Brickworks Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

Brickworks faces significant competitive pressures, with moderate buyer power and the constant threat of new entrants in the building materials sector. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Brickworks’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of raw material suppliers is a key consideration for Brickworks. The availability and pricing of essential inputs such as clay, sand, aggregates, and cement directly influence production costs. For instance, fluctuations in global commodity prices, like cement, can create cost pressures. In 2023, global cement prices saw volatility due to energy costs and supply chain disruptions, directly impacting manufacturers like Brickworks.

Energy, especially natural gas and electricity, represents a significant cost for companies like Brickworks that rely on firing-intensive processes to manufacture bricks and other building materials. In 2024, the volatility of global energy markets directly impacts these operational expenses, with natural gas prices experiencing notable fluctuations throughout the year. For instance, average industrial electricity prices in many developed nations saw an increase of 5-10% in early 2024 compared to the previous year, directly squeezing margins for energy-intensive manufacturers.

When a few dominant energy providers control the supply, they gain considerable leverage over businesses such as Brickworks. This bargaining power allows them to potentially dictate terms and prices, directly impacting Brickworks' overall profitability and its ability to maintain competitive pricing for its products. The reliance on a limited number of suppliers means fewer alternatives for securing essential energy, amplifying the suppliers' influence.

The bargaining power of labor suppliers for Brickworks is significantly influenced by the availability of skilled workers across its manufacturing, property development, and logistics operations within Australia. A constrained labor market, as seen in some periods of 2024 with specific trades experiencing shortages, can empower employees and unions, potentially driving up wage costs for the company.

Equipment and Technology Suppliers

The bargaining power of equipment and technology suppliers significantly impacts Brickworks. Specialized machinery for brickmaking and concrete production often originates from a concentrated global market, meaning there are few alternatives for critical components or advanced manufacturing technology. This reliance can empower these suppliers, allowing them to influence pricing and terms for essential equipment, maintenance services, and technology upgrades. For instance, in 2024, the global construction equipment market, which includes specialized machinery relevant to Brickworks, was valued at approximately $220 billion, with a notable portion driven by advanced, proprietary technologies.

This concentration of specialized suppliers means Brickworks may face limited negotiation leverage when acquiring new technology or replacement parts. Dependence on specific vendors for proprietary equipment, crucial for maintaining production efficiency and quality, can translate into higher costs or less favorable contract conditions. For example, a supplier of advanced kiln technology might dictate terms due to the unique nature of their offering, impacting Brickworks' capital expenditure and operational costs.

- Limited Global Suppliers: Specialized machinery for brick and concrete production is often sourced from a small number of global manufacturers.

- Dependence on Critical Equipment: Reliance on specific vendors for essential machinery, maintenance, and upgrades grants suppliers considerable leverage.

- Impact on Capital Expenditure: The cost and terms associated with acquiring advanced manufacturing technology from these suppliers directly affect Brickworks' investment decisions.

- Maintenance and Upgrades: Exclusive service agreements or proprietary parts for specialized equipment can further solidify supplier power.

Logistics and Transport Suppliers

The bargaining power of logistics and transport suppliers is a significant factor for Brickworks, given the substantial volume of building materials they handle. The cost and efficiency of moving products from manufacturing sites to customers directly affect profitability. In 2024, the transportation sector, particularly trucking, faced ongoing challenges including driver shortages and rising fuel prices, which can amplify the leverage of these service providers.

For Brickworks, the dependence on a limited number of specialized transport providers for certain regions or types of materials can increase supplier power. If alternative shipping or rail options are scarce or less economical for their specific needs, these suppliers can command higher rates. This was particularly evident in late 2023 and early 2024, where supply chain disruptions continued to put pressure on freight costs globally.

- Dependence on Specialized Transport: Brickworks relies on efficient logistics for bulky building materials, making transport providers critical partners.

- Cost Impact: Rising fuel costs and driver shortages in 2024 directly increased transportation expenses, empowering logistics suppliers.

- Limited Alternatives: Scarcity of alternative shipping or rail options for specific routes or materials can grant suppliers greater pricing power.

