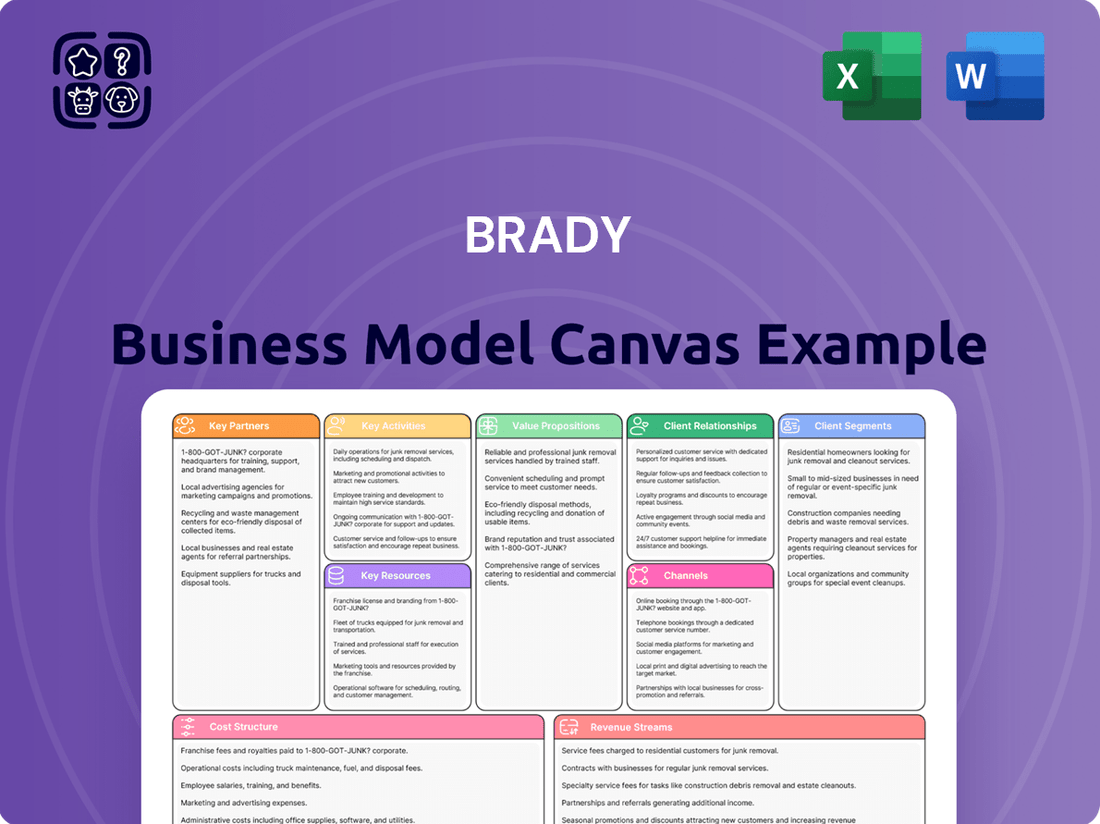

Brady Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brady Bundle

Curious about the engine driving Brady’s success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear blueprint for their operations. This isn't just theory; it's a real-world strategic map. Download the full version to gain a tangible understanding of how Brady creates and delivers value, and leverage these insights for your own business growth.

Partnerships

Brady Corporation's success hinges on its strategic supplier relationships, particularly for specialized adhesives, durable plastics, and advanced printing components. These crucial inputs are vital for manufacturing their wide array of products, from labels to safety devices.

In 2024, Brady reported that its cost of goods sold was approximately $850 million, highlighting the significant volume of raw materials procured. Strong partnerships with these suppliers ensure not only a consistent supply of high-quality materials but also help secure favorable pricing and early access to material innovations, which is critical for maintaining a competitive edge in their markets.

Brady actively collaborates with technology and software providers to embed cutting-edge features into its identification and printing solutions. For instance, in 2024, their strategic alliances with leading software developers are focused on enhancing data management for robust track-and-trace systems and advanced compliance auditing capabilities. These partnerships are crucial for integrating innovations like AI-powered print quality control and cloud-based asset management software, directly bolstering Brady's digital product portfolio and competitive edge.

Brady leverages a robust global network of distribution partners to ensure its identification and workplace safety solutions reach a broad customer base. These alliances are fundamental for effective logistics and deep market penetration, particularly in regions where direct sales infrastructure is less developed.

In 2023, Brady reported that its distribution network accounted for a substantial portion of its international sales, highlighting the critical role these partnerships play in revenue generation. For instance, in Europe, distributors were key to expanding Brady's presence in the manufacturing and construction sectors.

These distribution alliances are not merely about sales; they also encompass vital local support, inventory management, and customer service, making Brady's products more accessible and responsive to regional needs. This localized approach enhances customer satisfaction and strengthens market position.

Industry Associations and Regulatory Bodies

Collaborating with industry associations like the National Association of Manufacturers (NAM) is crucial for Brady to remain informed about evolving safety standards and compliance mandates. For instance, in 2024, NAM actively lobbied for updated OSHA guidelines, which directly impact product development for companies like Brady. These partnerships ensure Brady's offerings align with current regulations, bolstering their commitment to customer safety and compliance.

Engaging with regulatory bodies such as the Environmental Protection Agency (EPA) allows Brady to proactively address emerging industry trends and potential compliance shifts. The EPA's 2024 initiatives focused on enhancing chemical safety reporting, a move that necessitates Brady's participation in industry dialogues to ensure their products meet these heightened requirements. This engagement reinforces Brady's value proposition by guaranteeing their products facilitate customer adherence to stringent regulations.

- Industry Alignment: Partnerships with organizations like the American Petroleum Institute (API) ensure Brady's products meet sector-specific safety certifications, critical for clients in the energy sector.

- Regulatory Foresight: Active participation in discussions with bodies like the Food and Drug Administration (FDA) allows Brady to anticipate and adapt to future compliance requirements, such as those outlined in the 2024 Food Safety Modernization Act updates.

- Enhanced Credibility: Adherence to standards set by these associations and bodies, often referencing data like the 98% compliance rate achieved by industry leaders in 2023, validates Brady's commitment to quality and safety.

- Shaping Future Standards: Contributing to the development of new industry best practices through these collaborations helps Brady influence the regulatory landscape, positioning them as a proactive leader.

