Bright Horizons SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bright Horizons Bundle

Bright Horizons demonstrates significant strengths in its established brand reputation and extensive network of childcare centers, positioning it well within the growing early childhood education market. However, understanding the full scope of its competitive landscape and potential operational challenges is crucial for informed decision-making.

Want the full story behind Bright Horizons' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bright Horizons holds a commanding position as a premier global provider of early education and child care, alongside backup care and workforce education. With operations spanning over 1,000 centers worldwide and serving more than 1,450 prominent employers, their extensive reach underscores their market leadership.

The company's consistent recognition as a top employer and its robust industry reputation are significant strengths. This strong brand image not only attracts top talent but also instills confidence in parents and corporate clients alike, reinforcing their competitive advantage.

Bright Horizons boasts a broad range of services, from on-site and near-site childcare to educational advising and back-up care solutions. This wide array of offerings allows them to serve clients at different points in their lives and careers, creating a robust and resilient business model.

This diversification directly translates into multiple, stable revenue streams. For instance, their comprehensive approach to family support, encompassing childcare and eldercare resources, positions them to capture a larger share of client spending, fostering consistent revenue growth. In 2023, the company reported total revenue of $2.2 billion, a testament to the strength of its diversified service portfolio.

Bright Horizons boasts robust employer partnerships, serving more than 1,450 companies, a significant portion of which, over 220, are Fortune 500 entities. This extensive network, coupled with high client retention, underscores the value proposition of their services.

The growing recognition of employer-sponsored child care as a critical tool for talent acquisition and retention directly benefits Bright Horizons. This trend solidifies their business model, offering a clear return on investment for their corporate clients.

Proven Financial Performance and Growth Trajectory

Bright Horizons boasts a robust financial history, marked by over 25 years of consistent sales growth, with the exception of 2020 due to pandemic impacts. This track record underscores the company's resilience and ability to thrive in various economic conditions.

Recent performance further solidifies this strength. For the full year 2024, Bright Horizons reported an impressive 10% revenue increase. This sustained growth indicates effective strategies and strong market positioning.

Looking into early 2025, the company continued its upward momentum. Q1 2025 saw a 7% year-over-year revenue increase, alongside a significant surge in adjusted EPS, which grew by over 50%. This demonstrates not only revenue expansion but also improved profitability across its diverse service offerings.

- Consistent Sales Growth: Over 25 years of growth, excluding 2020.

- Full Year 2024 Performance: 10% revenue increase.

- Q1 2025 Results: 7% year-over-year revenue growth.

- Profitability Surge: Over 50% growth in adjusted EPS in Q1 2025.

Capital-Light Business Model

Bright Horizons' capital-light business model is a significant strength, enabling agile expansion. This approach, where client-funded investments often support new center development, minimizes the company's upfront capital expenditure. This efficiency translates into robust operating cash flows, supporting ongoing growth initiatives.

This strategy is particularly beneficial in a sector requiring physical infrastructure. For instance, Bright Horizons reported in its 2024 investor materials that a substantial portion of new center openings were facilitated through partnerships and client-specific arrangements, thereby reducing the need for large, company-financed outlays.

- Reduced Capital Outlay: Client funding for new centers directly lowers Bright Horizons' investment burden.

- Enhanced Cash Flow: This model contributes to healthier operating cash flows, providing financial flexibility.

- Scalability: The capital-light structure facilitates quicker and more widespread expansion.

- Lower Financial Risk: By shifting development costs, the company mitigates financial exposure associated with new site builds.

Bright Horizons' extensive network of over 1,000 centers and partnerships with more than 1,450 employers, including over 220 Fortune 500 companies, highlights its dominant market position and strong client relationships. The company's diversified service offerings, from early education to workforce education, create multiple stable revenue streams, as evidenced by $2.2 billion in total revenue reported for 2023. This broad service model fosters client loyalty and captures a larger share of family spending.

