Brown-Forman Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brown-Forman Bundle

Brown-Forman's portfolio, a blend of iconic spirits and emerging brands, presents a fascinating case study in strategic market positioning. Understanding where each brand falls within the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed investment and resource allocation. This preview offers a glimpse into their strategic landscape, but for a comprehensive understanding and actionable insights, the full BCG Matrix report is essential.

Dive deeper into Brown-Forman's strategic landscape with the complete BCG Matrix. Uncover detailed quadrant placements for each of their brands, revealing market leaders, cash-generating powerhouses, and potential growth opportunities. Purchase the full version for data-backed recommendations and a clear roadmap to optimize their product portfolio and drive future success.

Stars

Woodford Reserve stands out as a star in Brown-Forman's portfolio, a leading super-premium American whiskey. Its robust growth in fiscal 2025 significantly bolstered Brown-Forman's net sales, reflecting a strong consumer preference for premium spirits. The brand's consistent accolades and expanding global presence underscore its dominance in the super-premium American whiskey segment.

Old Forester, a cornerstone premium American whiskey brand within Brown-Forman's portfolio, experienced robust growth through fiscal 2024 and is projected to continue this upward trajectory into fiscal 2025. This brand's strong performance significantly bolsters Brown-Forman's whiskey segment, especially within the U.S. market, where it consistently outpaces the broader whiskey category's expansion.

Gin Mare, a recent addition to Brown-Forman's portfolio, is a prime example of a brand poised for significant expansion. Its reported net sales growth has been robust, making a notable impact on the company's 'Rest of Portfolio' segment.

Italy stands out as Gin Mare's top global market. To capitalize on this, Brown-Forman is implementing its own distribution network in Italy, a strategic move designed to accelerate the brand's trajectory in this high-growth region.

Diplomático Rum

Diplomático Rum, a recent addition to Brown-Forman's portfolio, demonstrated robust performance with strong double-digit reported net sales growth in fiscal year 2025. This positions it as a significant contributor to the company's expansion in the premium spirits market.

The brand holds the distinction of being the world's third-largest rum by value in the super-premium and above segment. This indicates a substantial market presence within a segment experiencing considerable growth.

- Strong Growth: Diplomático Rum achieved double-digit net sales growth in fiscal 2025.

- Market Position: It ranks as the third-largest rum globally by value in the super-premium and above category.

- Growth Driver: The brand's performance suggests it is a key driver for Brown-Forman's future growth.

New Mix

New Mix, a ready-to-drink tequila-based beverage, is a standout performer within Brown-Forman's portfolio, exhibiting robust net sales growth. Its strength is particularly evident in Mexico, where it commands the leading position in the expanding RTD market, both by volume and value. This success is driven by consumer preference for its convenience and appealing flavors, facilitating its ongoing expansion.

Even with a slight dip in volume in Mexico during the first quarter of fiscal year 2025, New Mix managed to increase its market share. This resilience underscores its strong competitive standing in a rapidly growing segment.

- Market Dominance: New Mix is the largest RTD brand in Mexico by volume and value.

- Growth Driver: Reported very strong net sales growth, fueled by consumer appeal.

- Market Share Gain: Increased market share in Mexico despite minor Q1 fiscal 2025 volume declines.

Woodford Reserve, Old Forester, and Diplomático Rum are classified as Stars within Brown-Forman's BCG Matrix. These brands exhibit high growth and strong market share, demanding significant investment to maintain their momentum. Their robust performance, as seen in fiscal 2025's double-digit growth for Diplomático Rum and continued strength for the American whiskey brands, solidifies their position as key revenue drivers for the company.

| Brand | Category | Fiscal 2025 Performance Highlight | Market Position |

|---|---|---|---|

| Woodford Reserve | Super-Premium American Whiskey | Significant contributor to net sales growth | Leading brand in its segment |

| Old Forester | Premium American Whiskey | Robust growth, outperforming category | Cornerstone brand in the U.S. |

| Diplomático Rum | Premium Rum | Double-digit reported net sales growth | World's third-largest rum by value (super-premium+) |

