The Burnet Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Burnet Group Bundle

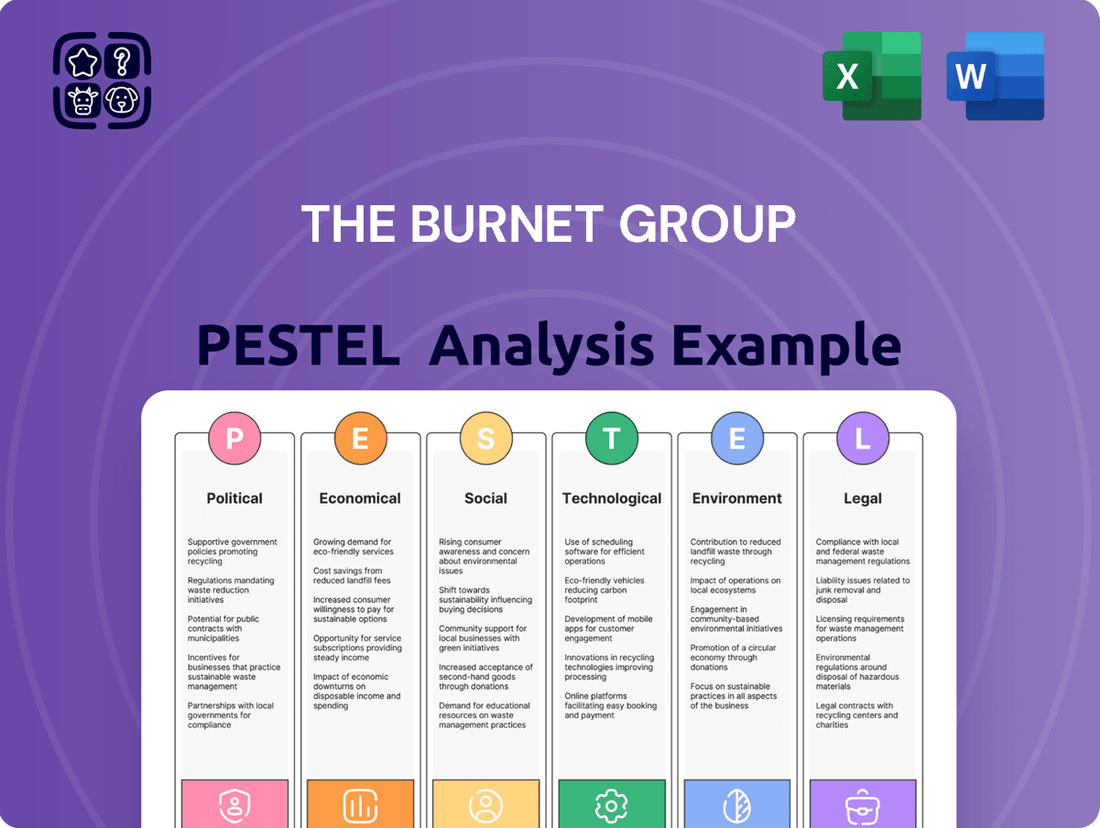

Navigate the complex external landscape affecting The Burnet Group with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. This expertly crafted analysis offers actionable intelligence to inform your strategic decisions. Don't get left behind; gain a competitive edge by uncovering these vital insights. Purchase the full PESTLE analysis now and unlock a deeper understanding of The Burnet Group's market dynamics.

Political factors

Government policies on urban planning and zoning are critical for The Burnet Group. For example, in 2024, many cities are implementing stricter zoning laws to encourage mixed-use developments, which can impact the feasibility of traditional residential projects. The group needs to stay abreast of these changes to guide clients effectively.

Regulations concerning sustainable development and green building standards are also gaining traction. By late 2024, a significant percentage of new construction projects are expected to adhere to enhanced energy efficiency mandates, potentially increasing initial development costs but also opening avenues for eco-conscious investment opportunities that appeal to a growing market segment.

Incentive programs, such as tax credits for affordable housing initiatives or infrastructure development bonds, can significantly shape investment strategies. For instance, a new federal program announced in early 2025 offers substantial tax relief for developers building in designated opportunity zones, a key area for The Burnet Group to explore for client portfolios.

The Burnet Group's advisory role requires a deep understanding of how these evolving policies, including potential shifts in property taxation or land use regulations, directly influence investment returns and development viability across different real estate sectors.

Changes in property taxes, capital gains taxes, and other real estate-specific fees directly affect investment profitability. For instance, a rise in capital gains tax from 20% to 25% could significantly reduce net returns for The Burnet Group's clients in 2024/2025.

A supportive tax climate generally encourages capital inflow, whereas higher tax burdens can discourage investment activity. The Burnet Group must therefore develop advanced financial models that accurately incorporate these varying tax considerations to guide client decisions.

Political stability is a cornerstone for attracting and retaining investor confidence, particularly in the real estate sector where long-term commitments are common. For instance, countries experiencing consistent governance and predictable regulatory environments, like Switzerland, often see higher foreign direct investment in property. This stability directly translates into reduced risk premiums for investors.

