Brookfield Reinsurance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookfield Reinsurance Bundle

Discover the core strategies behind Brookfield Reinsurance's impressive growth with our comprehensive Business Model Canvas. This detailed breakdown reveals their unique approach to value creation, customer relationships, and key resources, offering a powerful blueprint for success.

Unlock the full strategic blueprint behind Brookfield Reinsurance's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Brookfield Reinsurance's strategic alliance with Brookfield Asset Management is foundational to its business model, granting access to a vast global network and deep expertise in alternative investments. This synergy allows Brookfield Reinsurance to tap into a diverse array of high-yielding assets, essential for effectively managing and optimizing returns on its reinsured liabilities.

This crucial partnership is a significant competitive advantage, enabling Brookfield Reinsurance to construct and deliver complex, long-term financial solutions that cater to sophisticated client needs. For instance, in 2024, Brookfield Asset Management managed over $925 billion in assets, underscoring the scale and breadth of investment opportunities available to its reinsurance arm.

Primary insurance companies are Brookfield Reinsurance's core clients, offloading their life and annuity insurance liabilities. These relationships are built on intricate contracts where Brookfield assumes risk for premiums, helping insurers optimize their capital and risk management. The 2024 acquisition of American Equity Investment Life Holding Company significantly broadened this crucial client segment.

Brookfield Reinsurance leverages a robust network of Independent Marketing Organizations (IMOs), banks, and broker-dealers to distribute its annuity products. This strategy is crucial for reaching a broad customer base. For instance, through its subsidiary American Equity Investment Life (AEL), Brookfield Reinsurance collaborates with over 40,000 independent agents and advisors.

These partnerships function as essential distribution channels, facilitating the connection between potential policyholders and Brookfield Reinsurance's annuity solutions. This extensive network is fundamental to originating new annuity sales and expanding market penetration. The sheer volume of agents underscores the importance of these third-party relationships in driving business growth.

Regulatory Bodies

Brookfield Reinsurance's key partnerships include insurance regulatory bodies across its operating regions. This collaboration is essential for maintaining licenses and ensuring compliance with financial regulations. For instance, in 2024, regulators like the U.S. Securities and Exchange Commission (SEC) and the UK's Prudential Regulation Authority (PRA) set stringent capital requirements for reinsurers.

Brookfield Reinsurance actively engages with these supervisory colleges, providing detailed information on its capital position. This proactive approach fosters trust and demonstrates financial stability. A strong relationship with regulators is fundamental to operating within the global financial ecosystem.

- Regulatory Compliance: Adherence to rules set by bodies like the SEC and PRA ensures operational legitimacy.

- License Maintenance: Ongoing dialogue with regulators is crucial for retaining operating licenses in key markets such as the US, Canada, UK, and Japan.

- Capital Position Transparency: Proactive sharing of capital details with supervisory colleges builds confidence in financial strength.

- Ecosystem Trust: Strong regulatory partnerships are vital for establishing and maintaining trust within the broader financial industry.

Investment Partners (e.g., Castlelake LP)

Brookfield Reinsurance actively collaborates with specialized investment partners, such as Castlelake LP, to bolster its credit operations and refine its investment strategies. These alliances are crucial for channeling reinsurance capital into a variety of proprietary investment approaches that aim for higher yields, thereby optimizing overall returns.

These strategic alliances are designed to leverage the expertise of partners like Castlelake LP, which is known for its focus on opportunistic credit and real assets. For instance, in 2023, Castlelake LP managed approximately $22 billion in assets, demonstrating the scale of capital that can be deployed through such partnerships. This collaboration allows Brookfield Reinsurance to access a broader spectrum of investment opportunities and enhance its risk management capabilities.

- Strategic Alignment: Partnerships are formed with firms that complement Brookfield Reinsurance's strategic objectives, particularly in areas like credit investing and asset management.

- Capital Deployment: These relationships facilitate the efficient deployment of reinsurance capital into diverse, higher-yielding investment strategies, enhancing profitability.

- Enhanced Returns: By tapping into specialized investment expertise, Brookfield Reinsurance aims to achieve superior risk-adjusted returns on its invested capital.

- Risk Diversification: Collaborating with partners like Castlelake LP aids in diversifying the investment portfolio and mitigating concentration risk.

Brookfield Reinsurance's Key Partnerships are crucial for its operational success and growth. These include its foundational relationship with Brookfield Asset Management, which provides access to extensive investment expertise and capital. Additionally, primary insurance companies are key clients, offloading liabilities, as exemplified by the 2024 acquisition of American Equity Investment Life Holding Company. Distribution is driven by a wide network of Independent Marketing Organizations (IMOs), banks, and broker-dealers, such as the over 40,000 agents associated with American Equity Investment Life.

| Partner Type | Key Role | Example/Data Point (2024 unless noted) |

| Brookfield Asset Management | Investment Expertise & Network Access | Managed over $925 billion in assets |

| Primary Insurance Companies | Source of Reinsured Liabilities | Acquisition of American Equity Investment Life Holding Company |

| IMOs, Banks, Broker-Dealers | Annuity Product Distribution | Over 40,000 agents via American Equity Investment Life |

| Specialized Investment Partners (e.g., Castlelake LP) | Credit Operations & Investment Strategy Enhancement | Castlelake LP managed approx. $22 billion in assets (2023) |

| Regulatory Bodies (e.g., SEC, PRA) | License Maintenance & Compliance | Ensuring adherence to capital requirements |

What is included in the product

Brookfield Reinsurance's business model focuses on acquiring and managing insurance and reinsurance businesses, leveraging Brookfield's asset management expertise to generate stable, long-term returns for its investors.

Brookfield's Reinsurance Business Model Canvas offers a structured approach to identify and address complex financial risks, providing clarity and actionable strategies for managing liabilities.

It serves as a powerful tool for visualizing and optimizing the intricate relationships within their reinsurance operations, alleviating the pain of fragmented risk management.

Activities

Brookfield Reinsurance's key activity involves reinsuring life and annuity liabilities, essentially taking on a portion of risk from other insurance companies. This process includes carefully evaluating and structuring these reinsurance deals, where they receive premium payments for assuming these policy obligations.

