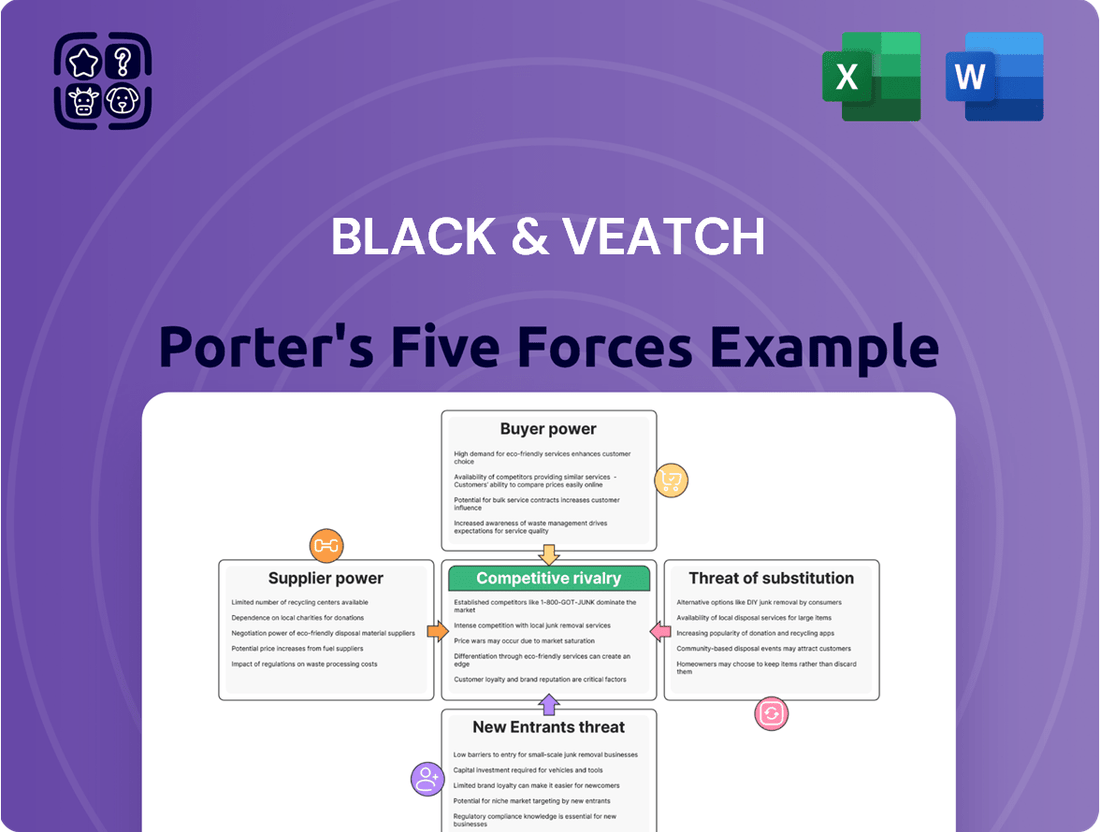

Black & Veatch Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Black & Veatch Bundle

Black & Veatch navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp their strategic positioning.

The complete report reveals the real forces shaping Black & Veatch’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Black & Veatch's reliance on specialized technology and equipment suppliers for crucial infrastructure projects, such as those in the energy and water sectors, highlights a significant source of supplier bargaining power. The proprietary nature of these advanced systems often means few alternatives exist.

This can translate into higher costs for Black & Veatch, as suppliers with unique offerings can command premium prices. For instance, if a particular turbine technology for a power plant is only available from one manufacturer, that supplier holds considerable leverage. The cost and complexity of integrating new, specialized equipment also create high switching costs, further entrenching the supplier's position.

Black & Veatch's reliance on highly skilled engineers, project managers, and specialized construction subcontractors means these labor pools wield significant bargaining power. A tight labor market, such as the one observed in 2024 with ongoing demand in infrastructure and energy sectors, can drive up wages and subcontractor rates. For instance, reports from industry associations in late 2023 and early 2024 indicated a persistent shortage of experienced civil and electrical engineers, pushing average salaries up by 5-7% year-over-year in specialized fields.

