Box SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Box Bundle

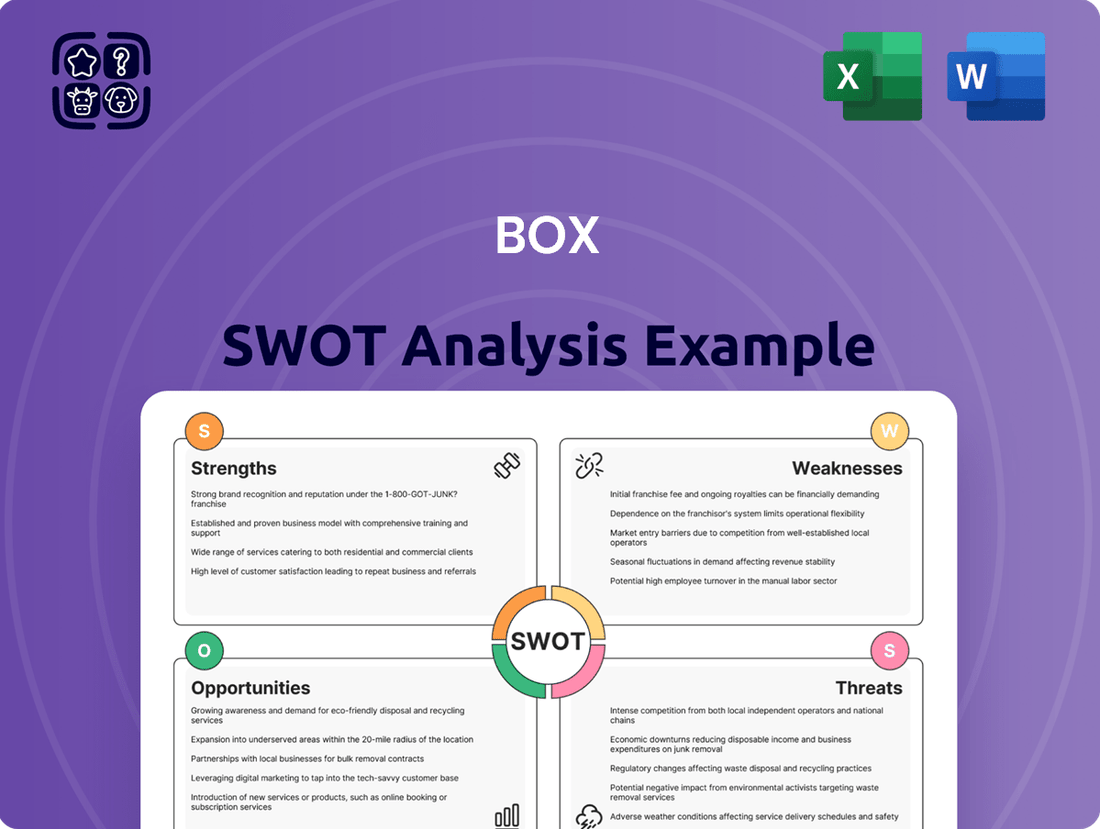

This SWOT analysis provides a crucial snapshot of the company's current standing, highlighting key internal strengths and weaknesses alongside external opportunities and threats. Understanding these elements is vital for any informed strategic decision-making.

Strengths

Box has solidified its position as a frontrunner in Intelligent Content Management, deeply embedding AI capabilities throughout its offerings. This strategic push is evident in innovations like Box AI, Box AI Studio, and Box Hubs, which are designed to revolutionize how businesses interact with their data, offering powerful tools for analysis, summarization, and even automated content generation.

The introduction of Box AI, for instance, allows users to leverage generative AI for tasks such as summarizing lengthy documents, extracting key information, and answering questions directly from content. This capability is vital for boosting employee productivity and streamlining workflows by making vast amounts of unstructured data more accessible and actionable.