This core function is vital for Brookfield Reinsurance's mission as a capital solutions provider, enabling primary insurers to manage their risk and capital more effectively. For instance, in 2023, Brookfield Reinsurance completed a significant block reinsurance transaction with a major U.S. life insurer, reinsuring approximately $3 billion of annuity liabilities.

Brookfield Reinsurance actively manages the capital generated from its reinsurance premiums, a core activity that distinguishes its business model. This capital is strategically deployed into alternative assets, leveraging the deep expertise of Brookfield Asset Management. The objective is to achieve superior risk-adjusted returns and ensure optimal utilization of capital resources.

A critical performance metric for this activity is the investment portfolio yield. For instance, as of the first quarter of 2024, Brookfield Asset Management reported a record $925 billion in assets under management, with a significant portion allocated to alternative strategies, demonstrating the scale and scope of this key activity.

Brookfield Reinsurance, notably via its subsidiary American Equity Investment Life Holding Company (AEL), is a key player in originating and selling annuity products. This activity is fundamental to growing its insurance assets.

In 2024, AEL reported strong annuity sales, with fixed indexed annuity sales reaching $5.5 billion in the first quarter, a significant increase from the prior year. This growth directly fuels Brookfield Reinsurance's insurance liabilities and investment portfolio.

Beyond retail sales, Brookfield Reinsurance also secures substantial pension risk transfer (PRT) premiums. These transactions, like the $1.5 billion PRT deal with a major U.S. corporation announced in late 2023, are crucial for expanding its annuity book and generating fee income.

Capital and Risk Management

Brookfield Reinsurance actively manages its capital and risk exposures to ensure financial stability and meet regulatory requirements. This involves rigorous stress testing and scenario analysis to understand potential impacts from market downturns or interest rate fluctuations.

A key focus is maintaining robust liquidity buffers, which are essential for meeting policyholder obligations and operational needs, especially during periods of economic uncertainty. As of the first quarter of 2024, Brookfield Reinsurance reported strong capital adequacy ratios, reflecting its prudent approach to financial management.

- Capital Adequacy Maintaining strong capital ratios above regulatory minimums is paramount.

- Risk Mitigation Strategies Implementing hedging and diversification techniques to counter market and interest rate risks.

- Liquidity Management Ensuring sufficient cash and readily marketable securities to meet short-term obligations.

- Financial Strength Ratings Consistently aiming for and maintaining high ratings from agencies like AM Best and S&P to foster investor and policyholder confidence.

Strategic Acquisitions and Expansions

Brookfield Reinsurance's key activities include strategically acquiring companies to bolster its insurance and reinsurance capabilities. A prime example is the significant acquisition of American Equity Investment Life Holding Company (AEL) in 2024, a move designed to expand its annuity business. They also completed the acquisition of Argo Group, further diversifying their specialty insurance offerings.

Beyond acquisitions, Brookfield Reinsurance is actively pursuing geographic expansion. In 2024, they launched a new reinsurance unit in Japan, signaling a commitment to growing their presence in the Asian market. This follows their earlier entry into the United Kingdom market, demonstrating a clear strategy to broaden their global reach and client base.

- Strategic Acquisitions: Completed the acquisition of American Equity Investment Life Holding Company (AEL) in 2024, enhancing its annuity platform.

- Market Expansion: Acquired Argo Group to strengthen its specialty insurance segment.

- Geographic Growth: Launched a new reinsurance unit in Japan in 2024, targeting Asian market opportunities.

- International Presence: Continued expansion efforts in the UK market.

Brookfield Reinsurance's key activities revolve around reinsuring life and annuity liabilities, managing capital by investing in alternative assets, and originating annuity products. They also focus on securing pension risk transfer premiums and strategically expanding their global footprint through acquisitions and new market entries.

| Key Activity | Description | 2024 Data/Examples |

|---|---|---|

| Reinsuring Liabilities | Assuming risk from other insurers for premiums. | Completed significant block reinsurance transactions. |

| Capital Management & Investment | Deploying capital into alternative assets for yield. | Leveraging Brookfield Asset Management's $925 billion AUM (Q1 2024). |

| Annuity Origination | Selling annuity products, notably through AEL. | AEL's fixed indexed annuity sales reached $5.5 billion (Q1 2024). |

| Pension Risk Transfers | Securing PRT premiums to grow annuity book. | $1.5 billion PRT deal announced late 2023. |

| Strategic Expansion | Acquiring companies and entering new markets. | Acquired American Equity Investment Life Holding Company (AEL) and launched a unit in Japan. |

