Brinker International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brinker International Bundle

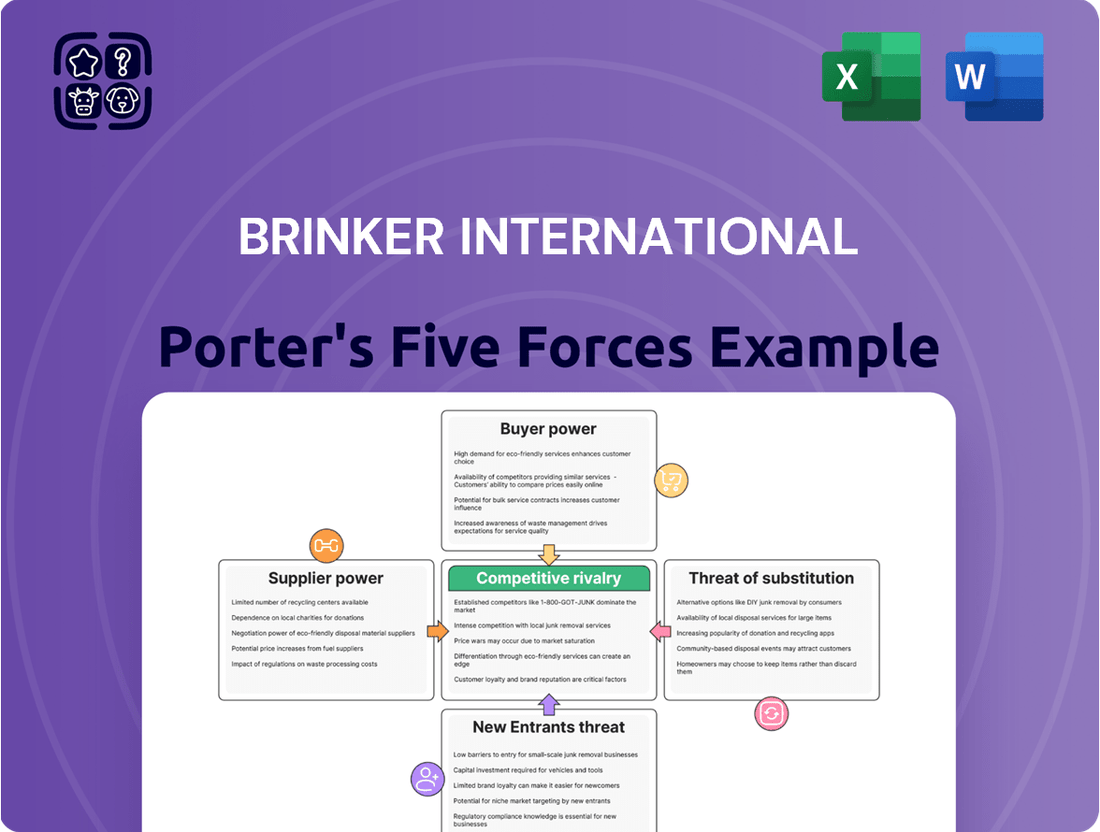

Brinker International operates in a dynamic restaurant landscape, facing significant pressures from rivals and the constant threat of new entrants. Understanding the bargaining power of both its customers and suppliers is crucial for navigating this competitive environment.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brinker International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Brinker International, like many in the casual dining sector, navigates a landscape where a few dominant suppliers control crucial ingredients such as beef and chicken. This concentration of power among these large suppliers means they can exert considerable influence over pricing and contract conditions, directly impacting Brinker's operational costs.

For instance, the U.S. beef processing industry, a critical supplier for restaurants like Brinker's Chili's and Maggiano's Little Italy, has seen significant consolidation. In 2023, the four largest beef processors accounted for approximately 80% of the nation's processing capacity, a figure that has remained consistently high in recent years. This limited supplier base grants them substantial bargaining power, allowing them to command higher prices for raw materials, which Brinker must then absorb or pass on to consumers.

Brinker International likely faces moderate switching costs with its suppliers. Changing suppliers for key ingredients or established distribution networks could necessitate significant adjustments to recipes, operational processes, and staff training, potentially leading to disruptions and added expenses.

While many food ingredients are standard commodities, Brinker International also sources specialized items. For instance, suppliers of artisanal cheeses or heritage meats can command higher prices due to the unique quality and limited availability of their products. This uniqueness can give these specific suppliers more leverage.

