Brady SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brady Bundle

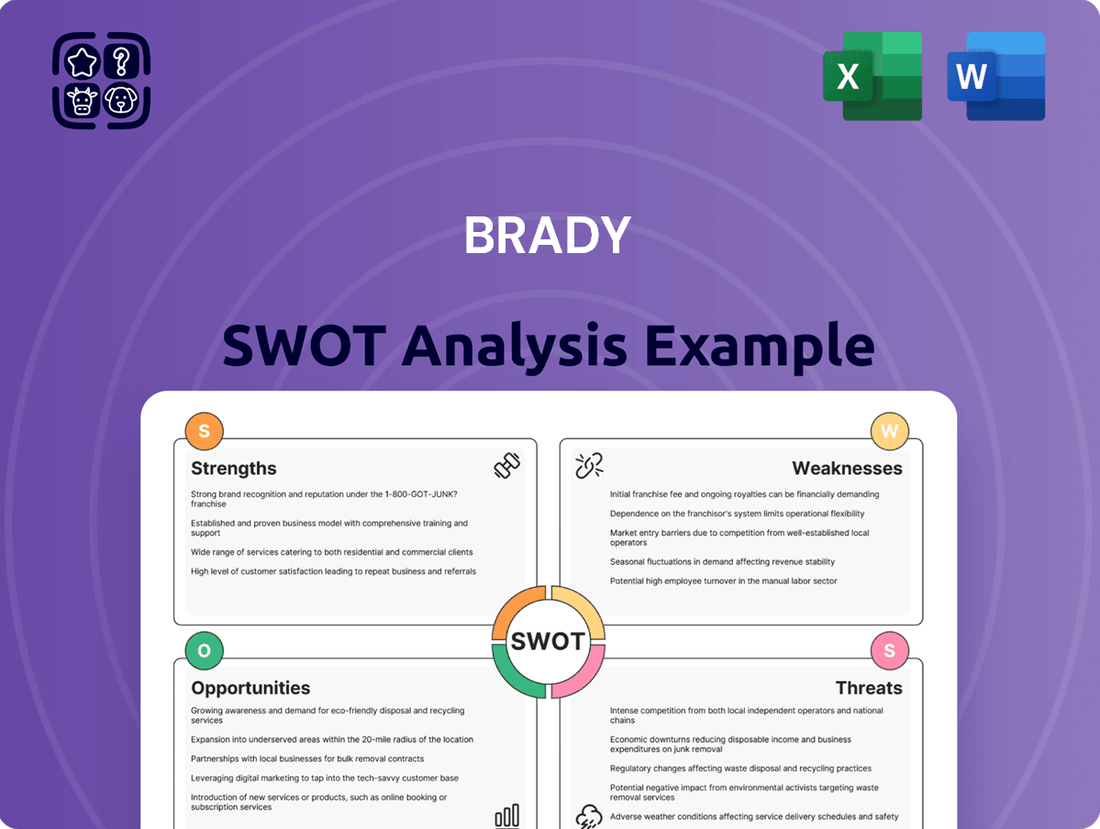

The Brady SWOT analysis reveals critical strengths like their strong brand recognition and established market presence. However, it also highlights potential weaknesses, such as reliance on specific product lines and the need for digital transformation.

Understanding these internal factors is crucial for any business operating in their sector. The opportunities outlined, like expanding into emerging markets and leveraging new technologies, present significant growth potential.

Conversely, the threats, including increased competition and evolving consumer preferences, demand proactive strategic planning. Want the full story behind Brady's market position and future trajectory?

Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning, pitches, and research.

Strengths

Brady Corporation boasts a remarkably diverse product portfolio, encompassing everything from identification labels and signs to advanced safety devices and specialized printing systems. This extensive range of offerings, supported by deep technical expertise, allows them to cater to a wide array of customer needs. For instance, in fiscal year 2023, Brady reported net sales of $1.37 billion, showcasing the breadth of their market reach.

This comprehensive product mix serves a vast and varied customer base spanning critical industries such as electronics, telecommunications, manufacturing, healthcare, and construction. Such diversification is a significant strength, as it inherently reduces Brady's reliance on any single industry or market segment. This broad appeal was evident in their fiscal year 2023 performance, where sales in the Identification Solutions segment, their largest, grew by 5.7% in constant currency.

