Brown-Forman PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brown-Forman Bundle

Navigate the complex external forces shaping Brown-Forman's future with our comprehensive PESTEL analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for this iconic spirits company. Gain the strategic foresight needed to make informed decisions and stay ahead of the curve.

Unlock actionable intelligence on the technological advancements and environmental regulations impacting Brown-Forman's operations and market position. Our expertly crafted analysis provides the critical insights you need to identify emerging threats and capitalize on new growth avenues. Download the full PESTEL analysis now to gain a competitive edge.

Political factors

Brown-Forman navigates a complex web of government regulations impacting its global operations, from production standards to marketing and sales. These rules vary widely across its 170+ markets, influencing everything from product formulation to point-of-sale advertising. For instance, the company must adhere to differing alcohol content regulations, labeling requirements, and distribution channel restrictions in countries like the United States versus those in the European Union.

Changes in fiscal policies, such as excise taxes and import duties, directly affect Brown-Forman's cost structure and pricing strategies. In 2023, for example, the spirits industry continued to monitor potential shifts in alcohol excise taxes in key markets like the UK, where such taxes represent a significant portion of the retail price of spirits. These tax structures can influence consumer purchasing decisions and the overall competitiveness of Brown-Forman's brands.

Trade policies and geopolitical tensions present ongoing challenges. Tariffs imposed on American-made spirits, such as those seen in past trade disputes between the US and the EU, can escalate costs for consumers and create barriers to market entry. Brown-Forman, with its significant export business, closely watches international trade agreements and potential disruptions that could impact the accessibility and affordability of its premium brands like Jack Daniel's and Woodford Reserve in crucial global markets.

Brown-Forman's global operations expose it to the risks of political instability and geopolitical tensions. Events like social unrest or international conflicts can disrupt its supply chains, dampen consumer spending, and create unpredictable market conditions. For instance, in fiscal year 2025, the company highlighted that macroeconomic and geopolitical uncertainties negatively affected consumer confidence and discretionary spending in key markets.

This instability also translates into currency volatility, which can significantly impact Brown-Forman's financial performance. Fluctuations in exchange rates, often driven by geopolitical events, can alter the value of international earnings and costs, adding another layer of complexity to its financial reporting and strategic planning.

The global conversation around alcohol consumption, marked by public health campaigns advocating for moderation and the rise of low- and no-alcohol (LNA) alternatives, directly impacts consumer choices. Stricter regulations on alcohol advertising, a growing trend in many markets, also shape how brands like Brown-Forman can connect with consumers, potentially limiting reach and requiring innovative marketing approaches.

Brown-Forman needs to strategically adjust its brand development and market entry plans to resonate with shifting societal attitudes towards alcohol. This is particularly crucial as younger demographics, such as Gen Z, show a growing preference for mindful drinking and a greater interest in LNA products. For instance, the LNA segment in the US beverage alcohol market was projected to grow significantly, with some reports indicating double-digit growth rates in the early 2020s, suggesting a substantial market shift.

Taxation and Fiscal Policies

Taxation and fiscal policies significantly influence Brown-Forman's profitability and market reach. Fluctuations in excise taxes, value-added taxes (VAT), and other government-imposed fiscal measures directly affect the final price and consumer accessibility of its diverse product portfolio. For instance, an upward adjustment in these taxes can necessitate higher retail prices, potentially impacting sales volumes, particularly for premium spirit brands where price sensitivity can be more pronounced.

Brown-Forman's financial projections highlight the impact of these fiscal considerations. The company's outlook for fiscal year 2026 anticipates an elevated effective tax rate. This projected increase in the tax burden is expected to exert further pressure on the company's profit margins, underscoring the critical need for strategic financial planning to mitigate these effects.

- Excise Taxes: These are levied on specific goods, including alcoholic beverages, and can vary significantly by country and region, directly impacting Brown-Forman's cost of goods sold and pricing strategies.

- VAT/Sales Taxes: Applied at various stages of the supply chain or at the point of sale, these taxes add to the final consumer price, influencing purchasing decisions.

- Fiscal Policy Changes: Government decisions on tax rates, subsidies, or trade policies can create both opportunities and challenges, requiring constant adaptation from the company.

- Projected Tax Rate Impact: For fiscal 2026, Brown-Forman anticipates a higher tax rate, which is a key factor in its margin expectations.

Corporate Governance and Political Contributions

Brown-Forman actively participates in the political landscape through corporate contributions, where legally allowed, to advocate for its business interests. This engagement is overseen by the company's Corporate Governance and Nominating Committee, ensuring alignment with strategic objectives and ethical standards.

The company also supports an employee-funded Political Action Committee (PAC), which makes contributions to federal, state, and local political campaigns. This structure allows employees to collectively support candidates and causes they believe in, further extending Brown-Forman's political influence.

