Bulten Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

Bulten operates within a competitive landscape shaped by five key forces. Understanding the bargaining power of buyers and suppliers is crucial for navigating pricing and supply chain dynamics. The threat of new entrants and the intensity of rivalry among existing players significantly impact market share and profitability.

Furthermore, the presence of substitute products can alter customer choices and demand. This initial overview highlights the critical factors influencing Bulten's market position.

The complete report reveals the real forces shaping Bulten’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bulten's reliance on a concentrated group of specialized suppliers for essential raw materials like steel and aluminum, as well as sophisticated machinery, directly impacts supplier bargaining power. When only a limited number of suppliers can provide critical, high-specification materials, such as certain alloys crucial for safety-rated fasteners, their leverage increases significantly.

For example, a 2024 market analysis indicated that the global supply of high-strength, corrosion-resistant steel alloys for automotive applications is dominated by a few key producers. This concentration means Bulten may face higher prices or less favorable terms if these specialized suppliers face capacity constraints or decide to pass on increased production costs.

The specialization of these suppliers further amplifies their power. If a supplier develops unique manufacturing processes or proprietary technologies for producing specific fastener components, Bulten's ability to switch to alternative suppliers becomes limited, strengthening the original supplier's negotiating position.

Input switching costs represent a significant factor influencing Bulten's bargaining power with its suppliers. The financial and operational implications of changing a supplier can be considerable, involving expenses for re-tooling machinery and undergoing new certification processes, which can disrupt Bulten's production schedules. These costs make it less attractive for Bulten to switch, thus enhancing the supplier's leverage.

For instance, in the automotive supply chain, a shift to a new fastener supplier might necessitate extensive testing and validation of new components, potentially costing hundreds of thousands of dollars and delaying product launches. This reality underscores why Bulten prioritizes maintaining stable, long-term relationships with its current suppliers to avoid these substantial switching expenses and the associated operational risks.

Suppliers could indeed threaten Bulten by integrating forward, essentially becoming competitors. Imagine a supplier of specialized steel alloys deciding to start producing fasteners themselves. This move would directly challenge Bulten's market share.

While raw material suppliers are less likely to make this leap, those providing crucial components or manufacturing equipment might see an opportunity if the fastener industry shows particularly strong growth. For instance, if the global automotive fastener market, which Bulten serves, continues its projected upward trend, reaching an estimated $30 billion by 2026, such integration could become more appealing.

However, the significant capital investment and technical know-how needed to manufacture fasteners effectively act as a substantial deterrent. Bulten, with its established infrastructure and decades of experience, possesses a competitive advantage that would be difficult for a new entrant, even a supplier, to overcome quickly.

Importance of Supplier's Input to Bulten's Product

The quality and timely delivery of raw materials and components are absolutely crucial for Bulten. Fasteners are essential for automotive safety and performance, meaning any issues with inputs directly affect Bulten's standing and client trust. This significant reliance on suppliers gives them considerable power.

Steel, a primary material for automotive fasteners, represents a substantial portion of the market in 2024. This dependence on key materials like steel highlights the leverage suppliers hold.

- High dependence on steel: Steel is a major cost component for automotive fasteners, with its price volatility directly impacting Bulten's production costs.

- Criticality of fasteners: The safety-critical nature of automotive fasteners means input quality cannot be compromised, reinforcing supplier importance.

- Supply chain reliability: Consistent and on-time delivery of components is vital to meet automotive production schedules, further empowering suppliers.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier power. For Bulten, the presence of alternative raw materials or components, such as advanced composites or different types of metals, can cap the leverage of existing suppliers. For instance, while steel fasteners remain prevalent, the automotive sector is increasingly adopting lighter materials like aluminum and plastics, driven by the demand for fuel efficiency and the rise of electric vehicles.

This shift towards alternative materials directly impacts the bargaining power of traditional steel suppliers. If Bulten can readily transition to these substitutes without substantial cost increases or quality degradation, the supplier's ability to dictate terms diminishes.

