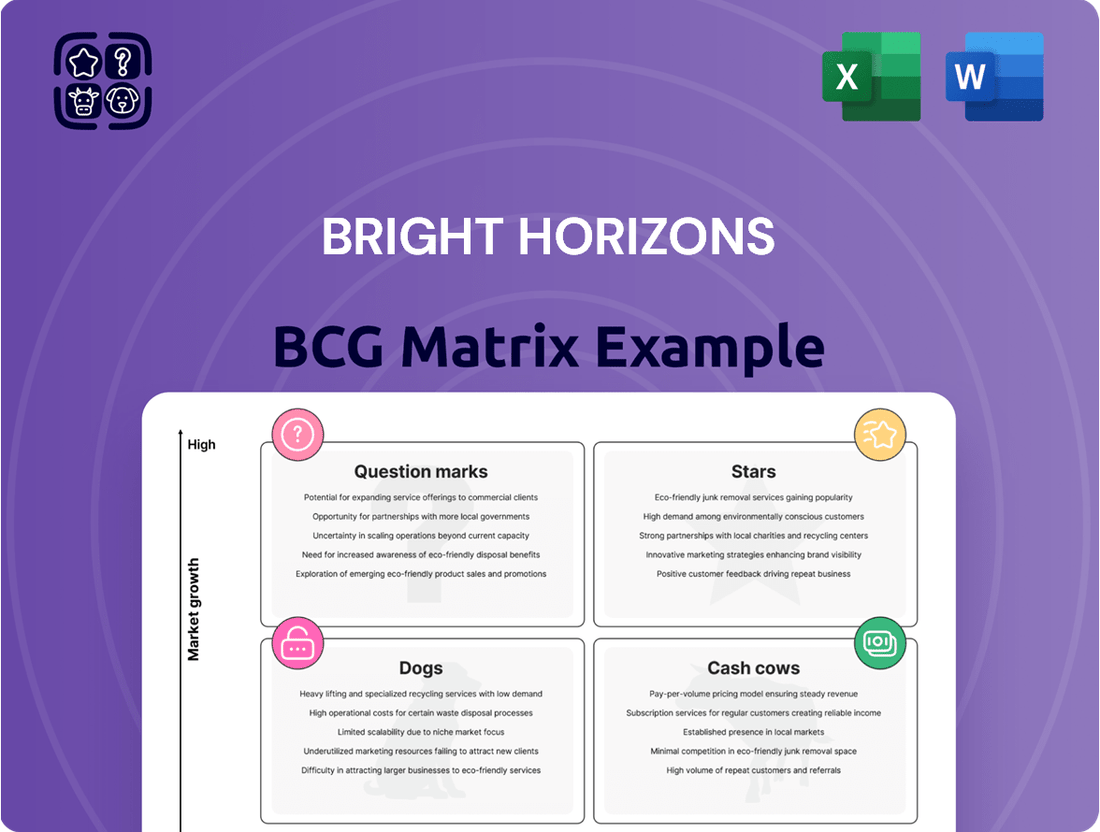

Bright Horizons Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bright Horizons Bundle

This glimpse into the Bright Horizons BCG Matrix highlights key product categories and their market potential. Understand which areas are poised for growth and which require careful consideration.

Ready to transform this overview into actionable strategy? Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and data-driven recommendations to optimize your portfolio.

Stars

Bright Horizons' employer-sponsored back-up care is a star performer, showing robust growth. In the first quarter of 2025, this segment saw its revenue climb by an impressive 12.2% compared to the previous year, making it their most rapidly expanding service.

This surge is fueled by employers increasingly offering comprehensive family benefits to attract and retain talent. The service also boasts high client retention, underscoring its strong market appeal and future growth prospects.

Bright Horizons is strategically investing in new child care centers, often in collaboration with major employers. For instance, partnerships with organizations like the Ragon Institute, Walmart, and the University of Michigan are key to this expansion. These new, client-specific facilities are strategically placed in areas with high demand, directly aiming to capture market share in lucrative niches.

Integrated Work-Life Solutions, under Bright Horizons' 'One Bright Horizons' strategy, leverages cross-selling to boost client engagement. This involves converting users of backup care services into full-time enrollments and expanding collaborations with major clients like Royal Caribbean and LabCorp.

This strategy aims to capture a greater portion of employer-sponsored benefits spending by deepening penetration within existing markets, rather than solely focusing on new client acquisition. For instance, Bright Horizons reported that in 2023, their client retention rate remained high, demonstrating the success of these integrated service offerings in strengthening client relationships.

