Brookfield Reinsurance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

Brookfield Reinsurance operates in a dynamic market shaped by intense competition and significant regulatory oversight. Understanding the bargaining power of buyers and the threat of substitute products is crucial for navigating this landscape effectively.

The complete report reveals the real forces shaping Brookfield Reinsurance’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The primary suppliers to Brookfield Reinsurance are its capital providers. These include traditional reinsurers, alternative capital sources like insurance-linked securities, and its parent, Brookfield Asset Management. External capital providers can exert influence, particularly for substantial deals or when overall market capital is scarce.

In 2024, the insurance-linked securities (ILS) market continued to demonstrate its importance. The total capital invested in ILS funds reached approximately $100 billion by the end of 2023, with expectations of further growth in 2024, indicating the increasing reliance on these alternative capital sources and their potential bargaining power.

The growing availability of alternative capital, like insurance-linked securities (ILS) and catastrophe bonds, is starting to shift the balance. By mid-2024, alternative capital stood at an impressive $113 billion, with property catastrophe bonds alone accounting for over $45 billion in 2024. This broadens the capital supply for insurers, potentially reducing reliance on traditional reinsurers.

Suppliers of capital, whether from internal sources or external investors, are primarily motivated by the potential returns on their investments. If alternative investment avenues outside of the reinsurance industry offer more compelling risk-adjusted returns, capital providers may consequently demand higher compensation from Brookfield Reinsurance. This directly translates to an increased cost of capital for the company.

The reinsurance sector experienced robust returns on equity throughout 2024, with projections indicating this strength is likely to persist into 2025. This favorable performance makes reinsurance a highly attractive sector for capital deployment, potentially influencing the bargaining power of capital suppliers.

Regulatory Capital Requirements

Regulatory capital requirements significantly shape the bargaining power of suppliers in the reinsurance market. Bodies like the UK's Prudential Regulation Authority (PRA) mandate capital levels for reinsurers, directly impacting the cost and availability of capital from suppliers.

Stricter regulations, such as increased collateral requirements, can elevate the expense and complexity for capital providers. This effectively strengthens their position by making it more challenging for reinsurers to secure the necessary funding. For instance, India's move to introduce collateral requirements for cross-border reinsurers starting in 2025 highlights this trend.

- Increased Capital Buffers: Regulators often require reinsurers to hold larger capital buffers, which means suppliers of capital must meet higher solvency standards.

- Collateral Demands: New regulations, like those in India from 2025, can compel reinsurers to post collateral for foreign liabilities, increasing the demand for liquid assets from capital providers.

- Compliance Costs: Adhering to evolving regulatory frameworks adds compliance costs for reinsurers, which can be passed on to capital suppliers through higher return expectations.

- Market Stability Focus: The primary goal of these regulations is financial stability, which can sometimes lead to a more cautious approach from capital suppliers, potentially limiting their willingness to provide capital on less favorable terms.

Specialized Investment Expertise

Brookfield Reinsurance distinguishes itself by tapping into Brookfield Asset Management's extensive expertise in alternative investments. This specialized investment capability, managing over $800 billion in assets as of early 2024, acts as a crucial ‘supplier’ of value to the reinsurance business.

The unique ability to generate enhanced returns through these alternative investment strategies significantly diminishes the bargaining power of other capital providers. These alternative providers may lack the integrated investment solutions that Brookfield Reinsurance can offer, making them less attractive as capital suppliers.

- Brookfield Asset Management's AUM: Over $800 billion in early 2024, highlighting its scale and influence.

- Specialized Expertise: Focus on alternative investments as a key differentiator.

- Reduced Supplier Power: Integrated investment solutions limit the leverage of other capital sources.

The bargaining power of suppliers for Brookfield Reinsurance is influenced by the availability and attractiveness of capital. With alternative capital, like insurance-linked securities, reaching $113 billion by mid-2024, including over $45 billion in property catastrophe bonds, suppliers have more options.

