued focus on consumer protection in the US telecommunications sector in 2024.

- Industry Trend: Increasing global scrutiny on data handling practices across all tech sectors.

Labor Laws and Employment Regulations

As a global entity, Black & Veatch navigates a complex web of labor laws. These regulations cover everything from minimum wage and working hours to employee rights and the ability to unionize, varying significantly by country. For instance, in 2024, the International Labour Organization (ILO) reported ongoing efforts to strengthen worker protections globally, with many nations updating their employment standards.

Effectively managing its international workforce, which includes thousands of employees, demands a deep understanding of these localized employment rules. This ensures fair treatment and compliance, crucial for avoiding legal challenges and fostering a productive atmosphere. In 2025, companies are increasingly investing in specialized HR technology to manage these diverse compliance requirements.

- Global Compliance: Adherence to varying wage, working condition, and employee rights laws across all operational countries.

- Workforce Management: Ensuring fair labor practices and preventing disputes through diligent understanding of local employment regulations.

- Employee Relations: Maintaining a positive work environment by respecting and upholding diverse national labor standards.

- Regulatory Updates: Staying abreast of evolving labor laws and their impact on global operations, a key focus for 2024-2025.

Black & Veatch must adhere to a multitude of legal frameworks, including evolving environmental regulations, stringent safety standards, and international contract laws. The company's global operations necessitate compliance with diverse labor laws and data privacy mandates, such as GDPR and CCPA. Failure to comply can result in significant financial penalties and reputational damage, as seen with GDPR fines potentially reaching 4% of global annual revenue.

| Legal Area | Key Considerations | 2024/2025 Impact/Data |

|---|---|---|

| Environmental | Emissions, waste, water, land use compliance | Billions in global compliance costs; increasing carbon emission scrutiny |

| Safety & Building Codes | Adherence to updated safety standards and building codes | Stricter seismic retrofitting requirements; 2025 IBC revisions emphasizing fire resistance and energy efficiency |

| International Contracts | Navigating varying contract laws and dispute resolution | 10% increase in ICC arbitrations administered in 2023; data privacy law changes (GDPR, CCPA) impacting cross-border projects |

| Data Privacy & Telecom | Compliance with GDPR, CCPA, FCC consumer protection rules | GDPR fines up to 4% global revenue; continued FCC enforcement on broadband providers in 2024 |

| Labor Laws | Adherence to wage, working hours, and employee rights globally | ILO efforts to strengthen worker protections; increased HR tech investment for compliance in 2025 |

Environmental factors

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, are compelling a fundamental shift towards more resilient infrastructure. Black & Veatch is therefore increasingly focused on engineering solutions capable of withstanding the impacts of floods, droughts, intense storms, and rising sea levels.

This imperative translates into a growing demand for climate adaptation projects. Examples include advanced stormwater management systems designed to handle increased rainfall, coastal defense structures to mitigate erosion and inundation, and the development of more robust and adaptable energy grids. The global market for climate adaptation solutions is projected to reach hundreds of billions of dollars annually by the late 2020s, underscoring the critical nature of this sector.

Global water scarcity is a growing concern, projected to affect 5 billion people by 2050, according to the UN. This escalating challenge fuels a strong demand for advanced water treatment, reuse, and conservation technologies, creating significant opportunities for companies like Black & Veatch. Their established expertise in sophisticated water and wastewater solutions, encompassing desalination and intelligent water network management, positions them to effectively tackle these critical environmental issues.

Sustainable water management projects represent a vital growth sector, directly aligning with pressing global environmental priorities. The World Bank estimates that investments in water infrastructure could reach $1 trillion annually by 2030 to meet growing demand and address climate impacts. Black & Veatch's commitment to these areas is therefore not only environmentally responsible but also strategically sound for future revenue streams.

The global push to slash carbon emissions is driving a major shift from fossil fuels to renewables. This trend is creating substantial growth avenues for Black & Veatch, particularly in developing solar, wind, and battery storage projects, alongside the crucial smart grid technology needed to manage these power sources.

Black & Veatch's involvement in decarbonization efforts is a cornerstone of its strategy within the energy sector. For instance, the company is actively engaged in projects like the development of offshore wind farms, a sector projected to see significant investment. Global investment in clean energy reached an estimated $1.7 trillion in 2023, highlighting the scale of this transition.

