Brookfield Reinsurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

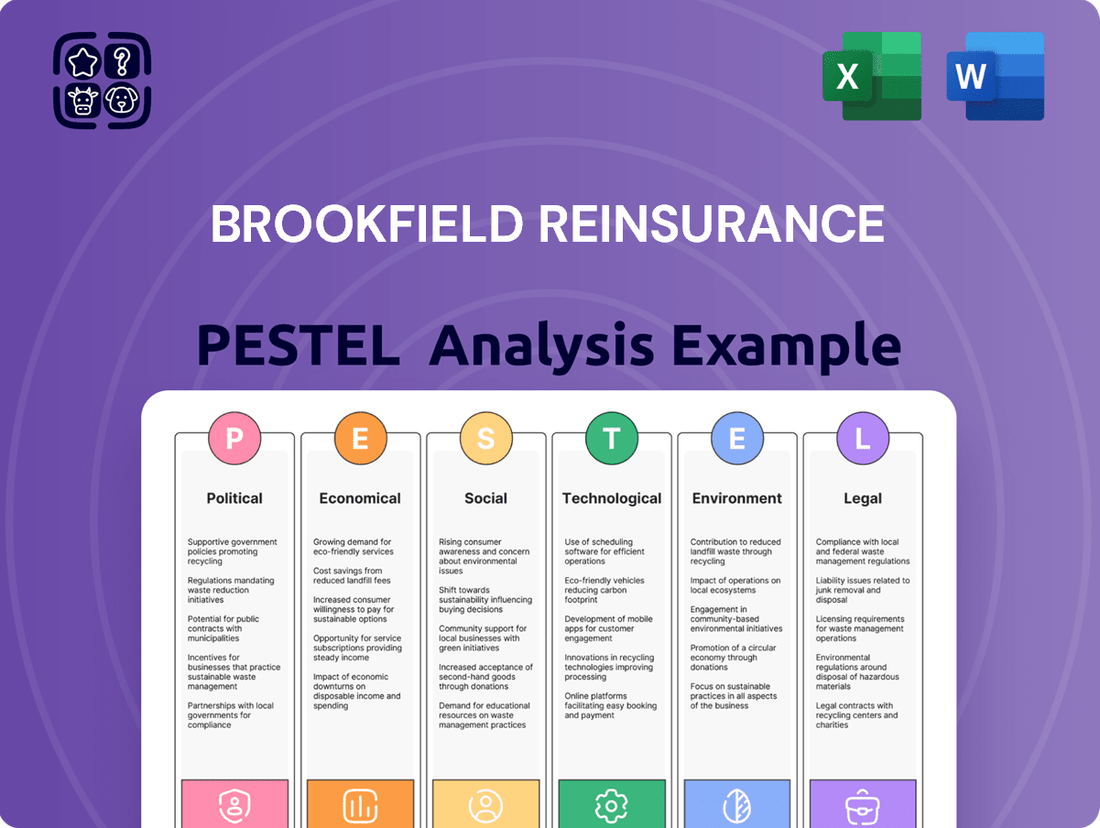

Unlock the critical external factors shaping Brookfield Reinsurance's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces impacting their operations and strategic decisions. Gain a competitive edge by understanding these dynamics.

Don't get left behind by unseen market shifts. Our comprehensive PESTLE analysis for Brookfield Reinsurance provides actionable intelligence to anticipate challenges and capitalize on opportunities. Invest in foresight—download the full report now.

Political factors

Brookfield Reinsurance navigates a landscape shaped by stringent governmental regulations and oversight across its global operations. Changes to capital requirements and solvency standards, such as those influenced by the National Association of Insurance Commissioners (NAIC), directly affect how the company manages its financial resources and conducts business.

The NAIC’s ongoing efforts to update risk-based capital (RBC) formulas and bolster consumer protections, particularly with initiatives planned for 2025, will necessitate adaptive strategies from Brookfield Reinsurance. These regulatory shifts can impact everything from investment strategies to product development, ensuring compliance remains a critical operational focus.

Global geopolitical tensions and trade friction, including tariffs, can introduce market volatility and affect investment income trajectories for reinsurers. For instance, the ongoing trade disputes between major economies in 2024 continue to create uncertainty, potentially impacting the profitability of cross-border investments and the cost of doing business.

Brookfield Reinsurance's strategy to generate enhanced returns through alternative investments is sensitive to such shifts, as political instability in key markets could disrupt investment opportunities and capital deployment. The company's exposure to diverse global markets means that regional conflicts or sudden policy changes, such as unexpected capital controls implemented in 2025, could directly impact its asset valuations and future growth prospects.