Transparency and accountability are key tenets of Brown-Forman's political spending. The company strives to ensure its political expenditures are managed responsibly and in compliance with all relevant laws and regulations, reflecting a commitment to ethical conduct in its public policy engagement.

- Corporate Political Contributions: Brown-Forman makes political contributions where permitted by law to advance its business interests.

- Employee PAC: An employee-funded Political Action Committee (PAC) facilitates contributions to federal, state, and local political campaigns.

- Oversight: The Corporate Governance and Nominating Committee provides oversight for the company's political activities and contributions.

- Transparency: Emphasis is placed on transparency and accountability in all political expenditures.

Government regulations significantly shape Brown-Forman's operations, from production standards to marketing across its 170+ markets, impacting product formulation and distribution. Fiscal policies, particularly excise taxes and import duties, directly influence cost structures and pricing, with potential tax rate increases for fiscal 2026 expected to affect profit margins. Trade policies and geopolitical tensions can disrupt supply chains and consumer spending, as noted by the company's fiscal year 2025 observations on macroeconomic uncertainties impacting consumer confidence.

| Factor | Impact on Brown-Forman | Example/Data Point |

|---|---|---|

| Regulatory Compliance | Adherence to varying global standards for production, labeling, and sales. | Different alcohol content regulations in the US vs. EU. |

| Fiscal Policy (Taxes) | Direct influence on cost of goods and pricing strategies. | Projected higher effective tax rate for fiscal 2026. |

| Trade & Geopolitics | Risk of tariffs, supply chain disruptions, and reduced consumer spending. | Fiscal year 2025 report on geopolitical uncertainties affecting consumer confidence. |

What is included in the product

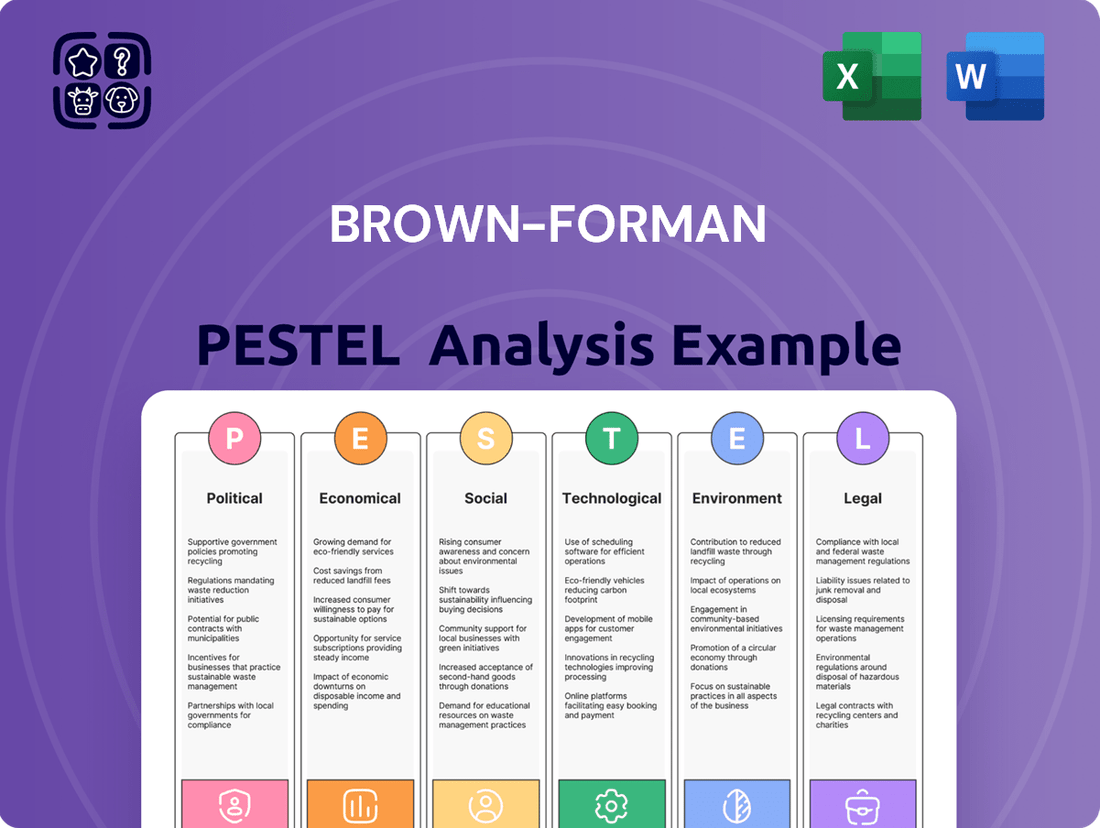

This PESTLE analysis delves into the external macro-environmental factors influencing Brown-Forman, examining Political, Economic, Social, Technological, Environmental, and Legal dimensions to uncover strategic opportunities and potential threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Brown-Forman.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key political, economic, social, technological, environmental, and legal influences on Brown-Forman's operations.