Preview Before You Purchase

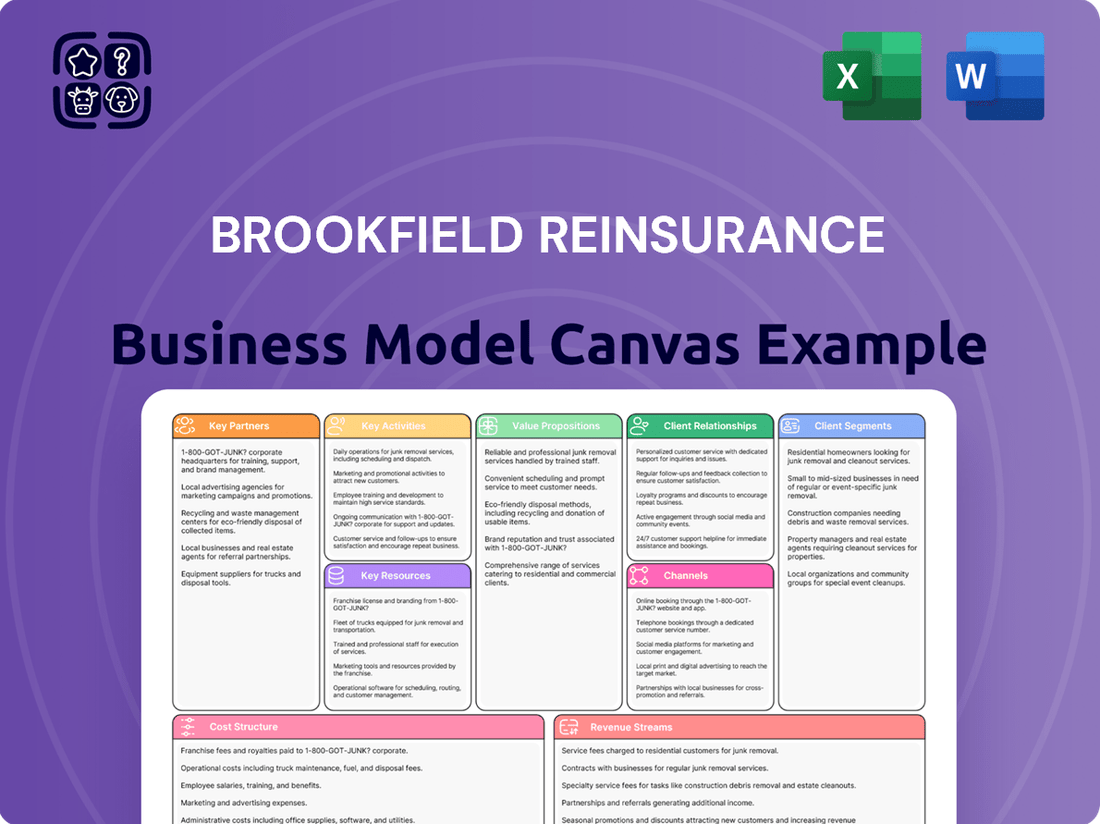

Business Model Canvas

The Brookfield Reinsurance Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final deliverable, showcasing the same structure, content, and professional formatting. Upon completing your order, you will gain full access to this exact file, ready for immediate use and customization.

Resources

Brookfield Reinsurance's business model heavily relies on significant financial capital, encompassing substantial cash reserves and readily available short-term investments. This financial muscle is absolutely essential for effectively underwriting complex reinsurance liabilities and executing their diverse investment strategies.

Maintaining a strong liquidity position is paramount for Brookfield Reinsurance. This robust liquidity ensures they can comfortably meet their ongoing obligations to policyholders and also provides the flexibility needed to efficiently rotate their investment portfolio, capitalizing on market opportunities as they arise.

As of the first quarter of 2024, Brookfield Reinsurance reported total assets of approximately $109 billion, with a significant portion allocated to cash and short-term investments, underscoring their commitment to financial strength and operational flexibility.

Brookfield Asset Management's deep expertise in alternative investments is a cornerstone of Brookfield Reinsurance's business model. This specialized knowledge allows them to effectively source, underwrite, and manage a diverse portfolio of assets, including infrastructure, real estate, and private equity, which are often illiquid and complex.

This proficiency translates into superior risk-adjusted returns on the insurance assets they manage. For instance, as of Q1 2024, Brookfield Reinsurance's total assets under management reached $106 billion, with a significant portion allocated to these alternative strategies, demonstrating their commitment to this value-driving approach.

Brookfield Reinsurance's ability to operate and grow hinges on its extensive portfolio of insurance and reinsurance licenses. These licenses are not just permits; they are the keys that unlock new markets and allow the company to underwrite a diverse range of risks globally. As of early 2024, the company holds licenses in numerous key jurisdictions, facilitating its expansion strategies.

Maintaining these regulatory approvals is a critical ongoing resource. Brookfield Reinsurance dedicates significant effort to ensuring compliance with evolving insurance regulations in each territory where it operates. This proactive approach is essential for sustained business operations and for building trust with policyholders and partners.

Experienced Management and Actuarial Teams

Brookfield Reinsurance’s business model hinges on its highly skilled management, actuarial, and investment teams. These professionals are critical for navigating the intricacies of reinsurance underwriting, performing rigorous risk assessments, and developing sophisticated financial models. Their collective expertise allows the company to craft innovative and tailored solutions for its clients, underpinning its strategic decision-making and operational success.

The depth of experience within these teams is a foundational element. For instance, as of early 2024, Brookfield Reinsurance continues to emphasize the recruitment and retention of top-tier talent with proven track records in financial services and risk management. This focus ensures the company remains at the forefront of industry best practices and possesses the acumen to manage complex portfolios and evolving market dynamics.

- Expertise in Underwriting and Risk Management: The management and actuarial teams possess deep knowledge in assessing and pricing complex risks, a core function for successful reinsurance operations.

- Financial Modeling and Strategic Planning: These teams are adept at building robust financial models to support strategic growth initiatives and capital allocation decisions.

- Investment Acumen: Experienced investment professionals are crucial for managing the substantial assets backing reinsurance liabilities, seeking to generate stable returns.

- Client-Centric Solution Development: The combined expertise enables the creation of customized reinsurance products that meet specific client needs and market demands.

Proprietary Investment Strategies and Sourcing Network

Brookfield Reinsurance leverages Brookfield's extensive global network to source unique investment opportunities, often in less liquid or specialized markets. This access allows them to identify and capitalize on higher-yielding assets that may be overlooked by competitors. For instance, in 2023, Brookfield Asset Management, the parent entity, deployed approximately $25 billion in capital across various strategies, a portion of which feeds into the reinsurance business.

These proprietary strategies are designed to generate attractive risk-adjusted returns, often by focusing on sectors or asset classes where Brookfield has deep expertise. This includes infrastructure, real estate, and private equity, where they can apply their operational and financial acumen. The sourcing network acts as a crucial differentiator, providing a consistent pipeline of deal flow that is not available through traditional channels.

- Proprietary Strategies: Brookfield Reinsurance employs unique investment approaches to uncover alpha.

- Sourcing Network: Access to Brookfield's broad ecosystem provides a competitive edge in deal origination.

- Yield Enhancement: The ability to tap into less liquid or specialized markets allows for higher potential returns.

- 2023 Capital Deployment: Brookfield Asset Management deployed around $25 billion in capital, illustrating the scale of opportunities available.