Government intervention, particularly through monetary policy adjustments, directly impacts Brookfield Reinsurance. For example, the Bank of England's Monetary Policy Committee’s decision to hold the Bank Rate at 5.25% as of May 2024, following a series of hikes, creates a stable but elevated interest rate environment. This stability can be beneficial for fixed-income portfolios, but future rate cuts could compress yields on new investments, affecting the profitability of its asset-intensive strategy.

International Regulatory Harmonization

The ongoing efforts toward international regulatory harmonization, or conversely, divergence, present a significant political factor for Brookfield Reinsurance. Operating across multiple jurisdictions means navigating a complex web of differing compliance requirements.

For instance, the European Union's evolving stance on Environmental, Social, and Governance (ESG) fund naming conventions, which came into effect in stages through 2024, necessitates flexible compliance structures. This can directly impact how Brookfield Reinsurance structures and markets its investment products, potentially influencing its global product development and strategic investment decisions.

Key considerations include:

- Adaptability of Compliance Frameworks: Brookfield Reinsurance must maintain agile compliance systems to address evolving international standards, such as the EU's SFDR (Sustainable Finance Disclosure Regulation) which saw significant updates in early 2024.

- Impact on Product Development: Differing regulations, like those concerning data privacy or capital requirements, can shape the design and availability of reinsurance products across various markets.

- Strategic Investment Alignment: The company's investment strategies must align with the regulatory landscapes of its operating regions, potentially leading to shifts in asset allocation or the types of investments pursued.

Tax Policy Changes

Changes in corporate tax rates, particularly in major markets like the United States and Bermuda, can significantly affect Brookfield Reinsurance's bottom line. For instance, the US corporate tax rate, currently at 21%, has been a subject of ongoing political discussion, with potential for adjustments that could impact the profitability of its US operations.

Specific tax treatments for the insurance and reinsurance sectors also play a crucial role. Favorable reforms, such as deductions for certain reserves or investment income, can bolster financial results, while unfavorable changes might reduce the attractiveness of Brookfield Reinsurance as a capital solutions provider. The company's ability to navigate these evolving tax landscapes directly influences its financial performance and strategic planning.

- US Corporate Tax Rate: Remains at 21% as of early 2024, but potential for future legislative changes could impact profitability.

- International Tax Reforms: Ongoing global discussions around base erosion and profit shifting (BEPS) could influence how multinational reinsurers are taxed.

- Impact on Profitability: Alterations in tax policy can directly affect net income and the company's ability to generate returns for shareholders.

Brookfield Reinsurance must remain acutely aware of evolving political landscapes, as governmental policies directly influence its operational environment and investment strategies. Regulatory changes, such as those by the NAIC impacting capital requirements, necessitate constant adaptation. Geopolitical tensions in 2024 continue to create market volatility, affecting investment income and cross-border operations.

Monetary policy, exemplified by the Bank of England’s 5.25% Bank Rate in May 2024, shapes the interest rate environment crucial for fixed-income portfolios. International regulatory divergence, particularly concerning ESG standards like the EU's SFDR updates in early 2024, impacts product development and global strategic alignment.

Changes in corporate tax rates, with the US rate at 21% in early 2024, also directly affect profitability. The company must navigate differing tax treatments for the insurance sector globally, as these can significantly influence its financial performance and attractiveness as a capital solutions provider.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Brookfield Reinsurance, offering a comprehensive view of the external landscape.

It provides actionable insights to identify strategic opportunities and mitigate potential risks for informed decision-making.

Provides a concise version of Brookfield Reinsurance's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions to quickly address external market dynamics.

Economic factors

The current interest rate environment is a critical factor for Brookfield Reinsurance. As of mid-2024, central banks in major economies like the US and Europe have maintained relatively stable, albeit higher, interest rates compared to the preceding decade. This stability has a dual effect: it bolsters investment income on the substantial fixed-income portfolios held by life and annuity insurers, a core business for Brookfield Reinsurance, while also influencing the attractiveness of savings products.

Higher interest rates, generally observed in 2024, tend to enhance profitability for life insurers. This is because they can earn more on their invested assets, particularly on the long-duration fixed-income securities that back their liabilities. For instance, a 1% increase in interest rates can significantly boost the net investment income of a large annuity provider. This trend also makes products like annuities more appealing to consumers seeking yield, potentially driving demand and improving margins on new business.

Inflation, though showing signs of cooling, continues to impact operational costs and the value of future liabilities for reinsurers like Brookfield Reinsurance. While global economic growth is anticipated to remain steady at approximately 3.2% in 2025, according to IMF projections, this overall positive outlook is tempered by significant regional disparities in growth rates.

