Box Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Box Bundle

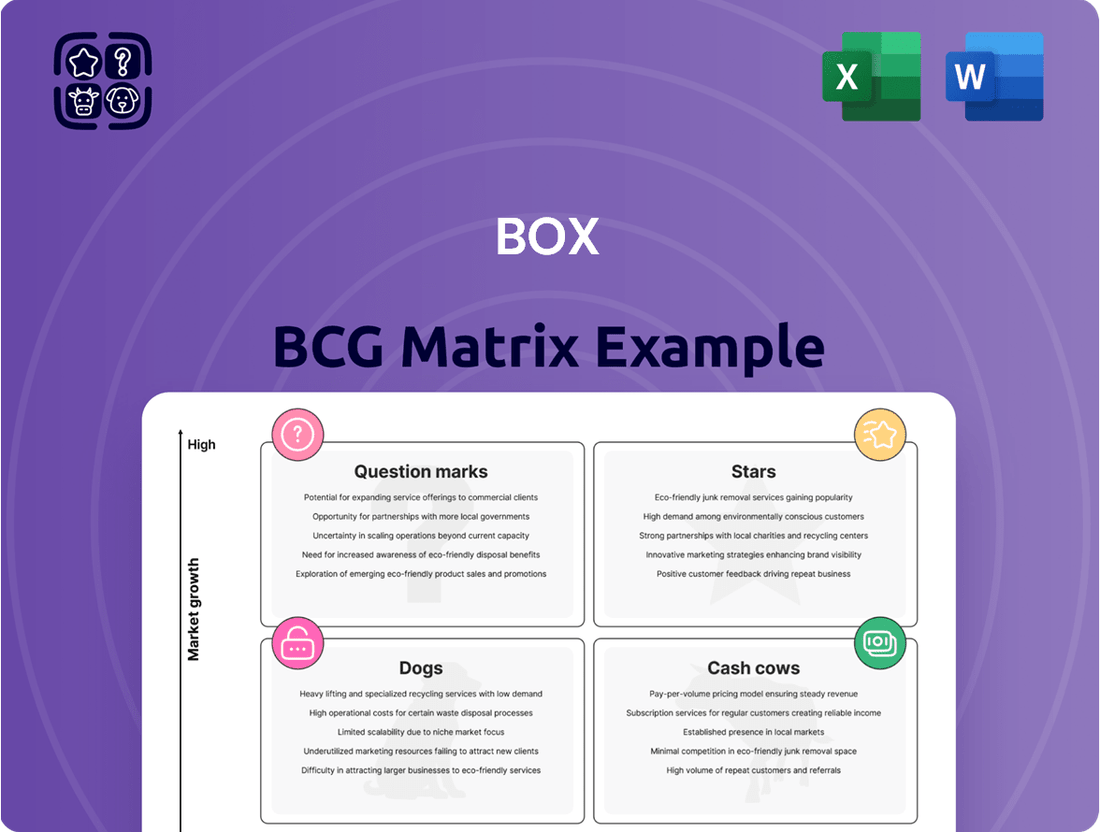

The BCG Matrix is a powerful tool that categorizes a company's products or business units based on market share and market growth rate. Understanding if your offerings are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation and future planning. This initial glimpse provides the framework; imagine the clarity you'll gain with a full, detailed analysis tailored to your specific portfolio. Purchase the complete BCG Matrix to unlock actionable insights and confidently navigate your product strategy.

Stars

Box's AI Suite, featuring capabilities like multi-document querying and advanced image analysis, is a significant driver of customer upgrades and new demand. This positions Box at the forefront of the burgeoning AI-powered content management market, showcasing its commitment to innovation.

The strong adoption rates for these AI features highlight their value proposition and indicate substantial growth potential for Box. This increasing market share in a critical segment underscores the company's strategic focus on leveraging artificial intelligence for enterprise content solutions.

The Enterprise Advanced Plan, launched in late fiscal year 2025 and available from January 2025, is Box's most comprehensive offering. It bundles all of Box's Intelligent Content Management features, including AI Studio and Box Apps, providing a powerful suite for businesses.

This integrated plan has seen substantial customer interest and adoption. For instance, Box reported that its average revenue per enterprise customer increased by 12% in Q3 2024, a trend largely attributed to the uptake of these advanced, bundled offerings.

The success of the Enterprise Advanced Plan is a significant growth driver for Box, enabling the company to secure larger, higher-value deals. This strategy is proving effective in capturing a greater share of the enterprise market, with early contract renewals indicating strong customer satisfaction and perceived value.