Brookfield Reinsurance's key resources include its substantial financial capital, robust liquidity, and extensive insurance licenses. These are complemented by Brookfield Asset Management's deep expertise in alternative investments and a highly skilled team of professionals. The company also benefits from Brookfield's global network for sourcing unique investment opportunities.

| Key Resource | Description | Supporting Data (as of Q1 2024) |

|---|---|---|

| Financial Capital & Liquidity | Significant cash reserves and short-term investments to support underwriting and investment strategies. | Total Assets: ~$109 billion; Strong liquidity position. |

| Alternative Investment Expertise | Deep knowledge in sourcing, underwriting, and managing complex, less liquid assets. | Assets Under Management: ~$106 billion, with significant allocation to alternative strategies. |

| Insurance Licenses | Global portfolio of licenses enabling market access and diverse risk underwriting. | Licenses held in numerous key jurisdictions. |

| Skilled Human Capital | Expert management, actuarial, and investment teams for risk assessment and financial modeling. | Emphasis on recruiting top-tier talent with proven track records. |

| Global Sourcing Network | Access to Brookfield's ecosystem for unique, higher-yielding investment opportunities. | Brookfield Asset Management deployed ~$25 billion in capital in 2023. |

Value Propositions

Brookfield Reinsurance aims to deliver superior returns by tapping into Brookfield Asset Management's extensive experience with alternative investments. This strategic advantage allows them to move beyond the typical offerings of traditional reinsurers, seeking out opportunities that can generate higher yields.

By actively managing capital within these alternative asset classes, Brookfield Reinsurance can optimize its deployment for enhanced profitability. This approach is crucial in today's market, where traditional fixed-income investments may not offer the same growth potential.

For instance, in 2024, the global alternative investment market continued its robust growth, with assets under management projected to reach over $20 trillion. Brookfield's ability to access and manage these diverse strategies, from infrastructure to private equity, positions them to capture these growth opportunities for their policyholders and partners.

Brookfield Reinsurance offers specialized capital management solutions designed to help insurers navigate complex risk landscapes. These solutions are crucial for optimizing their capital efficiency and bolstering financial resilience.

By reinsuring significant blocks of liabilities, Brookfield Reinsurance effectively liberates substantial amounts of capital for primary insurers. This strategic move empowers them to reinvest in growth initiatives and core operational strengths, rather than being constrained by capital requirements.

For instance, in 2023, Brookfield Reinsurance completed a significant transaction with American Equity Investment Life Insurance Company, reinsuring approximately $10 billion of its annuity liabilities. This demonstrates their capacity to manage large-scale capital redeployments for their partners.

Brookfield Reinsurance provides policyholders, especially those in the annuity market, with dependable long-term financial security and predictable retirement income. This stability is a direct result of the company's robust capitalization and its strategic emphasis on managing low-risk, long-term liabilities.

Access to Diversified and High-Quality Investment Portfolio

Clients gain access to a highly diversified and quality investment portfolio, managed by Brookfield Asset Management, which underpins their liabilities. This robust backing is crucial for meeting reinsurance obligations effectively.

Brookfield Reinsurance's investment strategy focuses on high-quality assets, aiming to generate stable returns that align with long-term liability management. This approach is designed to provide security and predictable performance.

- Diversification: Spreads risk across various asset classes, reducing volatility.

- Quality Focus: Emphasizes investments with strong credit ratings and stable cash flows.

- Expert Management: Leverages Brookfield Asset Management's extensive experience and global reach.

- Liability Alignment: Ensures investment returns are structured to match the timing and nature of policyholder claims.

Sophisticated and Tailored Reinsurance Solutions

Brookfield Reinsurance excels in providing highly sophisticated and tailored reinsurance solutions designed for complex client needs.

These offerings extend beyond typical reinsurance, focusing on structuring intricate transactions for institutional clients and managing significant pension liabilities.

For instance, in 2024, Brookfield Reinsurance continued to execute large-scale block reinsurance deals, demonstrating its capacity to handle substantial and unique risk transfers.

- Customized Transaction Structuring

- Management of Pension Liabilities

- Sophisticated Risk Transfer Mechanisms

- Institutional Client Focus

Brookfield Reinsurance offers superior returns by leveraging Brookfield Asset Management's expertise in alternative investments, allowing for optimized capital deployment and access to growth opportunities beyond traditional markets.

They provide specialized capital management solutions, freeing up capital for primary insurers to reinvest in growth by reinsuring significant liabilities, exemplified by a $10 billion transaction in 2023.

Policyholders receive long-term financial security and predictable retirement income, backed by a diversified, high-quality investment portfolio managed by Brookfield Asset Management.

Brookfield Reinsurance delivers sophisticated, tailored reinsurance solutions for complex needs, including institutional clients and pension liabilities, with a demonstrated ability to execute large-scale block reinsurance deals in 2024.

| Value Proposition | Key Features | Supporting Data/Examples |

|---|---|---|

| Superior Returns via Alternative Investments | Access to diverse strategies, optimized capital deployment | Global alternative investment market projected over $20 trillion in AUM (2024) |

| Capital Liberation for Insurers | Reinsuring liabilities to free up capital for growth initiatives | $10 billion annuity liabilities reinsured with American Equity (2023) |

| Long-Term Financial Security for Policyholders | Dependable retirement income, robust capitalization | Focus on managing low-risk, long-term liabilities |

| Sophisticated & Tailored Reinsurance Solutions | Complex transaction structuring, pension liability management | Execution of large-scale block reinsurance deals (2024) |

Customer Relationships

Brookfield Reinsurance cultivates enduring strategic partnerships with institutional clients, predominantly primary insurance companies. These relationships are built on continuous dialogue and collaborative development of tailored solutions, ensuring alignment with evolving capital and risk management objectives.

In 2024, Brookfield Reinsurance continued to solidify these institutional ties, leveraging its expertise to offer complex risk transfer and capital solutions. The company's focus on deep engagement allows it to proactively address the unique challenges faced by its partners in a dynamic financial landscape.

Brookfield Reinsurance leverages dedicated relationship management teams to cultivate strong connections with its core clientele. These specialized groups provide tailored service, ensuring each client's specific needs are met with prompt attention.

