Black & Veatch Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

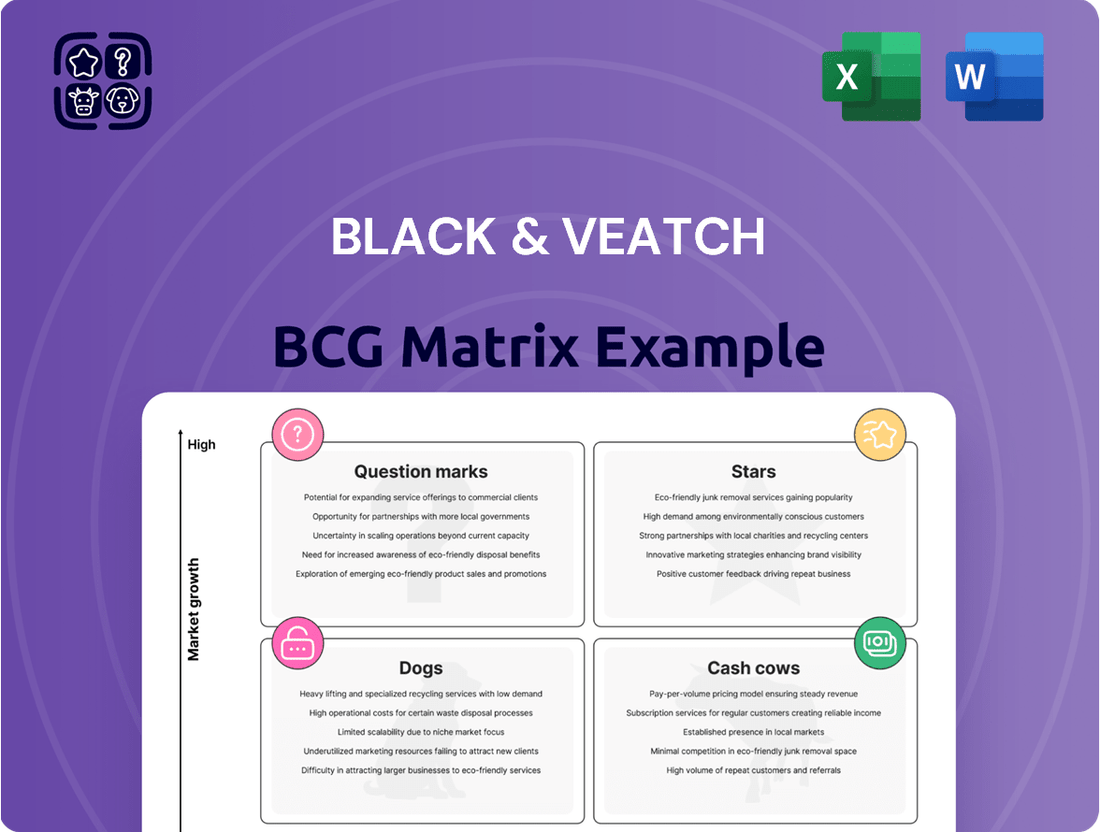

Curious about Black & Veatch's strategic positioning? This glimpse into their BCG Matrix reveals how their portfolio might be segmented into Stars, Cash Cows, Dogs, and Question Marks. To truly understand their competitive landscape and unlock actionable insights for your own business, purchase the full BCG Matrix report.

Dive deeper into Black & Veatch's strategic framework with the complete BCG Matrix. This comprehensive report provides detailed quadrant analysis and expert recommendations, empowering you to make informed decisions about resource allocation and future investments. Don't miss out on the critical data that will shape your competitive advantage.

Unlock the full potential of Black & Veatch's market strategy by acquiring the complete BCG Matrix. This detailed analysis goes beyond a simple overview, offering a clear roadmap for identifying growth opportunities and managing underperforming assets. Invest in clarity and strategic foresight today.

Stars

Black & Veatch is a major player in the burgeoning green hydrogen infrastructure market. They've completed or are working on 245MW of projects worldwide, showcasing their significant involvement. This sector is booming due to global decarbonization goals and substantial government support, ensuring continued growth and opportunity for B&V.