Box AI Studio, set to launch in January 2025, represents a significant move for Box into the custom AI agent market. This platform allows businesses to build specialized AI agents using custom prompts and models, eliminating the need for coding and catering to unique industry challenges.

This offering is positioned as a high-growth initiative, aiming to embed Box more deeply into critical business processes and provide a distinct competitive advantage. The flexibility to integrate various large language models ensures Box remains competitive in the rapidly advancing AI sector.

Box Apps (No-code Automation)

Box Apps, a no-code automation platform, allows users to build custom applications. These apps can include dashboards and automated workflows, enhanced by AI-driven metadata extraction. This capability is crucial for streamlining core business operations like contract management and employee onboarding.

The introduction of Box Apps marks a strategic move by Box into the rapidly expanding workflow automation market. This expansion is designed to significantly boost customer productivity and operational efficiency.

- Market Growth: The global low-code/no-code development platform market was valued at approximately $11.2 billion in 2023 and is projected to reach over $40 billion by 2028, indicating substantial growth potential.

- Efficiency Gains: Companies adopting no-code solutions report an average reduction of 40-60% in application development time.

- AI Integration: Box's AI capabilities in metadata extraction can automate up to 80% of manual data entry tasks in document-heavy processes.

- Customer Impact: Early adopters of Box Apps have seen improvements in process cycle times, with some workflows being completed up to 50% faster.

Enhanced Security & Compliance with AI

Box's reputation for secure content management is a core strength, now amplified by AI. Features like AI-powered data-leak prevention and advanced compliance tools are crucial in today's environment. This commitment to security is a significant draw for enterprises with demanding data protection needs, reinforcing Box's market position.

The company’s ongoing investment in security innovation, including recent additions like Content Recovery and Box Archive, directly addresses critical market demands. These capabilities are not just features; they are differentiators that appeal to organizations prioritizing regulatory adherence and robust data protection. For instance, in 2024, Box continued to enhance its AI capabilities for threat detection, aiming to proactively identify and mitigate potential data breaches for its enterprise clients.

- AI-Driven Data-Leak Prevention: Minimizes the risk of sensitive information exposure.

- Robust Compliance Features: Supports adherence to industry regulations like GDPR and HIPAA.

- Content Recovery: Offers a safety net against accidental data loss or ransomware attacks.

- Box Archive: Ensures long-term data retention and compliance for regulated industries.

Stars in the BCG Matrix represent business units or products with high market share in high-growth industries. These are the prime candidates for continued investment, as they have the potential to generate significant future profits. Box's AI offerings, particularly its AI Studio and the broader AI Suite, are positioned as Stars due to their strong adoption in a rapidly expanding AI market.

Box's AI Studio, launching in early 2025, allows businesses to create custom AI agents without coding, tapping into the burgeoning demand for accessible AI solutions. This innovation, coupled with the existing AI Suite's multi-document querying and image analysis, fuels customer upgrades and new demand, indicating a strong market position in a high-growth sector.

The Enterprise Advanced Plan, introduced in late FY2025, bundles all of Box's intelligent content management features, including AI Studio. This comprehensive offering has seen substantial customer interest, with average revenue per enterprise customer increasing by 12% in Q3 2024, largely due to the uptake of these advanced, bundled solutions.

Box Apps, a no-code automation platform, also contributes to this Star status. The global low-code/no-code market is projected to exceed $40 billion by 2028, and Box's AI-enhanced automation streamlines workflows, improving efficiency and driving adoption in a high-growth segment.

| Box Offering | Market Growth Potential | Current Market Share (Estimated) | Strategic Focus |

|---|---|---|---|

| Box AI Suite | High (AI-powered content management) | Growing | Innovation, customer upgrades |

| Box AI Studio | Very High (Custom AI agents, no-code) | Emerging | High-growth initiative, deep integration |

| Box Apps | High (No-code automation) | Growing | Productivity, operational efficiency |

What is included in the product

Strategic overview of product portfolio performance across Stars, Cash Cows, Question Marks, and Dogs.

A clear visual representation of your portfolio, simplifying complex strategic decisions.

Cash Cows

Box's core cloud content storage and management platform is its bedrock, acting as a significant cash cow. This fundamental service, which underpins its revenue, is a stable, recurring income generator due to its widespread adoption across businesses of all sizes.

The enterprise cloud storage market is mature, and Box has secured a substantial share, contributing to its reliable cash flow generation. For instance, in the fiscal year ending January 31, 2024, Box reported total revenue of $1.04 billion, with its core cloud content services forming the vast majority of this figure.