- Shifting Material Trends: The automotive industry's move towards lightweight materials like aluminum and plastics, particularly for electric vehicles, provides Bulten with alternatives to traditional steel.

- Cost-Benefit Analysis of Substitutes: Bulten's ability to switch materials depends on whether the cost and performance of substitutes align with its production needs.

- Supplier Dependence: A high reliance on a single material supplier weakens Bulten's position, whereas access to multiple material sources increases its bargaining strength.

Bulten faces significant bargaining power from its suppliers due to the specialized nature of its inputs and the concentration within certain supply markets. The high switching costs associated with re-tooling and certification for new suppliers, coupled with the critical importance of input quality for safety-sensitive applications, further amplify supplier leverage. The automotive industry's ongoing material shifts, however, offer potential avenues to mitigate this power.

| Factor | Impact on Bulten | 2024 Data/Insight |

|---|---|---|

| Supplier Concentration | High leverage for limited specialized suppliers | Global market for high-strength steel alloys for automotive is dominated by a few key producers. |

| Switching Costs | Discourages supplier changes, strengthening supplier position | Potential costs of hundreds of thousands of dollars and product launch delays for automotive fastener component validation. |

| Input Criticality | Suppliers of critical, high-quality inputs hold significant power | Steel, a primary material, represents a substantial cost component for automotive fasteners in 2024. |

| Availability of Substitutes | Can reduce supplier power if viable alternatives exist | Automotive sector's increasing adoption of aluminum and plastics for fuel efficiency impacts traditional steel supplier leverage. |