What is included in the product

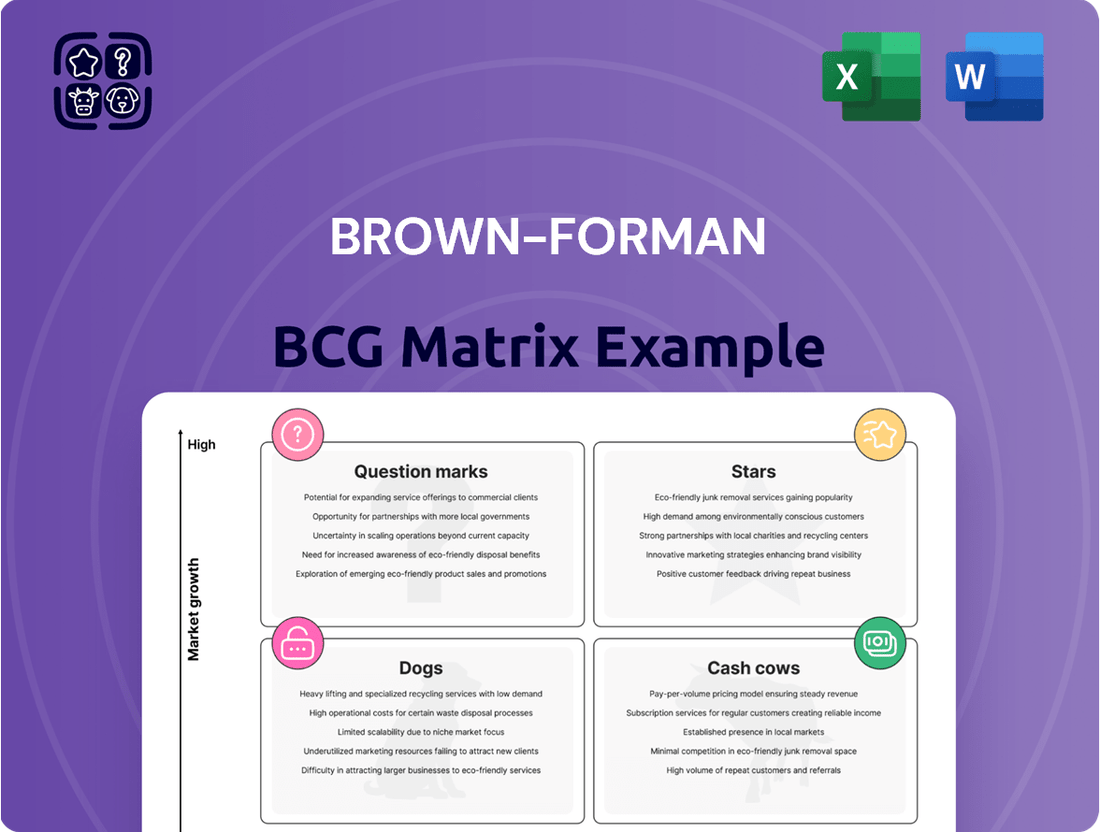

Brown-Forman's BCG Matrix offers a tailored analysis of its product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Brown-Forman's portfolio, easing strategic decision-making by highlighting growth and market share.

Cash Cows

Jack Daniel's Tennessee Whiskey, despite facing some reported net sales declines in fiscal 2024 and 2025, continues to be a powerhouse for Brown-Forman. Its status as the world's most valuable spirits brand, as recognized by Interbrand, underscores its enduring market dominance and significant cash-generating ability.

This foundational brand, even with challenges like distributor inventory adjustments and evolving consumer tastes, provides a substantial and consistent cash flow. Brown-Forman's ongoing investment in Jack Daniel's, including new marketing initiatives, is a testament to its commitment to preserving its leading market position.

Jack Daniel's Tennessee Apple is a prime example of a Cash Cow for Brown-Forman. It has demonstrated robust double-digit reported net sales growth, solidifying its position as a leader in the flavored whiskey market. This success is largely due to the strong brand recognition of Jack Daniel's, appealing to consumers looking for innovative, flavored spirits.

El Jimador, a cornerstone of Brown-Forman's spirits portfolio, operates as a classic Cash Cow within the BCG Matrix. Its substantial sales volume, especially in its home market of Mexico, ensures a steady and significant contribution to the company's overall revenue and profitability.

Despite facing some volume headwinds in the U.S. and Mexico during fiscal year 2025, El Jimador's mature market position and widespread brand recognition allow it to generate consistent cash flow. Brown-Forman's strategic focus remains on efficient distribution and carefully managed pricing to maximize the brand's financial output.

Herradura

Herradura, a premium tequila brand, holds a significant market position, especially within the United States and Mexico. Despite experiencing some volume dips in the U.S. during fiscal year 2024, largely attributed to inventory adjustments by distributors, its premium branding and loyal customer base are expected to maintain its status as a substantial cash contributor for Brown-Forman.