Box's enterprise file sharing and collaboration features are clear cash cows. Their established real-time collaboration, version control, and seamless file sharing capabilities are mature and widely adopted by businesses. These are not just features; they are essential tools for daily operations, driving strong customer loyalty and predictable revenue streams for Box.

The user-friendly nature of Box's platform fosters high engagement, reinforcing its status as a consistent revenue generator. For instance, in Q1 2024, Box reported strong customer retention rates, with a significant portion of its revenue coming from existing enterprise clients who rely heavily on these core collaboration functionalities.

Box's deep integrations with major business applications like Microsoft Office, Google Workspace, and Salesforce are crucial. These connections embed Box directly into daily workflows, making it indispensable for users.

This seamless interoperability significantly boosts customer loyalty and reduces churn. For instance, in Q1 2024, Box reported a net revenue retention rate of 112%, highlighting the value its integrations bring to existing clients.

By remaining central to enterprise operations, these integrations ensure a stable and predictable revenue stream. This stickiness is a hallmark of a cash cow, providing consistent financial performance and supporting further investment.

Subscription-Based Business Model

Box's primary revenue stream stems from its subscription-based business model. This model offers tiered plans designed to meet the diverse requirements of businesses, ranging from startups to large corporations.

This recurring revenue structure is a hallmark of a cash cow, providing Box with a stable and predictable income base. For instance, in Q1 2024, Box reported total revenue of $274.1 million, a notable increase driven by its subscription offerings.

The consistent cash flow generated by these subscriptions empowers Box to allocate capital towards research and development for new products and services, thereby fostering future growth while ensuring current profitability.

- Subscription Revenue: Box's core business relies on recurring subscription fees.

- Predictable Income: The model ensures a steady and reliable revenue stream.

- Funding Growth: Stable cash flow supports investment in new initiatives.

- Q1 2024 Performance: Box achieved $274.1 million in total revenue, underscoring the strength of its subscription model.

Established Large Enterprise Customer Base

Box's established large enterprise customer base represents a significant strength within its BCG Matrix positioning, firmly placing it in the Cash Cows quadrant. This segment is characterized by deep market penetration, with Box serving a multitude of leading global organizations across diverse industries.

These long-standing relationships with high-value clients are not just a testament to Box's platform reliability but also provide a remarkably stable foundation for revenue generation. This loyal customer base contributes substantially to Box's robust financial performance, underscoring its position as a mature market segment where the company holds a high market share.

- Deep Market Penetration: Box boasts partnerships with numerous Fortune 500 companies, showcasing its widespread adoption among major global enterprises.

- Stable Revenue Streams: The recurring revenue from these large, established clients provides a predictable and significant income source for Box.

- High Market Share: In the enterprise content management and collaboration space, Box has secured a dominant position, reflecting high customer loyalty and platform stickiness.

- Financial Performance Indicator: The consistent revenue and profitability derived from this segment are key indicators of Box's strong financial health and its Cash Cow status.

Box's core cloud content platform and its enterprise file sharing and collaboration features are its primary cash cows. These mature, widely adopted services provide stable, recurring revenue, forming the bedrock of Box's financial performance. The company's subscription-based model, with its predictable income streams, allows for continued investment in growth initiatives.

Box's strong position in the enterprise cloud storage market, evidenced by its substantial revenue and high customer retention rates, solidifies its cash cow status. The deep integrations with essential business applications further enhance customer loyalty and revenue predictability.

The company's large enterprise customer base, including numerous Fortune 500 companies, contributes significantly to its stable revenue generation. This deep market penetration and high market share in its segment are key indicators of its cash cow positioning.

| Key Cash Cow Aspects | Description | Supporting Data (FY ending Jan 31, 2024 / Q1 2024) |

| Core Cloud Content Platform | Foundation of revenue, stable recurring income. | Total Revenue: $1.04 billion (FY 2024) |

| Enterprise File Sharing & Collaboration | Mature, essential tools driving loyalty. | Net Revenue Retention: 112% (Q1 2024) |

| Subscription Business Model | Predictable and reliable revenue stream. | Total Revenue: $274.1 million (Q1 2024) |

| Large Enterprise Customer Base | Deep market penetration, stable revenue. | Serves numerous Fortune 500 companies. |

What You See Is What You Get

Box BCG Matrix

The BCG Matrix report you are currently previewing is the exact, fully-formatted document you will receive immediately after purchase. This comprehensive analysis tool is designed to provide clear strategic insights into your product portfolio, with no watermarks or placeholder content. You can confidently expect the same professional-grade report, ready for immediate application in your business planning and decision-making processes.