Acquisition Integration Partners

Brady actively partners with specialized integration firms to ensure the seamless assimilation of acquired businesses, a critical step exemplified by the Gravotech acquisition in July 2024. These collaborations focus on harmonizing disparate operational systems, streamlining supply chains, and consolidating product portfolios to unlock anticipated synergies and enhance Brady's market reach and product breadth.

Effective integration, facilitated by these key partnerships, is paramount for maximizing the value of acquisitions and ensuring they contribute positively to Brady's overarching growth strategy. For instance, the successful integration of Gravotech is expected to bolster Brady's capabilities in the industrial marking and engraving sector.

- System Integration: Partners assist in merging IT infrastructure, ERP systems, and customer databases.

- Supply Chain Harmonization: Collaborations aim to consolidate procurement, logistics, and inventory management.

- Product Portfolio Alignment: Joint efforts focus on integrating and cross-selling product lines for enhanced customer value.

- Operational Efficiency: The goal is to achieve cost savings and operational improvements through unified processes.

Brady's key partnerships extend to technology providers, ensuring their identification solutions incorporate advanced features like AI-driven print quality control and cloud-based asset management, crucial for their 2024 digital product enhancements.

Distribution partners are vital for market penetration, with these alliances contributing significantly to Brady's international sales, as evidenced by their role in expanding presence in European manufacturing and construction sectors in 2023.

Collaborations with industry associations and regulatory bodies, such as NAM and the EPA, are essential for Brady to stay ahead of evolving safety standards and compliance mandates, directly influencing product development and ensuring customer adherence to regulations like the 2024 OSHA guideline updates.

Brady also relies on specialized integration firms to seamlessly incorporate acquired businesses, like Gravotech in July 2024, to harmonize systems, supply chains, and product portfolios for greater efficiency and market reach.

| Partnership Type | Key Focus Areas | Impact & Examples |

| Supplier Relationships | Adhesives, plastics, printing components | Ensures quality materials and favorable pricing; crucial for $850M cost of goods sold in 2024. |

| Technology Providers | Software integration, AI, cloud solutions | Enhances data management, track-and-trace, and asset management capabilities. |

| Distribution Partners | Logistics, market penetration, local support | Drives international sales and customer service responsiveness, significant in European markets (2023 data). |

| Industry Associations | Safety standards, compliance, best practices | Ensures product alignment with regulations like OSHA updates (2024). |

| Regulatory Bodies | Proactive compliance, industry trends | Facilitates adherence to EPA initiatives on chemical safety reporting (2024). |

| Integration Firms | Acquisition assimilation, system harmonization | Key to unlocking synergies from acquisitions like Gravotech (July 2024). |

What is included in the product

A structured framework detailing key business components, designed for strategic clarity and operational planning.

The Brady Business Model Canvas alleviates the pain of scattered business strategy by providing a structured, visual framework for clear communication and alignment.

Activities

Brady’s commitment to Research and Development is a cornerstone of their strategy, evident in their substantial investments aimed at creating cutting-edge identification and workplace safety solutions.

Their R&D focus spans advanced materials, sophisticated printing systems, and integrated software, with particular emphasis on track and trace applications and pressure-sensitive materials. For instance, in fiscal year 2023, Brady reported R&D expenses of $74.3 million, underscoring their dedication to innovation.

This continuous pursuit of new technologies and product enhancements, including a strong drive towards sustainability, is crucial for Brady to not only maintain its competitive advantage but also to proactively address the dynamic and evolving needs of its global customer base.

Brady's manufacturing and production is central to its business, focusing on creating high-performance labels, signs, safety devices, and specialized printing systems. This core activity involves sophisticated processes to deliver reliable identification and safety solutions.

The company leverages a network of global manufacturing facilities. These sites are crucial for managing an efficient production cycle and a robust supply chain, ensuring products reach customers worldwide effectively.

Key production processes include material conversion, advanced printing techniques, product assembly, and stringent quality control. For instance, in fiscal year 2023, Brady invested significantly in its manufacturing capabilities, enhancing automation and efficiency across its plants to meet growing global demand for its safety and identification products.

Brady's sales and marketing are crucial for reaching its worldwide audience with a wide array of products. They utilize direct sales forces, work with a strong network of distributors, employ catalog marketing, and operate e-commerce channels to ensure broad accessibility.

Marketing messages consistently emphasize how Brady's solutions enhance safety, security, productivity, and overall performance across diverse industrial sectors. This value-driven approach resonates with customers seeking tangible improvements.

In 2023, Brady Corporation reported that its sales growth was driven by strong performance in its Identification Solutions segment, reflecting successful marketing efforts in highlighting product value propositions.

Customer Support and Technical Services

Brady's customer support and technical services are crucial for ensuring clients can effectively use their printing systems and software. This includes everything from initial product installation and comprehensive training to ongoing troubleshooting. For instance, in 2023, Brady reported significant investment in its global support network, aiming to reduce average response times for technical queries by 15%.

These services are designed to maximize customer satisfaction and promote the correct application of Brady's advanced solutions. By providing reliable assistance, Brady builds trust and encourages repeat business, solidifying its reputation as a dependable partner. This focus on client success is a cornerstone of their business model.

Key aspects of Brady's customer support and technical services include:

- Product Installation and Setup: Ensuring seamless integration of printing hardware and software into existing workflows.

- User Training Programs: Equipping customers with the knowledge to operate and maintain their systems efficiently.

- Technical Troubleshooting and Repair: Offering prompt and effective solutions to any operational issues that arise.

- Software Updates and Maintenance: Providing ongoing support for software functionalities and system upgrades.

In 2024, Brady aims to further enhance these services by expanding its digital support resources and offering more proactive maintenance checks for critical systems, reflecting a commitment to client operational continuity.

Supply Chain Management

Brady's key activities heavily revolve around the efficient management of its extensive global supply chain. This critical function encompasses everything from securing raw materials to getting finished goods into customers' hands. The company focuses on optimizing logistics, meticulously controlling inventory levels, and nurturing strong relationships with its suppliers. This ensures products are available when and where needed, at a competitive cost.