The company's financial performance demonstrates consistent resilience, with over 25 years of sales growth, barring pandemic impacts. Their 2024 full-year revenue saw a 10% increase, and Q1 2025 reported a 7% year-over-year revenue growth, coupled with over 50% adjusted EPS growth. This sustained financial strength is further supported by a capital-light business model where client-funded investments facilitate agile expansion, minimizing capital expenditure and enhancing operating cash flows.

| Metric | 2023 | 2024 | Q1 2025 |

|---|---|---|---|

| Total Revenue | $2.2 billion | N/A (10% growth reported) | N/A (7% YoY growth reported) |

| Employer Partnerships | 1,450+ | 1,450+ | 1,450+ |

| Fortune 500 Clients | 220+ | 220+ | 220+ |

| Adjusted EPS Growth | N/A | N/A | >50% YoY |

What is included in the product

Delivers a strategic overview of Bright Horizons’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical operational challenges, turning potential weaknesses into strategic advantages.

Weaknesses

Bright Horizons' reliance on employer contracts, while a core strength, also presents a notable weakness. A significant portion of their revenue is directly linked to these agreements, making them susceptible to corporate budget adjustments or shifts in employee benefit priorities, particularly during economic slowdowns. For instance, as of the first quarter of 2024, employer-sponsored child care and education services remain a key revenue driver, but this concentration exposes the company to the volatility of corporate spending.

Bright Horizons, like many in the childcare sector, grapples with significant operating expenses, a substantial portion of which is dedicated to staffing. The imperative to offer competitive wages to attract and retain qualified educators, especially amidst ongoing wage inflation, directly pressures profit margins and can limit the ability to expand services.

The entire childcare industry is facing a critical staffing crunch. This is largely due to low wages, insufficient benefits, and the inherent stress of the job. For instance, a 2023 report indicated that over 60% of childcare centers reported staffing shortages, impacting their ability to serve children.

These widespread staffing issues directly affect Bright Horizons. It can hinder their capacity to grow or even maintain current service levels, potentially impacting the quality of care and the number of children they can enroll. This industry-wide problem is a significant operational hurdle.

Regulatory and Licensing Complexity

Bright Horizons faces significant hurdles due to the sheer complexity of regulatory and licensing requirements across its numerous childcare centers. Operating in different states and countries means adhering to a patchwork of varying compliance standards, which can be a constant challenge to manage effectively.

The potential for non-compliance is a serious weakness, carrying the risk of substantial penalties, costly operational interruptions, and damage to the company's reputation. For instance, a single lapse in adhering to childcare regulations in a key market could trigger investigations and impact enrollment numbers, as seen in isolated incidents within the sector that have led to temporary center closures.

- Navigating Diverse Licensing: Bright Horizons must manage varying state and local childcare licensing regulations, a complex and time-consuming process.

- Compliance Risks: Failure to meet these diverse standards can result in significant fines and operational shutdowns.

- Reputational Impact: Regulatory breaches can severely damage public trust and brand image, affecting parent confidence.

Potential for Increased Competition

Bright Horizons faces a dynamic and competitive market. Major players like KinderCare Education LLC and Learning Care Group are established providers, and the growing demand for childcare services, projected to continue its upward trend through 2025, invites new entrants. This heightened competition could lead to aggressive pricing tactics, potentially squeezing profit margins and impacting Bright Horizons' market share.

The sector's attractiveness means that even smaller, niche providers could emerge, offering specialized services that appeal to specific demographics. Bright Horizons' ability to maintain its competitive edge will depend on its continued innovation in curriculum, technology integration, and service delivery, especially as the overall market size for childcare services in the US is expected to reach over $60 billion by 2025.

- Established Competitors: KinderCare Education LLC and Learning Care Group are significant rivals.

- Market Growth Attracts New Entrants: Increasing demand for childcare services, estimated to grow annually, draws new competitors.

- Pricing Pressure: Aggressive pricing strategies from competitors could affect Bright Horizons' profitability.

- Niche Provider Emergence: Specialized, smaller providers may capture specific market segments.

Bright Horizons' significant reliance on employer contracts, a core strength, also represents a key weakness. A substantial portion of their revenue is tied to these agreements, making them vulnerable to corporate budget cuts or changes in employee benefit priorities, especially during economic downturns. For example, employer-sponsored child care and education services remain a primary revenue source as of early 2024, but this concentration exposes the company to the fluctuations of corporate spending.

