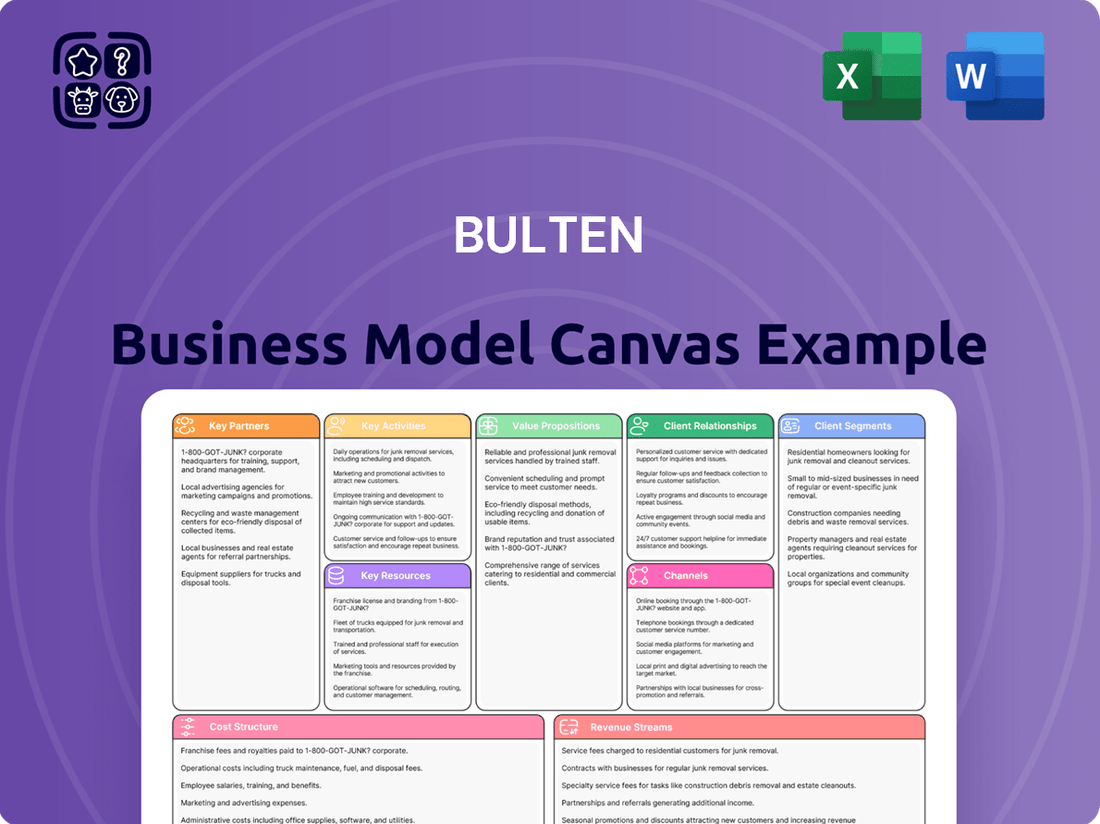

Bulten Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bulten Bundle

Discover the strategic core of Bulten’s success with our comprehensive Business Model Canvas. This detailed analysis unpacks how Bulten effectively delivers value to its customers and maintains its competitive edge.

Uncover Bulten's key customer segments, revenue streams, and cost structures. This professional blueprint offers a clear, actionable overview of their operational strategy.

Gain invaluable insights into Bulten's critical partnerships and resources. This full canvas is an essential tool for anyone studying successful business operations.

Want to understand Bulten's competitive advantages? Our complete Business Model Canvas provides a deep dive into their value proposition and customer relationships.

Unlock the full strategic blueprint behind Bulten's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bulten maintains strategic, long-term relationships with key suppliers of steel and other specialty metals, crucial for ensuring a stable supply of high-quality raw materials.

These partnerships are vital for managing cost volatility, especially as raw materials often represent over 40% of manufacturing costs for automotive component suppliers.

Collaborations frequently extend to co-developing specific material grades to meet evolving automotive standards for enhanced strength and reduced weight in 2024 vehicle models.

This proactive approach secures material availability and supports Bulten's operational efficiency and innovation.

Bulten views Automotive OEMs and Tier 1 suppliers not merely as customers but as crucial strategic partners, deeply integrated into product development. This collaboration begins from the initial design phases of new vehicle platforms, ensuring fastener solutions are perfectly optimized for performance, assembly efficiency, and cost from the outset. For instance, in 2024, Bulten continued its strong engagement with major European and North American OEMs, reflecting a significant portion of its SEK 4.7 billion estimated annual revenue from these long-term relationships. This early involvement helps address complex challenges, such as lightweighting and electrification trends, which saw Bulten secure new projects for EV battery applications.

