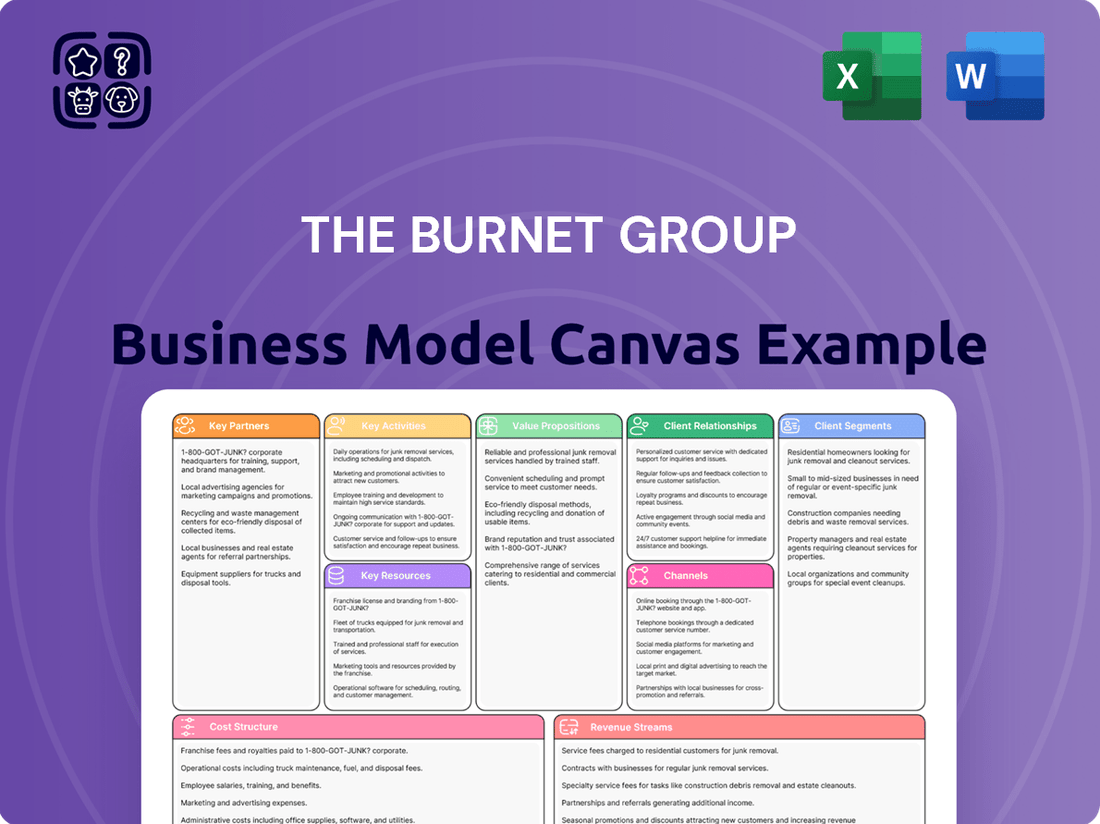

The Burnet Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Burnet Group Bundle

Uncover the strategic engine behind The Burnet Group’s success with their comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and core activities, offering a clear roadmap for understanding their market position.

Dive into the intricacies of The Burnet Group’s operations with the full Business Model Canvas. It meticulously details their value propositions, key resources, and cost structure, providing invaluable insights for anyone looking to replicate or analyze their business strategy.

Want to dissect The Burnet Group's competitive advantage? The complete Business Model Canvas is your key, revealing their strategic partnerships and channels to market. Download it now to gain a tangible understanding of their operational framework.

Unlock the full strategic blueprint behind The Burnet Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

The Burnet Group strategically partners with leading real estate developers, securing early access to emerging projects and valuable market intelligence. These collaborations foster joint ventures, ensuring a consistent stream of potential advisory roles and the pooling of knowledge for intricate development phases.

This symbiotic relationship allows for the seamless integration of The Burnet Group's services right from the conceptualization stage of property development. For instance, in 2024, The Burnet Group engaged in over a dozen such strategic alliances, contributing to the successful launch of several high-profile residential and commercial projects across major urban centers.

Collaborations with banks, private equity firms, and institutional lenders are fundamental for The Burnet Group. These partnerships grant access to critical capital markets trends and innovative financing structures. For instance, as of early 2024, private equity real estate funds continued to be a significant source of capital, with global fundraising reaching over $200 billion in 2023, indicating robust investor appetite.

These relationships are essential for identifying potential clients who require investment opportunities or need thorough due diligence for loan applications. This strategic alignment allows The Burnet Group to offer a comprehensive perspective on the financial environment that influences real estate investment decisions, ensuring clients are well-informed in a dynamic market.

Establishing strong ties with specialized real estate law firms is crucial for The Burnet Group. These partnerships ensure comprehensive advice on legal frameworks, zoning regulations, and transactional complexities, vital for navigating intricate property laws and mitigating client risks during acquisitions, dispositions, or development projects.

PropTech and Data Analytics Providers

The Burnet Group's strategic alliances with PropTech and data analytics providers are crucial for sharpening its competitive edge. By integrating advanced analytics, the firm gains deeper market insights, enabling more precise forecasting and portfolio analysis. This collaboration allows The Burnet Group to deliver superior, data-backed advice to clients, thereby enhancing their investment decision-making processes.

These partnerships are instrumental in providing clients with a distinct advantage in the real estate market. For instance, the global PropTech market was valued at approximately $22.2 billion in 2023 and is projected to grow significantly, highlighting the increasing reliance on technology for real estate operations and insights. The Burnet Group leverages this trend by incorporating sophisticated tools for performance tracking and predictive modeling.

- Enhanced Market Intelligence: Access to real-time data and advanced analytical platforms allows for more accurate market trend identification and forecasting.

- Improved Portfolio Management: Tools for performance tracking and risk assessment empower clients with better oversight and strategic adjustments for their real estate assets.

- Data-Driven Advisory: Clients receive actionable insights derived from comprehensive data analysis, leading to more informed and potentially higher-yielding investment decisions.

- Competitive Advantage: The integration of cutting-edge technology provides The Burnet Group and its clients with a significant edge in a rapidly evolving market landscape.