However, Brookfield Reinsurance leverages Brookfield Asset Management's substantial $800 billion+ in assets under management as of early 2024, offering specialized alternative investment expertise that can reduce the bargaining power of less integrated capital providers.

Regulatory capital requirements, such as increased collateral demands highlighted by India's 2025 regulations, can strengthen supplier leverage by raising compliance costs and complexity for reinsurers.

The reinsurance sector's strong performance in 2024, with robust equity returns expected to continue, makes it an attractive destination for capital, potentially influencing supplier demands for higher returns.

| Capital Source | Approximate Market Size (mid-2024) | Key Influence Factor |

|---|---|---|

| Insurance-Linked Securities (ILS) | $113 billion | Growing availability, alternative returns |

| Property Catastrophe Bonds | >$45 billion (2024) | Specific risk transfer mechanism |

| Brookfield Asset Management (Internal/Affiliated) | >$800 billion AUM (early 2024) | Specialized investment expertise, integrated solutions |

What is included in the product

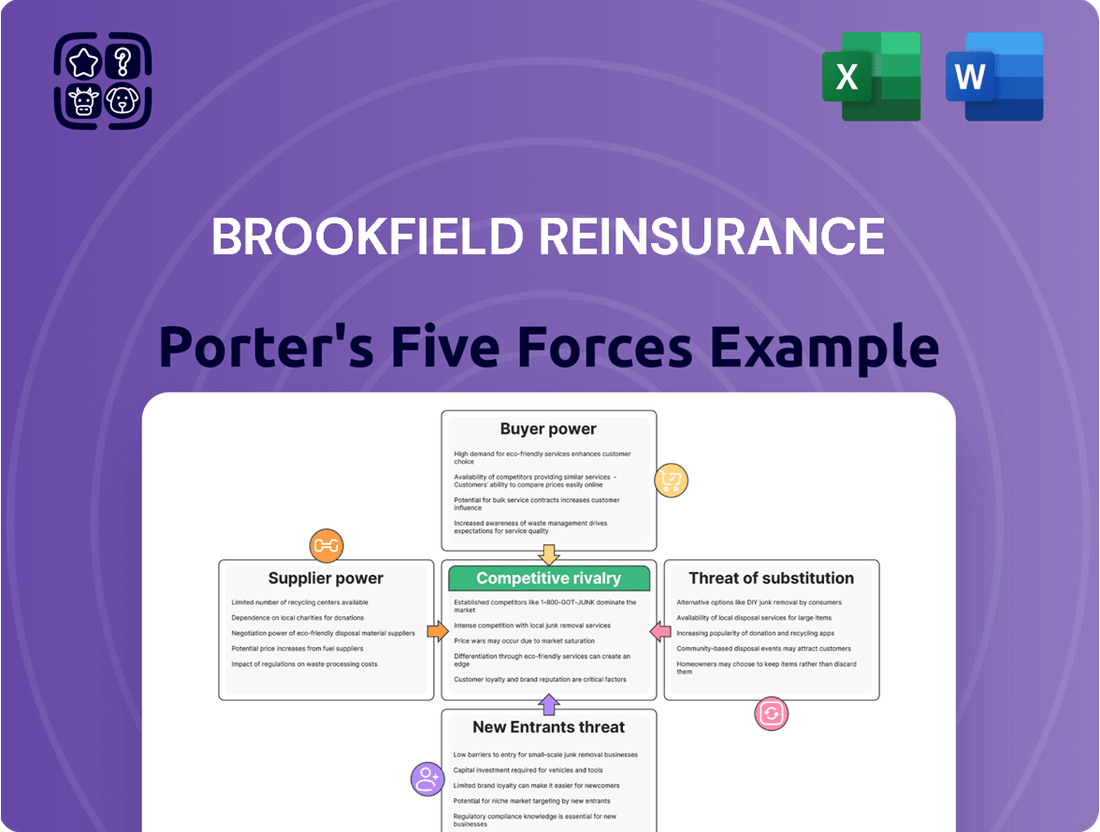

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants and substitutes specifically for Brookfield Reinsurance's market position.