What is included in the product

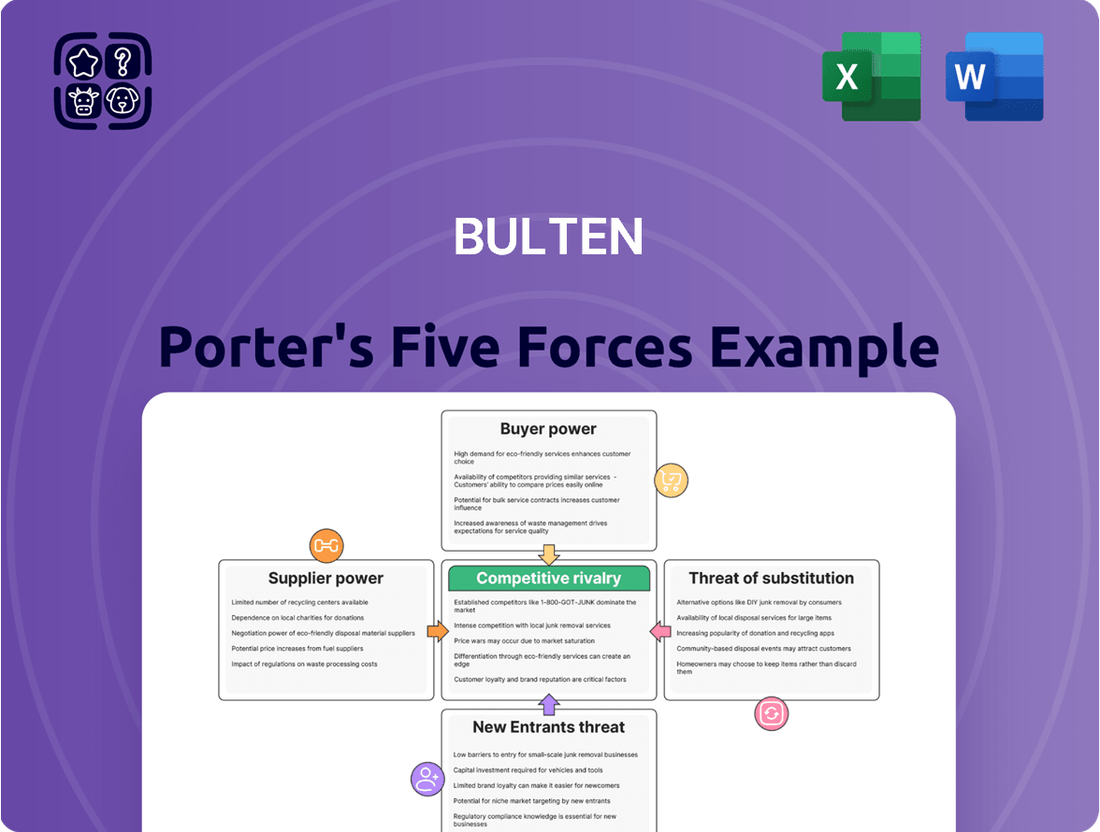

This analysis dissects the competitive forces shaping Bulten's market, examining industry rivalry, buyer and supplier power, the threat of new entrants and substitutes, to inform strategic decision-making.

Pinpoint competitive threats and opportunities with a visual, easy-to-understand breakdown of each Porter's Force.

Easily identify and address potential market disruptions by clearly mapping the intensity of each competitive force.

Customers Bargaining Power

Bulten's customer base is heavily concentrated among major global automotive manufacturers, who are inherently powerful buyers. These Original Equipment Manufacturers (OEMs) buy fasteners in massive quantities, granting them substantial bargaining power. This means they can strongly influence pricing, dictate quality expectations, and set delivery schedules, all of which can impact Bulten's profitability.

In 2024, the automotive OEM sector represented a dominant 92.56% of the overall fasteners market size. This overwhelming reliance on a few large, powerful customers underscores the significant bargaining power Bulten faces. Their sheer volume of purchases gives them considerable leverage in negotiations, making it crucial for Bulten to manage these relationships effectively.

Customer switching costs significantly influence Bulten's bargaining power of customers. While automotive manufacturers are large entities, the process of changing fastener suppliers is not a simple swap. It can entail substantial expenses and inherent risks. These include the costs associated with re-engineering components, rigorous testing to ensure safety and performance standards are met, and the necessary re-certification of parts. For instance, a single change in a critical fastener could necessitate months of validation and millions in retooling for an automotive OEM.

These high switching costs inherently reduce the likelihood of original equipment manufacturers (OEMs) frequently changing their fastener suppliers. This dynamic offers Bulten a degree of leverage, particularly if they deliver specialized, high-quality, or proprietary fastening solutions that are difficult for competitors to replicate or for OEMs to easily replace. The integration of Bulten's Full Service Provider (FSP) model is designed to exacerbate these switching costs even further by embedding Bulten deeply within the customer's manufacturing and supply chain operations.

Automotive OEMs generally have the financial muscle and technical know-how to consider making their own fasteners, a concept known as backward integration. This could theoretically shift power towards them.

However, the reality is that fastener production is quite specialized, requiring specific expertise and significant investment in machinery. For instance, in 2024, the global automotive fastener market, while substantial, is dominated by dedicated manufacturers who benefit from economies of scale across a vast product range.

The sheer diversity of fasteners needed for a single vehicle, from small bolts to specialized structural components, makes it challenging and often uneconomical for OEMs to produce everything in-house. Bulten, a key player, offers thousands of different fastener types, a breadth that's hard for an OEM to replicate efficiently.

Consequently, while the threat of backward integration exists, its practical implementation is often limited by cost and complexity, thus moderating the bargaining power of automotive customers in this specific area.

Price Sensitivity of Customers

Automotive manufacturers, facing intense competition and thin profit margins, are acutely price-sensitive. This sensitivity translates directly to their suppliers, such as Bulten, who must consistently offer competitive pricing to secure business.

The pressure to keep costs down means Bulten must navigate a landscape where even small price variations can significantly impact contract awards. This dynamic is a constant challenge, requiring efficient operations and cost management.

The global automotive fasteners market is expected to see growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% through 2028. However, within this expanding market, the imperative for competitive pricing remains paramount for suppliers like Bulten.

- Automotive manufacturers operate on tight margins, making them highly price-conscious.

- This cost pressure is passed down to suppliers, demanding competitive pricing.

- The global automotive fasteners market is projected for growth, emphasizing the need for cost-effectiveness.