Furthermore, Box AI Studio empowers users to build custom AI agents without requiring deep technical expertise, enabling businesses to tailor AI solutions to their specific needs. This democratizes AI development, allowing for the creation of specialized tools that can automate complex content-related processes, thereby unlocking significant value from an organization's digital assets and driving efficiency gains.

Box's robust security and compliance features are a significant strength, especially for organizations handling sensitive information. The platform's encryption for data both in transit and at rest, coupled with granular access controls, ensures a high level of data protection. This focus on security is crucial, as evidenced by the increasing number of data breaches reported globally, making Box's adherence to standards like HIPAA, GDPR, and SOC 2 a key differentiator.

Box boasts a significant strength in its established enterprise customer base, serving a wide spectrum of organizations from nimble startups to Fortune 500 companies. This diverse clientele spans critical sectors like aerospace, financial services, legal, and the public sector, demonstrating the platform's versatility and trust among major players.

The company's commitment to building strong relationships is evident in its continued wins and expansions with key enterprise clients. For instance, Box reported strong performance in its fiscal year 2024, with its largest customers driving significant revenue growth, highlighting the stickiness and value proposition for its enterprise segment.

Furthermore, Box has strategically deepened its partnerships with industry giants such as Amazon Web Services (AWS), IBM, and Oracle (NetSuite). These collaborations are crucial, not only expanding Box's technological capabilities and integration options but also enhancing its market reach and credibility by associating with trusted cloud and enterprise software providers.

Consistent Revenue Growth and Margin Expansion

Box has shown a solid track record of increasing its revenue year after year, alongside improvements in its operating and gross margins. This consistent financial growth is a key strength.

For fiscal year 2024, Box achieved a significant milestone by exceeding $1 billion in annual revenue. This demonstrates their ability to scale effectively and capture market share.

The company's financial health is further underscored by its Q1 fiscal year 2025 performance, where it reported $265 million in revenue, marking a 5% increase compared to the previous year. Additionally, non-GAAP gross margins reached an impressive 80.2% during this period.

- Consistent Revenue Growth: Exceeded $1 billion in FY24, with Q1 FY25 revenue at $265 million, up 5% year-over-year.

- Margin Expansion: Achieved 80.2% non-GAAP gross margins in Q1 FY25, indicating strong cost management.

- Financial Discipline: Efficient cost structure leads to robust free cash flow generation.

Comprehensive Platform and Ecosystem Integrations

Box offers a robust cloud content management and file sharing system, featuring secure storage, collaborative tools, and automated workflows. This comprehensive suite addresses a wide range of business requirements for content management.

The platform's strength lies in its extensive integration capabilities, connecting with over 1,500 business applications. This includes major players like Microsoft, Google, Slack, and Adobe, creating a powerful and interconnected digital workspace.

These integrations significantly boost user productivity and streamline content operations. For instance, Box's integration with Microsoft 365 allows for seamless co-authoring and version control of documents directly within the Box environment, a feature highly valued by businesses relying on Microsoft's suite.

The broad ecosystem support makes Box a versatile solution, adaptable to various industries and workflows. This adaptability is crucial in today's dynamic business landscape, where companies often utilize a mix of specialized software.

Box's strengths are anchored in its advanced AI capabilities, exemplified by products like Box AI and Box AI Studio, which enhance data analysis and custom AI agent creation. Its robust security and compliance framework, including encryption and adherence to standards like GDPR and SOC 2, provides critical data protection for sensitive information.

The company benefits from a deep-rooted enterprise customer base across various sectors and a consistent track record of revenue growth, surpassing $1 billion in FY24. Furthermore, strategic partnerships with tech giants like AWS and IBM expand its technological reach and market presence.