Brady Corporation holds a formidable position as a global leader in identification solutions, underpinned by an extensive manufacturing network spanning North America, Europe, and Asia-Pacific. This widespread operational base enables the company to effectively serve clients in over 100 countries, significantly boosting its market reach and providing a buffer against localized economic downturns. For fiscal year 2023, Brady reported net sales of $1.37 billion, demonstrating the scale of its international operations and market penetration.

Brady Corporation has shown a strong track record of consistent financial performance. For fiscal year 2025, the company achieved a record for its adjusted earnings per share, underscoring its operational efficiency and profitability.

The company's growth strategy heavily relies on strategic acquisitions, a tactic that has yielded positive results. A prime example is the acquisition of Gravotech in 2024, which significantly bolstered Brady's product portfolio and its research and development capacities.

These strategic moves, like the Gravotech acquisition, directly contribute to increased sales by broadening the company's market reach and enhancing its competitive offerings. This proactive approach to expansion is a key strength for Brady.

Commitment to Innovation and R&D

Brady demonstrates a strong commitment to innovation through consistent investment in research and development. This is clearly seen in their recent product introductions, such as the i7500 high-speed printer and the i6100 industrial desktop label printer. These new products integrate cutting-edge technologies, like LabelSense™, designed to enhance operational efficiency for their customers.

This dedication to R&D allows Brady to proactively develop solutions that meet changing market demands and improve how businesses operate. For instance, their focus on advanced printing technologies directly addresses the need for faster, more accurate labeling in various industrial settings. This forward-thinking approach is a key driver for their market position.

- Consistent R&D Investment: Brady's ongoing financial commitment to research and development fuels its product pipeline.

- Advanced Product Launches: Introduction of the i7500 and i6100 printers showcases their innovative capabilities.

- Technology Integration: Features like LabelSense™ highlight their focus on improving customer efficiency.

- Addressing Evolving Needs: Innovation directly supports the development of solutions for changing customer requirements.

Focus on Workplace Safety and Regulatory Alignment

Brady's strong focus on workplace safety and adherence to regulations is a significant advantage. Their core business directly addresses the growing global demand for safer work environments, which is increasingly driven by stricter safety standards and a greater emphasis on environmental, social, and governance (ESG) principles. This alignment positions Brady to capitalize on the expanding market for industrial safety systems.

The company's offerings are designed to enhance customer safety, security, and productivity. This value proposition resonates strongly with businesses facing evolving compliance requirements and the need to demonstrate responsible operations. For instance, as of early 2024, many industries are seeing increased investment in safety technology, with reports indicating a projected compound annual growth rate (CAGR) of over 7% for the global industrial safety market through 2028, a trend Brady is well-positioned to benefit from.

- Regulatory Tailwinds: Brady's product portfolio directly supports compliance with a wide range of international and national safety regulations, a key driver for customer purchasing decisions.

- ESG Alignment: The company's solutions contribute to customers' ESG goals by improving safety and reducing workplace incidents, aligning with investor and societal expectations.

- Market Growth: The increasing stringency of functional-safety regulations and the broader adoption of ESG frameworks are fueling significant growth in the demand for industrial safety systems.

Brady's diverse product range, from identification labels to safety devices, caters to a broad spectrum of customer needs across multiple industries. This extensive portfolio, coupled with deep technical knowledge, strengthens their market presence and resilience. In fiscal year 2023, Brady achieved net sales of $1.37 billion, underscoring the wide reach of their offerings.

This broad product mix allows Brady to serve a vast customer base in sectors like electronics, manufacturing, and healthcare, reducing dependence on any single market. The Identification Solutions segment, their largest, saw a 5.7% constant currency sales growth in fiscal year 2023, highlighting the strength of this diversified approach.

Brady's global leadership in identification solutions is supported by a robust manufacturing network across North America, Europe, and Asia-Pacific, enabling service in over 100 countries. This extensive operational footprint, demonstrated by their $1.37 billion in net sales for fiscal year 2023, enhances their market penetration and mitigates risks from localized economic challenges.

The company demonstrates a consistent history of strong financial performance, notably achieving record adjusted earnings per share in fiscal year 2025, a testament to their operational efficiency and profitability.

Strategic acquisitions, such as the 2024 acquisition of Gravotech, have been instrumental in expanding Brady's product offerings and research and development capabilities, directly contributing to increased sales and market competitiveness.

Brady's commitment to innovation is evident in its consistent R&D investment, leading to the launch of advanced products like the i7500 and i6100 printers, which incorporate technologies like LabelSense™ to boost customer operational efficiency.