- Bulten must maintain competitive pricing to secure and retain its position within the automotive supply chain.

Importance of Fasteners to Customer's Product

Fasteners are crucial for vehicle safety and structural integrity, meaning even small failures can have severe consequences. This criticality elevates the importance of quality and reliability for automotive customers, making them less sensitive to minor price differences when choosing fastener suppliers. For instance, in 2024, the automotive industry continues to emphasize advanced safety features, underscoring the need for dependable componentry.

Customers, therefore, balance cost considerations with the non-negotiable requirement for performance and reliability in their fastener selection. This dynamic allows Bulten to leverage its reputation for quality and specialized solutions as a key differentiator. The automotive sector's ongoing commitment to reducing recalls and improving vehicle longevity further amplifies the value placed on high-performing fasteners.

- Criticality for Safety: Fasteners are essential for maintaining the structural integrity of a vehicle, directly impacting passenger safety.

- Performance and Reliability: Customers prioritize the consistent performance and long-term reliability of fasteners over marginal cost savings.

- Supplier Differentiation: Bulten can differentiate itself by offering superior quality and specialized fastener solutions that meet stringent automotive standards.

- Reduced Recall Risk: High-quality fasteners contribute to fewer warranty claims and recalls, a significant concern for automotive manufacturers.

The bargaining power of customers for Bulten is significant, primarily due to the concentrated nature of its customer base in the automotive sector. Major Original Equipment Manufacturers (OEMs) represent a substantial portion of the fasteners market, giving them considerable leverage in negotiations over pricing, quality, and delivery. While switching suppliers can be costly and complex for OEMs, involving re-engineering and extensive testing, this factor is somewhat offset by the OEMs' price sensitivity driven by their own tight profit margins.

| Factor | Impact on Bulten | 2024 Data/Context |

|---|---|---|

| Customer Concentration | High power for large OEMs | OEMs constitute 92.56% of the fasteners market. |

| Switching Costs | Reduces customer power | High costs for re-engineering, testing, and re-certification. |

| Backward Integration Threat | Moderate power | Specialized nature and economies of scale limit in-house production. |

| Price Sensitivity | High customer power | OEMs' tight margins necessitate competitive pricing from suppliers. |

| Product Criticality | Reduces customer power | Focus on safety and reliability outweighs minor price differences. |

What You See Is What You Get

Bulten Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for Bulten meticulously examines the competitive landscape, covering the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the fastener industry. Each force is thoroughly detailed with relevant insights and strategic implications for Bulten's market position and future success. The document you see here is exactly what you’ll be able to download after payment, offering actionable intelligence for your strategic planning.

Rivalry Among Competitors

The automotive fastener market is quite crowded, featuring a substantial number of global and regional competitors. Major players like Illinois Tool Works Inc., LISI Group, SFS Group AG, and Stanley Engineered Fastening are actively competing with Bulten, creating a dynamic environment. This wide array of companies, varying in size and market reach, means intense rivalry as each tries to capture a larger piece of the market across different product categories.

The automotive fasteners market is growing steadily, with projections indicating a global market value of USD 51.54 billion by 2035, growing at a compound annual growth rate of 5.3% between 2025 and 2035. This expansion is a double-edged sword for competitive rivalry.

While market growth typically signals a healthy industry and attracts new entrants, it also intensifies competition among existing players. As the pie gets bigger, companies are naturally driven to capture a larger slice, leading to more aggressive strategies in pricing, product development, and market penetration.

The Asia Pacific region is anticipated to lead this growth, meaning competition will likely be particularly fierce in this area as both domestic and international manufacturers vie for dominance. This heightened competition can put pressure on profit margins and necessitate greater innovation to stand out.

Bulten actively combats the commodity nature of many fasteners by focusing on specialized products and comprehensive full-service solutions (FSP). This strategy moves beyond mere price competition.

The company's emphasis on high-quality, engineered fasteners, particularly those designed for lightweighting applications and the burgeoning electric vehicle (EV) market, creates a distinct value proposition. For instance, Bulten's commitment to innovation in EV fasteners addresses specific industry needs for reduced weight and enhanced performance.