Effortlessly navigate complex competitive landscapes by visualizing Brookfield Reinsurance's Porter's Five Forces, offering immediate clarity on strategic pressures.

Customers Bargaining Power

Brookfield Reinsurance's customer base consists mainly of insurance companies, especially those in the life and annuity markets. These clients are generally large, well-informed financial entities that possess robust internal risk management systems and extensive market expertise.

This advanced understanding empowers them to negotiate more favorable terms and readily compare the services offered by different reinsurers. For instance, in 2024, the global reinsurance market size was estimated to be around $700 billion, indicating a competitive landscape where client leverage is significant.

The escalating demand for capital solutions within the insurance sector significantly bolsters customer bargaining power. Insurers are increasingly pressured by factors such as persistent inflation, the growing impact of climate change on risk assessment, and the continuous evolution of regulatory frameworks. This creates a strong need for effective capital and risk management strategies.

Consequently, insurance companies are actively pursuing reinsurance services to navigate these challenges, ensuring sustained demand for providers like Brookfield Reinsurance. In 2024, the global reinsurance market continued to see robust activity, with major reinsurers reporting strong premium growth, reflecting this underlying demand. For instance, the industry anticipated continued price increases in many lines of business, driven by these accumulating risks, giving buyers more leverage in negotiations for capacity and terms.

The reinsurance market is quite competitive, featuring major global players like Munich Re, Swiss Re, and Hannover Re. This abundance of choice empowers primary insurers.

With many reinsurers vying for business, primary insurers can effectively compare offerings and negotiate favorable terms and pricing. This competition directly translates to increased bargaining power for the customer, which in this case is the primary insurer.

Ability to Retain More Risk

In the current reinsurance landscape, characterized by escalating rates and more stringent contract terms, primary insurers are increasingly inclined to self-insure or retain a greater share of their risks. This shift directly enhances the bargaining power of customers by diminishing their dependence on reinsurers.

The capacity for primary insurers to absorb more risk acts as a significant negotiation tool. For instance, in 2024, many insurers found it more cost-effective to increase their retentions rather than accept the higher premiums and restrictive conditions demanded by reinsurers in a hardening market.

- Increased Retention Levels: Primary insurers are raising their self-insured retentions, reducing the amount of risk they need to pass on.

- Cost Efficiency: In a rising rate environment, retaining risk can be cheaper than accepting higher reinsurance premiums.

- Market Hardening Impact: The challenging conditions in the reinsurance market, evident throughout 2023 and continuing into 2024, have amplified this trend.

Focus on Long-Term Partnerships

While price is a significant factor, primary insurers often prioritize long-term relationships with reinsurers that can deliver stable, sophisticated, and customized solutions. Brookfield Reinsurance's commitment to providing enduring financial solutions, bolstered by the extensive expertise of Brookfield Asset Management, cultivates more resilient client partnerships. This strategic approach can diminish the customer's leverage derived solely from short-term price negotiations.

Brookfield Reinsurance’s strategy emphasizes building enduring relationships, which can shift the focus from immediate cost savings to the value of consistent, high-quality service and risk management support. For instance, in 2024, the global reinsurance market continued to see a demand for specialized products and long-term capacity, indicating that insurers are willing to commit to reinsurers offering more than just competitive pricing.

- Focus on Long-Term Partnerships: Insurers value reinsurers providing stability and tailored solutions over purely price-driven transactions.

- Brookfield's Advantage: Leveraging Brookfield Asset Management’s expertise enhances the appeal of long-term financial solutions.

- Reduced Price Sensitivity: This focus can decrease customers' bargaining power based solely on immediate price considerations.