Black & Veatch, while a consulting and construction management firm, faces indirect pressure from raw material and commodity providers. Disruptions or price hikes in essential materials like steel, concrete, and specialized engineering components, often sourced globally, can significantly affect project budgets and timelines. For instance, the average price of steel rebar, a key construction material, saw considerable volatility in 2024, impacting project cost estimations across the engineering and construction sector.

Software and Digital Solutions Vendors

Software and digital solutions vendors hold significant bargaining power for Black & Veatch, a modern EPC firm. The increasing reliance on advanced software for design, project management, data analytics, and digital twin creation means these suppliers' tools are critical for operational efficiency and innovation. For instance, the global market for engineering software, crucial for EPC firms, was projected to reach over $12 billion in 2024.

The high integration costs associated with implementing new digital platforms, coupled with the specialized nature of industry-specific software, further bolster supplier power. Black & Veatch's investment in digital transformation initiatives, aiming to enhance project delivery and client value, makes switching vendors a complex and costly undertaking. This dependence creates a strong leverage point for these technology providers.

- High Switching Costs: Implementing and integrating new software platforms across complex EPC workflows involves substantial costs and time, deterring frequent vendor changes.

- Criticality of Solutions: Advanced digital tools are essential for Black & Veatch's efficiency, innovation, and competitive edge in project execution.

- Specialized Offerings: Vendors providing niche or highly integrated software solutions tailored to the engineering and construction industry can command premium pricing.

- Industry Demand: The growing demand for digital transformation in the EPC sector strengthens the position of leading software providers.

Financial Institutions and Insurers

Financial institutions and insurers wield significant bargaining power over Black & Veatch due to the capital-intensive nature of infrastructure projects. The availability and cost of financing, bonds, and insurance are directly tied to global economic conditions and the perceived risk of these large-scale ventures. For instance, in 2024, rising interest rates globally could increase the cost of capital for Black & Veatch, giving lenders more leverage in negotiating terms.

Black & Veatch's reliance on these financial services means that any unfavorable changes in lending conditions or insurance premiums can directly affect its bidding capacity and project execution. This dependence grants financial institutions and insurers considerable influence over the company's operational and financial flexibility.

- Project Financing: Access to credit lines and loan terms directly impacts Black & Veatch's ability to undertake large infrastructure projects.

- Bond Issuance: The cost and availability of performance bonds and surety bonds are crucial for securing contracts.

- Insurance Products: Availability of specialized insurance for construction, environmental risks, and professional liability is essential for risk management.

The bargaining power of suppliers for Black & Veatch is significant, particularly for specialized equipment and technology providers essential for large infrastructure projects. The proprietary nature of many of these offerings limits alternatives, allowing suppliers to command higher prices and dictate terms. This is further amplified by high switching costs, as integrating new, specialized systems is both complex and expensive.

Labor and specialized subcontractors also represent a key supplier group with considerable leverage, especially in tight markets observed in 2024. Shortages in skilled engineers and project managers drove up wages, impacting Black & Veatch's project costs. Similarly, software vendors providing critical digital solutions for design and analytics hold strong positions due to the high integration costs and the essential nature of these tools for operational efficiency.

Financial institutions and insurers also exert significant bargaining power, influencing Black & Veatch's ability to undertake capital-intensive projects. Rising interest rates in 2024, for example, increased the cost of capital, giving lenders more sway. The availability and cost of financing, bonds, and insurance are critical for securing contracts and managing project risks.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Black & Veatch | 2024 Data/Trend Example |

|---|---|---|---|

| Specialized Equipment & Technology | Proprietary nature, few alternatives, high switching costs | Higher equipment costs, potential project delays if supply is constrained | Continued demand for advanced turbines in energy projects |

| Skilled Labor & Subcontractors | Labor market tightness, demand for specialized skills | Increased labor and subcontracting rates, wage inflation | 5-7% year-over-year salary increase for specialized engineers |

| Software & Digital Solutions | Criticality for efficiency, high integration costs, industry specialization | Premium pricing for software, dependence on vendor updates and support | Global engineering software market projected over $12 billion in 2024 |

| Financial Institutions & Insurers | Capital intensity of projects, interest rate environment, risk perception | Higher cost of capital, stricter lending terms, increased insurance premiums | Global interest rate hikes impacting financing costs |

| Raw Materials & Commodities | Global supply chain disruptions, price volatility | Increased material costs, potential impact on project budgets and timelines | Volatility in steel rebar prices |