Economic factors

Brown-Forman navigated a challenging economic landscape in fiscal year 2025, grappling with a global economic slowdown and persistent inflationary pressures. These macroeconomic headwinds directly impacted consumer behavior, leading to a noticeable decline in spirits consumption across key developed markets.

The company's financial performance reflected these pressures, with reported declines in net sales. This trend was further underscored by a cautious outlook for fiscal year 2026, as Brown-Forman anticipated the continuation of these economic headwinds, which dampen consumer confidence and discretionary spending.

Consumer spending on premium alcoholic beverages is a key driver for Brown-Forman. In the first half of 2024, U.S. consumer spending on alcoholic beverages saw a modest increase, but the premium segment faced pressure as inflation persisted. For instance, while overall retail sales of alcohol grew by an estimated 2.1% year-over-year in the first quarter of 2024, premium spirits experienced slower growth compared to value-oriented options.

Economic uncertainty and rising prices directly impact consumer willingness to purchase premium products. In 2024, persistent inflation, particularly in food and energy, has squeezed disposable incomes for many households. This has led to a noticeable trend of consumers trading down to more affordable brands or reducing their overall spending on discretionary items like high-end spirits, a challenge Brown-Forman's premiumization strategy must navigate.

Brown-Forman's extensive global presence, with sales in over 170 countries, makes it highly susceptible to currency exchange rate volatility. When the U.S. dollar strengthens, it can diminish the reported value of international earnings and sales when converted back to dollars.

This currency headwind was a contributing factor to a reported decline in net sales within emerging markets during fiscal year 2025, even as the underlying business experienced organic growth. For example, in Q3 FY25, reported net sales were impacted by unfavorable currency movements, partially offsetting strong underlying brand performance.

Interest Rates and Access to Capital

Changes in interest rates directly influence Brown-Forman's cost of borrowing, affecting its capacity for investments, acquisitions, and share repurchases. Even with a history of sound financial management, including proactive debt reduction, a persistently elevated interest rate environment makes securing capital more costly. For instance, the Federal Reserve has maintained a target federal funds rate range of 5.25%-5.50% as of late 2024, a significant increase from previous years, which impacts borrowing benchmarks across the economy.

Brown-Forman's strategic focus on efficient capital allocation remains crucial for fueling future growth and maintaining its competitive edge. The company's ability to access capital at favorable terms is intrinsically linked to prevailing interest rate conditions. As of its fiscal year ending April 30, 2024, Brown-Forman reported total debt of approximately $4.3 billion, meaning even small shifts in interest rates can have a material impact on its interest expense.

The company's approach to financing its operations and growth initiatives will need to adapt to potential shifts in the interest rate landscape. This includes evaluating the optimal mix of debt and equity financing and carefully managing its debt maturity profile. The Federal Reserve's forward guidance and any anticipated rate adjustments by central banks globally will be key considerations for Brown-Forman's treasury and strategic planning teams in 2025.

- Impact on Borrowing Costs: Higher interest rates increase the expense of any new debt issuance or variable-rate debt for Brown-Forman.

- Financing Growth: The cost of capital directly affects the feasibility and attractiveness of potential acquisitions or major capital expenditure projects.

- Debt Management: Brown-Forman's strategy of managing its debt levels becomes even more critical in a rising rate environment.

- Investor Returns: Increased interest expenses can potentially reduce net income, impacting earnings per share and dividend capacity.

Supply Chain Costs and Raw Material Prices

Brown-Forman's production expenses are significantly impacted by the fluctuating costs of essential raw materials. Grains, water, and notably, wood for aging barrels have all experienced notable price hikes, directly affecting the company's bottom line. This surge in input costs has unfortunately led to a contraction in gross margins.

To combat these rising expenses, Brown-Forman has implemented proactive strategies. These include efforts to optimize its wood supply chain and the strategic closure of its cooperage, aiming to build greater efficiencies and mitigate the pressure of increased raw material prices.

- Raw Material Cost Impact: Increased prices for grains, water, and wood for barrels have directly pressured Brown-Forman's production costs.

- Margin Contraction: The rise in these input costs has contributed to a noticeable contraction in the company's gross margins.

- Strategic Mitigation: Brown-Forman is actively working to offset these pressures through supply chain optimization and operational adjustments like cooperage consolidation.

Brown-Forman's performance in fiscal year 2025 was shaped by a global economic slowdown and persistent inflation, impacting consumer spending on premium spirits. For instance, U.S. consumer spending on alcohol saw modest growth in early 2024, but premium spirits lagged behind value options due to inflation squeezing disposable incomes.