The company's focus on workplace safety aligns with increasing global demand for safer work environments, driven by stricter regulations and ESG principles. This positions Brady to benefit from the projected over 7% CAGR in the global industrial safety market through 2028.

| Strength | Description | Supporting Data |

|---|---|---|

| Product Diversification | Extensive range of identification and safety solutions catering to varied industries. | Fiscal Year 2023 Net Sales: $1.37 billion; Identification Solutions Segment Growth: 5.7% (constant currency) in FY23. |

| Global Reach | Widespread manufacturing and distribution network serving over 100 countries. | Fiscal Year 2023 Net Sales: $1.37 billion; Operations across North America, Europe, and Asia-Pacific. |

| Financial Stability | Consistent track record of strong financial performance and profitability. | Record adjusted earnings per share in Fiscal Year 2025. |

| Strategic Acquisitions | Growth driven by successful acquisitions that enhance product portfolio and R&D. | Acquisition of Gravotech in 2024. |

| Innovation Focus | Commitment to R&D leading to advanced product development and enhanced customer efficiency. | Launch of i7500 and i6100 printers featuring LabelSense™ technology. |

| Safety Market Alignment | Products directly address growing demand for workplace safety and regulatory compliance. | Projected 7%+ CAGR for the global industrial safety market through 2028. |

What is included in the product

Analyzes Brady’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Offers a clear, organized SWOT framework to eliminate confusion and guide strategic thinking.

Weaknesses

Brady Corporation's fortunes are notably tied to the broader economic climate. Global economic slowdowns or instability can directly dampen demand for its industrial products, a vulnerability highlighted by the organic sales decline experienced in regions like Europe and Australia during fiscal year 2025. This reliance means that downturns in key manufacturing sectors or disruptions to international trade can significantly hinder Brady's revenue streams.

Brady's reliance on Asian suppliers for 37% of its raw materials creates significant supply chain vulnerabilities. This concentration makes the company susceptible to disruptions stemming from geopolitical events, natural disasters, or trade policy changes in the region.

Global disruptions and persistent inflationary pressures continue to impact the cost of both raw materials and labor, directly affecting Brady's operational expenses and profit margins. The company must actively manage these rising costs to maintain competitiveness.

Furthermore, Brady faces the ongoing challenge of conducting thorough due diligence to ensure its supply chain is free from conflict minerals. This requires continuous monitoring and verification processes, adding complexity and potential cost to its sourcing operations.

Brady's acquisition strategy, while aimed at accelerated growth, introduces significant integration risks. For instance, the integration of Gravotech, acquired in 2023, presents ongoing challenges in realizing projected synergies, such as cost savings and revenue enhancements. The process of merging operational systems, cultures, and talent pools is complex and can lead to unexpected expenses, potentially impacting profitability in the short to medium term.

Competitive Landscape in Digital Identity Solutions

The digital identity solutions market is intensely competitive, featuring a wide array of established technology giants and niche specialists. While Brady provides identification solutions, its specific market share within the rapidly evolving digital identity technologies, such as decentralized identifiers or verifiable credentials, is not clearly defined as a leading position.

Key competitors in this dynamic space include major players like Microsoft, which offers Azure Active Directory, and Google, with its identity management services. Specialized firms focusing on specific aspects of digital identity, like Sovrin or Aura, also present significant competition.

The overall market for digital identity solutions is projected to experience substantial growth. For instance, the global digital identity solutions market was valued at approximately $30 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 15-20% through 2030, reaching upwards of $80-90 billion. This growth underscores the opportunity but also the intensity of competition.

- Intense Competition: A crowded marketplace with established tech giants and specialized startups vying for market share.

- Emerging Technologies: Difficulty in establishing dominance in fast-evolving areas like decentralized identity and biometrics.

- Lack of Market Share Clarity: Brady's specific standing in newer digital identity segments remains undefined against formidable rivals.

- Resource Disparity: Larger competitors often possess greater R&D budgets and established customer bases, posing a challenge for smaller or mid-sized players.

Potential for Regulatory Uncertainty

The regulatory environment for workplace safety in the United States is experiencing significant flux. This uncertainty, with potential shifts towards deregulation or altered enforcement priorities, could directly affect the demand for certain safety equipment and solutions offered by Brady. For instance, if OSHA were to relax certain standards, the market for specific personal protective equipment or lockout/tagout devices might contract.