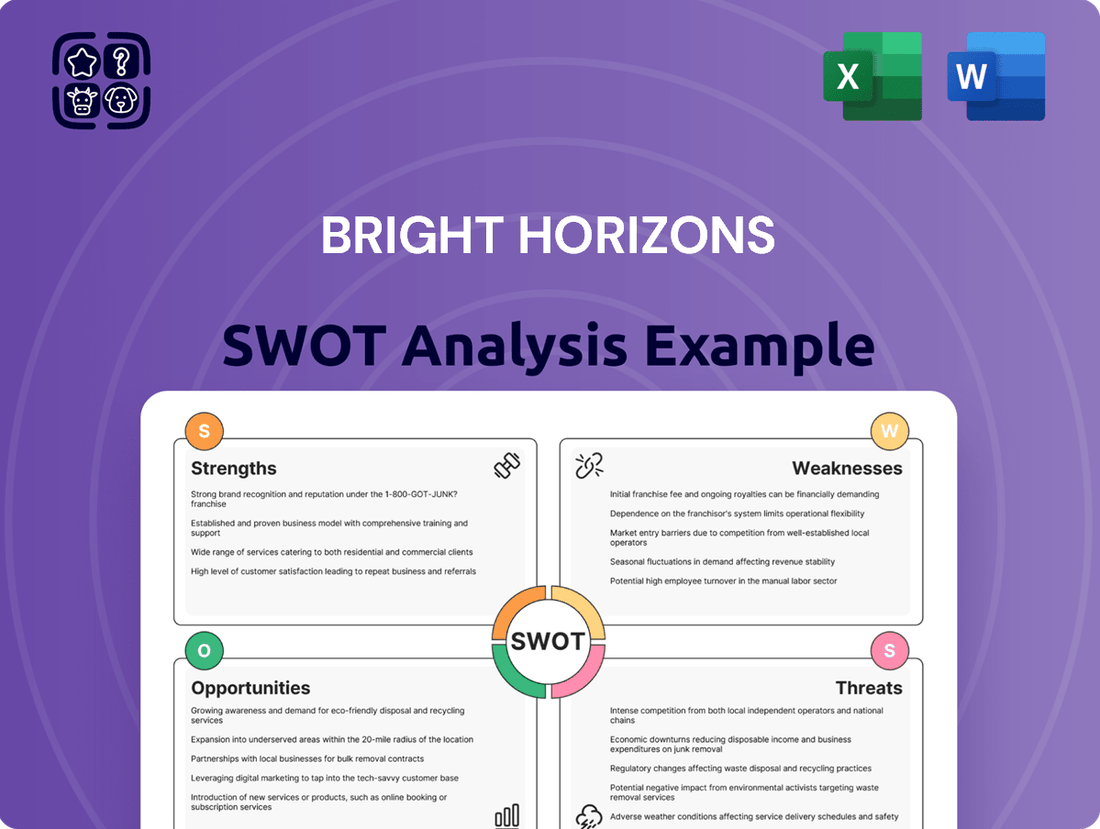

Preview the Actual Deliverable

Bright Horizons SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report provides a comprehensive overview of Bright Horizons' Strengths, Weaknesses, Opportunities, and Threats. You can be confident that the content is accurate and professionally presented.

Opportunities

The demand for employer-sponsored childcare and work-life balance solutions is on the rise. Companies are increasingly understanding that offering these benefits boosts employee productivity, improves retention rates, and enhances overall engagement. This growing recognition of childcare as a critical employee benefit presents a substantial opportunity for Bright Horizons.

The trend is further amplified by a larger number of working parents and a societal shift towards prioritizing family-friendly workplace benefits. In 2024, reports indicated a significant increase in companies exploring or expanding childcare support programs to attract and retain talent in a competitive labor market. Bright Horizons is well-positioned to capitalize on this escalating demand for comprehensive support services.

Bright Horizons' back-up care segment is a significant growth driver, with utilization rates climbing and directly boosting revenue. This area has seen robust expansion, reflecting a strong market demand for flexible childcare solutions.

The company is also experiencing continued growth in its educational advisory services. This segment offers valuable support to families navigating educational choices and career paths.

By further developing and innovating within both back-up care and educational advisory services, Bright Horizons can broaden its revenue streams. This strategic focus also allows the company to adapt to and fulfill the changing requirements of its diverse client base.

Bright Horizons is actively pursuing geographic expansion, building on its existing global footprint. The company has successfully entered new markets, including the Netherlands, Australia, and India, demonstrating a strategic approach to international growth.

Acquisitions remain a key lever for expanding market reach and service capabilities. For instance, the 2022 acquisition of Only About Children in Australia significantly bolstered Bright Horizons' presence in that region, integrating a substantial network of childcare centers and further diversifying its service portfolio.