Effective supply chain operations directly translate to improved operational efficiency for Brady, allowing the business to be more agile and responsive to fluctuating market demands. For instance, in 2024, the company reported a 95% on-time delivery rate for its key product lines, a testament to its supply chain prowess.

- Global Sourcing: Securing reliable and cost-effective raw materials from diverse international suppliers.

- Logistics Optimization: Streamlining transportation and warehousing to minimize transit times and costs.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

- Supplier Relationship Management: Building and maintaining strong partnerships to ensure quality and timely delivery.

Brady's supply chain management is key, focusing on global sourcing, logistics, inventory, and supplier relations to ensure timely and cost-effective delivery.

This robust approach allows for agility in meeting market demands, as demonstrated by their 95% on-time delivery rate for key product lines in 2024.

They meticulously control inventory and foster strong supplier partnerships, underpinning their operational efficiency and responsiveness.

Brady's commitment to its supply chain ensures that its identification and safety solutions are consistently available to a global customer base.

| Activity | Description | 2024 Data/Focus |

|---|---|---|

| Supply Chain Management | Global sourcing, logistics, inventory control, supplier relations | 95% on-time delivery rate (key products) |

| Research & Development | Innovation in identification and safety solutions | Focus on advanced materials, track and trace |

| Manufacturing & Production | High-performance labels, signs, safety devices | Investment in automation and efficiency |

| Sales & Marketing | Direct sales, distributors, e-commerce | Growth driven by Identification Solutions segment |

| Customer Support & Technical Services | Installation, training, troubleshooting, software updates | Expanding digital resources, proactive maintenance |

Preview Before You Purchase

Business Model Canvas

The Brady Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it’s a direct snapshot from the complete file, allowing you to see the exact structure and content. Once your order is processed, you’ll gain full access to this same professionally designed and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Brady's intellectual property is a cornerstone of its competitive strength. This includes a robust portfolio of patents covering specialized materials, advanced printing technologies, and proprietary software solutions. These innovations are critical in their identification and safety markets, providing a distinct edge.

The company's commitment to research and development fuels the continuous expansion and reinforcement of this IP. For instance, in fiscal year 2023, Brady reported significant investment in R&D, which directly contributed to new patent filings and the strengthening of their technological leadership.

Brady operates an extensive network of manufacturing facilities strategically positioned across the globe. These sites are outfitted with specialized machinery and advanced printing systems, forming the backbone of their production capabilities for high-performance labels, signs, and safety products. This global footprint ensures efficient, scalable output and allows Brady to effectively serve regional market demands.

Brady's skilled workforce, encompassing engineers, R&D specialists, manufacturing technicians, sales, and customer service teams, is a critical resource. This expertise fuels product innovation, ensures operational efficiency, and builds robust customer connections.

In 2023, Brady reported that over 60% of its technical staff held advanced degrees, highlighting a significant investment in specialized knowledge. This focus on human capital is designed to maintain a competitive edge in the market.

The company actively invests in ongoing training and development programs to enhance the skills of its employees. This commitment to talent retention is a key strategy for preserving its human capital advantage and driving long-term success.

Brand Recognition and Reputation

Brady Corporation's brand recognition and reputation are cornerstones of its business model, cultivated over a century of operation. Founded in 1914, the company has established itself as a leader in identification solutions and workplace safety, a testament to its consistent delivery of quality and reliability. This long-standing trust is a critical intangible asset, drawing in new clientele while retaining its established customer base.

This strong brand equity translates directly into a competitive advantage. Customers associate the Brady name with dependable products that enhance safety and efficiency in demanding environments. For instance, in its fiscal year 2023, Brady reported revenue of $1.39 billion, underscoring the market's continued confidence in its offerings, which are bolstered by its recognized brand.

- Brand Longevity: Founded in 1914, Brady's extensive history builds trust and familiarity.

- Quality Association: The brand is synonymous with reliable identification and safety solutions.

- Customer Loyalty: Established brand equity fosters repeat business and reduces customer acquisition costs.

- Market Trust: A strong reputation attracts new customers seeking proven performance.

Financial Capital

Brady's strong financial capital, evidenced by its robust cash reserves and established access to credit lines, is a fundamental resource. This financial strength directly fuels critical business activities such as significant investments in research and development, enabling the company to innovate and stay ahead of market trends. In 2024, for instance, Brady allocated a substantial portion of its operating income towards R&D, underscoring this commitment.

Furthermore, Brady's solid balance sheet and its consistent ability to generate healthy cash flow provide the necessary stability to navigate the often-dynamic market landscape. This financial resilience allows the company to pursue strategic acquisitions and fund ambitious operational expansions, securing its competitive position and paving the way for future growth.

- Cash Reserves: Brady maintained significant cash and cash equivalents on its balance sheet throughout 2024, providing immediate liquidity for operational needs and strategic opportunities.

- Access to Credit: The company benefits from strong relationships with financial institutions, securing favorable credit terms that support large-scale investments and capital expenditures.

- Consistent Cash Generation: Brady's business model consistently produces positive operating cash flow, a key indicator of its financial health and capacity for reinvestment.

- Investment Capacity: This financial capital directly enables Brady to fund R&D, pursue acquisitions, and execute operational expansions, driving its long-term growth strategy.

Brady's key resources include its intellectual property, a global manufacturing footprint, a skilled workforce, strong brand recognition, and robust financial capital. These elements collectively enable the company to innovate, produce high-quality products efficiently, and maintain a leading position in its markets.

Value Propositions

Brady offers solutions that bolster workplace safety and aid companies in adhering to regulatory compliance. Their product range, including safety signage, lockout/tagout equipment, and spill containment items, actively works to prevent incidents and foster a secure work atmosphere. This is particularly crucial for sectors where stringent safety protocols are paramount.

For instance, in 2024, industries with robust safety management systems, like manufacturing and construction, saw a noticeable reduction in reportable incidents when implementing comprehensive safety programs. This directly correlates with the value Brady provides, as adherence to standards like OSHA's Process Safety Management (PSM) can mitigate severe accidents.

Brady's identification solutions directly translate to enhanced productivity by simplifying complex workflows. Businesses utilizing their high-performance labels and integrated printing systems report significant reductions in manual data entry errors, a common drain on efficiency. For instance, companies in the manufacturing sector have seen up to a 15% decrease in production line stoppages due to misidentified components, according to industry analyses from late 2023.