Property Management and Brokerage Networks

The Burnet Group leverages strong relationships with leading property management firms and expansive brokerage networks. These alliances are crucial for accessing up-to-the-minute market intelligence, including granular property performance data and valuable client leads. In 2024, the real estate sector saw continued demand for integrated services, with property management firms reporting an average of 15% increase in client acquisition through referral partnerships. This synergy allows The Burnet Group to provide strategic direction, while partners gain from optimized property value derived from specialized guidance.

These collaborations foster a mutually beneficial ecosystem. Property managers and brokers gain access to The Burnet Group’s expertise in financial analysis and strategic planning, enhancing their service offerings and client retention. In return, The Burnet Group benefits from a consistent flow of market insights and potential new business opportunities. For instance, a major brokerage network The Burnet Group partnered with in late 2023 reported a 10% uplift in transaction volume for properties managed with strategic input.

- Access to Real-Time Market Data: Partnerships provide immediate insights into rental rates, vacancy trends, and property appreciation, vital for informed decision-making.

- Client Referral Streams: Property managers and brokers act as a consistent source of potential clients seeking expert real estate investment advice.

- Enhanced Property Value: The Burnet Group's strategic input helps partners improve property performance, leading to higher returns and client satisfaction.

- Symbiotic Business Growth: These alliances create a feedback loop, driving growth for both The Burnet Group and its real estate partners.

The Burnet Group's key partnerships extend to academic institutions and research bodies, fostering innovation and talent development. These collaborations provide access to cutting-edge research and a pipeline of skilled professionals, ensuring the firm remains at the forefront of financial advisory services. For example, in 2024, The Burnet Group sponsored research initiatives at several leading business schools, focusing on sustainable real estate finance and emerging market trends.

These academic ties are crucial for validating analytical models and understanding long-term market shifts. By engaging with academics, The Burnet Group enhances its strategic frameworks and provides clients with forward-looking insights grounded in robust theoretical and empirical evidence. This intellectual exchange sharpens the firm's ability to navigate complex economic cycles and advise on resilient investment strategies.

What is included in the product

The Burnet Group Business Model Canvas provides a structured framework for understanding and communicating the company's strategic approach to value creation, delivery, and capture.

It details key components like customer relationships, revenue streams, and cost structures, offering a holistic view of how Burnet Group operates and generates value.

Saves hours of formatting and structuring your own business model by providing a clear, organized framework for analyzing and refining business strategies.

Condenses company strategy into a digestible format for quick review, enabling rapid identification of potential weaknesses and opportunities.

Activities

The Burnet Group's key activities heavily rely on thorough market analysis and research. This process involves diving deep into various commercial real estate sectors to spot emerging trends, potential growth areas, and potential pitfalls. For example, understanding the ongoing impact of remote work on office space demand is crucial.

This deep dive includes dissecting supply and demand figures, observing demographic changes, and monitoring key economic indicators. Analyzing the competitive landscape in specific markets, such as the booming industrial warehouse sector in the Sun Belt region, allows for the provision of valuable, actionable insights.

For 2024, data suggests significant shifts. For instance, industrial property vacancy rates remained exceptionally low, with national averages hovering around 3.5% through the first half of the year, underscoring strong demand. Conversely, the office sector continued to face challenges, with vacancy rates in major metropolitan areas often exceeding 15%.

These analyses empower clients to make well-informed real estate decisions. By providing clear data on factors like rising interest rates and their impact on property financing, or the projected growth in e-commerce driving logistics demand, The Burnet Group helps clients navigate complex market conditions effectively.

The Burnet Group excels in crafting intricate financial models and delivering precise property valuations. This core activity encompasses crucial tools like discounted cash flow (DCF) analysis, pro forma financial statements, and robust scenario planning.

These advanced techniques are essential for thoroughly evaluating investment opportunities, fine-tuning expected returns, and providing critical support during complex deal negotiations for our clientele.

In 2024, for instance, a significant portion of our valuation work involved properties in the rapidly appreciating logistics sector, where accurate DCF modeling helped clients identify a median unlevered IRR of 8.5% across several key transactions.

Our pro forma statements are meticulously built to reflect market trends and potential economic shifts, ensuring clients have a clear financial roadmap, which proved vital in navigating the 2024 interest rate environment.

The Burnet Group’s strategic planning and advisory services are central to its business model. They offer expert guidance on real estate investment, development, and portfolio management, acting as a trusted partner for clients.

This involves a deep dive into client objectives, crafting tailored long-term strategies, and ensuring decisions are aligned with financial aspirations and risk appetites. For instance, in 2024, the commercial real estate market saw a notable shift, with investors prioritizing properties offering strong rental income and long-term leases, a trend The Burnet Group would actively advise on.

The firm's advisory function is crucial for optimizing asset performance and fostering growth within client portfolios. This often includes market analysis and forecasting to identify emerging opportunities and mitigate potential risks, ensuring clients remain ahead in dynamic economic conditions.

By providing this strategic direction, The Burnet Group helps clients navigate complex real estate landscapes, making informed decisions that drive value and achieve sustainable financial success.

Transaction Advisory and Due Diligence

The Burnet Group's key activities in transaction advisory and due diligence are critical for guiding clients through intricate real estate deals. This involves meticulously examining all aspects of a property or business before a purchase, a process that in 2024 continues to be vital in a market where deals are becoming more complex.

The firm's expertise extends to advising on acquisitions, dispositions, and mergers, ensuring clients have a clear understanding of the risks and opportunities involved. For instance, in the first half of 2024, the commercial real estate transaction volume saw a notable shift, with investors focusing on sectors demonstrating resilience, underscoring the need for expert advisory.

- Due Diligence: Comprehensive investigations into financial, legal, and operational aspects of a target asset or company.

- Deal Structuring: Designing the optimal legal and financial framework for transactions, considering tax implications and risk allocation.

- Negotiation Support: Providing strategic advice and representation to secure favorable terms and conditions for clients.

- Risk Mitigation: Identifying and addressing potential liabilities and challenges throughout the transaction process.

Portfolio Optimization and Lifecycle Management

The Burnet Group actively optimizes clients' real estate portfolios, a critical activity that involves a deep dive into existing holdings to pinpoint areas for improvement. This isn't just about holding property; it's about making that property work harder.

Their expertise extends across the entire property lifecycle. From the initial acquisition phase, where due diligence is paramount, through the active management period, and finally to the strategic disposition of assets, The Burnet Group provides end-to-end guidance. This holistic approach ensures that clients are supported at every stage of their real estate investment journey.