This product differentiation directly addresses the intense rivalry in the fastener industry. By offering unique solutions, Bulten can command better pricing and build stronger customer loyalty, lessening the impact of competitors who primarily compete on cost alone.

Exit Barriers

High capital investment in manufacturing facilities, specialized machinery, and established supply chains represent significant exit barriers within the automotive fastener industry. Companies like Bulten, with its approximately 1,900 global employees and substantial infrastructure, face considerable costs and complexities when considering divestment or closure. These entrenched investments mean that even less profitable or struggling firms often remain in the market, sustaining or even intensifying competitive rivalry.

The sheer scale of investment required to operate in this sector, particularly for established players with extensive production capabilities, means that exiting is not a simple decision. For instance, retooling or decommissioning specialized fastener manufacturing equipment often incurs substantial write-offs. This economic reality forces businesses to continue operating, even at reduced profitability, rather than incur the full cost of exit, thereby maintaining a crowded competitive landscape.

Consequently, the high exit barriers contribute directly to the intensity of competitive rivalry in the automotive fastener market. Companies are less likely to withdraw, leading to persistent competition for market share and profitability. This situation can pressure all players, including well-established ones like Bulten, to continually innovate and optimize their operations to remain competitive in a market where capacity is unlikely to shrink significantly due to exit costs.

- High Capital Investment: Significant financial outlay required for specialized manufacturing equipment and facilities.

- Established Supply Chains: Existing relationships and infrastructure with suppliers and customers create switching costs.

- Specialized Assets: Machinery and technology are often specific to fastener production, limiting resale value or alternative use.

- Sustained Rivalry: Difficulty in exiting keeps underperforming firms in the market, intensifying competition.

Strategic Commitments and Acquisitions

The competitive landscape within the fastener industry is characterized by significant strategic maneuvering and consolidation. Companies are actively making substantial commitments to gain or solidify market positions. For instance, Fontana Gruppo's acquisition of a stake in Right Tight Fasteners in March 2025 exemplifies this trend, alongside Bossard Group's completion of the Ferdinand Gross takeover in January 2025.

These moves are not isolated; they reflect an intense drive for market share and technological superiority. Bulten itself secured a notable contract in August 2024, underscoring its active participation in this competitive environment. Such strategic actions heighten rivalry as firms expand their operational capabilities and consolidate their influence within the market.

- Fontana Gruppo acquired a stake in Right Tight Fasteners (March 2025).

- Bossard Group took over Ferdinand Gross (January 2025).

- Bulten secured a significant contract (August 2024).

- These actions indicate aggressive competition and consolidation.

Competitive rivalry in the automotive fastener market is intense due to a crowded field of global and regional players, including giants like Illinois Tool Works and LISI Group. This fierce competition is further fueled by a growing market, projected to reach USD 51.54 billion by 2035, with a CAGR of 5.3% between 2025 and 2035, particularly in the Asia Pacific region.

Companies like Bulten are differentiating themselves by focusing on specialized, high-quality fasteners for sectors like electric vehicles, moving beyond simple price competition. Strategic moves such as Fontana Gruppo's stake acquisition in Right Tight Fasteners (March 2025) and Bossard Group's takeover of Ferdinand Gross (January 2025) highlight the ongoing consolidation and aggressive pursuit of market share among major players, a trend Bulten also participates in, evidenced by its August 2024 contract win.

| Competitor Action | Date | Market Impact |

| Fontana Gruppo stake in Right Tight Fasteners | March 2025 | Increased consolidation and market influence |

| Bossard Group takeover of Ferdinand Gross | January 2025 | Further market consolidation and expanded capabilities |

| Bulten contract win | August 2024 | Demonstrates active competition and ability to secure business |

SSubstitutes Threaten

Advanced joining technologies like laser beam welding and adhesive bonding pose a significant threat to traditional mechanical fasteners. These methods are increasingly favored in automotive manufacturing, especially for electric vehicles (EVs), due to their suitability for lightweight materials and complex multi-material structures. For instance, the automotive industry's push towards lighter, more fuel-efficient vehicles, a trend heavily amplified in 2024 with stringent emissions standards, directly drives the adoption of these alternative joining techniques. This shift could consequently dampen demand for mechanical fasteners in certain segments.