- Supply Chain Vulnerability: Disruptions in the logistics sector can exacerbate supplier leverage, impacting Brickworks' distribution costs.

The bargaining power of suppliers for Brickworks is influenced by several factors, including the availability of raw materials, energy costs, labor, equipment, and logistics. Concentrated markets for specialized equipment and limited alternatives in logistics can significantly empower suppliers. For instance, in 2024, rising energy prices and skilled labor shortages directly impacted operational costs for manufacturers like Brickworks.

| Supplier Category | Key Factors Influencing Power | Impact on Brickworks | 2024 Context/Data Point |

|---|---|---|---|

| Raw Materials (Clay, Sand) | Availability, quality, extraction costs | Directly affects cost of goods sold | Stable in most Australian regions, localized price variations |

| Energy (Natural Gas, Electricity) | Global energy market volatility, supplier concentration | Significant operational cost driver | Industrial electricity prices up 5-10% in early 2024 in many developed nations |

| Labor (Skilled Trades) | Labor market tightness, unionization | Influences wage costs and operational efficiency | Skilled trade shortages reported in certain Australian regions in 2024 |

| Equipment & Technology | Supplier market concentration, proprietary technology | Affects capital expenditure and maintenance costs | Global construction equipment market valued ~ $220 billion in 2024, driven by advanced tech |

| Logistics & Transport | Fuel prices, driver availability, route exclusivity | Impacts distribution costs and delivery times | Trucking sector faced driver shortages and rising fuel costs in 2024 |

What is included in the product

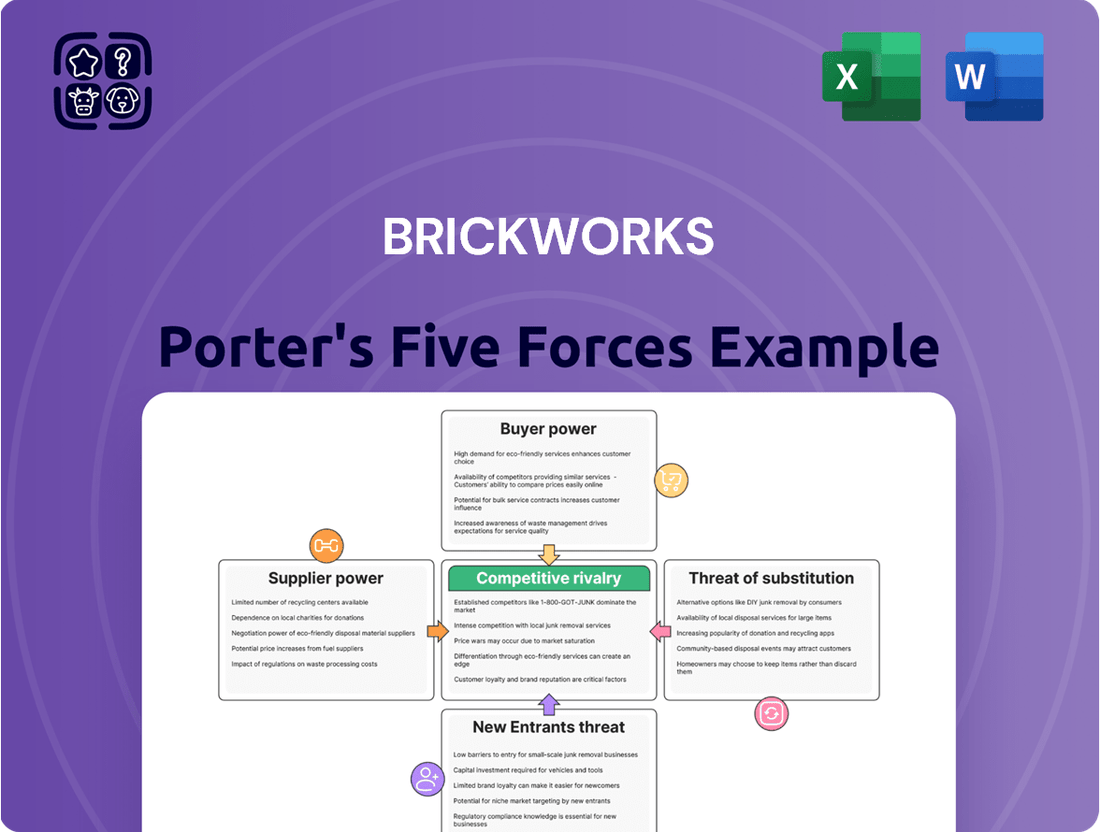

Tailored exclusively for Brickworks, this analysis dissects the five competitive forces shaping its industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