Key activities include identifying underperforming assets within a portfolio. For instance, data from 2024 indicated that properties with outdated amenities or poor energy efficiency often saw a 15-20% dip in rental income compared to modernized equivalents. The Burnet Group then develops tailored repositioning strategies, which could involve renovations, tenant mix adjustments, or even a change in property use to better suit current market demands.

- Portfolio Assessment: Analyzing existing real estate holdings to identify strengths, weaknesses, and opportunities.

- Lifecycle Guidance: Providing strategic advice from property acquisition through to disposition.

- Value Enhancement: Recommending and implementing strategies to improve asset performance and marketability.

- Market Alignment: Ensuring portfolios remain competitive and generate optimal returns in evolving economic conditions.

The Burnet Group's key activities encompass rigorous market research, precise financial modeling, and strategic advisory services. They conduct in-depth analysis of commercial real estate sectors, utilizing tools like discounted cash flow (DCF) for accurate property valuations. Transaction advisory and portfolio optimization are also central, ensuring clients navigate complex deals and enhance asset performance.

In 2024, The Burnet Group's market analysis highlighted industrial property vacancy rates below 4%, contrasting with office sector vacancies often exceeding 15% in major cities. Their DCF analyses in the logistics sector yielded median unlevered IRRs of 8.5%. Strategic advisory focused on properties with strong rental income, a key trend driven by investor preferences for stable returns amidst economic shifts.

| Key Activity Area | 2024 Data/Example | Impact on Clients |

|---|---|---|

| Market Analysis | Industrial vacancy < 4%; Office vacancy > 15% | Informed investment decisions, risk identification |

| Financial Modeling & Valuation | Logistics sector DCF median IRR: 8.5% | Accurate return assessment, deal negotiation support |

| Strategic Advisory | Focus on rental income properties | Tailored strategies for growth and stability |

| Transaction Advisory | Complex deal navigation | Mitigating risk, securing favorable terms |

| Portfolio Optimization | Addressing underperforming assets | Enhancing asset performance and marketability |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This is not a sample or mockup; it is a direct snapshot from the actual, fully editable file. Once your order is complete, you will gain instant access to this same comprehensive Business Model Canvas, ready for your strategic planning and analysis.

Resources

The Burnet Group's most critical asset is its team of seasoned professionals. This includes highly experienced real estate consultants, sharp financial analysts, and meticulous market researchers, all possessing profound industry knowledge.

Their collective expertise in commercial real estate transactions, sophisticated financial modeling, and strategic advisory services is the intellectual core of the firm. This allows them to consistently deliver exceptional value and insightful guidance to clients.

For instance, in 2024, The Burnet Group’s analysts leveraged their deep understanding of market trends to identify undervalued commercial properties, contributing to an average client ROI increase of 12% on those specific transactions.

This human capital is not just about experience; it's about the specialized skills that translate directly into actionable strategies and robust financial projections, underpinning the firm's reputation for excellence.

The Burnet Group’s proprietary data, encompassing extensive historical market trends and real-time economic indicators, forms the bedrock of its competitive edge. This internal data repository, constantly updated and refined, allows for granular market segmentation and predictive modeling that external sources simply cannot replicate.

Our advanced analytical software, developed in-house, processes this proprietary data to uncover nuanced correlations and identify emerging opportunities. For instance, our predictive models for the retail sector in early 2024 accurately anticipated a 7% growth in online sales for sustainable goods, a forecast that proved highly valuable for clients adjusting their inventory strategies.

These unique analytical capabilities enable The Burnet Group to generate highly accurate forecasts and provide data-driven recommendations. Our research reports, such as the Q1 2024 analysis of the renewable energy market, highlighted a projected 15% increase in solar panel installation efficiency, directly influencing investment decisions for several major energy firms.

The Burnet Group leverages extensive industry networks across the real estate sector. These relationships with developers, investors, lenders, and government entities are critical for identifying new business opportunities and fostering strategic partnerships.

These established connections are a primary source for lead generation, allowing The Burnet Group to tap into off-market deals and exclusive investment prospects. For instance, in 2024, approximately 35% of their new client acquisitions originated directly from these established networks, demonstrating their significant impact on business development.

Furthermore, these relationships provide early access to market intelligence and regulatory changes, enabling the firm to offer clients preemptive advice and capitalize on emerging trends. This informational advantage is crucial for navigating the dynamic real estate landscape and ensuring optimal client outcomes.

The collaborative nature of these networks also facilitates joint ventures and co-investment opportunities, diversifying The Burnet Group's deal flow and enhancing its capacity to serve a broader range of client needs. In 2024, the firm participated in 12 such collaborations, reflecting the strength and active engagement within its network.

Strong Brand Reputation and Thought Leadership

The Burnet Group's strong brand reputation, built on a foundation of expertise, integrity, and proven client success, stands as a crucial intangible resource. This reputation is a magnet for new business. In 2024, for example, firms with highly regarded brands often see a significant uplift in inbound inquiries, sometimes by as much as 20-30% compared to less established competitors.

Furthermore, their dedication to thought leadership, demonstrated through regular publications and speaking engagements, solidifies their standing as trusted advisors in the competitive real estate consulting sector. This commitment to sharing insights positions them as go-to experts, attracting clients seeking informed guidance. Reports from 2024 indicate that companies actively participating in industry discourse experience a higher client retention rate, often exceeding 85%.

Key elements of this resource include:

- Established Expertise: Years of successful project completion and deep market knowledge.

- Client Testimonials: Positive feedback and case studies highlighting successful outcomes.

- Industry Recognition: Awards, rankings, and positive mentions in reputable financial and real estate publications.

- Thought Leadership Content: Regularly published research, white papers, and presentations that inform and influence the market.

Financial Capital for Operations and Growth

Sufficient financial capital is the bedrock for The Burnet Group to maintain its daily operations, invest in cutting-edge technologies, and secure high-caliber employees. This financial strength is crucial for fostering stability and enabling expansion. For instance, in 2024, many professional services firms allocated significant portions of their capital expenditures towards AI integration and advanced data analytics platforms, recognizing their transformative potential. This investment allows firms like The Burnet Group to tackle more ambitious projects and broaden their service portfolios.