These uneven growth patterns create a complex environment for the insurance sector. Stronger economies can lead to increased demand for insurance products, boosting premium volumes. Conversely, areas experiencing economic slowdown or recession risk can depress premium growth and potentially lead to higher claims frequencies or severity as individuals and businesses cut back on expenses or face financial distress.

Furthermore, the investment performance of reinsurers is directly tied to economic conditions. Higher inflation can erode the real returns on fixed-income investments, a significant component of reinsurer portfolios. Conversely, robust economic expansion might offer better opportunities for capital appreciation in equities and other growth assets, but this is contingent on navigating the aforementioned regional growth variations.

Capital market volatility significantly impacts Brookfield Reinsurance's investment income, a key driver of its profitability. The company's strategy, which includes leveraging Brookfield Asset Management's expertise in alternative investments, means its performance is closely tied to the broader financial markets.

In 2024, persistent inflation and interest rate uncertainties contributed to fluctuating bond yields and equity market performance. For instance, the U.S. 10-year Treasury yield saw considerable swings throughout the year, directly affecting the income generated from the company's fixed-income portfolio.

The reinsurance sector generally benefits from higher interest rates, as they increase the yield on the large pools of capital reinsurers manage. This tailwind was evident in 2023 and continued into early 2024, bolstering investment income for companies like Brookfield Reinsurance, even amidst market choppiness.

Demand for Insurance and Reinsurance Products

The demand for insurance and reinsurance products is a significant economic factor, particularly for life and annuity lines. This demand is being bolstered by several key trends. For instance, the ongoing aging of populations in developed nations naturally increases the need for retirement savings and life insurance solutions.

Furthermore, the expansion of the middle class in emerging markets is a powerful engine for growth. As more individuals gain disposable income, they increasingly seek financial security and long-term savings vehicles offered by life insurers. This demographic shift is a cornerstone of premium growth in the sector.

Persistently elevated interest rates, a notable economic condition in 2024 and projected into 2025, also play a crucial role. Higher rates make savings products, like annuities, more attractive to consumers looking for guaranteed returns and income streams. This environment directly fuels demand for these products and, consequently, the reinsurance capacity needed to support them.

- Aging Demographics: Global life expectancy continues to rise, increasing the need for retirement income and life insurance.

- Emerging Market Growth: The expanding middle class in regions like Asia and Latin America is a key driver of new insurance policy demand.

- Interest Rate Environment: Higher interest rates make annuity products more appealing, boosting demand for these savings solutions.

- Reinsurance Demand: Increased life insurance sales directly translate to a greater need for reinsurance to manage risk and capital.

Competitive Landscape and Capital Levels

The global reinsurance market is characterized by robust competition and substantial capital. This environment directly impacts pricing strategies and the overall discipline observed within the sector. As of early 2025, the industry continues to demonstrate strong financial health, with dedicated capital reaching record highs and operating profits remaining solid.

This well-capitalized position provides a stable outlook for the reinsurance market through 2025. However, the abundance of capital could potentially lead to increased pricing pressure in specific insurance lines as reinsurers vie for market share. For instance, while the overall market is strong, certain specialty lines might experience more aggressive pricing due to the availability of capacity.

- Record Capital Levels: The reinsurance sector has seen unprecedented levels of dedicated capital, bolstering its capacity to absorb risk.

- Strong Operating Profits: Reinsurers have reported healthy operating profits, contributing to the sector's financial resilience.

- Stable Outlook: The industry's financial standing suggests a stable outlook through 2025, supported by strong capital and earnings.

- Potential Pricing Pressure: The high level of capital could lead to increased competition and downward pressure on pricing in certain reinsurance segments.

Economic factors significantly shape Brookfield Reinsurance's operating landscape, with interest rates and inflation being paramount. As of mid-2024, interest rates remained elevated, boosting investment income on fixed-income portfolios, a key asset class for reinsurers. Inflation, while moderating, continues to influence operational costs and the real value of liabilities, necessitating careful asset-liability management.

Global economic growth projections for 2025, estimated around 3.2% by the IMF, present a generally supportive backdrop, though regional disparities create varied demand and investment opportunities. The aging global population and the expanding middle class in emerging markets are powerful demographic drivers increasing the demand for life and annuity products, which in turn fuels the need for reinsurance.