Currency fluctuations also presented a challenge, with a strengthening U.S. dollar diminishing the reported value of international sales, as seen in emerging markets during FY25. This was partially offset by strong underlying brand performance, but the impact was noticeable on reported net sales.

Rising interest rates, with the Federal Reserve's target range at 5.25%-5.50% in late 2024, increased borrowing costs for Brown-Forman, which had approximately $4.3 billion in total debt as of April 30, 2024. This elevated cost of capital affects investment and growth initiatives.

Production costs were also pressured by increased prices for key inputs like grains and wood for barrels, leading to margin contraction. Brown-Forman is addressing this through supply chain optimization and cooperage consolidation to improve efficiency.

| Economic Factor | Impact on Brown-Forman | Data Point / Example |

| Global Economic Slowdown | Reduced consumer spending on premium spirits | Consumer spending on premium spirits faced pressure in key developed markets in FY25. |

| Inflation | Decreased disposable income, leading to trading down | In early 2024, premium spirits saw slower growth than value options amid persistent inflation. |

| Currency Exchange Rates | Diminished reported international earnings | Strengthening USD impacted reported net sales in emerging markets during FY25. |

| Interest Rates | Increased borrowing costs | Federal Funds Rate target range of 5.25%-5.50% (late 2024) impacts debt financing costs for Brown-Forman's ~$4.3 billion debt. |

| Raw Material Costs | Pressured production costs and margins | Increased prices for grains and wood for barrels contributed to gross margin contraction. |

Preview Before You Purchase

Brown-Forman PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Brown-Forman delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a strategic overview essential for understanding the external landscape Brown-Forman navigates.

Sociological factors

A notable shift is underway in consumer habits, with a growing preference for moderation and a rise in low- and no-alcohol beverage options. This trend, often termed 'tempo drinking' where consumers alternate alcoholic and non-alcoholic drinks, is significantly reshaping the beverage alcohol landscape. For instance, in 2024, the global market for non-alcoholic beverages saw robust growth, with projections indicating continued expansion through 2025 as more consumers, particularly younger demographics like Gen Z, actively seek out these alternatives.

This evolving demand directly impacts volume sales for traditional alcoholic products and necessitates strategic adjustments from companies like Brown-Forman. The company needs to actively adapt its product offerings and marketing strategies to align with this growing consumer interest in moderation and the burgeoning non-alcoholic segment to maintain its market position.

Despite overall market fluctuations, a significant trend in the spirits industry is premiumization. Consumers are increasingly willing to spend more on higher-quality spirits, even if they purchase less frequently. This indicates a desire for more refined experiences and a willingness to invest in perceived value.

Within this premium trend, there's a noticeable shift towards 'affordable luxury.' This means consumers are seeking out mid-range premium products that offer a taste of luxury without the highest price tags. It's about finding that sweet spot of quality and value.

Brown-Forman's strategic focus on premium and super-premium brands, which now represent 70% of its portfolio's value, directly taps into this consumer behavior. This alignment positions the company well to capitalize on the enduring demand for elevated spirits experiences.

The increasing purchasing power of Gen Z, now legally able to buy alcohol, is reshaping the beverage market. This generation shows a notable preference for moderation and a keen interest in a wider array of drink choices beyond traditional spirits, impacting how companies like Brown-Forman approach product innovation and marketing.

Understanding generational drinking patterns is vital for sustained success. For instance, while Millennials might favor craft cocktails, Gen Z's embrace of low-alcohol or non-alcoholic options presents a distinct opportunity. In 2024, the U.S. adult population is projected to be over 260 million, with each generation bringing unique consumption habits that Brown-Forman must analyze to remain competitive.

Health and Wellness Consciousness

Growing consumer awareness around health and wellness is a significant sociological factor impacting the beverage industry. This trend is fueling demand for non-alcoholic options and promoting more mindful consumption of alcoholic beverages. For Brown-Forman, this means a dual challenge and opportunity to adapt.

The rise of low- and no-alcohol (LNA) products is a direct response to this shift. In 2024, the global non-alcoholic beverage market was valued at over $1.3 trillion, with the LNA segment showing particularly robust growth. This indicates a clear consumer preference for healthier alternatives.

- Market Shift: Consumers are increasingly prioritizing health, leading to greater interest in LNA products.

- Opportunity for Innovation: Brown-Forman can leverage this trend by expanding its LNA portfolio or developing new offerings.

- Responsible Consumption: Emphasizing responsible drinking for its existing brands can also resonate with health-conscious consumers.

- Data Point: The LNA market is projected to reach $30 billion globally by 2025, highlighting significant growth potential.