- Market Trend: The 2024 reinsurance landscape highlights a continued demand for specialized products and dependable long-term capacity.

Brookfield Reinsurance's primary customers, large insurance companies, wield significant bargaining power due to their market knowledge and the competitive reinsurance landscape. In 2024, with a global reinsurance market estimated around $700 billion, insurers can readily compare offerings and negotiate favorable terms, especially as they increasingly opt for higher self-insured retentions to manage costs in a hardening market.

This increased retention, driven by the desire to avoid rising reinsurance premiums and restrictive contract terms observed throughout 2023 and into 2024, directly enhances customer leverage. For instance, many insurers found it more economical to absorb more risk internally rather than accept the elevated prices and conditions demanded by reinsurers.

While price is a factor, the demand for long-term, sophisticated solutions in 2024 means some customers prioritize stable partnerships over short-term cost savings. Brookfield's strategy of offering enduring financial solutions, supported by Brookfield Asset Management's expertise, aims to build these deeper relationships, potentially mitigating some customer bargaining power derived solely from price.

| Factor | Impact on Customer Bargaining Power | 2024 Market Context |

|---|---|---|

| Market Knowledge & Competition | High | Global reinsurance market size ~ $700 billion; numerous competitors. |

| Increased Retention Levels | High | Insurers retaining more risk due to rising reinsurance costs. |

| Demand for Long-Term Solutions | Moderate | Focus on stable partnerships can reduce price-driven negotiation leverage. |

Preview Before You Purchase

Brookfield Reinsurance Porter's Five Forces Analysis

This preview showcases the complete Brookfield Reinsurance Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or missing information.

Rivalry Among Competitors

Brookfield Reinsurance faces significant competitive rivalry from major global reinsurers. Giants like Munich Re, Swiss Re, and Hannover Re are dominant forces, boasting robust balance sheets and extensive product portfolios. These established players have a long history of strong performance, with all three reporting excellent results in 2024 and anticipating continued success into 2025.

These global reinsurers possess deep client relationships and offer a comprehensive suite of reinsurance solutions, making it challenging for newer entrants like Brookfield Reinsurance to gain substantial market share. Their established reputations and extensive resources create a high barrier to entry and intensify the competitive landscape for all participants seeking to secure business in this market.

Competitive rivalry in the reinsurance sector is heavily shaped by capitalization and financial strength. Global reinsurance capital hit an all-time high in 2024, bolstered by retained earnings and robust catastrophe bond issuance, signaling a strong and well-funded market. Brookfield Reinsurance leverages its own solid financial standing and the substantial capital access provided by Brookfield Asset Management as significant differentiators against competitors.

While the reinsurance market often presents a landscape of similar offerings, Brookfield Reinsurance carves out its niche by specializing in unique solutions, particularly within the life and annuity segments. This focus, combined with their deep expertise in alternative investments, allows them to stand out.

Brookfield Reinsurance differentiates itself by strategically deploying capital to generate superior returns through alternative assets. This specialized approach appeals to clients looking for tailored financial solutions beyond traditional reinsurance products.

Pricing Dynamics and Market Conditions

Competitive rivalry in the reinsurance sector is heavily influenced by pricing, which tends to move in cycles. While property reinsurance rates saw some moderation in 2024 due to abundant capital, the casualty segment continued to experience upward price pressure.

The market is anticipated to remain a compelling environment for both those seeking reinsurance and those providing it through 2025. However, reinsurers must differentiate themselves by offering value that extends beyond mere cost savings to stand out amongst competitors.

- Property Reinsurance Rates: Moderated in 2024 due to increased market capacity.

- Casualty Reinsurance Rates: Continued to see price increases in 2024.

- Market Outlook 2025: Expected to remain attractive for buyers and sellers.

- Competitive Imperative: Reinsurers must demonstrate value beyond price.