Large construction companies and property developers are significant customers for Brickworks, often purchasing materials in bulk. In 2024, major developers like Lendlease and Mirvac, known for their large-scale projects, would have had considerable leverage to negotiate pricing and terms due to their substantial order volumes. This scale allows them to demand discounts and favorable payment schedules, directly impacting Brickworks' profitability on these contracts.

Building material retailers and distributors hold significant bargaining power over manufacturers like Brickworks. These intermediaries, ranging from large retail chains to independent distributors, act as crucial links to the end consumer. Their ability to stock products from multiple manufacturers, or even develop their own private label brands, provides them with considerable leverage in negotiations regarding pricing, payment terms, and supply chain logistics.

Government and public sector clients, particularly those involved in large infrastructure or public housing projects, wield significant bargaining power. Their substantial order volumes and the competitive nature of public tenders, where pricing is a key determinant, allow them to negotiate favorable terms and pricing. For instance, in 2024, major government infrastructure spending initiatives across various developed economies are expected to drive demand for construction materials, placing these public bodies in a strong position to influence supplier pricing.

Individual Home Builders and Renovators

Individual home builders and renovators, while typically buying in smaller quantities, represent a substantial collective market for building materials. Their bargaining power is generally limited on an individual basis, but their aggregate demand, often funneled through intermediaries like large retail chains, can still exert pressure on pricing. For instance, in 2023, the U.S. saw over 1.4 million housing starts, indicating a significant volume of individual projects relying on suppliers.

These customers' sensitivity to price and their brand preferences can indirectly influence manufacturers' strategies. Retailers, acting as aggregators of this demand, can leverage this collective power to negotiate better terms with suppliers like Brickworks. This dynamic means that while a single renovator might not have much sway, the combined purchasing power of thousands of such individuals, managed by retailers, becomes a factor in the supply chain.

- Low Individual Bargaining Power: Individual builders and renovators typically purchase smaller volumes, limiting their direct negotiation leverage.

- Significant Collective Demand: The aggregate demand from numerous individual projects creates substantial market volume.

- Price Sensitivity and Brand Preference: These customer segments are often influenced by price points and specific brand reputations.

- Retailer Influence: Retail channels amplify customer demand, enabling retailers to exert greater bargaining power with suppliers.

Diversified Product Portfolio

Brickworks' extensive range of building products, encompassing everything from bricks and masonry blocks to roofing solutions, can indeed dilute the bargaining power of customers who might otherwise seek a singular material. This diversification means a customer needing multiple components for a project is more likely to source them from a single, comprehensive supplier like Brickworks, reducing their leverage.

However, customers retain a degree of influence. They can still exert pressure by strategically switching between different material types for specific applications or by sourcing particular product categories from alternative suppliers. For instance, a builder might opt for Brickworks' bricks but source roofing tiles from a competitor if pricing or availability is more favorable for that specific item.

In 2024, the construction industry continued to see fluctuations in material costs. For example, the price of certain types of clay bricks saw an average increase of 4-6% in the first half of the year, according to industry reports. This environment can amplify customer sensitivity to pricing across Brickworks' entire product offering, even with a diversified portfolio.

- Diversification Benefit: Brickworks' broad product line reduces reliance on any single material category, potentially lowering overall customer bargaining power.

- Material Substitution: Customers can still switch between material types (e.g., brick vs. concrete block) or seek alternative suppliers for specific products, maintaining some leverage.

- 2024 Market Context: Rising material costs in 2024, with some brick types increasing by 4-6%, made customers more price-sensitive across a wider range of building products.