Cultural Influences and Social Norms

Cultural influences and evolving social norms around drinking significantly shape consumption patterns, with the rise of at-home cocktailing and the increasing popularity of ready-to-drink (RTD) beverages being key trends. For instance, the global RTD market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a substantial shift in consumer preference towards convenience and new flavor profiles.

Brown-Forman's brand-building strategies must actively resonate with these cultural shifts to maintain brand appeal and drive engagement across diverse global markets. This includes adapting marketing messages to reflect changing attitudes towards alcohol consumption, emphasizing responsible drinking, and innovating product offerings to align with emerging consumer tastes.

- Growing RTD Market: The global market for ready-to-drink beverages is experiencing robust growth, with projections indicating continued expansion through 2030.

- At-Home Consumption: Post-pandemic trends show a sustained increase in at-home entertaining and cocktail creation, influencing demand for premium spirits and mixers.

- Health and Wellness: Evolving social norms also include a greater focus on moderation and wellness, impacting preferences for lower-alcohol or non-alcoholic options.

Sociological factors significantly influence consumer behavior in the beverage alcohol industry, with a notable trend towards moderation and a rising demand for low- and no-alcohol (LNA) options. This is driven by a broader societal focus on health and wellness, prompting consumers to make more mindful choices. For example, the global non-alcoholic beverage market was valued at over $1.3 trillion in 2024, with the LNA segment showing particularly strong growth, projected to reach $30 billion globally by 2025.

Generational differences also play a crucial role, with younger consumers like Gen Z showing a distinct preference for moderation and a wider variety of beverage choices, including LNA products. This contrasts with older generations who may have different drinking patterns. Understanding these evolving generational habits is key for companies like Brown-Forman to adapt their product development and marketing strategies effectively.

Cultural shifts, such as the increasing popularity of at-home cocktailing and ready-to-drink (RTD) beverages, further shape consumption. The global RTD market was valued at approximately $1.1 trillion in 2023, highlighting a consumer preference for convenience and new flavor experiences. Brown-Forman must align its brand-building efforts with these cultural trends to maintain relevance and engagement across diverse global markets.

| Sociological Factor | Trend Description | Impact on Brown-Forman | Relevant Data (2024/2025) |

|---|---|---|---|

| Health & Wellness | Increased consumer focus on well-being and moderation. | Drives demand for LNA products and responsible consumption messaging. | LNA market projected to reach $30 billion globally by 2025. |

| Generational Preferences | Gen Z favors moderation and diverse drink options. | Requires product innovation and targeted marketing for younger demographics. | U.S. adult population over 260 million in 2024, with diverse generational habits. |

| Cultural Shifts | Rise of at-home cocktailing and RTD beverages. | Opportunity to expand RTD portfolio and leverage convenience trends. | Global RTD market valued at ~$1.1 trillion in 2023, with continued growth expected. |

Technological factors

The ongoing digital transformation and the burgeoning e-commerce sector are fundamentally reshaping how alcoholic beverages reach consumers. Alcohol delivery apps, for example, saw significant growth, with the US online alcohol market estimated to reach $32 billion by 2025, a substantial increase from previous years.

Brown-Forman needs to actively invest in digital capabilities to improve how it connects with customers and makes its operations more efficient. This includes leveraging online sales platforms and exploring direct-to-consumer (DTC) strategies to capture the expanding digital market share.

Brown-Forman’s ability to leverage advanced data analytics is paramount for understanding evolving consumer tastes and market dynamics. By analyzing vast datasets, the company can pinpoint emerging trends and predict purchasing behaviors, enabling more targeted product development and marketing efforts. For instance, in 2023, the spirits industry saw a continued rise in premiumization, with consumers willing to spend more on high-quality products, a trend Brown-Forman can capitalize on by analyzing sales data across its portfolio.

Technological advancements are significantly reshaping production and supply chains for companies like Brown-Forman. More efficient manufacturing equipment, often incorporating AI and robotics, can directly translate into lower production costs and a higher, more consistent product quality. For instance, the spirits industry is seeing increased adoption of automated bottling lines and advanced distillation techniques, which can boost output by 10-15% while reducing energy consumption.

Innovations in supply chain management are equally crucial. Automation in warehouses, predictive analytics for demand forecasting, and integrated digital platforms are streamlining operations. Brown-Forman's global footprint benefits from these, enabling faster delivery times, better inventory control, and reduced waste. In 2024, the logistics sector reported a 20% increase in efficiency gains from advanced tracking and automation systems, a trend directly impacting how efficiently goods move from distillery to consumer.

Marketing Technology and Brand Building

Brown-Forman leverages advanced marketing technology, including digital asset management (DAM) systems, to streamline content creation and distribution across its diverse portfolio. This allows for the efficient management of brand assets, ensuring consistency and enabling rapid deployment of campaigns worldwide. For instance, in 2024, the company continued to invest in digital platforms to enhance its global brand presence.

