Bulten PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

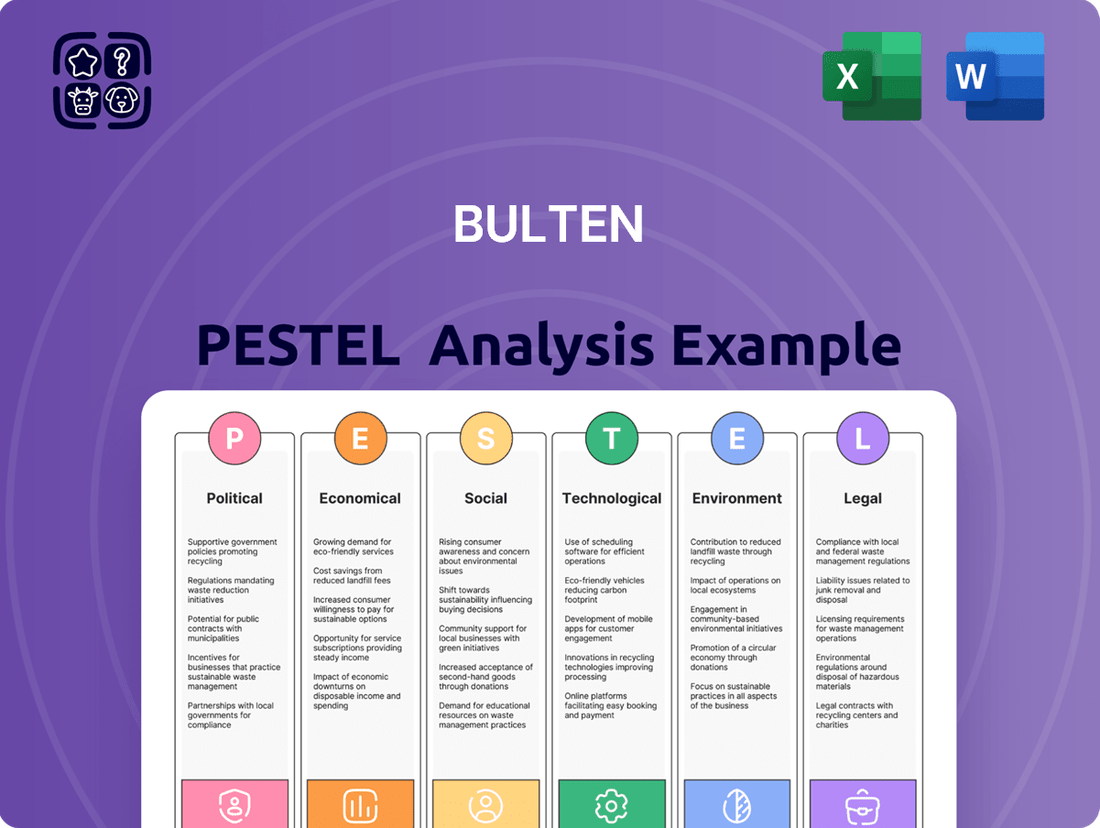

Navigate the complex external environment impacting Bulten with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing the company's operations and future growth. This expertly crafted report provides the crucial intelligence you need to anticipate challenges and capitalize on emerging opportunities. Unlock actionable insights and gain a significant competitive advantage. Download the full Bulten PESTLE analysis now and empower your strategic decision-making.

Political factors

Government regulations significantly shape the automotive industry, directly affecting fastener requirements. Changes in vehicle safety standards, emissions regulations, and manufacturing processes demand constant adaptation in fastener design and production. For instance, the European Union's ambitious CO2 emission reduction targets, aiming for a 55% cut by 2030 compared to 1990 levels (building on the 2025 goals), push for lighter and more fuel-efficient vehicles. This translates to a need for advanced, lightweight fastener solutions that Bulten must develop to remain competitive.

Global trade policies and the increasing imposition of tariffs on automotive components, including fasteners, present a significant challenge for Bulten. These measures directly impact the cost of goods sold, forcing adjustments to supply chain strategies and potentially diminishing market competitiveness. For instance, anti-dumping duties levied on fasteners originating from China and entering the European Union have already exerted pressure on Bulten's operating earnings, as evidenced by the Q1 2025 financial results.

The evolving landscape of international trade, particularly the potential for new tariffs specifically targeting electric vehicles (EVs) and associated auto parts, introduces a notable layer of uncertainty for Bulten's future operations. This ongoing trade friction necessitates careful monitoring and strategic planning to mitigate risks and capitalize on any emerging opportunities within the global automotive supply chain.