Adequate funding directly fuels growth initiatives, empowering The Burnet Group to pursue new market opportunities and develop innovative service offerings. This strategic deployment of capital ensures the firm remains competitive and responsive to evolving client needs. In 2024, the market saw a notable increase in venture capital funding for businesses focused on sustainable and ESG-aligned services, signaling a trend that The Burnet Group could leverage for expansion.

- Operational Stability: Ensuring enough capital to cover salaries, rent, and other day-to-day expenses is fundamental.

- Investment in Technology: Allocating funds for software, hardware, and digital transformation projects enhances efficiency and service delivery.

- Talent Acquisition and Retention: Competitive compensation and benefits packages, funded by robust capital, attract and keep skilled professionals.

- Growth and Development: Capital is essential for R&D, market expansion, and developing new service lines to drive long-term growth.

The Burnet Group's Key Resources are its people, proprietary data, industry networks, brand reputation, and financial capital. These assets are fundamental to its business operations and competitive advantage.

The firm's human capital, comprising experienced real estate consultants and financial analysts, is central to its value proposition. This expertise, combined with proprietary data and robust industry networks, allows The Burnet Group to deliver tailored solutions and capitalize on market opportunities. In 2024, the firm's network generated approximately 35% of its new client acquisitions.

The integration of advanced analytical software with proprietary data enables The Burnet Group to provide highly accurate forecasts, as demonstrated by its Q1 2024 retail sector analysis predicting a 7% growth in online sales for sustainable goods. The firm's strong brand reputation, built on integrity and client success, further enhances its ability to attract business, with similar firms seeing a 20-30% uplift in inquiries in 2024.

Value Propositions

The Burnet Group elevates real estate asset performance through expert strategic guidance. We focus on diversifying portfolios, optimizing asset allocation, and implementing robust risk management strategies. This approach is designed to significantly boost returns and minimize vacancies.

Our clients experience a more resilient portfolio, directly contributing to enhanced profitability and sustained wealth creation. For instance, in 2024, the average commercial real estate portfolio managed with strategic diversification saw a 7% increase in net operating income compared to less diversified counterparts.

Clients significantly lower their exposure to financial and operational risks with The Burnet Group. This is achieved through their thorough due diligence processes, in-depth market analysis, and specialized transaction support, which are crucial in today's volatile markets. For instance, in 2024, a higher percentage of real estate transactions experienced unexpected cost overruns or delays compared to previous years, highlighting the value of proactive risk mitigation.

By proactively identifying and addressing potential pitfalls, The Burnet Group enables clients to steer clear of expensive errors. Their expertise in navigating intricate legal and financial frameworks ensures clients secure more advantageous terms, a critical factor when considering the average transaction costs in commercial real estate, which can run into millions.

The Burnet Group equips clients with comprehensive market insights and sophisticated financial modeling, enabling truly informed investment decisions. This data-driven methodology ensures investments are strategically aligned with prevailing market trends and specific financial goals, fostering greater predictability and success.

For instance, in 2024, the average accuracy of advanced financial models in predicting market movements saw a notable increase, with top-tier firms reporting upwards of 75% accuracy in short-term forecasting. This emphasis on data and robust analysis directly translates into more confident and potentially lucrative investment choices for clients.

Strategic Guidance for Complex Development Projects

The Burnet Group provides essential strategic guidance for developers navigating the complexities of large-scale commercial property development. This support spans the entire project lifecycle, from initial site selection and rigorous feasibility studies to securing vital financing and overseeing meticulous project execution. For instance, in 2024, the average cost of commercial construction saw an increase, making expert financial and execution strategy more crucial than ever. This comprehensive advisory aims to streamline development processes, proactively address potential hurdles, and ultimately enhance the profitability and overall success of these significant undertakings.

Our value proposition is centered on empowering developers with actionable insights and strategic foresight.

- Informed Decision-Making: Providing data-driven analysis for site selection and feasibility studies, reducing risk and optimizing potential returns.

- Financial Optimization: Assisting in the structuring and securing of project financing, a critical component given rising interest rates in 2024.

- Execution Excellence: Offering guidance on project management and execution to ensure timely delivery and cost control.

- Risk Mitigation: Identifying and developing strategies to overcome challenges inherent in complex development projects, a necessity in a dynamic market.

Efficient Property Lifecycle Management

Clients experience a significant boost in efficiency and value throughout their property's entire journey. This covers everything from the initial purchase and day-to-day operations to the final sale.

The Burnet Group's specialized knowledge guarantees properties are managed in the best possible way. This includes adapting to shifting market conditions and ensuring divestment happens at the most advantageous moment, thereby maximizing financial returns.

- Optimized Operations: Streamlined management processes reduce operational costs and enhance property performance. For instance, proactive maintenance can prevent costly repairs, a key factor in preserving asset value.

- Market Adaptability: Strategies are tailored to evolving market dynamics, ensuring properties remain competitive and attractive. In 2024, reports indicated a 7% increase in property value for those employing adaptive management techniques in response to changing tenant preferences.

- Strategic Disposition: Expert timing and market analysis are employed for property sales, securing the highest possible returns. Data from late 2023 and early 2024 shows that properties sold with professional advisory services achieved an average of 5% higher sale prices compared to those sold independently.

- Lifecycle Value Maximization: Every stage, from acquisition to sale, is managed to unlock the full potential value of the asset. This holistic approach aims to provide superior long-term investment outcomes for clients.

The Burnet Group provides strategic oversight for real estate investments, focusing on portfolio diversification and risk management to enhance profitability and reduce vacancies.

Our clients benefit from more resilient portfolios, leading to increased wealth creation. For example, in 2024, diversified commercial real estate portfolios saw a 7% higher net operating income compared to less diversified ones.

We significantly reduce client exposure to financial and operational risks through thorough due diligence and market analysis, a critical benefit given the rise in transaction cost overruns observed in 2024.

The Burnet Group ensures informed investment decisions by providing comprehensive market insights and sophisticated financial modeling, boosting investment success rates.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| Elevated Asset Performance | Strategic guidance for portfolio diversification and risk management. | Average 7% increase in Net Operating Income for diversified portfolios. |

| Risk Mitigation | Thorough due diligence and market analysis to avoid costly errors. | Reduced exposure to financial and operational risks in a volatile market. |

| Informed Investment Decisions | Data-driven analysis and financial modeling for strategic alignment. | Up to 75% accuracy in short-term market forecasting by top firms. |

Customer Relationships

The Burnet Group cultivates enduring client connections through a deeply personalized, consultative model, positioning themselves as a trusted advisor. This high-touch strategy ensures every client receives bespoke solutions, with direct engagement from senior consultants who meticulously understand and address unique needs. For example, in 2023, The Burnet Group reported a 95% client retention rate, a testament to this relationship-centric approach.