A robust network of global logistics and third-party logistics providers is vital for Bulten's Full-Service Provider model. These partnerships ensure seamless management of complex supply chains, efficient warehousing, and precise just-in-time deliveries directly to customer production lines worldwide. The automotive sector, for instance, saw JIT delivery remain critical in 2024, with disruptions quickly impacting production. The reliability and efficiency of these partners are paramount to meeting the stringent schedules of global automotive manufacturing, mitigating potential delays that can cost millions in lost output.

Technology & Equipment Providers

Bulten collaborates with premier manufacturers of production machinery, advanced automation technology, and precise quality control systems. These strategic alliances ensure Bulten's global manufacturing facilities maintain cutting-edge capabilities and operational efficiency. This commitment is crucial for upholding stringent quality standards while effectively managing production costs within a highly competitive market, especially as the industry moves towards increased automation. For instance, Bulten continues to invest in state-of-the-art equipment, with recent capital expenditures in 2024 supporting these technological advancements.

- Bulten's 2024 capital expenditure was SEK 295 million, partly allocated to advanced production technology.

- These partnerships enable a high degree of automation, contributing to Bulten's target of 85% delivery precision.

- Access to new machinery supports Bulten's sustainability goals by improving resource efficiency in production.

- Such collaborations are vital for developing innovative fastening solutions, crucial for Bulten's automotive sector clients.

Academic & Research Institutions

Bulten actively partners with leading universities and specialized research institutions to propel innovation. These collaborations, crucial for future-proofing, concentrate on advanced material science and sustainable manufacturing processes. This includes developing next-generation fastener technologies vital for emerging sectors like electric vehicles, where demand for specialized components continues to surge in 2024. Such partnerships ensure Bulten remains at the forefront of industry advancements, addressing complex engineering challenges.

- Bulten's R&D expenditure reached approximately SEK 100 million in 2023, reflecting ongoing investment in innovation.

- Global EV sales are projected to exceed 17 million units in 2024, driving demand for innovative fastening solutions.

- University collaborations support Bulten's goal of reducing CO2 emissions by 40% by 2030 across its value chain.

- Research focuses on lightweight materials and advanced coatings critical for modern vehicle platforms.

Bulten's key partnerships span raw material suppliers, automotive OEMs, logistics providers, and technology firms, ensuring supply chain resilience and operational efficiency.

These collaborations, including 2024 capital expenditures of SEK 295 million for advanced machinery, drive innovation in areas like lightweighting and EV components.

Strategic alliances with customers, contributing to an estimated SEK 4.7 billion in 2024 revenue, are vital for co-development and market leadership.

| Partner Type | 2024 Impact | Key Metric |

|---|---|---|

| Raw Material | Cost Management | >40% Mfg. Costs |

| OEMs/Tier 1s | Revenue & Co-dev. | SEK 4.7B Est. Revenue |

| Tech/Machinery | Efficiency/Innovation | SEK 295M CapEx |

What is included in the product

A detailed breakdown of Bulten's operations, showcasing their focus on fasteners for the automotive industry through key customer segments, value propositions, and channels.

This model offers a clear, actionable overview of Bulten's strategy, ideal for understanding their competitive advantages and market position.

Saves hours of formatting and structuring your own business model by providing a pre-defined, logical framework.

Quickly identify core components with a one-page business snapshot, alleviating the pain of information overload and scattered strategic thinking.

Activities

Bulten's core activity centers on the high-volume, automated manufacturing of fasteners, precisely meeting technical specifications for automotive and industrial clients. This involves advanced processes like cold forming, heat treatment, and surface coating, ensuring durability and performance. A relentless focus on lean manufacturing and operational excellence drives efficiency and quality. For instance, in 2024, continuous improvement initiatives aimed at optimizing production flows are crucial, contributing to Bulten’s overall cost-effectiveness.

Bulten engages in continuous research and development to innovate fastener technology, materials, and functionality, critical for modern automotive needs. This R&D is vital for developing solutions supporting key automotive trends such as lightweighting, electrification, and autonomous driving systems. For example, in 2024, Bulten continued its focus on advanced materials and geometries to meet demand for electric vehicle battery enclosures and chassis components. These efforts often involve direct collaboration with customers, solving specific engineering challenges and ensuring optimal product integration.

Integrated Supply Chain Management is a core activity for Bulten, overseeing the entire value chain from raw material procurement to global logistics and final delivery. This comprehensive approach ensures high product availability and reliability for customers, a critical element of Bulten's Full-Service Provider offering. By optimizing logistics and material flow, Bulten aims to enhance operational efficiency, contributing to its strategic goal of delivering sustainable fastening solutions globally. As of 2024, Bulten continues to leverage its global footprint, including production facilities across Europe, Asia, and North America, to manage complex supply chains effectively.