This personalized approach is crucial for building trust and nurturing long-term partnerships. For instance, in 2024, Brookfield Reinsurance reported significant growth in its client retention rates, a testament to the effectiveness of these dedicated relationship managers.

Brookfield Reinsurance prioritizes transparent reporting, offering institutional clients and shareholders clear insights into financial results and capital strength. This commitment builds essential trust.

In 2024, the company continued its practice of providing regular updates, detailing performance metrics and strategic progress. For instance, their second-quarter 2024 earnings report highlighted a significant increase in assets under management, reaching $95 billion, up from $88 billion at the end of 2023, underscoring their growth and stability.

Advisory and Consultative Approach

Brookfield Reinsurance positions itself as a trusted advisor, providing clients with deep insights and specialized expertise to navigate intricate financial markets and evolving regulatory frameworks. This advisory role is crucial for clients seeking to enhance their financial strategies.

Their consultative approach extends to actively assisting clients in optimizing their business strategies and capital management. For instance, in 2024, Brookfield Reinsurance closed a significant transaction with American Equity Investment Life Holding Company, a deal valued at approximately $1.4 billion, demonstrating their capacity to provide strategic financial solutions.

- Expert Guidance: Offers specialized knowledge in complex financial and regulatory environments.

- Strategic Optimization: Helps clients refine their business and capital management strategies.

- Transaction Support: Facilitates significant financial deals, such as the 2024 American Equity transaction.

- Long-Term Partnerships: Fosters relationships built on trust and mutual benefit.

Agent and Advisor Network Management

Brookfield Reinsurance’s annuity business relies heavily on a vast network of independent agents and advisors, numbering in the thousands, to reach its customer base. Effective management of these relationships is paramount for successful distribution and client engagement.

To foster this network, Brookfield Reinsurance provides comprehensive support, including ongoing training programs and access to competitive annuity products. This ensures advisors are well-equipped to serve client needs and effectively represent Brookfield's offerings.

- Agent Support: Providing resources and assistance to thousands of independent agents.

- Training Programs: Equipping advisors with the knowledge to sell annuity products.

- Product Competitiveness: Offering attractive annuity solutions to drive sales.

- Distribution Effectiveness: Ensuring efficient reach to potential clients through the advisor network.

Brookfield Reinsurance prioritizes building strong, long-term relationships with its institutional clients, primarily other insurance companies. This involves continuous dialogue and collaborative development of customized solutions to meet their evolving risk and capital needs. In 2024, the company's focus on deep engagement and providing expert guidance, exemplified by its $1.4 billion transaction with American Equity, solidified its role as a trusted advisor and strategic partner.

| Relationship Type | Key Activities | 2024 Highlights |

| Institutional Clients | Tailored solutions, risk transfer, capital management, expert advisory | Closed $1.4B transaction with American Equity, assets under management reached $95B (Q2 2024) |

| Independent Agents/Advisors | Training, product support, distribution network management | Supported thousands of agents to distribute annuity products |

Channels

Brookfield Reinsurance prioritizes direct engagement with primary insurance companies to build strong, lasting partnerships for reinsurance deals. This hands-on approach is crucial for understanding each insurer's unique needs and structuring tailored solutions.

Their dedicated sales teams and business development professionals actively cultivate these relationships, often at the executive level. This direct interaction fosters trust and facilitates the complex negotiations inherent in reinsurance agreements.

For instance, in 2024, Brookfield Reinsurance continued to expand its direct outreach, securing significant quota share and excess of loss treaties. This strategy was instrumental in their reported growth, with premiums ceded to them showing a substantial year-over-year increase, reflecting successful direct client acquisition.

Brookfield Reinsurance leverages vast networks of independent agents and advisors as a crucial distribution channel for its annuity products, especially following the American Equity Investment Life (AEL) acquisition. These professionals are instrumental in connecting with individual policyholders, acting as the primary interface for product sales and client relationships.

In 2024, the importance of these networks was highlighted as they facilitated a significant portion of annuity sales, contributing to Brookfield Reinsurance's growth in the individual annuity market. The company's strategy relies on these advisors' expertise to navigate complex financial needs and present tailored solutions to a broad customer base.

Brookfield Reinsurance leverages its corporate website and digital platforms as crucial channels for broad information dissemination, particularly for investor relations. These platforms offer a centralized hub for financial reports, company news, and strategic updates, ensuring transparency and accessibility to stakeholders.

These digital touchpoints also serve as an initial point of contact for prospective clients, facilitating inquiries and providing essential information about Brookfield Reinsurance's offerings. This digital presence enhances customer engagement and streamlines the initial stages of business development.

In 2024, Brookfield Reinsurance continued to invest in its digital infrastructure, aiming to provide an intuitive user experience and robust data security across its platforms, reflecting a commitment to modernizing client and investor interactions.

Industry Conferences and Events

Brookfield Reinsurance actively participates in major industry gatherings, such as the S&P Global Ratings Insurance Conference and the annual conference of the Bermuda International Business Association. These events are crucial for demonstrating their deep understanding of the reinsurance market and for forging new relationships. In 2024, the company's executives were prominent speakers at several key events, sharing insights on capital management and the evolving regulatory landscape.

Attending and speaking at these forums provides a platform to highlight Brookfield Reinsurance's innovative solutions and its strong financial backing. For instance, at the 2024 Monte Carlo Rendez-Vous de Septembre, a premier global reinsurance event, Brookfield Reinsurance executives discussed their approach to complex risk transfer. This engagement helps attract potential clients and partners seeking reliable reinsurance solutions.

The strategic value of these events extends to market intelligence gathering. By being present at conferences, Brookfield Reinsurance gains firsthand knowledge of emerging trends, competitor strategies, and client needs. This information is vital for refining their business model and ensuring they remain at the forefront of the industry. For example, discussions around ESG integration in underwriting at a 2024 industry seminar directly influenced their updated product development strategy.

- Showcasing Expertise: Speaking slots and panel participation at events like the Insurance Ireland Annual Conference allow Brookfield Reinsurance to position itself as a thought leader.