Alternative joining methods, such as welding or adhesive bonding, can offer advantages like reduced weight and enhanced structural integrity in automotive applications. However, these alternatives frequently present higher application costs, increased complexity in their implementation, or limitations tied to specific material compatibility.

Despite these advancements, traditional fasteners continue to provide a cost-effective and remarkably versatile solution across a broad spectrum of automotive assembly needs. For instance, in 2024, the global automotive fasteners market was valued at approximately $30 billion, underscoring their continued dominance.

Bulten's strategic emphasis on developing engineered fastening solutions is specifically designed to present a compelling performance-cost balance when measured against these competing joining technologies. This approach allows them to maintain competitiveness by offering optimized solutions that address specific application requirements without the prohibitive costs or complexities of some substitutes.

Automotive manufacturers are increasingly considering substitute joining technologies as vehicle design evolves and new materials like advanced composites and aluminum gain traction, driven by lightweighting trends and the shift towards electric vehicles. For instance, the projected reduction in fastener counts for EVs, potentially by up to 30% in some designs, directly impacts the demand for traditional fastening solutions.

The adoption of these alternatives is accelerated by manufacturing process changes and the potential for cost savings or performance improvements they offer. As the automotive industry navigates the complexities of EV integration, with some estimates suggesting a 15-20% potential reduction in overall fastening needs per vehicle platform, customers show a growing propensity to explore and adopt these new joining methods.

Evolution of Material Science

Advances in material science are creating significant threats of substitutes for traditional fasteners. New lightweight alloys like advanced aluminum grades and high-performance composites are emerging, offering properties that can rival or even surpass traditional materials in certain applications. These materials often lend themselves to alternative joining methods beyond mechanical fastening.

For example, the automotive industry, a major consumer of fasteners, is increasingly adopting aluminum and composite materials to reduce vehicle weight and improve fuel efficiency. While this drives demand for compatible fasteners, it simultaneously fuels the development and adoption of substitute joining technologies. Estimates suggest the global automotive market will see a substantial increase in the use of lightweight materials, with aluminum content in vehicles projected to grow significantly by 2030.

- Lightweight Material Adoption: The increasing use of aluminum in automotive manufacturing, driven by fuel efficiency mandates, creates opportunities for alternative joining methods.

- Composite Integration: The growing application of advanced composites in aerospace and automotive sectors favors bonding and welding over traditional mechanical fasteners.

- Emerging Joining Technologies: Innovations in adhesive bonding, laser welding, and friction stir welding offer lighter, stronger, and more streamlined joining solutions.

- Market Erosion Potential: These evolving material and joining technologies pose a direct threat to the market share of traditional fastener manufacturers.

Impact of Electric Vehicle Design

The threat of substitutes for traditional automotive fasteners is heightened by the evolving design of electric vehicles (EVs). EVs, with their simpler powertrains, generally require fewer fasteners than internal combustion engine (ICE) vehicles. For instance, a typical ICE vehicle might use between 3,000 to 4,000 fasteners, whereas some EV designs are projected to reduce this number. This shift directly impacts fastener manufacturers by potentially lowering overall demand for certain fastener types.

Furthermore, the unique construction of EVs, particularly their battery packs and the emphasis on lightweighting, is spurring the adoption of alternative joining methods. This includes specialized fasteners designed for new composite materials and advanced adhesives that offer weight savings and improved structural integrity. For example, the use of adhesives in EV body structures can reduce the need for traditional mechanical fasteners, presenting a direct substitution threat.

- Reduced Fastener Count: EVs' simpler mechanical architecture, lacking engines and complex exhaust systems, leads to fewer attachment points, impacting traditional fastener suppliers.