Geopolitical instability, particularly ongoing regional conflicts, significantly impacts global supply chains, directly affecting Bulten's access to and cost of essential raw materials. This volatility can lead to unpredictable fluctuations in production expenses and hinder timely delivery of finished products to customers.

The automotive sector, Bulten's primary market, has been grappling with persistent shortages of specialized metals like palladium and critical electronic components throughout 2024 and into 2025. These shortages have already caused considerable production delays for many automotive manufacturers, a trend expected to continue.

In response to these persistent supply chain vulnerabilities, Bulten is actively developing and implementing more resilient supply chain strategies. This includes diversifying its supplier base and increasing inventory levels for key components to better absorb shocks and maintain operational continuity.

Government Incentives for Electric Vehicles (EVs)

Government incentives play a crucial role in driving electric vehicle (EV) adoption, which in turn impacts the demand for specialized fasteners. Many countries are offering substantial tax credits and rebates for EV purchases. For instance, the Inflation Reduction Act in the United States provides up to $7,500 in tax credits for eligible new EVs, while also incentivizing domestic battery manufacturing. This policy environment directly boosts EV sales volumes, creating a larger market for EV components like fasteners.

As EV production scales up, manufacturers require robust and tailored fastening solutions. Bulten, as a fastener supplier, can benefit significantly from this trend. The increasing global push towards electrification, supported by policies like the European Union's Fit for 55 package aiming to reduce CO2 emissions by 55% by 2030, means higher demand for EVs and consequently, their constituent parts. Bulten's strategic focus on developing innovative fastening solutions for lightweight materials and advanced battery systems positions it well to capture this growth.

- EV Sales Growth: Global EV sales are projected to reach over 15 million units in 2024, a substantial increase from previous years, driven by government support.

- Government Support: Over 40 countries have set targets for phasing out internal combustion engine vehicles, creating a long-term demand signal for EVs.

- Investment in EV Infrastructure: Significant public and private investment in charging infrastructure, often facilitated by government grants, further encourages EV adoption.

- Regulatory Pressure: Increasingly stringent emission standards worldwide compel automakers to accelerate their EV production plans.

Industrial Policy and Local Content Requirements

Governments worldwide are increasingly using industrial policies to bolster domestic manufacturing and encourage local sourcing. This trend directly influences companies like Bulten, a fastener manufacturer, by potentially shaping their global production strategies and supply chain configurations. For instance, policies promoting local content can necessitate adjustments in where components are sourced and assembled to meet regulatory requirements.

The European Union, through initiatives like the European Commission's Automotive Industrial Action Plan, is actively working to enhance the competitiveness of its automotive sector. This plan specifically targets accelerating the shift towards zero-emission mobility, which often involves substantial investment and support for critical upstream components, such as battery manufacturing. These developments could create both opportunities and challenges for Bulten's business model, depending on how it aligns with the EU's strategic objectives for the automotive supply chain.

In 2024, the automotive industry in Europe experienced significant shifts, with a strong emphasis on localization and securing supply chains for electric vehicle (EV) components. For example, the EU aims to produce at least 80% of its battery needs by 2025, indicating a clear push for local manufacturing. This policy direction directly impacts suppliers like Bulten, who may need to adapt their production and sourcing to align with these regional manufacturing mandates, potentially leading to increased demand for locally produced fasteners used in EV assembly.

- Industrial Policy Focus: Governments are prioritizing domestic production and local sourcing to strengthen national economies and supply chain resilience.

- EU Automotive Strategy: The European Commission's Automotive Industrial Action Plan aims to boost the EU's automotive sector competitiveness and accelerate the EV transition.

- Upstream Component Support: This strategy includes potential support for critical areas like battery manufacturing and the components that feed into it.

- Impact on Bulten: These policies could influence Bulten's global manufacturing footprint and sourcing decisions, potentially favoring local production where industrial policies are in place.

Government regulations are a constant force shaping the automotive industry, and by extension, fastener suppliers like Bulten. Stricter emissions standards, for example, push for lighter vehicles, requiring advanced fastener solutions. The European Union's commitment to reducing CO2 emissions by 55% by 2030 directly influences the demand for lightweight materials and, consequently, specialized fasteners.

Trade policies, including tariffs, present a direct cost challenge. Anti-dumping duties on fasteners from certain regions have already impacted earnings, as seen in early 2025 financial reports. Furthermore, the potential for new tariffs on electric vehicle (EV) components adds a layer of uncertainty to global supply chain strategies, necessitating proactive risk management.

Government incentives are a significant driver for EV adoption, directly boosting demand for EV-related components. Tax credits in countries like the US, alongside global targets to phase out internal combustion engine vehicles, create a strong long-term market signal for EVs. This growth in EV sales, projected to exceed 15 million units globally in 2024, translates to increased demand for specialized fasteners used in these vehicles.