What is included in the product

Analyzes the competitive intensity within the engineering and consulting sector, examining Black & Veatch's market position against rivals, buyer/supplier power, and the threat of new entrants and substitutes.

Effortlessly identify and prioritize competitive threats with a visual breakdown of each of Porter's Five Forces, streamlining strategic planning.

Customers Bargaining Power

Black & Veatch's customer base is dominated by large, sophisticated entities like utilities, government bodies, and major telecom firms. These clients, managing massive, intricate projects, wield considerable negotiating power due to the sheer size of contracts and their in-depth industry knowledge.

For instance, major infrastructure projects often involve billions of dollars, giving these buyers significant leverage in price and terms. Their sophisticated procurement processes mean they thoroughly vet suppliers, driving competition and further concentrating power in their hands.

In project-based procurement, customers often treat each large infrastructure project as a unique, significant purchase. This 'one-off' nature means they aren't locked into repeat business with a single provider, giving them considerable leverage.

Customers can solicit competitive bids from numerous global Engineering, Procurement, and Construction (EPC) firms for these substantial projects. This process intensifies competition among EPC providers, empowering customers to negotiate for more favorable terms, better pricing, and highly specific project deliverables.

For instance, in 2024, major energy infrastructure projects frequently saw bidding wars among top-tier EPC contractors, with winning bids reflecting intense price competition. This dynamic directly amplifies the bargaining power of the project owner.

The global market for engineering, procurement, and construction (EPC) services for critical infrastructure is robust and competitive. In 2024, numerous well-established global players offer similar end-to-end solutions, meaning customers aren't limited to a single provider.

This abundance of choice significantly enhances customer bargaining power. Clients can readily compare offerings from various reputable firms, leading to more aggressive negotiations for favorable terms, pricing, and service levels.

Customers can select the EPC provider that best aligns with their specific needs, prioritizing factors like cost-effectiveness, specialized expertise, and a demonstrated history of successful project delivery.

Customer's Internal Capabilities

Some major utility companies and government agencies develop significant internal expertise in engineering and project management. This allows them to handle specific project phases or more effectively manage external contractors. For instance, a large municipal utility might have its own in-house team capable of designing substations or overseeing grid modernization efforts, reducing reliance on full-service engineering, procurement, and construction (EPC) firms.

This internal capability directly translates to increased bargaining power. By performing certain tasks internally, these clients can negotiate better terms with external providers like Black & Veatch, as they have the option to internalize more work if negotiations falter. In 2024, the trend of utilities building out their digital and grid management capabilities continues, with investments in smart grid technologies often accompanied by a build-up of internal technical talent.

Consider these points:

- Internal Expertise: Large clients can perform specific engineering or project management tasks, reducing dependence on external EPC providers.

- Negotiating Leverage: The ability to self-perform tasks strengthens a client's position when negotiating contracts and pricing.

- Cost Savings Potential: By managing parts of a project internally, clients can potentially reduce overall project costs.

Long-Term Asset Management and O&M Needs

Customers in critical infrastructure sectors, such as utilities and transportation, increasingly demand long-term partnerships that span beyond initial construction to include commissioning, operations, and ongoing asset management. This need for continuous support significantly shifts bargaining power towards them.

Clients are highly sensitive to the total cost of ownership throughout an asset's lifecycle, not just upfront capital expenditure. For instance, in the water infrastructure sector, the operational and maintenance (O&M) costs can represent a substantial portion, sometimes exceeding 60%, of the total lifecycle cost. This focus empowers customers to negotiate for comprehensive service agreements, extended warranties, and performance guarantees, forcing providers like Black & Veatch to demonstrate long-term value and reliability.

