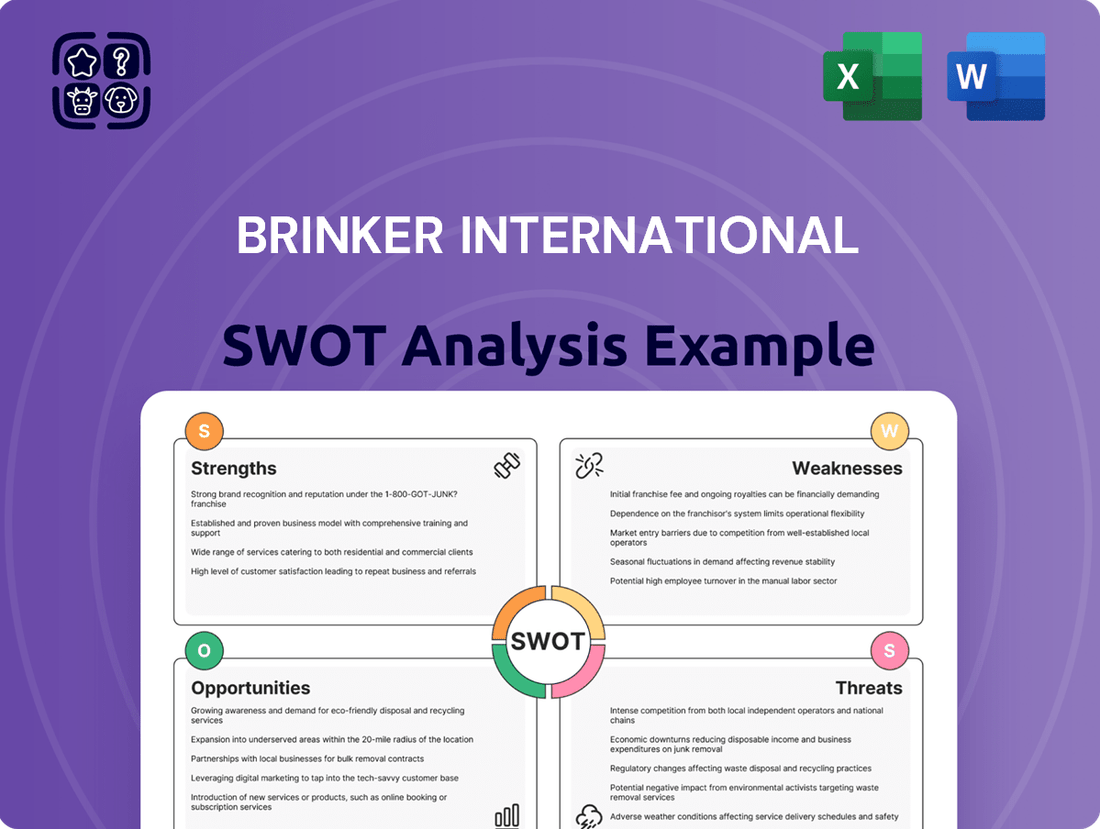

Brinker International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brinker International Bundle

Brinker International, a leader in casual dining, boasts strong brand recognition and a diverse portfolio of popular restaurants. However, they also face intense competition and evolving consumer preferences, making strategic agility crucial for sustained success.

Want the full story behind Brinker's competitive advantages, potential threats, and growth opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Brinker International's strength lies in its robust portfolio, anchored by the widely recognized Chili's Grill & Bar and Maggiano's Little Italy. Chili's, a cornerstone of the casual dining sector, consistently draws a broad customer base, underscoring its significant market presence. This strong brand equity fosters customer loyalty and ensures a reliable dining experience.

Chili's demonstrated exceptional performance in fiscal year 2025, with comparable restaurant sales surging by 31.4% in the second quarter and 31.6% in the third quarter. This growth was fueled by strategic advertising campaigns, compelling value-driven menu options, and enhanced operational execution, all contributing to a significant increase in guest traffic.

The success of Chili's recent initiatives is clearly evidenced by the strong customer response to specific promotions. The introduction of the 'Big Smasher' burger and the enduring popularity of the '3 for Me' value combos have been instrumental in attracting new diners and encouraging repeat visits, showcasing effective menu innovation and a keen understanding of consumer preferences.