Industrial policies aimed at bolstering domestic manufacturing and local sourcing are becoming more prevalent. These policies can influence where companies like Bulten source materials and assemble products to meet regulatory requirements, potentially shifting global production strategies. The EU's focus on localizing battery manufacturing, with a goal to meet 80% of its battery needs by 2025, exemplifies this trend, creating opportunities for local fastener suppliers.

What is included in the product

This Bulten PESTLE analysis examines the influence of external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal forces, on the company's strategic landscape.

Provides a clear, actionable framework by dissecting complex external factors into manageable PESTLE components, simplifying strategic decision-making and reducing the overwhelm associated with market analysis.

Economic factors

The global economy's strength and automotive manufacturing output are key drivers for Bulten's fastener sales. A robust economy typically translates to higher vehicle production, boosting demand for Bulten's products.

While the automotive fastener sector is projected for consistent expansion, challenges like escalating material expenses and economic unpredictability pose risks to profit margins. These factors can squeeze pricing power.

Bulten's first quarter 2025 sales figures demonstrated a decline compared to the prior year, underscoring the impact of a more difficult economic climate on the company's performance.

Fluctuations in the prices of essential raw materials like steel, aluminum, and various metals directly affect Bulten's manufacturing expenses. For instance, global steel prices saw significant volatility throughout 2023 and into early 2024, influenced by energy costs and geopolitical events, impacting Bulten's cost base.

The automotive sector, a key market for Bulten, is currently grappling with persistent supply chain disruptions. These issues, combined with elevated raw material costs, have driven up the overall price of components, making it more challenging for manufacturers to maintain previous cost structures.

Effectively managing these escalating raw material and supply chain expenses is paramount for Bulten to safeguard its profitability. In 2023, many automotive suppliers reported margin pressures specifically attributed to these cost increases, highlighting the critical nature of cost control for companies like Bulten.

High inflation, particularly in key manufacturing inputs, directly impacts Bulten's operational costs. For instance, if raw material prices like steel surge by 15% year-over-year as seen in early 2024, Bulten faces increased production expenses.

Simultaneously, rising interest rates, such as central bank policy rates moving from 4.5% towards 5.0% in major economies by mid-2024, elevate Bulten's borrowing costs for capital investments and working capital. This also makes it more expensive for automotive manufacturers, Bulten's clients, to finance inventory and new vehicle production lines, potentially slowing demand for Bulten's components.

These intertwined macroeconomic forces create a challenging financial environment. Increased borrowing costs can reduce capital expenditure budgets for Bulten's clients, directly impacting order volumes.

The overall financial landscape is thus shaped by the dual pressure of rising operational expenses and a potentially contracting customer demand due to higher financing costs for vehicle production.

Currency Exchange Rates

As a global supplier, Bulten’s financial results are significantly influenced by currency exchange rate movements. Fluctuations can impact the value of revenues earned in foreign currencies and the cost of materials sourced internationally. For instance, a stronger Swedish Krona against currencies like the Euro or US Dollar would make Bulten’s exports more expensive and imports cheaper.

Volatility in exchange rates directly affects Bulten's competitiveness in various markets. If the Krona strengthens considerably, products sold in Euros or Dollars will translate into fewer Kronor, potentially eroding profit margins or forcing price adjustments. Conversely, a weaker Krona can boost earnings from foreign sales when repatriated.

Consider the Eurozone, a key market for Bulten. If the EUR/SEK rate falls, for example, from 11.50 to 11.00, Bulten's revenue from sales denominated in Euros would decrease in Krona terms. In 2023, Bulten reported that approximately 60% of its sales were in SEK, with the remaining 40% spread across other currencies, highlighting the material impact of these shifts.

- Impact on Revenue: A stronger SEK reduces the Krona value of foreign sales revenue.

- Cost of Goods Sold: A weaker SEK increases the Krona cost of imported raw materials and components.

- Market Competitiveness: Exchange rate shifts can alter the price competitiveness of Bulten's products in export markets.

- Hedging Strategies: Bulten likely employs financial instruments to mitigate some of the risks associated with currency fluctuations.

Consumer Spending and Vehicle Demand

Consumer confidence and overall purchasing power are key drivers for new vehicle sales, directly impacting the demand for automotive fasteners. In 2024, consumer confidence indices, like the Conference Board Consumer Confidence Index, will continue to be a critical barometer. For instance, a sustained rise in consumer sentiment often correlates with increased discretionary spending on big-ticket items such as vehicles.