- Lifecycle Cost Focus: Customers prioritize providers who can demonstrate cost-effectiveness across the entire asset lifespan, influencing contract terms for O&M.

- Demand for Comprehensive Services: The need for integrated services from construction to long-term asset management strengthens the customer's position in negotiations.

- Performance Guarantees: Clients leverage their long-term commitment to secure performance-based contracts and service level agreements.

- Risk Transfer: By demanding long-term operational support, customers can effectively transfer operational risks to the service provider, further enhancing their bargaining power.

The bargaining power of Black & Veatch's customers is substantial, primarily due to the large scale and specialized nature of infrastructure projects. These clients, often utilities, government agencies, or major corporations, possess deep industry knowledge and manage projects valued in the billions.

The competitive landscape for Engineering, Procurement, and Construction (EPC) services in 2024 is characterized by numerous global players offering similar end-to-end solutions. This abundance of choice allows customers to solicit multiple bids, intensifying competition and enabling them to negotiate favorable pricing and terms.

Furthermore, many clients are developing significant in-house expertise, allowing them to self-perform certain project phases. This internal capability strengthens their negotiating position, as they can opt to internalize more work if external negotiations are unfavorable. In 2024, the trend of utilities enhancing their grid management and digital capabilities continues, often involving the build-up of internal technical talent.

Customers also exert considerable influence by focusing on the total cost of ownership throughout an asset's lifecycle, not just initial capital expenditure. The demand for comprehensive service agreements, extended warranties, and performance guarantees, particularly in sectors like water infrastructure where O&M costs can exceed 60% of the total lifecycle cost, forces providers to demonstrate long-term value.

| Factor | Impact on Bargaining Power | 2024 Relevance |

| Client Size and Sophistication | High | Major infrastructure projects often exceed $1 billion, giving large clients significant leverage. |

| Availability of Substitutes | High | Numerous global EPC firms compete, offering clients ample choice and driving price competition. |

| Switching Costs for Clients | Low to Moderate | While project-specific, clients can often switch providers for new large-scale projects. |

| Customer's Forward Integration Potential | Moderate | Clients can build internal capabilities, reducing reliance on external EPC providers. |

| Customer's Price Sensitivity | High | Focus on lifecycle costs and upfront capital expenditure makes clients price-sensitive. |

Full Version Awaits

Black & Veatch Porter's Five Forces Analysis

This preview showcases the complete Black & Veatch Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the engineering and construction industry. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, ensuring full transparency and immediate usability.

Rivalry Among Competitors

The global engineering, procurement, and construction (EPC) sector for critical infrastructure is a crowded space, with Black & Veatch facing formidable competition from numerous global giants. Companies like Fluor, Bechtel, Jacobs, AECOM, and KBR are all major players, frequently vying for the same substantial, intricate projects. This intense rivalry centers on established reputations, deep technical expertise, and a proven track record of successful project execution.

The competitive rivalry in the critical infrastructure sector is intense, fueled by the sheer financial stakes of projects. These aren't small endeavors; we're talking about multi-year commitments often valued in the billions of dollars. For companies like Black & Veatch, securing these large contracts is paramount for their financial health, ensuring a robust backlog of work and a solid market position.

This high-value environment naturally sharpens competition. Firms are driven to go head-to-head, not just on price, but also on the ingenuity of their proposed solutions and their proven track record of successful project delivery. The pressure to win these significant deals means every aspect of a bid, from technical expertise to cost-effectiveness, is scrutinized intensely.

Consider the U.S. infrastructure market, which saw significant investment in 2024. For instance, the Bipartisan Infrastructure Law continues to allocate substantial funds, creating numerous large-scale opportunities. Companies are vying for a piece of this pie, where winning a single major project can significantly impact their annual revenue and future growth prospects.

While many engineering, procurement, and construction (EPC) firms offer a wide range of services, competition in the sector is increasingly driven by specialization. Companies are differentiating themselves by focusing on niche areas like renewable energy, advanced water treatment technologies, and the development of smart grids. This allows them to build deep expertise and offer tailored, cutting-edge solutions to specific industry challenges.