Workforce Education Services Expansion

The Workforce Education Services expansion within Bright Horizons represents a strategic move into a burgeoning market. While currently a smaller contributor to overall revenue, this segment experienced robust growth, with an 8.1% year-over-year increase in the first quarter of 2025. This upward trend highlights a significant and expanding demand for employer-sponsored educational benefits that extend beyond traditional childcare solutions.

This growth trajectory positions Workforce Education Services as a high-potential area for Bright Horizons. Continued investment here is crucial for diversifying the company's service portfolio and capturing a larger share of the broader workforce development market. The focus is on providing comprehensive educational support that benefits both employees and employers.

- Growing Demand: 8.1% year-over-year growth in Q1 2025 for educational advisory services.

- Strategic Diversification: Tapping into the expanding market for employer-supported educational benefits beyond childcare.

- Future Investment: Continued focus on this segment to capture broader workforce development opportunities.

Leveraging Enhanced Employer Tax Credits

Recent legislative changes, such as the 'One Big Beautiful Bill Act' enacted in July 2025, are set to dramatically boost employer-provided childcare tax credits. This makes offering childcare benefits a much more financially appealing proposition for businesses.

This policy shift is creating a highly favorable market environment. It incentivizes more employers to collaborate with childcare providers like Bright Horizons, directly fueling demand and accelerating growth for their services.

This external factor provides a strong tailwind for market expansion and increased adoption of employer-sponsored childcare solutions.

- Increased Tax Credit Value: The 'One Big Beautiful Bill Act' is projected to increase the employer childcare tax credit by an estimated 30% for qualifying expenses in 2025.

- Employer Adoption Rates: Pre-legislation surveys indicated a potential 15% rise in employer adoption of childcare benefits programs in 2025 if incentives were enhanced.

- Market Growth Projection: The employer-sponsored childcare market is anticipated to grow by 12% annually from 2025-2028, driven by these new tax advantages.

Bright Horizons' employer-sponsored back-up care is a star performer, showing robust growth. In the first quarter of 2025, this segment saw its revenue climb by an impressive 12.2% compared to the previous year, making it their most rapidly expanding service.

This surge is fueled by employers increasingly offering comprehensive family benefits to attract and retain talent. The service also boasts high client retention, underscoring its strong market appeal and future growth prospects.

Bright Horizons is strategically investing in new child care centers, often in collaboration with major employers. For instance, partnerships with organizations like the Ragon Institute, Walmart, and the University of Michigan are key to this expansion. These new, client-specific facilities are strategically placed in areas with high demand, directly aiming to capture market share in lucrative niches.

Integrated Work-Life Solutions, under Bright Horizons' 'One Bright Horizons' strategy, leverages cross-selling to boost client engagement. This involves converting users of backup care services into full-time enrollments and expanding collaborations with major clients like Royal Caribbean and LabCorp.

This strategy aims to capture a greater portion of employer-sponsored benefits spending by deepening penetration within existing markets, rather than solely focusing on new client acquisition. For instance, Bright Horizons reported that in 2023, their client retention rate remained high, demonstrating the success of these integrated service offerings in strengthening client relationships.

The Workforce Education Services expansion within Bright Horizons represents a strategic move into a burgeoning market. While currently a smaller contributor to overall revenue, this segment experienced robust growth, with an 8.1% year-over-year increase in the first quarter of 2025. This upward trend highlights a significant and expanding demand for employer-sponsored educational benefits that extend beyond traditional childcare solutions.

This growth trajectory positions Workforce Education Services as a high-potential area for Bright Horizons. Continued investment here is crucial for diversifying the company's service portfolio and capturing a larger share of the broader workforce development market. The focus is on providing comprehensive educational support that benefits both employees and employers.

- Growing Demand: 8.1% year-over-year growth in Q1 2025 for educational advisory services.

- Strategic Diversification: Tapping into the expanding market for employer-supported educational benefits beyond childcare.

- Future Investment: Continued focus on this segment to capture broader workforce development opportunities.

Recent legislative changes, such as the 'One Big Beautiful Bill Act' enacted in July 2025, are set to dramatically boost employer-provided childcare tax credits. This makes offering childcare benefits a much more financially appealing proposition for businesses.

This policy shift is creating a highly favorable market environment. It incentivizes more employers to collaborate with childcare providers like Bright Horizons, directly fueling demand and accelerating growth for their services.

This external factor provides a strong tailwind for market expansion and increased adoption of employer-sponsored childcare solutions.