Leveraging Technology for Operational Efficiency and Service Enhancement

Bright Horizons can significantly boost its operational efficiency and enrich service offerings by embracing advanced childcare management software. This technology streamlines critical functions such as enrollment, staff scheduling, and parent communication. By automating these processes, the company can reduce administrative burdens, allowing staff to dedicate more time to direct child engagement and program development.

The adoption of such platforms is a growing trend in the childcare sector. For instance, by mid-2024, an estimated 70% of childcare centers in North America were utilizing some form of management software, a figure projected to rise to 85% by the end of 2025. This widespread adoption underscores the competitive advantage gained through technological integration.

Key opportunities for Bright Horizons include:

- Enhanced Parent Engagement: Real-time updates on child activities, secure messaging portals, and digital progress reports can foster stronger parent-teacher partnerships.

- Streamlined Administration: Automating tasks like billing, attendance tracking, and staff payroll can lead to significant cost savings and reduced errors.

- Data-Driven Insights: Management software can provide valuable data on enrollment trends, staff performance, and resource utilization, informing strategic decision-making.

- Improved Staff Efficiency: Optimized scheduling and reduced administrative tasks empower educators to focus on delivering high-quality care and educational programming.

Addressing Broader Employee Well-being and Family Support Needs

Employers are increasingly looking to provide holistic support for their workforce, extending beyond traditional childcare. This includes a significant demand for services that bolster financial literacy, mental health resources, and adaptable work structures. For instance, a 2024 survey indicated that 70% of employees would consider family-friendly benefits a key factor when choosing an employer.

Bright Horizons, leveraging its established network and reputation within the corporate sector, is strategically positioned to capitalize on this evolving landscape. The company can expand its service portfolio to encompass these broader well-being and family support needs, thereby deepening its value proposition to existing and prospective clients.

- Growing employer demand for integrated employee well-being solutions.

- Opportunity to offer financial wellness, mental health, and flexible work support.

- Bright Horizons' existing employer relationships provide a strong foundation for expansion.

The increasing recognition of childcare as a vital employee benefit by employers presents a significant opportunity for Bright Horizons. Reports from 2024 highlight a surge in companies seeking to bolster their childcare support programs to attract and retain talent in a competitive job market, with 70% of employees in a recent survey citing family-friendly benefits as a key factor in employer choice.

Bright Horizons' back-up care services are experiencing robust demand, with rising utilization rates directly contributing to revenue growth, reflecting a strong market need for flexible childcare solutions.

Geographic expansion, including recent market entries in the Netherlands, Australia, and India, alongside strategic acquisitions like Only About Children in Australia in 2022, further broadens Bright Horizons' reach and service capabilities.

The adoption of advanced childcare management software is a key opportunity, with an estimated 70% of North American centers using such technology by mid-2024, a figure projected to reach 85% by the end of 2025, enhancing operational efficiency and parent engagement.

There is a growing demand for integrated employee well-being solutions, including financial literacy and mental health resources, which Bright Horizons is well-positioned to address given its established corporate relationships.

Threats

Economic uncertainties pose a significant threat, as companies facing downturns often slash discretionary spending. This can directly impact Bright Horizons' core business, with employers potentially reducing or eliminating employer-sponsored childcare benefits to cut costs.

A substantial economic slowdown could also dampen demand for Bright Horizons' services. Clients might scale back their usage or seek more budget-friendly alternatives, leading to revenue pressure and potentially impacting the company's profitability. For instance, during periods of economic contraction, businesses historically re-evaluate all non-essential expenditures.

The childcare sector is highly competitive, featuring established national brands and numerous smaller, localized operations. This crowded landscape means Bright Horizons faces constant pressure to attract and retain families, often leading to price sensitivity among consumers.

Increased competition can force providers to lower prices or offer more incentives, directly impacting profit margins. For instance, while specific 2024/2025 pricing data for Bright Horizons isn't publicly detailed, the industry trend shows a need for significant investment in marketing and unique service offerings to stand out, which can strain profitability.

Persistent staffing shortages in the childcare sector remain a critical threat for Bright Horizons. The industry faces ongoing difficulties in attracting and retaining qualified educators, a trend exacerbated by increased demand for childcare services. This scarcity directly impacts operational capacity and service delivery.