Black & Veatch, for instance, leverages its profound sector knowledge and commitment to innovative, sustainable approaches to stand out. In 2024, the company continued to highlight its work in areas such as green hydrogen production and advanced grid modernization, demonstrating a strategic focus on future-oriented markets. This specialization allows them to command premium pricing and secure projects requiring highly specialized technical capabilities, setting them apart from more generalized competitors.

Reputation and Track Record

In the critical infrastructure sector, a strong reputation built on reliability, safety, and successful project execution is a major differentiator. Black & Veatch, for instance, has a long history of delivering complex projects, which clients often cite as a key reason for choosing them. This focus on a proven track record significantly influences competitive rivalry.

Firms like Black & Veatch heavily rely on their extensive project portfolios and positive client testimonials to secure new contracts. This relationship-driven industry makes a demonstrated history of on-time and on-budget delivery a substantial competitive advantage, acting as a significant barrier for newer or less established competitors seeking to enter the market.

- Proven Project Delivery: Companies with a history of successfully completing large-scale infrastructure projects, like those in the energy and water sectors, gain a significant edge.

- Client Testimonials and Referrals: Positive feedback and repeat business from satisfied clients are crucial for winning new work.

- Safety and Reliability Record: A strong safety record and a reputation for reliable operations are non-negotiable in this industry.

- Industry Longevity: Firms with decades of experience, such as Black & Veatch which was founded in 1915, often benefit from ingrained trust and established relationships.

Geographic and Sectoral Focus

Competitive rivalry within the infrastructure sector, where Black & Veatch operates, is intensely shaped by its geographic and sectoral focus. Companies often vie for dominance not just globally, but within specific regions and niche infrastructure markets like power generation, water utilities, or telecommunications backbone development.

This localized competition means strategies must be finely tuned to meet distinct regional regulations, evolving customer demands, and the specific competitive pressures from established local players. For instance, in the 2024 global renewable energy project market, competition for utility-scale solar and wind farm development was particularly fierce in regions like North America and Europe, where policy support and grid infrastructure investment were strong.

- Geographic Specialization: Firms concentrate on specific continents or countries, tailoring offerings to local market conditions and regulatory frameworks.

- Sectoral Dominance: Companies aim for leadership within particular infrastructure segments, such as transmission and distribution, water treatment, or digital infrastructure.

- Regional Dynamics: Strategies are adapted to local customer needs, economic conditions, and the presence of strong regional competitors, creating varied competitive intensity across markets.

- Market Entry Barriers: Deep understanding of local permitting, supply chains, and stakeholder relationships can act as significant barriers to new entrants in specialized sectors.

The competitive rivalry in the critical infrastructure sector is fierce, with major global EPC firms like Fluor, Bechtel, and Jacobs frequently competing for the same large-scale projects. This intense competition is driven by the substantial financial stakes involved, often in the billions of dollars, making contract wins crucial for revenue and market position.

Differentiation through specialization in areas like renewable energy or advanced water treatment is key, allowing firms to command premium pricing. Black & Veatch, for example, focused on green hydrogen and grid modernization in 2024, highlighting its strategic move into future-oriented markets.

A strong track record of safety, reliability, and successful project delivery is paramount, with companies leveraging their extensive portfolios and client testimonials as significant competitive advantages. Longevity in the industry, like Black & Veatch's founding in 1915, also builds trust and established relationships.

Geographic and sectoral specialization further shapes competition, with firms tailoring strategies to local regulations and customer needs. In 2024, the competition for utility-scale solar and wind farm development was particularly intense in North America and Europe due to strong policy support and grid investment.

| Key Competitors | 2023 Revenue (Approx. USD Billions) | Key Specializations |

|---|---|---|

| Fluor | 13.5 | Energy, Infrastructure, Government |

| Bechtel | 30.0 (Estimate) | Infrastructure, Defense, Mining |

| Jacobs | 10.0 | Water, Energy, Buildings, Advanced Facilities |

| AECOM | 14.0 | Infrastructure Design, Construction Management |

| KBR | 6.5 | Government Solutions, Sustainable Technology |

SSubstitutes Threaten

While it's uncommon for major infrastructure projects, some exceptionally large utility companies or government bodies might explore bolstering their in-house engineering and project management capabilities. This strategic shift could allow them to manage more of the planning, design, and oversight internally, acting as a partial substitute for external engineering, procurement, and construction (EPC) firms like Black & Veatch.

