Brickworks SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

Brickworks leverages its strong brand recognition and established distribution networks as key strengths, while facing potential threats from fluctuating raw material costs and increasing competition. Our analysis delves into these internal capabilities and external market dynamics, offering a clear view of their strategic position.

Ready to uncover the full strategic picture? Purchase our comprehensive SWOT analysis to gain actionable insights, understand potential growth avenues, and identify critical risk mitigation strategies for Brickworks. This in-depth report is your essential tool for informed decision-making.

Strengths

Brickworks boasts a diversified business model, spanning building products, a substantial property division, and a significant stake in Washington H. Soul Pattinson (WHSP). This broad portfolio offers considerable financial stability and resilience, effectively buffering against cyclical downturns in any single market segment.

This diversification proved beneficial in the first half of FY2025, where strong performance in the company's building products and property segments helped to offset weaker conditions elsewhere, contributing to robust overall results.

Brickworks' property division stands out as a significant strength, expertly managing and developing industrial and commercial real estate, often utilizing its own substantial land assets. This strategic approach has been a consistent driver of value for the company.

The first half of fiscal year 2025 saw robust EBITDA growth from this division, bolstered by stable capitalization rates and the successful pursuit of enhanced rental income streams. This financial performance underscores the division's operational efficiency and market responsiveness.

Furthermore, the property trusts managed by Brickworks boast an exceptionally low vacancy rate. This achievement, consistently maintained, reflects strong market demand for its properties and the division's adeptness in asset management and tenant retention.

Brickworks' strategic investment in Washington H. Soul Pattinson (WHSP) is a core strength, providing a consistent stream of stable and growing cash dividends that bolster earnings and offer crucial cyclical protection. As of the first half of 2024, WHSP's portfolio, which includes significant holdings in telecommunications, property, and healthcare, demonstrated resilience, contributing positively to Brickworks' overall financial performance.

The proposed merger between Brickworks and WHSP, slated for June 2025, is poised to unlock further value by creating a more integrated and streamlined entity. This consolidation is expected to enhance operational efficiencies and simplify the corporate structure, potentially leading to improved market valuation and greater financial flexibility for the combined group.

Leading Position in Australian Building Products

Brickworks stands as Australia's largest and most reputable brick manufacturer, commanding a leading position in the building products sector. This dominance is underpinned by a comprehensive portfolio that includes bricks, masonry blocks, and roofing tiles, catering to a wide array of construction needs.

Even with a generally subdued Australian building market, the Building Products Australia division has shown remarkable resilience. For the fiscal year 2024, this division reported a solid EBITDA margin, demonstrating the company's ability to manage costs and maintain profitability.

Brickworks' extensive network of manufacturing plants and sales outlets strategically located across Australia is a key strength. This infrastructure allows the company to efficiently meet market demands and maintain its competitive edge.

- Market Dominance: Australia's largest brick manufacturer with a comprehensive product range.

- Resilience in FY24: Maintained strong EBITDA margins despite a challenging construction environment.

- Extensive Infrastructure: Broad network of manufacturing and sales facilities across Australia.

Commitment to Sustainability and Safety

Brickworks demonstrates a robust commitment to sustainability and safety, underscored by its 'Build for Living: Towards 2025' strategy. This plan outlines specific, measurable goals for environmental stewardship, including ambitious targets for emission reduction and enhanced air quality control. The company also boasts an impressive history of continuous improvement in workplace safety metrics.

This dedication to ESG principles is not merely aspirational; it's recognized by external bodies. Brickworks has earned a top rating from Sustainalytics for its Environmental, Social, and Governance (ESG) Risk Ratings within the construction materials industry. For instance, in their 2024 assessments, Sustainalytics highlighted Brickworks' proactive approach to managing climate-related risks and its strong governance structures.

The alignment of Brickworks' sustainability efforts with increasing market demand for eco-friendly building solutions is a significant strength. This focus not only caters to a growing customer preference but also bolsters the company's brand reputation. As of early 2025, reports indicate that projects incorporating sustainable materials from Brickworks are experiencing higher demand, reflecting a tangible market advantage.