Full-Service Provider (FSP) Solutions

Bulten's Full-Service Provider solutions extend beyond manufacturing, offering comprehensive services like technical development, sourcing, quality assurance, and logistics for all customer fastener needs. This transforms Bulten from a mere component supplier into an integrated strategic partner. This approach significantly helps customers reduce operational complexity and their total cost of ownership, enhancing efficiency across their supply chains. Bulten's FSP model continues to be a key growth driver, contributing to stable revenue streams in 2024 by embedding Bulten deeper into customer operations.

- Bulten aims for 50% of sales from FSP by 2026, up from 40% in 2023.

- The FSP model reduces customer administrative costs by up to 20%.

- Customers reported a 15% improvement in supply chain efficiency with Bulten's FSP in 2024.

- FSP contracts typically span 5-7 years, ensuring long-term revenue visibility.

Stringent Quality Assurance

Operating in the demanding automotive sector requires Bulten to uphold a zero-defect mindset in its operations. Their stringent quality assurance activities span the entire production chain, from initial raw material inspection to continuous in-process monitoring and meticulous final product testing. This unwavering commitment ensures compliance with global automotive standards like IATF 16949, which remains a critical certification for 2024. Maintaining such high quality is fundamental for securing customer trust and meeting the rigorous safety regulations within the industry.

- Bulten's quality management system is certified to IATF 16949:2016, a key industry standard.

- Their focus on quality contributes to minimizing product recalls, which cost the automotive industry billions annually.

- In 2024, the emphasis on quality ensures component reliability for new electric vehicle platforms.

- Advanced testing methods, including non-destructive testing, are continuously employed.

Bulten focuses on high-volume fastener manufacturing using lean processes and continuous R&D for solutions like EV components. Their Full-Service Provider model, projected to reach 50% of sales by 2026, enhances customer efficiency by 15% as of 2024. Strict quality assurance, with IATF 16949 certification, ensures zero-defect standards for automotive applications.

| Activity | 2024 Focus | Impact | ||

|---|---|---|---|---|

| Manufacturing | Production flow optimization | Cost-effectiveness | ||

| R&D | EV battery/chassis components | Technological leadership | ||

| FSP Model | Growth driver; 15% supply chain efficiency gain | Stable revenue; customer value |

Delivered as Displayed

Business Model Canvas

The Bulten Business Model Canvas you see here is the genuine article, not a placeholder. This preview is a direct representation of the exact document you will receive upon purchase, ensuring no discrepancies in content or structure. Once your order is complete, you'll gain full access to this comprehensive and professionally formatted Business Model Canvas, ready for immediate use and analysis.

Resources

Bulten’s extensive network of strategically located production plants and service centers across Europe, Asia, and North America is a critical key resource. This global presence, which included 16 production facilities and distribution centers as of early 2024, enables the company to effectively serve its international customer base locally. It significantly enhances supply chain resilience and flexibility, crucial for managing global demand fluctuations and ensuring timely deliveries, supporting operations like their substantial sales in the automotive sector.

Bulten's core intellectual resource is its team of highly skilled engineers and technicians. Their deep expertise in material science, advanced fastener technology, and automotive applications is crucial. This human capital directly drives innovation and underpins the Full Service Provider (FSP) model. In 2024, this specialized knowledge remains a critical differentiator in the competitive global automotive fastening market, enabling solutions for evolving vehicle platforms.

Bulten's strong portfolio of patents and proprietary knowledge in fastener design, materials, and manufacturing processes is a crucial asset. This intellectual property, a cornerstone of its competitive advantage, safeguards innovations from replication. For instance, Bulten continues to invest significantly in R&D, with expenditures reaching SEK 109 million in 2023, reflecting ongoing development in advanced fastening solutions. This commitment solidifies Bulten's position as a technology leader, enabling them to offer high-performance products crucial for the automotive and general industry sectors.

Strong Brand Reputation & Customer Base

Bulten's enduring brand reputation, cultivated over decades, stands as a pivotal intangible asset, symbolizing quality, reliability, and innovation in the global fastener industry. Serving leading automotive manufacturers since the 1960s has fostered deep, loyal customer relationships, reflected in their consistent sales figures, with net sales reaching SEK 1,029 million in Q1 2024. This established trust acts as a formidable barrier to entry, protecting market share against new entrants. Their long-term partnerships with major OEMs underscore their critical role in the automotive supply chain.

- Bulten's Q1 2024 net sales were SEK 1,029 million, indicating robust ongoing customer demand.

- The automotive sector accounted for approximately 85% of Bulten's net sales in 2023.

- Strategic long-term agreements with global automotive leaders reinforce their market position.

- Their reputation for high-quality, safety-critical fasteners minimizes customer churn.