- Networking Opportunities: Direct engagement with industry peers, potential clients, and regulators at events such as the Pan-Asian Reinsurance Forum facilitates business development.

- Market Trend Analysis: Information gathered from presentations and discussions at conferences, such as the 2024 Global Insurance Summit, informs strategic planning and product innovation.

- Brand Visibility: Sponsorship and active participation in events like the A.M. Best ReFocus conference enhance brand recognition and credibility within the global reinsurance community.

Referral Networks and Strategic Introductions

Brookfield Reinsurance leverages its strong ties to Brookfield Asset Management, a global leader in alternative asset management. This affiliation provides access to extensive referral networks and facilitates strategic introductions across the financial and investment landscape. These connections are crucial for identifying and securing new partnership opportunities, which are vital for expanding its business reach and capabilities.

The company actively cultivates these relationships, understanding that a robust referral ecosystem can significantly de-risk business development and accelerate growth. For instance, in 2023, Brookfield Asset Management managed over $850 billion in assets, showcasing the vast potential for cross-referrals and synergistic ventures.

- Access to a Global Network: Brookfield Reinsurance benefits from introductions within Brookfield's established relationships with institutional investors, corporations, and financial institutions worldwide.

- Synergistic Opportunities: The affiliation allows for the identification of business lines and clients that can be efficiently served by both Brookfield Asset Management and Brookfield Reinsurance.

- Enhanced Credibility: Association with a reputable entity like Brookfield Asset Management lends significant credibility to Brookfield Reinsurance, making potential partners more receptive.

- Deal Flow Generation: These referral networks are a consistent source of new business opportunities, ranging from reinsurance treaties to strategic acquisitions and capital solutions.

Brookfield Reinsurance utilizes direct engagement with primary insurers as a core channel, fostering tailored reinsurance solutions through strong partnerships. Their sales teams actively build executive-level relationships, crucial for complex negotiations and securing treaties. In 2024, this direct outreach resulted in substantial growth in ceded premiums, underscoring its effectiveness.

Independent agents and advisors are a vital distribution channel, particularly for annuity products following the American Equity Investment Life acquisition. These professionals serve as the primary interface for individual policyholders, driving annuity sales. Their expertise is key to meeting diverse client needs in 2024.

Digital platforms, including their corporate website, serve as essential channels for broad information dissemination and investor relations. These sites offer transparency and accessibility to stakeholders, acting as initial contact points for prospective clients. Investment in digital infrastructure in 2024 aimed to enhance user experience.

Industry gatherings provide a critical platform for showcasing expertise and forging new relationships. Prominent speaking roles at events like the 2024 S&P Global Ratings Insurance Conference highlight their market understanding and solutions. This presence is vital for attracting clients and partners.

Strong ties to Brookfield Asset Management provide extensive referral networks, facilitating strategic introductions across the financial landscape. This affiliation enhances credibility and generates deal flow. In 2023, Brookfield Asset Management's $850 billion in assets under management highlighted the potential for synergistic ventures.

Customer Segments

Primary life and annuity insurance companies represent Brookfield Reinsurance's core customer base. These entities are actively seeking sophisticated capital solutions to manage their existing life and annuity liabilities. By ceding these blocks of business, they aim to improve their capital efficiency, reduce risk exposure, and gain greater financial flexibility in a dynamic market.

Pension funds and corporate sponsors are key customer segments for Brookfield Reinsurance, particularly those looking to offload defined benefit pension plan obligations. These entities seek to mitigate the financial and administrative burdens associated with managing these long-term liabilities. In 2024, the pension risk transfer market continued to see significant activity, with estimates suggesting hundreds of billions of dollars in potential transfers globally.

Brookfield Reinsurance offers a solution for these sponsors to transfer their pension liabilities, effectively de-risking their balance sheets and allowing them to focus on their core business operations. This strategic move can improve financial stability and predictability for the sponsoring company. The increasing complexity and regulatory scrutiny of pension plans further drive demand for such transfer solutions.

Individual policyholders, while not directly engaging with Brookfield Reinsurance, represent a crucial indirect customer base. These individuals purchase annuity products from primary insurers, seeking long-term financial security and retirement income.

Brookfield Reinsurance's role is to provide the financial backing for these annuity liabilities, ensuring that the promises made to policyholders are met. This backing is vital for the stability and trustworthiness of the annuity products they hold.

The demand for annuities continues to be robust, with the U.S. annuity market experiencing significant growth. In 2024, total annuity sales were projected to reach hundreds of billions of dollars, reflecting a sustained interest in guaranteed income solutions for retirement.

Institutional Investors and Financial Institutions

Institutional investors and financial institutions represent a key customer segment for Brookfield Reinsurance, seeking tailored reinsurance solutions and leveraging Brookfield's extensive investment management expertise. These entities often require sophisticated risk transfer mechanisms and capital management strategies, which Brookfield Reinsurance is well-equipped to provide.

Brookfield Reinsurance's ability to offer bespoke solutions caters to the unique needs of other financial institutions, such as pension funds, endowments, and asset managers. These clients may look to reinsure specific blocks of business or to enhance their portfolio returns through Brookfield's specialized investment capabilities. For instance, in 2024, the company continued to focus on large, complex transactions, often involving partnerships with other financial players looking to de-risk their balance sheets or optimize capital allocation.

- Bespoke Reinsurance Solutions: Tailored products for financial institutions seeking to manage specific risks or capital requirements.

- Investment Management Services: Offering Brookfield's renowned investment management capabilities to enhance portfolio performance for institutional clients.

- Capital Optimization: Assisting financial institutions in optimizing their capital structures and regulatory capital through reinsurance transactions.

- Risk Transfer: Providing efficient mechanisms for transferring financial risks, thereby strengthening the balance sheets of partner institutions.

Global Markets Seeking Capital Solutions

Brookfield Reinsurance is actively pursuing global markets that need sophisticated ways to manage their capital and the risks they face. This includes entities in regions like the United Kingdom and Japan, where the company is expanding its presence.

The primary focus is on insurance companies and other financial institutions within these expanded territories. These organizations often have complex needs related to managing their balance sheets and protecting themselves from unforeseen events.

