Brinker International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brinker International Bundle

Brinker International's portfolio is a dynamic mix, with some brands fueling growth and others requiring careful consideration. Understanding their position within the BCG Matrix is crucial for strategic decision-making.

Unlock a comprehensive understanding of Brinker International's brand portfolio by purchasing the full BCG Matrix. Gain clarity on their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment and resource allocation choices.

Stars

Chili's Grill & Bar stands out as the undisputed leader in the casual dining sector for 2024, a testament to its robust market presence. This dominance is underscored by its consistent performance and ability to capture a significant market share within a competitive landscape.

The brand's success in 2024 is attributed to strategic operational enhancements and marketing campaigns that have effectively connected with a broad consumer base. This focus has allowed Chili's to not only maintain but also grow its leading position against rivals.

Chili's is demonstrating exceptional sales growth, a key indicator for its position in the BCG matrix. In Q3 of fiscal year 2025, comparable restaurant sales saw an impressive jump of 31.6%. This follows a similarly strong performance in Q2 fiscal 2025, where sales grew by 31.4%.

This robust growth is particularly noteworthy when compared to the wider casual dining sector, which has actually seen a decline. Chili's consistent double-digit increases highlight its ability to capture market share and maintain a high growth trajectory, positioning it as a star performer.

Chili's is experiencing robust traffic growth, a key indicator of its Star status within Brinker International's portfolio. The brand saw a significant 21% increase in customer traffic during Q3 of fiscal year 2025, following a nearly 20% rise in Q2 fiscal 2025. This surge highlights strong brand appeal and effective strategies in drawing in diners.

Effective Value-Based Marketing

Chili's, a key player in Brinker International's portfolio, has seen significant success through its value-based marketing. The '3 for Me' platform, offering a combo meal at an attractive price point, and the viral 'Big Smasher' burger campaign, especially on platforms like TikTok, have resonated strongly with consumers.

These campaigns have been instrumental in attracting younger demographics and boosting engagement with existing customers. For instance, in the first quarter of fiscal year 2024, Chili's comparable restaurant sales increased by 5.1%, demonstrating the effectiveness of these value-driven initiatives in driving traffic and revenue.

- Value-driven campaigns like '3 for Me' and the 'Big Smasher' burger have boosted Chili's sales.

- Social media virality, particularly on TikTok, has attracted new and younger customer segments.

- Increased visit frequency among existing guests is a direct result of these successful marketing efforts.

- Chili's comparable restaurant sales grew 5.1% in Q1 FY24, underscoring the impact of its value marketing.

Operational Excellence and Guest Experience

Brinker International has strategically focused on operational excellence to elevate the guest experience. These efforts include significant investments in simplifying operations, optimizing labor, and upgrading facilities, all contributing to increased customer satisfaction and encouraging repeat business. For instance, Chili's reduced its menu by a notable 22%, enhancing kitchen efficiency and order accuracy.

Technology plays a crucial role in this strategy. The implementation of features like pay-at-the-table devices has streamlined the dining process, improving service speed and overall guest convenience. These foundational improvements are key to Chili's continued market leadership and sustained growth.

- Menu Streamlining: A 22% reduction in menu items at Chili's has boosted operational efficiency.

- Technology Integration: Pay-at-the-table technology enhances service speed and guest satisfaction.

- Investment Focus: Strategic investments target labor, facilities, and operational simplification.

- Guest Experience: These initiatives directly translate to higher customer satisfaction and repeat visits.

Chili's Grill & Bar is a clear Star within Brinker International's portfolio, demonstrating exceptional growth and market leadership in 2024. Its success is fueled by effective value-driven marketing, such as the '3 for Me' platform, and viral social media campaigns that attract younger demographics. Operational enhancements, including menu streamlining and technology integration, further bolster its strong performance, leading to increased customer traffic and repeat visits.