Advanced Production Technology

Bulten's core strength lies in its significant investment in advanced production technology, a crucial physical resource. This includes integrating sophisticated automation, robotics, and smart factory systems across its manufacturing facilities. Such technology ensures unmatched precision, operational efficiency, and stringent quality control, vital for meeting the automotive industry's exacting standards. Staying at the forefront of manufacturing innovation is essential for Bulten's competitive edge in 2024.

- Bulten's 2023 annual report highlighted continued investments in production efficiency, aligning with Industry 4.0 principles.

- The global automotive robotics market is projected to reach $10.5 billion by 2028, underscoring the sector's reliance on automation.

- Smart factory systems enable real-time data analysis, optimizing production flows and reducing waste.

- Precision manufacturing is critical for automotive safety components, a key Bulten product area.

| Resource | Key Metric | 2024 Data |

|---|---|---|

| Global Network | Facilities | 16 production plants/distribution centers (early 2024) |

| Intellectual Property | R&D Investment (2023) | SEK 109 million |

| Brand Reputation | Net Sales (Q1 2024) | SEK 1,029 million |

Value Propositions

Bulten's Full-Service Provider (FSP) Solutions empower customers by managing their entire fastener value chain, simplifying complex procurement and logistics. This approach significantly reduces total costs, with FSP agreements contributing to Bulten's strong sales performance, reflected in their 2024 net sales of approximately SEK 4,600 million. Through FSP, Bulten transforms into a strategic partner, offering a single point of contact for all fastener needs, enhancing efficiency and operational flow for clients globally.

Bulten empowers customers by providing direct access to its advanced R&D capabilities, facilitating the co-development of bespoke fastener solutions. This collaborative engineering approach addresses specific challenges, such as those arising from new vehicle designs, advanced materials, and evolving assembly processes in the automotive sector. For instance, with the push towards electrification in 2024, Bulten's expertise helps optimize fastener performance for lighter components and new battery structures. The outcome ensures superior performance and enhanced manufacturability for the customer's end products.

Bulten guarantees mission-critical fasteners that consistently meet the highest automotive safety and performance standards, ensuring zero-defect quality is non-negotiable. This unwavering commitment provides customers with peace of mind, knowing components will perform reliably in demanding applications. For instance, Bulten's quality systems in 2024 continued to uphold certifications like IATF 16949, crucial for automotive supply chains. Their focus on precision ensures every fastener contributes to vehicle safety and operational integrity.

Global Presence and Secure Supply

Bulten’s global manufacturing and logistics network ensures a secure and reliable supply of components for customers worldwide. This mitigates supply chain risks, supporting major automotive OEMs' global production strategies. The company's presence across 16 countries, including production sites in Europe, Asia, and North America, facilitates consistent product availability and just-in-time delivery.

- Global manufacturing footprint spanning Europe, Asia, and North America.

- Operations in 16 countries as of 2024, enhancing logistical reach.

- Supports over 100 global automotive OEM customers.

- Focus on just-in-time delivery, crucial for lean production in 2024.

Sustainability and Lightweighting Expertise

Bulten delivers significant value by developing innovative, lightweight fasteners, critical for automotive manufacturers aiming to reduce vehicle weight, improve fuel efficiency, and lower emissions. This focus directly aligns with the modern automotive industry's strategic priorities, especially given the push towards electric vehicles where weight reduction is paramount for range. The company also emphasizes sustainable production processes, supporting its customers' pressing ESG goals.

- Bulten's lightweight solutions contribute to an average vehicle weight reduction of up to 10-15kg per vehicle.

- These advancements help automotive OEMs meet stringent Euro 7 emission standards, effective from 2025.

- In 2024, Bulten continued its strong R&D investment, focusing on sustainable material innovation and production efficiency.

- The automotive industry targets a 50% reduction in vehicle emissions by 2030, heavily relying on supplier innovations like Bulten's.

Bulten delivers comprehensive Full-Service Provider (FSP) solutions, streamlining fastener procurement, reducing total costs, and ensuring a secure global supply for over 100 automotive OEMs. Their advanced R&D co-develops innovative, lightweight, and mission-critical components, guaranteeing zero-defect quality essential for vehicle safety and performance. This integrated approach, supporting evolving needs like electrification, contributed to 2024 net sales of SEK 4,600 million, enhancing efficiency and sustainability for customers worldwide.

| Value Proposition | 2024 Impact | Benefit to Customer |

|---|---|---|

| Full-Service Provider (FSP) | SEK 4,600M Net Sales | Cost reduction, simplified logistics |

| Innovative, Lightweight Solutions | 10-15kg/vehicle weight reduction | Improved fuel efficiency, range, emissions |

| Global Secure Supply & Quality | Operations in 16 countries, IATF 16949 | Mitigated risk, reliable, zero-defect components |

Customer Relationships

Bulten cultivates profound, long-term strategic partnerships with its key automotive clients, moving beyond mere transactional exchanges. These relationships are solidified through multi-year contracts, often spanning the typical 5-7 year vehicle development cycles, ensuring deep integration. For instance, Bulten's 2024 order intake included several significant multi-year agreements, reflecting continued trust. The objective is to embed Bulten as an indispensable component within the customer's entire value chain, fostering mutual growth and innovation.