Large customers like construction firms and developers have significant power due to bulk purchases, allowing them to negotiate favorable pricing and payment terms. Retailers also wield considerable influence by stocking multiple brands and having direct access to consumers, which strengthens their negotiating position with manufacturers like Brickworks.

| Customer Segment | Bargaining Power Drivers | Impact on Brickworks |

|---|---|---|

| Major Developers | Bulk purchasing, project scale | Price negotiation, favorable payment terms |

| Retailers/Distributors | Product aggregation, alternative sourcing | Pricing, payment, logistics influence |

| Government/Public Sector | Large order volumes, tender processes | Price control, contract terms |

| Individual Home Builders | Aggregate demand (via retailers) | Indirect price pressure |

What You See Is What You Get

Brickworks Porter's Five Forces Analysis

This preview showcases the complete Brickworks Porter's Five Forces Analysis, detailing the competitive landscape for the company, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently assess the strategic insights and actionable recommendations within this comprehensive report, knowing it accurately reflects the final deliverable.

Rivalry Among Competitors

The Australian building materials sector is characterized by a concentrated market with a few dominant players, including Boral, Adbri, and CSR, in addition to Brickworks. This oligopolistic structure means that rivalry among these large, diversified companies is inherently high as they compete for market share across a broad range of products.

The Australian construction and property sectors are experiencing varied growth. For instance, the Australian Bureau of Statistics reported that building activity in the March quarter of 2024 saw a 1.4% increase in the value of total construction work done, a modest but positive sign. However, this overall growth rate directly fuels competitive intensity within the brick manufacturing industry.

When the broader market expands, there's more room for all players, potentially softening rivalry. Conversely, during economic downturns or periods of stagnation, companies like Brickworks must fight harder for market share. This can manifest as aggressive pricing strategies or increased promotional spending as businesses strive to secure sales volumes and avoid a decline in profitability.

While building materials often seem interchangeable, companies like Brickworks strive to stand out. They achieve this by emphasizing superior quality, appealing aesthetics, eco-friendly attributes, and cultivating a strong brand image. Brickworks benefits from its established history and well-known name in the brick industry, giving it a distinct edge.

However, competitors are always on the lookout for new ways to innovate or present attractive substitute products. This ongoing pursuit of differentiation means that even established players must continually adapt to maintain their market position.

Exit Barriers

The building materials sector, including companies like Brickworks, faces substantial exit barriers. These are largely driven by the significant capital investments required for manufacturing plants, specialized machinery, and established distribution channels. For instance, the cost of setting up a new brick manufacturing facility can run into tens of millions of dollars, making it economically unviable for many to simply shut down operations during periods of low demand.

These high fixed costs mean that companies are incentivized to continue operating even when profitability is low, rather than incur further losses by exiting. This leads to a scenario where firms often compete aggressively to maintain market share, even in challenging economic conditions. The commitment to these fixed assets fosters sustained competitive rivalry.

- High Capital Investment: The building materials industry demands substantial upfront investment in plant, property, and equipment, creating a significant hurdle for new entrants and a disincentive for existing players to exit.

- Specialized Assets: Many assets, such as kilns for brick production or specialized concrete mixing equipment, have limited alternative uses, increasing the cost of exiting the market.

- Distribution Networks: Developing and maintaining extensive logistics and distribution networks for bulky materials represents another substantial investment that ties companies to the industry.

Cost Structure and Economies of Scale

Companies that can produce goods or services at a lower cost, often by leveraging economies of scale, tend to have a significant advantage. This means that larger operations can spread their fixed costs over more units, reducing the cost per unit. For instance, a major brick manufacturer producing millions of bricks annually will likely have a lower cost per brick than a smaller producer.

Brickworks benefits from its integrated business model, encompassing both manufacturing and property development. This integration can lead to cost efficiencies through streamlined supply chains and shared resources. However, competitors are also actively pursuing operational optimization to remain competitive on price. In 2024, the building materials sector saw continued pressure on input costs, with energy prices remaining a significant factor influencing production expenses for brick manufacturers.

- Economies of scale in brick production significantly lower per-unit costs.