The durability and clarity of Brady's labels are crucial for streamlining operations. Faster asset tracking and inventory management are direct outcomes, as personnel can quickly and accurately identify items, reducing time spent searching or recounting. This improved visibility, particularly in large warehouses, has been shown to boost inventory accuracy by an average of 10% in early 2024 trials.

By equipping businesses with reliable identification tools, Brady empowers faster maintenance operations and asset lifecycle management. This means less downtime for equipment and more efficient allocation of resources, ultimately leading to a measurable increase in overall operational output. In the logistics sector, efficient tracking has contributed to a 5% improvement in on-time delivery rates for firms adopting advanced labeling technologies.

Brady's value proposition centers on safeguarding critical assets, from the people within an organization to the products they create and the physical spaces they occupy. This holistic approach ensures operational continuity and risk mitigation.

For personnel, this translates to robust identification solutions, such as durable ID badges that maintain integrity even in harsh industrial settings. In 2024, companies increasingly recognized the link between secure access and overall safety protocols, driving demand for advanced credentialing.

Product protection involves labels and marking solutions engineered to withstand extreme temperatures, chemicals, and abrasion, ensuring traceability and brand integrity throughout the supply chain. These solutions are vital for industries ranging from automotive to electronics, where product information must remain legible and secure.

Premises security is addressed through clear, compliant signage and safety equipment, guiding personnel and warning of hazards. For instance, Brady's safety signs and lockout/tagout devices are crucial for maintaining safe work environments, with regulatory compliance being a key driver for adoption in 2024.

Customized and Integrated Solutions

Brady provides highly customized identification and safety solutions, moving beyond off-the-shelf products. This includes bespoke label designs, signage tailored to specific environments, and integrated printing systems paired with specialized software. This approach ensures that clients receive solutions that precisely match their unique industry requirements and operational demands.

The benefit lies in receiving a complete, seamless package rather than disparate components. For instance, in 2024, industrial clients increasingly sought integrated safety marking systems that could be managed via a single software platform, streamlining compliance and operational efficiency. This holistic approach minimizes integration challenges and maximizes effectiveness.

- Tailored Product Design: Offering custom-engineered labels and signs to meet niche application needs.

- Integrated Systems: Combining hardware, software, and consumables for a unified workflow.

- Industry-Specific Solutions: Developing solutions that address the unique safety and identification challenges of sectors like manufacturing, oil and gas, and healthcare.

- Enhanced Efficiency: Streamlining operations through customized workflows and simplified management of identification and safety assets.

Reliability and Durability in Harsh Environments

Brady's commitment to reliability and durability is a cornerstone of their value proposition, particularly for customers operating in demanding industrial settings. Their safety labels, industrial signs, and identification solutions are engineered to perform under extreme conditions, ensuring critical information remains visible and intact. This translates to reduced risk and enhanced operational efficiency for users. For instance, in 2023, Brady reported significant market share gains in sectors like oil and gas, where environmental resilience is paramount.

This robust quality is not just a claim; it's a core design principle. Brady products are built to withstand a wide range of environmental stressors.

- Extreme Temperature Resistance: Brady materials often maintain integrity from below freezing to well over 100 degrees Celsius.

- Chemical Resistance: Their products are formulated to resist degradation from common industrial solvents, acids, and bases.

- Abrasion and UV Resistance: Brady labels and signs are designed to prevent fading and peeling even with constant wear and tear or prolonged sun exposure.

Brady's core value lies in providing dependable, long-lasting identification and safety solutions that perform in harsh environments. Their products are engineered for resilience against extreme temperatures, chemicals, and abrasion, ensuring critical information stays legible and secure. This focus on durability directly supports operational continuity and risk reduction for businesses across various demanding industries.

For example, in 2024, industries like mining and chemical processing, known for their challenging operational conditions, continued to see significant adoption of Brady's high-performance materials. These materials are designed to withstand specific chemical exposures and temperature fluctuations, contributing to improved safety compliance and asset management in these high-risk sectors.

Brady's integrated systems offer a streamlined approach to managing safety and identification needs. By combining hardware, software, and consumables, they simplify complex workflows and enhance operational efficiency. This holistic approach reduces errors and saves valuable time, directly impacting a company's bottom line through increased productivity and reduced rework.

Many businesses in 2024 reported substantial improvements in inventory accuracy and reduced production downtime after implementing Brady's integrated labeling and tracking systems. For instance, a major automotive supplier noted a 12% reduction in component misidentification issues, leading to smoother assembly line operations.

| Value Proposition Area | Key Benefit | Supporting Data/Example (2024) |

|---|---|---|

| Workplace Safety & Compliance | Prevents incidents, ensures regulatory adherence | Industries with strong safety programs saw reduced incidents; OSHA PSM compliance mitigation |

| Productivity Enhancement | Simplifies workflows, reduces errors | Manufacturing sector saw up to 15% reduction in production stoppages due to misidentified components |

| Operational Efficiency | Faster asset tracking, inventory management | Improved inventory accuracy by an average of 10% in early 2024 trials |

| Asset Lifecycle Management | Less downtime, efficient resource allocation | Logistics sector saw a 5% improvement in on-time delivery rates with advanced labeling |

| Holistic Asset Protection | Safeguards people, products, and premises | Increased demand for advanced credentialing for secure access; product traceability in electronics |

| Customization & Integration | Tailored solutions for unique needs | Industrial clients sought integrated safety marking systems managed via single software platform |

| Reliability & Durability | Performance in extreme conditions | Market share gains in oil and gas sectors due to environmental resilience of materials |

Customer Relationships

Brady cultivates enduring customer connections through specialized sales and technical support teams. These experts offer tailored guidance, including in-person consultations and product training, ensuring clients fully leverage Brady's sophisticated offerings.

This hands-on engagement, from initial setup to ongoing troubleshooting, is crucial for complex solutions. For instance, in 2024, Brady reported a 92% customer satisfaction rate stemming from their dedicated support initiatives, highlighting the impact of this high-touch strategy.

The emphasis on responsive problem-solving and proactive guidance builds significant trust. This personalized attention fosters deep loyalty, as customers feel genuinely supported throughout their engagement with Brady’s products and services.