Box's comprehensive cloud content management system, featuring over 1,500 integrations with applications such as Microsoft and Google, significantly boosts productivity and workflow efficiency for its users.

| Metric | Value | Period |

|---|---|---|

| FY24 Revenue | >$1 Billion | Fiscal Year 2024 |

| Q1 FY25 Revenue | $265 Million | Q1 Fiscal Year 2025 |

| Year-over-Year Revenue Growth (Q1 FY25) | 5% | Q1 Fiscal Year 2025 |

| Non-GAAP Gross Margin (Q1 FY25) | 80.2% | Q1 Fiscal Year 2025 |

| Integrations | >1,500 Applications | Ongoing |

What is included in the product

Analyzes Box’s competitive position through key internal and external factors, highlighting its strengths in cloud content management and opportunities in AI integration while addressing weaknesses in market share and threats from larger competitors.

Offers a clear, structured framework to identify and address critical business challenges.

Weaknesses

The cloud content management market is incredibly crowded, featuring giants like Google Drive, Microsoft OneDrive, Dropbox, and Amazon Web Services, all of whom are constantly enhancing their services. This fierce rivalry can squeeze Box's pricing power and market share, necessitating ongoing innovation to stand out.

Box's significant reliance on international markets, with roughly one-third of its revenue originating from outside the U.S., presents a notable weakness. This global footprint, particularly its substantial exposure to Japan, which accounts for approximately 60-65% of its international sales, makes the company vulnerable to currency fluctuations.

These foreign exchange headwinds have demonstrably impacted Box's financial performance. In recent fiscal periods, unfavorable currency movements have been cited as a negative factor affecting revenue growth, compressing operating margins, and reducing free cash flow, highlighting the tangible risks associated with its international revenue streams.

While Box has demonstrated consistent revenue growth, some financial analyses indicate a potential deceleration in its growth rate when compared to earlier periods or key competitors. For instance, in Q1 2024, Box reported 4.7% year-over-year revenue growth, a figure that, while positive, reflects a moderation from higher historical rates.

To fully meet market expectations and satisfy investor demands, Box must showcase its capacity to re-accelerate revenue growth back into robust double-digit figures. This acceleration is crucial for demonstrating continued market leadership and capturing a larger share of the expanding cloud content management market.

Stock-Based Compensation (SBC) and Profitability Concerns

Stock-based compensation (SBC) is a notable weakness for Box, with it approaching 20% of revenue and expanding at a quicker pace than revenue itself. This trend could prompt scrutiny regarding the company's compensation approach and its implications for profitability.

Despite strong gross margins, Box has experienced a dip in operating income and net profit in recent quarters. This decline is largely attributed to heightened investments in research and development and workforce restructuring initiatives.

- Stock-Based Compensation: Nearing 20% of revenue and growing faster than revenue.

- Profitability Pressure: Declining operating income and net profit in recent periods.

- Investment Impact: Increased R&D spending and workforce reorganization affecting bottom line.

Potential Market Sentiment and Valuation Risks

Despite strong performance, Box's stock has seen volatility, with some analysts flagging its Price-to-Earnings (P/E) ratio as potentially high compared to the broader market. This concern is amplified by projections of slower future earnings growth, suggesting a risk of overvaluation if the company's ambitious growth targets aren't met.

For instance, as of early 2024, Box's P/E ratio has been observed to be above the average for the software industry, creating a sensitivity to market sentiment. A downturn in overall tech market sentiment or any perceived slowdown in Box's execution could disproportionately impact its valuation.

- Valuation Sensitivity: Box's P/E ratio may be higher than industry averages, making it susceptible to market corrections or shifts in investor sentiment towards growth stocks.

- Growth Expectations: Forecasts for decelerating earnings growth could put pressure on the stock price if Box fails to meet its aggressive expansion targets.

- Market Sentiment Impact: Negative shifts in the broader tech market could lead to a de-rating of Box's stock, even if its underlying business remains sound.

Box faces intense competition from established tech giants, which can limit its pricing flexibility and market share. This crowded landscape necessitates continuous innovation to differentiate its offerings and maintain a competitive edge.