| Metric | Q3 FY25 | Q2 FY25 | Q1 FY24 |

|---|---|---|---|

| Comparable Restaurant Sales Growth | 31.6% | 31.4% | 5.1% |

| Customer Traffic Growth | 21% | ~20% | N/A |

| Menu Item Reduction | 22% | N/A | N/A |

What is included in the product

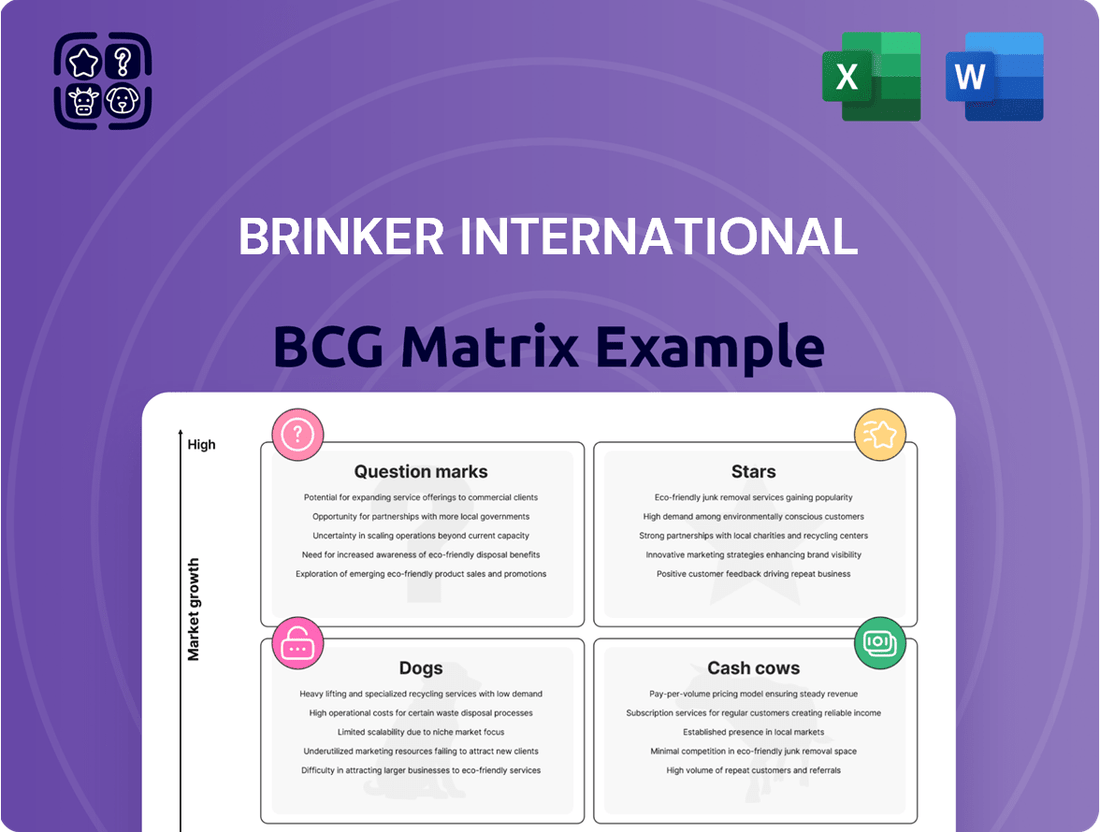

The Brinker International BCG Matrix analyzes its restaurant brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each brand.

A clear Brinker International BCG Matrix visualizes restaurant performance, relieving the pain of uncertainty.

Cash Cows

Maggiano's Little Italy holds a significant market share in the polished casual dining space. Its larger restaurant footprint and higher average customer spending, exceeding that of Chili's, solidify its position.

The brand boasts a dedicated following and impressive revenue generation per location. In fiscal year 2024, Maggiano's restaurants averaged $9.8 million in annual sales, underscoring its robust standing in a well-developed market.

Maggiano's Little Italy, despite facing traffic headwinds, stands as a strong cash cow for Brinker International. In the fiscal year 2023, Maggiano's reported comparable sales growth of 3.1%, a testament to its ability to maintain revenue streams even with declining customer visits. This consistent revenue generation, supported by strategic menu pricing and a favorable product mix, requires less aggressive investment in marketing compared to growth-oriented brands, fitting the profile of a cash cow.

Maggiano's Little Italy, a key component of Brinker International's portfolio, is being strategically managed as a cash cow. The company is actively implementing a turnaround plan for Maggiano's, focusing on menu enhancements, streamlining operations, and modernizing restaurant layouts. These efforts are designed to boost the overall guest experience and operational productivity.