If Brinker's restaurant concepts, such as Maggiano's Little Italy, depend on these distinctive ingredients to create their signature dishes, the bargaining power of these particular suppliers is amplified. For example, a supplier of a specific imported pasta or a rare cut of beef could significantly influence Brinker's costs if that ingredient is crucial to a popular menu item.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for a company like Brinker International, which operates casual dining chains such as Chili's and Maggiano's Little Italy, is generally low. The significant capital investment and intricate operational expertise required to manage a restaurant chain make it an unattractive prospect for most food and beverage suppliers. For instance, a major produce supplier would likely find the transition to managing restaurant locations, staffing, and customer service immensely challenging compared to their core business of agricultural production and distribution.

Suppliers typically focus on their specialized areas, such as growing ingredients, processing food products, or distributing beverages. Entering the restaurant industry would necessitate a complete overhaul of their business model, supply chains, and talent acquisition strategies. This high barrier to entry means that suppliers are unlikely to pose a direct competitive threat by opening their own restaurant outlets to compete with Brinker.

- Low Likelihood of Forward Integration: Most food suppliers lack the capital and operational expertise to successfully operate a large casual dining chain.

- Focus on Core Competencies: Suppliers concentrate on production and distribution, not the complex management of restaurant operations.

- High Capital and Operational Barriers: The significant investment and know-how needed to run restaurant chains deter suppliers from this path.

Impact of Commodity Price Volatility

Brinker International's reliance on food and non-alcoholic beverages, a significant cost driver for its Chili's and Maggiano's brands, exposes it to considerable commodity price volatility. For instance, in fiscal 2024, these inputs represented a substantial portion of Brinker's overall sales, making the company particularly sensitive to market swings.

Escalating costs for essential ingredients, coupled with potential import duties on items like tequila and avocados, directly impact restaurant operating expenses. This financial pressure can inadvertently strengthen the bargaining position of suppliers, enabling them to dictate more favorable pricing terms.

- Food Cost Sensitivity: In fiscal 2024, food and non-alcoholic beverages constituted a significant percentage of Brinker International's sales, highlighting the direct impact of commodity price fluctuations on its financial performance.

- Supplier Leverage: Rising costs for key commodities, such as avocados and tequila, can increase supplier power, allowing them to negotiate higher prices and potentially squeeze Brinker's profit margins.

- Tariff Impact: The threat of tariffs on imported goods used in its menu items adds another layer of complexity, further empowering suppliers who control access to these essential ingredients.

Brinker International faces considerable bargaining power from its suppliers, particularly for key commodities like beef and chicken. The consolidation within the U.S. beef processing industry, where the top four processors controlled approximately 80% of capacity in 2023, exemplifies this concentration. This limited supplier base allows them to influence pricing, directly impacting Brinker's cost of goods sold.

While Brinker experiences moderate switching costs for its ingredients, the reliance on specialized or unique items, such as artisanal cheeses or specific imported pastas, can amplify the leverage of those particular suppliers. For instance, if a signature dish at Maggiano's Little Italy depends on a rare ingredient, that supplier holds significant sway over pricing and availability.

The threat of forward integration by suppliers is low due to the substantial capital and operational expertise required to manage a restaurant chain, making it an unattractive venture for most food producers. Suppliers tend to focus on their core competencies in production and distribution rather than entering the complex restaurant management sector.

| Supplier Characteristic | Impact on Brinker International | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | High Bargaining Power | Four largest U.S. beef processors held ~80% of capacity in 2023. |

| Switching Costs | Moderate | Changes in recipes, processes, and training can be disruptive. |

| Product Differentiation | Amplified Supplier Power | Specialty ingredients for signature dishes increase supplier leverage. |

| Forward Integration Threat | Low | High capital and operational barriers for suppliers to enter restaurant management. |

What is included in the product

This analysis meticulously examines the five forces impacting Brinker International, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its restaurant brands.

Quickly identify and address competitive threats with a visual breakdown of Brinker International's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Consumers in the casual dining sector are showing heightened price sensitivity, with many indicating they'll cut back on dining out if prices rise. This trend directly impacts Brinker International's ability to maintain its pricing strategies.

For instance, Brinker's Chili's brand, which saw an average check per person of around $20.28 in fiscal year 2024, has been actively addressing this by emphasizing value-oriented menu options and promotional campaigns to attract and retain customers.