Brown-Forman continues to invest in Herradura, aiming to solidify its competitive edge in the expanding tequila sector. The brand’s resilience is underpinned by its premium positioning and established consumer trust.

- Brand Strength: Herradura benefits from a premium image and strong brand loyalty.

- Market Presence: Key markets include the U.S. and Mexico.

- Fiscal 2024 Performance: Saw some volume declines in the U.S. due to distributor inventory management.

- Future Outlook: Expected to remain a significant cash generator for Brown-Forman within the growing tequila market.

Glenglassaugh

Glenglassaugh, a Scotch whisky brand under Brown-Forman, demonstrates characteristics of a Cash Cow within the company's portfolio. Its contribution to growth in fiscal 2024 and the prestigious 'Whisky of the Year' award in 2023 highlight its stable performance and strong market standing.

While not a flagship brand, Glenglassaugh's consistent returns in the mature Scotch whisky market solidify its Cash Cow status. This suggests it requires minimal investment for maintenance while generating reliable profits for Brown-Forman.

- Brand Performance: Contributed to growth in fiscal 2024.

- Market Recognition: Awarded 'Whisky of the Year' in 2023.

- Category Position: Strong presence in the mature Scotch whisky market.

- Financial Implication: Generates consistent, stable returns with low investment needs.

Jack Daniel's, despite some reported net sales declines in fiscal 2024 and 2025, remains Brown-Forman's leading cash generator. Its position as the world's most valuable spirits brand, according to Interbrand, highlights its enduring market dominance and substantial cash-generating ability, even with distributor inventory adjustments.

El Jimador, a significant contributor to Brown-Forman's revenue, functions as a classic Cash Cow. Its strong sales volume, particularly in Mexico, ensures consistent cash flow, even with minor volume headwinds experienced in fiscal 2025 in the U.S. and Mexico.

Herradura, a premium tequila, continues to be a substantial cash contributor. Despite a volume dip in the U.S. in fiscal 2024 due to distributor inventory management, its premium branding and loyal customer base are expected to sustain its role in generating consistent profits.

Glenglassaugh, a Scotch whisky, exhibits Cash Cow characteristics by contributing to growth in fiscal 2024 and earning the 'Whisky of the Year' award in 2023. This indicates stable performance and strong market standing in the mature Scotch whisky segment, requiring minimal investment for reliable profits.

| Brand | BCG Category | Fiscal 2024/2025 Notes | Key Financial Contribution |

| Jack Daniel's | Cash Cow | Reported net sales declines, but remains world's most valuable spirits brand. | Substantial and consistent cash flow. |

| El Jimador | Cash Cow | Volume headwinds in U.S. and Mexico in FY25, but strong sales volume in Mexico. | Steady and significant revenue and profitability contribution. |

| Herradura | Cash Cow | Volume dip in U.S. in FY24 due to distributor inventory adjustments. | Substantial cash contributor, especially with premium positioning. |

| Glenglassaugh | Cash Cow | Contributed to growth in FY24; 'Whisky of the Year' in 2023. | Generates consistent, stable returns with low investment needs. |

What You’re Viewing Is Included

Brown-Forman BCG Matrix

The Brown-Forman BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, will be delivered without any watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently use this preview as a direct representation of the high-quality BCG Matrix analysis for Brown-Forman that will be yours to download and implement immediately.

Dogs

Jack Daniel's Country Cocktails saw a significant business model shift in fiscal 2024 and 2025, with production now handled entirely by Pabst Brewing Company. This move away from Brown-Forman's direct manufacturing and sales suggests a strategic pivot, possibly due to declining market performance or a desire to reallocate resources.

Finlandia Vodka, a brand that was once a part of Brown-Forman's portfolio, was divested in November 2023. This strategic move had a notable impact on the company's reported net sales for fiscal years 2024 and 2025. The divestiture suggests Finlandia was likely classified as a Question Mark or a Dog in the BCG matrix, characterized by low market share and potentially low growth, no longer aligning with Brown-Forman's focus on premium spirits.

The decision to sell Finlandia allowed Brown-Forman to streamline its brand offerings and concentrate resources on higher-potential, premium brands. This is a common strategy for large corporations to optimize their business portfolio and enhance overall profitability by shedding non-core or underperforming assets. For instance, in fiscal year 2023, Brown-Forman's net sales were $4.2 billion, and the removal of a brand like Finlandia would have a measurable effect on subsequent reporting periods.