- Targeting UK and Japan: Brookfield Reinsurance is actively engaging with financial institutions in these key global markets.

- Need for Advanced Solutions: These institutions require sophisticated capital and risk management services.

- Global Capital Needs: The demand for such solutions is driven by the evolving regulatory landscape and economic conditions worldwide.

Brookfield Reinsurance serves primary life and annuity insurers, pension funds, and institutional investors. These clients seek capital solutions, risk transfer, and de-risking strategies for liabilities. The company also indirectly serves individual policyholders through its partnerships with primary insurers, ensuring the security of their annuity products.

In 2024, the pension risk transfer market showed substantial global activity, with potential transfers reaching hundreds of billions of dollars. Similarly, the U.S. annuity market saw robust sales, projected to exceed hundreds of billions, highlighting sustained demand for retirement income solutions.

| Customer Segment | Needs | 2024 Market Insight |

|---|---|---|

| Primary Insurers | Capital solutions, risk management for liabilities | Continued demand for efficient capital deployment |

| Pension Funds | De-risking defined benefit obligations | Hundreds of billions in potential global transfers |

| Institutional Investors | Bespoke reinsurance, investment management | Focus on large, complex transactions and partnerships |

| Individual Policyholders (Indirect) | Financial security, retirement income | Annuity sales projected to reach hundreds of billions in the US |

Cost Structure

Managing Brookfield Reinsurance's substantial alternative investment portfolio incurs significant costs. These include substantial fees paid to Brookfield Asset Management for their expertise and operational support. For instance, in 2024, Brookfield Asset Management reported managing over $800 billion in assets, a portion of which directly supports reinsurance operations.

A key driver of these expenses is the investment-led strategy, which necessitates considerable outlays for originating proprietary investment strategies. This involves research, due diligence, and the establishment of specialized investment vehicles. These costs are fundamental to the business model, ensuring a continuous pipeline of attractive investment opportunities.

Brookfield Reinsurance incurs significant costs in its underwriting and risk management functions. These expenses are crucial for accurately assessing and pricing potential reinsurance risks, ensuring the long-term solvency and profitability of the business. In 2024, the insurance industry, including reinsurers, continued to grapple with rising claims costs, particularly from natural catastrophes and increasing litigation expenses, which directly impact these operational expenditures.

Key cost drivers include the fees paid to actuaries for complex modeling and reserving, the technology and personnel required for efficient claims processing, and the ongoing investment in compliance systems to meet stringent regulatory demands. For instance, the increasing complexity of financial regulations and the need for robust data security measures add to the overhead associated with risk management. These costs are fundamental to maintaining the integrity of the reinsurance contracts and protecting the company's capital base.

Brookfield Reinsurance's cost structure is heavily influenced by acquisition and integration expenses. Significant outlays are incurred for mergers and acquisitions, exemplified by the purchases of American Equity Investment Life Holding Company (AEL) and Argo Group. These costs encompass thorough due diligence, substantial legal fees, and the complex process of integrating newly acquired businesses into existing operations.

In 2024, Brookfield Reinsurance continued to invest in growth through strategic acquisitions. For instance, the ongoing integration of AEL, which was completed in early 2024, involved considerable costs related to systems alignment and operational consolidation. Similarly, the acquisition of Argo Group, announced in 2023 and progressing through 2024, necessitates significant investment in combining IT infrastructure and streamlining administrative functions to realize projected synergies.

Operational and Administrative Expenses

Brookfield Reinsurance's operational and administrative expenses are the backbone of its daily functions, encompassing a broad range of costs essential for managing its complex business. These include significant investments in human capital, such as salaries and benefits for a skilled workforce, covering actuarial, underwriting, legal, and investment management teams. The company also incurs substantial costs related to its technology infrastructure, ensuring robust data management, cybersecurity, and efficient communication systems are in place to support its global operations.

Beyond personnel and technology, general overheads form a crucial part of this cost structure. This involves the expenses associated with maintaining office spaces, utilities, insurance, and professional services like auditing and legal counsel. For instance, in 2024, companies in the financial services sector, which includes reinsurance, often see administrative costs representing a notable percentage of their revenue, reflecting the regulatory compliance and expertise required.

- Salaries and Benefits: Compensation for actuaries, underwriters, investment professionals, and administrative staff.

- Technology Infrastructure: Costs for IT systems, software, data security, and digital platforms.

- Office Administration: Expenses for office leases, utilities, supplies, and general management.

- Professional Services: Fees for legal, accounting, auditing, and consulting services.

Sales and Marketing Expenses (for annuity distribution)

Brookfield Reinsurance incurs significant costs in its annuity distribution channels, primarily through sales and marketing efforts. These expenses are crucial for reaching potential customers and securing new annuity contracts.

A substantial portion of these costs involves commissions paid to independent agents and advisors. These professionals are incentivized to promote and sell Brookfield Reinsurance's annuity products, acting as a vital link to the market.

For instance, in 2024, the annuity industry saw continued growth, with sales of fixed annuities alone reaching over $300 billion. This highlights the competitive landscape and the necessity for robust distribution networks, which directly impacts sales and marketing expenditure.

- Marketing and Advertising: Costs associated with campaigns to build brand awareness and generate leads for annuity products.

- Commissions: Payments made to agents and advisors based on the volume and value of annuity contracts they successfully place.

- Distribution Support: Expenses related to training, licensing, and providing marketing materials to the distribution network.

Brookfield Reinsurance's cost structure is significantly impacted by fees paid to Brookfield Asset Management for investment management and operational support, reflecting the scale of assets managed. The company also incurs substantial costs in originating proprietary investment strategies, a core element of its investment-led approach, ensuring a steady flow of opportunities.

Underwriting and risk management are key cost centers, involving actuarial fees, claims processing technology, and compliance investments. These are essential for accurate risk assessment and maintaining solvency, especially with rising industry claims costs observed in 2024.

Acquisition and integration expenses, such as those related to the AEL and Argo Group deals throughout 2024, represent significant outlays for due diligence, legal services, and operational consolidation.