Mergers and Acquisitions Activity

The reinsurance sector has experienced significant merger and acquisition (M&A) activity, directly impacting competitive rivalry. Brookfield Reinsurance itself has been a key player, notably acquiring American National and Argo Group. These strategic moves consolidate market share and create larger, more formidable entities.

This consolidation trend leads to the emergence of competitors with broader diversification and enhanced pricing power. Such developments intensify the competitive landscape, as established players and new, larger entities vie for market dominance and client portfolios. For instance, the acquisition of Argo Group by Brookfield Reinsurance in 2023, valued at approximately $1.1 billion, significantly reshaped the competitive dynamics within the North American property and casualty reinsurance market.

- Increased Market Concentration: M&A consolidates the industry, leading to fewer, larger players.

- Enhanced Pricing Power: Larger reinsurers can exert more influence on pricing due to increased market share.

- Diversification Benefits: Acquired companies often bring new lines of business, broadening the competitor's offerings.

- Heightened Competition: The presence of larger, more diversified competitors raises the bar for all market participants.

Brookfield Reinsurance operates in a highly competitive environment against established global reinsurers like Munich Re and Swiss Re, which possess significant financial strength and extensive client networks. These larger players demonstrated strong performance in 2024, with many reporting double-digit growth in net income, and are well-positioned for continued success in 2025.

The reinsurance market's intense rivalry is also fueled by consolidation, with Brookfield Reinsurance itself making strategic acquisitions, such as Argo Group for approximately $1.1 billion in 2023. This trend creates larger, more diversified competitors with enhanced pricing power, intensifying the competition for market share and client portfolios.

Pricing dynamics, particularly the moderation in property reinsurance rates in 2024 due to ample capital, alongside continued upward pressure in casualty reinsurance, further shape the competitive landscape. To thrive, reinsurers must offer value beyond cost, emphasizing specialized solutions and superior returns, especially in segments like life and annuity where Brookfield Reinsurance focuses.

| Competitor | 2024 Performance Indicator (Example) | Key Differentiator |

|---|---|---|

| Munich Re | Strong capital position, robust P&C results | Global reach, extensive product diversification |

| Swiss Re | Positive earnings growth, strategic partnerships | Innovation in risk solutions, strong life segment |

| Hannover Re | High profitability, efficient operations | Specialization in niche markets, strong capital management |

| Brookfield Reinsurance | Growing market presence, capital deployment in alternatives | Focus on life & annuity, alternative asset expertise |

SSubstitutes Threaten

Primary insurance companies increasingly choose to retain more risk on their balance sheets instead of ceding it to reinsurers. This decision is often driven by rising reinsurance costs or unfavorable terms, making direct risk retention a more attractive alternative. For instance, in 2023, the global property catastrophe reinsurance market saw rate increases averaging 10-25% or more at the January 1 renewal, prompting some insurers to re-evaluate their retention strategies.

Large corporations, and increasingly mid-sized businesses, are opting for self-insurance or establishing captive insurance companies. This strategy allows them to retain risk internally, effectively bypassing the traditional reinsurance market. For instance, in 2024, the global captive insurance market was estimated to be worth over $100 billion, showcasing its substantial scale.

This trend represents a significant threat of substitutes for traditional reinsurers, particularly for predictable or recurring risks where the cost of self-insuring can be lower than purchasing reinsurance. Companies can tailor their coverage and potentially achieve cost savings by managing their own risk pools, diverting substantial premium volume away from the open market.

Alternative Risk Transfer (ART) mechanisms, like insurance-linked securities (ILS) and catastrophe bonds, offer a significant substitute for traditional reinsurance. These capital markets solutions allow insurers to transfer risk directly to investors, bypassing the conventional reinsurance market. For instance, the ILS market saw substantial growth, with gross market capacity estimated to be around $100 billion in early 2024, demonstrating its increasing appeal as an alternative to traditional reinsurance capacity.