Brinker International faces considerable customer bargaining power due to the sheer volume of dining alternatives available. Customers can easily opt for other casual dining chains, fast-casual spots, or even quick-service restaurants if they find Brinker's offerings unsatisfactory or too expensive. In 2024, the U.S. restaurant industry saw a continued rise in food delivery services, with platforms like DoorDash and Uber Eats facilitating access to a vast array of culinary choices, further empowering consumers.

Customers face very low switching costs when deciding where to eat. For instance, if Brinker International's Chili's or Maggiano's doesn't hit the mark, a diner can easily walk into a nearby Applebee's or a fast-casual spot without incurring significant financial penalties or emotional attachment costs.

This ease of movement means that if Brinker International falters on price, quality, or the overall dining experience, customers have readily available alternatives. In 2023, the casual dining segment saw intense competition, with many chains offering similar value propositions, further underscoring the low barriers for customers to shift their patronage.

Customer Information and Transparency

Brinker International, like many in the casual dining sector, faces significant customer bargaining power, largely driven by increased information transparency. The digital age has equipped consumers with unprecedented access to data, allowing them to readily compare prices, quality, and overall dining experiences across a multitude of restaurants. This ease of access to information, including online reviews and detailed menu breakdowns, directly fuels their ability to negotiate or seek better value.

The proliferation of online review platforms and social media channels means that customer feedback is highly visible and influential. For instance, platforms like Yelp and TripAdvisor allow diners to share their experiences, impacting potential customers' decisions. Brinker International's customers can easily research competitor pricing and menu offerings, making it harder for the company to command premium prices without delivering exceptional value. In 2024, the average consumer is more likely to consult at least three online sources before choosing a restaurant, a trend that continues to amplify customer leverage.

- Informed Decisions: Customers can compare Brinker International's pricing and menu options against competitors like Darden Restaurants (Olive Garden, LongHorn Steakhouse) or Chipotle Mexican Grill with a few clicks.

- Price Sensitivity: With readily available price comparisons, customers are more sensitive to price increases and can easily switch to more affordable alternatives.

- Quality Expectations: Online reviews and social media discussions set high expectations for food quality and service, pressuring Brinker International to consistently meet or exceed these benchmarks.

Impact of Loyalty Programs and Brand Strength

Brinker International actively works to lessen customer bargaining power by cultivating strong brand loyalty. Initiatives like Chili's enhanced loyalty program have demonstrably driven repeat business, with the brand reporting significant growth in loyalty sales. This focus on customer retention, supported by effective marketing and operational enhancements, makes customers less inclined to seek out competitors.

The strength of brands like Chili's and Maggiano's Little Italy plays a crucial role in this strategy. By fostering positive brand perception and consistent customer experiences, Brinker can command a degree of loyalty that mitigates price sensitivity. For instance, Chili's has highlighted operational improvements contributing to increased guest satisfaction and, consequently, a stronger customer connection.

- Brand Strength: Brinker leverages its established restaurant brands to build customer loyalty.

- Loyalty Programs: Chili's loyalty program has shown success in driving repeat visits and sales growth.

- Marketing & Operations: Investments in marketing and operational improvements enhance customer experience and retention.

- Customer Retention: These efforts aim to reduce the likelihood of customers switching to competitors based on price alone.

Brinker International faces substantial customer bargaining power due to the vast array of dining choices and minimal switching costs. Consumers in 2024 are highly informed, readily comparing prices and quality online, making them sensitive to price hikes and quick to switch if dissatisfied. This empowers customers to easily shift their patronage to competitors if Brinker's offerings don't meet their expectations for value and experience.

| Factor | Impact on Brinker International | Customer Action |

|---|---|---|

| Availability of Alternatives | High competition from other casual dining, fast-casual, and QSR chains. | Easily switch to competitors like Applebee's or Chipotle. |

| Switching Costs | Negligible financial or emotional costs for customers to change restaurants. | No penalty for trying a different restaurant for the next meal. |

| Information Transparency | Online reviews and price comparison sites empower consumers. | Research competitor pricing and quality before dining. |

| Price Sensitivity | Customers are increasingly focused on value and may reduce dining out if prices rise. | Opt for promotions or less expensive dining options. |

Full Version Awaits

Brinker International Porter's Five Forces Analysis

This preview displays the complete Brinker International Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the casual dining industry. You're looking at the actual document, which details the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The casual dining sector is a crowded space, with Brinker International's Chili's facing off against a multitude of established brands. Thousands of casual dining restaurants operate across the U.S., creating a highly competitive landscape. This intense rivalry extends beyond direct casual dining competitors to include a vast array of fast-casual and quick-service options, all vying for consumer dollars.