Geopolitical tensions and evolving trade policies, however, can inject significant uncertainty into global markets. The ongoing trade disputes between major economies in 2024, for example, have led to increased volatility in international capital flows, impacting real estate markets by creating hesitations in cross-border investment. These shifts can dramatically alter market sentiment and investment appetite.

The Burnet Group's strategic advice hinges on its ability to integrate thorough assessments of these broader political risks. Understanding how potential trade disruptions or shifts in international relations might affect specific markets, such as the impact of sanctions on real estate investment in affected regions, is crucial for providing clients with truly robust and forward-looking guidance.

Government Incentives for Specific Sectors

Government initiatives aimed at stimulating growth in particular real estate segments, like data centers, life sciences, or build-to-rent accommodations, present significant profit potential. For instance, the US government's CHIPS and Science Act of 2022, with its over $50 billion in funding, is designed to boost domestic semiconductor manufacturing, indirectly benefiting data center development and related real estate. Similarly, the Inflation Reduction Act of 2022 offers tax credits that can spur investment in energy-efficient construction, impacting the build-to-rent sector.

These incentives often manifest as direct grants, advantageous tax concessions, or expedited regulatory pathways. The Burnet Group can capitalize on these by proactively identifying and integrating them into client strategies.

Key areas benefiting from such policies include:

- Data Centers: Governments worldwide are offering tax breaks and grants to encourage the development of domestic data infrastructure, recognizing its critical role in the digital economy.

- Life Sciences: Significant investment, often supported by government R&D grants and tax credits, is being channeled into life sciences hubs, driving demand for specialized laboratory and research facilities.

- Build-to-Rent Housing: In many markets, governments are providing incentives like reduced property taxes or development subsidies to encourage the construction of rental housing to address affordability issues.

Regulatory Environment and Ease of Doing Business

The United States' regulatory landscape significantly influences property development. In 2024, efforts to streamline permitting processes are ongoing, aiming to reduce project timelines and associated costs. For instance, some states have implemented faster review periods for certain types of construction, potentially cutting weeks off initial development phases.

The ease of navigating bureaucratic procedures directly impacts The Burnet Group's clients. A complex web of zoning laws, environmental reviews, and building codes can add substantial time and expense. Efficiently guiding clients through these requirements is a core component of their strategic planning services.

For example, the time it takes to obtain a building permit can vary dramatically. In 2023, the average time for a major commercial project in some metropolitan areas exceeded six months, highlighting the need for expert navigation. The Burnet Group's expertise helps mitigate these delays.

Key factors influencing ease of doing business in property development include:

- Permitting efficiency: Streamlined processes reduce project lead times.

- Zoning regulations: Clarity and flexibility in zoning impact development potential.

- Environmental compliance: Navigating environmental impact assessments is crucial.

- Property transaction laws: Clear and predictable legal frameworks facilitate smoother deals.

Government policies on urban planning and zoning continue to shape real estate development, with many cities in 2024 focusing on mixed-use zoning to foster vibrant communities. Regulatory focus on sustainable building standards is also intensifying, with a notable increase in projects adhering to enhanced energy efficiency by late 2024, potentially increasing initial costs but appealing to a growing eco-conscious market. Incentive programs, such as the early 2025 federal initiative offering substantial tax relief for developments in designated opportunity zones, present significant opportunities for The Burnet Group to leverage for client portfolios.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting The Burnet Group, providing a comprehensive understanding of its external operating landscape.

It offers actionable insights into emerging trends and potential challenges, equipping stakeholders with the knowledge to develop robust strategies and capitalize on opportunities.

The Burnet Group's PESTLE Analysis offers a clear and concise version that can be dropped into PowerPoints or used in group planning sessions, effectively alleviating the pain of complex data presentation.

Economic factors

Interest rate fluctuations are a significant economic factor impacting real estate investment. Central banks, like the Federal Reserve, adjust rates to control inflation, directly affecting how much it costs to borrow money for development and purchasing properties. For instance, in early 2024, the Federal Funds Rate remained in the 5.25%-5.50% range, a level maintained to combat persistent inflation.

These rate adjustments have a direct consequence on investor returns and the overall affordability of debt. When interest rates are low, borrowing becomes cheaper, encouraging more investment and activity in the real estate market. Conversely, higher interest rates can dampen market enthusiasm, as the cost of financing increases, potentially slowing down transactions and development.

Inflation directly impacts property values and rental income potential, while also significantly driving up construction costs. For instance, the Producer Price Index for construction materials saw a notable year-over-year increase in early 2024, impacting project budgets. This dynamic means The Burnet Group's financial modeling must carefully project these rising expenses and their effect on real estate investment profitability.

Managing inflationary pressures is crucial; uncontrolled inflation can quickly diminish the real returns on real estate investments. Conversely, predictable inflation allows for more reliable financial forecasting, enabling more robust valuation models. The Burnet Group's expertise in financial modeling is therefore essential for clients to navigate these economic uncertainties and ensure project feasibility.