Brinker International demonstrated a notable uplift in its operational performance during fiscal 2025. The company reported enhanced operating income and restaurant operating margins, a direct result of effective sales leverage and strategic operational improvements.

These gains were fueled by initiatives such as streamlining kitchen workflows and simplifying menu offerings, which collectively boosted profitability. This focus on efficiency underscores Brinker's dedication to refining its business model and elevating the overall guest experience.

Effective Marketing and Value Propositions

Brinker International excels at crafting compelling value propositions, notably at Chili's, which has been a key driver of customer traffic. Targeted advertising and social media efforts effectively communicate these offers, such as the popular '3 for Me' combos and the 'Big Smasher' burger, resonating well with consumers.

This marketing prowess is vital in the highly competitive casual dining sector. For instance, Chili's saw a notable increase in comparable restaurant sales in the fiscal year 2024, partly attributed to these successful marketing initiatives that highlight affordability and choice.

- Targeted Campaigns: Chili's '3 for Me' and 'Big Smasher' promotions demonstrably boost customer visits.

- Value Communication: Marketing effectively highlights industry-leading value, a critical differentiator.

- Traffic Driver: Strong marketing capabilities are directly linked to increased restaurant traffic and sales.

Strong Financial Health and Debt Reduction

Brinker International demonstrates robust financial health, a key strength amidst industry headwinds. The company has made significant strides in debt reduction, notably repaying $200 million of its funded debt during fiscal year 2024. This focused approach to deleveraging strengthens its balance sheet and enhances financial flexibility.

This prudent financial management allows Brinker to accelerate investments in its core business operations and strategic growth initiatives. The company's confidence in its future performance is further underscored by its upward revision of fiscal 2025 earnings per share guidance. For instance, the updated guidance projects diluted EPS to be in the range of $3.70 to $3.90, a notable increase from previous estimates.

- Strong Financial Health: Maintained a solid financial standing despite industry pressures.

- Significant Debt Reduction: Repaid $200 million of funded debt in fiscal year 2024.

- Enhanced Financial Flexibility: Prudent management enables accelerated business investments.

- Positive Earnings Outlook: Raised fiscal 2025 EPS guidance to $3.70-$3.90.

Brinker International's brand strength, particularly with Chili's, is a significant advantage. Chili's achieved impressive comparable restaurant sales growth of 31.4% in Q2 FY25 and 31.6% in Q3 FY25, driven by effective marketing and value offerings like the '3 for Me' combos.

The company's operational efficiency also stands out, leading to improved operating income and restaurant margins in fiscal 2025 through streamlined processes. Furthermore, Brinker's robust financial health, evidenced by $200 million in debt repayment in FY24 and an increased FY25 EPS guidance of $3.70-$3.90, provides a solid foundation for future investments and growth.

| Brand Strength | Fiscal Year 2025 Performance | Financial Health |

|---|---|---|

| Chili's comparable sales growth (Q2) | 31.4% | |

| Chili's comparable sales growth (Q3) | 31.6% | |

| Debt Reduction (FY24) | $200 million | |

| Projected FY25 Diluted EPS | $3.70 - $3.90 |

What is included in the product

Delivers a strategic overview of Brinker International’s internal and external business factors, assessing its competitive position and the opportunities and risks shaping its future.

Offers a clear breakdown of Brinker International's competitive landscape, helping to identify actionable strategies for overcoming market challenges.

Weaknesses

Brinker International's financial health is significantly tied to Chili's, which accounted for a substantial portion of its revenue and recent growth. For instance, in fiscal year 2023, Chili's comparable restaurant sales increased by 5.1%, a strong performance that buoyed the company. However, this heavy reliance makes Brinker vulnerable; a downturn at Chili's could severely impact overall financial results.

While Chili's has been a growth engine, Maggiano's, another key brand, has faced challenges. Despite modest sales increases, Maggiano's has experienced declining customer traffic, a trend that needs careful management to avoid a drag on Brinker's consolidated performance.

Maggiano's Little Italy has shown more subdued comparable restaurant sales growth than its sister brand, Chili's. This segment of the market, upscale casual dining, is particularly sensitive to changes in consumer spending habits, making sustained traffic growth a significant hurdle.

