Brickworks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brickworks Bundle

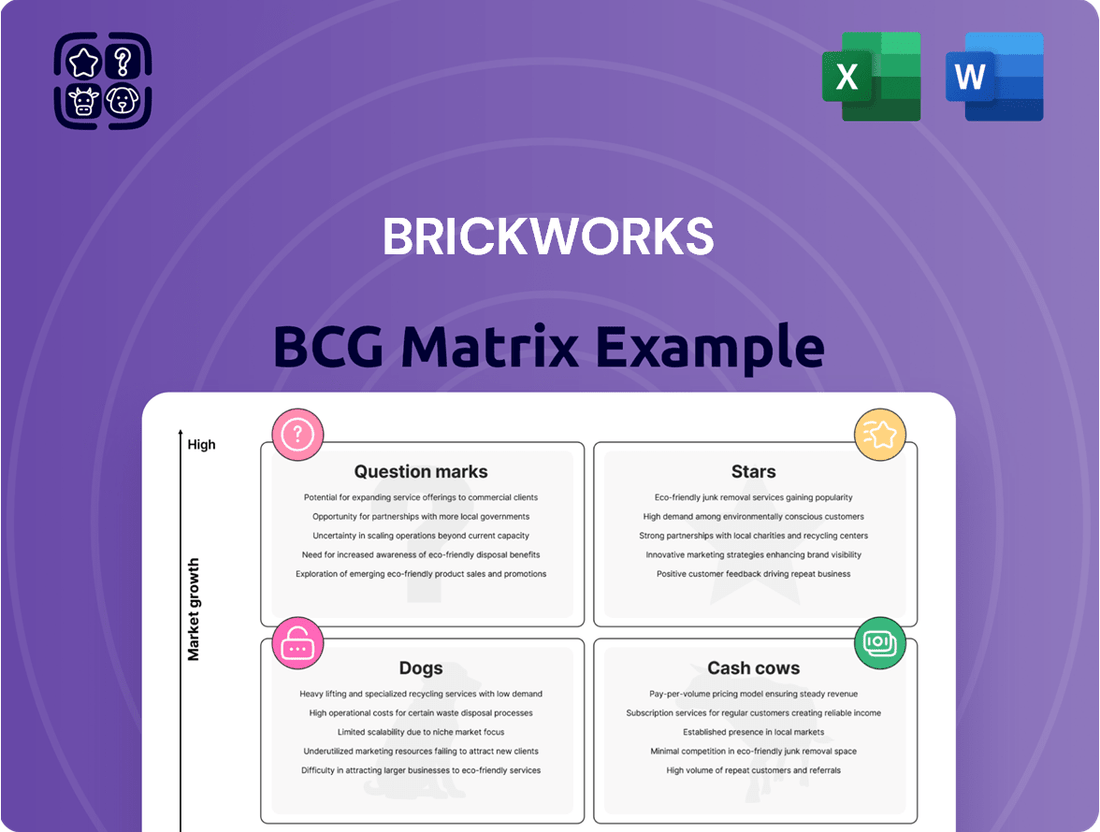

This glimpse into the Brickworks BCG Matrix highlights how their diverse portfolio is positioned for growth and stability. Understand which segments are driving revenue and which require strategic attention to unlock their full potential.

Ready to transform this understanding into actionable strategy? Purchase the full BCG Matrix report for a complete quadrant breakdown, data-driven insights, and a clear roadmap to optimize Brickworks' product portfolio for maximum market impact.

Stars

Brickworks' property division, especially its collaborations with Goodman Group, showcases robust growth potential. The successful completion of Oakdale West Estate and obtaining planning permission for Oakdale East Stage 2, which includes a pre-lease commitment from Amazon, underscore the strong market appetite for premium industrial real estate in Western Sydney.

These significant developments are projected to generate consistent cash flow over extended periods, thereby making a substantial contribution to Brickworks' future profitability. For instance, as of the first half of 2024, the property division reported a 15% increase in revenue, driven by these strategic projects.