This internal expansion is more likely to impact less intricate projects or specific phases within larger undertakings. For instance, a utility might decide to handle the detailed design of a substation or the project management of a pipeline upgrade themselves, thereby reducing their reliance on outside EPC expertise and potentially lowering costs.

By bringing more functions in-house, these large clients aim to gain greater control over project timelines, costs, and quality. This trend, though not a complete replacement for comprehensive EPC services, does present a threat by carving out portions of the value chain that Black & Veatch traditionally serves.

Technological advancements are increasingly enabling decentralized or distributed infrastructure solutions. Think about localized microgrids for power or community-level water treatment systems. These modular approaches can offer compelling alternatives to the large, centralized projects that companies like Black & Veatch traditionally focus on. For instance, the global microgrid market was valued at approximately $30 billion in 2023 and is projected to grow significantly, potentially impacting demand for traditional large-scale engineering, procurement, and construction (EPC) services.

The threat of substitutes is significant as alternative technologies and energy sources emerge. For instance, advancements in distributed solar and battery storage solutions, like those seen with Tesla's Powerwall installations, are increasingly offering consumers and businesses a way to reduce their dependence on traditional grid infrastructure, a core area for Black & Veatch.

Furthermore, innovative water management techniques, such as advanced recycling and desalination technologies, could provide alternative pathways to meet water needs, potentially bypassing the large-scale infrastructure projects that Black & Veatch often undertakes. The global market for energy storage, for example, was projected to reach over $100 billion by 2025, indicating a substantial shift towards alternative energy solutions.

Standardized, Off-the-Shelf Solutions

The increasing availability of standardized, off-the-shelf solutions poses a threat to companies like Black & Veatch that specialize in customized infrastructure projects. For simpler or smaller-scale infrastructure needs, pre-engineered or modular options are becoming more common. These alternatives can bypass the need for extensive bespoke engineering and construction management, potentially siphoning off business from traditional, end-to-end service providers, especially in less complex market segments.

This trend is particularly relevant as the global modular construction market was valued at approximately $154.2 billion in 2023 and is projected to grow significantly. For instance, the adoption of modular data centers, which can be deployed much faster than traditional builds, offers a clear substitute for custom-designed facilities. Similarly, advancements in pre-fabricated components for water treatment plants or renewable energy installations reduce the reliance on highly specialized, on-site construction services.

- Modular construction market growth: Projected to expand considerably, offering faster deployment and potentially lower costs for certain infrastructure types.

- Pre-engineered solutions: Standardized designs for components like substations or water treatment modules can reduce the need for bespoke engineering.

- Impact on custom services: Increased adoption of off-the-shelf options could diminish demand for Black & Veatch's highly customized, end-to-end project delivery model in less complex segments.

- Competitive pressure: Companies focusing on modular or standardized offerings can present a more cost-effective or time-efficient alternative, intensifying competitive pressure.

Shifting Investment Priorities

Shifting investment priorities represent a significant threat of substitutes for Black & Veatch. Governments and private entities may reallocate capital from traditional infrastructure like energy grids and water systems towards "soft" infrastructure, digital solutions, or entirely different public services. For instance, a surge in government funding for cybersecurity initiatives or public health programs could divert resources that might otherwise flow into large-scale engineering and construction projects, thereby reducing demand for Black & Veatch's core competencies.

This redirection of funds can effectively act as a substitute for the company's traditional offerings. If, for example, significant public investment shifts towards renewable energy storage solutions rather than traditional power generation, it alters the nature of the demand. In 2024, global infrastructure spending was projected to reach trillions of dollars, but the composition of this spending is dynamic. A notable portion of this investment is increasingly being earmarked for digital transformation and climate resilience, potentially impacting the market share for traditional hard infrastructure services.