Despite implementing menu price increases, Maggiano's has struggled with declining customer traffic. This suggests that pricing alone isn't sufficient to drive volume, and a more comprehensive strategy is needed to revitalize the brand and attract more diners.

Brinker International, as a casual dining operator, faces significant vulnerability to economic fluctuations and changes in consumer spending habits. During periods of economic strain, consumers often cut back on discretionary purchases, including dining out, leading to reduced traffic and sales for Brinker's brands. This direct correlation between economic health and consumer spending represents a core weakness, as evidenced by the impact of inflation on consumer budgets in 2024, which has pressured discretionary income.

Rising Labor Costs and Operational Expenses

The restaurant sector, including Brinker International, continues to grapple with the persistent issue of increasing labor costs and elevated general and administrative (G&A) expenses. This rise is often driven by factors such as higher incentive compensation structures and investments in new technology. For instance, in the fiscal year 2023, Brinker reported that while labor as a percentage of sales saw improvement due to stronger sales, the absolute dollar amount of labor costs still presented a challenge.

Despite efforts to leverage sales growth for better labor cost management, the overall increase in operational expenses remains a significant hurdle. Effectively controlling these escalating costs is paramount for Brinker to achieve and sustain its margin expansion goals. The company's ability to navigate these cost pressures will be a key determinant of its profitability in the coming periods.

- Labor Costs: Brinker International, like many in the restaurant industry, faces upward pressure on wages and benefits.

- G&A Expenses: Investments in technology and higher incentive compensation contribute to rising administrative overhead.

- Margin Pressure: Managing these escalating costs is critical for Brinker to maintain and grow its profit margins.

- Sales Leverage: While sales growth has helped offset some labor cost increases as a percentage of revenue, absolute costs remain a concern.

Potential for Growth Rate Normalization

While Brinker International, particularly its Chili's brand, has demonstrated strong recent growth, there's a recognized weakness in the potential for this rate to normalize. Analysts are flagging that tougher year-over-year comparisons are on the horizon, suggesting that the exceptionally high growth seen recently might not be sustainable. For instance, in the first quarter of fiscal year 2024, Chili's comparable restaurant sales increased by 10.1%.

This anticipated normalization of comparable sales growth could introduce market valuation sensitivity. If future growth rates fail to meet the elevated expectations set by recent performance, investors might react negatively, impacting the company's stock price. The market often prices in continued high growth, making any deceleration a potential concern.

The company's ability to maintain momentum will be crucial. For example, while Brinker reported a total revenue of $1.05 billion for Q1 FY24, a 10.1% increase year-over-year, the sustainability of such percentage increases is under scrutiny.

Brinker International's reliance on Chili's for a significant portion of its revenue, as seen with Chili's comparable restaurant sales increasing by 5.1% in fiscal year 2023, presents a vulnerability. A downturn in this primary brand could disproportionately impact the company's overall financial performance.

Maggiano's, while showing modest sales increases, has experienced declining customer traffic, a trend that poses a risk to Brinker's consolidated results. This segment of upscale casual dining is sensitive to economic shifts, making sustained traffic growth a challenge for Maggiano's.

The company faces ongoing pressure from rising labor and general and administrative (G&A) expenses, driven by factors like incentive compensation and technology investments. Despite sales growth in fiscal year 2023, absolute labor costs remained a concern, impacting overall profitability.

The sustainability of recent high growth rates is a concern, with analysts anticipating tougher year-over-year comparisons. For instance, Chili's comparable restaurant sales saw a 10.1% increase in Q1 FY24, a pace that may be difficult to maintain.

Same Document Delivered

Brinker International SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Brinker International has a prime opportunity to replicate the successful turnaround strategies that revitalized Chili's at its Maggiano's Little Italy brand. This involves implementing operational simplifications, enhancing the menu with customer-focused upgrades, and reinforcing a strong value proposition.

By applying this proven playbook, Maggiano's can directly address its recent traffic declines. For instance, Chili's saw a notable increase in comparable restaurant sales following its strategic shifts, a success Brinker can aim to mirror for Maggiano's to drive more sustainable growth within its portfolio.