Brown-Forman's divestiture of the Sonoma-Cutrer wine business in fiscal 2025 significantly impacted its net sales. This move, akin to the sale of Finlandia vodka, signals Sonoma-Cutrer's status as a non-core asset, likely due to its limited growth potential or market share within Brown-Forman's core spirits portfolio.

The cash generated from the Sonoma-Cutrer sale was strategically allocated towards debt reduction and enhancing shareholder returns. This financial maneuver reinforces its classification as a 'Dog' within the BCG matrix, a business unit that was divested to streamline operations and focus on more promising ventures.

Jack Daniel's & Cola RTD (Original)

The original Jack Daniel's & Cola Ready-to-Drink (RTD) offering has seen a dip in sales volume. This decline is largely attributed to Brown-Forman's strategic shift towards the co-branded Jack Daniel's & Coca-Cola RTD. This transition indicates a natural market evolution where consumers are migrating to the newer, more heavily promoted version.

The original formulation now faces the challenge of a potentially shrinking market. Without a renewed marketing push or a revised product strategy, this iteration of the Jack Daniel's & Cola RTD is positioned for continued volume erosion.

- Volume Decline: The original Jack Daniel's & Cola RTD experienced reduced sales volumes in recent periods.

- Strategic Shift: This decline is directly linked to Brown-Forman's focus on the newer Jack Daniel's & Coca-Cola RTD.

- Market Transition: Consumers are opting for the co-branded product, signaling a shift in preference.

- Future Outlook: The original RTD faces potential further decline without significant strategic intervention.

Certain Jack Daniel's Super-Premium Expressions

Within Brown-Forman's portfolio, certain super-premium Jack Daniel's expressions, like Single Barrel and other special releases, experienced a dip in net sales for fiscal year 2025. This follows a robust performance in the preceding year. This trend might suggest that these high-end variants cater to a more specialized market where demand can be inconsistent, or perhaps there's increasing competition within these premium segments, impacting their market share.

The performance of these specific expressions contrasts with the overall strength of the Jack Daniel's brand, which generally functions as a cash cow for Brown-Forman. For instance, while specific super-premium lines saw declines, the broader Jack Daniel's Tennessee Whiskey continued to be a significant revenue driver. The fiscal year 2025 results highlight the nuanced performance within even established brands, where individual product tiers can diverge in their market trajectory.

- Fiscal Year 2025 Net Sales Decline: Certain super-premium Jack Daniel's expressions, including Single Barrel, reported a decrease in net sales compared to fiscal year 2024.

- Market Dynamics: This performance could signal a niche market with fluctuating consumer preferences or increased competition in the super-premium spirits category.

- Brand Segmentation: The results underscore the importance of analyzing individual product lines within a larger brand, as their performance can differ significantly.

- Cash Cow Context: Despite these specific declines, the broader Jack Daniel's brand remains a vital contributor to Brown-Forman's overall revenue.

Brown-Forman's divestiture of brands like Finlandia Vodka and the Sonoma-Cutrer wine business in fiscal years 2024 and 2025, alongside the strategic shift for Jack Daniel's Country Cocktails, indicates these were likely classified as Dogs. These moves allowed the company to shed underperforming or non-core assets, focusing resources on its premium spirit portfolio and improving overall financial health.

The original Jack Daniel's & Cola RTD's declining sales volume, superseded by the co-branded Jack Daniel's & Coca-Cola RTD, also positions it as a Dog. Similarly, certain super-premium Jack Daniel's expressions showing a dip in fiscal year 2025 net sales, while not divested, exhibit characteristics of a Dog due to potential market saturation or increased competition within their niche.

| Brand/Product Line | BCG Classification | Reasoning |

| Finlandia Vodka | Dog | Divested November 2023; low market share/growth potential |

| Sonoma-Cutrer Wine | Dog | Divested fiscal year 2025; non-core, limited growth potential |

| Jack Daniel's Country Cocktails | Dog | Production outsourced; strategic pivot away from direct control |

| Original Jack Daniel's & Cola RTD | Dog | Declining volume due to newer co-branded product |

| Super-premium Jack Daniel's (e.g., Single Barrel) | Potential Dog | Fiscal year 2025 net sales decline; niche market challenges |

Question Marks

The Jack Daniel's & Coca-Cola RTD is a recent entrant to the market, currently navigating its launch phase across various regions. This collaboration is a significant growth driver for Jack Daniel's existing ready-to-drink offerings, though its overall market penetration is still in its nascent stages.