- Adhesive and Alternative Joining: The automotive industry's push for lightweighting in EVs is increasingly favoring structural adhesives and advanced bonding techniques over mechanical fasteners, especially in battery enclosures and body panels.

- Specialized Fastener Demand: While overall fastener volume might decrease, there's a growing demand for highly specialized fasteners engineered for the unique thermal and structural requirements of EV components like battery modules.

- Material Innovation: New lightweight materials used in EV construction, such as carbon fiber composites, often necessitate different joining solutions than those traditionally used with metals, further challenging existing fastener markets.

The threat of substitutes for traditional fasteners is significant, particularly in industries like automotive and aerospace that are embracing lightweight materials and advanced joining technologies. These substitutes, such as advanced adhesives, laser welding, and friction stir welding, offer advantages like reduced weight, enhanced structural integrity, and streamlined assembly processes.

The automotive sector's push towards electric vehicles (EVs) and stringent emissions standards in 2024 has accelerated the adoption of these alternatives. For instance, some EV designs are projected to reduce fastener counts by up to 30%, directly impacting demand for traditional solutions. The global automotive fasteners market, valued at approximately $30 billion in 2024, faces potential erosion from these evolving technologies.

While fasteners remain a cost-effective and versatile option, the increasing use of aluminum and composites in vehicle manufacturing, coupled with innovations in joining methods, poses a clear challenge. This trend necessitates strategic adaptation from fastener manufacturers to remain competitive.

| Substitute Joining Technology | Key Advantages | Market Trend/Impact |

| Adhesive Bonding | Weight reduction, stress distribution, sealing | Growing adoption in EV battery enclosures and body panels; potential to reduce fastener count by 15-20% per platform. |

| Laser Beam Welding | High speed, precision, clean joints | Increasing use in multi-material structures and lightweight automotive components. |

| Friction Stir Welding | Strong, defect-free welds, suitable for dissimilar metals | Key for joining aluminum alloys in automotive body-in-white construction. |

Entrants Threaten

The automotive fastener industry demands substantial capital, creating a formidable barrier for newcomers. Significant investments are needed for specialized machinery, advanced manufacturing plants, and ongoing research and development to stay competitive.

For instance, establishing a modern automotive fastener production facility can easily run into tens or even hundreds of millions of dollars, encompassing everything from stamping presses and thread-rolling machines to quality control equipment and automation systems.

Companies like Bulten, with their extensive global manufacturing footprint, demonstrate the sheer scale of operations that require this high level of capital commitment. This global presence often involves multiple facilities strategically located to serve key automotive manufacturing hubs, further amplifying the initial investment.

The need for continuous innovation, particularly in areas like lightweight materials and advanced joining technologies, also necessitates ongoing R&D expenditure, adding another layer of capital requirement that deters less-resourced entrants.

Established manufacturers within the fastener industry, such as Bulten, leverage significant economies of scale. This advantage stems from high-volume production, bulk purchasing of raw materials, and optimized distribution networks, all contributing to a lower per-unit cost. For example, in 2023, Bulten reported net sales of SEK 7,308 million, reflecting substantial operational volume.

Newcomers face a considerable hurdle in matching these cost efficiencies. Without the established volume, new entrants would find it challenging to compete on price, particularly in segments like standard threaded hardware where price is a primary differentiator. Achieving comparable cost savings requires immense initial investment to reach a production scale that can rival incumbents.

Newcomers find it incredibly difficult to access established distribution channels and cultivate the deep customer relationships that Bulten enjoys. Bulten's long-standing partnerships with major automotive manufacturers are often cemented by multi-year agreements and its comprehensive Full Service Provider (FSP) model. For a new player, building the necessary trust, obtaining critical certifications, and replicating the intricate global supply chains serving Original Equipment Manufacturers (OEMs) presents a monumental hurdle. The automotive market heavily favors this OEM channel, making it a significant barrier to entry.