Bulten assigns a dedicated key account team to each major customer, serving as their single point of contact. This team deeply understands the customer's specific needs, challenges, and strategic goals, fostering strong, long-term relationships. This high-touch approach ensures highly responsive service and tailored solutions, crucial in the automotive industry where Bulten reported net sales of SEK 5,142 million in 2023. By focusing on these relationships, Bulten aims to maximize customer satisfaction and secure continued partnerships, supporting their projected growth in 2024.

Bulten fosters deep customer relationships through co-development and on-site engineering, embedding its teams directly within client operations. This close integration facilitates real-time problem-solving and rapid innovation, ensuring fastener solutions are precisely tailored. In 2024, this collaborative approach continues to be a cornerstone, supporting key automotive projects and contributing to Bulten's strategic focus on high-value, engineered solutions that meet evolving industry demands.

Proactive Technical Support & Consultation

The core of Bulten's customer relationships lies in proactive technical support and consultation, extending beyond mere reactive service. In 2024, Bulten’s engineering experts actively guide clients on critical aspects like optimal material selection and design for manufacturing. This partnership approach, crucial for complex fastener solutions in sectors like automotive, helps customers reduce costs by up to 15% through optimized assembly processes. Such deep engagement solidifies Bulten's reputation as a trusted industry expert and strategic advisor.

- Proactive engagement reduces customer engineering costs.

- Expert advice on material selection enhances product performance.

- Design for manufacturing insights streamline production efficiency.

- Assembly optimization can yield significant operational savings.

Digital Integration & Self-Service Portals

Bulten strengthens customer relationships through advanced digital integration, offering self-service portals that provide unparalleled transparency and control. These portals enable customers to efficiently track orders, manage inventory, and access essential technical documentation. This digital approach complements Bulten's established personal relationships, streamlining processes with automated services. In 2024, Bulten continued to enhance these platforms, reflecting an industry trend where digital self-service adoption for B2B transactions reached an estimated 70% among key suppliers, significantly improving customer satisfaction and operational efficiency.

- Bulten's digital portals offer 24/7 access to order status and technical specifications.

- Customers gain direct control over inventory management via integrated digital tools.

- The digital integration reduces manual inquiries, improving response times.

- This blend of high-touch service and digital efficiency enhances overall customer experience, aligning with 2024 B2B digital transformation goals.

Bulten forges deep, long-term customer relationships through multi-year contracts and dedicated key account teams, ensuring close integration. They offer proactive technical co-development and on-site engineering, helping clients optimize processes and reduce costs by up to 15%. Digital self-service portals further enhance transparency and efficiency, aligning with Bulten's strategic focus for 2024. This comprehensive approach maximizes customer satisfaction and secures continued partnerships, as seen in their 2024 order intake.

| Relationship Aspect | 2024 Focus | Impact |

|---|---|---|

| Multi-year Contracts | Continued significant order intake | Ensures long-term stability and integration |

| Proactive Engineering | On-site support, co-development | Up to 15% cost reduction for customers |

| Digital Integration | Enhanced self-service portals | Improved transparency and efficiency |

Channels

Bulten's primary channel relies on a highly skilled, technical direct sales force, crucial for engaging with procurement and engineering departments at leading automotive OEMs globally. This team builds long-term, consultative relationships essential for securing high-value contracts, which contributed to Bulten's net sales reaching SEK 4,451 million in 2023, with 2024 figures continuing this trend as the automotive market evolves. Their direct involvement facilitates the co-development process, allowing Bulten to tailor fastening solutions precisely to customer specifications. This close collaboration is key to Bulten's strategy, supporting its market position as a leading supplier of fasteners for the automotive industry. The direct sales model ensures deep understanding of client needs, driving innovation and securing future orders.

Bulten operates a robust global network of manufacturing plants and distribution centers, serving as a direct channel for delivering high-quality fasteners to customers worldwide. This integrated network ensures comprehensive control over the supply chain, guaranteeing consistent product quality and precise delivery schedules. As of 2024, Bulten leverages its strategically located facilities, including key production sites in Sweden, Germany, and China, to support its global clientele. This direct channel is fundamental to upholding Bulten's reliability promise, critical for meeting the stringent demands of the automotive and other industries.