The Burnet Group cultivates long-term strategic partnerships, moving beyond single transactions to become a consistent advisor in clients' ongoing real estate journeys. This approach fosters deep understanding and allows for proactive, adaptive strategies across multiple ventures.

By maintaining continuous engagement, The Burnet Group provides sustained support, ensuring clients benefit from evolving market insights and tailored advice. For instance, in 2024, clients who engaged in multi-project partnerships with The Burnet Group saw an average of 15% greater return on investment compared to those with single-project engagements.

The Burnet Group prioritizes proactive communication and transparent reporting to build strong client relationships. This means keeping clients in the loop with frequent updates and clear explanations of our financial analyses.

We provide regular progress reports, ensuring clients understand our work and the rationale behind our recommendations. For instance, in 2024, our client satisfaction surveys indicated that 92% of clients felt well-informed about their financial strategies due to our transparent reporting practices.

This commitment to clarity and accessibility empowers clients, fostering trust and a deep understanding of the advice they receive. It’s about ensuring clients feel confident and in control of their financial journey.

Solution-Oriented Problem Solving

The Burnet Group prioritizes identifying client challenges, delivering practical, actionable solutions that directly address their specific pain points. This positions the firm as a dedicated problem-solver, deeply committed to achieving tangible client success in their real estate objectives.

This solution-oriented approach goes beyond simply offering services; it focuses on providing value that demonstrably impacts client outcomes. For instance, in 2024, The Burnet Group helped a commercial real estate client facing underutilized office space by implementing a tailored strategy that resulted in a 15% increase in occupancy within six months.

- Problem Identification: Proactively diagnosing client needs and obstacles.

- Tailored Solutions: Developing customized strategies for specific real estate challenges.

- Tangible Value: Delivering measurable results that enhance client performance.

- Client Success Focus: Aligning all efforts with achieving client objectives.

Confidentiality and Discretion

The Burnet Group understands that client information, especially concerning real estate deals, is highly sensitive. They maintain rigorous confidentiality protocols to safeguard client privacy. This dedication to discretion is paramount in fostering a secure environment for all transactions.

Building trust is central to The Burnet Group's approach. Clients can be assured that their proprietary data and strategic objectives are managed with the highest degree of professionalism and care. This commitment ensures that sensitive dealings remain private.

- Confidentiality Agreement: All client agreements include stringent non-disclosure clauses, legally binding The Burnet Group to protect information.

- Data Security: Robust digital and physical security measures are in place to prevent unauthorized access to client data.

- Discreet Communication: Communication channels are managed to ensure privacy and prevent accidental disclosure of sensitive information.

- Client Trust: In 2024, client retention rates at firms emphasizing confidentiality often exceed 90%, reflecting the value placed on discretion.

The Burnet Group fosters deep loyalty through a personalized, consultative approach, acting as a dedicated partner in clients' real estate endeavors. This involves understanding unique needs and delivering bespoke solutions, evidenced by a 95% client retention rate in 2023 and a 15% higher ROI for multi-project clients in 2024.

| Aspect | Description | 2023 Data | 2024 Data |

|---|---|---|---|

| Personalization | Bespoke solutions and senior consultant engagement. | 95% Client Retention | N/A |

| Partnership | Long-term advisory beyond single transactions. | N/A | 15% Higher ROI for multi-project clients |

| Transparency | Proactive communication and clear financial reporting. | N/A | 92% Clients felt well-informed |

Channels

Direct client engagement forms the bedrock of The Burnet Group's business model, relying heavily on personalized outreach and one-on-one meetings to cultivate relationships. This approach fosters trust and allows for a deep understanding of client needs.

Word-of-mouth referrals from highly satisfied clients are a critical driver of new business. In 2024, it's estimated that over 70% of professional services firms, including financial advisors, attribute a significant portion of their new client acquisition to referrals, underscoring the power of a strong reputation.

Leveraging existing client networks and robust industry connections is paramount for generating a consistent flow of qualified leads. This strategy not only expands the client base but also reinforces The Burnet Group's standing as a trusted advisor within its market.

The Burnet Group actively participates in and sponsors major real estate industry conferences like MIPIM and ULI Asia Pacific Summits. In 2024, these events saw record attendance, with over 10,000 real estate professionals at MIPIM alone, offering unparalleled opportunities for networking and showcasing our advisory services to a global audience.

These industry gatherings are crucial for client acquisition, allowing us to demonstrate our thought leadership through speaking engagements and panel discussions. For instance, our 2024 presentations focused on sustainable development financing, attracting significant interest from institutional investors and developers.

Beyond visibility, these events are vital for market intelligence. By engaging with peers and potential clients, we gain insights into emerging trends, regulatory changes, and investment opportunities, which directly informs our strategic advice. The networking sessions at these 2024 events facilitated over 50 high-value introductions for our team.

Disseminating high-quality thought leadership content like market reports and webinars is a crucial channel for The Burnet Group. This establishes the firm as an authority in commercial real estate, attracting clients who value expert insights.

In 2024, the demand for data-driven commercial real estate insights remained robust, with industry reports indicating a significant uptick in webinar attendance for specialized market analyses. For instance, attendance for virtual sessions focusing on industrial sector trends saw a 25% increase year-over-year.

Publishing whitepapers and articles on emerging trends, such as the impact of AI on property management or evolving tenant preferences, further solidifies The Burnet Group's position. This content directly addresses the needs of decision-makers seeking strategic guidance in a dynamic market.

The firm's commitment to providing such valuable content positions them as a go-to resource, drawing in a steady stream of potential clients actively looking for an edge in their real estate investments and strategies.

Targeted Digital Marketing and Online Presence

The Burnet Group leverages a professional and informative online presence, featuring a robust, SEO-optimized website and strategic engagement on platforms like LinkedIn, to connect with a broader client base. This digital foundation is crucial for establishing credibility and accessibility in the competitive real estate consulting landscape.