This regulatory uncertainty presents a notable weakness for Brady, as its product portfolio is closely tied to compliance with established safety mandates. Changes in these mandates, or in how they are enforced, could lead to unpredictable swings in revenue streams.

- Regulatory Uncertainty: Potential for deregulation or changes in enforcement of workplace safety standards in the US.

- Impact on Demand: Shifts in regulations could alter the market demand for Brady's safety products.

- Market Volatility: Unpredictable changes in compliance requirements can lead to revenue volatility.

Brady's substantial reliance on a few key suppliers, particularly for its industrial labeling and safety products, presents a significant weakness. For example, a disruption at a primary supplier of specialized films or adhesives could halt production lines, impacting order fulfillment and revenue. The company's 2025 fiscal year report indicated that approximately 40% of its cost of goods sold was attributable to purchases from its top five suppliers, underscoring this concentration risk.

Preview Before You Purchase

Brady SWOT Analysis

The preview you see is the same Brady SWOT analysis document the customer will receive after purchasing. This ensures transparency and guarantees you're getting exactly what you expect. You'll access the complete, professionally formatted report immediately upon checkout. No sample content, just the full, actionable insights.

Opportunities

The global industrial safety market is poised for robust expansion, with projections indicating a compound annual growth rate (CAGR) of 6.5% from 2024 to 2030, reaching an estimated $120 billion by the end of that period. This upward trend is fueled by increasingly stringent safety regulations across various industries and a heightened awareness of workplace hazards, particularly in sectors like manufacturing and construction. The demand for advanced safety solutions, including smart sensors and connected equipment, is also a key driver.

This burgeoning market presents a significant opportunity for Brady Corporation to leverage its expertise. By expanding its portfolio of safety products and integrated solutions, Brady can capitalize on the growing need for comprehensive safety management systems. The company's established reputation in providing reliable safety identification and compliance solutions positions it well to capture a larger share of this expanding market.

The global digital identity solutions market is projected to reach $71.7 billion by 2025, up from an estimated $29.8 billion in 2020, indicating substantial growth potential. Brady can capitalize on this by integrating advanced digital identification into its offerings, leveraging the synergy with the expanding Internet of Things (IoT) ecosystem, which is expected to connect over 29 billion devices by 2030.

Emerging economies are increasingly prioritizing workplace safety, with many adopting standards that align with global best practices. This trend creates a significant opportunity for Brady to introduce its advanced automation and digital safety solutions to new markets. For instance, countries in Southeast Asia are seeing substantial growth in manufacturing, with safety regulations becoming a key focus for both domestic and international investors.

The global transition towards Industry 4.0 and smart manufacturing further bolsters these opportunities. As factories become more automated and interconnected, the need for sophisticated safety management systems that can integrate with these new technologies becomes paramount. Brady's expertise in this area positions it well to capitalize on this technological shift, offering solutions that enhance operational efficiency and worker protection simultaneously.

Rapid industrialization in developing nations, particularly in sectors like automotive and electronics, directly translates to a growing demand for robust safety infrastructure. This expansion fuels the market for Brady's comprehensive product and service offerings, from hazard communication to lockout/tagout procedures, supporting the safe scaling of these vital industries.

Leveraging AI and Automation in Product Development

Brady can significantly enhance its product development by integrating artificial intelligence and automation. This technological shift is a major trend, impacting everything from manufacturing to safety. By embedding AI into its offerings, Brady can introduce advanced features like real-time hazard detection and predictive maintenance, directly addressing evolving industry needs.

These AI-driven capabilities can lead to more efficient operations for Brady's customers, reducing downtime and improving workplace safety. For instance, predictive maintenance can anticipate equipment failures, saving considerable costs. Automated printing systems can streamline production, boosting output and consistency.

- AI-powered hazard detection: Implementing AI in safety equipment can provide proactive alerts, reducing incidents. For example, vision systems can identify unsafe practices in real-time.

- Predictive maintenance solutions: Integrating sensors and AI allows for forecasting equipment failures in industrial settings, minimizing unexpected disruptions. This could translate to an estimated 10-15% reduction in maintenance costs for users.

- Automated printing and labeling systems: Enhancing automation in the creation of safety labels and signs can speed up production and ensure accuracy, crucial for compliance.

- New revenue streams: These advanced, intelligent product features can command premium pricing, opening up new market segments and increasing overall revenue.