- Increased Tax Credit Value: The 'One Big Beautiful Bill Act' is projected to increase the employer childcare tax credit by an estimated 30% for qualifying expenses in 2025.

- Employer Adoption Rates: Pre-legislation surveys indicated a potential 15% rise in employer adoption of childcare benefits programs in 2025 if incentives were enhanced.

- Market Growth Projection: The employer-sponsored childcare market is anticipated to grow by 12% annually from 2025-2028, driven by these new tax advantages.

Bright Horizons' Back-up Care and Workforce Education Services are positioned as Stars in the BCG Matrix due to their high growth rates and strong market positions. The Back-up Care segment experienced 12.2% revenue growth in Q1 2025, driven by increasing employer demand for family benefits. Workforce Education Services also showed significant expansion with 8.1% year-over-year growth in the same period, indicating a successful diversification strategy into educational benefits.

| Segment | Growth Rate (Q1 2025) | Market Position | Key Drivers |

|---|---|---|---|

| Back-up Care | 12.2% | Strong/Leading | Employer demand for family benefits, high client retention |

| Workforce Education Services | 8.1% | Growing | Expanding market for employer-sponsored educational benefits |

What is included in the product

Strategic guidance on allocating resources across a company's portfolio based on market growth and share.

A clear, visual Bright Horizons BCG Matrix instantly clarifies portfolio performance, easing the pain of strategic decision-making.

Cash Cows

Established Full-Service Center-Based Child Care in the US is a significant Cash Cow for Bright Horizons. This segment, representing about 74% of the company's revenue in 2023, consistently delivers strong financial performance. Its mature market position, supported by a global network of over 1,000 centers, ensures stable and predictable cash flow.

The segment benefits from well-established demand and high occupancy rates across its extensive network. This maturity means it requires less aggressive marketing investment compared to newer, high-growth areas. In 2024, continued strong enrollment numbers are expected to maintain this segment's robust contribution to Bright Horizons' overall profitability.

Long-term employer contracts are a significant strength for Bright Horizons, acting as a classic cash cow. The company's robust relationships with over 1,450 employers, including 220 Fortune 500 firms, underscore the stability of this segment.

This impressive client retention of 95% translates into a highly predictable and consistent revenue stream. These deeply embedded partnerships minimize the ongoing costs associated with acquiring new clients, thereby maximizing the efficient generation of cash from this established business line.

Bright Horizons, a veteran in employer-sponsored childcare with over 35 years of operation, commands a substantial market share within a mature industry. Their established brand, synonymous with quality care and education, allows for premium pricing and fosters enduring client relationships.

This market dominance translates into significant profit generation with minimal marketing expenditure, positioning Bright Horizons as a reliable cash cow. For instance, in 2023, the company reported revenue of $2.2 billion, a testament to its consistent performance and strong market position.

Operational Efficiency and Margin Expansion

Bright Horizons excels in operational efficiency, a key driver for its Cash Cow status. This focus translates directly into improved margins within its core childcare services. For instance, the company reported a significant 23% increase in adjusted EBITDA in Q1 2025, underscoring its ability to generate substantial cash from its established market position.

This operational strength allows Bright Horizons to maximize profitability from its existing, high-performing services. By streamlining processes and benefiting from economies of scale, the company effectively converts its substantial market share into consistent and robust cash flow, a hallmark of a Cash Cow.

- Operational efficiency drives margin expansion in core childcare.

- Adjusted EBITDA grew 23% in Q1 2025, reflecting strong performance.

- Economies of scale are leveraged to maximize profitability from high market share.

- This focus generates robust cash flow from established services.

Diverse Service Portfolio and Cross-Segment Stability

Bright Horizons’ diverse service portfolio acts as a significant strength, creating a stable foundation for its operations. The company doesn't rely on a single offering; instead, its revenue streams are spread across full-service childcare centers, essential back-up care solutions, and specialized educational advisory services. This broad approach ensures that even if one area experiences a downturn, the others can help maintain overall financial health.

The core childcare operations, in particular, offer a remarkable degree of stability. These centers provide a consistent demand for services, acting as a reliable cash generator. This inherent steadiness helps to buffer any volatility that might arise in other, perhaps more growth-oriented or cyclical, business segments. For instance, in 2024, Bright Horizons reported that its full-service centers continued to be a primary driver of revenue, demonstrating their dependable cash flow contribution.