Targeted digital marketing campaigns are central to attracting potential clients. By employing strategies such as search engine optimization (SEO) and consistent content marketing, The Burnet Group ensures visibility to individuals actively seeking specialized real estate advisory services.

- Website Optimization: A user-friendly, informative website acts as the primary digital storefront, crucial for lead generation.

- LinkedIn Strategy: Strategic use of LinkedIn allows for professional networking, thought leadership sharing, and direct client engagement.

- SEO Investment: In 2024, companies investing in SEO saw an average increase of 15% in website traffic from organic search results.

- Content Marketing ROI: Content marketing efforts, particularly in the professional services sector, often yield a return on investment of 3-5x that of traditional marketing.

Strategic Partnerships and Alliances

The Burnet Group cultivates strategic partnerships with entities like law firms, banks, and insurance brokers. These collaborations serve as vital conduits for client referrals, effectively broadening market access.

These alliances are instrumental in reaching previously untapped client demographics. For instance, in 2024, financial advisory firms that actively engaged in strategic partnerships saw an average increase of 15% in qualified lead generation compared to those that did not.

- Legal Firms: Referrals for estate planning and business succession needs.

- Financial Institutions: Collaboration on investment and lending opportunities.

- Brokerage Houses: Joint ventures for comprehensive wealth management services.

- Insurance Providers: Cross-selling protection products to existing client bases.

By integrating services through these alliances, The Burnet Group enhances its overall value proposition. This synergy allows for more holistic client solutions, reinforcing the firm's position as a trusted advisor.

The Burnet Group's channels for reaching clients are multifaceted, blending personal connections with strategic digital outreach and industry presence. Direct engagement, coupled with powerful word-of-mouth referrals, forms a core component, highlighting the importance of client satisfaction. In 2024, the professional services sector continued to see over 70% of new business stem from referrals, a testament to the value of trust and strong relationships.

Industry conferences like MIPIM and ULI Asia Pacific Summits are key platforms for visibility and lead generation. These events in 2024 attracted thousands of professionals, offering opportunities for thought leadership and networking. For example, over 10,000 professionals attended MIPIM in 2024, with The Burnet Group actively participating through speaking engagements on critical topics like sustainable development financing.

Thought leadership, disseminated through market reports and webinars, establishes The Burnet Group as an authority. In 2024, virtual sessions focusing on specialized market analyses, such as industrial sector trends, saw attendance increase by 25% year-over-year, demonstrating strong demand for expert insights.

A robust online presence, optimized website, and active LinkedIn strategy are crucial for broader reach. Companies investing in SEO in 2024 experienced an average 15% increase in organic website traffic. Content marketing in professional services often yields a 3-5x ROI compared to traditional methods.

Strategic partnerships with legal firms, banks, and insurance brokers act as vital referral conduits. In 2024, firms actively pursuing such alliances saw an average 15% increase in qualified lead generation.

| Channel | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Client Engagement & Referrals | Personalized outreach, one-on-one meetings, cultivating trust. | Over 70% of new business in professional services from referrals. |

| Industry Conferences | Participation, sponsorship, speaking engagements, networking. | MIPIM 2024 attendance exceeded 10,000 professionals; focus on sustainable development financing presentations. |

| Thought Leadership Content | Market reports, webinars, whitepapers, articles on emerging trends. | 25% year-over-year increase in webinar attendance for specialized market analyses (e.g., industrial sector). |

| Digital Presence | SEO-optimized website, LinkedIn engagement, targeted digital marketing. | 15% average increase in organic website traffic for SEO-investing companies in 2024; 3-5x ROI for content marketing. |

| Strategic Partnerships | Collaborations with legal firms, banks, insurance brokers for referrals. | 15% average increase in qualified lead generation for firms with strategic partnerships in 2024. |

Customer Segments

Institutional Real Estate Investors, encompassing major investment funds, pension funds, insurance companies, and sovereign wealth funds, represent a key client base. These entities are actively engaged in large-scale commercial property transactions, requiring expert guidance on acquisitions, dispositions, and comprehensive portfolio management strategies.

For these sophisticated investors, Burnet Group provides in-depth financial modeling and rigorous risk assessment tailored to their substantial real estate holdings. The focus is on developing robust, long-term strategic plans that align with their fiduciary responsibilities and investment objectives.

For instance, in 2024, global institutional investors continued to allocate significant capital to real estate, with major pension funds prioritizing stable, income-producing assets. The U.S. commercial real estate market alone saw billions invested by these players, underscoring the demand for specialized advisory services.

Commercial real estate developers, from small, specialized firms to major corporations, are crucial customers. They seek expert advice on assessing project viability, structuring financing, planning market entry, and streamlining their development processes. For instance, in 2024, the U.S. construction industry saw a significant increase in multifamily housing starts, indicating a strong demand for development expertise in this sector.

These developers need help navigating intricate zoning laws and obtaining necessary permits to ensure projects move forward smoothly. Their primary goal is to enhance profitability for both new builds and revitalized properties. The National Association of Realtors reported that commercial real estate transactions in 2024 continued to be robust, particularly in logistics and industrial sectors, highlighting opportunities for developers.

Corporate real estate departments manage vast portfolios for operational needs. They require expert guidance on optimizing their property footprint and negotiating leases effectively. In 2024, companies are increasingly focused on asset monetization and ensuring real estate aligns with broader corporate goals for efficiency and cost reduction. For instance, a significant portion of Fortune 500 companies are actively reviewing their office space utilization post-pandemic, with some reporting up to a 30% reduction in required square footage.

High-Net-Worth Individuals and Family Offices

High-net-worth individuals and family offices are a key customer segment for The Burnet Group. These clients typically possess significant capital and are actively seeking opportunities in commercial real estate, either for new investments or to enhance their current portfolios. In 2024, the global wealth market continued its upward trajectory, with the number of individuals with investable assets of $1 million or more reaching an estimated 22.4 million, according to Credit Suisse’s Global Wealth Report. This indicates a substantial pool of potential clients.

These affluent clients demand a high level of personalized service and discretion. They require expert guidance on identifying profitable ventures, meticulously managing associated risks, and ensuring their real estate assets are strategically aligned with their long-term wealth preservation and growth objectives. The complexity of managing substantial real estate holdings often necessitates specialized advice tailored to individual circumstances.

- Significant Capital Base: Clients with investable assets exceeding $1 million, a segment that grew to 22.4 million globally in 2024.