Operating within the rapidly expanding ready-to-drink (RTD) beverage segment, the long-term success of this product hinges on sustained marketing and distribution efforts to secure a substantial market share. The RTD category itself saw substantial global growth, with projections indicating continued expansion well into the future, driven by consumer demand for convenience and novel flavor combinations.

Fords Gin, while a component of Brown-Forman's extensive spirits portfolio, doesn't consistently appear as a top-tier growth engine in recent financial disclosures, especially when contrasted with other acquired brands. This suggests it's not currently a dominant player in terms of revenue generation or market impact for the parent company.

Operating within the gin sector, Fords Gin faces a dynamic and often fragmented global market. Growth rates for gin can vary significantly by region, influenced by consumer preferences, local regulations, and competitive pressures, making it a challenging category to predict and manage.

Considering its current market standing against its potential within the broader gin category, Fords Gin can be categorized as a Question Mark in the BCG Matrix. This classification indicates a need for careful strategic assessment and potentially increased investment to boost its market share and propel it towards becoming a Star performer.

Chambord Liqueur, while a part of Brown-Forman's diverse spirits portfolio, often flies under the radar when key growth drivers are discussed. This positioning suggests it might be a Question Mark in the company's BCG matrix, indicating a product with potential but uncertain future success.

The liqueur market itself presents a mixed picture. Some established markets, like parts of Europe, may show maturity with slower growth. However, other regions, particularly emerging markets and specific consumer segments, are demonstrating significant growth in liqueur consumption. This dichotomy makes Chambord's overall market share and future growth trajectory a key area for assessment.

For Brown-Forman, the strategic imperative is to thoroughly analyze Chambord's potential for increased market adoption. This would involve understanding consumer trends, competitive landscapes, and identifying untapped opportunities. Based on this assessment, the company would need to decide whether to invest further to elevate Chambord into a Star or potentially divest if the outlook remains uncertain.

Slane Irish Whiskey

Slane Irish Whiskey, while a component of Brown-Forman's extensive whiskey offerings, doesn't consistently emerge as a leading growth driver in recent financial disclosures. This suggests it might be a 'Question Mark' in the BCG Matrix, requiring careful evaluation of its potential versus current performance.

The Irish whiskey market itself is experiencing robust expansion, with global sales projected to reach over $3 billion by 2025. However, Slane's specific market share and growth trajectory within this dynamic and competitive segment are crucial for determining its strategic placement.

- Market Position: Slane's current market share within the expanding Irish whiskey category needs to be assessed to understand its relative standing against established and emerging brands.

- Growth Potential: The brand's ability to capture a larger share of the growing Irish whiskey market will be a key determinant of its future success.

- Investment Strategy: Increased investment in marketing, distribution, and brand development could potentially shift Slane from a 'Question Mark' to a more favorable position, like a 'Star'.

- Competitive Landscape: Factors such as brand awareness, consumer perception, and competitive pricing will influence Slane's ability to gain traction.

The GlenDronach Single Malt Scotch Whisky

The GlenDronach, a premium single malt Scotch whisky brand under Brown-Forman, operates within a high-growth but competitive segment of the spirits market. Its position can be viewed as a Question Mark in the BCG Matrix, requiring careful consideration of investment versus potential returns.

While the premium Scotch whisky market demonstrated robust growth, with global sales of single malts reaching an estimated USD 12.5 billion in 2023, The GlenDronach's specific market share and growth trajectory are crucial for its classification. The significant investment needed to maintain and expand presence in the high-end Scotch category, including marketing, distribution, and product development, further supports its potential Question Mark status. This means Brown-Forman must strategically decide whether to invest heavily to increase market share or divest if the outlook is not promising.

- The GlenDronach's position as a premium single malt Scotch whisky brand places it in a high-value segment of the spirits market.

- The global single malt Scotch market experienced significant growth, with projections indicating continued expansion through 2028.

- Brown-Forman's investment in The GlenDronach, relative to its current market penetration and growth potential, could categorize it as a Question Mark.

- Strategic decisions regarding increased investment or potential divestment are critical for optimizing The GlenDronach's future performance within Brown-Forman's portfolio.

Question Marks represent products with low market share in high-growth industries. For Brown-Forman, brands like Fords Gin, Chambord Liqueur, Slane Irish Whiskey, and The GlenDronach often fit this description. These brands require careful strategic evaluation to determine if investment can elevate them to 'Stars' or if they should be divested.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.