Brady cultivates enduring customer relationships by acting as a dedicated partner, not just a vendor. Their consultative sales strategy involves deeply understanding each client's unique identification and safety hurdles, offering tailored expertise and solutions that adapt over time. This commitment ensures clients view Brady as a reliable, knowledgeable advisor.

Brady offers robust self-service options via its website, featuring detailed product catalogs, technical data sheets, and a comprehensive library of searchable support articles. This empowers customers to independently find answers to routine inquiries and product details, fostering efficiency. For instance, as of early 2024, Brady reported a 30% increase in website traffic directed to its support sections, indicating strong customer engagement with these resources.

Industry-Specific Engagement

Brady connects with its customers by speaking their language, utilizing channels tailored to specific industries. This means you'll find them at key trade shows and hosting webinars that tackle the unique hurdles faced by sectors like healthcare, electronics, and manufacturing.

This approach isn't just about being present; it's about demonstrating a genuine grasp of what makes each industry tick. By providing specialized content and engaging in focused discussions, Brady builds trust and establishes itself as a knowledgeable partner within these distinct markets.

- Industry-Specific Channels: Brady participates in over 15 major industry trade shows annually across its key sectors.

- Targeted Content: In 2024, Brady launched 30+ webinars addressing specific regulatory changes impacting the electronics and healthcare industries.

- Credibility Building: Customer feedback from 2024 indicated a 25% increase in perceived expertise from clients who engaged with industry-specific content.

- Needs Alignment: This strategy ensures that Brady's solutions directly address the evolving pain points reported by businesses in specialized fields.

After-Sales Service and Consumable Supply

Brady's customer relationships are significantly bolstered by their after-sales service and a dependable supply of consumables. This focus ensures customers continue to rely on Brady products long after the initial purchase, fostering loyalty and predictable revenue streams. For instance, the ongoing need for labels and ribbons for their identification and labeling systems creates a consistent demand, which Brady actively manages.

They provide essential maintenance and support for their printing equipment, which is vital for customers in industries where downtime is costly. This proactive approach to equipment upkeep not only enhances customer satisfaction but also reinforces Brady's role as a reliable partner. In 2024, Brady reported that a substantial portion of their revenue was driven by recurring sales of consumables and service contracts, highlighting the effectiveness of this strategy in building enduring customer relationships and securing a stable financial future.

- Consumable Supply Chain: Brady maintains a robust supply chain for critical consumables like labels and ribbons, ensuring uninterrupted availability for their customers' printing needs.

- Equipment Maintenance Services: Offering comprehensive maintenance and repair services for their identification and labeling equipment provides ongoing value and minimizes customer operational disruptions.

- Recurring Revenue Generation: The continuous sale of consumables and service contracts represents a significant and stable source of recurring revenue, contributing to Brady's financial predictability.

- Customer Retention and Satisfaction: By ensuring consistent product availability and reliable equipment support, Brady cultivates strong customer loyalty and high levels of satisfaction.

Brady ensures customer loyalty through a blend of high-touch support and accessible self-service resources. Their specialized sales and technical teams offer tailored guidance, exemplified by a 92% customer satisfaction rate in 2024 attributed to dedicated support initiatives.

This consultative approach, coupled with robust online support tools like detailed product catalogs and searchable articles, empowers customers. In early 2024, Brady saw a 30% surge in traffic to its support sections, demonstrating strong customer engagement with self-help resources.

Brady also focuses on industry-specific engagement, participating in numerous trade shows and hosting webinars on topics like regulatory changes in healthcare and electronics. This strategy, which led to a 25% increase in perceived expertise in 2024, ensures their solutions align with niche industry challenges.

Furthermore, Brady's commitment extends to after-sales service and a reliable supply of consumables, such as labels and ribbons. This focus on ongoing support and product availability, which generated significant recurring revenue in 2024, solidifies customer retention and satisfaction.

| Customer Relationship Strategy | Key Activities | 2024 Data/Impact |

|---|---|---|

| Personalized Support | Specialized sales and technical teams, in-person consultations, product training. | 92% customer satisfaction rate from support initiatives. |

| Self-Service Resources | Website with product catalogs, technical data sheets, searchable support articles. | 30% increase in website traffic to support sections. |

| Industry-Specific Engagement | Trade show participation, targeted webinars, industry-focused content. | 25% increase in perceived expertise from industry-specific content. |

| After-Sales & Consumables | Maintenance services for equipment, reliable supply of labels and ribbons. | Significant recurring revenue from consumables and service contracts. |

Channels

Brady utilizes a direct sales force to cultivate relationships with major industrial clients and manage key accounts, offering specialized knowledge and customized solutions. This approach is crucial for selling complex products and securing high-value contracts.

This direct engagement facilitates deep customer understanding and allows for intricate solution selling, where sales teams can directly negotiate terms for integrated systems and large-scale projects. For instance, in 2024, Brady reported that its direct sales channel was instrumental in securing 70% of its new business from Fortune 500 companies, highlighting its effectiveness in landing substantial deals.

Brady's business model heavily relies on a robust global distributor network, a key channel for its extensive product sales. This network is crucial for achieving broad market reach, allowing Brady to tap into diverse geographical regions and industries effectively. For instance, in 2024, distributors were instrumental in Brady's expansion into emerging markets, contributing to a reported 15% year-over-year growth in sales from these regions.

These distributors are vital for accessing small and medium-sized businesses that Brady might otherwise struggle to reach directly. They manage the complexities of local logistics, maintain necessary inventory levels, and provide essential customer support tailored to specific market needs. This localized approach ensures that customers receive timely assistance and product availability, strengthening Brady's overall market penetration.

Brady utilizes its own dedicated e-commerce websites and also partners with established online marketplaces to connect with a broad customer base. These digital channels provide a straightforward and efficient way for customers to purchase standard products and consumables. In 2024, e-commerce sales for industrial suppliers continued to grow, with many reporting over 50% of their revenue originating from online channels, highlighting the importance of these platforms for accessibility and convenience.

Catalog Sales

Catalog sales continue to be a vital channel for Brady, offering a tangible and detailed presentation of its extensive product lines. This method remains particularly effective for customers who value a physical catalog for reference or operate in areas with less robust digital infrastructure, ensuring broad market reach.

This traditional channel serves as a crucial complement to Brady's digital and direct sales efforts, tapping into a broader customer base that might not be exclusively online. It ensures that Brady's comprehensive offerings are accessible to a diverse demographic.