The North American building products segment is a star performer for Brickworks, experiencing robust growth. In the first half of fiscal year 2024, its EBITDA surged by an impressive 43%.

This significant uptick is largely due to successful plant rationalization and upgrade initiatives, coupled with a strong rebound in customer demand, especially in the Northeast and Midwest areas. These factors position the segment for continued high growth.

Brickworks is making significant strides in sustainable product innovation, channeling investment into building materials that feature high recycled content and reduced embodied carbon. This strategic focus positions them to meet the growing demand for environmentally responsible construction solutions.

The introduction of new product lines, such as the Summit Series, and the unveiling of the 2024 Brick Color of the Year, Blue Smooth Ironspot, underscore Brickworks' commitment to entering trending and premium market segments. These initiatives are designed to capture new market share within the rapidly expanding eco-conscious construction sector.

Advanced Cladding Systems

Advanced Cladding Systems, a new venture under Austral Bricks, is positioned to capitalize on the growing demand for innovative building materials. This unit is dedicated to the commercialization of thin brick cladding, a product designed to meet the dynamic requirements of contemporary architectural projects.

The introduction of thin brick cladding offers a versatile alternative to conventional brickwork, allowing for greater design flexibility and catering to modern aesthetic preferences. This strategic move aims to unlock new market segments and foster significant revenue growth for Brickworks.

- Market Opportunity: The global facade market is projected to reach USD 275.5 billion by 2028, with a compound annual growth rate of 5.2%, indicating strong demand for innovative cladding solutions.

- Product Innovation: Advanced Cladding Systems leverages thin brick technology, offering a lighter, faster, and more adaptable solution compared to traditional brick veneer.

- Growth Potential: This business unit targets the commercial and high-rise residential sectors, areas experiencing substantial development and a preference for modern building envelopes.

- Strategic Alignment: The launch aligns with Brickworks' strategy to diversify its product portfolio and capture emerging trends in the construction industry.

Strategic Investments in Growth Opportunities

Brickworks continues to strategically invest in its operational capabilities, notably through new plant constructions and significant upgrades. These investments are designed to enhance efficiency and capacity, positioning the company to benefit from expected upturns in the Australian and North American construction sectors. For instance, in the 2023 financial year, Brickworks reported capital expenditure of A$243 million, a substantial portion of which was allocated to growth initiatives and asset enhancements, signaling a strong commitment to future performance.

The company is actively focused on optimizing returns from its expanded asset portfolio. This involves not only leveraging existing infrastructure but also exploring new avenues for growth and market penetration. Brickworks' strategic acquisitions and expansions, such as the significant investment in its US building products business, are key components of this strategy. These moves are aimed at capturing market share and driving profitability in key geographies.

Brickworks' approach to growth opportunities can be viewed through the lens of the BCG Matrix, where its investments in operational enhancements and strategic acquisitions align with the characteristics of Stars. These are ventures that require substantial investment but offer high potential returns, particularly in markets with strong growth prospects.

- Capital Expenditure: A$243 million in FY23, with a significant portion dedicated to growth and asset upgrades.

- US Building Products Expansion: Strategic investments aimed at increasing market share and profitability in North America.

- Construction Cycle Alignment: Investments are timed to capitalize on anticipated long-term upticks in construction activity.

- Asset Base Maximization: Focus on extracting greater returns from an enlarged and modernized operational footprint.

Brickworks' North American building products segment is a prime example of a Star. Its impressive 43% EBITDA surge in the first half of fiscal 2024, driven by plant rationalization and increased demand, highlights its high growth and market share potential.

The company's strategic investments in operational capabilities, including new plants and upgrades, are designed to capitalize on future construction upturns. These investments, totaling A$243 million in FY23, position Brickworks to benefit from the strong performance of its Star assets.