The casual dining segment, where Brinker International primarily operates, is experiencing moderate growth compared to faster-growing segments like fast-casual and quick-service restaurants. For instance, in 2024, the U.S. foodservice industry overall saw a projected growth of around 4.5%, but casual dining's contribution was closer to 2-3%.

This comparatively slower growth rate means that companies within the casual dining space, including Brinker, face intensified competition. They must work harder to capture market share as the overall pie grows at a less rapid pace, leading to a more aggressive battle for customer dollars.

In the casual dining sector, differentiation hinges on factors like menu creativity, service excellence, ambiance, and perceived value. Brinker International actively cultivates this through Chili's emphasis on its 'Core 4' popular dishes and targeted marketing campaigns. This strategy is designed to foster strong brand loyalty, a key differentiator against a backdrop of intense competition.

Exit Barriers

Brinker International, like many in the casual dining sector, faces substantial exit barriers. The significant capital investment in restaurant leases, kitchen equipment, and ongoing labor costs creates a high hurdle for any company considering leaving the market. These sunk costs can trap businesses, compelling them to continue operations even when facing diminished profitability, which in turn can fuel intensified competitive rivalry as struggling entities remain in the fray.

For instance, the restaurant industry often involves long-term lease agreements and specialized equipment that are difficult and costly to divest. This financial entanglement means that exiting the market isn't a simple decision; it often involves substantial financial penalties or the inability to recoup initial investments. This reality can prolong the presence of less successful players, contributing to a more crowded and competitive landscape for established brands like Brinker.

- High Fixed Costs: Leases, equipment, and staffing represent significant ongoing expenses that are hard to recover upon exit.

- Asset Specificity: Restaurant-specific assets have limited resale value outside the industry, increasing exit costs.

- Contractual Obligations: Long-term leases and supplier contracts can further bind companies to operations.

Advertising and Marketing Intensity

Competitive rivalry in the casual dining sector is significantly amplified by aggressive marketing and advertising efforts. Brinker International, for instance, consistently invests in advertising to highlight value propositions and drive customer traffic. This is evident in the performance of brands like Chili's, which saw strong traffic in fiscal 2025, underscoring a highly promotional environment.

Companies in this space continuously strive to capture consumer attention and market share through various campaigns. This intense promotional activity means that staying competitive often requires substantial marketing budgets to cut through the noise.

- High Advertising Spend: Brinker International's commitment to marketing is a key factor in its competitive strategy.

- Promotional Environment: The industry is characterized by frequent promotions aimed at attracting price-sensitive consumers.

- Brand Differentiation: Effective advertising is crucial for differentiating brands like Chili's and Maggiano's Little Italy in a crowded market.

- Traffic Driving Initiatives: Marketing efforts are directly tied to driving foot traffic and sales volume.

Brinker International operates in a highly competitive casual dining market, facing numerous rivals vying for consumer attention. This intense rivalry is fueled by a saturated market with thousands of casual dining establishments, alongside strong competition from fast-casual and quick-service restaurants. The industry's moderate growth in 2024, around 2-3% for casual dining within a 4.5% overall U.S. foodservice growth, intensifies the battle for market share.

Differentiation through menu innovation, service, ambiance, and value is critical, with Brinker focusing on Chili's popular dishes and targeted marketing. High exit barriers, including significant capital investments in leases and equipment, keep many players in the market, further intensifying competition. Aggressive marketing and advertising are essential for brands like Chili's and Maggiano's Little Italy to stand out and drive traffic in this dynamic environment.

| Competitor Type | Key Characteristics | Impact on Brinker |

|---|---|---|

| Direct Casual Dining Competitors | Established brands with similar offerings and pricing. | Intense price and promotion wars, pressure on margins. |

| Fast-Casual Restaurants | Quicker service, often perceived higher quality ingredients. | Siphoning off customers seeking convenience and value. |

| Quick-Service Restaurants (QSR) | Speed and low price points. | Capturing a significant portion of the budget-conscious consumer market. |

SSubstitutes Threaten

The fast-casual dining segment represents a significant threat of substitutes for Brinker International's brands. These establishments blend the speed of fast food with the quality and atmosphere of casual dining, offering consumers affordable meals made with fresh ingredients. This segment’s growth has been substantial, with market research indicating continued expansion as consumers increasingly value convenience without sacrificing quality.