- Brickworks' integrated operations offer potential cost efficiencies.

- Competitors are also focused on optimizing their cost structures.

- Rising energy costs in 2024 impacted the cost structure of brick manufacturers.

Competitive rivalry in the Australian building materials sector, particularly for brick manufacturers like Brickworks, is intense due to the presence of a few large, established players. This high degree of competition is further fueled by the cyclical nature of the construction industry, where fluctuating demand can lead to aggressive pricing and promotional activities as companies fight for market share.

Companies differentiate themselves through product quality, aesthetics, and sustainability, but the underlying pressure to maintain sales volumes remains constant. For example, in the March quarter of 2024, while construction work saw a slight increase, the ongoing need to secure contracts means that price and value propositions are critical battlegrounds.

The industry's high exit barriers, stemming from substantial capital investments in specialized manufacturing assets and distribution networks, compel existing firms to compete vigorously even during downturns. This commitment to fixed assets creates a persistent rivalry, as companies must operate at high capacity to amortize costs, leading to a constant struggle for every available project.

| Competitor | Market Focus | Key Strengths |

|---|---|---|

| Boral | Building products, including bricks, concrete, and roofing | Diversified product portfolio, strong brand recognition |

| Adbri | Cement, concrete, and aggregates | Extensive quarrying and logistics network |

| CSR | Building materials, including plasterboard, insulation, and roofing | Broad product range, significant market share in various segments |

SSubstitutes Threaten

The threat of substitutes for traditional bricks in construction is significant. For residential and commercial projects, alternatives like timber framing with diverse cladding, lightweight concrete, and pre-fabricated modular systems are readily available. These options present varied aesthetics, insulation capabilities, and faster construction timelines, directly impacting demand for brick products.

For instance, the global modular construction market was valued at approximately USD 129.2 billion in 2023 and is projected to grow substantially, indicating a strong preference for faster building solutions. Similarly, the timber construction sector is experiencing robust growth, driven by sustainability initiatives and design flexibility, further intensifying competition for brick manufacturers.

While Brickworks is known for its clay and concrete roofing tiles, the threat of substitutes is significant. Metal roofing, particularly Colorbond, has gained popularity due to its durability and modern aesthetic, with the Australian metal roofing market valued at approximately AUD 2.5 billion in 2023, projected to grow steadily.

Asphalt shingles also present a cost-effective alternative, especially in markets where they are more prevalent. Furthermore, emerging options like green roofs, while niche, are gaining traction driven by sustainability trends and government incentives for energy-efficient buildings.

Beyond traditional pavers, driveways and outdoor spaces can be constructed using poured concrete, asphalt, gravel, timber decking, or natural stone. These alternatives offer varying cost points and aesthetic appeals, directly influencing consumer choices away from brick pavers.

The cost-effectiveness of alternatives like asphalt, which can range from $2 to $4 per square foot in 2024, presents a significant challenge to brick pavers, often priced between $10 to $30 per square foot installed. This price disparity makes concrete ($3 to $7 per square foot) and even gravel ($1 to $3 per square foot) more attractive options for budget-conscious consumers, thereby limiting the market share for brick paver manufacturers like Brickworks.

Precast Concrete Alternatives

While Brickworks offers precast concrete, the threat of substitutes remains a significant consideration. Alternative structural materials like steel framing, engineered timber, and traditional on-site poured concrete can fulfill similar load-bearing roles in construction. The choice often depends on project specifics such as the building’s size, the desired construction timeline, and unique engineering demands.

The market for structural solutions is diverse. For instance, in 2023, the global steel construction market was valued at approximately $200 billion, indicating a substantial alternative to precast concrete. Timber construction is also gaining traction, with the global engineered wood market projected to reach over $30 billion by 2027, driven by sustainability trends.

- Steel Framing: Offers high strength-to-weight ratio and rapid assembly, particularly for large-scale commercial and industrial projects.

- Timber Construction: Increasingly popular for its environmental benefits and aesthetic appeal, especially in residential and mid-rise buildings.

- On-Site Poured Concrete: Provides flexibility in design and can be cost-effective for certain custom or complex structures, though often slower to erect.