Shifts in consumer preferences are significantly reshaping the automotive landscape and, consequently, the fastener market. The accelerating adoption of electric vehicles (EVs) is a prime example. By 2025, it's projected that EVs will account for a substantial portion of new vehicle sales, requiring different types of fasteners compared to traditional internal combustion engine vehicles, often with a focus on lightweighting and specialized materials.

The affordability of vehicles, influenced by factors like interest rates and inflation, plays a crucial role in the automotive supply chain. If vehicle prices become prohibitive due to economic conditions, consumer sentiment can sour, leading to reduced demand. This slowdown trickles down, affecting the volume of fasteners produced and supplied by companies like Bulten. For example, if average new car prices continue to rise in 2024, it could dampen demand.

- Consumer Confidence: Fluctuations in consumer confidence directly correlate with new vehicle sales, impacting fastener demand.

- EV Transition: The growing preference for electric vehicles necessitates specialized fasteners, altering market dynamics.

- Vehicle Affordability: Economic factors like interest rates and inflation influence vehicle purchasing power and overall automotive demand.

- Purchasing Power: Higher disposable incomes generally translate to greater demand for new vehicles and associated components.

Macroeconomic conditions significantly influence Bulten's performance, with global economic growth directly impacting automotive production volumes and, consequently, fastener demand. Persistent inflation, particularly in raw materials like steel, alongside rising interest rates, squeezes Bulten's operational costs and can dampen client investment in new vehicle production, as evidenced by Bulten's Q1 2025 sales decline. Currency fluctuations also pose a risk; for instance, a stronger Swedish Krona can reduce the value of Bulten's foreign earnings.

Same Document Delivered

Bulten PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bulten PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Bulten's strategic landscape with this detailed report.

Sociological factors

Societal values are increasingly prioritizing sustainability, directly impacting consumer choices in the automotive sector. This growing environmental awareness fuels a significant shift towards electric vehicles (EVs). For instance, in 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, highlighting this trend.

This surge in EV adoption translates into a direct demand for specialized fasteners. Manufacturers require robust and lightweight fastening solutions for critical EV components like battery housings, interior trim, and complex electronic modules. The complexity and unique material needs of EVs present new opportunities and challenges for fastener suppliers.

Societal expectations are increasingly shaping how companies like Bulten operate, particularly regarding sustainability and ethical sourcing. Consumers and regulatory bodies are demanding that products be made with materials and processes that minimize harm to the environment. This means Bulten faces pressure to ensure its manufacturing and supply chain practices align with these values.

The push for eco-friendly fasteners is growing, with a focus on designing products that can be reused or recycled. This trend reflects a broader societal shift towards a circular economy, where waste is minimized and resources are kept in use for as long as possible. Bulten's efforts in this area are often detailed in its annual and sustainability reports.

For instance, Bulten's 2023 Sustainability Report likely detailed progress on reducing its carbon footprint and ensuring ethical labor practices within its supply chain. Companies in the automotive sector, a key market for Bulten, are also setting ambitious sustainability targets, influencing their suppliers to do the same.

The automotive sector faces a complex labor market. While some areas, like traditional parts manufacturing, are seeing job reductions, there's a simultaneous surge in wages for skilled labor. This trend, particularly noticeable in 2024 and projected into 2025, puts pressure on companies like Bulten to secure talent proficient in advanced manufacturing and new technologies.

Demographic Shifts and Urbanization

Global demographics are changing, with a growing and aging population in many regions. By 2050, the UN projects the world population to reach 9.7 billion. This shift impacts vehicle demand, potentially increasing the need for reliable and potentially specialized vehicles for an older demographic, affecting fastener requirements.

Urbanization continues at a rapid pace. As of 2024, over 57% of the world's population lives in urban areas, a figure expected to rise to 68% by 2050 according to the UN. This trend influences transportation needs, possibly boosting demand for smaller, more fuel-efficient vehicles or shared mobility solutions, which in turn shapes the types and volumes of fasteners Bulten supplies.

These demographic and urbanization trends create specific demands for Bulten:

- Shifting Vehicle Preferences: An aging population might favor vehicles with easier access and advanced safety features, impacting the design and, consequently, the fasteners used.

- Urban Mobility Needs: Increased urban living could drive demand for electric vehicles (EVs) and compact cars, requiring different fastener solutions than traditional larger vehicles. For instance, the EV market is projected to grow significantly, with global sales reaching an estimated 25 million units in 2024, a figure expected to climb.

- Service and Maintenance: As vehicle fleets age or change types due to demographic shifts, the demand for efficient maintenance and replacement parts, including specialized fasteners, will likely increase.