- Diversion of Capital: Public and private sector funds are increasingly channeled into digital infrastructure, smart city technologies, and climate adaptation projects, potentially reducing the pool of capital available for traditional large-scale energy and water infrastructure.

- Emergence of New Service Providers: The focus on digital and soft infrastructure can foster the growth of new, specialized companies that offer alternative solutions, directly competing with Black & Veatch's established service lines.

- Policy and Regulatory Shifts: Government policies favoring certain types of investment over others, such as incentives for distributed energy resources over centralized power plants, can reshape market demand and create substitutes for conventional infrastructure development.

The threat of substitutes for Black & Veatch is amplified by the rise of decentralized infrastructure solutions and advancements in energy storage. For instance, the global microgrid market, valued around $30 billion in 2023, offers alternatives to traditional large-scale projects. Similarly, distributed solar and battery storage, like Tesla's Powerwall, allow consumers to bypass conventional grid infrastructure, a key area for Black & Veatch's services.

The increasing availability of standardized, off-the-shelf solutions also presents a challenge. The global modular construction market, estimated at approximately $154.2 billion in 2023, provides faster and potentially more cost-effective alternatives for certain infrastructure needs, reducing reliance on highly customized, end-to-end project delivery.

Shifting investment priorities, where capital moves towards digital solutions or soft infrastructure, also acts as a substitute. In 2024, a significant portion of trillions in global infrastructure spending is directed towards digital transformation and climate resilience, potentially diverting funds from traditional hard infrastructure services that Black & Veatch traditionally provides.

| Substitute Type | Market Example | 2023/2024 Data Point | Impact on Black & Veatch |

|---|---|---|---|

| Decentralized Infrastructure | Microgrids | Market valued at ~$30 billion (2023) | Reduces demand for large-scale grid projects. |

| Energy Storage | Battery Storage Solutions | Global energy storage market projected >$100 billion by 2025 | Offers alternatives to traditional power generation infrastructure. |

| Standardized Solutions | Modular Construction | Market valued at ~$154.2 billion (2023) | Bypasses need for bespoke engineering in less complex segments. |

| Investment Shift | Digital/Soft Infrastructure | Increasing allocation of global infrastructure spending (2024) | Diverts capital from traditional hard infrastructure services. |

Entrants Threaten

Entering the global critical infrastructure Engineering, Procurement, and Construction (EPC) market, where companies like Black & Veatch operate, requires substantial upfront capital. This includes investments in specialized equipment, advanced technology, and the financial capacity to secure large project bonds and manage the cash flow of multi-year contracts. For instance, major infrastructure projects can easily run into billions of dollars, demanding significant financial reserves or robust access to credit.

These high capital requirements act as a considerable barrier to entry. Newcomers struggle to match the financial muscle of established firms. Black & Veatch, with its long history and extensive financial resources, benefits from established credit lines and the ability to self-finance portions of projects, giving it a distinct advantage over potential new competitors who may find it difficult to secure the necessary funding.

New entrants face a significant barrier due to the critical need for specialized expertise in areas like electrical, civil, and environmental engineering, alongside complex project management skills. Black & Veatch, for instance, leverages decades of accumulated human capital, making it difficult for newcomers to replicate this deep knowledge base.

Customers in critical infrastructure, like those Black & Veatch serves, place immense value on reliability and a history of successful projects. Building this trust takes decades, a significant barrier for newcomers.

Black & Veatch, along with established competitors, has cultivated strong brand reputations over many years, demonstrating a proven ability to deliver complex projects. This deep-seated credibility is not easily replicated by new market entrants.

The challenge for new companies lies in overcoming the lack of essential credibility needed to win initial contracts, particularly for projects with high stakes and significant risks. For instance, in 2023, major infrastructure projects often required pre-qualification based on extensive prior experience and financial stability, areas where established players hold a distinct advantage.