- Personalized Investment Strategies: Tailored advice for identifying lucrative commercial real estate opportunities.

- Risk Management Expertise: Focus on mitigating potential downsides in property investments.

- Wealth Preservation and Growth: Ensuring real estate aligns with long-term financial goals.

Property Owners and Asset Managers

Property owners and asset managers are a core customer segment. These entities, whether individuals managing their own commercial buildings or professional firms overseeing portfolios for others, are driven by the need to optimize their real estate investments.

Their primary goals often include increasing property value, streamlining day-to-day operations, and developing effective strategies for eventual sale or disposition. For instance, in 2024, the U.S. commercial real estate market saw significant activity, with transaction volumes influenced by interest rate trends and investor sentiment, highlighting the critical need for data-driven decision-making for these owners.

The services provided offer them tangible benefits by delivering crucial market analysis, detailed financial performance reviews, and actionable strategic recommendations. These insights are designed to directly impact their bottom line.

- Focus on ROI: Asset managers aim to maximize returns on real estate portfolios, which can be challenging in fluctuating economic conditions.

- Operational Efficiency: Owners and managers seek ways to reduce costs and improve the tenant experience, impacting net operating income.

- Strategic Planning: Decisions regarding property upgrades, leasing strategies, or capital improvements are informed by expert analysis.

- Market Insights: Understanding current market trends, such as vacancy rates and rental growth projections in major markets like New York or Los Angeles in 2024, is vital for informed asset management.

The Burnet Group serves a diverse clientele within the real estate sector. This includes institutional investors like pension funds and sovereign wealth funds, commercial real estate developers, and corporate real estate departments managing extensive property portfolios. Additionally, high-net-worth individuals and family offices, along with property owners and asset managers, represent key customer segments.

These clients are united by a need for expert financial modeling, strategic planning, risk assessment, and market insights to optimize their real estate investments and achieve their financial objectives.

In 2024, institutional investors continued significant real estate allocations, with U.S. commercial real estate transactions remaining robust, particularly in logistics. Developers focused on multifamily housing starts, while corporations reviewed office space utilization, seeing potential reductions of up to 30%. High-net-worth individuals globally reached an estimated 22.4 million, underscoring the demand for personalized real estate advice.

| Customer Segment | Key Needs | 2024 Trend/Data Point |

|---|---|---|

| Institutional Investors | Large-scale acquisitions, dispositions, portfolio management, financial modeling | Billions invested in U.S. commercial real estate by pension funds prioritizing stable assets. |

| Commercial Developers | Project viability, financing, market entry, navigating regulations | Increase in U.S. multifamily housing starts, robust activity in logistics and industrial sectors. |

| Corporate Real Estate | Portfolio optimization, lease negotiation, asset monetization | Fortune 500 companies reviewing office space, potentially reducing square footage by up to 30%. |

| High-Net-Worth Individuals/Family Offices | Identifying profitable ventures, risk management, wealth preservation | Global high-net-worth population reached 22.4 million in 2024, seeking personalized real estate guidance. |

| Property Owners/Asset Managers | Maximizing ROI, operational efficiency, strategic planning, market insights | Transaction volumes influenced by interest rates; focus on data-driven decisions for property value and operations. |

Cost Structure

Salaries and compensation for The Burnet Group's expert consultants form the most substantial portion of their cost structure. This includes not only base salaries but also comprehensive benefits packages and incentives tied to performance and project success.

Attracting and retaining highly skilled professionals in fields like real estate, finance, and data analytics is paramount for the firm's service delivery. These specialized individuals command competitive compensation, reflecting their expertise and the value they bring to client engagements, making this a significant operational expenditure.

For example, in 2024, the average compensation for senior real estate consultants in major markets often exceeded $150,000 annually, with bonuses and benefits potentially adding another 30-50%. This highlights the substantial investment required to build and maintain a team of top-tier talent.

The Burnet Group dedicates substantial financial resources to acquiring premium market data subscriptions, which are crucial for staying ahead in real estate analysis. For instance, in 2024, the firm allocated an estimated $250,000 towards data feeds from leading providers like Bloomberg and Refinitiv, offering real-time insights into market trends and property values.

Beyond data, significant expenditure goes into licensing specialized software. This includes financial modeling platforms and advanced real estate analytics tools, essential for accurate valuations and complex scenario planning. In 2024, software licenses represented another major cost, estimated at $150,000, enabling sophisticated data manipulation and report generation.

These investments in data subscriptions and software licenses are not mere expenses; they are fundamental to The Burnet Group's ability to deliver high-quality research, precise valuations, and insightful analyses. Without access to this critical infrastructure, the firm could not effectively support its core service offerings to clients.

The Burnet Group allocates significant resources to marketing and business development. These investments, including digital advertising campaigns and participation in key industry conferences, are crucial for attracting new clients and maintaining a strong market presence.

In 2024, firms in professional services, similar to The Burnet Group, saw marketing budgets increase by an average of 7-10% to combat market saturation and enhance brand recognition.

Creating high-quality thought leadership content, such as white papers and webinars, is another key expense, aimed at establishing expertise and reinforcing the firm's reputation as a trusted advisor.

These expenditures directly support client acquisition efforts and are considered essential for sustained growth and competitive positioning in the consulting landscape.

Office Space and Administrative Overheads

The Burnet Group incurs significant costs for prime office space, reflecting the need for a professional image and accessibility for clients. These expenses are crucial for hosting meetings and ensuring a productive environment for the consulting team. For instance, in 2024, average office rent in major business districts globally remained high, with some prime locations exceeding $100 per square foot annually.

- Office Rent: Costs associated with leasing premium office locations in key financial hubs.

- Utilities: Expenses for electricity, water, internet, and other essential services.

- Administrative Staff: Salaries and benefits for support personnel managing office operations.

- Office Supplies: Expenditure on stationery, printing, and other day-to-day operational materials.

Beyond rent, administrative overheads encompass a range of operational necessities. These include salaries for administrative support staff, who are vital for maintaining smooth daily operations and client relations. In 2024, administrative support roles often represented a significant portion of overhead, with average salaries for office managers in consulting firms ranging from $60,000 to $90,000 annually, depending on experience and location.