The adoption of dynamic templates within their marketing technology stack empowers Brown-Forman to personalize content for specific markets while maintaining strict brand integrity. This capability is vital for building strong brand equity and supporting market expansion efforts. Local teams can adapt materials, ensuring relevance and adherence to global brand standards.

- Digital Asset Management (DAM): Facilitates centralized storage, retrieval, and distribution of brand content, ensuring consistency and brand compliance across all markets.

- Dynamic Templates: Enable localized customization of marketing materials while adhering to global brand guidelines, enhancing relevance and market penetration.

- Content Optimization: Marketing technology allows for data-driven adjustments to content, improving engagement and campaign effectiveness in real-time.

- Global Brand Consistency: Ensures a unified brand message and visual identity across all touchpoints, crucial for building strong, recognizable brands in diverse international markets.

Cybersecurity and Data Protection

Brown-Forman's increasing reliance on digital systems necessitates strong cybersecurity to prevent financial losses and reputational damage from cyberattacks. In 2023, the global cost of cybercrime was estimated to reach $10.5 trillion annually, a figure expected to climb. This underscores the critical need for robust data protection measures.

The company's implementation of a zero-trust architecture is a proactive step in this direction, ensuring that all access requests are verified, regardless of origin. This approach is vital for safeguarding proprietary information, customer data, and intellectual property in an environment where threats are constantly evolving.

- Increased Cybersecurity Spending: Global spending on cybersecurity solutions is projected to reach $215 billion in 2024, reflecting the growing importance of these investments.

- Data Breach Costs: The average cost of a data breach in 2023 was $4.45 million, highlighting the significant financial implications of security failures.

- Regulatory Compliance: Evolving data protection regulations, such as GDPR and CCPA, mandate stringent security protocols, making cybersecurity a compliance imperative.

Technological advancements are significantly impacting Brown-Forman's operations, from production efficiency to consumer engagement. The company leverages advanced manufacturing equipment, including AI and robotics, to improve output and quality, with the spirits industry seeing adoption of automated bottling lines boosting efficiency by 10-15%.

Digital transformation is key, with the US online alcohol market projected to reach $32 billion by 2025, driving Brown-Forman to invest in e-commerce and direct-to-consumer strategies. Data analytics is also crucial for understanding consumer trends, such as the premiumization trend observed in 2023, allowing for more targeted product development and marketing.

Cybersecurity is a growing concern, with global cybercrime costs estimated at $10.5 trillion annually in 2023, necessitating robust data protection measures like zero-trust architecture for Brown-Forman to safeguard its assets and intellectual property.

| Technological Factor | Impact on Brown-Forman | Supporting Data (2023-2025 Estimates) |

| E-commerce & Digital Sales | Expanded market reach and direct consumer engagement | US online alcohol market to reach $32 billion by 2025 |

| Automation & AI in Production | Increased manufacturing efficiency and product consistency | Automated bottling lines can boost output by 10-15% |

| Data Analytics | Informed product development and targeted marketing | Premiumization trend in spirits industry (2023) |

| Cybersecurity | Protection of data, intellectual property, and financial assets | Global cybercrime costs estimated at $10.5 trillion annually (2023) |

Legal factors

Brown-Forman navigates a complex web of alcoholic beverage regulations across its global operations, impacting production, distribution, and sales. These laws, which vary significantly by country and even by locality, dictate everything from ingredient sourcing and manufacturing processes to advertising claims and retail channel access. For instance, in the United States, the Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees federal regulations, while individual states impose their own licensing and sales restrictions, creating a patchwork of compliance requirements.

Staying compliant is critical; failure to adhere to these legal frameworks can result in substantial fines, license revocation, and damage to brand reputation. In 2023, the global alcoholic beverage market generated over $1.5 trillion in revenue, underscoring the economic significance of these regulations. Brown-Forman's commitment to rigorous compliance ensures its ability to operate and compete effectively in this highly scrutinized sector.

International trade laws and the potential for new tariffs significantly impact Brown-Forman's global business, especially for its exported American whiskey brands like Jack Daniel's. For instance, in 2018, retaliatory tariffs imposed by the EU on American spirits increased the cost of Brown-Forman products by an estimated $100 million annually, affecting sales volumes.

Trade disputes and the imposition of tariffs directly lead to higher costs for consumers and reduced competitiveness in key international markets. This poses a direct threat to sales and profitability, as seen with the impact of tariffs on the spirits sector in various regions.

Brown-Forman has acknowledged preparing for potential tariffs, a strategy crucial for mitigating supply chain disruptions and maintaining market access. The company's proactive approach aims to safeguard its global revenue streams against unpredictable trade policy shifts.