The primary objective for Maggiano's is to optimize its existing, well-established business model to generate increased cash flow. Instead of prioritizing aggressive market expansion, the strategy centers on refining and improving the profitability of its current locations. This approach underscores a commitment to maximizing returns from a mature and stable business segment.

Mature Market Positioning

Maggiano's Little Italy, a Brinker International brand, occupies a mature position within the casual dining sector. This segment is characterized by slower growth compared to more dynamic markets. Consequently, Maggiano's focus is on optimizing its current operations and customer experience rather than aggressive expansion.

This strategic approach aligns with its status as a cash cow, signifying a strong market share in a low-growth industry. Brinker International's 2024 fiscal year saw Maggiano's contributing to overall revenue stability, reflecting its established customer base and consistent performance.

- Mature Market Segment: Casual dining growth rates are generally subdued.

- Focus on Refinement: Strategy emphasizes enhancing existing offerings and customer loyalty.

- Established Clientele: Benefits from a loyal customer base in a stable market.

- Cash Cow Status: High market share in a low-growth environment, generating consistent cash flow.

Strategic Investment to Maintain Value

Brinker International strategically invests in Maggiano's Little Italy, classifying it as a Cash Cow within its BCG Matrix. This investment is not geared towards rapid expansion, but rather to preserve its established market position and ensure it remains a consistent contributor to the company's overall revenue. For instance, in fiscal year 2023, Maggiano's reported comparable restaurant sales growth of 3.1%, demonstrating its steady performance.

The focus for Maggiano's is on enhancing the dining experience and menu to retain its loyal customer base while attracting new patrons. This includes initiatives like introducing new dishes and refining service standards. The strategy aims to offer a sense of accessible indulgence, a concept that resonates with consumers seeking quality without an exorbitant price tag. This approach is crucial for maintaining the brand's appeal in a competitive casual dining landscape.

The company's commitment to Maggiano's as a Cash Cow is evident in its ongoing efforts to optimize operations and marketing. While not expecting hyper-growth, Brinker understands the value of nurturing a mature brand that generates stable cash flow. This allows for reinvestment into other business segments or shareholder returns.

Key strategic points for Maggiano's as a Cash Cow include:

- Maintain Market Share: Focus on retaining existing customers through consistent quality and service.

- Menu Innovation: Introduce new, appealing dishes to keep the offering fresh and relevant.

- Operational Efficiency: Streamline processes to ensure profitability and consistent customer experience.

- Brand Reinforcement: Emphasize the value proposition of 'democratizing luxury' to attract and engage diners.

Maggiano's Little Italy functions as a stable Cash Cow for Brinker International, benefiting from a strong market share in the mature casual dining sector. The brand's strategy centers on optimizing existing operations and enhancing the guest experience, rather than pursuing aggressive expansion, to maximize cash flow generation.

In fiscal year 2024, Maggiano's demonstrated its cash cow status with average annual sales per restaurant reaching $9.8 million. This consistent revenue generation, supported by a loyal customer base and strategic menu pricing, allows Brinker International to allocate resources to other growth areas.

The brand's financial performance in fiscal year 2023, with comparable sales growth of 3.1%, highlights its ability to maintain revenue streams. This stability, coupled with a focus on operational efficiency and menu refinement, solidifies Maggiano's role as a reliable cash generator within Brinker's portfolio.

Brinker International's management of Maggiano's aligns with its cash cow designation by prioritizing brand reinforcement and operational excellence. Initiatives aimed at improving the dining experience and ensuring profitability at current locations underscore the strategy to extract maximum value from this mature segment.

Delivered as Shown

Brinker International BCG Matrix

The Brinker International BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a ready-to-use report. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix you'll download, perfect for immediate business planning and presentations.

Dogs

Brinker International's decision to de-emphasize virtual brands, including those operating out of Chili's kitchens, directly impacted traffic at its core brand. This strategic shift suggests these virtual brands were not meeting performance expectations, failing to capture significant market share or drive incremental growth. For fiscal year 2023, Brinker reported that virtual brands contributed a minimal portion of their overall revenue, reinforcing the rationale behind this de-emphasis.