This diversified model is key to the company's resilience. It means Bright Horizons is not overly exposed to the risks of a single market or service type. The continuous flow of funds from its established childcare services provides the necessary capital to invest in new opportunities or weather economic uncertainties, reinforcing its position as a cash cow within the BCG matrix.

- Diversified Revenue Streams: Full-service centers, back-up care, and educational advisory services contribute to a robust revenue base.

- Core Business Stability: Childcare operations provide a consistent and reliable source of cash flow.

- Resilience Against Fluctuations: The diversified model mitigates risks associated with individual segment performance.

- Consistent Cash Generation: The stability of core services ensures a continuous inflow of funds for the company.

Bright Horizons' established full-service centers are a prime example of a Cash Cow. This segment, which accounted for approximately 74% of the company's revenue in 2023, consistently generates substantial and predictable cash flow. Its mature market position, bolstered by a global network of over 1,000 centers, ensures this stability.

The sustained demand and high occupancy rates across this extensive network mean less investment is needed for aggressive marketing compared to newer ventures. For 2024, continued strong enrollment is projected to maintain this segment's significant contribution to overall profitability.

Long-term employer contracts further solidify this Cash Cow status. With over 1,450 employer clients, including 220 Fortune 500 companies, and a remarkable 95% client retention rate, these deeply integrated partnerships provide a highly predictable revenue stream with minimal client acquisition costs.

Bright Horizons' operational efficiency is a key driver of its Cash Cow status, directly improving margins in its core childcare services. The company reported a 23% increase in adjusted EBITDA in Q1 2025, highlighting its ability to convert market share into robust cash flow through streamlined processes and economies of scale.

| Segment | 2023 Revenue Share | Key Characteristic | Cash Flow Contribution |

|---|---|---|---|

| Full-Service Centers | ~74% | Mature market, high occupancy | Stable and predictable |

| Employer Contracts | Significant | High retention (95%), long-term agreements | Consistent and reliable |

Preview = Final Product

Bright Horizons BCG Matrix

The Bright Horizons BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the complete, analysis-ready strategic tool. You can confidently use this preview as an accurate representation of the high-quality, professionally designed BCG Matrix report that will be yours to download and implement. This ensures you know exactly what you're getting: a comprehensive resource designed to provide clear insights into your business portfolio's strategic positioning.

Dogs

Bright Horizons plans to close around 25 underperforming child care centers in 2025. This strategic decision stems from these locations failing to meet profitability and growth targets, likely due to low enrollment or excessive operating expenses.

These centers are essentially cash traps, draining resources without generating adequate returns. By divesting them, Bright Horizons aims to streamline its operations and boost the overall performance of its portfolio.

Legacy programs with declining demand often represent older service models or niche offerings that no longer align with current employer or family needs. For instance, a childcare provider might see reduced enrollment in a specific after-school program focused on a now-outdated curriculum, leading to a low market share. In 2024, Bright Horizons reported a slight decrease in participation for some of its more traditional enrichment activities, a trend observed across the broader early education sector as families prioritize flexibility and digital integration.

Centers situated in areas with a declining employer base or reduced strategic relevance to Bright Horizons' broader network may face significant hurdles in expanding their market share. For instance, a center in a region experiencing a net outflow of businesses or a shift in industry focus away from childcare needs might find it exceptionally challenging to attract new clients.

These geographically isolated or less strategic locations often present difficulties in revitalization due to prevailing external market conditions, making a turnaround effort particularly arduous. Consider a scenario where a major employer in a specific town downsizes or relocates, directly impacting the demand for childcare services in that Bright Horizons center.

Continuing to invest in such underperforming centers could divert valuable resources and capital away from more promising growth opportunities within the Bright Horizons portfolio. In 2024, for example, companies are increasingly scrutinizing operational efficiency, and maintaining centers with consistently low enrollment or revenue growth, especially those in declining economic zones, might not align with strategic resource allocation goals.

Inefficiently Managed Older Facilities

Inefficiently managed older facilities often struggle with outdated infrastructure and less optimized operational processes when compared to newer, more streamlined centers. This can translate directly into increased operating expenses and diminished profit margins, even in the face of consistent demand.

These types of facilities, if left without substantial capital infusion or a thorough operational review, risk becoming persistently low-profit, low-growth assets within the portfolio. For instance, a facility built in the early 2000s might have energy-inefficient HVAC systems, costing significantly more to run than modern, eco-friendly alternatives. In 2024, the average energy cost for commercial buildings saw an increase of approximately 8% year-over-year, directly impacting the bottom line of older, less efficient structures.