The reinsurance market's robust capitalization, with dedicated capital at record highs in early 2025, ensures stability and capacity. However, this abundance of capital may intensify competition, potentially leading to pricing pressures in specific market segments, even as overall industry profitability remains strong.

| Economic Factor | 2024/2025 Trend | Impact on Brookfield Reinsurance |

|---|---|---|

| Interest Rates | Elevated and stable | Boosts investment income, enhances annuity product appeal |

| Inflation | Moderating but persistent | Increases operational costs, erodes real value of liabilities |

| Global Economic Growth | Projected ~3.2% for 2025 (IMF) | Supports insurance demand, but regional variations create complexity |

| Reinsurance Capitalization | Record highs in early 2025 | Ensures market stability and capacity, but may increase competition |

Preview the Actual Deliverable

Brookfield Reinsurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Brookfield Reinsurance PESTLE Analysis covers all critical factors impacting the business, ensuring you have a complete understanding. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

The world's population is getting older. In 2024, over 10% of the global population is aged 65 and over, a figure projected to reach nearly 16% by 2050. This aging trend, especially the large number of baby boomers entering retirement, directly fuels the need for life insurance and annuity products.

Brookfield Reinsurance is well-positioned to capitalize on this. Their focus on managing life and annuity liabilities and offering retirement solutions aligns perfectly with the growing demand from an aging demographic seeking financial security in their later years.

Millennials and Gen Z, representing significant emerging buyer demographics, are increasingly prioritizing digital-first interactions, adaptable policy structures, and clear pricing within the life insurance sector. This evolving landscape demands that Brookfield Reinsurance and its clientele embrace technology to deliver intuitive, customer-centric solutions and tailored products that align with contemporary expectations.

The increasing focus on health and wellness, amplified by the widespread adoption of wearable fitness trackers and health monitoring apps, is reshaping how insurance policies are created and underwritten. For instance, by 2024, it's estimated that over 100 million Americans regularly use fitness trackers, providing a wealth of data.

Insurers like Brookfield Reinsurance are increasingly incorporating this data into their risk assessment models. This integration can translate into tangible benefits for consumers, such as reduced premiums for individuals who demonstrate healthier lifestyles through their tracked data, potentially lowering average health insurance costs for proactive individuals.

Social Inflation and Litigation Trends

Social inflation, a significant concern for the broader insurance sector, particularly regarding adverse reserve development in US casualty lines, is a key topic for 2025 renewals. While Brookfield Reinsurance primarily operates in life and annuity, these pervasive social trends, especially those influencing litigation and claims, can indirectly shape overall market sentiment and investment approaches.

These trends can impact the cost of risk and capital deployment across the entire insurance ecosystem.

- Litigation Trends: Increased social awareness and a more litigious environment can drive up claim costs.

- Reserve Development: Adverse reserve development in property and casualty lines can signal broader economic pressures affecting the insurance industry.

- Market Sentiment: Negative trends in one segment of insurance can create a ripple effect, influencing investor confidence and capital availability for all market participants.

Public Perception of the Insurance Industry

Public perception of the insurance industry significantly impacts consumer trust and regulatory engagement. In 2024, a significant portion of consumers expressed concerns regarding transparency and claims processing. For instance, a recent survey indicated that only 45% of policyholders felt completely confident in their insurer's transparency.

Companies like Brookfield Reinsurance, which emphasize customer-centricity and clear communication, are better equipped to build and maintain trust. This focus is crucial as evolving market demands require insurers to be more accountable and responsive to policyholder needs. Trust is a key differentiator in a competitive landscape.

The industry's reputation is often shaped by high-profile cases of perceived unfairness or lack of clarity. In 2024, regulatory bodies continued to focus on consumer protection, with new guidelines aimed at enhancing transparency in policy terms and conditions. This heightened scrutiny underscores the importance of proactive reputation management.

- Public Trust: A 2024 study revealed that only 45% of insurance customers reported high levels of trust in their providers.

- Transparency Concerns: Issues like unclear policy language and complex claims processes remain significant pain points for consumers.

- Regulatory Focus: Governments worldwide are increasing oversight to ensure fair practices and consumer protection within the insurance sector.

- Customer-Centricity: Insurers demonstrating a commitment to clear communication and efficient service are gaining a competitive edge.

Societal shifts, like the increasing global life expectancy, directly impact demand for life insurance and annuity products. With the population aging rapidly, particularly the large baby boomer generation entering retirement, Brookfield Reinsurance's focus on these areas is strategically aligned with growing consumer needs for financial security.

Younger demographics, Millennials and Gen Z, are driving a demand for digital-first experiences, flexible policies, and transparent pricing in insurance. Brookfield Reinsurance must continue to leverage technology to meet these evolving expectations, offering user-friendly platforms and tailored solutions.

Growing interest in health and wellness, evidenced by the widespread use of fitness trackers, presents opportunities for insurers to refine risk assessment through data. By integrating this data, Brookfield Reinsurance can potentially offer more personalized pricing, rewarding healthier lifestyles with lower premiums.