Economic growth, as measured by Gross Domestic Product (GDP) performance, is a critical driver for commercial real estate. A strong GDP indicates a healthy economy where businesses are expanding and consumers are spending, directly translating to higher demand for office, retail, and industrial properties. For instance, the projected global GDP growth for 2024 is around 3.2%, suggesting a supportive environment for real estate markets.

When economies expand, businesses tend to hire more people and increase their operational footprints, which fuels the need for office space. Simultaneously, rising consumer confidence and disposable income boost retail sales, benefiting the retail property sector. The Burnet Group closely tracks these GDP trends to anticipate shifts in real estate demand.

The United States economy, for example, saw a GDP growth of approximately 2.5% in 2023, and projections for 2024 remain positive, indicating continued underlying demand for commercial spaces. This sustained economic activity is a key factor The Burnet Group considers when forecasting market performance and advising clients.

Availability of Credit and Lending Standards

The availability of credit and the strictness of lending standards are crucial for real estate investment. When banks and other lenders make it easier to get loans, it often leads to more development and property purchases. Conversely, if credit becomes harder to obtain, it can slow down the market.

In late 2024 and early 2025, the Federal Reserve's monetary policy continues to shape credit conditions. While interest rates have stabilized compared to earlier periods, lending standards remain a key factor for developers and investors. For instance, commercial real estate loan growth has seen varied performance, with some sectors experiencing tighter underwriting due to higher capital costs and evolving risk assessments.

Here are some key aspects:

- Lending Standards: Banks are scrutinizing loan-to-value ratios and debt-service coverage more closely, especially for properties with uncertain income streams.

- Interest Rates: While not as volatile as in 2023, the prevailing interest rate environment directly impacts the cost of borrowing and thus project feasibility.

- Credit Availability: Access to capital for new construction and acquisitions remains dependent on lender confidence in market stability and borrower financial health.

- Impact on Investment: Tighter credit can curb transaction volumes, while a more accommodating credit market can stimulate activity and support property valuations.

Employment Rates and Consumer Spending

High employment rates are a significant driver for consumer spending, directly impacting demand across commercial real estate sectors. As more people are employed, disposable income rises, fueling purchases of goods and services, which in turn boosts retail and office space requirements. For instance, the US unemployment rate hovered around 3.9% in early 2024, a historically low figure that generally supports robust consumer activity.

This strong labor market also underpins the residential property market. Increased job security and higher wages translate into greater demand for housing, influencing both sales and rental markets. Furthermore, businesses, seeing increased consumer demand, are more likely to expand, leading to greater absorption of office and industrial spaces. The Burnet Group actively monitors these employment trends to forecast market performance and inform strategic decisions for clients.

- Low Unemployment: A low unemployment rate, such as the projected 3.8% for the US in 2025, signals a healthy economy where consumers have the confidence and means to spend.

- Consumer Confidence: Employment directly correlates with consumer confidence, which is a key indicator for retail sales and service sector growth.

- Business Expansion: Strong employment figures encourage businesses to invest and expand, increasing demand for commercial properties like offices and warehouses.

- Residential Demand: A stable job market is crucial for mortgage affordability and rental demand, supporting the residential real estate sector.

Economic growth, particularly GDP, fuels commercial real estate demand as businesses expand and consumer spending rises. For 2024, global GDP growth is anticipated around 3.2%, with the US economy showing resilience with a projected 2.5% growth in 2023 and positive outlook for 2024. This sustained activity directly influences the need for office, retail, and industrial spaces, making GDP a key indicator for market performance analysis.

Interest rate movements, guided by central banks like the Federal Reserve, directly impact borrowing costs for real estate. The Federal Funds Rate remained between 5.25%-5.50% in early 2024 to control inflation, affecting investor returns and affordability. Higher rates increase financing costs, potentially slowing transactions, while lower rates stimulate market activity.

Inflation, evidenced by rising construction material costs in early 2024, impacts property values and operational expenses. Managing inflation is crucial for preserving real returns on investments; predictable inflation aids financial forecasting, enhancing the robustness of valuation models.

Employment levels are a strong indicator of consumer spending and, consequently, real estate demand. The US unemployment rate, around 3.9% in early 2024, supports robust consumer activity, boosting demand for retail and office spaces. A stable job market also underpins residential demand through increased mortgage affordability and rental capacity.

| Economic Factor | Key Data Point (2024/2025) | Impact on Real Estate |

|---|---|---|

| Global GDP Growth | Projected 3.2% (2024) | Supports demand for commercial properties |

| US GDP Growth | ~2.5% (2023), positive 2024 outlook | Drives expansion and hiring, increasing space needs |

| Federal Funds Rate | 5.25%-5.50% (early 2024) | Influences borrowing costs and investment returns |

| US Unemployment Rate | ~3.9% (early 2024), projected 3.8% (2025) | Boosts consumer spending and housing demand |

| Construction Material Costs | Notable year-over-year increase (early 2024) | Increases development expenses and impacts project feasibility |

What You See Is What You Get

The Burnet Group PESTLE Analysis

The preview you see here showcases the complete Burnet Group PESTLE analysis, offering a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business. What you're previewing here is the actual file, fully formatted and professionally structured, providing you with immediate access to valuable strategic insights. This detailed analysis is designed to equip you with the knowledge needed to navigate external influences effectively. The content and structure shown in the preview is the same document you’ll download after payment, ensuring you receive exactly what you expect.