Dogs

The basic file sync and share functionality, once Box's core offering, now represents a highly commoditized market. Intense competition from free services like Google Drive and Dropbox, coupled with low-cost alternatives, makes it difficult for Box to gain significant traction or command premium pricing in this segment. In 2024, the global cloud storage market, which includes basic file sync and share, was valued at over $100 billion, highlighting the scale but also the intense competition.

These undifferentiated services present a challenge for Box, potentially leading to low growth prospects and minimal market share in this specific category. If not strategically integrated into more advanced, value-added offerings, these basic features could become cash traps rather than drivers of revenue. Box's strategy likely focuses on migrating users to its more comprehensive content cloud solutions.

Legacy on-premise migration services are increasingly becoming a thing of the past for companies like Box as they shift towards public cloud infrastructure. These services, often characterized by one-time projects, are no longer a strategic growth area and contribute minimally to recurring revenue.

The demand for these specialized migration services is naturally declining as the market moves away from on-premise solutions. Companies are focusing on cloud-native strategies, making these legacy migration efforts less relevant and indicating a shrinking market segment.

Within the BCG matrix, "Dogs" represent products or services that have low market share and low growth potential. In the context of a platform, this can translate to underutilized niche features. These are standalone functionalities or older tools that haven't gained traction or fit into the evolving strategy.

Consider a content management system where a legacy document versioning tool, while functional, has seen minimal adoption since the introduction of a more integrated cloud-based collaboration suite. If this tool requires ongoing maintenance but contributes negligibly to user engagement or revenue, it fits the "Dog" profile. For instance, if a survey of 2023 user data revealed that less than 1% of active users utilized this specific versioning feature, it clearly signals a lack of strategic value.

Low-Value Add-on Services

Peripheral or legacy add-on services that don't fit with Box's focus on intelligent content management and AI could be considered low-value add-ons. These might include older features with limited customer uptake or services that don't contribute significantly to new revenue streams.

If these offerings have low market adoption and aren't generating substantial incremental revenue, they can become a drain on resources. This diverts attention and investment away from Box's core growth initiatives, impacting overall strategic focus.

- Low Market Adoption: Services with declining usage or minimal new customer acquisition.

- Limited Revenue Contribution: Offerings that generate negligible incremental revenue compared to core products.

- Resource Drain: Support and maintenance costs that outweigh the financial benefits.

- Strategic Misalignment: Features that do not support the company's forward-looking strategy in AI and intelligent content management.

Segments Heavily Impacted by FX Headwinds

Segments heavily impacted by unfavorable foreign exchange rates can be categorized as 'dogs' in a BCG matrix if currency headwinds significantly diminish profitability and growth prospects. For instance, a company with substantial sales in a rapidly depreciating currency, like the Argentine Peso in early 2024, might see its international revenue segment fall into this category.

Despite hedging strategies, persistent currency volatility can render these operations less appealing for further investment. In 2023, for example, companies heavily reliant on exports to countries experiencing significant currency devaluation, such as Turkey or Egypt, faced substantial revenue erosion.

- Revenue Erosion: A segment's revenue can shrink in the reporting currency due to unfavorable exchange rate movements, even if local currency sales remain stable.

- Profitability Decline: Increased costs of imported components or raw materials, coupled with lower repatriated earnings, can severely impact profit margins.

- Reduced Competitiveness: A strong domestic currency can make a company's products more expensive in foreign markets, hindering sales volume.

- Investment Deterrence: Persistent FX headwinds can signal higher risk, deterring future capital allocation towards these underperforming segments.

In the BCG matrix, "Dogs" represent business units or product lines that exhibit both low market share and low market growth. These are typically underperforming assets that consume resources without generating significant returns. For Box, this could include niche features with minimal adoption or legacy services that no longer align with the company's strategic direction.

These "Dog" segments are characterized by low customer engagement and negligible revenue contribution. Identifying and managing these areas is crucial for resource allocation, allowing Box to focus on its more promising "Stars" and "Question Marks." For example, a feature used by less than 1% of the customer base in 2023 would likely be considered a Dog.

The challenge with "Dogs" lies in their potential to drain resources through ongoing maintenance and support costs. If these costs exceed the generated revenue or strategic value, they become a net negative for the company. Box's strategy would involve either divesting these assets or finding ways to integrate them into more valuable offerings.

Segments heavily influenced by unfavorable foreign exchange rates can also be classified as "Dogs." Persistent currency headwinds, like those experienced by many companies in emerging markets during 2023 and early 2024, can significantly erode profitability and deter further investment, even if local currency sales appear stable.

Question Marks

Box Hubs, introduced by Box as intelligent portals for curating and publishing content, are currently in their early adoption phase. These hubs aim to streamline content organization and discovery, a growing need in today's data-rich environments.