Brinker International can significantly boost customer loyalty and sales by further developing its digital platforms, including its mobile app and Maggiano's Inner Circle and Chili's Rewards programs. This focus on digital initiatives, especially in 2024 and 2025, aligns with growing consumer demand for convenience and personalized experiences. For example, a strong digital presence can capture a larger share of the off-premise dining market, which has seen sustained growth.

Brinker International is actively targeting international expansion for its Chili's brand, focusing on markets exhibiting strong growth potential. This strategy primarily utilizes franchise agreements, which are key to generating both initial development fees and ongoing royalty income.

This approach to international growth is designed to diversify Brinker's revenue streams, lessening its reliance on the U.S. market. Such diversification offers significant long-term growth prospects and helps to buffer the company against risks tied to specific domestic economic conditions.

For instance, as of Q3 fiscal year 2024, Brinker reported that international comparable restaurant sales increased by 3.4%. This demonstrates the tangible impact of their expansion efforts, contributing to overall company performance and providing a pathway for sustained international development.

Menu Innovation and Catering to Evolving Preferences

Brinker International has a significant opportunity in menu innovation, focusing on new, exciting, and value-driven items to maintain brand relevance and attract a broader customer base. This aligns with their strategy to keep offerings fresh and appealing.

Adapting to evolving consumer preferences is key. This includes catering to the growing demand for healthier options, plant-based meals, and highly customizable dishes, which represent clear avenues for revenue growth. For example, the demand for plant-based options continues to surge, with the global plant-based food market projected to reach $162 billion by 2030, according to Bloomberg Intelligence.

Offering a diverse range of menu choices, including seasonal specials, can significantly boost customer interest and overall satisfaction. This approach encourages repeat visits and allows Brinker to capitalize on current food trends.

- Menu Innovation: Introduction of new, value-driven items to enhance brand appeal.

- Evolving Preferences: Catering to demand for healthier, plant-based, and customizable meals.

- Customer Engagement: Utilizing diverse menu choices and seasonal specials to drive interest and satisfaction.

Capitalizing on Casual Dining's Value Perception

Casual dining's value proposition is at a five-year peak in 2024, presenting a significant opportunity for Brinker International. As quick-service restaurants experience a downturn, Brinker can leverage this by highlighting its affordability.

The company can attract more customers seeking good deals by continuing to offer attractive everyday value. For instance, Chili's popular '3 for Me' combos are a prime example of this strategy.

- Casual dining value perception at a five-year high in 2024.

- Opportunity to attract budget-conscious diners.

- Chili's '3 for Me' combos as a successful value offering.

- Potential to gain market share from struggling quick-service competitors.

Brinker International can capitalize on the heightened perception of value in casual dining, which reached a five-year peak in 2024. By continuing to emphasize affordable options like Chili's '3 for Me' combos, the company can attract budget-conscious consumers, potentially gaining market share from struggling quick-service competitors.

The brand has a significant opportunity in menu innovation, introducing new, value-driven items to keep its offerings fresh and appealing. This includes adapting to consumer demand for healthier, plant-based, and customizable meals, a trend supported by the projected growth of the plant-based food market to $162 billion by 2030.

Further development of digital platforms, including loyalty programs and mobile apps, presents a chance to enhance customer engagement and capture more of the off-premise dining market. International expansion, particularly for the Chili's brand, also offers diversification and revenue growth, as evidenced by a 3.4% increase in international comparable restaurant sales in Q3 fiscal year 2024.

Threats

The casual dining sector, where Brinker International operates significantly, is incredibly crowded. Numerous brands are all trying to attract the same diners, making it tough to stand out. For instance, in 2024, the U.S. restaurant industry saw continued growth, but also intense pressure on operators to differentiate.

The increasing popularity of fast-casual restaurants presents a direct challenge. These establishments often provide a compelling mix of speed, quality ingredients, and value, which can draw customers away from traditional casual dining experiences. This trend has been accelerating, with fast-casual chains capturing a larger share of consumer spending in recent years.

This fierce competition directly affects Brinker's ability to maintain its market share and its pricing flexibility. When more options are available at attractive price points, consumers become more price-sensitive, potentially forcing brands to lower prices or offer more promotions, impacting overall profitability.