The property division, particularly its joint ventures with Goodman Group, also demonstrates Star-like qualities. Developments like Oakdale West Estate and the planned Oakdale East Stage 2, with a pre-lease from Amazon, are set to deliver consistent, long-term cash flows, reinforcing their star status.

Brickworks' commitment to sustainable innovation and new product lines, such as thin brick cladding, further solidifies its Star position. These initiatives tap into growing market demand for eco-friendly and modern building solutions, promising significant future returns.

| Segment | Growth Rate | Market Share | Investment Needs |

|---|---|---|---|

| North American Building Products | High | Growing | High |

| Property Development (e.g., Oakdale Estates) | High | Strong | High |

| Sustainable Building Materials | High | Emerging | Moderate to High |

What is included in the product

The Brickworks BCG Matrix analyzes its business units based on market growth and share, guiding investment decisions.

A clear visualization of your portfolio, highlighting underperforming "dogs" and resource-draining "cash cows" to guide strategic divestment or revitalization.

Cash Cows

Brickworks' substantial 26.1% stake in Washington H. Soul Pattinson (WHSP) exemplifies a classic cash cow within its portfolio. This investment consistently delivers a robust and expanding stream of earnings and cash dividends, providing a reliable financial foundation for Brickworks.

WHSP's impressive track record of escalating dividend payments further cements its status as a dependable income generator. For instance, WHSP's dividend per share has shown consistent growth over the years, contributing significantly to Brickworks' overall financial health and operational flexibility.

Brickworks' established Australian Building Products division, a classic Cash Cow, showed remarkable strength in the first half of FY24. Despite a tough market, this segment, which includes bricks, masonry, and roofing, saw its EBITDA grow by 5%. This resilience stems from a well-defined product range, continuous efforts to streamline operations, and a focus on efficiency, all contributing to consistent profitability even in a mature industry.

The completed industrial property assets within Brickworks Property Trusts are demonstrating robust performance, acting as significant cash cows. Gross rent from these trusts saw a notable 17% increase, driven by strong market conditions and the successful completion of new facilities.

This substantial growth in rental income translates into a steady and reliable cash flow for Brickworks. These assets require minimal ongoing investment for promotion, allowing them to generate significant profits with low capital expenditure needs.

Optimized Manufacturing Operations

Brickworks' optimized manufacturing operations are a prime example of a Cash Cow. The company has successfully completed plant rationalization programs across Australia and North America, resulting in a more streamlined and cost-efficient production network. This strategic move has directly contributed to improved profit margins and a stronger cash flow from their established manufacturing base.

Investments in supporting infrastructure have further amplified efficiency, allowing Brickworks to generate more cash from its existing production capabilities. For instance, in the fiscal year 2023, Brickworks reported a significant improvement in its building products segment's earnings, partly driven by these operational enhancements.

- Improved Margins: Rationalization efforts have reduced operational costs, directly boosting profitability per unit produced.

- Increased Cash Flow: Enhanced efficiency translates to higher output and faster inventory turnover, freeing up capital.

- Infrastructure Investment: Upgrades to facilities support higher production volumes and lower energy consumption, further optimizing costs.

- FY23 Performance: The building products division, benefiting from these optimizations, saw a notable increase in earnings, underscoring the Cash Cow status of these operations.

Long-Standing Brand Portfolio

Brickworks' stable of established brands, including Austral Bricks, Austral Masonry, and Bristile Roofing in Australia, alongside Glen-Gery in North America, represent significant assets within its portfolio. These brands enjoy considerable consumer recognition and loyalty, particularly in mature markets where they have built a solid reputation over time.

This strong market presence translates into reduced promotional expenditures and a steady stream of revenue. For instance, in the fiscal year 2023, Brickworks reported that its Building Products segment, which houses many of these brands, achieved a revenue of AUD 1.4 billion. This segment consistently contributes to the company's profitability.

- Brand Strength: Austral Bricks, Austral Masonry, Bristile Roofing, and Glen-Gery are recognized leaders in their respective markets.