Financial Derivatives and Hedging Strategies

Financial derivatives present a significant threat of substitutes for certain aspects of reinsurance. Insurers can utilize these instruments to manage risks like interest rate volatility and market downturns, which are also key areas addressed by traditional reinsurance. For instance, in 2024, the global derivatives market continued to expand, with the notional value of outstanding derivatives contracts remaining in the hundreds of trillions of dollars, indicating their widespread use as risk management tools.

While derivatives may not fully replace the comprehensive risk transfer offered by all reinsurance contracts, they provide a flexible and often more cost-effective alternative for specific risk exposures. This means that as the sophistication and accessibility of derivative markets grow, they can chip away at the demand for certain types of reinsurance coverage, particularly for standardized risks.

- Derivatives offer alternative hedging for interest rate risk, a common reinsurance coverage.

- The vast scale of the global derivatives market in 2024 highlights their role as substitutes.

- Flexibility and cost-effectiveness of derivatives can reduce reliance on certain reinsurance.

Government-Backed Insurance Programs

Government-backed insurance programs can act as substitutes, especially for systemic risks. For instance, discussions around a potential EU public-private reinsurance scheme for cyber threats illustrate this. Such initiatives aim to provide coverage where private markets might find it prohibitively expensive or complex.

These programs can absorb risks that might otherwise be borne by private reinsurers like Brookfield Reinsurance. The sheer scale of potential losses from widespread natural disasters or sophisticated cyberattacks can make them attractive alternatives for governments seeking to protect their economies and citizens.

- Government programs can offer coverage for large-scale, systemic risks.

- Public-private partnerships are emerging as potential substitutes.

- Discussions for an EU public-private reinsurance scheme highlight this trend.

- These initiatives can impact the demand for private reinsurance services.

The threat of substitutes for reinsurers like Brookfield Reinsurance is substantial, encompassing direct risk retention by primary insurers, the growing captive insurance market, and alternative risk transfer mechanisms like insurance-linked securities.

Primary insurers are increasingly retaining more risk due to rising reinsurance costs, with global property catastrophe reinsurance rates increasing by 10-25% or more in early 2024 renewals. Large and mid-sized corporations are also forming captive insurance companies, a market valued at over $100 billion in 2024, to manage their own risks. Furthermore, the insurance-linked securities market, with an estimated capacity of around $100 billion in early 2024, offers a direct capital markets alternative for risk transfer.

| Substitute Category | Key Characteristics | Market Indicator (2024 Data) |

|---|---|---|

| Direct Risk Retention | Cost savings, tailored coverage | 10-25%+ rate increases in property catastrophe reinsurance renewals (2023/2024) |

| Captive Insurance | Internal risk management, cost control | Global captive market > $100 billion |

| Insurance-Linked Securities (ILS) | Capital markets risk transfer, diversification | ILS market capacity ~ $100 billion |

Entrants Threaten

The reinsurance market demands immense upfront capital, acting as a formidable barrier for aspiring companies. Historically, a new reinsurer would need at least $1 billion in equity to even be considered, and even today, that level of capital would place a new entrant in the lower tiers of market participants.

Brookfield Reinsurance, with the backing of Brookfield Asset Management's substantial financial resources, is well-positioned to navigate and capitalize on this high barrier to entry. This deep capital pool provides a significant competitive advantage, allowing Brookfield Reinsurance to absorb larger risks and invest in growth opportunities that smaller, less capitalized competitors cannot.

The reinsurance industry presents significant barriers to entry due to stringent regulatory frameworks. New entrants must navigate complex licensing procedures and ongoing compliance obligations, which differ across various global jurisdictions.

These regulatory hurdles, including strict solvency capital requirements and collateral mandates, demand substantial upfront investment and ongoing operational resources, making it challenging for new companies to establish a foothold. For instance, in 2024, compliance costs for new reinsurers can easily run into millions of dollars before they can even begin underwriting business.