Operational and administrative costs include substantial investments in personnel, technology infrastructure for data management and cybersecurity, and general overheads like office leases and professional services.

| Cost Category | Key Components | 2024 Relevance/Example |

|---|---|---|

| Investment Management Fees | Fees to Brookfield Asset Management | Supports management of over $800 billion in assets by BAM. |

| Investment Origination | Research, due diligence, vehicle establishment | Essential for a continuous pipeline of investment opportunities. |

| Underwriting & Risk Management | Actuarial fees, claims processing, compliance | Industry-wide rising claims costs in 2024 impact these expenses. |

| Acquisition & Integration | Due diligence, legal fees, integration costs | Ongoing integration of AEL and Argo Group acquisitions in 2024. |

| Operational & Administrative | Salaries, technology, office overheads, professional services | Significant investments in human capital and IT infrastructure. |

Revenue Streams

Brookfield Reinsurance's core revenue generation hinges on reinsurance premiums. These are payments received from primary insurance companies that transfer a portion of their risk, specifically life and annuity liabilities, to Brookfield Reinsurance.

This foundational income stream is critical, as it represents the direct compensation for taking on these long-term financial obligations. In 2024, the company continued to see robust growth in this area, reflecting the increasing demand for risk transfer solutions in the insurance sector.

Brookfield Reinsurance draws a significant portion of its revenue from the performance of its investment portfolio, especially from alternative assets. These investments, managed by Brookfield Asset Management, are designed to generate higher yields. In 2023, Brookfield Reinsurance reported substantial investment income, reflecting the strong performance of these diverse holdings.

This income primarily comes from interest earned on fixed-income securities, dividends from equity investments, and importantly, capital gains realized from the appreciation of alternative assets like infrastructure, private equity, and real estate. For instance, Brookfield Reinsurance's strategic allocation to these asset classes aims to capture growth opportunities beyond traditional markets, contributing to robust returns.

Brookfield Reinsurance generates significant revenue from the sale of annuity products. This includes both retail annuities and premiums from pension risk transfer (PRT) deals, often facilitated by its acquired subsidiaries.

These annuity sales directly bolster the company's insurance assets, which in turn generate substantial investment income. For instance, in the first quarter of 2024, Brookfield Reinsurance reported record inflows of $7.7 billion for its annuity business, a key driver of its growth.

Fee-Related Earnings from Investment Management

Brookfield Reinsurance generates revenue through fees earned from investment management services. This occurs when the company allocates capital to investment strategies managed by Brookfield Asset Management and its affiliated partners.

These fee-related earnings are a direct result of the expertise and operational capabilities provided by these asset management entities. For instance, in 2023, Brookfield Asset Management reported approximately $4.7 billion in fee-related earnings, showcasing the significant revenue potential from such arrangements.

The fee structure typically involves a base management fee, often a percentage of assets under management, and potentially performance-based fees or carried interest, depending on the specific investment strategy and fund agreements.

Key aspects of these fee-related earnings include:

- Management Fees: A consistent revenue stream based on a percentage of the assets managed by Brookfield Asset Management on behalf of Brookfield Reinsurance.

- Performance Fees: Additional earnings generated when investment strategies achieve predefined performance benchmarks, aligning manager incentives with investor returns.

- Strategic Allocation: Capital is strategically deployed into diverse investment strategies, maximizing fee generation opportunities across various asset classes and geographies.

- Partnership Leverage: Collaboration with Brookfield Asset Management and its network of partners allows for access to specialized investment expertise and broader market opportunities.

Capital Solutions and Advisory Fees

Brookfield Reinsurance generates revenue through capital solutions and advisory fees, offering specialized services to insurance companies. This involves leveraging their deep expertise in capital and risk management to assist clients in optimizing their financial structures and strategies.

These services can include structuring bespoke reinsurance transactions, providing capital raising support, and offering strategic advice on mergers and acquisitions within the insurance sector. For instance, in 2024, the demand for such advisory services remained robust as insurers navigated evolving regulatory landscapes and sought to enhance their capital efficiency.

- Capital Solutions: Structuring and providing capital to insurance companies, often through reinsurance or other bespoke financial instruments.

- Advisory Services: Offering strategic guidance on capital management, risk transfer, and corporate finance within the insurance industry.

- Expertise Leverage: Monetizing Brookfield Reinsurance's specialized knowledge in insurance capital and risk management.

- Market Demand: Capitalizing on the ongoing need for sophisticated financial solutions by insurance entities, particularly in dynamic market conditions throughout 2024.

Brookfield Reinsurance's revenue streams are diverse, encompassing reinsurance premiums, investment income, annuity sales, asset management fees, and capital solutions. The company's ability to generate substantial income from these varied sources underscores its robust business model.

In 2024, reinsurance premiums remained a cornerstone, driven by the increasing demand for risk transfer. Investment income, particularly from alternative assets, continued to be a significant contributor, reflecting successful capital deployment. The annuity business also saw strong growth, with notable inflows reported in early 2024.

Furthermore, fee-related earnings from asset management services and advisory fees for capital solutions highlight the company's integrated approach, leveraging its expertise across the financial spectrum.

| Revenue Stream | Description | 2023/2024 Data Highlight |

|---|---|---|

| Reinsurance Premiums | Premiums from primary insurers transferring risk. | Robust growth in 2024 reflecting market demand. |

| Investment Income | Returns from diverse investment portfolio, including alternatives. | Substantial income reported in 2023 from strong asset performance. |

| Annuity Sales | Retail annuities and pension risk transfer (PRT) premiums. | Record inflows of $7.7 billion in Q1 2024 for annuity business. |

| Asset Management Fees | Fees earned from capital allocated to Brookfield Asset Management. | Brookfield Asset Management reported ~$4.7 billion in fee-related earnings in 2023. |

| Capital Solutions & Advisory | Fees for specialized services to insurance companies. | Robust demand for advisory services in 2024 due to evolving regulatory landscapes. |

Business Model Canvas Data Sources

The Brookfield Reinsurance Business Model Canvas is informed by a robust blend of financial statements, actuarial reports, and regulatory filings. These sources provide the foundational data for understanding risk, capital, and operational efficiency.