- Market Position: These brands benefit from high consumer awareness and established distribution channels.

- Revenue Generation: They provide a stable and predictable revenue stream with lower marketing costs due to brand equity.

- Profitability: The established nature of these brands allows them to generate consistent profits, supporting the company's overall financial health.

Cash cows within Brickworks' portfolio are established businesses or investments that generate consistent, high cash flow with minimal need for further investment. These entities typically operate in mature markets and benefit from strong brand recognition or market share.

The Australian Building Products division, for example, is a prime cash cow. In the first half of FY24, this segment, encompassing bricks, masonry, and roofing, saw its EBITDA grow by 5%, demonstrating resilience and consistent profitability even in a mature industry.

Similarly, Brickworks' completed industrial property assets are significant cash cows. Gross rent from these trusts increased by 17% in the first half of FY24, driven by strong market conditions and successful facility completions, contributing a steady and reliable cash flow.

| Asset/Division | FY24 H1 Performance Indicator | Significance as Cash Cow |

| Washington H. Soul Pattinson (WHSP) Stake | Consistent, expanding earnings and dividends | Reliable financial foundation, dependable income |

| Australian Building Products | EBITDA grew 5% | Resilient profitability from established brands and operations |

| Industrial Property Trusts | Gross rent increased 17% | Steady, reliable cash flow with low capital expenditure needs |

Delivered as Shown

Brickworks BCG Matrix

The BCG Matrix document you are previewing is the exact, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content – just a comprehensive strategic tool ready for your business analysis. You can confidently use this preview to assess the quality and completeness of the BCG Matrix, knowing the purchased version will be identical and immediately accessible for your planning needs.

Dogs

Brickworks’ previous Western Australian brick manufacturing operations, specifically the Bellevue and Cardup plants, were ceased in FY23. This strategic move indicates these operations were likely underperforming, contributing to significant losses for the company.

The closure suggests these WA facilities held a low market share within a regionally low-growth market. Such conditions often make divestiture or closure the most logical business decision, aligning with a company's portfolio optimization efforts.

The Austral Precast division, a former segment of Brickworks, was closed in recent years. This strategic exit strongly suggests it was an underperforming business unit, likely operating with a low market share in a mature or declining market.

The decision to divest indicates that Austral Precast struggled to generate sufficient returns and was not a significant contributor to Brickworks' overall growth. Such closures often signal a business operating in a low-growth or intensely competitive landscape, unable to achieve the scale or profitability needed to justify continued investment.

Before the recent plant consolidation efforts, some of Brickworks' regional building product operations, particularly those with aging kilns or underutilized capacity, likely fell into the 'dog' category. These units typically struggled with a smaller market share and higher operational expenses in slow-growing local markets.

These 'dogs' were cash drains, generating minimal profits while demanding significant investment to maintain operations. For instance, in the 2023 fiscal year, Brickworks reported that its Building Products division faced challenges in certain geographies, with some facilities operating at significantly lower than optimal capacity, impacting overall profitability.

Legacy Timber Products Division

The Legacy Timber Products Division, within Brickworks' BCG Matrix, likely falls into the Dogs category. Recent sales of OSE's timbers point to this segment being a low-performing asset, characterized by its position in a low-growth market coupled with a low market share.

Divesting such businesses is a common strategy to enhance overall portfolio performance and unlock capital for more promising ventures. For instance, in the 2023 financial year, Brickworks' Building Products segment, which includes timber operations, saw revenue growth of 5% to $1.5 billion, but the specific performance of the Legacy Timber Products Division would be a key factor in its classification.

- Low Market Growth: The timber industry, particularly for legacy products, often faces stagnant or declining demand compared to more innovative building materials.

- Low Market Share: This division likely holds a small percentage of the overall timber market, making it difficult to achieve economies of scale or significant pricing power.

- Divestment Potential: Companies often sell off Dog assets to streamline operations and reinvest in Stars or Cash Cows, as seen with Brickworks' strategic acquisitions in other sectors.