Public trust in the insurance industry remains a critical factor, with many consumers in 2024 expressing concerns about transparency and claims processing. Companies like Brookfield Reinsurance that prioritize clear communication and customer-centricity are better positioned to build and maintain consumer confidence in a competitive market.

Technological factors

The insurance sector is rapidly integrating AI and data analytics, fundamentally reshaping underwriting and risk management. Brookfield Reinsurance can harness these tools to analyze extensive datasets, pinpoint new risks, streamline operations, and improve the precision of its underwriting. For instance, by 2024, the global AI in insurance market was projected to reach over $10 billion, highlighting the significant investment and potential for efficiency gains.

The insurance industry is rapidly adopting accelerated underwriting, a process leveraging technology and minimal medical checks to speed up policy approvals. By 2025, this method is projected to become the dominant approach in the market. This digital transformation also fuels the expansion of term life insurance offerings.

Brookfield Reinsurance stands to gain significantly from these technological shifts. By embracing accelerated underwriting and robust digital platforms, the company can achieve greater operational efficiency and deliver an enhanced customer experience, making the application and policy management process smoother and faster for clients.

Brookfield Reinsurance, like all modern insurers, faces escalating cybersecurity risks. The growing digital footprint means a larger attack surface for malicious actors. Data privacy is paramount, with regulators worldwide, including those influencing the 2025 landscape, placing significant emphasis on protecting sensitive customer information. Failure to comply with these evolving regulations can result in substantial fines and reputational damage.

Legacy Systems and Digital Transformation

Legacy systems continue to pose a significant challenge for insurers, hindering operational efficiency and profitability through reliance on manual processes and outdated models. Brookfield Reinsurance's strategic imperative lies in its capacity to adopt and integrate cutting-edge technologies, modernizing its infrastructure to maintain a competitive edge and operational agility.

The ongoing digital transformation in the insurance sector is reshaping customer expectations and operational paradigms. For Brookfield Reinsurance, the ability to migrate from these entrenched legacy systems to more flexible, cloud-based platforms is paramount. This transition is not merely about technological upgrade but a fundamental shift towards data-driven decision-making and enhanced customer engagement.

By 2024, a significant portion of the insurance industry was still grappling with the costs and complexities of modernizing core systems. For instance, reports indicated that IT spending in the insurance sector was projected to reach over $250 billion globally in 2024, with a substantial portion allocated to digital transformation initiatives, including the overhaul of legacy infrastructure. Brookfield Reinsurance's progress in this area will directly impact its ability to innovate and respond to market dynamics.

- Modernizing core insurance platforms is critical for efficiency gains.

- Digital transformation enables better data analytics and customer service.

- Global IT spending in insurance is substantial, highlighting industry-wide modernization efforts.

- Brookfield Reinsurance's infrastructure upgrades directly influence its competitive positioning.

Emergence of Generative AI and Automation

Generative AI (GenAI) and automation are poised to significantly reshape the insurance landscape, offering Brookfield Reinsurance avenues to enhance customer interactions and streamline operations. These technologies can lead to more personalized customer journeys, potentially boosting engagement and conversion rates.

The integration of GenAI promises to optimize underwriting, claims processing, and customer service, driving efficiency and reducing operational costs. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human agents for more complex tasks.

- Enhanced Customer Experience: GenAI can personalize policy recommendations and claims communication, improving customer satisfaction and loyalty.

- Operational Efficiency: Automation of routine tasks, like data entry and initial claim assessments, can significantly reduce processing times and errors.

- Improved Risk Assessment: Advanced AI models can analyze vast datasets to provide more accurate risk assessments, leading to better pricing and underwriting decisions.

- Increased Engagement: AI-driven insights can help insurers proactively engage with policyholders, fostering stronger relationships and reducing churn.

The insurance industry's embrace of artificial intelligence and advanced data analytics is revolutionizing underwriting and risk management. By 2024, the global AI in insurance market was projected to exceed $10 billion, signaling substantial investment in these transformative technologies.

Accelerated underwriting, leveraging technology for faster policy approvals with minimal medical checks, is expected to become the dominant market approach by 2025. This digital shift also supports the growth of term life insurance products.

Brookfield Reinsurance can leverage these technological advancements to enhance operational efficiency and customer experience through faster application and policy management processes.