Sociological factors

Demographic shifts are profoundly reshaping real estate demand. For instance, the U.S. population is projected to reach over 370 million by 2030, with a growing segment of individuals aged 65 and older. This age demographic directly fuels demand for senior living facilities and specialized healthcare properties. Simultaneously, the rise of smaller household sizes and a continued preference for urban living are boosting the need for multifamily housing in metropolitan areas.

Migration patterns also play a crucial role, with Sun Belt states in the U.S. experiencing significant in-migration, driving up demand for all property types in those regions. The Burnet Group leverages detailed demographic data, such as the projected growth of the 25-34 age cohort in key markets for 2024-2025, to pinpoint areas ripe for development and advise clients on strategic site selection for student housing or starter homes.

The widespread adoption of remote and hybrid work models, accelerated by events in 2020, has fundamentally reshaped demand for traditional office spaces. Data from Q4 2024 indicates a sustained vacancy rate of around 18% in prime office markets across major global cities, reflecting this ongoing trend. This necessitates new strategies for office portfolio optimization.

The Burnet Group observes that successful adaptation requires a focus on flexibility, enhanced amenities, and the creation of collaborative environments that draw employees back to the office. For instance, companies are increasingly investing in flexible lease terms and reconfiguring existing spaces to prioritize shared workspaces and meeting hubs over individual desks.

Consumer preferences are rapidly shifting towards experiences over possessions. For instance, a 2024 report indicated that over 60% of consumers prioritize spending on travel and dining out, influencing the demand for mixed-use developments that offer entertainment and lifestyle amenities alongside retail. This trend necessitates a reevaluation of commercial property design to incorporate more adaptable spaces that cater to these evolving desires.

Sustainable living is no longer a niche interest but a mainstream expectation. Data from 2025 surveys reveal that a significant majority of consumers actively seek out brands and businesses with strong environmental, social, and governance (ESG) credentials. This translates to a growing demand for properties that feature green building certifications and promote eco-friendly lifestyles, impacting everything from material sourcing to energy efficiency in commercial developments.

The rise of the "experience economy" means that consumers are looking for more than just a place to shop or work; they want engaging environments. Mixed-use developments that blend retail, residential, and entertainment components are becoming increasingly popular, reflecting a desire for convenience and integrated lifestyles. The Burnet Group assists clients in identifying and capitalizing on these shifts, ensuring their projects resonate with contemporary consumer values and choices.

Urbanization and Suburbanization Trends

Urbanization remains a significant global force, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. However, a notable counter-trend is the increasing migration towards suburban and exurban areas, particularly in developed economies. This shift is often fueled by a desire for greater affordability and more living space, as evidenced by the continued growth in housing starts in these regions. For instance, in the United States, while major cities continue to attract residents, many metropolitan areas are experiencing faster population growth in their surrounding suburban counties.

This dynamic interplay between urban concentration and suburban expansion presents a complex landscape for businesses like The Burnet Group. Understanding these migratory patterns is crucial for identifying emerging market opportunities. For example, the increasing demand for housing and amenities in suburban areas can translate into significant growth potential for sectors such as retail, construction, and local services. The Burnet Group leverages sophisticated market analysis to pinpoint these high-growth corridors, enabling clients to capitalize on both urban revitalization and suburban development.

- Urban Population Growth: Global urban population is projected to reach 6.7 billion by 2050, up from 4.4 billion in 2020.

- Suburban Migration Drivers: Factors like the median home price increase in urban centers versus suburban areas significantly influence residential choices.

- Economic Impact: Growth in suburban areas often leads to increased local employment and demand for infrastructure development.

- Market Opportunity: Identifying areas experiencing net in-migration, both urban and suburban, is key for strategic business expansion.

Social Responsibility and Community Impact

There's a growing expectation for businesses, including real estate developers like The Burnet Group, to actively contribute positively to society. This means looking beyond just building structures and considering the broader social impact. For instance, in 2024, there's a noticeable trend of municipalities incorporating social impact assessments into zoning approvals, requiring developers to demonstrate community benefits. This often translates to demands for affordable housing components or investments in local infrastructure.

The Burnet Group is navigating this shift by advising clients on how to proactively integrate social responsibility into their project planning. This includes identifying opportunities for community engagement throughout the development lifecycle and ensuring equitable development practices are considered. A key focus area is often the provision of affordable housing, a critical need in many urban centers.