Quick-service restaurants (QSRs) represent a significant threat of substitution for Brinker International's brands, especially for consumers prioritizing affordability and speed. Despite recent improvements in value perception for casual dining, QSRs consistently offer competitive pricing and convenience, making them a readily available alternative for everyday meals. In 2024, the fast-food industry continued its robust growth, with the U.S. market alone projected to reach over $300 billion, underscoring the persistent appeal of these substitutes.

The increasing adoption of meal delivery services and meal kits presents a significant threat of substitution for Brinker International. These services provide consumers with the convenience of preparing fresh meals at home, directly competing with the dine-in and takeout options offered by restaurants like Chili's and Maggiano's Little Italy. For instance, the U.S. meal kit delivery market was valued at approximately $7.6 billion in 2023 and is projected to grow substantially.

Home Cooking and Groceries

The threat of substitutes, particularly home cooking and groceries, poses a significant challenge for Brinker International. During periods of economic uncertainty, consumers are more inclined to prepare meals at home to manage their budgets. This trend was evident in 2024, where persistent inflation continued to impact household spending, making restaurant dining a less attractive option for many.

Consumers are increasingly price-sensitive, and the cost difference between dining out and purchasing groceries for home preparation can be substantial. For instance, the average cost of a restaurant meal can easily exceed the cost of ingredients for several home-cooked meals. This economic reality directly pressures casual dining establishments like those operated by Brinker.

- Consumer Spending Shift: In 2024, a significant portion of consumers reported reducing discretionary spending, including dining out, due to inflation.

- Grocery vs. Dining Out Costs: Data from early 2024 indicated that the cost of groceries for a family meal was, on average, 30-40% lower than dining at a comparable casual restaurant.

- Convenience Factor: While home cooking is cost-effective, the convenience of restaurant dining remains a counter-argument, though this is increasingly being offset by meal kit services and prepared foods from grocery stores.

Other Entertainment and Leisure Options

Beyond direct restaurant rivals, other entertainment and leisure activities pose a significant threat of substitution for Brinker International. Consumers often have limited discretionary income, and when dining out becomes less appealing or more costly, they can easily divert funds to other experiences. For instance, in 2024, spending on live events, streaming services, and travel continues to capture a substantial portion of consumer leisure budgets, directly competing with restaurant spending.

This means that if Brinker's offerings, like those at Chili's or Maggiano's, are perceived as poor value or inconvenient, customers might opt for a movie night at home with a delivered meal, a concert, or a weekend getaway instead. The increasing variety and accessibility of these alternatives mean that the threat of substitutes remains a constant pressure point for casual dining chains.

- Alternative Leisure Spending: In 2024, consumers are allocating significant portions of their discretionary income to activities like streaming subscriptions, gaming, and home entertainment, diverting funds that might otherwise go to dining out.

- Value Perception: If the price-to-experience ratio at Brinker's restaurants is not competitive with other leisure options, consumers are likely to choose substitutes that offer greater perceived value.

- Convenience Factor: The ease of accessing at-home entertainment or other local leisure activities can be a strong substitute for the effort involved in dining out, especially for time-constrained consumers.

- Economic Sensitivity: During periods of economic uncertainty, consumers are more likely to cut back on dining out in favor of less expensive or more essential leisure pursuits.

The threat of substitutes for Brinker International is multifaceted, encompassing fast-casual dining, quick-service restaurants (QSRs), meal delivery services, home cooking, and alternative leisure activities. Consumers increasingly seek value, convenience, and quality, making these substitutes potent competitors. In 2024, economic pressures and evolving consumer preferences continued to amplify these threats, forcing casual dining establishments to adapt.

| Substitute Category | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Fast-Casual Dining | Speed, quality ingredients, casual atmosphere | Continued growth as consumers balance convenience and quality. |

| Quick-Service Restaurants (QSRs) | Affordability, speed, accessibility | U.S. QSR market projected over $300 billion in 2024, highlighting persistent value appeal. |

| Meal Delivery & Kits | Convenience, at-home preparation | U.S. meal kit market valued at ~$7.6 billion in 2023, with strong growth projections. |

| Home Cooking & Groceries | Cost-effectiveness, budget control | Grocery costs for family meals estimated 30-40% lower than casual dining in early 2024. |

| Alternative Leisure Activities | Discretionary spending, varied experiences | Streaming, gaming, and home entertainment capture significant consumer leisure budgets. |

Entrants Threaten

Launching a casual dining chain comparable to Brinker International's portfolio, which includes brands like Chili's and Maggiano's Little Italy, demands significant upfront capital. This investment covers prime real estate acquisition or leasing, restaurant construction and design, kitchen and dining equipment, initial inventory, and pre-opening marketing expenses. For instance, establishing a single full-service restaurant can easily cost upwards of $500,000 to $1 million, with larger flagship locations or multiple units requiring tens of millions.