Brown-Forman, as a major producer of alcoholic beverages, faces significant scrutiny under product liability and consumer safety laws. These regulations are critical for ensuring the integrity of products like Jack Daniel's and Finlandia Vodka. Failure to comply can result in severe consequences, including costly lawsuits and damaged brand perception.

In 2023, the U.S. Food and Drug Administration (FDA) continued its focus on food and beverage safety, with recalls impacting various sectors. While specific data for Brown-Forman's product liability cases isn't publicly detailed, the industry as a whole saw increased regulatory attention. For instance, in 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continued to enforce labeling requirements and advertising standards, with penalties for non-compliance impacting companies of all sizes.

The potential for product contamination or misleading labeling is a constant risk. A significant recall or a high-profile product liability lawsuit could lead to substantial financial losses and erode consumer trust, which is vital for a company like Brown-Forman. Their commitment to quality control and responsible production is therefore not just a matter of good practice, but a crucial legal and business imperative.

Intellectual Property Protection

Intellectual property protection is paramount for Brown-Forman, a company built on the strength of its premium brands like Jack Daniel's and Woodford Reserve. Legal frameworks are vital to shield these valuable trademarks and proprietary recipes from infringement and counterfeiting, thereby preserving brand integrity and market exclusivity.

In 2023, the global spirits market saw continued growth, underscoring the importance of robust IP enforcement. Brown-Forman actively monitors and litigates to prevent unauthorized use of its intellectual property, which directly impacts its ability to maintain premium pricing and brand loyalty. The company's investment in legal strategies to protect its IP is a direct investment in its long-term financial health and brand equity.

- Brand Value Preservation: Legal protection safeguards the substantial financial investment in building and maintaining its iconic brands.

- Counterfeit Prevention: Strong IP laws deter the production and sale of counterfeit goods, which can damage brand reputation and consumer trust.

- Market Exclusivity: Protecting trademarks ensures that Brown-Forman's products are uniquely identifiable and command their premium positioning.

- Licensing and Partnerships: Clear IP ownership facilitates strategic licensing agreements and collaborations, expanding brand reach responsibly.

Labor Laws and Workforce Restructuring

Brown-Forman navigates a complex web of labor laws across its global operations, ensuring compliance with regulations concerning wages, working conditions, and employee rights in each territory. This adherence is critical, especially during periods of strategic adjustment.

Recent workforce restructuring, including potential reductions and site consolidations, necessitates careful management of labor relations and adherence to laws governing layoffs and severance. Failure to comply can result in significant legal challenges and financial penalties, impacting operational continuity.

Initiatives like offering early retirement packages are carefully designed within legal parameters. For example, in 2024, companies offering such programs often structure them to meet specific age and service requirements defined by national labor statutes, aiming to mitigate legal exposure and ensure fair treatment of departing employees.

- Global Compliance: Brown-Forman must adhere to diverse labor laws in countries like the U.S., Mexico, and Ireland, each with unique regulations on hiring, termination, and collective bargaining.

- Restructuring Risks: Workforce reductions in 2024 could trigger legal scrutiny under laws like the WARN Act in the U.S., requiring advance notice for mass layoffs.

- Mitigation Strategies: Offering voluntary early retirement in 2025 is a strategy to manage headcount changes while staying within legal frameworks, potentially reducing severance costs and avoiding wrongful termination claims.

Brown-Forman operates under a stringent regulatory environment, with laws governing alcohol production, distribution, and marketing varying significantly by region. Compliance with these diverse legal frameworks, from U.S. TTB regulations to international trade agreements, is crucial for market access and brand integrity. For instance, the company's adherence to labeling laws and advertising standards, enforced by bodies like the TTB in 2024, directly impacts its consumer engagement and sales strategies.

The company's global operations are also shaped by international trade laws and the potential for tariffs, which can significantly affect pricing and competitiveness. The impact of retaliatory tariffs, such as those seen in 2018 affecting American whiskey exports, highlights the financial risks associated with trade policy shifts. Brown-Forman's proactive approach to managing these legal and trade complexities is vital for safeguarding its international revenue streams.

Protecting its intellectual property, including trademarks for brands like Jack Daniel's, is a legal imperative for Brown-Forman to maintain brand value and prevent counterfeiting. The company actively engages in legal measures to defend its IP, recognizing that robust protection directly supports its premium market positioning and financial health. This focus on IP enforcement is critical in a growing global spirits market where brand equity is a key differentiator.

Labor laws also play a significant role, requiring Brown-Forman to comply with diverse regulations regarding wages, working conditions, and employee rights across its global workforce. Managing workforce changes, such as potential restructuring or early retirement programs in 2024-2025, necessitates careful adherence to laws like the WARN Act in the U.S. to mitigate legal risks and ensure fair employee treatment.

Environmental factors

Brown-Forman is actively addressing climate change by focusing on reducing greenhouse gas (GHG) emissions. This commitment extends across its entire operational footprint and its extensive supply chain.