Established reinsurers benefit from deep-rooted relationships with primary insurers, built over years of reliable claims handling and demonstrated financial strength. These enduring partnerships are a significant barrier. For instance, in 2024, the average tenure of a reinsurer-primary insurer relationship in the property and casualty sector remained substantial, reflecting the trust and stability required in this market.

A strong reputation for consistent claims payment and financial solvency is hard-won and takes considerable time to cultivate. New entrants face the challenge of proving their reliability, a process that can deter potential clients who prioritize security and predictability. This intangible asset, reputation, is a key differentiator that new companies struggle to replicate quickly.

Access to Specialized Expertise and Data

The reinsurance market, especially for complex products like life and annuity, demands highly specialized knowledge. This includes advanced underwriting skills, intricate actuarial modeling, and access to vast amounts of historical data. New companies entering this space would face substantial hurdles in building or acquiring these critical competencies.

For instance, developing proprietary actuarial models can take years and significant investment. A new entrant might need to spend millions just to replicate the data analytics capabilities that established reinsurers already possess. This barrier is particularly high in life reinsurance, where long-term mortality trends and policyholder behavior are key to accurate pricing.

- Specialized Underwriting: Requires deep understanding of mortality, morbidity, and longevity risks.

- Actuarial Modeling: Sophisticated software and expertise are needed for pricing and reserving.

- Data Access: Historical policy data is crucial for building reliable predictive models.

- Regulatory Compliance: Navigating complex solvency and reporting requirements adds to the challenge.

Competition from Existing Players and Alternative Capital

The reinsurance landscape is intensely competitive, with established reinsurers and a burgeoning influx of alternative capital sources creating significant hurdles for newcomers. This dynamic means that new entrants struggle to carve out profitable market segments and secure necessary investment, as capital providers often favor the proven track records of existing reinsurers or the established structures of Insurance-Linked Securities (ILS).

In 2024, the reinsurance market continued to see substantial participation from alternative capital. For instance, the Insurance-Linked Securities (ILS) market, a key alternative capital provider, saw its capacity remain robust, with estimates suggesting a market size in the tens of billions of dollars, continuing its growth trajectory from previous years. This readily available alternative capital means that even if a new entrant offers a compelling product, they must compete not only with traditional reinsurers but also with these increasingly sophisticated and well-funded alternative capital providers for investor attention and capital allocation.

- Established Reinsurers: Dominant players with significant market share and long-standing client relationships make it difficult for new entrants to gain traction.

- Alternative Capital: The growing presence of ILS and other non-traditional capital sources provides ample capacity, often at competitive pricing, challenging new entrants' ability to attract business.

- Investor Preferences: Investors frequently gravitate towards established entities with demonstrated performance and lower perceived risk, making it harder for start-ups to raise capital.

The threat of new entrants in the reinsurance market is significantly mitigated by substantial capital requirements, stringent regulatory oversight, and the need for deep industry expertise. These factors create formidable barriers, making it exceptionally difficult and costly for new players to establish themselves. For example, in 2024, the cost of regulatory compliance alone for a new reinsurer can easily amount to millions, even before underwriting can commence.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Requires billions in equity for even basic market participation. | High cost of entry, limiting the number of potential new players. |

| Regulatory Hurdles | Complex licensing and ongoing compliance across jurisdictions. | Significant upfront investment and operational resources needed. |

| Specialized Expertise | Demands advanced underwriting, actuarial modeling, and data analysis. | Challenges in building or acquiring critical competencies quickly. |

| Established Relationships | Long-standing trust and reliability with primary insurers. | Difficult to displace existing, trusted partners. |

| Reputation & Trust | Hard-won reputation for consistent claims payment and solvency. | New entrants must prove reliability, a time-consuming process. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookfield Reinsurance is built upon a robust foundation of data, including publicly available financial reports, industry-specific market research, and regulatory filings. We also incorporate insights from reputable financial news outlets and analyst reports to capture current market dynamics and competitive landscapes.