Brinker International's strategic decision to scale back its virtual brands indicates these ventures likely possessed a low market share and limited growth potential within the company's overall portfolio. These initiatives were probably experimental, failing to demonstrate long-term viability or scalability. This aligns with the characteristics of Dogs in the BCG matrix, which operate in low-growth markets with a small market share.

Brinker International's virtual brands, like "It's Just Wings," often found themselves in the Cash Traps or Minimal Contribution quadrant of the BCG Matrix. These initiatives, while innovative, consumed resources without generating substantial returns. For instance, in fiscal year 2023, Brinker reported that while virtual brands contributed to revenue, their profitability was significantly lower compared to their brick-and-mortar counterparts, indicating a minimal net contribution.

The de-emphasis of these virtual brands, as observed in Brinker's strategic shifts, suggests they were not meaningfully contributing to the company's overall profitability or strategic objectives. This led to a redirection of investments towards more promising areas, such as the core Chili's and Maggiano's brands, which demonstrated stronger performance and higher return potential.

Candidates for Divestiture or Minimization

Brinker International’s strategic decisions regarding certain brands align with the Boston Consulting Group (BCG) matrix recommendation for 'Dogs' to be minimized or divested. This approach involves reducing investment and focus on underperforming segments to reallocate capital to more promising areas of the business.

While Brinker International may not have formally announced divestitures of specific brands, the action to de-emphasize them is a clear indication of a move towards minimization. This strategy is designed to improve overall portfolio performance by shedding or reducing exposure to ventures with low market share and low growth potential.

For instance, if a particular brand within Brinker's portfolio has shown declining sales and profitability, the company might choose to reduce marketing spend, close underperforming locations, or limit new development. This allows for a more concentrated effort on brands that are either Stars or Cash Cows, thereby optimizing resource allocation. In 2024, Brinker International reported a net sales increase of 2.4% to $4.1 billion for fiscal year 2024, showcasing a need to carefully manage all brand performance.

- De-emphasis as Minimization: Reducing investment and focus on brands with low market share and growth potential.

- Resource Reallocation: Freeing up capital and management attention for more profitable business segments.

- Portfolio Optimization: Improving overall company performance by managing underperforming assets.

- Fiscal Year 2024 Performance: Brinker International's net sales reached $4.1 billion, highlighting the importance of strategic brand management.

Underperforming Strategic Experiments

Brinker International's exploration into virtual brands, an effort to tap into evolving consumer dining habits, unfortunately, did not yield the anticipated results. These initiatives, initially positioned as potential growth avenues, struggled to gain significant traction and market share. For instance, in fiscal year 2023, Brinker reported a modest contribution from its virtual brands, indicating they did not significantly move the needle on overall revenue growth.

The challenges faced by these virtual brands can be attributed to several factors, including intense competition within the delivery-only space and potentially underestimating the operational complexities involved. Their inability to transition from 'Question Marks' to robust revenue generators meant they did not develop the necessary market momentum. This underperformance led to a strategic re-evaluation, with Brinker scaling back its investment and focus in this area.

- Virtual Brands as Underperformers: Brinker's virtual brand strategy, aimed at capitalizing on delivery trends, failed to achieve desired market penetration.

- Shift from Question Marks: These ventures did not evolve into strong market players, remaining in a state of unproven potential.

- Operational Hurdles: The complexities of managing delivery-only operations may have hindered their success and profitability.

- Strategic Re-evaluation: Brinker has consequently reduced its emphasis on virtual brands, reflecting their underperformance in fiscal year 2023.

Brinker International's virtual brands, such as those operating out of Chili's kitchens, have been de-emphasized due to their limited market share and growth potential. These initiatives are characteristic of 'Dogs' in the BCG matrix, consuming resources without generating substantial returns. For fiscal year 2023, virtual brands contributed minimally to overall revenue, reinforcing the rationale behind this strategic shift.

The decision to scale back virtual brands indicates they did not achieve the expected market penetration or profitability. This aligns with the BCG matrix's recommendation to minimize investment in 'Dogs' to reallocate capital to more promising segments. Brinker's fiscal year 2024 net sales reached $4.1 billion, underscoring the need for efficient portfolio management.

| BCG Category | Brinker International Example | Market Share | Market Growth | Strategic Implication |

| Dogs | Virtual Brands (e.g., It's Just Wings) | Low | Low | De-emphasize, minimize investment, potential divestment |

Question Marks

While Maggiano's Little Italy is generally considered a Cash Cow for Brinker International, the strategic development of new units, such as the planned opening in fiscal 2025, positions these initiatives as potential Stars. This single new unit, entering potentially underserved markets, represents a high-growth opportunity.