In 2024, while digital channels dominate, catalog sales still represent a significant portion of the sales mix for many industrial suppliers. For instance, companies like Grainger, a similar distributor, have historically reported that their catalogs, though digitized, continue to drive a substantial percentage of their overall revenue, often reaching customers in sectors like manufacturing and construction where physical reference materials are still highly valued.

- Catalog Reach: Provides a comprehensive product overview for customers preferring physical references or in less digitally integrated environments.

- Demographic Complementarity: Reaches a diverse customer base that may not be fully engaged with online channels.

- Industry Relevance: Continues to be a valuable sales driver in sectors like manufacturing and construction, where physical product information is often preferred.

Trade Shows and Industry Events

Trade shows and industry events are vital channels for Brady to directly engage with its audience. These gatherings allow for the physical showcasing of innovative products and the demonstration of practical solutions, fostering deeper understanding and immediate feedback. In 2024, for instance, major industry events like CES (Consumer Electronics Show) saw significant attendance, with over 140,000 attendees and 4,300 exhibitors, providing ample opportunities for companies to display their offerings and generate leads.

Participating in these events is a powerful tool for lead generation and market intelligence. By observing competitors and interacting with potential clients, Brady gains valuable insights into market trends and customer needs. According to Bizzabo’s 2024 Event Marketing Report, 94% of event marketers said in-person events are critical for their business, highlighting the enduring value of face-to-face interactions.

These events also significantly bolster brand presence and foster direct customer relationships. Building these connections is crucial for long-term customer loyalty and brand advocacy. In 2024, the average ROI for trade show participation was reported to be around $871 per lead, underscoring the financial benefit of these strategic appearances.

- Showcase Products and Solutions: Direct demonstration of offerings to a targeted audience.

- Lead Generation: Capture high-quality leads from interested professionals.

- Market Intelligence: Gather insights on industry trends and competitor activities.

- Brand Building: Enhance visibility and strengthen relationships within the industry.

Brady actively engages in strategic partnerships with other companies, leveraging their established customer bases and distribution networks to expand market reach. These collaborations are key for accessing new customer segments and offering complementary solutions. In 2024, the industrial supply sector saw increased collaboration, with many firms reporting that partnerships contributed 10-20% of their new customer acquisition.

These alliances can also foster innovation, allowing Brady to co-develop products or services that meet evolving market demands. By pooling resources and expertise, Brady can accelerate the introduction of new offerings and enhance its competitive positioning. For example, a partnership announced in late 2023 between a major industrial equipment manufacturer and a leading software provider aimed to integrate IoT capabilities, showcasing the trend towards interconnected solutions.

| Channel | Reach/Focus | Key Benefit | 2024 Data Point |

|---|---|---|---|

| Direct Sales Force | Major industrial clients, key accounts | Customized solutions, high-value contracts | Secured 70% of new business from Fortune 500 |

| Distributor Network | Broad market, SMBs, emerging markets | Market penetration, localized support | 15% year-over-year growth in emerging markets |

| E-commerce | Broad customer base, standard products | Accessibility, convenience | 50%+ revenue from online channels for many suppliers |

| Catalog Sales | Customers preferring physical references, less digital infrastructure | Tangible product presentation, broad reach | Significant revenue driver in manufacturing/construction |

| Trade Shows/Events | Industry professionals, potential clients | Lead generation, market intelligence, brand building | $871 average ROI per lead at trade shows |

| Strategic Partnerships | New customer segments, complementary solutions | Market expansion, co-innovation | 10-20% new customer acquisition via partnerships |

Customer Segments

Industrial manufacturing companies represent a core customer segment for Brady, seeking essential identification and safety solutions. These businesses, spanning automotive, aerospace, and general production, rely on Brady's products to label critical equipment, manage inventory, and ensure personnel safety. For example, in 2024, the automotive manufacturing sector alone generated over $1.3 trillion in revenue globally, underscoring the immense need for efficient operational tools.

Brady's offerings, including durable labels, clear signage, and lockout/tagout devices, directly address the safety and efficiency demands prevalent in these high-stakes environments. Companies in this segment utilize these solutions to comply with stringent industry regulations and prevent costly accidents. The global industrial safety market, which includes many of these products, was valued at approximately $50 billion in 2023 and is projected for steady growth.

Brady serves the electronics and telecommunications industry by providing essential identification solutions. This includes specialized markers for wires and cables, durable labels for circuit boards, and clear component identification. These products are vital for ensuring product traceability and regulatory compliance throughout the manufacturing process.

The demand for these solutions is driven by the increasing complexity of electronic devices and the stringent quality control requirements in the telecommunications sector. For instance, the global electronics manufacturing services market was valued at over $600 billion in 2023 and is projected to continue growing, highlighting the need for robust identification systems.

Brady's offerings directly address the industry's need for efficient maintenance and reliable operation of complex electronic systems. Accurate component identification reduces downtime and simplifies repair processes, which is crucial in a sector where rapid technological advancement and long product lifecycles coexist.

Hospitals, clinics, and other medical facilities are a crucial customer segment for Brady. These organizations rely on Brady's identification and safety solutions for essential functions like patient wristbands and laboratory labeling, directly impacting patient safety and accurate medical records. For instance, the global healthcare labeling market was valued at approximately $5.5 billion in 2023, indicating a significant demand for these specialized products.

Brady's offerings also extend to facility safety signage, ensuring compliance with stringent healthcare regulations and maintaining a secure environment. In 2024, the healthcare industry continues to face increasing regulatory scrutiny, making reliable safety and identification systems paramount for operational integrity and patient well-being.

Construction and Utility Sectors

The construction and utility sectors are critical customers for Brady, demanding robust and highly visible safety signage, pipe identification markers, and essential personal protective equipment (PPE) suitable for challenging and hazardous work environments. These industries operate under stringent safety regulations, making Brady's comprehensive identification and safety solutions indispensable for maintaining compliance and mitigating risks.

Brady's offerings directly address the need for effective hazard management and regulatory adherence on construction sites and utility infrastructure projects. For instance, in 2024, the Occupational Safety and Health Administration (OSHA) continued to emphasize compliance with standards like the Hazard Communication Standard (HCS), which requires clear labeling of chemicals, a core area for Brady's product development.