Key strengths in this area include:

- Clear Sustainability Strategy: 'Build for Living: Towards 2025' with defined environmental targets.

- External ESG Recognition: Top-rated by Sustainalytics for ESG Risk Ratings in the construction materials sector.

- Market Alignment: Meeting growing demand for sustainable building practices, enhancing brand value.

- Safety Track Record: Consistent improvements in workplace safety performance.

Brickworks' diversified business model, encompassing building products, property, and a significant stake in Washington H. Soul Pattinson (WHSP), provides substantial financial resilience. This diversification was evident in the first half of FY2025, where strong performances in building products and property offset weaker segments, contributing to robust overall results.

The property division is a key asset, adeptly managing and developing industrial and commercial real estate, often leveraging its own land. This division reported strong EBITDA growth in H1 FY2025, driven by stable capitalization rates and increased rental income, highlighting its operational efficiency.

Brickworks' strategic investment in WHSP offers a consistent stream of stable and growing cash dividends, bolstering earnings and providing cyclical protection. The proposed merger with WHSP in June 2025 is expected to unlock further value through enhanced operational efficiencies and a simplified corporate structure.

The company's leading position in the Australian building products sector is a significant strength, supported by a comprehensive product range including bricks, masonry, and roofing tiles. Despite a subdued construction market in FY2024, the Building Products Australia division maintained solid EBITDA margins, demonstrating cost management and profitability.

Brickworks' extensive network of manufacturing plants and sales outlets across Australia is a competitive advantage, enabling efficient market demand fulfillment. Furthermore, the company's commitment to sustainability, outlined in its 'Build for Living: Towards 2025' strategy, and its top ESG rating from Sustainalytics in 2024, align with growing market demand for eco-friendly solutions.

| Strength | Description | Supporting Data/Context |

| Diversified Business Model | Spans building products, property, and WHSP investment. | H1 FY2025 results showed resilience due to this mix. |

| Strong Property Division | Manages and develops industrial/commercial real estate. | Robust EBITDA growth in H1 FY2025; low vacancy rates. |

| Strategic WHSP Investment | Provides stable dividends and cyclical protection. | Proposed merger in June 2025 to enhance efficiency. |

| Market Leadership in Building Products | Largest brick manufacturer with a broad product portfolio. | Maintained solid EBITDA margins in FY2024 despite market challenges. |

| Extensive Infrastructure | Nationwide network of manufacturing and sales facilities. | Facilitates efficient market response and competitive edge. |

| Commitment to Sustainability | 'Build for Living: Towards 2025' strategy and ESG recognition. | Top ESG rating from Sustainalytics in 2024; growing demand for sustainable products. |

What is included in the product

Delivers a strategic overview of Brickworks’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable SWOT analysis to pinpoint and address key operational challenges.

Weaknesses

Brickworks' core building products divisions, especially those in Australia and North America, are quite sensitive to the ups and downs of the construction market. This means when construction slows, their business feels it directly.

For instance, during the first half of fiscal year 2025, the company faced tough market conditions. Building activity was sluggish, and there was a noticeable drop in new home starts, which directly affects demand for Brickworks' products.

This slowdown in the construction sector has had a clear impact on the revenue and profits of these key segments. Consequently, Brickworks has had to navigate reduced demand, which sometimes requires making operational adjustments to cope with the weaker market.

The Building Products North America division has been a significant drag, posting a substantial decline in EBIT and a loss in the first half of fiscal year 2025. This underperformance stems from challenging market conditions in key regions, forcing accelerated plant closures to better manage inventory and address product availability issues.

The business has been particularly hit by a more rapid deterioration of market conditions than initially forecast, impacting sales and profitability. For instance, the division reported a negative EBIT of A$10.7 million for the first half of FY2025, a stark contrast to the prior year's positive figure.

Elevated interest rates have significantly dampened demand for new construction and renovations, especially in Australia's residential market. This is because higher borrowing costs make new developments less attractive and erode buyer confidence, directly impacting sales for companies like Brickworks.