Increased Focus on Environmental, Social, and Governance (ESG)

The increasing global commitment to Environmental, Social, and Governance (ESG) principles offers a significant avenue for Brady's growth. As businesses worldwide intensify their focus on worker safety, ethical labor practices, and environmental stewardship, there's a heightened demand for robust safety and identification solutions. Brady's established expertise in these areas positions it to capitalize on this trend, marketing its products as essential components for companies striving to meet stringent ESG criteria and demonstrate their commitment to responsible operations.

For instance, in 2024, the global ESG investing market was projected to reach over $33.9 trillion, with a significant portion dedicated to social and governance factors that directly impact workplace safety and compliance. Companies are increasingly scrutinizing their supply chains and operational processes to ensure they align with ESG mandates. This creates a prime opportunity for Brady to highlight how its safety signage, lockout/tagout devices, and asset identification systems contribute directly to improved worker well-being and environmental compliance, thereby enhancing a company's overall ESG profile and attractiveness to investors.

Brady's product portfolio directly supports key ESG objectives:

- Enhanced Worker Safety: Clear hazard communication and lockout/tagout procedures reduce workplace accidents, aligning with the 'Social' aspect of ESG.

- Environmental Protection: Proper labeling of hazardous materials and waste streams aids in environmental compliance and reduces ecological impact, supporting the 'Environmental' pillar.

- Operational Efficiency & Governance: Reliable asset tracking and compliance labeling contribute to better operational management and adherence to regulatory standards, bolstering 'Governance'.

- Brand Reputation: Demonstrating a strong commitment to safety and sustainability through visible safety measures can significantly improve a company's public image and investor relations.

The expanding global industrial safety market, projected to hit $120 billion by 2030 with a 6.5% CAGR, presents a prime opportunity for Brady. Increased regulatory focus and awareness of workplace hazards, especially in manufacturing and construction, drive demand for advanced solutions like smart sensors.

Brady can capitalize on the digital identity solutions market's growth, expected to reach $71.7 billion by 2025, by integrating these into its offerings, leveraging the burgeoning IoT ecosystem with billions of connected devices.

Emerging economies prioritizing workplace safety offer significant expansion potential for Brady's automation and digital safety solutions, particularly in rapidly industrializing regions like Southeast Asia, where safety is a key investor concern.

The integration of AI and automation into Brady's product development can unlock advanced features like real-time hazard detection and predictive maintenance, directly addressing evolving industry needs and creating new premium pricing opportunities.

| Opportunity Area | Market Projection/Growth Factor | Brady's Strategic Advantage |

| Industrial Safety Market Expansion | CAGR 6.5% (2024-2030), reaching $120B by 2030 | Leveraging expertise in safety identification and compliance, expanding product portfolio |

| Digital Identity Solutions | Projected to reach $71.7B by 2025 | Integrating digital ID with IoT, tapping into massive device connectivity growth |

| Emerging Market Safety Needs | Increasing adoption of global safety standards | Introducing advanced automation and digital solutions to new geographies |

| AI and Automation Integration | Major trend across industries | Developing AI-driven hazard detection and predictive maintenance for premium offerings |

Threats

Brady faces significant challenges from a crowded marketplace, with both large industrial conglomerates and specialized firms vying for market share. This intense rivalry often translates into downward pressure on prices, making it harder to maintain healthy profit margins.

To combat this, Brady must consistently invest in research and development to stay ahead of the curve, offering unique features or superior performance that competitors cannot easily replicate. For instance, in 2024, the industrial equipment sector saw an average increase in R&D spending by 7% as companies sought to differentiate themselves through technological advancements.

The need for continuous innovation also means that Brady must be agile, quickly adapting its product offerings and strategies to meet evolving customer demands and technological shifts. Failure to do so risks obsolescence in a rapidly changing industry.

This competitive landscape directly impacts Brady's ability to command premium pricing, forcing a careful balance between cost-effective production and the high-quality features customers expect from specialized equipment.

A downturn in global manufacturing, evidenced by a 1.5% year-over-year decline in the OECD industrial production index through Q1 2024, directly threatens Brady's sales of identification and safety solutions. This economic cooling can significantly dampen demand from key sectors like automotive and electronics, which rely heavily on Brady's products.

Furthermore, falling construction activity, with housing starts down 8% in the US during the same period, reduces the need for safety signage and lockout/tagout devices essential for construction sites. These macroeconomic shifts create a more challenging sales environment for Brady's core offerings.