Brinker International faces significant threats from macroeconomic headwinds, notably sustained inflation. For instance, the Consumer Price Index (CPI) for food away from home saw a notable increase, contributing to higher operating costs. This inflationary environment directly impacts the cost of goods sold, from ingredients to wages, potentially squeezing profit margins if not effectively passed on to consumers.

The risk of economic instability and potential recession further exacerbates these pressures. Consumers facing economic uncertainty may reduce discretionary spending, impacting dining out frequency and overall sales volumes for brands like Chili's and Maggiano's. This can lead to a double whammy of rising costs and potentially declining revenue, creating a challenging operating landscape for Brinker in 2024 and into 2025.

Shifting consumer tastes toward fast-casual and quick-service restaurants, alongside a growing demand for convenience through takeout and delivery, present a significant challenge to Brinker International's traditional casual dining model. For instance, the fast-casual segment in the US is projected to reach $127.5 billion by 2026, indicating a strong consumer preference for speed and value. Brinker needs to actively evolve its strategies to cater to these changing dining habits to remain competitive and appeal to a broader customer base.

Sustainability of Traffic Growth and Marketing Effectiveness

A significant threat for Brinker International is the potential slowdown in traffic growth, particularly for its flagship Chili's brand, which has seen robust gains. As competitor promotional activity intensifies, maintaining this momentum becomes increasingly challenging.

The ongoing effectiveness of marketing and advertising strategies is crucial. Brinker must continually adapt its campaigns to capture new customers and encourage repeat visits in a highly competitive and evolving casual dining landscape.

- Sustaining Traffic Growth: While Chili's reported a 6.1% increase in comparable restaurant traffic in Q1 FY24, the long-term sustainability of this growth is a concern given rising promotional activity from rivals.

- Marketing ROI: Ensuring marketing spend delivers consistent returns and drives incremental traffic requires ongoing evaluation and innovation in campaign messaging and channel mix.

- Competitive Landscape: Increased promotional offers from competitors could erode market share and necessitate more aggressive discounting, impacting profitability.

Labor Shortages and Workforce Management Challenges

Brinker International, like many in the casual dining sector, grapples with persistent labor shortages. This challenge directly affects their ability to maintain consistent service levels across brands like Chili's and Maggiano's Little Italy. For instance, in early 2024, the restaurant industry broadly reported difficulties in filling open positions, with some surveys indicating millions of unfilled jobs. This scarcity can lead to longer wait times for customers and increased stress on existing staff, potentially impacting morale and retention.

Managing workforce needs in the face of wage inflation presents another significant hurdle. As the cost of labor rises, Brinker must balance competitive compensation to attract and keep employees with maintaining profitability. This dynamic was evident throughout 2023 and into 2024, where many restaurant companies adjusted their pricing strategies or focused on operational efficiencies to offset increased labor expenses. Ensuring adequate staffing levels is crucial to prevent operational disruptions, such as reduced hours or slower service, which can deter diners.

The impact of these workforce challenges on Brinker's financial performance and customer satisfaction metrics is substantial. High employee turnover, a common symptom of labor shortages, can increase recruitment and training costs. Furthermore, understaffing can lead to a decline in the dining experience, potentially damaging brand reputation and reducing repeat business. Brinker's success hinges on its ability to implement effective strategies for talent acquisition, development, and retention to navigate these ongoing industry-wide pressures.

- Labor Shortages: The restaurant industry, including Brinker, continues to face difficulties in recruiting and retaining staff.

- Operational Impact: Inadequate staffing can negatively affect service quality, leading to longer wait times and reduced customer satisfaction.

- Wage Inflation: Rising labor costs require Brinker to manage compensation effectively while maintaining profitability and operational efficiency.

- Talent Management: Brinker's ability to attract, train, and retain a skilled workforce is critical for sustained success and avoiding service disruptions.

Brinker International faces intense competition from a crowded casual dining market, with fast-casual alternatives gaining significant traction. For example, the fast-casual segment is projected to reach $127.5 billion by 2026, highlighting a strong consumer shift towards speed and value. This trend pressures Brinker's market share and pricing power, as consumers may opt for quicker, more affordable options, impacting overall sales volumes and profitability.

SWOT Analysis Data Sources

This SWOT analysis draws from Brinker International's official financial filings, comprehensive industry market research, and expert analyses of the restaurant sector to provide a well-rounded strategic perspective.