Product Differentiation and Technology

The fastener industry, particularly for automotive applications, is seeing a growing need for highly specialized and high-performance products. This is driven by trends like lightweighting in vehicles and the rise of electric cars, which necessitate advanced materials and innovative designs. For instance, the automotive sector's push towards sustainability means more demand for fasteners made from advanced alloys and composites, which are not easily replicated.

New companies entering this market would face significant barriers related to technology and research and development. They would need to make substantial investments to develop advanced manufacturing processes and acquire the expertise to create the sophisticated fasteners that established players like Bulten offer. The complexity of producing these specialized components means a steep learning curve and considerable capital outlay.

Emerging technologies, such as smart fasteners equipped with sensors to monitor performance and structural integrity, represent another hurdle for new entrants. These intelligent fasteners require expertise in electronics and data integration, adding another layer of technological sophistication that incumbents are already exploring or implementing. The ability to integrate such smart features is becoming a key differentiator.

The threat of new entrants is therefore mitigated by the high R&D costs and the need for advanced manufacturing capabilities.

- High R&D Investment: New entrants require significant capital for research into advanced materials and fastener designs, especially for EV and lightweighting applications.

- Advanced Manufacturing: Competing with incumbents means investing in sophisticated production technologies, often beyond the reach of startups.

- Technological Sophistication: The demand for specialized, high-performance fasteners, including smart fasteners with sensors, creates a high technological barrier to entry.

- Incumbent Advantage: Established players like Bulten possess existing R&D expertise and manufacturing infrastructure, making it difficult for new entrants to match their product offerings and quality.

Regulatory and Certification Barriers

The automotive sector is heavily regulated, with strict quality, safety, and environmental standards that suppliers must meet. Obtaining the necessary certifications and ensuring ongoing compliance is a complex and expensive undertaking, creating a substantial barrier for newcomers. For instance, in 2024, the average cost for a new automotive supplier to achieve key certifications like IATF 16949 could range from $20,000 to $100,000, plus ongoing audit fees.

These rigorous requirements are crucial for guaranteeing the reliability and safety of fasteners used in critical automotive components. Failing to meet these standards can lead to significant penalties and reputational damage, discouraging potential new entrants who may lack the resources or expertise to navigate this landscape. The lengthy approval processes, often taking 12-24 months, further deter those without established operational frameworks.

- Regulatory Hurdles: Automotive suppliers must comply with global regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and various emissions standards, which require significant investment in testing and documentation.

- Certification Costs: Achieving certifications like IATF 16949, a key quality management standard for the automotive industry, can cost tens of thousands of dollars and involve extensive process audits.

- Lead Time for Compliance: The time required to gain necessary approvals and certifications can be substantial, delaying market entry for new players.

- Investment in Technology: Meeting environmental standards often necessitates investment in advanced manufacturing technologies and waste management systems, adding to the capital expenditure for new entrants.

The threat of new entrants in the automotive fastener market remains relatively low due to substantial capital requirements and established economies of scale. Bulten's 2023 net sales of SEK 7,308 million highlight the scale needed to compete effectively. New players would struggle to match the cost efficiencies derived from high-volume production and bulk purchasing that incumbents like Bulten benefit from.

Furthermore, the need for advanced technology and specialized R&D, particularly for lightweight materials and smart fasteners, presents a significant barrier. Obtaining crucial automotive certifications, such as IATF 16949, can cost tens of thousands of dollars and involve lengthy approval processes, discouraging less-resourced entrants.

| Barrier Category | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High initial investment for specialized machinery and plants. | Tens to hundreds of millions of dollars for a modern facility. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | Bulten's 2023 net sales: SEK 7,308 million. |

| Technology & R&D | Need for expertise in advanced materials and smart fastener technology. | Development costs for lightweight alloys and sensor integration. |

| Regulatory & Certification | Compliance with strict automotive quality and safety standards. | IATF 16949 certification costs: $20,000 - $100,000+. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bulten is built upon a foundation of robust data from Bulten's annual reports, investor presentations, and official press releases. We supplement this with industry-specific market research from leading firms and competitor financial filings to provide a comprehensive view of the competitive landscape.