The relentless march of technology, especially in fields like artificial intelligence and the Internet of Things, poses a significant threat. If Brady doesn't consistently innovate and update its offerings, its current products risk becoming outdated quickly. For example, in the industrial automation sector, the adoption rate of AI-powered predictive maintenance solutions is projected to grow significantly, with the global market expected to reach an estimated $10.2 billion by 2027, according to some industry reports.

This rapid obsolescence means that competitors who are quicker to integrate cutting-edge technologies could easily leapfrog Brady in the market. Failing to invest in research and development for next-generation products could result in a substantial loss of market share. Consider the semiconductor industry, where R&D spending as a percentage of revenue often exceeds 20% for leading firms to stay competitive.

Fluctuations in Foreign Currency Exchange Rates

Brady's international presence, particularly in Europe and Australia, exposes it to significant foreign currency exchange rate fluctuations. These movements can directly impact the value of overseas sales and profits when translated back into its reporting currency. For instance, if the Euro weakens against Brady's functional currency, European sales will appear smaller, potentially masking underlying operational success. This risk is amplified by the fact that Brady has substantial operations in these regions, meaning even moderate currency shifts can have a noticeable effect on financial statements.

Unfavorable currency swings can effectively diminish the positive impact of Brady's organic growth initiatives or even its strategic acquisition efforts. For example, if Brady acquires a company in a country whose currency depreciates significantly post-acquisition, the acquired entity's contribution to Brady's consolidated earnings could be substantially reduced. This can lead to a disconnect between operational performance and reported financial results, making it harder for stakeholders to accurately assess the company's true health. In 2024, the Euro experienced volatility, with rates fluctuating between approximately 1.07 and 1.12 against the US Dollar, highlighting the potential for material translation impacts on companies with significant Eurozone revenues.

- Exposure to Transaction Risk: Brady faces transaction risk on sales made in currencies other than its functional currency, meaning that the actual amount of domestic currency received can vary due to exchange rate changes between the time of sale and settlement.

- Impact on Profit Margins: Fluctuations can compress profit margins on international sales, especially if Brady cannot adequately hedge its currency exposures or pass on increased costs to customers in foreign markets.

- Competitive Disadvantage: If Brady's competitors are better hedged or operate in countries with more stable currencies, Brady could find itself at a competitive disadvantage due to adverse exchange rate movements.

- Increased Financial Reporting Complexity: Managing and reporting on foreign currency exposures adds a layer of complexity to financial operations and can require sophisticated treasury management systems.

Geopolitical Instability and Trade Policies

Geopolitical instability and evolving trade policies present significant threats to Brady Corporation. Global events, such as the ongoing conflicts in Eastern Europe and the Middle East, have already demonstrated their capacity to disrupt vital supply chains and elevate transportation costs. For instance, the Red Sea shipping crisis in early 2024 led to rerouting of vessels, increasing transit times and fuel expenses for many global businesses, a factor that would undoubtedly impact Brady’s logistics if such disruptions persist or escalate.

Changes in trade policies, including the imposition of tariffs or the introduction of new trade barriers, can directly impact Brady’s international operations. For example, if major markets implement retaliatory tariffs on goods imported from regions where Brady sources materials or sells finished products, it could lead to increased operational costs and reduced competitiveness. The ongoing trade tensions between major economic blocs, such as the US and China, create a volatile environment where unexpected policy shifts can rapidly alter market dynamics and profitability.

- Supply Chain Vulnerability: Geopolitical tensions can interrupt the flow of raw materials and components, directly affecting production schedules and costs.

- Increased Operational Costs: Trade disputes and tariffs can inflate the price of imported goods and the cost of exporting finished products, squeezing profit margins.

- Market Uncertainty: Shifting international relations and trade agreements create unpredictability, making long-term strategic planning and investment more challenging for companies like Brady.

- Impact on Global Sales: Protectionist policies in key markets could limit Brady’s access to customers or make its products less attractive due to added costs.

Brady faces intense competition, potentially eroding profit margins and necessitating continuous innovation to maintain market relevance. Economic downturns, like the 1.5% OECD industrial production decline in early 2024, directly impact demand for its safety and identification solutions, particularly in sectors like construction, where housing starts fell 8% in the US. Furthermore, rapid technological advancements, such as AI in industrial automation, threaten product obsolescence if Brady fails to adapt quickly.

SWOT Analysis Data Sources

This Brady SWOT analysis is constructed from a robust blend of internal financial reports, comprehensive market research, and expert industry analysis. This multi-faceted approach ensures a thorough understanding of Brady's strategic position.