Technological Advancements in Construction

New construction technologies, like 3D-printed buildings and advanced composite materials, are poised to become significant substitutes for traditional brick and mortar products. These innovations, though currently in early stages, have the potential to fundamentally alter the construction landscape.

The disruption could manifest through faster build times and reduced labor costs. For instance, 3D printing technology has demonstrated the ability to construct simple homes in a matter of days, a stark contrast to traditional methods. Furthermore, the development of lighter, stronger, and more sustainable materials could offer performance advantages, further incentivizing their adoption over conventional bricks.

- 3D Printing: Projects have shown completion times reduced by up to 50% compared to traditional builds.

- Advanced Composites: Offer superior strength-to-weight ratios, potentially lowering transportation and installation costs.

- Sustainability Focus: Emerging materials often boast lower embodied energy and reduced waste in production.

The threat of substitutes for Brickworks' core products, particularly traditional bricks and pavers, remains substantial. Alternatives like timber, lightweight concrete, and metal roofing offer competitive advantages in terms of cost, speed of construction, and evolving aesthetic preferences. The increasing adoption of modular construction and innovative materials like 3D-printed elements further intensifies this competitive pressure.

The cost-effectiveness of alternatives is a key driver, with asphalt driveways costing significantly less than brick pavers. For example, asphalt installation in 2024 can range from $2 to $4 per square foot, while brick pavers typically fall between $10 to $30 per square foot. This price gap makes concrete pavers ($3 to $7 per square foot) and even gravel ($1 to $3 per square foot) more appealing for budget-conscious projects, directly impacting Brickworks' market share in the paving segment.

In roofing, metal roofing, exemplified by Colorbond, is a strong substitute for traditional tiles. The Australian metal roofing market was valued at approximately AUD 2.5 billion in 2023, reflecting its significant market presence. While asphalt shingles offer a more budget-friendly option, emerging sustainable solutions like green roofs are also gaining traction, driven by environmental concerns and incentives.

| Product Category | Brickworks Product | Key Substitutes | Estimated Substitute Cost (2024) | Market Trend/Driver |

|---|---|---|---|---|

| Wall Construction | Traditional Bricks | Timber Framing, Lightweight Concrete, Steel Framing | Timber: Varies widely; Steel: $5-$15/sq ft (installed) | Speed of construction, sustainability, design flexibility |

| Roofing | Clay/Concrete Tiles | Metal Roofing (e.g., Colorbond), Asphalt Shingles | Metal: $4-$10/sq ft; Asphalt: $3-$7/sq ft | Durability, aesthetics, cost-effectiveness |

| Paving/Driveways | Brick Pavers | Poured Concrete, Asphalt, Gravel | Asphalt: $2-$4/sq ft; Concrete: $3-$7/sq ft; Gravel: $1-$3/sq ft | Cost, installation speed, maintenance |

Entrants Threaten

Establishing a new brickworks or large-scale building materials manufacturing facility demands significant upfront capital. This includes substantial investment in land acquisition, advanced machinery, and essential infrastructure, creating a formidable barrier for aspiring competitors.

For instance, in 2024, the cost of acquiring suitable industrial land and setting up a modern brick manufacturing plant can easily run into tens of millions of dollars, deterring smaller entities from entering the market.

Brickworks, as an established leader, leverages significant economies of scale across its operations. This means they can produce bricks, pavers, and other building materials at a lower cost per unit compared to potential newcomers. For instance, in 2023, Brickworks' building products segment reported revenues of AUD 2.7 billion, reflecting a substantial operational footprint that underpins these cost advantages.

New entrants would find it challenging to match these efficiencies without substantial upfront investment to achieve comparable production volumes. This cost disadvantage makes it difficult for new players to compete effectively on price against established entities like Brickworks, thereby acting as a barrier to entry.

Brickworks benefits significantly from deep-rooted brand loyalty, cultivated over decades of consistent quality and service. This loyalty makes it difficult for newcomers to attract customers away from established preferences. For instance, in 2024, Brickworks reported strong customer retention rates, indicating the stickiness of its brand among its core client base of builders and developers.