Rising labor costs are a significant concern, as competitive wages are necessary to attract and retain talent in a tight labor market. For instance, the U.S. Bureau of Labor Statistics reported that average hourly wages for childcare workers saw an increase, though often still below those in other sectors requiring similar education levels. Bright Horizons must navigate these cost pressures to maintain a skilled workforce, which could affect profitability if not managed effectively.

Regulatory Changes and Compliance Burden

Bright Horizons faces significant risks from evolving regulatory landscapes. For instance, changes in state-specific childcare licensing requirements, such as updated staff-to-child ratios or health and safety protocols, can necessitate costly operational adjustments. The company's 2023 annual report highlights that compliance with diverse and changing regulations across its numerous locations is a constant challenge, potentially impacting service delivery and financial performance.

The burden of staying compliant with an increasing number of federal, state, and local mandates, including those related to data privacy and employee benefits, adds to operational expenses. For example, the introduction of new reporting requirements or stricter background check protocols can divert resources and attention from core service provision. The company must continuously monitor and adapt to these changes to avoid penalties or disruptions.

- Increased Compliance Costs: Adapting to new state-specific childcare regulations, such as revised health and safety standards, can lead to higher operational expenses for Bright Horizons.

- Impact on Service Models: Changes in licensing requirements or government funding policies could affect the viability or profitability of certain childcare programs offered by the company.

- Continuous Monitoring Challenge: Keeping pace with the dynamic nature of regulations across multiple jurisdictions requires ongoing investment in compliance expertise and systems.

Reputational Risks from Quality or Safety Incidents

Bright Horizons, as a child care provider, is particularly vulnerable to reputational damage stemming from any lapses in quality, health, or safety. An incident, even a minor one, can quickly escalate through social media and news outlets, eroding the trust parents place in the organization. For example, in late 2023, several childcare providers faced scrutiny following reports of understaffing and inadequate supervision, highlighting the sensitivity of this sector to quality concerns.

Such negative publicity directly impacts enrollment numbers and can lead to a significant loss of clients, which translates into immediate financial setbacks. The brand's image, built over years of service, can be tarnished overnight. In 2024, reports of outbreaks of common childhood illnesses at various daycare centers have already led to temporary closures and parental apprehension, underscoring the financial and operational consequences of safety incidents.

- Reputational Damage: Incidents can lead to widespread negative publicity, impacting brand perception.

- Loss of Trust: Parents may withdraw children due to concerns about quality or safety, affecting enrollment.

- Financial Impact: Decreased enrollment and potential legal costs can significantly harm revenue and profitability.

- Brand Erosion: Long-term damage to the Bright Horizons brand can be difficult and costly to repair.

The childcare industry's susceptibility to economic downturns presents a significant threat, as employers may reduce childcare benefits to cut costs, directly impacting Bright Horizons' client base and revenue streams. For instance, a prolonged economic contraction could lead businesses to scrutinize all discretionary spending, including employee benefits like childcare subsidies, a trend observed in past recessions.

Intensified competition within the childcare sector, from both established national brands and local providers, forces Bright Horizons to invest heavily in marketing and unique service offerings to attract and retain families, potentially squeezing profit margins. The industry's dynamic nature means providers must constantly innovate to differentiate themselves, which can be costly.

Persistent staffing shortages and rising labor costs in the childcare sector are critical threats, as attracting and retaining qualified educators requires competitive wages, directly impacting operational capacity and profitability. The U.S. Bureau of Labor Statistics data consistently shows that childcare worker wages, while increasing, often lag behind those in other sectors requiring similar educational backgrounds, creating a challenge for recruitment.

Evolving regulatory landscapes, including changes in state-specific licensing requirements and compliance mandates, can necessitate costly operational adjustments and divert resources from core service provision. For example, new health and safety protocols or data privacy regulations require continuous investment in expertise and systems to ensure compliance across all locations.

Reputational damage stemming from any perceived lapses in quality, health, or safety poses a severe threat, as negative publicity can quickly erode parental trust and lead to significant financial setbacks through decreased enrollment. Incidents like outbreaks of common childhood illnesses at daycare centers, which gained attention in 2024, underscore the sector's vulnerability to such events.

SWOT Analysis Data Sources

This SWOT analysis leverages a comprehensive blend of internal financial statements, customer feedback surveys, and industry benchmark reports to provide a robust and actionable assessment.