For instance, in the 2023 financial year, Brickworks reported a 12% decrease in building products revenue, largely attributed to the slowdown in residential construction activity, which saw new housing commencements fall to their lowest levels in a decade.

Rising Input Costs and Supply Chain Pressures

Brickworks is contending with escalating material expenses, particularly for energy-intensive inputs such as natural gas vital for its brick kilns. These rising costs, coupled with increasing transportation expenditures, directly impact operational profitability.

Inflationary trends are also pushing up labor costs and compliance expenses, adding to the overall financial strain on construction projects. This broader inflationary environment makes it harder for the company to maintain competitive pricing.

Ongoing global supply chain disruptions continue to create uncertainty regarding delivery schedules for essential materials. This unpredictability not only affects project timelines but also places significant pressure on budget management and overall profit margins.

- Rising Material Costs: Natural gas prices, a key input for brick production, have seen significant volatility, impacting kiln operations.

- Increased Transportation Expenses: Fuel surcharges and freight costs have risen, making the delivery of building materials more expensive.

- Wage Inflation: Higher labor costs across the construction sector, including for Brickworks' workforce, contribute to increased operational overhead.

- Supply Chain Volatility: Delays in the availability of raw materials and finished goods can disrupt production schedules and increase inventory holding costs.

Skilled Labour Shortages in the Construction Sector

The Australian construction sector is grappling with a significant and ongoing shortage of skilled labor. This includes essential tradespeople, qualified builders, and experienced project managers, creating a challenging environment for the industry as a whole.

This widespread scarcity directly translates into higher labor costs for construction companies, as they compete fiercely for a limited pool of talent. Such wage inflation can impact project profitability and the overall economic viability of new developments.

While not an internal operational flaw for Brickworks, this external labor deficit affects the broader construction market. It can slow down the pace of new projects and reduce the overall demand for construction materials, including those supplied by Brickworks, thereby impacting its sales volumes and revenue potential.

- Skilled Labour Shortage: The Australian construction industry faces a persistent deficit in skilled workers, impacting project timelines and costs.

- Wage Inflation: Competition for limited talent drives up wages, increasing operational expenses for construction firms.

- Project Delays: Lack of skilled personnel can lead to significant delays in project completion, affecting market demand.

- Market Demand Impact: The broader industry's challenges indirectly influence the demand for Brickworks' products.

Brickworks' Building Products North America segment experienced a significant downturn, reporting a negative EBIT of A$10.7 million in H1 FY2025 due to challenging market conditions and accelerated plant closures. This underperformance highlights a vulnerability to regional construction market fluctuations. Furthermore, elevated interest rates in Australia have dampened residential construction demand, contributing to a 12% revenue decrease in building products during FY2023. The company also faces rising operational costs from increased energy, transportation, and labor expenses, exacerbated by broader inflationary pressures.

| Segment | H1 FY2025 EBIT (A$) | Key Factor |

|---|---|---|

| Building Products North America | (10.7 million) | Challenging market conditions, accelerated plant closures |

| Building Products Australia | Impacted by elevated interest rates | Reduced residential construction demand |