Looking ahead to 2025, this emphasis is projected to intensify. Data from recent urban planning reports indicate that projects with clear social benefit plans are more likely to receive expedited approvals and gain community support. The Burnet Group's expertise helps clients develop strategies that not only meet regulatory requirements but also foster genuine community goodwill and long-term value.

- Affordable Housing Mandates: Many cities are implementing or strengthening requirements for a percentage of units in new developments to be designated as affordable, with some areas targeting 15-20% by 2025.

- Community Benefit Agreements (CBAs): Developers are increasingly entering into formal CBAs with local communities, often securing commitments for job creation, local hiring, and investment in public amenities.

- ESG Integration: Environmental, Social, and Governance (ESG) criteria are becoming standard in real estate investment and development, with social factors like community impact playing a significant role in investment decisions.

- Social Impact Measurement: There's a growing demand for quantifiable metrics to assess the social return on investment (SROI) of real estate projects, moving beyond qualitative statements to data-driven evidence of positive impact.

Societal values are increasingly emphasizing sustainability and ethical practices, influencing consumer and investor behavior. By 2025, a significant majority of consumers are expected to prioritize brands with strong ESG credentials, driving demand for green-certified properties. This societal shift necessitates that businesses like The Burnet Group integrate eco-friendly design and community well-being into their core strategies.

Technological factors

PropTech, a fusion of property and technology, is rapidly reshaping the real estate landscape. Innovations like artificial intelligence, blockchain, the Internet of Things (IoT), and big data analytics are fundamentally changing how properties are bought, sold, managed, and valued. For instance, AI-powered platforms are now able to predict market trends with greater accuracy, while blockchain offers enhanced security and transparency in property transactions. The global PropTech market was valued at over $30 billion in 2023 and is projected to grow significantly, reaching an estimated $60 billion by 2028, demonstrating its accelerating impact.

These technological advancements are not just incremental improvements; they represent a digital transformation that boosts efficiency, fosters greater transparency, and sharpens decision-making across the real estate sector. IoT devices, for example, can monitor building performance in real-time, optimizing energy consumption and maintenance schedules, thereby reducing operational costs. Big data analytics allows for more sophisticated market analysis, identifying investment opportunities and risks with unprecedented precision.

The Burnet Group actively harnesses these powerful PropTech tools to deliver sophisticated and forward-thinking advisory services. By integrating AI for predictive analytics and blockchain for secure transaction management, the firm provides clients with a competitive edge. This strategic adoption of technology ensures that The Burnet Group remains at the forefront of real estate consulting, offering data-driven insights and innovative solutions that address the evolving needs of the market and its stakeholders.

Advanced data analytics and predictive modeling are revolutionizing how businesses like The Burnet Group approach market forecasting and risk assessment. These tools can sift through massive amounts of data, uncovering patterns that lead to more informed investment strategies. For instance, in 2024, the growth of AI-driven analytics platforms has accelerated, enabling businesses to process real-time economic indicators and property-specific data for more accurate valuations.

By leveraging these capabilities, The Burnet Group gains deeper insights into emerging market trends and the nuanced performance of specific properties. This allows for the development of more robust financial models. The ability to predict demand shifts or identify undervalued assets is a direct result of sophisticated analytics, giving a competitive edge in the dynamic real estate sector.

The integration of smart building technologies, powered by the Internet of Things (IoT), is revolutionizing operational efficiency and tenant satisfaction in commercial real estate. These interconnected systems optimize energy consumption, anticipate maintenance needs, and personalize occupant environments, leading to significant cost savings and improved user experiences.

For The Burnet Group, this translates into tangible benefits like reduced utility bills and enhanced property appeal. For instance, smart lighting and HVAC systems can cut energy usage by up to 30%, a critical factor in achieving sustainability targets and boosting property valuations in the competitive 2024-2025 market.

Advising clients to implement these forward-thinking features in both new constructions and retrofits is a key strategy. The market trend shows a growing demand for intelligent spaces, with IoT adoption in buildings projected to reach 20 billion devices globally by 2025, underscoring the financial imperative and competitive advantage these technologies offer.

Virtual Reality (VR) and Augmented Reality (AR)

Virtual Reality (VR) and Augmented Reality (AR) are transforming how properties are viewed and marketed. They offer immersive tours and virtual staging, making it easier for potential buyers or renters to experience a space remotely. For instance, a study by Statista in 2024 projected the global AR/VR market to reach over $100 billion by 2025, indicating significant adoption and investment in these visualization tools.

These technologies can significantly speed up property transactions and broaden reach. By allowing clients to virtually walk through properties from anywhere, The Burnet Group can overcome geographical limitations and reduce the need for physical site visits, potentially shortening sales cycles. This is especially impactful in the 2024-2025 real estate market, where efficiency is key.

The Burnet Group can leverage VR and AR to create more compelling client presentations and marketing campaigns. Imagine offering potential clients a virtual walkthrough of a new development before it's even built, complete with customizable furniture placements. This level of engagement can differentiate The Burnet Group from competitors and enhance client satisfaction.