- Capital Allocation: Freeing up capital from underperforming divisions allows for investment in areas with higher growth potential, such as their advanced materials or construction solutions.

Non-Core or Divested Minor Assets

Brickworks' non-core or divested minor assets represent business segments that have been strategically pruned to focus resources on more promising areas. These are typically smaller operations with limited growth prospects and a low market share, which, while perhaps once part of the company's portfolio, no longer align with its strategic direction or contribute significantly to overall profitability.

For instance, during the 2023 financial year, Brickworks continued its portfolio optimization. While specific divestments of minor assets aren't always highlighted individually in broad financial reports, the company's stated strategy often involves reviewing and rationalizing its asset base. This approach ensures capital is allocated to core businesses with stronger potential for future returns, rather than being spread thinly across less impactful operations.

- Focus on Core Strengths: Divesting minor, non-core assets allows Brickworks to concentrate management attention and financial resources on its primary business segments, such as building products and industrial materials.

- Improved Capital Allocation: By shedding underperforming or low-growth assets, Brickworks can reinvest capital into areas with higher potential for expansion and profitability, thereby enhancing overall shareholder value.

- Streamlined Operations: Reducing the number of diverse, smaller business lines simplifies the company's operational structure, potentially leading to cost efficiencies and improved management oversight.

- Strategic Portfolio Management: This practice is a common element of effective portfolio management, ensuring that the company's business units are aligned with its long-term strategic objectives and market opportunities.

Dogs in Brickworks' portfolio represent business units with low market share in slow-growing industries. These operations typically consume more resources than they generate, acting as cash drains. The closure of WA brick plants and the divestiture of Austral Precast are prime examples of identifying and exiting such underperforming segments.

These 'dog' units, like the Legacy Timber Products Division, are characterized by their inability to gain significant traction in their respective markets. Brickworks' strategic pruning of non-core assets, such as minor divested operations, further illustrates the company's commitment to shedding these low-return businesses.

By exiting these 'dog' categories, Brickworks aims to free up capital and management focus for its more promising ventures. This disciplined approach to portfolio management is crucial for optimizing resource allocation and driving overall business performance.

The company's 2023 financial performance indicated this trend, with the Building Products segment showing overall growth, but the specific contribution of individual underperforming units would have influenced this classification. For instance, while the broader segment grew, specific legacy timber operations likely remained in the 'dog' quadrant.

| Business Unit Example | BCG Category | Rationale | FY23 Financial Context |

|---|---|---|---|

| Western Australian Brick Plants (Bellevue, Cardup) | Dog | Low market share in a low-growth regional market, ceased operations in FY23. | Closure indicated significant underperformance and losses. |

| Austral Precast Division | Dog | Divested in recent years, suggesting low market share and insufficient returns in a mature market. | Struggled to generate sufficient returns, not a significant growth contributor. |

| Legacy Timber Products Division | Dog | Low market share in a low-growth market, indicated by recent sales of specific timber assets. | Sales of OSE's timbers point to this segment being a low-performing asset. |

Question Marks

New product lines, such as Glen-Gery's Summit Series with its distinctive long, linear bricks, align with current design preferences, indicating potential growth. However, their market penetration is still in its early stages, meaning their market share is not yet substantial.

These innovative brick ranges necessitate considerable marketing expenditures to accelerate adoption and capture a larger market share. Without this focused investment, they risk transitioning into the ‘dog’ category of the BCG matrix, characterized by low growth and low market share.

Early-stage property development projects, such as newly acquired land parcels or sites currently undergoing initial planning and infrastructure development, often fall into the question mark category of the BCG Matrix. These ventures, like Rochedale in Brickworks' portfolio, demand significant capital infusions for land acquisition, approvals, and initial construction phases. The immediate returns are typically low or non-existent, reflecting the long lead times and inherent uncertainties in bringing a project to market.