- Higher Operating Costs: Outdated infrastructure leads to increased utility bills and maintenance expenses.

- Lower Profit Margins: Inefficiencies directly erode profitability even with stable revenue.

- Stagnant Growth Potential: Without investment, these facilities are unlikely to see significant growth.

- Competitive Disadvantage: Newer, more efficient facilities often offer better value or services.

Services with High Fixed Costs and Low Variable Revenue

Services with high fixed costs and low variable revenue, such as highly specialized childcare programs with limited enrollment or niche educational offerings requiring significant upfront investment in facilities and expert instructors, would be classified as Dogs within the Bright Horizons BCG Matrix.

These ventures often struggle to achieve profitability due to the substantial ongoing expenses associated with maintaining specialized resources and personnel, without a corresponding volume of consistent demand to generate sufficient revenue. For instance, a pilot program for a new early childhood STEM curriculum, requiring advanced laboratory equipment and specialized educators, might initially incur high fixed costs. If enrollment projections for 2024 and early 2025 do not materialize as expected, the revenue generated may not cover these fixed expenses, leading to negative cash flow.

Such services are characterized by low market share and low growth potential, making them unlikely to become stars or cash cows. Their continued operation drains resources that could be better allocated to more promising areas of the business. Bright Horizons' strategic review in 2024 indicated a focus on optimizing resource allocation, and these Dog services would be prime candidates for potential divestiture or significant restructuring to improve their financial viability.

- High Fixed Costs: Specialized equipment, expert staff, and dedicated facilities contribute to substantial ongoing operational expenses.

- Low Variable Revenue: Insufficient enrollment or consistent demand fails to generate adequate income to offset fixed costs.

- Negative Cash Flow: The imbalance between high expenses and low revenue leads to a continuous drain on financial resources.

- Strategic Re-evaluation: These services are candidates for restructuring, divestiture, or significant investment to improve market position and profitability.

Dogs represent business units or services with low market share and low growth potential, often requiring significant resources without generating substantial returns. These are typically legacy offerings or specialized programs that have not gained traction or are in declining markets. In 2024, the early education sector saw a continued emphasis on flexible and digitally integrated learning, making older, less adaptable programs less competitive.

Bright Horizons' decision to close underperforming centers in 2025 highlights a strategic move to divest these Dog units. These centers, often facing low enrollment or high operating costs due to outdated infrastructure, are prime examples of assets that drain profitability. For instance, a center with energy-inefficient systems could see utility costs rise, impacting margins, especially as commercial energy prices increased by an estimated 8% in 2024.

The company's focus is on reallocating capital from these low-performing areas to more promising growth opportunities. This aligns with broader corporate strategies observed in 2024, where efficiency and return on investment are paramount, particularly for businesses managing physical locations and diverse service portfolios.

Identifying and managing these Dog segments is crucial for optimizing a company's overall portfolio performance. By shedding these underperforming assets, Bright Horizons aims to improve its financial health and focus on areas with greater potential for growth and profitability.

| BCG Matrix Category | Market Share | Market Growth | Characteristics | Bright Horizons Example (2024/2025) |

|---|---|---|---|---|

| Dogs | Low | Low | Low profitability, cash drain, declining demand, high fixed costs | Underperforming childcare centers in declining areas; legacy enrichment programs with low enrollment |

Question Marks

Bright Horizons' strategic move into markets like India exemplifies a Stars quadrant opportunity, driven by substantial growth in demand for childcare services. India's rapidly expanding middle class and increasing female workforce participation are key indicators of this burgeoning demand. For instance, the Indian childcare market was valued at approximately $1.5 billion in 2023 and is projected to grow at a compound annual growth rate of over 12% through 2030, presenting a significant upside for well-positioned players.

However, this expansion is not without its challenges. Navigating India's diverse and often complex regulatory landscape, which varies by state, poses a significant hurdle. Furthermore, establishing a strong brand presence and market share against established local childcare providers requires substantial upfront investment in infrastructure, marketing, and talent acquisition, making the path to profitability uncertain and capital-intensive.

Bright Horizons' exploration into advanced digital platform development, aiming to enhance parent engagement and operational efficiency, falls into the question mark category of the BCG matrix. While the digital services market is experiencing robust growth, the success of these new, highly integrated solutions in securing significant market share and generating substantial profits remains uncertain. These ventures demand considerable investment in research and development, alongside aggressive marketing campaigns.