These substantial capital requirements serve as a formidable barrier to entry for potential new competitors. Smaller, less-funded entrepreneurs or even established companies looking to diversify may find it prohibitively expensive to enter the casual dining market at a scale that could effectively compete with established players like Brinker, which benefits from economies of scale and brand recognition built over years of operation and investment.

Established players in the casual dining sector, like Brinker International, leverage significant economies of scale. This means they can negotiate better prices for ingredients and supplies due to their large purchasing volumes. For instance, in fiscal year 2023, Brinker reported total revenues of $4.0 billion, indicating substantial operational scale.

Newcomers face a considerable hurdle in matching these cost efficiencies. The ability to spread fixed costs, such as marketing campaigns and supply chain management, across a larger number of locations provides a distinct advantage to incumbents. This makes it challenging for new entrants to compete effectively on price, especially when considering the persistent upward pressure on food and labor costs, which saw the US Consumer Price Index for food away from home increase by approximately 5.1% year-over-year in 2023.

Brinker International benefits from strong brand loyalty with its popular Chili's and Maggiano's restaurants. These established brands have cultivated a dedicated customer base over many years, making it challenging for newcomers to gain traction. For instance, in fiscal year 2024, Brinker reported robust performance, with Chili's system-wide comparable sales increasing by 3.7% and Maggiano's by 4.3%, demonstrating the enduring appeal of their offerings and the significant hurdle new entrants face in capturing market share.

Access to Distribution Channels and Supply Chains

New entrants into the restaurant industry, like Brinker International, often struggle with securing access to established distribution channels and robust supply chains. This is a significant barrier because building these networks from scratch is both time-consuming and expensive.

Existing players, such as Brinker, have cultivated long-standing relationships with suppliers for key ingredients and beverages. These established partnerships often come with preferential pricing and guaranteed availability, making it challenging for newcomers to compete on cost and reliability. For instance, in 2024, the food and beverage supply chain faced ongoing disruptions, highlighting the value of pre-existing, resilient supplier agreements.

- Supplier Relationships: Brinker's established contracts provide a competitive edge in sourcing quality ingredients consistently.

- Distribution Networks: Access to efficient logistics and delivery systems is crucial and difficult for new entrants to replicate.

- Cost Advantages: Long-term supplier agreements often translate to lower per-unit costs, a hurdle for new competitors.

- Ingredient Specialization: Securing specialized ingredients, often unique to a brand's menu, requires deep industry connections.

Government Regulations and Permits

The restaurant industry, including chains like Brinker International, faces significant hurdles due to government regulations and permits. Navigating these requirements for health, safety, and operational standards can be a complex and lengthy process for any new player entering the market.

Compliance with these often stringent regulations adds considerably to the initial capital investment and ongoing operational costs. For instance, obtaining necessary food service permits, adhering to labor laws, and meeting zoning requirements all contribute to the barrier to entry.

- Regulatory Compliance Costs: New entrants must factor in costs associated with obtaining and maintaining various licenses and permits, which can range from local health department approvals to state liquor licenses.

- Time-Intensive Processes: The application and approval processes for these permits can be time-consuming, delaying a new restaurant's opening and impacting its ability to generate revenue quickly.

- Operational Standards: Strict adherence to food safety protocols, sanitation standards, and employment regulations necessitates ongoing training and investment in compliant infrastructure, increasing the operational burden on new businesses.

The threat of new entrants for Brinker International is generally considered moderate to low. The casual dining sector requires substantial capital for real estate, build-out, and initial marketing, creating a significant financial barrier. For example, opening a single full-service restaurant can cost upwards of $500,000 to $1 million, a figure that escalates with scale and prime locations.

Porter's Five Forces Analysis Data Sources

Our Brinker International Porter's Five Forces analysis is built upon a foundation of robust data, including Brinker's annual reports and SEC filings, alongside industry-specific reports from sources like IBISWorld and Technomic.