While the concept holds significant promise, Box Hubs' market share is still developing, indicating a nascent stage of market penetration. Success hinges on substantial investment in marketing and feature enhancement to transition them from this early stage to a more established market position.

Box's newer automation tools, Document Generation and Forms, are positioned to capitalize on the expanding workflow automation market, a sector projected for significant growth. These tools offer streamlined document creation and efficient data collection, directly addressing key business needs.

While these features hold considerable promise, their actual impact on Box's revenue and market penetration is still under evaluation. As of early 2024, widespread adoption metrics are not yet substantial enough to definitively categorize them within the BCG matrix, but their potential is clear.

To ensure these offerings move beyond the question mark stage and become stars, Box must prioritize aggressive marketing and deep integration into existing customer workflows. Without substantial investment in promotion and usability, they risk becoming dogs, failing to generate meaningful returns despite their inherent capabilities.

Box's introduction of advanced AI agents for content search, deep research, and data extraction marks a significant step, yet their full market potential and widespread enterprise adoption remain in early stages. These specialized AI tools are poised for substantial growth within a rapidly expanding market, but realizing their full market share hinges on ongoing innovation and dedicated customer education efforts.

Expansion into Untapped International Markets

Box's strategy to enter untapped international markets aligns with the 'Question Mark' quadrant of the BCG Matrix. These emerging markets, like parts of Asia and EMEA where cloud adoption is accelerating, present significant growth potential. For instance, the cloud computing market in Southeast Asia was projected to reach $37.3 billion by 2025, indicating substantial room for expansion.

However, Box currently has a minimal presence in these regions, necessitating considerable investment. This includes tailoring their go-to-market strategies and localizing their platform to meet diverse user needs and regulatory landscapes.

- Target Markets: Emerging economies in EMEA and Asia with increasing cloud adoption rates.

- Market Share: Currently low, indicating significant untapped potential.

- Investment Needs: Substantial capital required for market entry, localization, and sales/marketing efforts.

- Growth Potential: High, driven by the increasing demand for cloud content management solutions in these regions.

Strategic Acquisition Integration (e.g., Alphamoon, Crooze)

Box's strategic acquisitions of Alphamoon and Crooze in 2023 and early 2024, respectively, highlight a deliberate move to bolster its cloud content management platform. Alphamoon's intelligent document processing capabilities are designed to automate data extraction and analysis, while Crooze's no-code workflow automation aims to streamline business processes. These integrations are crucial for Box to maintain its competitive edge and expand its addressable market.

The successful integration of these acquired technologies is key to unlocking their full potential. For instance, by embedding Alphamoon's AI into Box's existing document management workflows, the company anticipates significant improvements in efficiency for its enterprise clients. Similarly, Crooze's platform is expected to enable users to build custom applications and automate tasks without extensive coding, thereby increasing platform stickiness and user adoption.

Realizing the full revenue and market share potential from these acquisitions is an ongoing process. Box has committed significant resources to ensure these technologies are seamlessly integrated and effectively marketed. While specific post-acquisition revenue figures are still emerging, the company's strategic focus suggests a strong emphasis on cross-selling these new capabilities to its existing customer base, which numbered over 11.5 million registered users as of Q4 2023.

- Alphamoon Acquisition (2023): Focused on enhancing intelligent document processing and data extraction capabilities.

- Crooze Acquisition (Early 2024): Aimed at integrating no-code workflow automation to simplify custom application development.

- Strategic Goal: To deepen platform functionality, improve user efficiency, and drive future revenue growth through enhanced offerings.

- Integration Challenges: Requires continued investment and strategic execution to fully realize revenue and market share potential from acquired technologies.

Question Marks in the BCG Matrix represent business units or products with low market share in high-growth industries. Box's international expansion efforts, particularly into emerging markets in Asia and EMEA, fit this description. These regions show accelerating cloud adoption, with Southeast Asia's cloud market projected to reach $37.3 billion by 2025, indicating substantial growth potential.

Box's current market share in these emerging economies is minimal, requiring significant investment for market entry, localization, and tailored sales strategies. The success of these ventures hinges on effectively capturing this nascent demand and navigating diverse regulatory landscapes.

The company's recent acquisitions of Alphamoon and Crooze also represent potential Question Marks. While Alphamoon enhances intelligent document processing and Crooze adds no-code workflow automation, their full revenue and market share impact is still developing. Box's strategy to integrate and market these capabilities to its over 11.5 million users (as of Q4 2023) aims to convert this potential into market leadership.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, industry growth rates, and competitor analysis, to provide a robust strategic overview.