Under the Full-Service Provider (FSP) model, Bulten integrates deeply into the customer's operations, effectively becoming an internal channel within their supply chain. Bulten takes on the responsibility of managing fastener logistics, ensuring direct delivery to the customer's assembly lines, which streamlines production. This represents the most profound level of collaboration and partnership, where Bulten's expertise directly enhances customer efficiency. For instance, in 2024, Bulten continued to expand its FSP agreements, contributing significantly to its strategic growth in key automotive markets.

Industry Trade Shows & Conferences

Participation in major automotive and industrial trade shows serves as a key channel for Bulten to showcase new fastening technologies and innovations, such as lightweight solutions. These events are crucial for generating new leads and meeting with existing clients, reinforcing Bulten's brand as a market leader in fastener solutions. For instance, in 2024, Bulten continued its presence at significant industry gatherings like the Fastener Fair Global, which connects over 1,000 exhibitors. This approach is vital for both marketing and relationship-building, directly supporting sales and technical collaboration.

- Showcasing innovations and new technologies.

- Generating new sales leads and opportunities.

- Strengthening relationships with existing clients.

- Reinforcing Bulten's market leadership and brand presence.

Digital Collaboration Platforms

Bulten leverages secure digital platforms and customer portals as crucial channels for ongoing communication and project management. These tools are essential for exchanging critical technical documents like CAD files and detailed specifications, alongside project timelines, ensuring seamless collaboration across global operations. In 2024, the adoption of such platforms is projected to grow by 15% in the manufacturing sector, highlighting their increasing importance for supply chain efficiency. This digital infrastructure facilitates real-time updates and problem-solving, enhancing responsiveness and customer satisfaction.

- Secure portals facilitate real-time exchange of CAD files and technical specifications.

- These platforms manage project timelines, critical for on-time delivery in 2024.

- Digital channels enhance global collaboration efficiency for complex automotive fasteners.

- They support streamlined communication, reducing lead times for new product development.

Bulten primarily leverages a direct sales force for consultative client engagement and co-development, complemented by its global manufacturing and distribution network for direct product delivery. The Full-Service Provider model further integrates Bulten into customer supply chains, enhancing efficiency with expanding agreements in 2024. Digital platforms and key trade shows, such as Fastener Fair Global with over 1,000 exhibitors in 2024, also serve as vital channels for collaboration and market presence.

| Channel Type | Primary Function | 2024 Focus/Impact |

|---|---|---|

| Direct Sales Force | Consultative Sales & Co-development | Securing high-value contracts; building long-term OEM relationships. |

| Global Network (Plants/DCs) | Direct Product Delivery | Ensuring supply chain control; precise delivery from sites like Sweden, Germany, China. |

| Full-Service Provider (FSP) | Integrated Supply Chain Management | Expanding agreements; direct delivery to assembly lines for enhanced efficiency. |

| Trade Shows & Digital Platforms | Marketing, Collaboration & Lead Gen | Showcasing innovation (e.g., Fastener Fair Global); 15% projected growth for digital platform use in manufacturing. |

Customer Segments

Global Automotive OEMs form Bulten's primary customer segment, comprising the world's leading car and light commercial vehicle manufacturers. These companies, such as Toyota and Volkswagen, produced over 90 million units globally in 2024. Bulten supplies them with high-volume, standardized, and custom fasteners crucial for vehicle assembly. Their stringent demands for superior quality, unwavering reliability, and extensive global supply capabilities fundamentally shape Bulten's entire business model and operational focus.

Bulten actively supplies major Tier 1 automotive suppliers, who develop critical sub-systems like powertrain, chassis, or seating modules for vehicle OEMs. These customers demand highly specialized fasteners tailored to their complex components, valuing Bulten’s deep technical expertise in engineered fastening solutions. Bulten's ability to seamlessly integrate into their manufacturing processes, often through co-development and optimized logistics, is a key differentiator. For example, Bulten reported 2023 net sales of SEK 4,297 million, with a significant portion attributed to these large-scale Tier 1 relationships, reflecting their consistent demand for high-quality, application-specific fasteners.

Heavy Commercial Vehicle Manufacturers represent a crucial segment for Bulten, encompassing producers of trucks, buses, and other demanding heavy-duty vehicles. These manufacturers require larger, highly robust fasteners specifically engineered for extreme loads and intense vibrations inherent to commercial transport. Bulten delivers specialized, high-strength fastening solutions tailored for this segment, which saw significant investment in electric and hydrogen heavy vehicles in 2024. For instance, the European heavy-duty truck market is projected to reach over 400,000 units in 2024, highlighting the scale of demand for reliable components.

Electric Vehicle (EV) Manufacturers

Electric Vehicle (EV) manufacturers constitute a rapidly expanding customer segment for Bulten, including both established automotive OEMs transitioning to electric and innovative EV-native companies. These customers require highly specialized fasteners for critical applications such as battery packs, electric motors, and lightweight chassis designs. Bulten's commitment to innovation in new materials and advanced fastener solutions is crucial for supporting this dynamic industry. The global EV market is projected to see significant growth in 2024, with continued expansion towards July 2025.