- Enhanced Property Visualization: VR/AR allows for immersive virtual tours and staging, providing a realistic feel of properties.

- Increased Transaction Speed: Remote viewing capabilities can accelerate the decision-making process for buyers and renters.

- Broader Market Reach: Overcoming geographical barriers allows access to a wider pool of potential clients.

- Competitive Advantage: Innovative use of these technologies can set The Burnet Group apart in marketing and client engagement.

Blockchain for Transactions and Records

Blockchain technology is poised to revolutionize how real estate transactions are conducted, offering unprecedented levels of transparency and security. This distributed ledger system could significantly streamline processes like property title transfers and the execution of smart contracts. For instance, by mid-2024, several pilot programs explored blockchain for property records, aiming to reduce the time for title searches from weeks to mere hours.

The potential for enhanced efficiency and fraud reduction is a key driver for its adoption. As of early 2025, the global real estate tokenization market is projected to reach hundreds of billions of dollars, demonstrating the growing interest in leveraging blockchain for asset management and transactions.

The Burnet Group actively monitors these technological advancements, recognizing their potential to reshape transaction advisory services. Future integration could lead to more secure, faster, and cost-effective property dealings, benefiting both buyers and sellers.

- Increased Transparency: All transaction data is recorded on an immutable ledger, visible to authorized parties.

- Enhanced Security: Cryptographic principles make it extremely difficult to tamper with records.

- Streamlined Processes: Automation through smart contracts can expedite title transfers and payments.

- Reduced Fraud: The decentralized and transparent nature of blockchain minimizes opportunities for fraudulent activities.

Technological advancements are fundamentally altering the real estate sector, with PropTech innovations like AI, IoT, and blockchain driving efficiency and transparency. The global PropTech market, valued at over $30 billion in 2023, is expected to reach $60 billion by 2028, underscoring the significant impact of these digital transformations. These technologies enable more accurate market forecasting, optimized property management, and streamlined transactions.

Legal factors

Property laws and land use regulations are critical for The Burnet Group's real estate ventures. These legal frameworks dictate everything from how land can be used and developed to the requirements for property ownership. For instance, in 2024, many municipalities are reviewing and updating zoning ordinances to encourage mixed-use development and address housing shortages, which could present new opportunities or challenges for The Burnet Group's projects.

Changes in building codes, often updated to improve safety and energy efficiency, directly affect construction costs and project timelines. For example, new regulations requiring higher standards for seismic retrofitting in certain regions, as seen in California's ongoing efforts, can significantly impact development feasibility. The Burnet Group must stay abreast of these evolving codes to ensure compliance and manage project budgets effectively.

Navigating the complexities of obtaining development permits is a significant undertaking. In 2024, the average time to secure a major development permit in large metropolitan areas can range from 6 to 18 months, depending on the project's scale and local governmental efficiency. The Burnet Group leverages its expertise to streamline this process, mitigating delays and associated costs for its clients.

Environmental protection laws are becoming more rigorous, impacting real estate development significantly. Regulations focusing on energy efficiency, carbon emissions reduction, and waste management are key considerations for The Burnet Group's clients. For instance, new building standards in many regions now mandate higher energy performance, potentially increasing upfront construction costs but leading to long-term operational savings.

Compliance with these evolving environmental standards is not optional; it's a necessity that directly influences project timelines, design choices, and overall development budgets. Failure to adhere can result in substantial fines and reputational damage, making proactive engagement with these legal frameworks critical for success. The Burnet Group actively guides clients through this complex landscape.

Contract law is the bedrock of real estate dealings, governing everything from initial purchase agreements to long-term leasing contracts and complex joint venture agreements. In 2024, the National Association of Realtors reported that the average time to close on a residential property was around 50 days, highlighting the critical need for well-structured legal frameworks to ensure these transfers are both smooth and secure. These legal intricacies are vital for protecting all parties involved in property transactions and partnerships.

The Burnet Group's expertise in transactional legal frameworks is designed to navigate these complexities. For instance, ensuring clarity in lease agreements can prevent disputes, which, according to a 2024 survey by the Institute for Real Estate Management, cost property owners an average of 3% of annual rental income when unresolved. Their advisory services provide clients with the necessary guidance to create robust and legally sound contracts, safeguarding investments and fostering successful business relationships.

Tenant Rights and Landlord Obligations

Tenant rights and landlord obligations are heavily shaped by local laws, which can significantly influence property management. For instance, in 2024, many states are seeing increased focus on tenant protections, including stricter regulations on security deposits and just cause eviction policies. These legal frameworks directly affect operational costs and potential profitability for property owners like those managed by The Burnet Group.

Understanding these varying legal landscapes is crucial for effective portfolio management. Landlord responsibilities can range from essential maintenance and habitability standards to limitations on rent increases and eviction processes. Non-compliance can lead to substantial fines and legal disputes, impacting The Burnet Group's clients.

Eviction procedures, in particular, are a critical legal factor. As of early 2025, many jurisdictions have implemented longer notice periods and require more stringent documentation for landlords seeking to evict tenants, adding complexity and potential delays. The Burnet Group helps clients navigate these often-complex legal requirements.