The company's significant international revenue, particularly its heavy reliance on Japan (around 60-65% of international sales), exposes it to currency exchange rate volatility. Unfavorable currency movements have impacted Box's revenue growth and profitability in recent fiscal periods, as noted in its Q1 2024 results.

Box's revenue growth rate, while positive, has shown signs of moderation. In Q1 2024, revenue grew by 4.7% year-over-year, a pace that needs to re-accelerate to meet market expectations for robust double-digit growth.

Stock-based compensation (SBC) is a notable concern, approaching 20% of revenue and growing faster than revenue itself, potentially impacting profitability and investor perception.

Despite strong gross margins, Box has experienced a decline in operating income and net profit in recent quarters, attributed to increased investments in R&D and workforce restructuring.

| Weakness | Description | Impact | Relevant Data (as of early 2024/Q1 2024) |

| Intense Competition | Crowded cloud content management market with major players. | Squeezes pricing power and market share. | Market includes Google Drive, Microsoft OneDrive, Dropbox, AWS. |

| International Revenue Exposure | Significant reliance on international markets, especially Japan. | Vulnerability to currency fluctuations impacting revenue and profit. | ~1/3 of revenue from outside U.S.; 60-65% of international sales from Japan. |

| Revenue Growth Deceleration | Moderation in year-over-year revenue growth rate. | Pressure to re-accelerate growth to meet market expectations. | Q1 2024 revenue growth: 4.7% YoY. |

| Stock-Based Compensation (SBC) | High and growing SBC relative to revenue. | Potential scrutiny on compensation and impact on profitability. | SBC approaching 20% of revenue and growing faster than revenue. |

| Profitability Pressure | Declining operating income and net profit. | Impacted by increased R&D and restructuring costs. | Recent quarters showed dips in operating income and net profit. |

| Valuation Sensitivity | Potentially high P/E ratio compared to market averages. | Susceptible to market sentiment and potential overvaluation. | P/E ratio observed above software industry average in early 2024. |

Same Document Delivered

Box SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version.

Opportunities

The surging demand for artificial intelligence capabilities within content management systems represents a prime opportunity for Box. The company's strategic focus on AI, evidenced by advancements like Box AI Studio and AI agents designed to streamline diverse business processes, positions it to significantly improve user engagement and automate complex tasks.

Box's commitment to AI development allows it to tap into the growing market for intelligent content solutions. By integrating these advanced features, Box can create a more compelling and differentiated product suite, potentially driving increased adoption and enabling the upselling of AI-powered functionalities to its existing clientele, thereby capitalizing on this evolving market trend.

Box has a significant opportunity to deepen its penetration into the high-end enterprise market, a segment that often commands higher average contract values. The recent launch of its Enterprise Advanced plan, specifically engineered with robust data security and compliance capabilities, directly addresses the stringent needs of these sophisticated clients. This strategic push into premium offerings and specialized industry solutions is poised to enhance Box's market share and revenue growth.

Box can significantly boost its market reach and product offering by strengthening ties with major tech players. Deepening its relationship with cloud giants like AWS, IBM, and Oracle (NetSuite) not only unlocks new avenues for sales but also enriches Box's platform with advanced functionalities. For instance, by integrating more tightly with AWS services, Box can offer enhanced data analytics and AI capabilities, appealing to a broader enterprise client base.

These strategic alliances are crucial for Box to present more unified and robust solutions. By ensuring seamless integration with partners' ecosystems, Box can better meet diverse customer demands, thereby solidifying its competitive edge. This collaborative approach allows Box to leverage the strengths of its partners, offering customers a more complete and compelling value proposition in the crowded cloud content management space.

Untapped International Market Potential

While currency fluctuations can pose a hurdle, significant growth potential lies within international markets, especially in regions like EMEA where cloud adoption is still gaining momentum. By strategically expanding its footprint and customizing offerings for these emerging markets, the company can achieve sustainable revenue diversification.

Consider these specific opportunities:

- EMEA Cloud Market Growth: The EMEA cloud market is projected to reach $155 billion by 2025, offering substantial room for expansion.