Black & Veatch's proprietary PRICO liquefaction technology is a cornerstone of their strong position in the Floating LNG (FLNG) sector. This technology is integral to significant projects like Golar's MK II FLNG vessel, showcasing its practical application and reliability.

The global push for adaptable and dependable energy solutions fuels the growth of FLNG. Black & Veatch's established PRICO technology provides them with a distinct competitive edge in this expanding market, poised for significant development in the coming years.

Black & Veatch is a significant player in the hyperscale data center power solutions market, providing essential infrastructure like substations. This sector is seeing massive expansion, driven by the insatiable demand from AI and cloud computing. B&V's ability to deliver power solutions quickly and at scale is a major advantage in this rapidly evolving landscape.

Large-Scale Renewable Energy Projects (Solar-Plus-Storage)

Black & Veatch is actively securing substantial contracts for large-scale renewable energy projects, notably multi-gigawatt solar-plus-storage developments in Indonesia and innovative floating solar installations. This positions them strongly in a rapidly expanding global clean energy market.

The company's robust project execution capabilities and established market share are key advantages. For instance, in 2023, the global solar power market alone was valued at over $200 billion, with significant growth projected for solar-plus-storage solutions. Black & Veatch's involvement in these high-growth areas suggests a strong market position.

- Market Growth: The global renewable energy market is experiencing unprecedented growth, driven by decarbonization efforts and energy security concerns.

- Project Pipeline: Black & Veatch's involvement in multi-gigawatt solar-plus-storage projects indicates a substantial and growing project pipeline.

- Competitive Edge: Strong project execution and market share in this segment provide a significant competitive advantage.

- Sector Potential: Solar-plus-storage projects are considered a high-potential growth area within the broader renewable energy sector.

Advanced Grid Modernization for Renewables

Black & Veatch is a key player in advanced grid modernization, essential for integrating renewable energy sources. This sector is experiencing significant expansion due to the global shift towards cleaner energy and the increasing demand for grid reliability. Their extensive experience in power transmission and distribution, coupled with their proficiency in smart grid technologies, positions them as a market leader. For instance, the global smart grid market was valued at approximately $30 billion in 2023 and is projected to grow substantially, with many forecasts suggesting a compound annual growth rate (CAGR) of over 15% through 2030.

Their capabilities in this area are crucial for utilities aiming to manage the intermittency of renewables like solar and wind. Black & Veatch's work often involves upgrading substations, implementing advanced metering infrastructure, and developing sophisticated control systems. These efforts are vital for ensuring grid stability and efficiency as renewable penetration increases. The company's commitment to innovation in this space is reflected in their project wins and their role in shaping the future of energy infrastructure.

- Market Leadership: Black & Veatch holds a strong position in the grid modernization market, driven by expertise in power delivery and smart grid solutions.

- Growth Drivers: The sector's expansion is fueled by the energy transition and the critical need for enhanced grid resilience.

- Industry Growth: The global smart grid market is a high-growth area, with significant projected expansion in the coming years.

- Key Technologies: Their work encompasses substation upgrades, advanced metering, and sophisticated grid control systems.

Stars in the BCG Matrix represent high-growth, high-market-share business areas. For Black & Veatch, their involvement in green hydrogen infrastructure and advanced grid modernization clearly aligns with this category. The substantial project pipeline in green hydrogen and the significant projected growth in the smart grid market, with a CAGR potentially exceeding 15% through 2030, underscore their strong position in these burgeoning sectors. These areas demand significant investment and offer substantial future returns, characteristic of star performers.

What is included in the product

This BCG Matrix overview details Black & Veatch's business units, classifying them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic recommendations on investment, holding, or divestment for each category.

The Black & Veatch BCG Matrix provides a clear, actionable overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Black & Veatch's core water infrastructure services are a classic Cash Cow. Their deep expertise in engineering, procurement, and construction for drinking water treatment and wastewater management has solidified their position in a mature market. This sector consistently requires maintenance and upgrades, ensuring a steady stream of revenue.

The demand for water infrastructure is unwavering, driven by population growth and the need to replace aging systems. In 2023, the U.S. EPA estimated that over $473 billion would be needed for drinking water and wastewater infrastructure upgrades over the next 20 years, highlighting the stable, long-term cash-generating potential for companies like Black & Veatch.