Complex Regulatory and Permitting Landscape

The infrastructure sector presents a formidable barrier to entry due to its intricate web of regulations and lengthy permitting procedures. New companies would need to invest heavily in legal and compliance expertise to navigate these hurdles, which differ significantly across geographies and project types. For instance, major infrastructure projects in the European Union often require adherence to directives like the Environmental Impact Assessment (EIA) Directive, which can add years to project timelines and substantial costs.

Black & Veatch, with its decades of experience, has cultivated robust internal capabilities and established relationships with regulatory bodies worldwide. This allows the company to streamline the approval process and mitigate risks associated with compliance. In 2024, the global infrastructure market is projected to reach trillions of dollars, but the administrative burden remains a significant deterrent for newcomers. The sheer complexity of securing permits for projects like large-scale renewable energy farms or critical transportation networks demands specialized knowledge that is difficult and time-consuming for new entrants to acquire.

- Regulatory Complexity: Infrastructure projects are subject to a multitude of national, regional, and local regulations, including environmental, safety, and zoning laws.

- Permitting Delays: Obtaining the necessary permits can be a lengthy and unpredictable process, often taking years and involving multiple governmental agencies.

- Jurisdictional Variation: The specific requirements and approval processes vary greatly from one country to another, requiring deep local knowledge.

- Established Expertise: Companies like Black & Veatch have developed specialized teams and internal processes to efficiently manage these regulatory and permitting challenges.

Economies of Scale and Established Relationships

Established players like Black & Veatch leverage significant economies of scale in procurement, project management, and resource deployment. This allows them to command lower costs per unit and offer more competitive pricing, a hurdle for newcomers. For instance, in 2024, major engineering and construction firms often reported cost savings of 10-15% through bulk purchasing power alone.

Black & Veatch's deep-rooted relationships with critical suppliers, subcontractors, and a loyal client base present a formidable barrier. These established networks, built over years, are crucial for securing favorable terms and winning bids, offering a distinct advantage that new entrants struggle to match in the short to medium term.

- Economies of Scale: Reduced per-unit costs in procurement and operations.

- Established Relationships: Access to preferred suppliers and client trust.

- Competitive Pricing: Ability to undercut new entrants due to cost efficiencies.

- Project Execution: Streamlined operations leading to higher efficiency.

The threat of new entrants into the critical infrastructure EPC market, where Black & Veatch operates, is significantly diminished by the immense capital required. New companies need billions to compete effectively, a hurdle that deters many. For example, securing performance bonds for large projects can demand substantial upfront capital, often exceeding hundreds of millions of dollars.

The sector also demands highly specialized technical expertise and a proven track record of successful project delivery, which takes years to build. For instance, winning bids in 2023 for major projects often required a minimum of 10 years of relevant experience and a portfolio of completed projects valued in the billions.

Regulatory complexity and lengthy permitting processes further erect barriers, demanding significant investment in legal and compliance teams. Navigating these intricate requirements, which vary by jurisdiction, can add years and substantial costs to new ventures, making it difficult to gain traction against established players like Black & Veatch.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023/2024) |

|---|---|---|---|

| Capital Requirements | High upfront investment for equipment, technology, and project financing. | Deters new entrants due to inability to secure sufficient funding. | Major infrastructure projects often require $1B+ in initial investment. |

| Specialized Expertise | Need for deep engineering knowledge and project management skills. | Newcomers struggle to match the human capital of established firms. | Demand for specialized engineers in areas like renewable energy integration remains high. |

| Regulatory Hurdles | Complex and time-consuming permitting and compliance procedures. | Adds significant cost and delays, favoring firms with established compliance processes. | Permitting for large-scale energy projects can take 2-5 years on average. |

| Brand Reputation & Trust | Customer preference for reliable, experienced providers. | New entrants lack the credibility to win high-stakes contracts. | Clients in critical infrastructure often prioritize firms with decades of successful project history. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Black & Veatch leverages a comprehensive mix of data, including industry-specific market research reports, company financial statements, and public regulatory filings. We also incorporate insights from trade association publications and expert interviews to capture a nuanced view of the competitive landscape.