- Emerging Market Tailoring: Developing localized solutions for specific regional needs in areas like Southeast Asia can unlock new customer segments.

- Partnership Expansion: Forging strategic alliances with local distributors and service providers in untapped territories can accelerate market penetration.

- Service Diversification: Introducing specialized services that cater to the unique demands of developing economies can create a competitive edge.

Enhancing Workflow Automation and No-Code Applications

Box has a significant opportunity to expand its workflow automation and no-code application development features. By investing further in these areas, the company can empower businesses to digitize operations and create custom solutions without requiring deep technical expertise.

This focus on user-friendly automation and application building can attract a wider range of customers, particularly those seeking to improve efficiency and streamline processes. For instance, the no-code/low-code market is projected to reach $65 billion by 2027, up from $21.5 billion in 2022, highlighting the growing demand for such solutions.

- Streamlined Processes: Enabling businesses to automate repetitive tasks, saving time and reducing errors.

- Digitization of Operations: Facilitating the conversion of manual processes into digital workflows.

- Custom Application Creation: Allowing users to build tailored applications to meet specific business needs.

- Broader Customer Attraction: Appealing to a wider market segment that values ease of use and accessibility in software solutions.

Box can capitalize on the expanding market for AI-driven content solutions, leveraging its AI Studio and agent developments to enhance user engagement and automate tasks. This strategic investment aligns with the growing demand for intelligent content management, positioning Box to differentiate its offerings and potentially drive higher revenue through AI-powered features.

The company has a clear opportunity to grow its enterprise customer base by offering advanced security and compliance features through its new Enterprise Advanced plan. This move targets a lucrative segment that values robust data protection, enabling Box to increase its average contract value and market share.

Box can expand its reach by deepening integrations with major cloud providers like AWS, IBM, and Oracle. These collaborations not only open new sales channels but also enhance Box's platform capabilities, offering customers more comprehensive solutions and strengthening its competitive standing.

International expansion, particularly in regions like EMEA where cloud adoption is rising, presents a significant growth avenue for Box. By tailoring its offerings to local market needs, the company can diversify revenue streams and capture new customer segments.

The growing demand for no-code/low-code solutions offers Box a chance to enhance its workflow automation and custom application development tools. This expansion can attract a broader customer base seeking to improve operational efficiency and digitize processes without extensive technical resources.

Threats

The cloud content management landscape is incredibly crowded, with giants like Microsoft offering OneDrive integrated into their widely adopted Office suite, and Google pushing Google Drive with its popular Workspace. Dropbox also remains a formidable competitor, constantly enhancing its own offerings.

This intense rivalry means Box faces significant pricing pressures. For instance, Microsoft's aggressive bundling of OneDrive with Microsoft 365 subscriptions, which had over 380 million paid seats as of Q1 2024, makes it challenging for standalone players like Box to compete solely on price without impacting revenue growth and margins.

Box's ability to differentiate its platform through advanced security, workflow automation, and industry-specific solutions becomes crucial. Failing to do so could lead to a struggle to maintain competitive pricing and, consequently, affect its profitability in a market where value perception is heavily influenced by bundled offerings.

The intensifying global landscape of data security and privacy regulations, such as GDPR and CCPA, presents a significant ongoing challenge for Box. As cyber threats become more sophisticated, Box must continuously invest in robust security measures and adapt its practices to maintain compliance and safeguard sensitive customer information. Failure to do so risks severe reputational damage and substantial financial penalties, impacting customer trust and operational stability.

Box is navigating significant macroeconomic headwinds, including inflation and potential recessions, which are squeezing IT budgets across many industries. This economic uncertainty directly impacts customer spending and can lead to delayed or reduced investments in cloud content management solutions.

Foreign exchange rate fluctuations also present a challenge, potentially impacting Box's reported revenue and profitability when converting international earnings back to U.S. dollars. For instance, a stronger dollar can make Box's services more expensive for international customers, dampening demand.