Black & Veatch's established power generation lifecycle services are a prime example of a Cash Cow within the BCG matrix. While the market for new traditional power plant construction is maturing, the company leverages its expertise to offer extensive operations, maintenance, and upgrade services for existing assets. This segment benefits from a stable, high-market-share position in a well-established sector, generating consistent and predictable revenue streams.

Black & Veatch's General Infrastructure Consulting and Advisory segment operates as a classic cash cow within its business portfolio. This division provides extensive strategic guidance, capital planning, and risk management services across diverse infrastructure domains, tapping into the company's deep industry expertise and long-standing client connections. The mature market for these services ensures a steady and reliable stream of revenue for Black & Veatch.

In 2024, the infrastructure consulting market, particularly in areas like water, energy, and transportation, continued to show robust demand, driven by aging assets and the need for modernization. Black & Veatch's established presence in these sectors allows it to capture a significant share of this stable market. For instance, the company's involvement in major water infrastructure upgrades, a sector experiencing consistent investment, directly contributes to the predictable cash flow generated by this segment.

Wireline and Fiber Telecommunications Infrastructure

Wireline and fiber telecommunications infrastructure stands as a cornerstone for Black & Veatch, even after divesting its public carrier wireless operations. This segment is characterized by its maturity and essential nature, ensuring consistent demand for expansion and upkeep. The company's continued investment here reflects its strategy to leverage stable cash flow generation from this vital sector.

The market for wireline and fiber connectivity remains robust, driven by the insatiable demand for bandwidth and reliable data transmission. Black & Veatch's expertise in deploying and maintaining these networks positions them to capitalize on ongoing infrastructure upgrades and new build-outs. This focus on critical infrastructure provides a predictable revenue stream.

- Stable Cash Flow: The mature nature of wireline and fiber infrastructure ensures a consistent and reliable cash flow for Black & Veatch.

- Essential Infrastructure: Ongoing needs for network expansion, upgrades, and maintenance in this sector provide continuous business opportunities.

- Strategic Focus: Despite shifts in other areas, Black & Veatch maintains a strong commitment to this core competency, recognizing its value.

- Market Demand: Increasing data consumption and the need for high-speed connectivity globally underpin the sustained relevance of wireline and fiber networks.

Environmental and Regulatory Compliance Services

Black & Veatch's Environmental and Regulatory Compliance Services are a solid cash cow within their portfolio. These services address a persistent and essential need for clients across all infrastructure sectors to navigate intricate environmental rules and maintain compliance, a fact underscored in their sustainability reporting. This consistent demand in a well-established regulatory environment ensures a steady, predictable revenue stream.

The company's expertise in this area is critical, as demonstrated by their involvement in numerous projects requiring adherence to stringent environmental standards. For instance, in 2024, Black & Veatch reported a significant portion of their revenue derived from services that directly support clients' environmental compliance efforts, reflecting the mature and stable nature of this market.

- Stable, High Demand: Environmental regulations are a constant requirement, not a trend, ensuring ongoing business.

- Mature Market: The regulatory landscape is well-defined, allowing for efficient service delivery and predictable revenue.

- Consistent Revenue Generation: This service area acts as a reliable income source for Black & Veatch.

- Client Essentiality: Non-compliance carries significant penalties, making these services indispensable for clients.

Black & Veatch's established expertise in grid modernization and smart grid technologies represents a significant Cash Cow. This segment benefits from the ongoing need to upgrade aging electrical infrastructure and integrate renewable energy sources, ensuring a consistent demand for their services in a mature market. The company's long-standing relationships and proven track record allow them to secure a substantial share of this stable revenue stream.