Safety and Quality Perception

Consumer awareness of vehicle safety and component quality is a significant sociological factor influencing the automotive industry. As buyers become more informed, they increasingly scrutinize the reliability of parts, directly impacting demand for suppliers like Bulten. For instance, a 2024 study indicated that over 70% of car buyers consider safety features paramount, a trend that extends to the underlying components.

The increasing frequency of product recalls and high-profile product liability lawsuits underscores the critical need for stringent quality control in automotive manufacturing. In 2024, the automotive industry saw a notable rise in recalls related to component failures, with fastener integrity being a recurring issue. This heightened scrutiny means suppliers must demonstrate exceptional quality assurance to maintain trust and market share.

Bulten's commitment to quality is therefore not just a technical requirement but a crucial element of its brand perception.

- Growing Consumer Demand for Safety: Approximately 65% of consumers in 2024 reported willingness to pay a premium for vehicles with demonstrably superior safety features, which includes the quality of every component.

- Impact of Recalls: A single major recall can cost manufacturers millions in repair costs and significant damage to brand reputation, directly affecting supplier relationships.

- Supplier Reputation: Bulten's reputation for high-quality fasteners is a key differentiator, influencing purchasing decisions by OEMs concerned about their own product liability.

- Regulatory Scrutiny: Increased regulatory oversight on vehicle safety in major markets like the EU and North America in 2024-2025 means suppliers must adhere to even stricter quality standards.

Societal values are increasingly driving demand for sustainable and ethically produced goods, influencing automotive purchasing decisions. This trend directly impacts fastener manufacturers like Bulten, requiring them to adopt eco-friendly materials and production methods. The growing consumer preference for electric vehicles (EVs), which saw global sales exceed 13.6 million units in 2023, further necessitates specialized, lightweight fasteners for battery systems and other EV components.

Demographic shifts, such as an aging global population and increasing urbanization, also shape the automotive market. By 2050, the UN projects the world population to reach 9.7 billion, with urban dwellers comprising 68% of that total. These changes may lead to a greater demand for specialized vehicles and urban mobility solutions, impacting the types of fasteners Bulten needs to supply.

Consumer awareness regarding vehicle safety and component quality is paramount. With safety being a top priority for over 70% of car buyers in 2024, and a willingness among 65% to pay a premium for enhanced safety features, Bulten's commitment to high-quality, reliable fasteners is a critical competitive advantage. The automotive sector's increasing focus on product recalls, with fastener integrity being a recurring concern in 2024, underscores the need for stringent quality assurance from suppliers.

Technological factors

The automotive industry's shift towards electric vehicles (EVs) is a major technological driver, significantly impacting demand for specialized components like advanced fasteners. EVs, with their heavier battery packs, necessitate overall weight reduction to maximize range and efficiency. This pursuit of lightweighting directly fuels the need for fasteners made from innovative materials such as composites, titanium, and advanced lightweight alloys. For instance, by 2025, the global automotive lightweight materials market is projected to reach over $30 billion, with fasteners being a critical component in achieving these weight savings.

The automotive sector's embrace of Industry 4.0 is reshaping fastener requirements. Automation, AI, and IoT are driving demand for fasteners designed for robotic handling and automated inspection, ensuring precision and efficiency. This technological shift is expected to reduce production defects, with some estimates suggesting potential reductions of up to 30% in assembly errors.

Enhanced data analytics, a cornerstone of Industry 4.0, are crucial for optimizing fastener performance and supply chains. By leveraging real-time data from production lines, manufacturers can improve quality control, predict potential failures, and streamline inventory management, aiming for a more resilient and cost-effective operation.

Technological advancements in materials science are a significant driver for Bulten. The development of novel high-strength polymers and advanced composites opens doors for Bulten to create specialized fasteners offering lighter weight and superior performance compared to traditional metal options. For instance, the automotive industry, a key market for Bulten, is increasingly adopting composite materials in vehicle construction, creating a demand for compatible fastening solutions.

Furthermore, a growing focus on sustainability and the circular economy is influencing fastener design. Bulten is positioned to capitalize on the trend towards fasteners engineered for reuse and recyclability. This aligns with global efforts to reduce waste and improve resource efficiency, a commitment echoed by major industrial players. For example, by 2025, many European countries aim to increase their recycling rates significantly, making durable and reusable components increasingly valuable.

Digitalization of Supply Chain and Predictive Analytics

The digitalization of Bulten's supply chain, incorporating predictive analytics, is a significant technological driver. This integration offers enhanced visibility, allowing for real-time monitoring of inventory, production, and logistics. For instance, advancements in AI-powered forecasting can help Bulten anticipate demand fluctuations more accurately, reducing the risk of stockouts or overstocking.