The increasing reliance on digital platforms exposes insurers like Brookfield Reinsurance to escalating cybersecurity threats and demands stringent adherence to data privacy regulations, which are becoming increasingly robust globally, impacting operations through 2025.

| Technology Trend | Impact on Brookfield Reinsurance | Relevant Data/Projection |

|---|---|---|

| AI & Data Analytics | Enhanced underwriting, risk management, operational efficiency | Global AI in insurance market projected over $10B by 2024 |

| Accelerated Underwriting | Faster policy approvals, improved customer experience | Expected to be dominant market approach by 2025 |

| Cybersecurity & Data Privacy | Increased risk exposure, regulatory compliance imperative | Growing digital footprint expands attack surface; stringent data protection regulations |

Legal factors

Brookfield Reinsurance operates within a complex web of global insurance and reinsurance regulations, dictating capital adequacy, solvency standards, and market conduct. These rules are crucial for maintaining financial stability and protecting policyholders.

Regulatory bodies, such as the National Association of Insurance Commissioners (NAIC) in the United States, are continuously updating risk-based capital frameworks. For instance, the NAIC's Risk-Based Capital (RBC) requirements are designed to ensure insurers have sufficient capital to absorb unexpected losses. These modernizations directly influence Brookfield's financial planning and operational strategies, demanding robust capital management.

Consumer protection laws are becoming increasingly stringent, especially regarding how insurance products like annuities are sold and what data is shared. Regulators are focusing on these areas, and by 2025, Brookfield Reinsurance must prioritize transparency and fairness in all its customer interactions to comply with evolving standards.

States are increasingly enacting new data privacy and cybersecurity laws, with a notable surge in 2024 and projected continued expansion into 2025. These regulations are often spurred by the rapid advancements in AI technology, which raises new concerns about data handling and potential misuse. For instance, California's Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), continue to set a high bar, with other states like Virginia (VCDPA) and Colorado (CPA) following suit, creating a complex compliance landscape.

Compliance with these evolving regulations, which frequently address algorithmic discrimination and strict data retention policies, is paramount for Brookfield Reinsurance. Failure to adhere could result in significant financial penalties; for example, violations of the CPRA can lead to fines of up to $7,500 per violation. Maintaining robust data governance frameworks is crucial not only for legal adherence but also for safeguarding customer trust and ensuring operational integrity in an increasingly data-dependent financial sector.

Anti-Discrimination Laws and AI Ethics

The increasing integration of Artificial Intelligence (AI) in insurance operations, such as underwriting and claims processing, presents significant legal challenges related to anti-discrimination laws. Regulators globally are scrutinizing AI algorithms to prevent unfair bias and ensure compliance with existing anti-discrimination statutes, which means Brookfield Reinsurance must prioritize ethical AI development and deployment.

Brookfield Reinsurance needs to implement rigorous data governance and bias detection mechanisms to mitigate risks associated with algorithmic discrimination. This proactive approach is crucial as regulatory bodies, like the European Union with its proposed AI Act, are establishing frameworks to govern AI's ethical use, impacting how financial services firms operate.

- Algorithmic Bias: AI models trained on historical data may inadvertently perpetuate or amplify existing societal biases, leading to discriminatory outcomes in pricing, coverage, or claims handling.

- Regulatory Scrutiny: Governments are actively developing regulations to ensure AI fairness, transparency, and accountability, potentially imposing penalties for non-compliance. For instance, the U.S. Equal Employment Opportunity Commission (EEOC) has issued guidance on AI in employment, which has implications for underwriting.

- Ethical AI Frameworks: Brookfield Reinsurance must establish internal ethical guidelines for AI development and usage, ensuring that fairness and non-discrimination are core principles throughout the AI lifecycle.

- Data Strategy: A robust data analytics strategy is essential, focusing on data quality, representativeness, and continuous monitoring of AI model performance to identify and correct any discriminatory patterns.

International Regulatory Compliance

Brookfield Reinsurance operates across numerous countries, necessitating adherence to a complex web of international legal and regulatory frameworks. This global footprint requires constant vigilance to ensure compliance with varying financial services laws, data privacy regulations, and consumer protection standards in each market.

A significant upcoming legal factor is the implementation of stringent ESG-related fund naming guidelines in Europe, set to be effective by May 2025. Financial institutions, including reinsurers, must comply with these rules to prevent greenwashing and guarantee the accuracy of sustainability claims made about their products. This directly impacts how Brookfield Reinsurance can market and structure its offerings in European markets.

The evolving landscape of international taxation also presents a critical legal consideration. Changes in tax treaties and transfer pricing regulations can significantly affect a multinational company's profitability and operational structure. Brookfield Reinsurance must continuously monitor and adapt to these shifts to maintain tax efficiency and legal standing globally.

Key legal considerations for Brookfield Reinsurance include:

- Adherence to diverse international financial services regulations, including those related to solvency, capital requirements, and market conduct.