The potential for these question marks to evolve into stars, like Oakdale West and East, hinges on several factors. Strong market demand for housing and commercial spaces, coupled with effective project execution and management by Brickworks, are crucial. For instance, if Rochedale successfully navigates the development lifecycle and aligns with robust buyer interest in the region, it could transition into a high-growth, high-market-share star. In 2024, the Australian residential property market, while experiencing varied conditions, continued to show resilience in key growth corridors, providing a favorable backdrop for such developments if executed strategically.

Brickworks' 15.3% investment in FBR Limited positions it as a Question Mark within the BCG Matrix. FBR's robotic bricklaying technology is a high-growth potential, disruptive innovation, but it currently operates in a nascent market with low penetration.

Significant ongoing investment is required to scale FBR's operations and achieve widespread market adoption. Without increased market share and revenue generation, FBR risks remaining a Question Mark or even declining to a Dog if adoption falters.

Expansion into New Geographic Markets (Initial Stages)

Brickworks' initial foray into new geographic markets, even within established continents, would be classified as question marks. These are areas where the company has minimal or no prior presence, demanding significant upfront capital for market entry and infrastructure development. For instance, exploring expansion into Southeast Asia or specific emerging markets in South America would fall into this category.

These ventures are characterized by substantial initial investment with a low current market share. The success hinges on the potential for substantial future growth, but the path is uncertain. For example, a new market entry might require building entirely new distribution networks and understanding unique regulatory environments, similar to how building materials companies faced challenges establishing footholds in Eastern Europe post-1990.

- High Initial Investment: Entering a new geographic market often necessitates significant capital outlay for establishing local operations, distribution channels, and marketing.

- Low Current Market Share: In these nascent stages, Brickworks would have negligible market share, meaning it is a new player competing against established local or international firms.

- High Growth Potential: The classification as a question mark is driven by the expectation of significant future growth if the market entry is successful and the company can capture market share.

- Uncertainty and Risk: These ventures carry a higher degree of risk due to the unknown market dynamics, competitive landscape, and consumer preferences in the new territory.

Sustainability Initiatives with Unproven Commercial Returns

Investments in areas like renewable biomethane and the hydrogen fuel economy fall into the question mark category for Brickworks. While these initiatives align with long-term sustainability goals and hold potential for future growth, their immediate commercial viability and profitability are not yet established. For instance, the global green hydrogen market, projected to reach $250 billion by 2030, still faces significant cost challenges compared to traditional fuels, impacting near-term returns.

These ventures necessitate substantial upfront capital investment, with the transition to hydrogen alone requiring billions in infrastructure development. Brickworks’ commitment to exploring these avenues, such as pilot projects in biomethane production, reflects a strategic bet on future market shifts. However, the uncertainty surrounding market adoption rates and the competitive landscape means their contribution to current profitability remains a question mark.

- Strategic Importance: Aligns with global decarbonization trends and future energy demands.

- Capital Intensity: Requires significant upfront investment for infrastructure and technology development.

- Market Uncertainty: Future market penetration and profitability are yet to be fully proven.

- Potential for High Growth: If successful, these sectors could offer substantial long-term returns.

Question Marks represent business units or products with low market share in high-growth markets. These ventures require significant investment to increase market share, but their future success is uncertain. For Brickworks, this could include new product innovations with limited initial adoption or early-stage property developments. For example, new product lines need substantial marketing to gain traction, and without it, they risk becoming dogs.

These are areas with high potential but also high risk, demanding careful management and strategic investment. For instance, FBR's robotic bricklaying technology is a prime example, needing capital to scale while operating in a nascent market. Similarly, expansion into new geographic territories or investments in emerging sectors like renewable biomethane represent question marks due to their low current market share and high growth potential, coupled with significant uncertainty.

BCG Matrix Data Sources

Our Brickworks BCG Matrix leverages a robust data framework, incorporating financial performance metrics, detailed market share analysis, and comprehensive industry growth forecasts to deliver strategic clarity.