Predictive analytics plays a crucial role in optimizing Bulten's operations. By analyzing historical data and current trends, Bulten can identify potential disruptions, such as supplier delays or transportation issues, before they impact production. This proactive approach leads to improved efficiency and reduced downtime, contributing to more resilient supply chains. Companies leveraging such technologies have reported significant improvements; for example, a McKinsey report indicated that companies using advanced analytics in their supply chains can achieve up to a 15% reduction in operating costs.

- Enhanced Visibility: Digital tools provide end-to-end tracking of goods and materials throughout the supply chain.

- Predictive Maintenance: AI can forecast equipment failures in manufacturing, minimizing unexpected shutdowns.

- Optimized Logistics: Real-time data allows for dynamic route planning and load optimization, reducing transportation costs and delivery times.

- Improved Demand Forecasting: Predictive analytics enables more accurate anticipation of customer needs, leading to better inventory management.

Smart Fasteners and Sensor Integration

The integration of sensors into fasteners is a significant technological shift, offering Bulten opportunities in smart manufacturing and enhanced product lifecycle management. This technology allows for real-time data collection on critical parameters like torque, vibration, and temperature, directly from the fastening point.

These smart fasteners are particularly valuable for safety-critical applications within the automotive sector, enabling proactive identification of potential issues before they lead to failures. For instance, by monitoring joint integrity, Bulten could contribute to the development of vehicles with improved reliability and reduced warranty claims.

The market for industrial sensors is projected to grow substantially. For example, the global industrial sensor market was valued at approximately $28.5 billion in 2023 and is expected to reach over $45 billion by 2028, indicating a strong demand for such integrated solutions.

- Real-time Monitoring: Sensors embedded in fasteners can track torque, tension, and vibration, providing immediate feedback on the health of a joint.

- Predictive Maintenance: This data enables the prediction of fastener fatigue or loosening, allowing for scheduled maintenance before critical failure occurs.

- Enhanced Safety: In automotive and other heavy industries, this technology directly contributes to improved safety by ensuring the integrity of critical structural connections.

- Data-driven Insights: The collected data can inform design improvements and manufacturing processes, leading to more robust and reliable products.

Technological advancements continue to reshape the demand for fasteners, particularly with the automotive industry's pivot towards electric vehicles and lightweighting initiatives. By 2025, the global automotive lightweight materials market is expected to exceed $30 billion, highlighting the need for specialized, lighter fasteners. Furthermore, the integration of Industry 4.0 principles, including AI and IoT, is driving the demand for fasteners compatible with automated assembly and inspection processes, aiming to reduce assembly errors by as much as 30%.

| Key Technological Drivers | Impact on Fasteners | Supporting Data/Projections (2024-2025) |

| Electric Vehicle (EV) Transition & Lightweighting | Increased demand for fasteners made from advanced, lightweight materials (composites, alloys). | Global automotive lightweight materials market projected to exceed $30 billion by 2025. |

| Industry 4.0 & Automation | Need for fasteners designed for robotic handling and automated quality control; improved precision. | Potential reduction in assembly errors by up to 30% through automation. |

| Advanced Materials Science | Development of high-strength polymers and composites necessitates compatible fastening solutions. | Growing adoption of composite materials in vehicle construction. |

| Smart Manufacturing & IoT | Integration of sensors into fasteners for real-time monitoring (torque, vibration) and predictive maintenance. | Global industrial sensor market expected to reach over $45 billion by 2028; growth driven by smart factory adoption. |

Legal factors

Product liability laws are becoming more stringent, particularly within the European Union. These updated regulations now clearly extend to software, artificial intelligence (AI) systems, and digital updates provided by manufacturers. This means companies like Bulten could be held responsible for cybersecurity breaches or defects in their software. For instance, the EU's AI Act, expected to be fully implemented by 2025, introduces strict liability for AI systems, potentially impacting automotive component suppliers if their AI-driven safety features fail.

This evolving legal framework demands a proactive approach from Bulten, requiring more rigorous documentation of product development processes and enhanced security checks for all digital components. Failure to comply could lead to significant legal repercussions and reputational damage. The increasing reliance on connected vehicle technology means that the liability for software-related issues, like a security vulnerability in an electronic control unit, could fall directly on the component supplier.

Bulten operates under increasingly stringent environmental regulations, impacting its manufacturing processes and material choices. For instance, directives like REACH and RoHS restrict hazardous substances, requiring careful sourcing and compliance checks. Failure to adhere to these environmental standards can lead to substantial financial penalties, potentially impacting Bulten's profitability and operational continuity. In 2023, the EU continued to strengthen its Green Deal initiatives, signaling a growing emphasis on sustainable manufacturing across all industries, including automotive component suppliers like Bulten.