Key initiatives include enhancing energy efficiency throughout its facilities and strategically shifting towards renewable energy sources to power its operations. These efforts are crucial for minimizing its environmental impact.

The company has established specific targets and commitments that align with leading global environmental standards, aiming to build climate resilience and lessen its overall carbon footprint.

Water is absolutely essential for spirits production, and Brown-Forman recognizes this, actively working to safeguard vital watersheds and cut down on water usage. This is especially important in areas facing water stress, such as parts of Mexico where their agave is cultivated.

The company is investing in more efficient machinery and looking into ways to reuse wastewater for cooling systems. For instance, in fiscal year 2023, Brown-Forman reported a 1.3% decrease in water withdrawal intensity across its global operations compared to its fiscal year 2020 baseline, demonstrating progress in their water stewardship efforts.

Brown-Forman is actively building a robust agricultural supply chain by championing sustainable methods, such as regenerative agriculture, with its direct farming partners. This strategic focus is crucial for ensuring the long-term availability of key ingredients like grains.

The company has set an ambitious goal to engage 100% of its direct farmers on regenerative practices before its 2025 target. This initiative is designed to enhance soil health, bolster biodiversity, and secure a consistent, high-quality supply of raw materials for its products.

Sustainable Packaging and Waste Reduction

Brown-Forman is actively working to lessen the environmental footprint of its packaging. The company has set a target for all its packaging to be recyclable or reusable by a certain date, reflecting a significant commitment to sustainability. This aligns with growing consumer demand and regulatory pressures for eco-friendly product presentation.

Key initiatives include minimizing waste throughout the production and distribution process and integrating circular economy principles. This means looking at how materials can be reused or repurposed, rather than simply discarded. For example, in 2023, Brown-Forman reported a 15% reduction in packaging material usage across its portfolio compared to a 2020 baseline.

- 100% recyclable or reusable packaging goal

- Focus on waste minimization and circular economy principles

- 15% reduction in packaging material usage (2023 vs. 2020)

Forestry and Biodiversity Conservation

Brown-Forman's reliance on oak for its bourbon barrels makes sustainable forestry and biodiversity conservation a critical environmental factor. The company actively works to conserve existing hardwood forests, understanding their integral role in its supply chain. For instance, in 2023, Brown-Forman continued its partnerships with organizations focused on forest management and restoration, aiming to ensure the long-term availability of high-quality oak. These efforts are not just about timber; they are about preserving the complex ecosystems that support the natural ingredients essential for their products.

The company is also exploring new agricultural goals to enhance its sustainable practices. This forward-looking approach recognizes that maintaining biodiversity is key to resilient ecosystems, which in turn support the quality and availability of their raw materials. Brown-Forman's commitment extends beyond immediate climate concerns to encompass broader ecological health, safeguarding the natural heritage that underpins its operations.

Brown-Forman is making significant strides in environmental stewardship, focusing on reducing greenhouse gas emissions and enhancing energy efficiency by shifting towards renewable sources. The company has set specific targets for climate resilience and carbon footprint reduction, aligning with global environmental standards.

Water conservation is paramount, with initiatives to safeguard watersheds and reduce water usage, particularly in water-stressed regions like Mexico. In fiscal year 2023, Brown-Forman achieved a 1.3% decrease in water withdrawal intensity globally compared to its fiscal year 2020 baseline.

Sustainable agriculture, including regenerative practices, is a key focus for securing raw materials, with a goal to engage 100% of direct farmers on these methods by 2025. Furthermore, Brown-Forman aims for 100% of its packaging to be recyclable or reusable, having already reduced packaging material usage by 15% in 2023 compared to 2020.

The company's reliance on oak for barrels underscores its commitment to sustainable forestry and biodiversity conservation, with ongoing partnerships for forest management and restoration to ensure long-term oak availability.

| Environmental Focus | Key Initiatives | Progress/Targets |

|---|---|---|

| Greenhouse Gas Emissions | Energy efficiency, renewable energy transition | Alignment with global environmental standards |

| Water Stewardship | Watershed protection, water usage reduction | 1.3% decrease in water withdrawal intensity (FY23 vs FY20) |

| Sustainable Agriculture | Regenerative farming practices | Engage 100% of direct farmers by 2025 |

| Packaging | Recyclable/reusable packaging, waste minimization | 100% recyclable or reusable packaging goal; 15% reduction in packaging material usage (2023 vs. 2020) |

| Forestry & Biodiversity | Sustainable forestry, forest restoration partnerships | Ensuring long-term oak availability |

PESTLE Analysis Data Sources

Our Brown-Forman PESTLE Analysis is informed by a comprehensive review of data from leading global economic institutions, government regulatory bodies, and respected industry analysis firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the spirits industry.