In 2024, investments in grid modernization continued to be a priority for utilities globally, driven by reliability concerns and the transition to cleaner energy. Black & Veatch's deep engineering capabilities in areas like substation automation and advanced metering infrastructure directly address these critical needs, translating into predictable and recurring revenue. For example, their work on upgrading distribution networks for major utility clients in 2024 exemplifies this stable cash flow generation.

| Service Area | BCG Category | Rationale | 2024 Market Insight | Black & Veatch's Position |

| Grid Modernization | Cash Cow | Mature market with consistent demand for upgrades and integration of new technologies. | Global investment in grid modernization reached over $150 billion in 2024, driven by reliability and renewable integration needs. | Strong market share due to established expertise and long-term client relationships. |

What You See Is What You Get

Black & Veatch BCG Matrix

The Black & Veatch BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no incomplete sections – just the professionally formatted and analysis-ready BCG Matrix report, prepared for immediate strategic application.

Dogs

Black & Veatch's divestiture of its public carrier wireless telecommunications infrastructure business to Dycom Industries for $150 million in 2024 signals a strategic repositioning. This move suggests the business unit, while contributing revenue, was likely categorized as a question mark or a dog in the BCG matrix due to its perceived low growth and market share within Black & Veatch's broader portfolio.

Highly commoditized general construction services represent segments of the building industry that are largely undifferentiated. Think of basic building projects where the primary differentiator is price due to intense competition and minimal need for specialized engineering expertise. For a company like Black & Veatch, which thrives on complex, critical infrastructure projects, these low-margin areas offer little strategic appeal and limited growth prospects.

In 2024, the general construction sector, particularly for standardized projects, saw continued pressure on margins. While specific figures for Black & Veatch's involvement in such commoditized areas are not publicly detailed, industry-wide data suggests that projects with low technological barriers to entry often operate with gross profit margins in the single digits. This contrasts sharply with the higher margins Black & Veatch can command on specialized engineering and design projects.

Projects involving outdated infrastructure, like older power grid components or legacy water treatment systems, fall into this category. Black & Veatch might see declining demand for services supporting these technologies as newer, more efficient alternatives emerge. For instance, the global market for legacy industrial control systems, while still present, is projected to grow at a much slower pace compared to modern digital solutions.

Projects in Geographies with Insufficient Strategic Alignment/Scale

Projects in geographies with insufficient strategic alignment or scale often represent Black & Veatch's 'Dogs' in a BCG-like analysis. These are typically regions where the company's market share is low, and the growth prospects for its services are also limited. This can be due to intense local competition, a lack of tailored service offerings for that specific market, or a strategic decision to deprioritize investment in these areas.

For instance, consider operations in a developing nation where Black & Veatch might have secured a few smaller infrastructure projects but lacks the scale or established partnerships to compete effectively for larger, more complex endeavors. The return on investment in such markets may be minimal, and the resources allocated could be better utilized in more promising geographies.

- Low Market Share: In these 'Dog' markets, Black & Veatch's presence is often marginal, meaning they hold a very small percentage of the available business.

- Limited Growth Potential: The overall market for Black & Veatch's services in these regions is not expanding significantly, offering few opportunities for increased revenue or project volume.

- Resource Drain: Maintaining operations or pursuing projects in these areas can consume valuable resources, including capital, personnel, and management attention, without yielding substantial returns.

- Strategic Re-evaluation: Companies often review these 'Dog' segments to decide whether to divest, minimize investment, or attempt a turnaround strategy if market conditions or strategic alignment are expected to change.

Small-Scale, Non-Strategic Consulting Engagements

Small-scale, non-strategic consulting engagements for Black & Veatch often represent projects that don't pave the way for larger engineering, procurement, and construction (EPC) contracts or enduring strategic alliances. These might be one-off advisory services with a limited scope.

These types of engagements can yield lower financial returns and offer restricted avenues for expanding market share or fostering future growth. For instance, a standalone feasibility study for a small renewable energy project, while valuable, might not have the same long-term revenue potential as a comprehensive EPC contract for a utility-scale solar farm.

- Limited ROI: These projects typically offer lower profit margins compared to core, large-scale Black & Veatch offerings.

- No Strategic Linkage: They do not inherently lead to follow-on business or deeper client relationships.

- Resource Drain: Can consume resources without contributing significantly to market share growth.

- Low Growth Potential: Offer minimal opportunities for expanding service offerings or client base.

Black & Veatch's 'Dogs' likely encompass commoditized construction services and projects in low-growth, low-market-share geographies. These segments consume resources without significant returns, unlike their core specialized engineering and design work. The divestiture of their public carrier wireless infrastructure business in 2024 for $150 million to Dycom Industries exemplifies a strategic move away from such less profitable or stagnant areas.