- Jurisdictional Variations: Laws governing landlord-tenant relationships differ significantly across states and even cities, impacting lease agreements, rent control, and property standards.

- Tenant Protections: Emerging legislation in 2024-2025 often strengthens tenant rights concerning lease renewals, habitability, and protection against retaliatory evictions.

- Landlord Responsibilities: Key obligations include maintaining safe living conditions, respecting tenant privacy, and adhering to legal procedures for rent collection and eviction.

- Eviction Process: Legal processes for eviction can be lengthy and require strict adherence to notice periods and court procedures, with some areas implementing emergency tenant protections extending into 2025.

Data Privacy and Cybersecurity Regulations

The Burnet Group operates in an environment where data privacy and cybersecurity are increasingly scrutinized. With the real estate sector heavily reliant on digital platforms for client interactions and property management, adherence to regulations like the GDPR and CCPA is non-negotiable. Failure to protect sensitive client and property data can lead to severe legal penalties and significantly damage The Burnet Group's reputation, underscoring the need for robust data protection strategies.

Ensuring compliance means The Burnet Group must implement strong cybersecurity measures to safeguard against data breaches. This includes secure data storage, encrypted communications, and regular security audits. The company's advisory services also need to reflect these stringent data handling requirements, guiding clients on best practices for their own digital security in real estate transactions.

- GDPR Fines: Non-compliance can result in fines of up to €20 million or 4% of global annual turnover.

- CCPA Impact: The California Consumer Privacy Act grants consumers rights over their personal data, requiring businesses to be transparent about data collection and usage.

- Cybersecurity Investment: Global spending on cybersecurity solutions is projected to reach $280 billion in 2024, highlighting the growing importance of data protection.

- Data Breach Costs: The average cost of a data breach in the US reached $9.48 million in 2023, emphasizing the financial risks of inadequate security.

Regulatory compliance is a cornerstone of The Burnet Group's operations, encompassing a wide array of legal factors from property law to data privacy. Staying ahead of evolving building codes, zoning ordinances, and environmental protection laws is crucial for project viability and cost management. As of 2024, many municipalities are reviewing zoning for mixed-use development, potentially opening new avenues for The Burnet Group's real estate ventures.

Navigating the complexities of permits and contract law also demands significant attention. The average time to secure major development permits in large cities can range from 6 to 18 months in 2024, a process The Burnet Group streamlines. Furthermore, well-structured contracts, like purchase agreements, are vital, with the National Association of Realtors reporting an average residential property closing time of 50 days in 2024, underscoring the need for legal efficiency.

Tenant rights and landlord obligations are increasingly shaped by legislation, with a focus on tenant protections in 2024-2025. Eviction procedures are becoming more stringent, often requiring longer notice periods and detailed documentation. The Burnet Group guides clients through these varying legal landscapes, managing risks associated with property management and tenant relations.

Data privacy and cybersecurity are paramount, with regulations like GDPR and CCPA setting strict standards for handling sensitive information. Non-compliance can result in substantial fines, such as up to €20 million or 4% of global annual turnover for GDPR violations. Global cybersecurity spending was projected to reach $280 billion in 2024, reflecting the critical importance of safeguarding data.

Environmental factors

Climate change presents tangible physical risks to property assets, including rising sea levels and more frequent extreme weather events. These can directly impact infrastructure and operational continuity. For instance, a 2024 report indicated that coastal properties globally face an escalating threat, with some areas projected to experience significant inundation by 2050 if emissions continue unchecked.

The Burnet Group's long-term investment viability hinges on its ability to accurately assess and proactively mitigate these environmental vulnerabilities. Failure to do so could lead to substantial asset depreciation and increased insurance costs. Understanding the specific regional impacts, such as increased wildfire risk in certain areas or heightened flood potential in others, is crucial for strategic planning.

The increasing emphasis on sustainability is significantly shaping the real estate market. Properties that meet green building certifications like LEED, BREEAM, or WELL are seeing higher demand and better marketability. For instance, a 2024 report indicated that LEED-certified buildings can command rental premiums of up to 20% and have lower operating costs, saving an average of 19% on energy expenses.

These standards directly impact property valuation and operational efficiency by promoting energy efficiency, water conservation, and healthier indoor environments. The Burnet Group leverages this trend, guiding clients to achieve these certifications, thereby enhancing portfolio performance and future-proofing assets against evolving regulatory landscapes and investor preferences.

Growing concerns over the availability of key resources like water, energy, and raw materials are significantly influencing the real estate sector. This scarcity is pushing developers to embrace circular economy principles, which prioritize minimizing waste and maximizing the reuse of materials throughout a building's lifecycle. For instance, the construction industry globally generated an estimated 37% of all waste in 2023, highlighting the urgency for change.