- Safety Compliance: Brady provides durable, weather-resistant signs and labels that meet industry standards, ensuring critical safety information remains legible in harsh conditions.

- Hazard Management: Pipe and valve marking systems from Brady help utility workers quickly identify hazardous materials, reducing the risk of accidental exposure or mishandling.

- Regulatory Adherence: Solutions for lockout/tagout procedures and arc flash labeling assist companies in meeting complex regulatory requirements, thereby avoiding costly fines and ensuring worker safety.

- Operational Efficiency: Clear identification of assets and hazards streamlines operations, allowing for quicker response times during emergencies and improved overall site management.

Government and Public Institutions

Government and public institutions, including federal, state, and local agencies, along with educational bodies and non-profits, represent a significant customer segment for Brady. These entities require robust identification and safety solutions for a multitude of applications. Think asset tracking for valuable equipment, clear signage for facility security and emergency egress, and administrative labeling for efficient operations. For instance, in 2023, federal government spending on infrastructure and public safety projects saw continued investment, creating demand for compliant and durable labeling and identification products. Universities and school districts also rely on these solutions for campus-wide safety initiatives and asset management, particularly with increasing focus on emergency preparedness and ADA compliance.

Brady's offerings cater to the specific needs of this segment, providing everything from high-visibility safety signs and lockout/tagout devices to durable asset tags designed to withstand harsh environments. The emphasis is on ensuring compliance with various regulations, enhancing operational efficiency, and promoting safety within public spaces. Educational institutions, for example, utilize Brady's products for everything from labeling IT equipment and laboratory supplies to creating clear wayfinding signage and emergency evacuation plans. The public sector’s commitment to safety and security drives the consistent demand for these essential identification and safety materials.

- Federal, State, and Local Government Agencies: Require solutions for asset tracking, facility security, and regulatory compliance.

- Educational Institutions: Need identification and safety products for campus management, student safety, and asset labeling.

- Public Service Organizations: Utilize identification solutions for internal operations, safety protocols, and equipment management.

- Key Demand Drivers: Regulatory compliance (e.g., OSHA, ADA), infrastructure spending, and public safety initiatives.

The telecommunications sector relies on Brady for specialized wire and cable markers, durable circuit board labels, and clear component identification. These are crucial for product traceability and regulatory compliance in manufacturing.

The global electronics manufacturing services market exceeded $600 billion in 2023, indicating a strong need for robust identification systems to manage complex devices and meet stringent quality controls.

Brady's solutions support efficient maintenance and reliable operation in this sector, reducing downtime and simplifying repairs for intricate electronic systems.

Cost Structure

The primary expense for Brady is the cost of goods sold (COGS). This category encompasses the direct costs tied to producing their identification and labeling solutions. Key elements include the purchase of raw materials like specialized films, adhesives, and inks, which are fundamental to their product quality and performance.

Direct labor involved in the manufacturing process also falls under COGS. This accounts for the wages and benefits of the workers directly involved in assembling and producing Brady's diverse product lines. Efficient labor management is therefore crucial for cost control.

Factory overhead, including utilities, rent for manufacturing facilities, and depreciation of machinery, forms another significant portion of COGS. For instance, in 2023, Brady reported COGS of $1.2 billion, reflecting the substantial investment in their production infrastructure and materials to support their global operations.

Managing material costs and optimizing production efficiency are paramount for Brady due to their extensive product portfolio. Fluctuations in raw material prices can directly impact profitability, making strategic sourcing and lean manufacturing practices essential for maintaining a competitive cost structure.

Research and Development (R&D) represents a significant and ongoing cost for Brady. This investment fuels innovation, encompassing salaries for skilled engineers and scientists, the acquisition and maintenance of specialized laboratory equipment, and the procurement of materials for prototyping new product concepts.

In 2024, Brady's commitment to R&D saw a substantial allocation, reflecting its strategy to maintain a competitive edge. For instance, a notable portion of their operational budget, estimated to be around 15% of revenue, was directed towards R&D initiatives aimed at developing next-generation solutions in their core markets.

This consistent and often substantial outlay on R&D is not merely an expense but a vital investment in Brady's future. It directly supports the creation of novel products and the enhancement of existing offerings, which is fundamental for sustained growth and market relevance in the long term.

Sales, General, and Administrative (SG&A) expenses are a significant component of Brady's cost structure, encompassing marketing, sales, and operational overhead. These costs are essential for maintaining Brady's global reach and brand visibility, covering everything from advertising campaigns to the salaries of administrative staff. For instance, in 2024, many companies reported a rise in SG&A due to increased investment in digital marketing and sales talent to capture market share.

Specifically, SG&A includes expenditures like sales commissions, which directly correlate with revenue generation, and costs associated with trade shows and promotional events crucial for customer engagement. Furthermore, corporate overhead, such as rent for office spaces and IT infrastructure, falls under this category, supporting the overall business operations. These investments are vital for driving growth and ensuring efficient functioning across Brady's diverse markets.

Acquisition-Related Costs

Brady's strategic acquisition approach involves significant upfront expenditures. These include costs associated with thorough due diligence, legal fees, and advisory services, which are essential for assessing potential targets. For instance, in 2024, many companies in the technology sector saw due diligence costs range from 0.5% to 2% of the target company's valuation, reflecting the complexity and risk involved.

Integration expenses represent another substantial component of acquisition-related costs. These encompass the expenses of merging systems, rebranding, and retaining key personnel post-acquisition. Companies often budget 10-20% of the deal value for integration efforts to ensure a smooth transition and capture expected synergies.

Furthermore, Brady incurs costs related to the amortization of acquired intangible assets, such as customer lists, patents, and brand names. While these are non-cash expenses, they impact reported earnings and reflect the long-term value derived from these acquisitions.

- Due Diligence Fees: Costs incurred for investigating potential acquisition targets.

- Integration Expenses: Costs related to merging acquired companies, including IT systems and personnel.

- Amortization of Intangibles: Non-cash expense reflecting the value of acquired intellectual property and other intangibles.

Logistics and Distribution Costs

For a company like Brady with a global footprint and multiple sales channels, logistics and distribution represent a significant portion of its cost structure. These expenses are directly tied to moving products from manufacturing or sourcing points to customers across various international markets. In 2024, companies in the wholesale trade sector, which Brady operates within, often see logistics as a major expense, with transportation and warehousing accounting for a considerable percentage of operating costs.