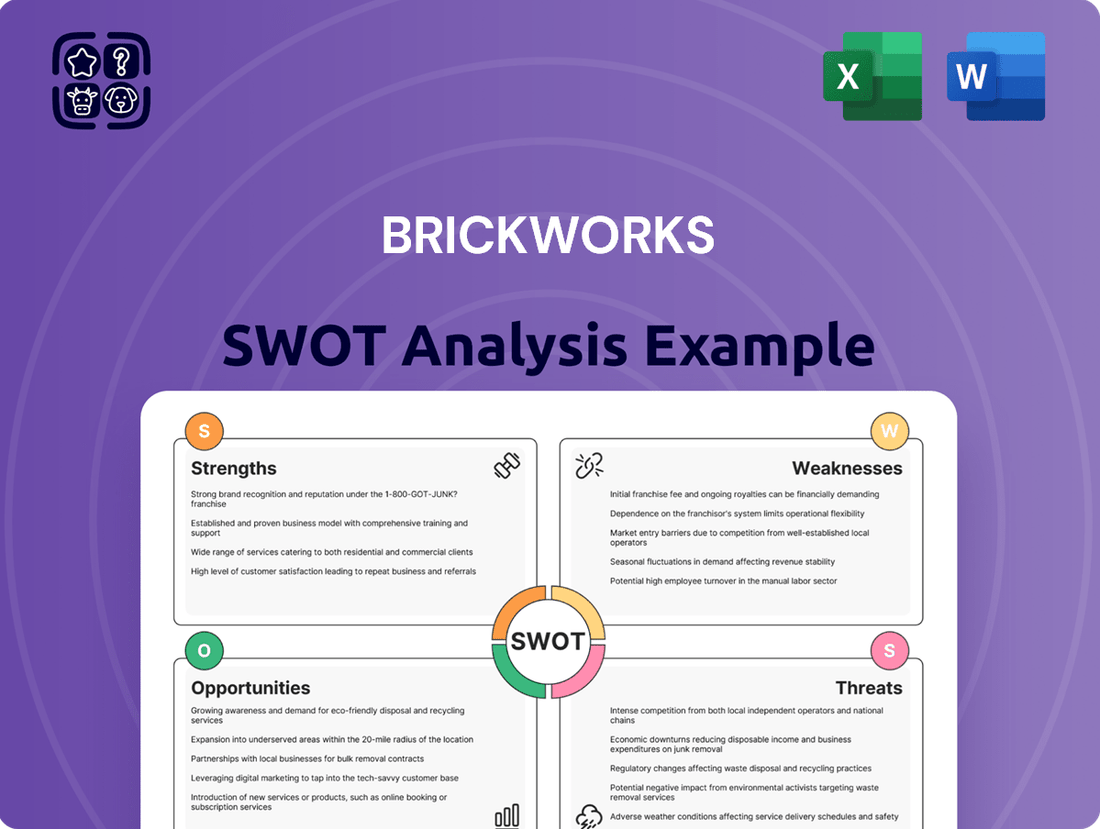

What You See Is What You Get

Brickworks SWOT Analysis

This is the actual Brickworks SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats, meticulously researched and presented for strategic decision-making.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights and a clear roadmap for leveraging advantages and mitigating risks within the brick manufacturing industry.

Opportunities

The Australian construction sector is poised for a rebound, with forecasts indicating improvement from fiscal year 2026 and continued strengthening into 2027. This recovery is underpinned by persistent housing shortages and the anticipated easing of interest rates, creating a more favorable environment for growth.

This projected cyclical upturn offers a substantial opportunity for Brickworks' building products segments. Renewed demand is expected to drive improved financial performance, particularly as the long-term need for housing remains robust in both Australia and North America.

Brickworks' industrial property portfolio presents a significant avenue for growth, with substantial opportunities to boost rental income. This expansion is expected from implementing mark-to-market rental adjustments on current leases and progressing its development of new industrial properties.

The strategic partnership with Goodman Group is a key enabler, strengthening Brickworks' ability to leverage the robust demand in the industrial real estate sector. For instance, Brickworks reported a 12% increase in its property earnings for the first half of FY24, reaching $161 million, underscoring the positive momentum in this segment.

The proposed merger with Washington H. Soul Pattinson (WHSP) presents a significant opportunity for Brickworks to create substantial value by increasing its operational scale and streamlining the complex historical cross-ownership. This strategic move aims to simplify the group structure, fostering greater transparency and efficiency.

For Brickworks shareholders, this consolidation is anticipated to deliver improved exposure to a more diversified asset base, which should offer better resilience against economic cycles and a stronger, more predictable cash flow generation capability. The combined entity is poised to boast a considerably larger net asset value and market capitalization, enhancing its financial standing and investment appeal.

Increasing Demand for Sustainable Building Materials

The Australian construction sector is seeing a significant shift towards sustainability, particularly with new mandatory climate-related financial disclosure requirements for large firms starting January 2025. This regulatory push is creating a stronger market demand for eco-friendly building materials.