- Compliance with upcoming ESG fund naming guidelines in Europe (effective May 2025) to ensure transparent and accurate sustainability claims.

- Navigating complex international tax laws and transfer pricing regulations across all operating jurisdictions.

- Meeting evolving data privacy and cybersecurity laws, such as GDPR and similar legislation, to protect client information.

Brookfield Reinsurance must navigate an increasingly complex global regulatory environment, with significant implications for its operations and financial strategy. For instance, the ongoing evolution of risk-based capital (RBC) requirements by bodies like the NAIC in the US demands continuous adaptation in capital management to meet solvency standards. Furthermore, by 2025, heightened consumer protection laws will necessitate greater transparency in product sales and data handling, impacting how Brookfield interacts with its clients.

The surge in data privacy and cybersecurity legislation, exemplified by California's CCPA/CPRA and similar laws in other states, creates a challenging compliance landscape. These regulations, often driven by AI advancements, impose strict data handling and retention policies, with violations potentially incurring substantial fines, such as up to $7,500 per violation under the CPRA.

The integration of AI in insurance processes like underwriting also brings legal scrutiny, particularly concerning anti-discrimination laws. Brookfield Reinsurance must prioritize ethical AI development and implement robust bias detection mechanisms to comply with emerging global frameworks, such as the EU's proposed AI Act, to avoid discriminatory outcomes and potential penalties.

Brookfield Reinsurance faces significant legal hurdles with the implementation of new ESG fund naming guidelines in Europe by May 2025, aimed at preventing greenwashing. Additionally, navigating evolving international tax laws and transfer pricing regulations across its global operations is critical for maintaining tax efficiency and legal compliance.

| Legal Factor | Description | Implication for Brookfield Reinsurance | Relevant Data/Timeline |

|---|---|---|---|

| Capital Adequacy | Maintaining sufficient capital reserves to absorb unexpected losses. | Requires robust capital management and strategic financial planning. | NAIC RBC modernization ongoing; Solvency II in Europe. |

| Consumer Protection | Ensuring fair practices in product sales and data usage. | Demands increased transparency and ethical customer interactions. | Heightened focus by 2025. |

| Data Privacy & Cybersecurity | Compliance with evolving laws governing data handling and protection. | Necessitates strong data governance and security measures. | CCPA/CPRA (US), GDPR (EU); continuous state-level updates. |

| AI Regulation & Ethics | Addressing potential biases and ensuring fairness in AI-driven processes. | Requires ethical AI development and bias mitigation strategies. | EU AI Act proposed; EEOC guidance on AI in employment. |

| ESG Disclosure | Adhering to regulations on sustainability claims for financial products. | Impacts marketing and product structuring in specific markets. | European ESG fund naming guidelines effective May 2025. |

| International Taxation | Compliance with global tax treaties and transfer pricing rules. | Requires continuous monitoring and adaptation for tax efficiency. | Ongoing OECD initiatives (e.g., Pillar Two). |

Environmental factors

The escalating frequency and intensity of climate-related disasters, including hurricanes and wildfires, present a significant challenge for the global reinsurance sector. For instance, the 2023 Atlantic hurricane season was the fourth most active on record, with 20 named storms, leading to substantial insured losses that ripple through the industry.

While Brookfield Reinsurance's core business lies in life and annuity products, these widespread catastrophe events can place considerable financial pressure on primary insurers. This strain can indirectly affect the broader market, potentially influencing investment strategies and capital allocation decisions across the financial landscape, including those relevant to Brookfield Reinsurance's investment portfolio.

The increasing global focus on sustainability is compelling reinsurers like Brookfield Reinsurance to embed Environmental, Social, and Governance (ESG) principles into their investment strategies. This shift is driven by growing investor and regulatory demand for responsible capital allocation.

Brookfield Reinsurance can capitalize on this trend by leveraging the deep ESG integration expertise within Brookfield Asset Management, its parent company. This strategic alignment allows for investments in projects that not only offer financial returns but also contribute positively to environmental solutions, such as renewable energy infrastructure.

For instance, as of early 2024, global sustainable investment assets under management were projected to exceed $50 trillion, showcasing the significant market opportunity. Brookfield Reinsurance's commitment to ESG integration, supported by Brookfield Asset Management's track record, positions it to attract capital and enhance long-term value creation through sustainable investments.

Insurance regulators are significantly increasing their attention on climate risk and resilience. The National Association of Insurance Commissioners (NAIC) has specifically highlighted this as a top priority for 2025, signaling a proactive stance from oversight bodies.