New entrants face substantial hurdles in replicating Brickworks' extensive distribution network. The company has built robust relationships with builders, developers, and retailers across Australia, providing them with reliable access to their products. Establishing similar widespread distribution channels would require significant investment and time, a barrier that deters many potential competitors.

Regulatory Hurdles and Environmental Compliance

The building materials sector faces significant regulatory challenges that deter new entrants. These include stringent environmental regulations, evolving building codes, and the need for various planning permits. For instance, in 2024, the European Union continued to strengthen its Green Deal initiatives, impacting material sourcing and production processes, which requires substantial investment in compliance for any new player.

Navigating these complex frameworks is a major barrier. New companies must invest heavily in understanding and adhering to these rules, often requiring specialized legal and technical expertise. This can translate into lengthy approval processes and considerable upfront costs, making market entry particularly difficult.

- Environmental Regulations: Compliance with emissions standards and sustainable material sourcing mandates.

- Building Codes: Adherence to local and national standards for structural integrity and safety.

- Planning Permits: Securing approvals for manufacturing facilities and distribution networks.

- Certification Requirements: Obtaining certifications for product quality and environmental impact.

Access to Raw Materials and Skilled Labor

New entrants face significant hurdles in securing essential raw materials like clay quarries. Established players often possess long-term leases or outright ownership of prime resource locations, giving them a cost advantage. For instance, in 2024, the global average cost of extracting construction-grade clay saw a notable increase due to stricter environmental regulations and limited new quarry discoveries, making it harder for newcomers to compete on price.

Attracting and retaining a skilled workforce in manufacturing and property development also presents a challenge. Experienced personnel are crucial for efficient production and successful project execution. Companies with a strong track record and established training programs tend to retain top talent, leaving new entrants to compete for a smaller pool of available expertise. In 2024, the construction industry continued to grapple with a skilled labor shortage, with some regions reporting a deficit of over 20% in experienced tradespeople.

- Resource Control: Established brick manufacturers often control key clay quarrying sites, limiting access for new competitors.

- Skilled Workforce: A shortage of experienced bricklayers and property developers in 2024 made it difficult for new entrants to build capable teams.

- Capital Investment: The significant capital required to acquire raw material sources and train personnel acts as a substantial barrier.

The threat of new entrants in the brickworks industry is moderate, primarily due to high capital requirements and established brand loyalty. Significant upfront investment in land, machinery, and infrastructure, often in the tens of millions of dollars as seen in 2024, deters many potential competitors. Furthermore, existing players like Brickworks benefit from economies of scale, with their 2023 building products segment generating AUD 2.7 billion in revenue, allowing for lower production costs that are difficult for newcomers to match.

New entrants also face challenges in replicating extensive distribution networks and overcoming strong brand loyalty. Regulatory hurdles, including environmental standards and planning permits, add further complexity and cost. For example, in 2024, stricter EU Green Deal initiatives necessitate significant compliance investments. Securing raw materials, such as prime clay quarries, and attracting a skilled workforce, a challenge exacerbated by a 2024 construction industry skilled labor shortage of over 20% in some regions, also act as substantial barriers.

| Barrier Type | Description | 2024 Impact/Example |

|---|---|---|

| Capital Investment | High costs for land, machinery, and infrastructure. | Tens of millions of dollars for a modern plant. |

| Economies of Scale | Lower per-unit costs for established players. | Brickworks' AUD 2.7 billion revenue in 2023 highlights operational scale. |

| Brand Loyalty & Distribution | Established customer relationships and networks. | Strong customer retention rates for Brickworks in 2024. |

| Regulatory Compliance | Meeting environmental and building code standards. | EU Green Deal initiatives increasing compliance costs. |

| Resource Access & Labor | Control of raw materials and skilled workforce availability. | Skilled labor shortage exceeding 20% in construction in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brickworks leverages data from annual reports, industry association publications, and market research firms to understand competitive intensity and market dynamics.

We also incorporate insights from financial news, government economic data, and company investor relations materials to provide a comprehensive view of the industry's competitive landscape.