Waste Management and Circular Economy Principles

The global push towards sustainability is significantly reshaping infrastructure development, with waste management and circular economy principles at the forefront. Black & Veatch, a prominent player in this space, is well-positioned to leverage this trend by designing projects that prioritize waste reduction, the incorporation of recycled materials, and efficient resource recovery systems. This growing emphasis is driving demand for innovative solutions in waste-to-energy technologies and advanced resource management facilities.

The economic implications are substantial. For instance, the global circular economy market was valued at approximately $2.8 trillion in 2023 and is projected to reach $4.5 trillion by 2030, indicating a strong growth trajectory. This expansion directly influences the types of infrastructure projects that receive investment and regulatory support. Black & Veatch's expertise in areas like advanced wastewater treatment and renewable energy integration aligns with these evolving market demands.

- Growing Market Value: The circular economy market is a significant growth area, projected to expand considerably in the coming years, creating opportunities for infrastructure providers.

- Focus on Resource Recovery: Projects are increasingly designed to recover valuable resources from waste streams, moving away from traditional linear models.

- Technological Advancements: Innovations in waste-to-energy and material recycling technologies are enabling more efficient and environmentally sound waste management solutions.

- Regulatory Tailwinds: Stricter environmental regulations and government incentives worldwide are further accelerating the adoption of circular economy principles in infrastructure.

Biodiversity Protection and Environmental Impact Mitigation

Black & Veatch’s infrastructure projects, particularly in energy and water, inherently interact with natural environments. For instance, large-scale renewable energy installations or water treatment facilities can impact local ecosystems and biodiversity. In 2024, regulatory bodies worldwide are increasingly scrutinizing these effects, demanding robust environmental impact assessments and mitigation plans. Companies like Black & Veatch are therefore prioritizing strategies such as habitat restoration and minimizing construction footprints to secure project approvals and maintain their social license to operate.

Effective environmental impact mitigation is not just a compliance issue but a core component of sustainable business practice. Black & Veatch’s commitment to biodiversity protection is demonstrated through initiatives like:

- Habitat Preservation: Identifying and protecting sensitive ecological areas before and during project development.

- Ecological Restoration: Implementing programs to restore disturbed habitats post-construction.

- Minimizing Disturbance: Employing advanced construction techniques to reduce noise, pollution, and physical disruption to wildlife.

- Biodiversity Monitoring: Conducting ongoing assessments to track the health of local ecosystems and the effectiveness of mitigation measures.

The increasing focus on environmental sustainability is driving significant changes in infrastructure development, with a strong emphasis on climate resilience and resource management. Black & Veatch is actively responding to these environmental shifts by engineering solutions that address extreme weather events and water scarcity.

The global transition to renewable energy sources and the imperative to reduce carbon emissions are creating substantial growth opportunities. Black & Veatch is investing in solar, wind, and battery storage projects, alongside the necessary smart grid technologies. These efforts are crucial for a sustainable energy future.

Circular economy principles are gaining traction, influencing waste management and resource recovery. Black & Veatch is positioned to capitalize on this trend by designing projects that prioritize waste reduction and efficient resource utilization. The company's expertise in advanced wastewater treatment and renewable energy integration aligns with these evolving market demands.

| Environmental Factor | Impact on Black & Veatch | Market Opportunity/Challenge | Relevant Data/Projections (2024/2025) |

|---|---|---|---|

| Climate Change & Extreme Weather | Demand for resilient infrastructure solutions | Growth in climate adaptation projects (stormwater, coastal defense, grid hardening) | Global market for climate adaptation solutions projected to reach hundreds of billions annually by late 2020s. |

| Water Scarcity | Increased demand for advanced water treatment and reuse technologies | Opportunities in desalination, intelligent water networks, and conservation | UN projects 5 billion people affected by water scarcity by 2050. World Bank estimates water infrastructure investments could reach $1 trillion annually by 2030. |

| Decarbonization & Renewables | Focus on solar, wind, battery storage, and smart grid development | Significant investment in clean energy sector | Global clean energy investment reached an estimated $1.7 trillion in 2023. |

| Circular Economy & Waste Management | Emphasis on waste reduction, resource recovery, and waste-to-energy | Growing market for innovative waste management solutions | Global circular economy market valued at ~$2.8 trillion in 2023, projected to reach $4.5 trillion by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting your business.