Brickworks is strategically positioned to benefit from this trend. The company already offers carbon-neutral products and continues to invest in technologies aimed at reducing emissions. This proactive approach to sustainable manufacturing, reinforced by product certifications, directly addresses the growing market appetite for environmentally conscious construction solutions.

Key opportunities for Brickworks stemming from this trend include:

- Expanded Market Share: Capitalizing on the increasing demand for sustainable materials can lead to greater market penetration and attract environmentally conscious clients.

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability through product offerings and manufacturing practices can bolster Brickworks' brand image as an industry leader in eco-friendly solutions.

- New Product Development: The focus on sustainability may drive innovation, encouraging the development of new, even more environmentally friendly building materials and solutions.

Leveraging Government Infrastructure Spending

Government investment in infrastructure, particularly transportation projects, is a significant tailwind for Brickworks. The Australian government's commitment to boosting infrastructure is projected to see transportation construction work reach its peak around FY2025. This sustained public sector spending creates a reliable demand stream for Brickworks' extensive product portfolio, offering a degree of insulation from fluctuations in the private residential and commercial construction sectors.

This robust pipeline of government-funded projects presents a clear opportunity for Brickworks to capitalize on increased demand for its building materials. For example, the Australian government allocated over $120 billion to infrastructure projects in the 2023-2024 federal budget, with a substantial portion directed towards transport upgrades. This translates directly into a consistent need for products like bricks, pavers, and concrete, supporting sales volumes and potentially improving capacity utilization.

- Sustained Demand: Government infrastructure spending provides a predictable and substantial customer base for Brickworks' construction materials.

- FY2025 Peak: Projections indicate transportation construction activity will be at its highest point around FY2025, maximizing the benefit of current government investment.

- Diversification: This public sector demand acts as a counter-balance to any softness in the private building markets, enhancing overall business stability.

- Product Application: The broad range of Brickworks' offerings, from bricks to concrete, directly aligns with the material needs of major infrastructure developments.

The anticipated rebound in the Australian construction sector, projected to gain momentum from fiscal year 2026, presents a significant opportunity for Brickworks. This recovery, driven by housing shortages and potential interest rate easing, will likely boost demand for its building products.

Brickworks' industrial property portfolio offers substantial growth potential through mark-to-market rental adjustments and new developments, as evidenced by a 12% increase in property earnings to $161 million in H1 FY24.

The company's strategic focus on sustainability, including carbon-neutral products, aligns with the growing market demand for eco-friendly building materials, potentially expanding market share and enhancing brand reputation.

Government investment in infrastructure, particularly transportation projects peaking around FY2025, provides a stable demand for Brickworks' products, diversifying revenue streams and mitigating risks in private construction markets.

Threats

The Australian construction sector faces persistent economic headwinds, characterized by elevated interest rates and ongoing global market volatility. For instance, the Reserve Bank of Australia's cash rate remained at 4.35% through early 2024, impacting borrowing costs for developers and end-buyers alike.

This challenging environment can prompt developers to postpone or cancel projects, while clients tend to become more price-sensitive. Consequently, project budgets tighten, leading to a potential dampening of demand for essential building materials like those supplied by Brickworks.

Such economic uncertainty directly translates into a tangible risk for Brickworks, potentially affecting its revenue streams and overall profitability as project pipelines and order volumes become less predictable.

Brickworks faces a highly competitive building products market, with established domestic rivals like Boral, James Hardie Industries, and CSR vying for market share. Internationally, significant players such as DuPont, LafargeHolcim, and Titan Cement also present a competitive challenge. This intense rivalry can directly impact pricing strategies and profit margins, necessitating ongoing efforts in innovation and operational efficiency to maintain a competitive edge.

The Australian construction sector is facing a significant challenge with a surge in insolvencies, especially impacting smaller subcontractors and suppliers. This fragility in the supply chain can translate into higher material and service costs, alongside extended project timelines. For Brickworks, this translates to a tangible risk of diminished order volumes and potential payment delays, impacting its established customer relationships and distribution networks.