The company's commitment to these cutting-edge technologies, while strategically aligned with market trends, presents a challenge. For instance, in 2024, the EdTech market alone was projected to reach over $300 billion globally, showcasing the immense potential but also the intense competition. Bright Horizons' ability to differentiate and monetize these new platforms, especially in areas like personalized learning or advanced childcare management systems, is yet to be fully demonstrated, necessitating careful monitoring of adoption rates and return on investment.

Bright Horizons’ existing backup care services, which include elder care, could serve as a springboard for a more focused expansion into comprehensive elder care solutions. This move aligns with significant demographic trends, as the global population ages, creating a growing demand for specialized services beyond temporary support.

While the elder care market presents a high-growth prospect, Bright Horizons' current market share in this broader segment is likely modest. Entering this space requires considerable investment in building specialized programs, establishing robust networks of care providers, and cultivating deep expertise to compete effectively against established players.

Untapped Employer Segments or Industries

Bright Horizons is actively exploring untapped employer segments and industries where their current market penetration is low, but the demand for comprehensive work-life solutions is significant. These represent emerging opportunities with the potential for high growth, even if initial market share is minimal.

For instance, consider the burgeoning tech startup ecosystem. While many startups offer flexible work arrangements, they often lack the robust benefits packages that larger, more established companies provide. Bright Horizons could tailor its offerings to these agile businesses, focusing on scalable solutions. In 2024, the venture capital funding for tech startups, while experiencing some recalibration from previous highs, still represented billions invested, indicating a fertile ground for new partnerships.

Another promising area is the healthcare sector, particularly smaller, independent clinics and specialized medical practices. These organizations often struggle with employee retention due to demanding work schedules and the need for reliable childcare. Bright Horizons' services could directly address these pain points, improving morale and reducing turnover. The healthcare industry, a massive employer, saw continued growth in its workforce throughout 2024, with a significant portion of this growth in non-hospital settings.

- Emerging Tech Sector: Focus on startups needing scalable, flexible work-life benefits to attract and retain talent in a competitive landscape.

- Healthcare Practices: Target independent clinics and specialized medical groups facing high employee stress and turnover, offering solutions that enhance work-life balance.

- Gig Economy Platforms: Explore partnerships with platforms that utilize independent contractors, providing access to benefits and support services that enhance their overall work experience.

- Non-Profit Organizations: Develop specialized packages for non-profits that often have limited budgets but a strong need to support their mission-driven employees.

Specialized Educational Programs (e.g., STEM-focused childcare)

Developing and launching specialized educational programs, like those with a strong STEM focus for young children, addresses a clear demand from parents seeking advanced early learning opportunities. This strategic move could position Bright Horizons to capture a segment of a growing market.

While the demand for specialized education is on the rise, Bright Horizons' current market share within these specific niches might be relatively small. This necessitates significant investment in curriculum design, specialized teacher training, and targeted marketing efforts to effectively build brand recognition and customer acquisition in these specialized areas.

- Market Growth: The global early childhood education market was valued at approximately $250 billion in 2023 and is projected to grow significantly, with specialized STEM programs being a key driver.

- Investment Needs: Developing a high-quality STEM curriculum can cost upwards of $50,000 to $100,000 per program, including materials and specialized educator training.

- Competitive Landscape: While specialized programs are growing, the market is becoming more competitive, requiring differentiation through unique pedagogical approaches or proprietary content.

Bright Horizons' investment in new digital platforms for parent engagement and operational efficiency represents a classic Question Mark in the BCG matrix. The success of these innovative, integrated solutions in capturing significant market share and generating substantial profits remains uncertain, requiring considerable R&D and marketing investment. In 2024, the global EdTech market was projected to exceed $300 billion, highlighting both immense potential and fierce competition.

The company's foray into specialized STEM education programs also falls into this category. While demand for advanced early learning is strong, Bright Horizons' current market share in these specific niches is likely small, necessitating significant investment in curriculum development, specialized teacher training, and targeted marketing to build brand recognition and acquire customers effectively.

These ventures, while strategically aligned with market trends, present a challenge. Bright Horizons' ability to differentiate and monetize these new platforms, particularly in personalized learning or advanced childcare management, is yet to be fully demonstrated, demanding careful monitoring of adoption rates and ROI.

The success of these new digital initiatives and specialized educational programs is not guaranteed, making them Question Marks. They require substantial capital for development and marketing, with uncertain returns. For instance, the global early childhood education market was valued at around $250 billion in 2023, with STEM programs being a key growth driver, yet competition is intensifying.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.