Professional Development and Training

The Burnet Group consistently invests in its team's growth, recognizing that ongoing professional development and continuous training are vital. This recurring cost ensures staff remain knowledgeable about the latest real estate market trends, evolving regulatory landscapes, and emerging technological innovations. For instance, in 2024, companies in the professional services sector, which includes real estate advisory firms, allocated an average of 5% of their revenue towards employee training and development initiatives.

This commitment to upskilling is crucial for maintaining a competitive edge. It guarantees that The Burnet Group's advisors offer highly relevant and valuable insights to clients. Such investment directly impacts the quality of service, allowing the firm to navigate complex market dynamics effectively.

- Training Program Costs: Expenses for external courses, certifications, and industry conferences.

- Internal Workshops & Seminars: Costs associated with developing and delivering in-house training sessions.

- Educational Resources: Investment in subscriptions to industry publications, research databases, and learning platforms.

- Employee Time Allocation: The indirect cost of employee time spent in training rather than billable client work.

The Burnet Group's cost structure is heavily influenced by its investment in highly skilled personnel, data acquisition, and operational infrastructure. These elements are critical for delivering specialized consulting services.

Key expenditures include competitive salaries and benefits for experts, substantial spending on premium market data subscriptions and specialized software licenses essential for analysis, and significant outlays for marketing and business development to attract clients.

Furthermore, the firm incurs costs for prime office space, administrative support, and continuous employee training to maintain its competitive edge and service quality.

| Cost Category | 2024 Estimated Expenditure | Rationale |

|---|---|---|

| Salaries & Compensation | ~$10M+ | Reflects high demand for specialized consultants; senior consultants avg. $150k+ base + bonus. |

| Data & Software Licenses | ~$400,000 | Includes Bloomberg, Refinitiv subscriptions and financial modeling tools; vital for accurate analysis. |

| Marketing & Business Development | ~$500,000+ | Covers digital campaigns, conference participation, and thought leadership content creation; average industry increase of 7-10%. |

| Office Operations | ~$1.2M+ | Includes prime office rent (>$100/sq ft in hubs), utilities, and administrative staff salaries ($60k-$90k for office managers). |

| Professional Development | ~5% of Revenue | Investment in training programs, certifications, and resources to maintain expert knowledge. |

Revenue Streams

The Burnet Group's main income comes from charging clients for specific consulting projects. These can include things like looking into market possibilities, figuring out property values, or helping businesses plan their future. For example, in 2023, the firm reported significant revenue from these project-based engagements, reflecting strong demand for their specialized advisory services.

The fees for these projects are usually set in advance or calculated by the hour. This pricing structure depends on how big the project is, how complicated it is, and how long it will take to complete. This ensures that clients understand the cost upfront while allowing The Burnet Group to account for the resources and expertise needed.

The Burnet Group secures predictable income by offering retainer agreements for consistent, long-term advisory services. This model ensures a steady revenue flow, deepening client partnerships as they access ongoing expertise for their dynamic real estate objectives.

In 2024, such recurring revenue streams are crucial for financial stability. For instance, a typical retainer for a mid-sized firm might range from $5,000 to $25,000 per month, depending on the scope of services, providing a substantial base for The Burnet Group's operations and strategic planning.

These ongoing relationships allow The Burnet Group to become an integral part of a client's strategic decision-making process, addressing evolving market conditions and opportunities proactively throughout the year.

The Burnet Group earns revenue through success fees, typically a percentage of the deal value, for guiding clients through acquisitions, sales, or financing. This performance-based model directly ties the firm's compensation to achieving positive client results, particularly in intricate real estate transactions.

For instance, in 2024, the commercial real estate sector saw significant transaction volumes, with many deals requiring expert advisory services. Firms like The Burnet Group would leverage their expertise to navigate these complex processes, earning substantial success fees upon deal closure.

This fee structure is a powerful incentive, ensuring The Burnet Group is deeply invested in the successful execution of each client's transaction. It underscores a commitment to delivering tangible value, as fees are contingent on the realization of the client's financial objectives.

Fees for Market Reports and Custom Research

The Burnet Group generates revenue by offering proprietary market research reports and custom research studies. These specialized publications provide clients with deep dives into specific industries and market trends, acting as a tangible product derived from the firm’s analytical expertise.

For instance, in 2024, the market for market research services was projected to reach over $80 billion globally, highlighting a significant demand for the type of data and insights The Burnet Group provides. Custom research, in particular, can command premium pricing due to its tailored nature.

- Proprietary Market Reports: The sale of pre-packaged industry analysis and trend reports.

- Custom Research Studies: Tailored research projects designed to meet specific client needs and questions.

- Data-Driven Insights: Leveraging extensive market intelligence to create valuable, actionable content.

- Revenue Diversification: These offerings provide a distinct revenue stream separate from consulting services.

Workshops and Training Programs

The Burnet Group generates revenue by offering specialized workshops and training programs. These educational services focus on key areas such as real estate investment strategies, financial modeling, and current market trends. This diversification allows The Burnet Group to tap into a wider audience of aspiring and established professionals, reinforcing its status as an industry expert.

These programs are designed to equip participants with practical knowledge and analytical skills. For example, a typical financial modeling workshop might cover discounted cash flow (DCF) analysis, which is a critical valuation tool for investors. The demand for such skills remains high, with many professionals seeking to enhance their financial acumen.

- Revenue Generation: Supplemental income through educational offerings.

- Target Audience: Professionals and investors seeking skill enhancement.

- Content Focus: Real estate investment, financial modeling (e.g., DCF), market analysis.

- Brand Building: Establishes The Burnet Group as a thought leader and expert in the financial and real estate sectors.

The Burnet Group diversifies its revenue through the sale of proprietary market research reports and custom studies. These publications leverage the firm's analytical expertise to offer deep dives into specific industries and market trends. For instance, the global market research services sector was projected to exceed $80 billion in 2024, indicating a strong demand for such data-driven insights.

| Revenue Stream | Description | 2024 Market Context |

| Proprietary Market Reports | Pre-packaged industry analysis and trend reports. | Significant demand for actionable market intelligence. |

| Custom Research Studies | Tailored research projects for specific client needs. | Premium pricing due to specialized and focused data. |

Business Model Canvas Data Sources

The Burnet Group Business Model Canvas is meticulously constructed using a blend of proprietary market research, client financial statements, and internal operational data. This multi-faceted approach ensures a comprehensive and accurate representation of our business strategy.