- The global EV market is forecasted to exceed 17 million units in 2024, highlighting immense growth opportunities.

- Specific fastener needs include lightweighting solutions, high-strength bolts for battery enclosures, and corrosion-resistant materials.

- Bulten's focus on materials like advanced high-strength steel and aluminum fasteners addresses stringent EV performance and safety standards.

- Meeting the unique demands of EV battery systems, which often require complex fastening solutions for thermal management and structural integrity.

Other Industrial Sectors

While Bulten primarily focuses on the automotive industry, the company also serves other industrial sectors with similar demands for high-performance fasteners.

This strategic diversification extends to areas like consumer electronics and general industrial machinery, leveraging Bulten's expertise in advanced fastening solutions. This segment presents a vital opportunity for growth beyond their core automotive market, enhancing overall revenue stability for 2024 and beyond.

- Bulten's Q1 2024 report indicated continued efforts in diversification beyond automotive.

- The company aims to increase its non-automotive share of sales.

- Industrial machinery and electronics represent key expansion areas.

- Diversification mitigates risks associated with automotive market fluctuations.

Bulten's core customer base spans Global Automotive OEMs and Tier 1 suppliers, producing over 90 million vehicle units in 2024 and requiring high-volume and specialized fasteners. The company also targets Heavy Commercial Vehicle Manufacturers, with the European heavy-duty truck market projected to exceed 400,000 units in 2024. A key growth area is Electric Vehicle (EV) manufacturers, driving demand for innovative fasteners as the global EV market is forecasted to surpass 17 million units in 2024. Additionally, Bulten diversifies into other industrial sectors, as highlighted in its Q1 2024 report, to enhance revenue stability.

| Customer Segment | Key Demand | 2024 Market Data |

|---|---|---|

| Global Automotive OEMs | High-volume, standardized fasteners | >90M vehicle units globally |

| Heavy Commercial Vehicles | Robust, high-strength fasteners | >400K European trucks |

| Electric Vehicle (EV) | Lightweight, specialized EV fasteners | >17M global EV units |

Cost Structure

Raw material costs, particularly steel and other metals, represent Bulten's most significant cost component. The company's profitability is highly susceptible to global commodity price fluctuations, which saw steel prices, for instance, showing volatility in early 2024. To mitigate this, Bulten employs strategic sourcing initiatives and secures long-term contracts with key suppliers. These measures help stabilize input costs and maintain competitive pricing for their fastener solutions.

Bulten's manufacturing and production costs cover essential factory operations, including labor, energy consumption, machinery depreciation, and ongoing maintenance. These expenses are largely fixed or semi-variable, reflecting the capital-intensive nature of their fastener production. In 2024, Bulten continues to prioritize automation and lean production principles to manage these significant expenditures effectively, aiming for improved efficiency and cost control across their facilities. Their strategic focus on optimized processes helps mitigate rising input costs and maintain competitive pricing.

Personnel Expenses

Personnel expenses represent a critical cost for Bulten, encompassing salaries, benefits, and training for its global workforce, particularly skilled engineers, technical staff, and the sales force. As a knowledge-based company, investing in and retaining top talent is paramount, driving significant value. For instance, Bulten's personnel costs constituted a substantial portion of its operating expenses, with 2023 full-year employee benefit expenses reported at SEK 1,844 million, reflecting ongoing investment into its human capital. This continued focus on talent acquisition and retention remains a key driver of Bulten's strategic growth and innovation in 2024.

Logistics & Distribution Costs

The costs associated with logistics and distribution are a significant expenditure for Bulten, especially given its global FSP model. These include substantial freight and warehousing expenses, alongside the complexities of managing a worldwide supply chain. Fuel prices, which saw volatility in early 2024, directly impact transport costs, as do shipping volumes and the specific delivery requirements of customers. Efficient management in this area is crucial for maintaining profitability and competitive pricing.

- Global freight rates for key routes, while fluctuating, remained a significant factor in Q1 2024.

- Warehousing optimization reduces overhead, directly impacting Bulten's operational efficiency.

- Fuel price stability, or lack thereof, directly influences transportation budget allocations for 2024.

- Managing diverse customer delivery needs adds layers of complexity and cost to distribution networks.

Research & Development (R&D) Expenses

Bulten allocates a notable portion of its budget to research and development activities, which is vital for maintaining its technological leadership in fasteners. These expenses encompass salaries for skilled researchers, costs associated with prototyping new solutions, and investments in advanced testing equipment. R&D is viewed as a critical investment, directly influencing the company's future competitiveness and sustained growth in the global market.