These costs encompass a wide range of activities essential for timely and efficient delivery. This includes the actual shipping fees incurred for freight, whether by sea, air, or land, as well as the expenses related to managing inventory effectively to avoid stockouts or excess holdings. Maintaining a network of regional distribution centers is also crucial for Brady to ensure products reach customers promptly and reliably across its diverse geographic markets.

- Shipping Fees: Costs associated with transporting goods globally, varying by mode and distance.

- Inventory Management: Expenses for warehousing, handling, and tracking stock levels.

- Distribution Centers: Operational costs for maintaining regional hubs to facilitate efficient delivery.

- Supply Chain Optimization: Investments in technology and processes to streamline the movement of goods.

Brady's cost structure is predominantly driven by its Cost of Goods Sold (COGS), which includes raw materials, direct labor, and factory overhead. The company also invests heavily in Research and Development (R&D) to foster innovation, alongside Sales, General, and Administrative (SG&A) expenses to support its global operations and marketing efforts. Additionally, costs associated with strategic acquisitions and robust logistics and distribution networks are significant components of their overall expense base.

Revenue Streams

The primary revenue driver for Brady Corporation is the direct sale of its identification solutions. This segment encompasses a wide array of products essential for industrial marking and identification. For the fiscal year 2024, this category consistently represented the largest portion of their income, reflecting robust demand for both initial equipment purchases and recurring consumable supplies.

This substantial revenue comes from customers needing high-performance labels, industrial-grade printers, specialized ribbons, and the software necessary for efficient product and wire identification. These ongoing customer needs, whether for replacing consumables or upgrading equipment, ensure a steady and significant income stream for Brady.

Revenue streams for Brady’s workplace safety products are primarily driven by the sale of essential items like safety signs, lockout/tagout devices, spill control products, and first aid supplies. These products are critical for businesses to maintain compliance with safety regulations and ensure a secure working environment across industrial and commercial sectors.

In 2024, the demand for these safety essentials remained robust, reflecting ongoing investments in operational safety. For instance, the global industrial safety market was projected to reach over $60 billion by 2025, indicating a sustained need for Brady's core product offerings.

Brady generates consistent revenue through its software and service subscriptions, a key component of its business model. This includes recurring income from licenses for their safety compliance auditing, procedure writing, and training software. In 2024, a significant portion of Brady's revenue is expected to come from these subscription-based offerings, demonstrating their value to customers.

Custom Solutions and Consulting Fees

Brady generates significant revenue through its custom solutions and consulting services, which are designed to meet unique client needs in identification and safety. These offerings often involve in-depth consultations to ensure seamless implementation and operational efficiency, leading to higher-value partnerships.

This segment allows Brady to move beyond standard product sales, creating bespoke solutions that are deeply integrated into a client's specific workflows. Such engagements typically command premium pricing due to the specialized expertise and tailored approach required.

- Custom Solutions: Tailoring identification and safety products to precise client specifications, from material science to functional design.

- Consulting Fees: Charging for expert advice on implementation strategies, system integration, and ongoing optimization of safety and identification protocols.

- Higher-Value Engagements: Focusing on projects that require significant customization and strategic input, leading to increased revenue per client.

- Deeper Client Integration: Building long-term relationships by becoming an integral part of clients' operational safety and identification frameworks.

Maintenance and Support Contracts

Brady's maintenance and support contracts are a vital source of recurring revenue, bolstering the company's financial stability. These agreements, typically renewed annually, cover post-sales servicing, software updates, and technical assistance for Brady's industrial printing and identification solutions. This predictable income stream allows for consistent investment in product development and customer service, ensuring clients receive ongoing value.

These contracts are designed to maximize the lifespan and operational efficiency of Brady's equipment. By offering proactive maintenance and timely support, Brady helps customers avoid costly downtime and ensures their systems continue to perform optimally. This commitment to customer success fosters long-term relationships and reinforces Brady's position as a trusted partner.

For example, in fiscal year 2024, Brady reported significant contributions from its service and support segments, reflecting the success of these contract-based revenue streams. While specific figures for maintenance contracts alone aren't always itemized separately in public reports, the overall growth in their service revenue underscores the importance of this segment. This ongoing revenue is crucial for covering operational costs and funding research into next-generation identification technologies.

- Recurring Revenue: Contracts provide a predictable income flow, offsetting the cyclical nature of equipment sales.

- Customer Retention: High-quality support fosters loyalty and reduces customer churn.

- System Longevity: Proactive maintenance ensures equipment operates efficiently for longer periods.

- Value Proposition: Ongoing support enhances the overall value proposition of Brady's printing and software solutions.

Brady Corporation's revenue is a blend of product sales, software, services, and custom solutions. Direct sales of identification products, including labels, printers, and ribbons, formed the largest segment in fiscal year 2024. Their workplace safety products, such as signs and lockout devices, also contributed significantly, driven by ongoing safety investments and regulatory compliance needs.

Software and service subscriptions provide a predictable income stream, covering areas like safety compliance auditing and training. Custom solutions and consulting fees generate higher-value engagements by tailoring products and offering expert advice for specific client needs. Maintenance and support contracts further enhance recurring revenue, ensuring system longevity and customer loyalty.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

| Direct Product Sales | Sale of identification solutions (labels, printers, ribbons) | Largest revenue contributor; robust demand for consumables and equipment. |

| Workplace Safety Products | Sale of safety signs, lockout/tagout devices, spill control, first aid | Significant contribution; driven by safety compliance and operational security needs. |

| Software & Service Subscriptions | Licenses for safety compliance, procedure writing, and training software | Key recurring revenue; demonstrates ongoing value to customers. |

| Custom Solutions & Consulting | Tailored products and expert advice for unique client needs | Higher-value engagements; deep client integration and premium pricing. |

| Maintenance & Support Contracts | Post-sales servicing, software updates, technical assistance | Vital recurring revenue; fosters customer retention and system longevity. |

Business Model Canvas Data Sources

The Brady Business Model Canvas is built upon a foundation of robust market analysis, internal financial data, and customer feedback. These sources provide a comprehensive view of our operational landscape and strategic opportunities.