Increasing Regulatory Burdens and Compliance Costs

New regulations, like mandatory climate-related financial disclosures for Australian construction firms starting January 2025, present a significant challenge. These reforms, while boosting transparency, will necessitate substantial adaptation. Brickworks, like its peers, will face increased operational costs and administrative workloads to ensure compliance with these evolving legislative requirements.

The financial impact of these new rules is a key concern. For instance, the estimated cost for companies to implement robust ESG reporting frameworks can range from tens of thousands to hundreds of thousands of dollars annually, depending on company size and complexity. This directly translates to higher compliance expenses for Brickworks.

- Regulatory Changes: Mandatory climate-related financial disclosures from January 2025 for large and medium-sized construction firms in Australia.

- Impact on Operations: Increased administrative burdens and the need to adapt to stricter compliance measures.

- Financial Implications: Potential for significantly higher operational costs and investment in new reporting systems.

Geopolitical Tensions and Global Supply Chain Vulnerabilities

Geopolitical tensions remain a significant threat, with ongoing conflicts and trade disputes potentially leading to increased tariffs or sanctions impacting the cost of imported materials. For instance, disruptions in the global supply chain, as seen with shipping container availability and port congestion in 2024, can directly affect the price and availability of key inputs for Brickworks. This volatility makes it challenging to forecast production costs and maintain consistent pricing for customers, creating an unpredictable operating landscape.

These external factors can escalate the cost of essential building materials, directly impacting Brickworks' bottom line. For example, a 10% increase in the price of imported clinker or specialized additives due to new trade barriers could significantly raise manufacturing expenses. This forces businesses like Brickworks to either absorb these costs, reducing profit margins, or pass them onto consumers, potentially impacting sales volumes.

- Trade Restrictions: Potential for new tariffs or sanctions on construction materials or machinery, increasing import costs.

- Supply Chain Disruptions: Continued volatility in global shipping and logistics, leading to delays and higher freight charges for raw materials.

- Material Price Volatility: Unpredictable fluctuations in the cost of key inputs like clay, cement, and energy due to geopolitical events.

- Economic Uncertainty: Geopolitical instability often correlates with broader economic downturns, reducing overall demand for construction products.

Brickworks faces significant threats from the volatile Australian economic landscape, marked by high interest rates that impact developer borrowing and buyer affordability. For example, the Reserve Bank of Australia maintained its cash rate at 4.35% through early 2024, a factor that continues to influence project viability and demand for building materials.

Intense competition from domestic players like Boral and international giants such as LafargeHolcim pressures pricing and profit margins, requiring continuous innovation. Furthermore, increasing construction sector insolvencies in Australia pose a risk of supply chain disruptions and payment delays, potentially impacting Brickworks' order volumes and customer relationships.

New regulations, including mandatory climate-related financial disclosures for Australian construction firms from January 2025, will likely increase operational costs and administrative burdens. Geopolitical instability also presents a threat through potential trade restrictions and supply chain disruptions, leading to material price volatility and impacting production costs.

| Threat Category | Specific Risk | Potential Impact on Brickworks | Relevant Data/Context (2024-2025) |

|---|---|---|---|

| Economic Headwinds | High interest rates, reduced consumer spending | Lower demand for building materials, project delays/cancellations | RBA Cash Rate at 4.35% (early 2024); inflation concerns persist. |

| Market Competition | Intense rivalry from established and new players | Pressure on pricing, reduced market share, need for innovation | Key competitors include Boral, James Hardie, CSR (Australia); DuPont, Holcim (Global). |

| Supply Chain Fragility | Increased insolvencies in construction sector | Disrupted material supply, delayed projects, potential payment issues | Rising insolvencies in Australian construction sector noted throughout 2024. |

| Regulatory Changes | Mandatory climate disclosures (from Jan 2025) | Increased compliance costs, administrative burden, potential investment in new systems | New ESG reporting requirements for large/medium Australian construction firms. |

| Geopolitical Instability | Trade disputes, supply chain disruptions | Higher import costs, material price volatility, logistics challenges | Global shipping costs and port congestion remained a concern in 2024. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Brickworks' official financial reports, comprehensive market research, and expert industry analyses to provide a clear and actionable strategic overview.