This heightened regulatory focus is likely to translate into more stringent data and reporting requirements for insurance companies like Brookfield Reinsurance. Expect new mandates concerning climate-related financial disclosures and the implementation of robust risk management strategies to address these evolving challenges.

Demand for Green and Sustainable Financial Products

The demand for green and sustainable financial products is rapidly expanding, fueled by increasing investor interest and evolving regulatory landscapes. This trend presents significant opportunities for companies like Brookfield Reinsurance to engage in financing environmentally beneficial projects.

Brookfield Reinsurance can leverage its expertise to invest in and underwrite green bonds and other sustainable financial instruments. These products are crucial for funding initiatives such as renewable energy development and climate resilience infrastructure, directly supporting global sustainability objectives.

- Market Growth: The global green bond market reached an estimated $1 trillion in issuance by early 2024, with projections indicating continued robust growth through 2025.

- Investor Demand: A significant majority of institutional investors, often exceeding 80%, now consider ESG (Environmental, Social, and Governance) factors in their investment decisions.

- Regulatory Push: Governments worldwide are implementing policies and incentives, such as tax credits for green projects and stricter disclosure requirements, which further stimulate the market for sustainable finance.

Reputational Risk and Stakeholder Expectations

Brookfield Reinsurance recognizes that its reputation is intrinsically linked to its environmental, social, and governance (ESG) performance. Embracing sustainability initiatives, such as reducing its carbon footprint and investing in green technologies, can significantly enhance its brand image. This positive perception is crucial for attracting a growing segment of socially responsible investors and clients who prioritize ESG factors in their decision-making. For instance, as of Q1 2024, the global sustainable investment market reached an estimated $37.4 trillion, demonstrating a clear demand for ESG-conscious companies.

Conversely, a perceived lack of commitment to environmental stewardship could expose Brookfield Reinsurance to substantial reputational damage. Negative publicity stemming from environmental incidents or a failure to meet evolving stakeholder expectations regarding climate change could erode trust. This erosion can manifest in difficulties attracting new business, retaining existing clients, and maintaining positive relationships with regulators and the broader community. For example, a 2024 survey by RepRisk indicated that 70% of investors consider ESG risks when making investment decisions.

- Reputational Enhancement: Proactive environmental strategies can bolster Brookfield Reinsurance's brand, attracting ESG-focused investors and clients.

- Stakeholder Alignment: Meeting or exceeding stakeholder expectations on environmental matters is vital for maintaining trust and long-term partnerships.

- Investor Demand: The increasing global demand for sustainable investments, valued at over $37 trillion in early 2024, underscores the financial benefits of strong ESG credentials.

- Risk Mitigation: Failing to address environmental concerns can lead to significant reputational harm and negatively impact business relationships.

Environmental factors significantly shape the operational landscape for reinsurers like Brookfield Reinsurance, with climate change posing a primary concern. The increasing frequency of extreme weather events, such as the record-breaking 2023 Atlantic hurricane season with 20 named storms, directly impacts the industry through rising insured losses, indirectly affecting Brookfield's investment strategies.

The growing emphasis on sustainability is driving a shift towards integrating Environmental, Social, and Governance (ESG) principles into investment portfolios. This trend is supported by substantial market growth, with global sustainable investment assets projected to exceed $50 trillion by early 2024, presenting a clear opportunity for Brookfield Reinsurance to align with its parent company's ESG expertise.

Regulatory bodies, like the NAIC, are prioritizing climate risk and resilience, signaling stricter data and reporting requirements for companies like Brookfield Reinsurance. This regulatory push, coupled with strong investor demand for sustainable products, as evidenced by the over $1 trillion global green bond market issuance by early 2024, necessitates a proactive approach to environmental stewardship.

| Factor | Impact on Brookfield Reinsurance | Data Point (2024/2025 Projections) |

|---|---|---|

| Climate Change & Extreme Weather | Increased claims, potential investment volatility | 2023 Atlantic Hurricane Season: 4th most active on record (20 named storms) |

| Sustainability & ESG Demand | Opportunity for green investments, reputational enhancement | Global Sustainable Investment Assets: Projected to exceed $50 trillion (early 2024) |

| Regulatory Scrutiny | Increased compliance burden, data reporting requirements | NAIC's top priority for 2025: Climate risk and resilience |

| Green Finance Market Growth | Opportunities in green bonds and sustainable instruments | Global Green Bond Market Issuance: Estimated $1 trillion (early 2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Brookfield Reinsurance is informed by a comprehensive review of data from leading financial institutions, regulatory bodies, and industry-specific publications. We incorporate economic forecasts from organizations like the IMF and World Bank, alongside policy updates from relevant governmental agencies.