Starting with minimal market share in its immediate area, this new Maggiano's unit has the capacity for substantial growth, aiming to capture new customer bases and establish a strong presence. Success in this venture could see it transition into a future Star performer for the brand.

Chili's has seen significant traction with Gen Z, fueled by buzzworthy items such as the Triple Dipper and Big Smasher. This highlights the power of innovative, targeted menu offerings to attract and retain younger consumers.

These specific product and marketing strategies for Chili's, while part of the larger brand, represent high-growth potential initiatives. They are designed to capture a nascent market share within new customer segments, with the ultimate goal of fostering long-term loyalty.

Brinker International is actively investing in technologies like pay-at-the-table and handheld ordering devices to boost operational efficiency and elevate the guest dining experience. These initiatives, while focused on current operations, lay the groundwork for future digital growth.

The company's foray into new digital ordering channels and customer engagement platforms could be considered a Stars or Question Marks category. For instance, in fiscal year 2024, digital sales represented a significant portion of revenue, indicating growing customer adoption of these channels.

Exploration of Premium Beverage Offerings

Chili's premium beverage offerings, particularly margaritas priced above $10, have experienced a remarkable doubling in sales. This surge highlights a significant consumer appetite for higher-end drink options.

While this premium segment currently represents a smaller fraction of total sales, its rapid growth trajectory suggests substantial future potential. This aligns with a broader trend of consumers seeking elevated experiences and being willing to pay more for them.

- Sales Growth: Margaritas priced over $10 have doubled in sales at Chili's.

- Market Segment: This represents a growing niche within the beverage market.

- Consumer Trend: Demonstrates a willingness to spend on premium experiences.

- Future Potential: Indicates a nascent product line with significant upside for Brinker International.

Strategic Expansion into Emerging Markets

Brinker International's strategic expansion into emerging markets, particularly through its franchise-operated Chili's restaurants, positions these ventures as potential Stars in the BCG Matrix. These markets often present high growth opportunities due to nascent consumer bases and developing economies, demanding substantial investment to capture market share. For example, in fiscal year 2024, Brinker continued to focus on international development, with a significant portion of new restaurant openings occurring in these high-potential regions.

The company's active development arrangements signify a proactive approach to establishing a strong presence in these nascent markets. This strategy requires significant capital outlay to build brand recognition and operational infrastructure, mirroring the investment needs of Stars. By 2024, Brinker's international segment demonstrated consistent growth, contributing to the overall company performance and highlighting the strategic importance of these emerging markets.

- High Growth Potential: Emerging markets offer substantial opportunities for revenue growth due to increasing disposable incomes and a growing middle class.

- Market Share Capture: Brinker's franchise model allows for rapid scaling and penetration into new territories, aiming to establish dominant market positions.

- Investment Requirements: Significant upfront investment is necessary for market entry, brand building, and supply chain development in these developing economies.

- Fiscal Year 2024 Focus: Continued emphasis on international development, with a notable number of new Chili's locations opened in emerging markets, underscoring their strategic importance.

Brinker International's investment in new digital ordering channels and customer engagement platforms can be viewed as Question Marks. While digital sales represented a significant portion of revenue in fiscal year 2024, indicating growing customer adoption, the ultimate market share and profitability of these initiatives are still uncertain.

These digital ventures, though promising, require substantial ongoing investment to refine user experience, expand reach, and compete effectively. Their success hinges on capturing a significant portion of a rapidly evolving digital dining market, a feat that is not yet guaranteed.

The potential for these digital platforms to become future Stars is high if they can successfully attract and retain a large customer base, thereby increasing their market share in the digital space.

However, without a proven track record of market dominance, they remain in the Question Mark quadrant, demanding careful monitoring and strategic adjustments.

BCG Matrix Data Sources

Our Brinker International BCG Matrix is informed by comprehensive data, including Brinker's financial reports, industry growth rates, and competitor performance analysis.