The European Union's imposition of anti-dumping duties on certain fasteners originating from China, such as those implemented in early 2024, directly impacts Bulten by potentially increasing the cost of imported components if they rely on such sources. These duties, designed to protect domestic industries from unfairly priced imports, can create significant financial burdens and necessitate legal appeals or adjustments to supply chains. For instance, the EU's initial anti-dumping measures on specific Chinese fasteners can range from 19.7% to 71.9%, illustrating the potential cost impact.

Labor Laws and Employment Regulations

Changes in labor laws, such as minimum wage adjustments and evolving working condition standards, directly influence Bulten's operating expenses and its approach to managing its workforce. For instance, a rise in the national minimum wage could increase Bulten's labor costs, particularly for entry-level positions.

The automotive sector is experiencing a dynamic shift in its labor landscape. While there are job reductions in certain areas of parts manufacturing, demand for skilled labor in areas like electric vehicle production and advanced manufacturing is increasing, often accompanied by rising wage expectations for these specialized roles.

Union agreements also play a crucial role. Negotiations and potential changes in collective bargaining agreements can impact wage structures, benefits, and work rules, necessitating adaptable human resource strategies for Bulten.

Recent data from Eurostat indicates that labor costs in the manufacturing sector across the EU have seen continued growth. For example, average labor costs per hour in manufacturing rose by approximately 4.5% in 2023 compared to the previous year, a trend Bulten must factor into its financial planning and competitive analysis.

- Minimum Wage Impact: Increases in statutory minimum wages directly affect Bulten's payroll expenses for lower-skilled roles.

- Skills Gap and Wages: The automotive industry's growing need for specialized skills, particularly in areas like EV technology, is driving up wages for qualified personnel.

- Union Negotiations: Evolving union agreements can alter wage scales, benefits packages, and employment terms, requiring proactive HR management.

- EU Labor Cost Trends: In 2023, average manufacturing labor costs per hour in the EU grew by about 4.5%, highlighting a general upward pressure on employment expenditure.

Intellectual Property Rights and Patents

Protecting intellectual property is key for Bulten's edge. This includes safeguarding new fastener designs, advanced manufacturing techniques, and their complete service offerings. Strong legal protection ensures Bulten can maintain its innovative lead without competitors easily copying their advancements.

Legal frameworks governing patents and trade secrets are fundamental to fostering Bulten's ongoing innovation. These regulations provide the necessary security for investment in research and development, allowing Bulten to bring novel solutions to market confidently. For instance, in 2023, the global patent filings related to fastening technologies saw a notable increase, highlighting the competitive landscape Bulten operates within.

- Patent protection for Bulten's innovative fastener designs is essential for market differentiation.

- Trade secret laws safeguard proprietary manufacturing processes, preventing unauthorized replication.

- The legal environment directly impacts Bulten's ability to secure and monetize its technological advancements.

- Global patent application trends indicate a growing emphasis on innovation within the fastener industry.

Product liability laws are increasingly stringent, especially in the EU, extending to software and AI. This means Bulten faces liability for cybersecurity breaches or software defects in its components, a risk amplified by the EU's AI Act expected by 2025. Stringent environmental regulations like REACH and RoHS also mandate careful material sourcing and compliance, with non-adherence leading to significant penalties. Furthermore, anti-dumping duties, such as those imposed on Chinese fasteners in early 2024, can increase component costs and necessitate supply chain adjustments for Bulten.

Environmental factors

The automotive industry, a key market for Bulten, faces increasing pressure to reduce its carbon footprint. Many nations are setting ambitious carbon emission targets, with the EU aiming for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels. This global push directly influences Bulten's need to invest in greener manufacturing technologies and optimize its supply chain for lower emissions.

Achieving carbon neutrality is no longer a niche concern; it's becoming a core expectation from both regulatory bodies and end consumers. For example, many car manufacturers are pledging to have carbon-neutral production facilities by 2030 or 2040. This trend necessitates that Bulten actively pursues and reports on its own carbon neutrality goals, potentially impacting its attractiveness to clients and investors.

The automotive industry's growing emphasis on sustainability is directly impacting Bulten's material sourcing. There's a clear upward trend in consumer and regulatory demand for automotive components made from recycled and renewable materials. For instance, by 2025, many automakers are targeting significant increases in the percentage of recycled content in their vehicles, pushing suppliers like Bulten to adapt.

This shift necessitates Bulten prioritizing eco-friendly sourcing for its fasteners. Exploring and integrating advanced materials, such as lightweight alloys and composites, is crucial. These materials not only offer environmental benefits through reduced weight and improved fuel efficiency but also align with the circular economy principles gaining traction in the automotive sector.