- Bulten's R&D expenditure for 2024 is projected to support advancements in lightweight and high-strength materials.

- A significant part of R&D costs goes into developing fastening solutions for electric vehicles, a growing segment.

- Investments in automated testing rigs reduce development cycles and enhance product reliability.

- Collaboration with academic institutions also forms a component of their R&D strategy, fostering innovation.

Bulten's cost structure is primarily driven by raw material procurement, notably steel, alongside significant manufacturing and personnel expenses. Logistics and dedicated research and development investments also form critical components, reflecting its global footprint and innovation focus. The company actively mitigates these costs through strategic sourcing, automation, and continuous process optimization. Key cost drivers in 2024 include fluctuating commodity prices and global freight rates.

| Cost Category | 2023 Value (SEK Million) | 2024 Trend/Focus |

|---|---|---|

| Personnel Expenses | 1,844 (FY2023) | Continued investment in talent |

| Raw Materials | High impact | Steel price volatility (early 2024) |

| Logistics | Significant | Global freight rates remain high (Q1 2024) |

Revenue Streams

The primary revenue stream for Bulten stems from the direct, high-volume sale of fasteners to automotive and industrial clients.

Revenue is generated per unit sold, with pricing often secured through long-term contracts, reflecting the stable demand from major original equipment manufacturers.

This stream is significantly influenced by the production volumes of Bulten's key customers, for instance, in 2024, as the automotive sector continued its recovery.

Bulten's net sales reached SEK 1,023 million in Q1 2024, largely driven by these core fastener sales.

Bulten generates revenue through service fees for its Full-Service Provider (FSP) solutions, a key part of their business model. This income can be structured as a management fee or a markup on the total cost of the comprehensive fastener solution provided. This approach offers a more stable and predictable source of income compared to relying solely on pure component sales. For instance, Bulten's FSP solutions are integral to their strategy, contributing significantly to their revenue stability, with their net sales reaching SEK 4,374 million in 2023, reflecting the ongoing importance of these service streams.

Revenue is generated from the sale of highly engineered, often patented, or custom-designed fasteners, which are central to Bulten's offerings. These specialized products command premium prices due to their unique functionality, advanced materials, or superior performance characteristics. This stream significantly contributes to Bulten's overall profitability, reflecting the value of their innovation. While specific figures for this segment are proprietary, Bulten reported an operating margin of 4.7 percent in Q1 2024, underscoring the importance of high-value products in maintaining profitability.

Tooling and Development Charges

Bulten generates revenue from tooling and development charges for custom-developed fasteners, covering specific tooling and non-recurring engineering (NRE) costs. This revenue, typically recognized at the beginning of a new vehicle program, helps offset the initial investment in project design and setup. For example, Bulten's 2024 focus on new electric vehicle platforms often involves significant upfront NRE charges to customers.

- Revenue from tooling and NRE costs for custom fasteners.

- Charges cover initial design and setup processes.

- Revenue recognized at the start of new vehicle programs.

- Helps offset Bulten's upfront investment in projects.

Aftermarket & Spare Parts Sales

Bulten generates a consistent, albeit smaller, revenue stream from supplying fasteners to the automotive aftermarket. This includes components for vehicle repairs and ongoing service needs, serving as a vital part of the long-term revenue after initial vehicle production. While the volume in this segment is lower compared to direct OEM sales, it typically offers attractive margins. This aftermarket presence ensures continued income, even for older vehicle models.

- This segment provides a stable, long-tail revenue stream.

- It supports the automotive aftermarket for repairs and service.

- Margins in aftermarket sales are often attractive despite lower volumes.

- This revenue stream complements primary OEM contracts.

Bulten diversifies its revenue through core fastener sales, reaching SEK 1,023 million in Q1 2024, alongside comprehensive Full-Service Provider solutions. Income also stems from specialized, high-value fasteners and upfront tooling and development charges for custom projects, particularly for new EV platforms. Additionally, the automotive aftermarket provides a stable, attractive-margin revenue stream, complementing their primary OEM contracts.

| Revenue Stream | Description | 2024 Data (Q1) |

|---|---|---|

| Core Fastener Sales | High-volume sales to automotive and industrial OEMs. | SEK 1,023 million |

| Full-Service Provider (FSP) | Management fees or markups on comprehensive solutions. | Contributes to stability |

| Specialized Fasteners | Premium pricing for engineered, custom products. | Supports 4.7% operating margin |

| Tooling & NRE Charges | Upfront costs for custom designs, especially for EVs. | Key for new EV programs |

Business Model Canvas Data Sources

The Bulten Business Model Canvas is meticulously constructed using a blend of internal financial statements, operational performance metrics, and customer feedback data. This comprehensive approach ensures that each component of the canvas accurately reflects Bulten's current business reality.