Question Marks

Black & Veatch, through its IgniteX Accelerator, is actively fostering innovation in Carbon Dioxide Removal (CDR) technologies, recognizing their critical role in impactful carbon reduction. This emerging sector presents significant growth potential, and while B&V is strategically investing, their direct market share in deploying these specific CDR solutions is still in its early stages of development.

Black & Veatch is actively pursuing digital transformation, integrating AI, digital twins, and advanced analytics to streamline infrastructure projects from design through asset management. This strategic focus aims to enhance efficiency and performance across the entire lifecycle.

The global market for AI in infrastructure is experiencing significant growth, projected to reach $2.4 billion by 2027, according to some market analyses. Black & Veatch's investment positions them to capture a share of this expanding sector.

While the company's commitment to these advanced digital solutions is clear, its precise market share in these specialized AI-driven services is still in the process of being defined and solidified as the market matures.

Black & Veatch has significantly bolstered its Strategic Advisory and Lifecycle Resiliency services, creating a more comprehensive offering that spans from initial bankability assessments to long-term capital planning and asset investment strategies. This expansion addresses a clear market demand for integrated, end-to-end solutions in the infrastructure and energy sectors.

The firm's strategic move aims to capture a larger share of the advisory market, which is increasingly seeking holistic approaches to project development and asset management. While the exact market share of this newly integrated division is still emerging, the industry trend toward bundled advisory services suggests strong potential for growth.

Advanced Microgrid Solutions Beyond Headquarters

Black & Veatch's commitment to microgrid technology is evident in their own headquarters' resilient power systems and their work with major clients like Shell. This showcases their ability to seamlessly integrate renewable energy sources and energy storage, a critical component for modern microgrids.

The global microgrid market is experiencing significant expansion, driven by the increasing demand for energy resilience and reliability. While Black & Veatch has established a strong presence, their overall market share in deploying these advanced solutions worldwide is likely still in a developing stage, indicating a need for continued strategic investment and market penetration.

- Market Growth: The global microgrid market was valued at approximately $26.1 billion in 2023 and is projected to reach $65.9 billion by 2030, growing at a CAGR of 14.2% during the forecast period.

- Renewable Integration: Black & Veatch's expertise in combining solar PV and battery storage solutions is key to unlocking the full potential of microgrids for enhanced sustainability and cost savings.

- Client Success: Projects like the one for Shell demonstrate Black & Veatch's capability to deliver complex microgrid solutions that meet diverse operational needs and improve energy security.

- Strategic Investment: Continued investment in R&D and global deployment capabilities will be crucial for Black & Veatch to capture a larger share of the rapidly expanding microgrid sector.

Early-Stage Clean Transportation Infrastructure (e.g., EV Charging)

Black & Veatch is actively developing its presence in the burgeoning clean transportation infrastructure sector, particularly focusing on electric vehicle (EV) charging solutions. This aligns with their broader strategy to offer comprehensive infrastructure services in response to global decarbonization imperatives.

The EV charging market is experiencing rapid expansion, fueled by supportive government policies and increasing consumer adoption of electric vehicles. For instance, global EV sales in 2023 surpassed 13 million units, a significant jump from previous years, indicating robust market growth.

- High Growth Potential: The market for EV charging infrastructure is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars globally by the end of the decade.

- Early Stage for B&V: While Black & Veatch has a strong legacy in traditional infrastructure, its market share and established presence in the EV charging segment are still developing compared to its more mature service areas.

- Strategic Expansion: This expansion into EV charging represents a strategic move to capitalize on emerging trends and diversify its service offerings within the clean energy transition.

- Investment and Innovation: Continued investment in technology and service delivery will be crucial for Black & Veatch to solidify its position in this competitive and rapidly evolving market.

Question marks in the context of Black & Veatch's BCG Matrix likely relate to their emerging technologies and services. These are areas where the company is investing heavily due to high growth potential, but their current market share is still relatively small or undefined. This category represents opportunities for significant future gains, but also carries higher risk and requires substantial ongoing investment to establish a strong market position.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.