The automotive sector's increasing adoption of circular economy principles is reshaping fastener design, prioritizing reuse and recyclability to cut waste across the product's lifespan. This shift means companies like Bulten are looking at how their products can be easily disassembled and their materials recovered. For instance, advancements in material science and manufacturing techniques are enabling fasteners that are more durable and easier to separate from end-of-life vehicles.

Manufacturers who effectively integrate these circular economy practices into their operations can unlock significant competitive advantages. By reducing material consumption and waste disposal costs, they can improve their bottom line. In 2024, the global automotive recycling market was valued at approximately $115 billion, demonstrating a substantial economic incentive for adopting more sustainable practices.

Resource Scarcity and Raw Material Availability

Concerns about the scarcity of critical raw materials, such as steel and aluminum, directly impact fastener production. These shortages can lead to increased material costs and potential disruptions in supply. For instance, the London Metal Exchange (LME) saw aluminum prices fluctuate significantly in early 2024, driven by geopolitical tensions and supply chain uncertainties, highlighting the vulnerability of manufacturers like Bulten.

Building resilient supply chains is crucial for Bulten to navigate these risks. This involves diversifying suppliers, securing long-term contracts, and exploring alternative materials where feasible. By proactively managing these environmental factors, Bulten can better mitigate the impact of material shortages on its operations and profitability.

- Steel Price Volatility: Global steel prices, a key input for fasteners, have experienced volatility. For example, benchmark steel rebar prices in China, a major producer, saw significant swings in late 2023 and early 2024 due to production adjustments and demand expectations.

- Aluminum Supply Chain Risks: Aluminum production is energy-intensive and geographically concentrated. Disruptions in energy supply or trade policies can impact the availability and cost of aluminum, a material used in certain fastener applications.

- Geopolitical Impact on Resources: International relations and conflicts can affect the extraction and transportation of raw materials, creating unpredictable supply chain challenges for companies like Bulten.

Environmental Reporting and Disclosure Requirements

Bulten faces growing pressure from regulators and stakeholders to be more transparent about its environmental footprint. This means providing detailed information on how its operations affect the environment. In 2023, Bulten continued its commitment to this by publishing its annual and sustainability report, which offers a comprehensive overview of its environmental performance and initiatives.

The company's reporting practices are crucial for demonstrating its commitment to sustainability and meeting evolving compliance standards. As environmental concerns become more prominent, Bulten's proactive disclosure helps build trust with investors, customers, and the wider community.

- Increased Scrutiny: Regulatory bodies globally are enhancing requirements for environmental data, impacting companies like Bulten.

- Stakeholder Expectations: Investors and customers are increasingly prioritizing companies with strong environmental, social, and governance (ESG) performance.

- Transparency Initiatives: Bulten's annual and sustainability reports serve as key communication tools for its environmental impact.

- Data Integration: The challenge lies in accurately collecting and reporting diverse environmental data across its operations.

The automotive industry's drive towards sustainability significantly impacts Bulten, with a strong push to reduce carbon emissions. For instance, the EU targets a 55% net greenhouse gas emission reduction by 2030. This necessitates greener manufacturing and supply chain optimization for Bulten.

Consumer and regulatory demand for recycled and renewable materials is rising, pushing companies like Bulten to adapt. Many automakers aim for higher recycled content in vehicles by 2025. Bulten must prioritize eco-friendly sourcing and explore advanced materials like lightweight alloys.

Raw material scarcity, particularly for steel and aluminum, poses a risk to fastener production. Price volatility, as seen with aluminum on the LME in early 2024, highlights supply chain vulnerabilities. Bulten needs to diversify suppliers and secure contracts to mitigate these impacts.

| Environmental Factor | Impact on Bulten | Example/Data Point (2023-2025) |

|---|---|---|

| Carbon Emission Reduction | Need for greener manufacturing and supply chain optimization. | EU target: 55% reduction by 2030. |

| Sustainable Materials Demand | Prioritization of recycled and renewable materials in sourcing. | Automakers targeting increased recycled content by 2025. |

| Raw Material Scarcity & Volatility | Risk of increased costs and supply disruptions. | Aluminum prices on LME showed significant fluctuation in early 2024. |

| Circular Economy Principles | Focus on product design for disassembly and recyclability. | Global automotive recycling market valued at ~ $115 billion in 2024. |

PESTLE Analysis Data Sources

Our Bulten PESTLE Analysis is meticulously constructed using data from reputable sources including official government publications, international economic organizations, and leading industry research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the automotive supply chain.