These pressures could result in slower deal closures and less expansion from existing clients. In 2023, many companies reported cautious IT spending, and this trend is expected to continue into 2024 and 2025 as businesses prioritize essential expenditures amidst economic volatility.

Technological Disruption and Rapid AI Advancements

The accelerating pace of AI development presents a significant threat. While Box is actively investing in AI, competitors could emerge with more advanced or disruptive AI-driven solutions, potentially outpacing Box's current offerings. For instance, by early 2024, many cloud storage providers began integrating generative AI features for content summarization and search, areas where Box is also focusing its efforts.

To counter this, Box needs to maintain relentless innovation in its AI strategy. Failure to adapt quickly could lead to Box's AI capabilities becoming outdated. By mid-2024, the market saw a surge in AI-powered collaboration tools, highlighting the need for continuous enhancement to remain competitive.

- Competitor AI Advancements: The risk that rivals will deploy more sophisticated AI features before Box can.

- Pace of Innovation: Box must keep pace with or lead AI development to avoid falling behind.

- Market Adaptability: The necessity for Box to quickly integrate new AI breakthroughs into its platform.

Customer Churn and Net Retention Rate Challenges

Customer churn remains a persistent threat for Box, as it directly impacts the company's recurring revenue and valuation. While Box has demonstrated a relatively stable net retention rate, any uptick in customers leaving or a failure to effectively upsell existing clients could significantly hinder its growth. For instance, a slight dip in net retention from 105% to 100% in a given quarter could translate to millions in lost annual recurring revenue.

The ability to maintain and ideally improve net retention rates is paramount for SaaS businesses like Box. This metric reflects the revenue retained from existing customers after accounting for churn and expansion.

- Threat: Increased Customer Churn

- Impact: Reduced Recurring Revenue

- Challenge: Upselling and Cross-selling to Existing Clients

- 2024/2025 Outlook: Continued pressure to demonstrate value and drive adoption to combat churn.

Intense competition from integrated cloud suites, particularly Microsoft's OneDrive with over 380 million paid Microsoft 365 seats in early 2024, creates significant pricing pressure for Box. This forces Box to differentiate on features like security and workflow automation to avoid margin erosion.

Box faces ongoing challenges in adapting to evolving data security and privacy regulations globally, such as GDPR and CCPA. Continuous investment in robust security measures is essential to maintain compliance and customer trust, especially as cyber threats grow more sophisticated through 2024 and into 2025.

Macroeconomic headwinds, including inflation and potential recessions impacting IT budgets, could slow Box's revenue growth. Foreign exchange rate fluctuations also pose a risk, potentially making services more expensive for international customers and affecting reported earnings.

The rapid advancement of AI presents a threat if competitors deploy more sophisticated AI features before Box. By mid-2024, many cloud providers were integrating generative AI, underscoring the need for Box to innovate quickly to avoid its AI capabilities becoming outdated.

| Threat Category | Specific Threat | Potential Impact | 2024/2025 Consideration |

|---|---|---|---|

| Competition | Aggressive bundling by rivals (e.g., Microsoft OneDrive) | Pricing pressure, reduced market share | Need for clear value differentiation beyond price. |

| Regulatory Environment | Increasingly stringent data privacy laws (GDPR, CCPA) | Compliance costs, reputational damage, financial penalties | Ongoing investment in security and compliance infrastructure. |

| Economic Conditions | Inflation, potential recessions, FX volatility | Reduced IT spending, lower international revenue | Focus on essential business value and cost optimization. |

| Technological Advancements | Faster AI integration by competitors | Risk of obsolescence in AI features | Accelerated R&D and rapid deployment of AI capabilities. |

SWOT Analysis Data Sources

This Box SWOT analysis is built upon a foundation of verified financial statements, comprehensive market intelligence reports, and insightful expert commentary. These diverse data streams ensure a robust and accurate assessment of Box's strategic position.