These shifts directly affect how buildings are constructed and operated long-term. Innovations in modular construction and the use of recycled materials are becoming more prevalent, aiming to reduce both initial waste and ongoing operational resource demands. By 2025, it's projected that the global circular economy market will reach $4.5 trillion, showing a strong economic driver for these practices.

The Burnet Group is well-positioned to assist clients in navigating these evolving environmental factors. Our expertise allows us to guide real estate developers and owners in integrating sustainable practices, from material sourcing and waste management during construction to optimizing building operations for resource efficiency. This ensures compliance with emerging regulations and enhances long-term property value.

Pollution and Environmental Remediation

Addressing pollution and the need for environmental remediation, especially on brownfield sites, can significantly increase development costs and extend project timelines. For instance, the UK government's Land Remediation Funding recently allocated £100 million to accelerate the cleanup of contaminated land. This focus on remediation is driven by both regulatory compliance and public perception, which are increasingly critical factors influencing project viability and investor confidence.

The Burnet Group's expertise in assessing and managing these environmental liabilities is therefore crucial. Their services help clients navigate complex regulations and mitigate risks associated with historical contamination. For example, in 2024, The Burnet Group completed environmental site assessments for over 50 commercial properties, identifying and proposing remediation strategies for potential soil and groundwater contamination.

- Regulatory landscape: Stricter environmental protection laws are being implemented globally, requiring thorough site assessments and remediation plans.

- Brownfield development incentives: Governments often provide tax breaks and grants to encourage the redevelopment of contaminated or derelict land, such as the £400 million Brownfield Land Fund in England.

- Public scrutiny: Increased public awareness of environmental issues means companies face greater scrutiny over their environmental impact, affecting brand reputation and stakeholder relations.

- Remediation technologies: Advances in soil and groundwater treatment technologies are making remediation more efficient and cost-effective, though upfront investment remains significant.

ESG Investment Mandates and Reporting

Environmental, Social, and Governance (ESG) criteria are fundamentally reshaping investment decisions, with a noticeable surge in capital directed towards sustainable real estate funds. This trend is underscored by the fact that by the end of 2023, global ESG assets under management were projected to reach $33.9 trillion, according to Bloomberg Intelligence. For The Burnet Group and its clients, adhering to ESG mandates and ensuring transparent reporting are no longer optional but essential for attracting and retaining crucial investment capital.

Meeting these evolving ESG expectations is paramount for financial viability in the current market. The Burnet Group actively assists clients in formulating and executing comprehensive ESG strategies. This includes:

- Developing tailored ESG frameworks aligned with investor expectations.

- Implementing robust data collection and reporting mechanisms for transparency.

- Identifying opportunities for environmental impact reduction and social value creation within real estate portfolios.

- Navigating evolving regulatory landscapes related to sustainability disclosures.

The escalating threat of climate change, manifesting in rising sea levels and more frequent extreme weather, directly impacts property assets and operational continuity. For instance, a 2024 report highlighted that coastal properties face increasing inundation risks, potentially causing significant asset depreciation and higher insurance premiums.

The drive towards sustainability is transforming the real estate market, with green certifications like LEED boosting demand and rental premiums. A 2024 report found LEED-certified buildings can achieve up to 20% higher rents and 19% lower energy costs.

Resource scarcity, particularly for water and energy, is accelerating the adoption of circular economy principles in construction, aiming to minimize waste. Globally, the construction sector generated an estimated 37% of all waste in 2023, underscoring the need for such shifts.

Addressing pollution and the remediation of brownfield sites are critical, with governments offering incentives like the £400 million Brownfield Land Fund in England to encourage redevelopment. The Burnet Group's 2024 assessments for over 50 commercial properties demonstrate expertise in navigating these environmental liabilities and remediation strategies.

| Environmental Factor | Impact on Real Estate | Data/Trend (2023-2025) | The Burnet Group's Role |

|---|---|---|---|

| Climate Change & Extreme Weather | Physical asset damage, operational disruption, increased insurance costs | Coastal property inundation risk (2024 report); escalating frequency of storms | Risk assessment, mitigation strategies, site selection guidance |

| Sustainability & Green Buildings | Higher demand, rental premiums, lower operating costs | LEED-certified buildings command up to 20% higher rents (2024 report) | Advising on green certifications, enhancing portfolio performance |

| Resource Scarcity & Circular Economy | Increased construction costs, drive for waste reduction, material innovation | Construction sector generated 37% of global waste in 2023; circular economy market projected to reach $4.5 trillion by 2025 | Guiding on circular economy principles, sustainable material sourcing |

| Pollution & Remediation | Development cost increases, project timeline extensions, regulatory compliance | £100 million UK Land Remediation Funding; 50+ commercial properties assessed by The Burnet Group in 2024 | Environmental liability assessment, remediation strategy development |

PESTLE Analysis Data Sources

Our PESTLE Analysis for The Burnet Group is meticulously constructed using a blend of official government data, reputable industry publications, and global economic indicators. We draw upon reports from leading financial institutions and market research firms to ensure comprehensive and accurate insights into political, economic, social, technological, legal, and environmental factors.